Essent PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Essent Bundle

Gain a crucial competitive advantage by understanding the external forces shaping Essent's future. Our meticulously researched PESTEL analysis delves into the political, economic, social, technological, legal, and environmental factors impacting the company. Equip yourself with actionable intelligence to refine your strategies and anticipate market shifts. Download the full version now for immediate access to these vital insights.

Political factors

Government housing policies, particularly those from the FHFA and CFPB, significantly shape the mortgage landscape and, consequently, the demand for private mortgage insurance (PMI). For example, FHFA's directives on affordable housing goals for Fannie Mae and Freddie Mac directly influence the volume of loans that may require PMI, impacting Essent's market.

Changes in GSE housing goals, such as the FHFA's proposed 2024 multifamily loan caps or new regulations on mortgage servicing, create a dynamic operational environment for Essent. These regulatory shifts can alter the competitive landscape and affect the overall need for Essent's risk mitigation solutions.

The potential reform of Fannie Mae and Freddie Mac, government-sponsored enterprises (GSEs), remains a significant political factor for Essent. These entities are crucial counterparties for private mortgage insurers like Essent. Changes to their capital requirements or market role could reshape Essent's business and risk profile.

Discussions around privatizing or restructuring the GSEs are ongoing. For example, in 2024, the Federal Housing Finance Agency (FHFA) continued to oversee the GSEs' conservatorship, with ongoing debates about their future structure. Any shift, such as a potential Initial Public Offering (IPO) for Fannie Mae or Freddie Mac, could alter market dynamics and potentially influence mortgage rates, impacting Essent's operating environment.

Government fiscal policies, like overall spending and tax structures, significantly shape the economic landscape for companies like Essent. For instance, the U.S. federal budget deficit was projected to reach $1.9 trillion in fiscal year 2024, a substantial figure that can influence interest rate environments, impacting mortgage affordability and thus the demand for private mortgage insurance (PMI).

Tax incentives for homeownership, such as deductions for mortgage interest, directly affect consumer purchasing power and housing market activity. While these don't directly regulate Essent, they create the broader economic context for mortgage originations. Changes in these incentives can alter the volume of mortgages written, indirectly influencing Essent's business volume.

Political Stability and Election Cycles

Political stability and the outcomes of election cycles can significantly impact the housing and mortgage sectors by introducing uncertainty or shifting policy directions. For Essent, a company deeply intertwined with these markets, understanding these dynamics is crucial. For instance, in the lead-up to the 2024 US Presidential election, discussions around housing affordability and mortgage interest rates became prominent policy talking points, potentially influencing market sentiment and regulatory approaches.

New administrations often prioritize different housing initiatives or regulatory frameworks, creating both opportunities and challenges. A shift towards policies encouraging first-time homebuyers, for example, could boost demand for Essent's mortgage insurance products. Conversely, increased regulatory scrutiny on lending practices might necessitate adjustments to Essent's operational strategies.

The potential for changes in leadership and policy requires Essent to maintain a high degree of adaptability. For example, if a new administration were to implement stricter capital requirements for mortgage insurers, Essent would need to respond by adjusting its financial planning and risk management. Staying informed about legislative proposals and election outcomes is therefore a key component of Essent's strategic planning.

- 2024 US Presidential Election: Heightened focus on housing affordability and mortgage interest rate policies.

- Regulatory Shifts: Potential for new administrations to alter housing finance regulations, impacting Essent.

- Adaptability is Key: Essent must be prepared for policy changes affecting its core business.

International Trade Policy

International trade policies, including tariffs on goods like lumber or steel, can directly impact construction material costs. For instance, a 25% tariff on imported steel could significantly increase building expenses, potentially slowing housing supply and affecting affordability. These policies can also influence broader economic growth, which in turn affects mortgage origination volumes for companies like Essent.

Changes in trade agreements or the imposition of new tariffs can create economic uncertainty. This uncertainty might lead to reduced builder confidence, impacting the pace of new home construction and the overall performance of the housing sector. For example, in late 2023 and early 2024, ongoing discussions about tariffs on various imported goods created a degree of apprehension in several industries, including construction.

- Tariffs on building materials: Increased costs for lumber, steel, and other imported components directly impact housing development budgets.

- Economic Growth Impact: Trade policies can influence GDP growth, affecting consumer spending and investment in the housing market.

- Mortgage Market Sensitivity: Economic jitters stemming from trade disputes can lead to fluctuations in mortgage origination volumes as consumer confidence wavers.

- Builder Confidence: Uncertainty in trade policy can dampen sentiment among home builders, potentially slowing new construction starts.

Government housing policies, particularly those from the FHFA and CFPB, significantly shape the mortgage landscape and, consequently, the demand for private mortgage insurance (PMI). For example, FHFA's directives on affordable housing goals for Fannie Mae and Freddie Mac directly influence the volume of loans that may require PMI, impacting Essent's market.

Changes in GSE housing goals, such as the FHFA's proposed 2024 multifamily loan caps or new regulations on mortgage servicing, create a dynamic operational environment for Essent. These regulatory shifts can alter the competitive landscape and affect the overall need for Essent's risk mitigation solutions.

The potential reform of Fannie Mae and Freddie Mac, government-sponsored enterprises (GSEs), remains a significant political factor for Essent. These entities are crucial counterparties for private mortgage insurers like Essent. Changes to their capital requirements or market role could reshape Essent's business and risk profile.

Discussions around privatizing or restructuring the GSEs are ongoing. For example, in 2024, the Federal Housing Finance Agency (FHFA) continued to oversee the GSEs' conservatorship, with ongoing debates about their future structure. Any shift, such as a potential Initial Public Offering (IPO) for Fannie Mae or Freddie Mac, could alter market dynamics and potentially influence mortgage rates, impacting Essent's operating environment.

Government fiscal policies, like overall spending and tax structures, significantly shape the economic landscape for companies like Essent. For instance, the U.S. federal budget deficit was projected to reach $1.9 trillion in fiscal year 2024, a substantial figure that can influence interest rate environments, impacting mortgage affordability and thus the demand for private mortgage insurance (PMI).

Tax incentives for homeownership, such as deductions for mortgage interest, directly affect consumer purchasing power and housing market activity. While these don't directly regulate Essent, they create the broader economic context for mortgage originations. Changes in these incentives can alter the volume of mortgages written, indirectly influencing Essent's business volume.

Political stability and the outcomes of election cycles can significantly impact the housing and mortgage sectors by introducing uncertainty or shifting policy directions. For Essent, a company deeply intertwined with these markets, understanding these dynamics is crucial. For instance, in the lead-up to the 2024 US Presidential election, discussions around housing affordability and mortgage interest rates became prominent policy talking points, potentially influencing market sentiment and regulatory approaches.

New administrations often prioritize different housing initiatives or regulatory frameworks, creating both opportunities and challenges. A shift towards policies encouraging first-time homebuyers, for example, could boost demand for Essent's mortgage insurance products. Conversely, increased regulatory scrutiny on lending practices might necessitate adjustments to Essent's operational strategies.

The potential for changes in leadership and policy requires Essent to maintain a high degree of adaptability. For example, if a new administration were to implement stricter capital requirements for mortgage insurers, Essent would need to respond by adjusting its financial planning and risk management. Staying informed about legislative proposals and election outcomes is therefore a key component of Essent's strategic planning.

- 2024 US Presidential Election: Heightened focus on housing affordability and mortgage interest rate policies.

- Regulatory Shifts: Potential for new administrations to alter housing finance regulations, impacting Essent.

- Adaptability is Key: Essent must be prepared for policy changes affecting its core business.

International trade policies, including tariffs on goods like lumber or steel, can directly impact construction material costs. For instance, a 25% tariff on imported steel could significantly increase building expenses, potentially slowing housing supply and affecting affordability. These policies can also influence broader economic growth, which in turn affects mortgage origination volumes for companies like Essent.

Changes in trade agreements or the imposition of new tariffs can create economic uncertainty. This uncertainty might lead to reduced builder confidence, impacting the pace of new home construction and the overall performance of the housing sector. For example, in late 2023 and early 2024, ongoing discussions about tariffs on various imported goods created a degree of apprehension in several industries, including construction.

- Tariffs on building materials: Increased costs for lumber, steel, and other imported components directly impact housing development budgets.

- Economic Growth Impact: Trade policies can influence GDP growth, affecting consumer spending and investment in the housing market.

- Mortgage Market Sensitivity: Economic jitters stemming from trade disputes can lead to fluctuations in mortgage origination volumes as consumer confidence wavers.

- Builder Confidence: Uncertainty in trade policy can dampen sentiment among home builders, potentially slowing new construction starts.

Political stability and election outcomes directly influence housing market sentiment and regulatory direction. For instance, the 2024 US Presidential election brought housing affordability and mortgage rates to the forefront of policy discussions, potentially shaping future regulations. Essent's strategy must account for these shifts, as new administrations can implement policies that either boost or hinder mortgage origination volumes.

Government fiscal policies, such as the projected $1.9 trillion U.S. federal budget deficit for fiscal year 2024, can impact interest rates and mortgage affordability. Tax incentives for homeownership also play a role by influencing consumer purchasing power and housing market activity, indirectly affecting Essent's business volume.

The ongoing conservatorship of Fannie Mae and Freddie Mac, and potential reforms like their privatization or IPO, represent significant political variables. Changes to these GSEs' capital requirements or market roles could fundamentally alter the competitive landscape and Essent's risk profile, necessitating strategic adaptation.

What is included in the product

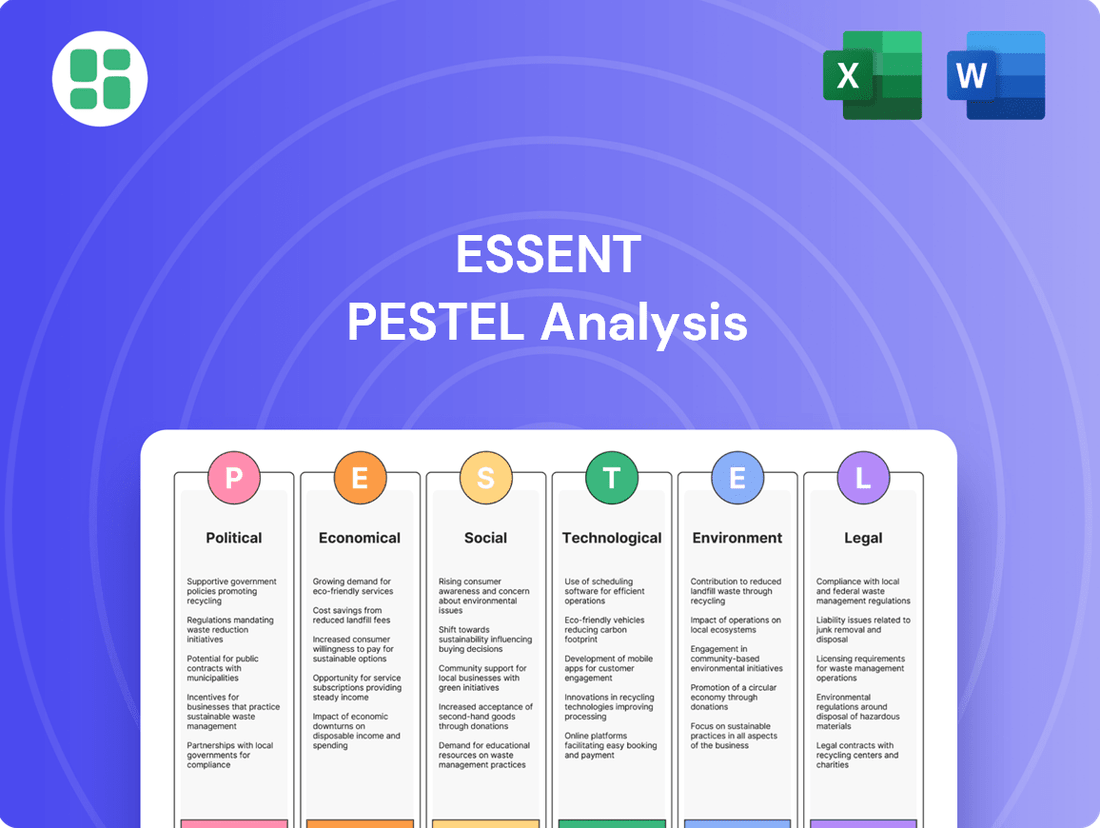

The Essent PESTLE Analysis provides a comprehensive examination of the external forces impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Essent's PESTLE Analysis provides a structured framework that simplifies complex external factors, alleviating the pain of information overload during strategic planning.

Economic factors

The interest rate environment significantly influences Essent's business. Fluctuations in mortgage rates directly impact housing affordability and mortgage origination volumes. For instance, the Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% through mid-2024, a level that generally dampens refinancing activity and can slow purchase demand.

Higher rates, like those seen in 2023 and continuing into 2024, typically reduce the volume of new mortgages originated, which in turn lowers the demand for private mortgage insurance (PMI). This can lead to decreased new insurance written (NIW) for companies like Essent. Conversely, a decrease in interest rates, if it occurs, could stimulate the housing market, leading to more loan originations and a greater need for PMI.

The U.S. housing market's vitality, marked by home price appreciation and sales volume, directly influences Essent's performance. For instance, in April 2024, the S&P CoreLogic Case-Shiller U.S. National Home Price Index showed a 6.3% annual increase, indicating robust price growth that could bolster Essent's premium volume by increasing average loan sizes.

However, this appreciation also presents a double-edged sword. While higher prices can mean more revenue per policy for Essent, they simultaneously strain affordability for potential buyers. This affordability squeeze might moderate demand for new mortgages, thereby impacting the volume of private mortgage insurance Essent writes.

Inventory levels are also a key factor. Low inventory, a persistent issue in recent years, can drive up prices but also limit the overall number of transactions. In Q1 2024, existing home sales saw a slight uptick but remained below historical averages, highlighting the delicate balance between price growth and sales activity that Essent must navigate.

Mortgage origination volume is a crucial metric for Essent, directly impacting its primary business of private mortgage insurance (PMI). In 2023, total mortgage originations were approximately $1.6 trillion, a decrease from previous years. This figure includes both purchase and refinance segments.

Industry forecasts for 2024 and 2025 indicate a rebound, particularly in purchase originations. Experts predict purchase originations to reach around $1.4 trillion in 2024, with a further increase anticipated for 2025. This upward trend in home buying activity is a positive signal for Essent, as it drives demand for new mortgages requiring PMI.

Employment Rates and Consumer Confidence

Robust employment rates and high consumer confidence are key indicators for Essent, a mortgage insurer. When more people are employed and feel secure about their finances, they are more likely to make their mortgage payments on time. This directly translates to lower claims for Essent. For instance, in May 2024, the U.S. unemployment rate stood at a low 3.9%, and consumer confidence, as measured by the Conference Board, remained elevated, suggesting a supportive environment for mortgage repayment.

A stable job market underpins borrowers' capacity to meet their mortgage obligations, thereby reducing the likelihood of defaults that Essent would need to cover. This positive economic backdrop generally leads to a stronger housing market, as increased consumer spending and financial stability encourage homeownership and investment. Essent benefits from this scenario through fewer claims and potentially higher premium volumes.

- U.S. Unemployment Rate: 3.9% as of May 2024, indicating a tight labor market.

- Consumer Confidence: The Conference Board Consumer Confidence Index showed a strong reading in May 2024, reflecting positive consumer sentiment.

- Impact on Essent: High employment and confidence reduce mortgage default risk, benefiting Essent's claims ratio.

- Economic Downturn Risk: Conversely, a rise in unemployment or a fall in consumer confidence would signal increased default risk for Essent.

Affordability and Economic Growth

Economic growth and housing affordability are key drivers for Essent's Private Mortgage Insurance (PMI) business. A robust economy generally translates to higher incomes and greater consumer confidence, which in turn can boost homeownership rates. However, when home prices and interest rates climb faster than wages, it creates affordability hurdles, particularly for first-time buyers who are a core demographic for PMI. For instance, in early 2024, while the US economy showed resilience, housing affordability remained a concern in many markets due to persistent inflation and elevated mortgage rates.

Essent's success is closely tied to the accessibility of mortgage financing for a wide range of consumers. When affordability is strained, fewer individuals can qualify for mortgages, especially those seeking low down payment options that necessitate PMI. The ability of a broad consumer base to enter the housing market directly impacts the volume of new PMI policies written. Data from the Mortgage Bankers Association in late 2023 and early 2024 indicated that while purchase applications saw some fluctuations, overall demand for housing remained present, albeit sensitive to affordability metrics.

- Economic Growth Rate: The US GDP growth rate for 2024 is projected to be moderate, around 2.0% to 2.5%, indicating a stable but not booming economic environment.

- Housing Affordability Index: National housing affordability declined in late 2023 and early 2024, with median home prices continuing to outpace income growth in many regions.

- Interest Rate Environment: Mortgage rates, while fluctuating, remained significantly higher in 2024 compared to the lows of previous years, impacting borrowing costs for potential homebuyers.

- First-Time Homebuyer Market: This segment, crucial for PMI, faces heightened challenges due to affordability constraints, potentially limiting the pool of eligible borrowers.

The economic climate for Essent in 2024 and 2025 is shaped by persistent inflation, elevated interest rates, and a generally resilient but sensitive housing market. While GDP growth is projected to be moderate, around 2.0% to 2.5% for 2024, housing affordability remains a significant concern due to home prices outpacing income growth in many areas.

This affordability squeeze, coupled with mortgage rates that stayed elevated throughout 2024, directly impacts Essent's core business by potentially limiting mortgage origination volumes, especially for first-time homebuyers who rely on low down payment options requiring PMI.

Despite these headwinds, a strong labor market, evidenced by a 3.9% unemployment rate in May 2024, and robust consumer confidence provide a supportive backdrop, mitigating the immediate risk of widespread mortgage defaults.

| Economic Factor | Metric | Value/Status (as of mid-2024) | Implication for Essent |

|---|---|---|---|

| GDP Growth | Projected 2024 Growth | ~2.0% - 2.5% | Moderate economic expansion, supportive but not a strong growth driver. |

| Unemployment Rate | May 2024 | 3.9% | Tight labor market, reduces default risk and supports housing demand. |

| Housing Affordability | National Index | Declined late 2023/early 2024 | Strains demand, particularly for first-time buyers; potential dampener on PMI volume. |

| Mortgage Rates | Benchmark Fed Rate | 5.25% - 5.50% | Higher rates curb refinancing and can slow purchase activity, impacting origination volumes. |

Same Document Delivered

Essent PESTLE Analysis

The preview you see here is the exact Essent PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, showcasing the comprehensive Essent PESTLE Analysis. You'll download this fully formatted and professionally structured document immediately after payment.

This is a real snapshot of the Essent PESTLE Analysis you’re buying. It’s delivered exactly as shown, ensuring no surprises and providing you with a complete, ready-to-use resource upon purchase.

Sociological factors

Demographic shifts are significantly reshaping the housing market, with Millennials and Gen Z increasingly entering as homebuyers. In 2023, Millennials, the largest generation, continued to drive demand, accounting for a substantial portion of mortgage originations. This trend is expected to persist as Gen Z matures into their prime homebuying years.

These younger demographics often face challenges with substantial down payments, making private mortgage insurance (PMI) a critical tool for achieving homeownership. As of early 2024, the national homeownership rate hovered around 65.9%, with younger cohorts showing a greater need for PMI to bridge the gap between their savings and down payment requirements.

Essent, as a leading PMI provider, must adapt its strategies to cater to these evolving generational needs. Understanding the financial behaviors and homebuying aspirations of Millennials and Gen Z is key to developing tailored products and services that support their entry into the housing market.

Societal views on homeownership are shifting. While the traditional 'American Dream' of owning a home persists for many, concerns about affordability are becoming more prominent. This evolving perspective can impact demand for housing and influence how people approach mortgage debt.

In 2024, data suggests that while homeownership remains a strong aspiration, rising home prices and interest rates are creating significant hurdles. For instance, the median home price in the U.S. continued its upward trend through early 2025, making it harder for first-time buyers to enter the market. This affordability crunch means more individuals might delay homeownership or seek alternative financing solutions.

Essent's focus on facilitating low down payment mortgages directly addresses these evolving consumer attitudes. By reducing the initial financial barrier, Essent can help more people achieve homeownership, even when facing affordability challenges. This strategy aligns with a growing segment of the population that desires homeownership but requires flexible financing options to make it a reality.

Household formation trends significantly shape housing demand. In 2024, the U.S. saw a continued rise in single-person households, accounting for a substantial portion of new households, which impacts demand for smaller living spaces. Conversely, while the traditional married-couple-with-children family remains a key demographic, its growth rate is slower, influencing the demand for larger family homes.

These shifts directly affect the mortgage market. The increasing prevalence of single-person households and diverse family structures means a greater need for flexible mortgage products. For instance, the demand for condos and smaller starter homes, often secured with mortgages that might utilize Private Mortgage Insurance (PMI) for lower down payments, is influenced by these formation patterns. By 2025, it's projected that over 30% of U.S. households will be single-person, a key driver for this market segment.

Wealth Inequality and Affordability Gaps

Growing wealth and income disparities are significantly impacting housing affordability, creating wider gaps for lower-income and minority communities. This trend directly influences the demographic makeup of private mortgage insurance (PMI) recipients, underscoring Essent's crucial function in expanding homeownership opportunities for historically underserved groups.

For instance, in 2024, the median net worth for white households in the U.S. was approximately $284,000, while for Black households it was around $43,000, and for Hispanic households, it was about $50,000, according to the Federal Reserve's Survey of Consumer Finances. These stark differences mean that a larger proportion of minority households rely on tools like PMI to bridge the down payment gap.

- Wealth Gap Impact: Significant disparities in household wealth mean fewer resources for down payments, increasing reliance on PMI for minority and lower-income buyers.

- Affordability Challenges: Rising home prices, especially in 2024 and projected into 2025, coupled with stagnant wage growth for many, exacerbate affordability issues.

- Demographic Shift: The profile of PMI users is increasingly diverse, reflecting the need for innovative solutions to reach a broader range of aspiring homeowners.

- Policy Focus: Addressing these affordability gaps is a key objective for housing policy and industry efforts aimed at promoting equitable access to homeownership.

Migration Patterns and Urbanization

Internal migration within the U.S. continues to reshape housing markets. For instance, data from 2024 indicates a sustained trend of individuals moving from major urban centers to suburban and even exurban areas, seeking affordability and space. This outward migration directly impacts demand, potentially cooling housing prices in some cities while inflating them in newly popular destinations.

These demographic shifts have a direct correlation with Essent's operational landscape. Understanding where populations are concentrating or dispersing is crucial for anticipating regional demand for mortgage services and identifying areas where risk profiles might be evolving due to changing economic conditions and housing affordability.

- Urban-to-Suburban Shift: Continued migration from major cities to surrounding suburbs, a trend observed throughout 2024, alters housing demand dynamics.

- Regional Market Impact: This movement influences home price appreciation and depreciation across different metropolitan areas.

- Mortgage Activity Concentration: Shifts in population directly affect where mortgage origination and servicing activities are most concentrated.

- Risk Profile Evolution: Essent must monitor these patterns to understand evolving risk exposures in different geographic markets.

Societal attitudes towards debt and financial responsibility are evolving, particularly among younger generations. While homeownership remains a significant aspiration, there's a growing awareness of the long-term implications of mortgage debt. This sentiment is amplified by economic uncertainties, leading some to prioritize flexibility over immediate large financial commitments.

In 2024, consumer confidence surveys indicated a cautious approach to borrowing, with many households actively managing their debt-to-income ratios. This trend suggests a market where financial literacy and responsible lending practices are highly valued, influencing how individuals interact with mortgage products and providers like Essent.

The increasing acceptance of diverse living arrangements, beyond the traditional nuclear family, also shapes housing demand. As of 2025, the rise in single-person households and co-living arrangements means a greater need for adaptable housing solutions and, consequently, flexible mortgage options that cater to varied income streams and ownership models.

Technological factors

The mortgage industry's rapid digitalization directly affects Essent's operations. Lenders are increasingly moving origination and servicing online, creating a more efficient and borrower-friendly environment. This shift means Essent must adapt its digital touchpoints to align with these evolving lender processes.

A fully digital mortgage workflow can significantly cut down processing times and boost overall efficiency. For Essent, this translates to faster turnaround on its insurance products and a smoother experience for its lender partners. For instance, in 2024, many mortgage originators reported reducing application-to-close times by an average of 10 days through enhanced digital tools.

Essent plays a dual role in this digital transformation, both benefiting from and contributing to a more integrated digital mortgage journey. By supporting lenders' digital initiatives, Essent ensures its private mortgage insurance (PMI) solutions are seamlessly incorporated into the streamlined online application and underwriting processes, enhancing the overall ecosystem.

The integration of AI and Machine Learning in mortgage underwriting is transforming risk assessment. These technologies allow for more nuanced evaluation of creditworthiness and enhanced fraud detection, directly impacting Essent's proprietary credit engines and risk models. By adopting these advancements, Essent can achieve more precise pricing and expedite decision-making processes.

AI-driven tools are now fundamental for efficient risk assessment and application processing. For instance, in 2024, many lenders reported a significant reduction in processing times, with some AI platforms achieving up to a 30% increase in underwriting efficiency compared to traditional methods. This translates to faster approvals and a better experience for both Essent and its clients.

Essent's reliance on advanced data analytics and predictive modeling is paramount for navigating the complex mortgage insurance landscape. By leveraging these capabilities, the company can more accurately forecast market trends, assess the performance of its diverse portfolio, and proactively manage inherent risks. For instance, in 2024, the mortgage industry saw a significant uptick in the use of AI-driven analytics to predict borrower default rates, with some reports indicating a potential reduction in losses by up to 15% for institutions that effectively implemented these tools.

The capacity to sift through and interpret massive datasets is a core advantage for Essent. This allows for a granular understanding of borrower behavior, the intricate dynamics of the housing market, and the identification of potential default risks before they materialize. Such deep insights empower Essent to make more strategic, data-backed decisions, ultimately strengthening its financial position. By Q1 2025, data analytics platforms were increasingly being integrated into risk management frameworks, with financial institutions reporting a 10% improvement in early-stage risk detection.

Cybersecurity and Data Privacy

Essent, as a financial services firm, faces significant technological challenges related to cybersecurity and data privacy. The company's handling of sensitive borrower information necessitates stringent security protocols to prevent data breaches. In 2024, the global average cost of a data breach reached $4.73 million, underscoring the financial implications of inadequate protection.

Compliance with an increasingly complex web of data privacy regulations, such as the GDPR and various state-level laws in the US, is a critical operational requirement. Failure to adhere to these standards can result in substantial fines and erosion of customer trust. For instance, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), impose significant obligations on businesses operating in the state.

- Cybersecurity Investment: Essent must continuously invest in advanced cybersecurity solutions to protect against evolving threats.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is non-negotiable for maintaining operational integrity and customer confidence.

- Reputational Risk: A single data breach can severely damage Essent's reputation, impacting its ability to attract and retain customers.

- Operational Resilience: Robust cybersecurity measures are vital for ensuring the uninterrupted operation of Essent's financial services.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are poised to reshape the mortgage landscape, offering enhanced transparency and security for processes like property title transfers and loan securitization. While adoption is still in its nascent stages, Essent must closely track these advancements, as they hold the potential to significantly boost the efficiency and trustworthiness of mortgage services. For instance, a 2024 report by Deloitte highlighted that DLT could reduce mortgage closing times by up to 25% and cut associated costs by 15% through streamlined record-keeping and verification.

These technologies promise to revolutionize financial transactions by providing immutable records and decentralized validation. Essent's strategic planning should incorporate how these emerging DLT applications might affect its operational models and competitive positioning within the next few years. The potential for increased data integrity and reduced fraud is a significant draw for financial institutions looking to modernize their back-office operations.

Key potential impacts for Essent include:

- Streamlined Title Transfers: Blockchain could create a secure and transparent digital registry for property titles, reducing the risk of fraud and speeding up the transfer process.

- Enhanced Loan Securitization: DLT can offer a more efficient and auditable way to manage the complex processes involved in securitizing mortgage loans.

- Improved Record-Keeping: Immutable ledger technology can ensure the integrity and accessibility of loan origination and servicing data, simplifying audits and compliance.

- Increased Transparency: All parties involved in a mortgage transaction could have access to a shared, verifiable ledger, fostering greater trust and reducing disputes.

Technological advancements are fundamentally reshaping the mortgage insurance sector. Essent must navigate the increasing digitalization of mortgage origination and servicing, where AI and machine learning are enhancing risk assessment and underwriting efficiency. For instance, in 2024, AI platforms were reported to boost underwriting efficiency by up to 30%.

The company's strategic advantage lies in its ability to leverage advanced data analytics and predictive modeling. By Q1 2025, financial institutions saw a 10% improvement in early-stage risk detection through integrated analytics. However, robust cybersecurity measures are critical, especially with the global average cost of a data breach reaching $4.73 million in 2024.

Emerging technologies like blockchain and DLT offer potential for greater transparency and efficiency in processes such as title transfers. A 2024 Deloitte report suggested DLT could reduce mortgage closing times by 25% and costs by 15%.

| Technology Trend | Impact on Essent | 2024/2025 Data Point |

|---|---|---|

| Digitalization of Mortgage Processes | Increased operational efficiency, faster turnaround times for PMI products. | Lenders reduced application-to-close times by an average of 10 days using digital tools. |

| AI and Machine Learning in Underwriting | More precise risk assessment, expedited decision-making, and improved fraud detection. | AI platforms achieved up to a 30% increase in underwriting efficiency. |

| Advanced Data Analytics and Predictive Modeling | Enhanced market trend forecasting, portfolio performance assessment, and risk management. | AI analytics potentially reduce default-related losses by up to 15%. |

| Cybersecurity and Data Privacy | Necessity for stringent security protocols to prevent breaches and ensure regulatory compliance. | Global average cost of a data breach was $4.73 million in 2024. |

| Blockchain and DLT | Potential for enhanced transparency and security in title transfers and loan securitization. | DLT could reduce mortgage closing times by 25% and costs by 15%. |

Legal factors

Essent operates within a stringent U.S. mortgage and lending regulatory framework, including RESPA, TILA, and Qualified Mortgage (QM) rules. These regulations, overseen by agencies like the Consumer Financial Protection Bureau (CFPB), significantly shape how mortgage originators and servicers function, directly affecting the market for private mortgage insurance.

Potential shifts in these rules, such as recent proposals to simplify mortgage servicing and loss mitigation, could alter Essent's operational landscape. For instance, changes to capital requirements or underwriting standards could influence the volume of mortgages requiring private mortgage insurance, impacting Essent's business volume.

Essent, as a mortgage insurer, operates under a complex web of state and federal insurance laws. These regulations mandate strict solvency requirements and capital adequacy standards, crucial for maintaining financial stability. For instance, the National Association of Insurance Commissioners (NAIC) sets risk-based capital (RBC) guidelines that insurers must adhere to, ensuring they have sufficient capital to cover potential losses. Failure to meet these financial benchmarks can jeopardize an insurer's license and reputation.

Regulatory bodies, such as state insurance departments and potentially federal agencies depending on the scope of operations, actively oversee Essent's financial health and operational practices. This oversight is designed to protect policyholders and the broader financial system by ensuring that mortgage insurers can reliably meet their contractual obligations. In 2024, continued scrutiny on capital reserves for mortgage insurers is expected, especially in light of evolving economic conditions.

Compliance with these rigorous financial regulations is not merely a procedural necessity; it is fundamental to Essent's continued license to operate and its counterparty strength. Strong capital reserves and adherence to solvency rules bolster investor confidence and solidify Essent's position as a reliable partner in the mortgage market.

Consumer protection laws are fundamental to how Essent operates, ensuring fair treatment for borrowers in the mortgage and insurance sectors. These regulations, like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA), govern everything from advertising to how Essent handles customer complaints, aiming to prevent deceptive practices. For instance, TILA mandates clear disclosure of loan terms and costs, a critical aspect of building consumer trust and avoiding costly litigation.

Fair Lending and Anti-Discrimination Laws

Fair lending laws, like the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act, are crucial for Essent. These regulations prevent discrimination in lending, ensuring everyone has a fair shot at mortgage insurance. Essent's underwriting and pricing must strictly adhere to these laws to maintain equitable access.

The increasing use of Artificial Intelligence (AI) in underwriting presents a new challenge. Regulators are closely watching AI’s potential for bias. Essent needs to implement AI carefully, ensuring it promotes fair outcomes and doesn't inadvertently discriminate against protected groups.

- ECOA and Fair Housing Act Compliance: Essent must ensure its lending practices, including underwriting and pricing, do not discriminate based on race, religion, national origin, sex, marital status, or age, as mandated by these federal laws.

- AI Bias Scrutiny: With AI adoption, Essent faces increased regulatory attention on potential algorithmic bias. In 2024, the Consumer Financial Protection Bureau (CFPB) has continued to emphasize fair lending in AI-driven decision-making.

- Promoting Equitable Access: Adherence to fair lending principles is vital for Essent to foster equitable access to mortgage insurance, particularly for underserved communities.

Data Privacy and Security Regulations

Data privacy and security are paramount for Essent, especially given the increasing volume of sensitive customer information handled through its digital platforms and data analytics. Beyond general cybersecurity, specific legal frameworks like the Gramm-Leach-Bliley Act (GLBA) and various state data privacy laws, such as the California Consumer Privacy Act (CCPA) as amended by the California Privacy Rights Act (CPRA), mandate stringent protection of financial data. Essent's compliance with these regulations is crucial to avoid significant penalties, which can include substantial fines and reputational damage, impacting its ability to operate and maintain customer trust. For instance, in 2023, data breach notification laws across the US saw increased enforcement, with some states imposing fines for non-compliance that can reach millions of dollars.

Essent’s operations, particularly those involving data analytics and digital processes, must strictly adhere to these evolving regulations. Failure to comply can lead to substantial financial penalties and legal challenges. For example, the CCPA, which grants consumers rights over their personal information, requires businesses to provide clear disclosures about data collection and usage. Essent's commitment to robust data governance and security protocols directly supports its legal standing and operational continuity in the financial services sector.

Legal factors significantly shape Essent's operations, from mortgage origination to insurance provision. Compliance with consumer protection laws like TILA and FCRA ensures fair borrower treatment, while fair lending statutes such as ECOA and the Fair Housing Act prevent discrimination. The evolving landscape of AI in underwriting necessitates careful implementation to avoid bias, a key focus for regulators like the CFPB in 2024.

Essent must navigate a complex regulatory environment, including federal laws like RESPA and state insurance regulations, which mandate solvency and capital adequacy. Adherence to these rules, overseen by bodies like the NAIC, is critical for maintaining operational licenses and financial stability. Continued scrutiny on capital reserves is expected in 2024, impacting Essent's financial health and market position.

Data privacy is a critical legal consideration, with laws like GLBA and CCPA/CPRA requiring stringent protection of sensitive customer information. Non-compliance can result in substantial fines, as seen with increased enforcement of data breach notification laws in 2023. Essent's commitment to robust data governance is essential for legal standing and customer trust.

Environmental factors

The escalating frequency and intensity of climate-related events like floods, wildfires, and hurricanes directly threaten property values, which are the bedrock of mortgage loan collateral. For Essent, a mortgage insurer, this translates to a heightened risk profile, as severe property damage can trigger borrower defaults and a surge in insurance claims.

In 2024, the economic impact of natural disasters globally is projected to be substantial, with insured losses alone expected to reach tens of billions of dollars. Essent's underwriting and risk management strategies must therefore incorporate robust assessments of these evolving environmental threats to accurately price policies and manage potential liabilities.

Investor and stakeholder focus on Environmental, Social, and Governance (ESG) factors is intensifying, directly impacting Essent's operational and reporting strategies. This growing emphasis means Essent must showcase its dedication to sustainability, ethical conduct, and positive social contributions to maintain a strong reputation, secure capital, and foster positive investor relations.

The financial world is increasingly integrating ESG criteria into lending and investment decisions. For instance, by the end of 2024, over 70% of institutional investors surveyed by PwC indicated they would increase their ESG-focused investments in the coming year, highlighting a significant trend Essent must address.

The increasing emphasis on sustainable finance and green lending is reshaping the financial landscape, potentially impacting Essent's operations. As lenders and investors prioritize environmental, social, and governance (ESG) factors, mortgage products, including those with Private Mortgage Insurance (PMI), could see indirect influences if they support energy-efficient or environmentally resilient properties. For instance, the global sustainable finance market reached an estimated $3.2 trillion in 2023, signaling a strong trend towards ESG-aligned investments.

Essent should proactively assess how its PMI offerings can align with this growing demand for green financing. This could involve exploring partnerships or product adjustments that support mortgages for homes with high energy efficiency ratings or those located in communities actively pursuing sustainability goals. The European Central Bank's recent stress tests, which incorporated climate-related risks, highlight the growing regulatory scrutiny on financial institutions' ESG integration, a trend likely to continue and expand globally.

Regulatory Focus on Climate-Related Financial Risk

Regulators globally, including those in the United States, are intensifying their scrutiny of climate-related financial risks, viewing them as systemic threats. For instance, the U.S. Securities and Exchange Commission (SEC) has been developing rules around climate-related disclosures, aiming for greater transparency from companies about their environmental impact and associated risks. This regulatory shift means Essent, as a financial institution, must proactively enhance its risk management to incorporate climate scenarios and potential impacts on its portfolio.

The evolving landscape could introduce new mandates for financial entities, such as insurers, requiring them to rigorously assess, manage, and report their exposure to climate change impacts. This might involve detailed analysis of physical risks (like extreme weather events) and transition risks (associated with shifting to a lower-carbon economy). Essent will likely need to adapt its existing risk management frameworks to align with these emerging regulatory expectations, potentially investing in new data analytics and reporting capabilities.

- Increased Disclosure Requirements: Expect more stringent rules on reporting climate-related financial risks, similar to proposals by the SEC for public companies.

- Enhanced Risk Management Frameworks: Essent may need to integrate climate risk assessment into its core risk management processes, covering underwriting, investments, and operations.

- Capital and Solvency Considerations: Regulators may begin to consider climate risk in capital adequacy assessments for insurers, potentially impacting Essent's capital planning.

- Focus on Transition Risk: Beyond physical damage, regulators will likely push for analysis of risks arising from the shift to a low-carbon economy, affecting asset values and liabilities.

Water Scarcity and Land Use Changes

Water scarcity is becoming a significant concern, particularly in arid and semi-arid regions. For instance, by 2025, it's projected that 1.8 billion people will experience severe water scarcity, according to the World Health Organization. This can directly impact housing development by limiting water availability for construction and ongoing residential use, potentially decreasing property values in affected areas.

Changes in land use, driven by factors like urban sprawl and agricultural demands, also reshape housing markets. In the US, urban and built-up areas expanded by 1.5% between 2010 and 2020, reaching 64.1 million acres. This shift can lead to increased competition for land, driving up development costs and potentially impacting the affordability and desirability of new housing projects, thereby influencing Essent's portfolio.

These long-term environmental trends, while not immediate disasters, can subtly alter the risk profile of Essent's real estate investments.

- Water Scarcity: Projections indicate widespread water stress, impacting regions where housing development is planned.

- Land Use Changes: Urbanization and agricultural needs are altering land availability and cost for housing.

- Property Value Impact: Environmental constraints can reduce the long-term viability and desirability of certain housing markets.

- Portfolio Risk: These factors contribute to a nuanced, long-term risk assessment for Essent's housing-related assets.

Environmental factors pose significant risks and opportunities for Essent. The increasing frequency of extreme weather events, like those seen in 2024 with billions in insured losses globally, directly impacts property values and increases the likelihood of mortgage defaults. Essent must integrate these evolving climate risks into its underwriting and risk management to accurately price policies.

The growing demand for sustainable finance, with the global market reaching $3.2 trillion in 2023, means Essent should consider aligning its offerings with green lending trends. Regulatory scrutiny on climate-related financial risks is also intensifying, as evidenced by the SEC's proposed climate disclosure rules, requiring enhanced risk management and reporting from financial institutions like Essent.

Longer-term environmental shifts, such as water scarcity, which is projected to affect 1.8 billion people by 2025, and changing land use patterns, like the 1.5% expansion of US urban areas between 2010 and 2020, can subtly alter the risk profile of housing markets and Essent's portfolio.

| Environmental Factor | Impact on Essent | Relevant Data/Projections (2024-2025) |

|---|---|---|

| Extreme Weather Events | Increased property damage, higher claim frequency, potential borrower defaults. | Global insured losses from natural disasters projected in tens of billions of dollars (2024). |

| Climate-Related Financial Risk Scrutiny | Need for enhanced risk management, disclosure, and potential capital adequacy adjustments. | SEC developing climate-related disclosure rules; over 70% of institutional investors increasing ESG investments (PwC survey, 2024). |

| Sustainable Finance Growth | Opportunity to align PMI with green lending; potential for product innovation. | Global sustainable finance market reached $3.2 trillion (2023). |

| Water Scarcity | Reduced housing development viability and property values in affected regions. | 1.8 billion people projected to experience severe water scarcity by 2025 (WHO). |

| Land Use Changes | Increased development costs and potential impact on housing affordability and desirability. | US urban and built-up areas expanded by 1.5% between 2010-2020. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Essent is meticulously crafted using data from official government publications, reputable financial institutions, and leading market research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in accurate and current information.