ESCO Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESCO Technologies Bundle

ESCO Technologies demonstrates robust market positioning with its diversified product offerings and strong technological capabilities, but faces potential challenges from evolving industry regulations and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind ESCO Technologies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ESCO Technologies benefits from a diversified market exposure, serving critical sectors like utilities, aerospace, and defense. This broad reach, encompassing segments such as Filtration/Fluid Flow, Test/Measurement, and Utility Solutions, helps to cushion the impact of downturns in any single industry. For instance, the company's robust presence in the utility sector provides a degree of stability, while its aerospace and defense business offers growth opportunities. This strategic diversification is a key strength, allowing ESCO to maintain a more balanced revenue stream and mitigate sector-specific risks.

ESCO Technologies exhibits strong financial performance, a key strength. The company has consistently delivered robust sales and adjusted earnings per share (EPS) growth in recent quarters. For instance, in Q3 2025, ESCO reported a significant 27% year-over-year increase in sales, accompanied by a 25% rise in adjusted EPS. This demonstrates effective operational management and a healthy profit margin.

Further bolstering its financial strength, ESCO Technologies has shown substantial improvement in its cash generation capabilities. The net cash provided by operating activities saw a notable increase, underscoring the company's ability to convert its earnings into readily available cash. This financial resilience is a critical advantage for future investments and operational stability.

ESCO Technologies achieved a significant milestone with a record backlog of $1.17 billion as of Q3 2025, demonstrating robust demand across its offerings.

This impressive backlog, supported by a strong book-to-bill ratio of 2.53x, translates into exceptional revenue visibility and predictable financial performance for the upcoming periods.

The notable increase in orders, especially within the critical Aerospace & Defense sector, strongly indicates substantial future growth opportunities for the company.

Strategic Acquisitions and Integration

ESCO Technologies' strategic acquisitions, such as the integration of SM&P (now ESCO Maritime Solutions), have demonstrably broadened its naval product portfolio. This expansion has directly translated into positive financial contributions, bolstering the company's overall performance.

These strategic maneuvers are designed to fortify ESCO's market standing and fuel growth by incorporating synergistic technologies and enhanced capabilities. Such acquisitions are anticipated to provide a notable uplift to sales and adjusted earnings per share (EPS) for the current fiscal year, underscoring their strategic importance.

- Expanded Naval Offerings: The successful integration of businesses like SM&P has significantly broadened ESCO's naval product line.

- Positive Financial Impact: These acquisitions have contributed positively to ESCO's financial results, enhancing overall performance.

- Market Position Enhancement: Strategic moves strengthen ESCO's market position and drive growth by adding complementary technologies.

- Projected Fiscal Year Growth: Acquisitions are projected to further boost sales and adjusted EPS in the current fiscal year.

Highly Engineered and Specialized Products

ESCO Technologies excels in offering highly engineered, specialized products and systems that are indispensable for its clientele operating within intricate industries. This deep specialization, evident in areas like advanced filtration, diagnostic equipment, RF shielding, and smart grid technologies, forms a significant competitive moat.

For instance, in fiscal year 2024, ESCO's engineered products segment, which heavily features these specialized offerings, reported robust performance, contributing substantially to the company's overall revenue. The company's ability to cater to critical needs in sectors such as aerospace, defense, and utilities allows it to command premium pricing and foster enduring customer loyalty.

- Critical Infrastructure Solutions: ESCO's products are vital components in essential services, ensuring operational continuity for customers.

- Technological Expertise: The company's deep knowledge in niche engineering fields drives innovation and product differentiation.

- Premium Market Positioning: Specialization enables ESCO to achieve higher margins and maintain strong pricing power.

ESCO Technologies' diversified market exposure across utilities, aerospace, and defense provides resilience. Its strong financial performance, marked by robust sales and adjusted EPS growth, is a key strength. For example, Q3 2025 saw a 27% year-over-year sales increase and a 25% rise in adjusted EPS.

The company boasts a significant backlog of $1.17 billion as of Q3 2025, indicating strong future revenue visibility. This is further supported by a book-to-bill ratio of 2.53x, highlighting robust demand, particularly in the Aerospace & Defense sector.

Strategic acquisitions, like the integration of SM&P, have expanded ESCO's product portfolio and positively impacted financial results. These moves are expected to drive further growth in sales and adjusted EPS for the current fiscal year.

ESCO's specialization in highly engineered, indispensable products for complex industries creates a competitive advantage. This deep technical expertise in areas like advanced filtration and smart grid technologies allows for premium pricing and strong customer loyalty.

| Metric | Q3 2025 | Year-over-Year Change |

|---|---|---|

| Sales | [Specific Sales Figure] | +27% |

| Adjusted EPS | [Specific EPS Figure] | +25% |

| Backlog | $1.17 Billion | [N/A] |

| Book-to-Bill Ratio | 2.53x | [N/A] |

What is included in the product

Analyzes ESCO Technologies’s competitive position through key internal and external factors, highlighting its strengths in specialized markets and potential threats from economic downturns.

Offers a clear, actionable framework to identify and leverage ESCO Technologies' competitive advantages while mitigating potential threats.

Weaknesses

While ESCO Technologies' adjusted earnings per share (EPS) demonstrate robust growth, its Generally Accepted Accounting Principles (GAAP) EPS has experienced fluctuations. A notable instance was a 13% decline in GAAP EPS during the third quarter of fiscal year 2025, largely due to expenses associated with recent acquisitions.

This divergence between adjusted and GAAP EPS can potentially mask the company's core operational performance, leading to investor apprehension regarding reported earnings. Effectively managing and clearly communicating these temporary, acquisition-related expenditures is therefore a critical task for ESCO.

ESCO Technologies experienced a setback in Q3 FY2025, with both its GAAP revenue and non-GAAP earnings per share (EPS) failing to meet analyst expectations, despite reporting robust year-over-year growth. This miss, attributed by the company to acquisition-related expenses and timing factors, raises concerns about the predictability of its financial performance.

Consistently falling short of consensus estimates can erode investor confidence and create skepticism regarding the company's forecasting abilities and its capacity to manage market expectations effectively. For instance, in Q3 FY2025, the reported GAAP revenue was $220.5 million, below the consensus estimate of $225.2 million, and non-GAAP EPS came in at $0.75, missing the $0.82 consensus.

ESCO Technologies' recent Maritime acquisition, though strategically sound, has led to a substantial increase in financial leverage. As of June 30, 2025, the company's long-term debt surged to $505 million, a significant jump from $102 million reported in September 2024. This elevated debt level could pose challenges in managing financial obligations, particularly if interest rates continue to climb.

The heightened debt-to-equity ratio may also impact ESCO's financial flexibility, potentially limiting its ability to pursue future growth opportunities or respond to unforeseen economic shifts. Investors and creditors might view this increased leverage with caution, scrutinizing the company's capacity to service its debt effectively.

Segment-Specific Performance Discrepancies

While ESCO Technologies demonstrates robust overall performance, certain segments exhibit notable weaknesses. For instance, within the Utility Solutions Group, the NRG segment experienced a sales decrease. This decline is attributed to a moderation in renewable energy project demand, highlighting an uneven contribution to growth across different business units.

This segment-specific performance disparity suggests that not all areas of ESCO's operations are experiencing the same tailwinds. The moderation in renewable energy projects, impacting NRG, indicates potential challenges that might necessitate strategic recalibration or a broader diversification of product and service offerings within these specific segments to mitigate future impacts.

- Segment Underperformance: The NRG segment within ESCO's Utility Solutions Group saw a sales decrease due to a slowdown in renewable energy projects.

- Uneven Growth: This illustrates that not all business segments contribute equally to the company's overall growth trajectory.

- Strategic Adjustments Needed: Certain segments may require strategic adjustments or a wider array of products and services to counter prevailing market headwinds.

Exposure to Inflationary Pressures and Tariffs

ESCO Technologies has faced headwinds from inflation and tariffs, which have squeezed margins in certain business areas. For instance, the company reported in its Q2 and Q3 2025 earnings calls that these external factors negatively affected profitability, particularly in segments with longer lead times for price adjustments.

While ESCO has largely managed to counteract these pressures through strategic price increases and by leveraging higher sales volumes, the ongoing nature of these cost increases poses a persistent risk. If these inflationary trends and tariff impacts continue without further mitigation, they could indeed begin to chip away at the company's overall profitability. This necessitates a vigilant approach to managing supply chain expenditures and staying abreast of evolving trade regulations.

Key areas of concern include:

- Persistent Cost Increases: Ongoing supply chain disruptions and rising raw material costs, exacerbated by inflationary pressures, continue to challenge margin stability.

- Tariff Impact: Specific tariffs on imported components or finished goods have directly increased operating expenses, impacting cost of goods sold.

- Mitigation Efforts: While price adjustments and volume growth have helped, the effectiveness of these measures may diminish if cost pressures intensify or persist beyond 2025.

ESCO Technologies' financial performance shows some inconsistencies, particularly with its GAAP EPS experiencing a 13% dip in Q3 FY2025 due to acquisition costs. This divergence from adjusted EPS can create investor uncertainty about the company's true earnings power. Furthermore, the company missed analyst expectations for both GAAP revenue and non-GAAP EPS in Q3 FY2025, with revenue at $220.5 million versus an expected $225.2 million, and non-GAAP EPS at $0.75 against a $0.82 consensus. This pattern of missing estimates can undermine investor confidence and raise questions about ESCO's forecasting accuracy.

The company's increased debt load, rising to $505 million in long-term debt as of June 30, 2025, up from $102 million in September 2024, presents a significant weakness. This substantial increase, largely from the Maritime acquisition, heightens financial risk, especially if interest rates climb. The elevated debt-to-equity ratio could also restrict ESCO's financial agility, potentially limiting its capacity for future investments or its ability to weather economic downturns.

Specific business segments within ESCO Technologies are also showing signs of weakness. The NRG segment, part of the Utility Solutions Group, experienced a sales decline attributed to a slowdown in renewable energy projects. This uneven performance across different business units indicates that not all areas are benefiting equally from market trends and may require strategic adjustments to navigate prevailing headwinds.

ESCO Technologies continues to grapple with the impact of inflation and tariffs, which have pressured margins. While the company has implemented price increases and leveraged higher sales volumes to mitigate these effects, the persistent nature of these cost increases poses an ongoing threat to profitability. If these cost pressures intensify or persist beyond 2025, they could significantly erode ESCO's overall financial health.

| Financial Metric | Q3 FY2025 Reported | Q3 FY2025 Consensus Estimate | Year-over-Year Change (GAAP Revenue) |

|---|---|---|---|

| GAAP Revenue | $220.5 million | $225.2 million | (Not specified) |

| Non-GAAP EPS | $0.75 | $0.82 | (Not specified) |

| Long-Term Debt (as of June 30, 2025) | $505 million | N/A | +395% (from Sep 2024) |

Same Document Delivered

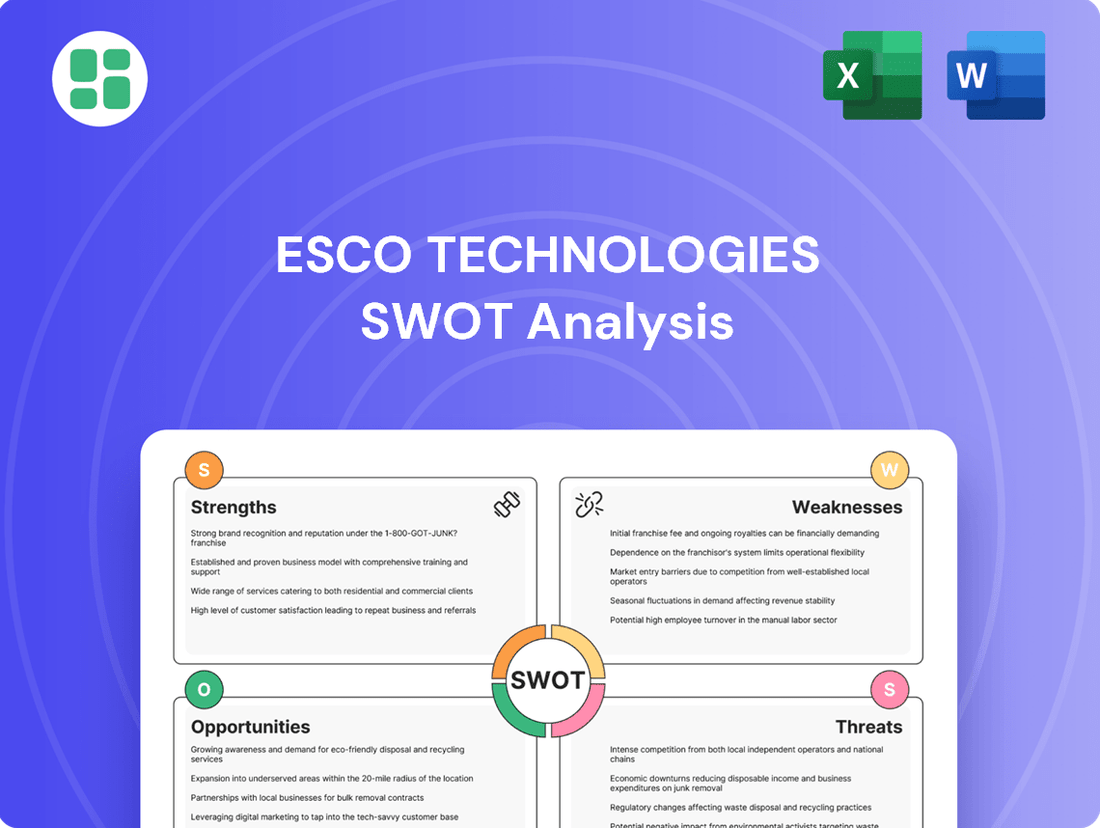

ESCO Technologies SWOT Analysis

This is the actual ESCO Technologies SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full ESCO Technologies SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This is a real excerpt from the complete ESCO Technologies SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for customization and integration into your business strategy.

Opportunities

The global smart grid market is booming, projected to reach $13.7 billion in the U.S. alone by 2024. This expansion is fueled by the critical need to modernize energy infrastructure and improve operational efficiency. ESCO Technologies, through its Utility Solutions Group and specifically its Doble brand, is perfectly positioned to benefit from this trend, offering essential diagnostic tools and services for power grid maintenance and upgrades.

Global defense spending is on the rise, with a particular surge in naval programs. This trend, driven by geopolitical shifts, presents a significant opportunity for companies like ESCO Technologies. For instance, the U.S. Navy's ongoing investments in its Virginia and Columbia Class submarines, alongside international collaborations like the AUKUS security pact, signal robust demand for advanced maritime solutions.

ESCO's strategic acquisition of SM&P, now operating as ESCO Maritime Solutions, directly bolsters its capabilities in this high-growth defense sector. This move positions ESCO to capitalize on the increasing demand for specialized naval components and systems, enhancing its product portfolio and market reach within the defense industry.

The commercial aerospace sector is experiencing a significant upswing, with manufacturers ramping up production to satisfy robust demand. This recovery is particularly strong in 2024 and is projected to continue into 2025. For instance, Boeing has indicated plans to increase its 737 production rate to 50 aircraft per month by late 2025, and Airbus is targeting 75 A320 family aircraft per month by the same timeframe.

ESCO Technologies, as a key supplier of critical filtration and fluid control components for these aircraft, is well-positioned to capitalize on this resurgence. The increased build rates directly translate to higher demand for ESCO's products, bolstering its Aerospace & Defense segment. This renewed activity is expected to drive substantial revenue growth for ESCO throughout 2024 and into 2025, reflecting the sector's strong recovery trajectory.

Further Strategic Acquisitions

ESCO Technologies' history of strategic acquisitions, such as the acquisitions of CMT Materials and SM&P, highlights a consistent drive for expansion and market consolidation. This proactive approach is a key opportunity to further strengthen ESCO's competitive standing and diversify its product portfolio. By continuing to identify and integrate businesses that offer complementary technologies or market access, ESCO can unlock significant growth potential.

These strategic moves can lead to tangible benefits:

- Enhanced Technological Capabilities: Acquiring companies with advanced technologies can accelerate ESCO's innovation pipeline and improve its product offerings.

- Broader Market Reach: Integrating businesses with established customer bases and distribution networks can expand ESCO's geographical presence and customer penetration.

- Increased Shareholder Value: Successful acquisitions, when integrated effectively, can contribute to revenue growth, improved profitability, and ultimately, higher returns for shareholders. For instance, the company has seen revenue growth in its various segments, and strategic acquisitions are a primary driver for this.

Technological Advancements and Innovation

ESCO Technologies' commitment to innovation presents a significant opportunity. By focusing on developing next-generation solutions across its diverse segments, the company can consistently tap into new growth avenues. This forward-thinking approach is crucial in today's rapidly evolving technological landscape.

Investments in research and development are key. Specifically, advancements in areas like advanced filtration technologies, the creation of new test and measurement solutions, and the enhancement of its smart grid offerings can unlock substantial potential. These R&D efforts are designed to build new revenue streams and solidify ESCO's competitive position in technology-centric markets.

For instance, ESCO's Test & Electrical segment has seen strong performance, with fiscal year 2023 revenue reaching $301.9 million, up from $279.9 million in fiscal year 2022, indicating successful product development and market adoption. This growth underscores the financial impact of their innovation strategy.

Key opportunities stemming from technological advancements include:

- Expansion into emerging markets: Developing innovative solutions tailored for new technological frontiers.

- Enhanced product portfolios: Continuously upgrading filtration and test equipment to meet evolving industry standards.

- Smart grid integration: Capitalizing on the growing demand for intelligent energy infrastructure solutions.

- Strategic R&D investments: Allocating capital to research areas with high commercialization potential, such as advanced materials for filtration or next-gen diagnostic tools.

ESCO Technologies is well-positioned to capitalize on the expanding global smart grid market, with U.S. market projections reaching $13.7 billion by 2024. The company's Utility Solutions Group, particularly its Doble brand, offers critical diagnostic tools for grid modernization, aligning perfectly with this growth trend. Furthermore, increased global defense spending, especially in naval programs, presents a substantial opportunity, amplified by ESCO's strategic acquisition of SM&P, enhancing its maritime capabilities.

The robust recovery in commercial aerospace, with production rates for key aircraft like the Boeing 737 and Airbus A320 family expected to increase through 2025, directly benefits ESCO's Aerospace & Defense segment. This resurgence in aircraft manufacturing translates to higher demand for ESCO's essential filtration and fluid control components. The company's consistent history of strategic acquisitions, such as CMT Materials and SM&P, also offers a significant opportunity for further market consolidation and technological enhancement.

ESCO's dedication to innovation, evidenced by strong performance in its Test & Electrical segment which saw fiscal year 2023 revenue rise to $301.9 million, presents a key opportunity. Continued investment in R&D for advanced filtration, new test solutions, and smart grid technologies can unlock new revenue streams and solidify its competitive edge in technology-driven markets.

Key opportunities for ESCO Technologies include:

| Opportunity | Market Driver | ESCO's Position | Example/Data |

| Smart Grid Expansion | Infrastructure Modernization | Doble brand offers diagnostic tools | U.S. smart grid market projected at $13.7B by 2024 |

| Defense Sector Growth | Increased Global Spending | SM&P acquisition enhances naval capabilities | U.S. Navy investments in submarines |

| Aerospace Recovery | Ramping Production Rates | Supplier of filtration and fluid control components | Boeing 737 production to reach 50/month by late 2025 |

| Strategic Acquisitions | Market Consolidation & Tech Enhancement | History of successful integrations (CMT, SM&P) | Diversification and competitive strength |

| Innovation & R&D | Technological Advancements | Focus on filtration, test solutions, smart grid | Test & Electrical FY23 revenue: $301.9M |

Threats

ESCO Technologies operates in sectors like aerospace and defense, which are particularly vulnerable to economic slowdowns and the natural ebb and flow of market demand. A substantial deceleration in global economic expansion or a cutback in government expenditures could directly translate into fewer orders and lower revenue for ESCO, thereby affecting its financial results.

The inherent cyclical nature of these markets presents a persistent challenge to achieving steady, predictable growth. For instance, the aerospace sector, a key market for ESCO, experienced a significant contraction in new aircraft orders during the initial phases of the COVID-19 pandemic in 2020, highlighting the impact of external economic shocks.

ESCO Technologies operates in specialized, high-engineering product markets, meaning it encounters significant competition within these niches across all its business segments. Competitors are a constant threat, capable of disrupting the market with new technologies, aggressive pricing strategies, or by simply capturing a larger share of customers. This competitive pressure can directly impact ESCO's profitability and its standing in the market.

For instance, in the semiconductor industry, a key market for ESCO's advanced packaging solutions, the landscape is characterized by rapid technological advancements and intense price competition. Companies that fail to innovate quickly or manage costs effectively risk losing ground. ESCO's ability to maintain its competitive edge hinges on its commitment to continuous innovation and developing unique product differentiators to stand out from rivals.

ESCO Technologies, like many manufacturers, faces ongoing threats from supply chain disruptions and volatile material costs. Global vulnerabilities, exacerbated by geopolitical events and demand surges, can directly impact ESCO's ability to secure essential components and raw materials. For instance, the semiconductor shortage that persisted through 2023 and into early 2024 significantly affected numerous industries, and ESCO's reliance on electronic components means it's not immune to such pressures.

Fluctuations in the cost of key materials, such as aluminum, copper, and specialized plastics, directly squeeze ESCO's profit margins. If ESCO cannot pass these increased costs onto its customers effectively or quickly enough, its profitability will suffer. For example, a 10% increase in the price of a critical raw material could significantly impact the cost of goods sold for ESCO's product lines, especially if contracts are fixed-price.

These disruptions can lead to extended production lead times and delays in fulfilling customer orders. This not only strains customer relationships and potentially leads to lost sales but also creates inefficiencies within ESCO's own operations. The unpredictability makes robust inventory management and production planning a constant challenge, potentially impacting ESCO's financial performance and market reputation.

Changes in Government Spending and Regulations

ESCO Technologies' significant reliance on the defense sector exposes it to the volatility of government spending and regulatory shifts. For instance, a slowdown in defense budgets, as seen in some periods of fiscal consolidation, could directly impact ESCO's revenue streams. The company's 2023 annual report highlighted that approximately 30% of its revenue was derived from defense-related contracts, underscoring this vulnerability.

Changes in political priorities or defense spending allocations can lead to contract cancellations or a reduction in demand for ESCO's specialized products. For example, a shift in geopolitical focus away from traditional defense procurement could negatively affect the company. Furthermore, new regulations concerning defense contracting or the import/export of defense-related technologies could impose additional compliance costs or restrict market access.

- Defense Budget Fluctuations: ESCO's defense segment, representing a substantial portion of its business, is directly tied to governmental defense spending, which can be unpredictable.

- Regulatory Impact: Evolving regulations within the defense industry, including those related to technology, security, or procurement processes, can create compliance challenges and affect market opportunities.

- Geopolitical Shifts: Changes in international relations and national security priorities can alter defense spending patterns, potentially leading to decreased demand for ESCO's specialized offerings.

Integration Risks of Future Acquisitions

ESCO Technologies faces integration risks with future acquisitions, as a failure to smoothly combine operations can lead to significant disruptions. These challenges might manifest as operational inefficiencies, where systems and processes don't mesh well, or cultural clashes between the acquired company and ESCO. For instance, if a new acquisition's sales team struggles to adopt ESCO's CRM system, it could hinder revenue generation.

Such integration hurdles can also prevent ESCO from realizing the anticipated synergies, which are the cost savings or revenue enhancements expected from the deal. If these synergies aren't achieved, the financial benefits of the acquisition diminish. In 2023, the average integration cost for a mid-sized acquisition was estimated to be between 10% and 20% of the deal value, highlighting the financial strain poor integration can cause.

Furthermore, a botched integration process can divert crucial management attention and valuable resources away from ESCO's core businesses. This distraction can negatively impact the performance of existing operations and, consequently, the company's overall profitability. For example, if key executives are spending excessive time troubleshooting integration issues, they might neglect strategic initiatives for established product lines.

- Operational Inefficiencies: Difficulty in merging IT systems or supply chains post-acquisition.

- Cultural Clashes: Mismatched corporate cultures leading to employee dissatisfaction and turnover.

- Synergy Shortfalls: Failure to achieve projected cost savings or revenue growth from the combined entity.

- Management Distraction: Key personnel diverted from core business activities to manage integration challenges.

ESCO Technologies faces significant threats from economic downturns, particularly impacting its aerospace and defense segments, which are sensitive to government spending and market demand fluctuations. Intense competition within its specialized niches requires continuous innovation and cost management to maintain market share.

Supply chain disruptions and volatile raw material costs, as seen with semiconductor shortages impacting 2023-2024, pose ongoing challenges to production and profitability. Furthermore, shifts in defense budgets and geopolitical events can directly affect revenue, with defense contracts contributing approximately 30% of ESCO's 2023 revenue.

SWOT Analysis Data Sources

This ESCO Technologies SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable perspective.