ESCO Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESCO Technologies Bundle

ESCO Technologies operates within a dynamic industrial landscape, where the intensity of competition and the power of suppliers significantly shape its strategic options. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping ESCO Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ESCO Technologies' reliance on highly specialized components, like advanced filtration membranes and precision electronic parts, grants its suppliers considerable bargaining power. The limited availability of equivalent substitutes for these unique inputs means suppliers can dictate terms, especially when ESCO has few alternative sourcing options.

Some suppliers for ESCO Technologies might wield significant power if they possess proprietary technology or unique intellectual property crucial for ESCO's product performance. For instance, if a key component relies on a patented innovation controlled by a single supplier, ESCO's ability to negotiate pricing or find alternatives becomes very limited.

This dependence on specialized, often patented, inputs directly translates into increased bargaining power for these suppliers. In 2023, ESCO Technologies reported a Cost of Goods Sold of $294.5 million, highlighting the substantial expenditure on raw materials and components where supplier power can have a direct impact on profitability.

The bargaining power of suppliers for ESCO Technologies is influenced by the availability of specialized inputs, particularly within sectors like utilities, aerospace, and defense. When there are only a few qualified suppliers for critical components or technologies, their leverage increases significantly.

A concentrated supplier base, where a small number of companies dominate the supply of a particular good or service, directly translates to greater individual power for each supplier. This limited competition among suppliers allows them to dictate pricing and terms more effectively, potentially impacting ESCO's cost structure and operational flexibility.

Supplier Power 4

The bargaining power of suppliers for ESCO Technologies is significant, largely due to high switching costs. When ESCO needs to change from one specialized supplier to another, it often incurs substantial expenses. These can include the costs associated with re-qualifying new suppliers, redesigning components to fit different specifications, and conducting extensive testing to ensure compliance with stringent industry standards.

These considerable switching costs directly limit ESCO's flexibility and, in turn, amplify the leverage held by its current suppliers. The deep integration of specialized components makes transitioning to a new vendor economically unappealing, solidifying the position of existing suppliers.

- High Switching Costs: ESCO faces significant expenses when changing specialized suppliers, including re-qualification, re-design, and compliance testing.

- Reduced Flexibility: These costs diminish ESCO's ability to easily switch suppliers, giving incumbent suppliers more power.

- Integration Investments: Prior investments in integrating supplier components make changing vendors financially burdensome.

Supplier Power 5

The cost of a supplier's input as a percentage of ESCO Technologies' total product cost significantly impacts supplier power. When critical components constitute a substantial portion of the final product's value, suppliers gain considerable leverage. This is especially evident in sectors like aerospace and defense, where high-value, performance-critical parts are essential. For instance, if a specialized electronic component makes up 30% of the cost of an ESCO defense system, that component's supplier holds substantial bargaining power.

ESCO Technologies' reliance on specialized, high-value components, particularly for its defense and aerospace segments, means suppliers of these critical parts can exert considerable influence. These suppliers often possess unique manufacturing capabilities or proprietary technology, making them difficult to substitute. In 2024, the increasing demand for advanced materials and specialized electronics in these sectors further amplified the bargaining power of their key suppliers, potentially leading to higher input costs for ESCO.

- Input Cost Percentage: The proportion of a supplier's input in ESCO's total product cost is a key determinant of supplier power.

- Critical Component Value: Suppliers of high-value, performance-critical parts, especially in aerospace and defense, possess greater leverage.

- Specialized Capabilities: Suppliers with unique manufacturing processes or proprietary technology often command stronger bargaining positions.

- Market Demand Influence: Rising demand for specialized components in key ESCO markets can strengthen supplier influence and potentially increase costs.

ESCO Technologies' suppliers of highly specialized components, particularly those with unique intellectual property or limited production capacity, hold significant bargaining power. This is exacerbated by high switching costs for ESCO, which include re-qualification, component redesign, and extensive testing, making it economically challenging to change vendors. For instance, in 2024, the demand for advanced filtration membranes and precision electronics in the aerospace and defense sectors, key markets for ESCO, intensified the leverage of their specialized suppliers.

| Factor | Impact on ESCO | Supporting Data/Context |

| Supplier Specialization | High Bargaining Power | Reliance on proprietary technology and unique manufacturing capabilities for critical components. |

| Switching Costs | Reduced ESCO Flexibility | Expenses for re-qualification, redesign, and compliance testing when changing suppliers. |

| Component Value Share | Increased Supplier Leverage | Critical components can represent a substantial portion of ESCO's product cost. |

| Market Dynamics (2024) | Amplified Supplier Power | Increased demand for specialized inputs in aerospace and defense sectors. |

What is included in the product

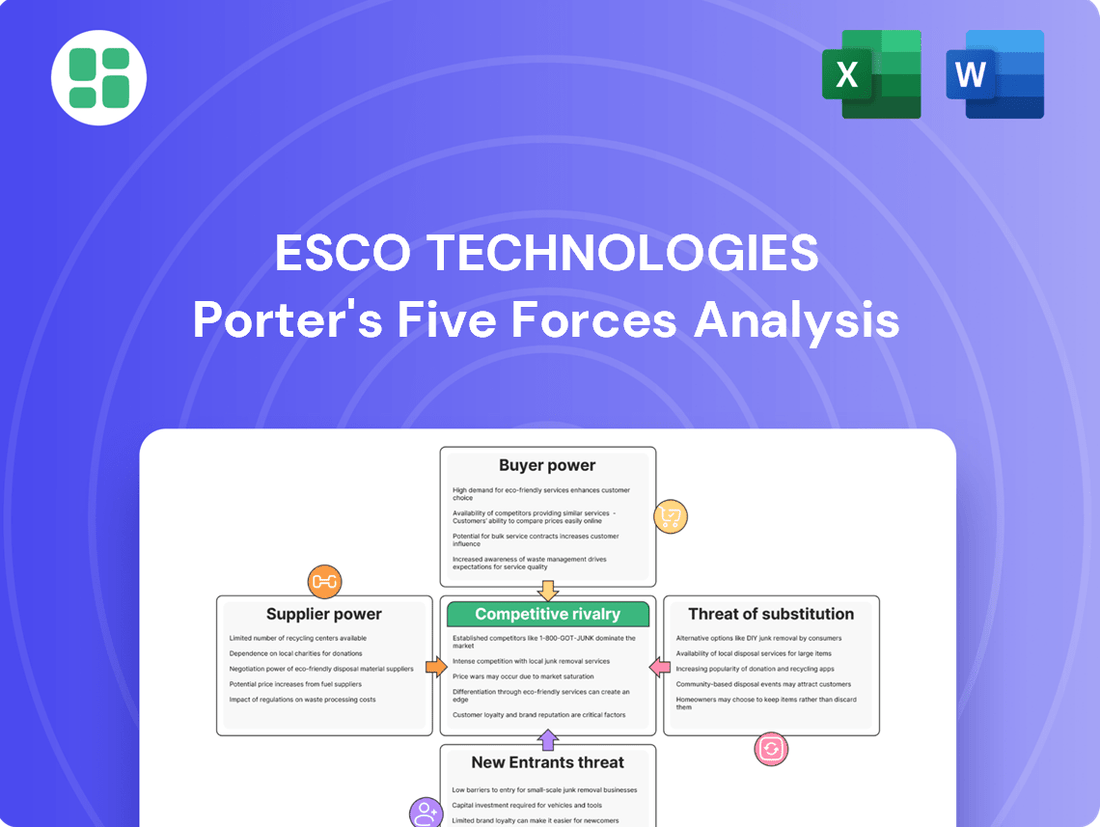

This analysis delves into the competitive forces impacting ESCO Technologies, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its markets.

Quickly identify and address competitive threats with a visual breakdown of ESCO Technologies' Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

ESCO Technologies' primary customers, such as large utility companies and major aerospace and defense contractors, are highly sophisticated entities with substantial procurement budgets. These powerful buyers, often consolidated in their industries, wield significant negotiating leverage due to the sheer volume of their purchases from ESCO.

This considerable purchasing power enables these customers to demand favorable terms, competitive pricing, and specific product customizations. For instance, in 2023, ESCO's Utility Solutions segment, which serves utility companies, represented a significant portion of its revenue, highlighting the importance of these large buyers.

While ESCO Technologies' products are highly engineered, customers still possess some bargaining power. This is because alternative options exist, including other specialized manufacturers and, for less critical components, the possibility of in-house development.

The market features multiple qualified suppliers for many of ESCO's offerings, which inherently reduces customer reliance on a single vendor. This competitive landscape enables buyers to effectively solicit and compare bids from various providers.

For instance, in the aerospace and defense sector, a key market for ESCO, customers often have a pre-qualified list of suppliers for critical components, allowing them to negotiate terms based on competitive pricing and delivery schedules. This dynamic limits ESCO's ability to unilaterally dictate terms.

For critical infrastructure solutions, like those ESCO Technologies provides for smart grids and aerospace, the cost and disruption of switching to a competitor are substantial. This significantly limits the bargaining power of these customers once they've integrated an ESCO system.

The long-term nature of these essential service relationships effectively locks customers in, further diminishing their ability to negotiate better terms due to the high switching costs involved.

Buyer Power 4

The bargaining power of customers for ESCO Technologies is influenced by the critical nature of its products. For instance, ESCO's components are vital for reliable power distribution and aircraft safety, making performance and dependability non-negotiable. This criticality can mitigate extreme price sensitivity, as customers prioritize guaranteed functionality for mission-critical systems.

However, customers still wield significant influence, particularly on larger contracts. They actively seek the optimal balance between cost and the high performance required for their essential operations. This often translates into price negotiations, especially when ESCO's products represent a substantial investment for the buyer.

- Criticality drives demand for reliability over pure cost savings.

- Customers, especially large ones, exert pricing pressure by balancing performance needs with budget constraints.

- ESCO's specialized products for sectors like aerospace and utilities mean customers often have fewer viable alternatives, somewhat tempering buyer power.

Buyer Power 5

The bargaining power of ESCO Technologies' customers is influenced by the degree of product differentiation. When ESCO provides highly engineered, unique solutions with superior performance, customer power diminishes, as alternatives are limited. For instance, in specialized aerospace components where ESCO’s technology is proprietary, buyers have less leverage.

Conversely, if some of ESCO's product lines become commoditized, meaning they have readily available, similar alternatives in the market, customer price sensitivity rises. This is particularly true for more standardized electrical transmission products where customers can more easily compare offerings and negotiate based on price. In 2023, ESCO reported that its Utility Solutions segment, which includes more standardized products, experienced competitive pricing pressures.

Customers often leverage standard specifications and industry certifications to drive down prices, especially when sourcing components for large infrastructure projects. This can be seen in procurement processes for utility companies where adherence to specific NEMA or ANSI standards allows for broader supplier competition. ESCO's ability to offer value beyond mere price, such as reliability and long-term support, becomes crucial in mitigating this buyer power.

- Product Differentiation: ESCO's engineered solutions reduce customer power when unique or superior.

- Commoditization: Increased customer price sensitivity arises when ESCO's offerings have close equivalents.

- Standard Specifications: Customers exploit standard industry specifications to negotiate lower prices.

- Market Competition: In 2023, the Utility Solutions segment faced competitive pricing, indicating customer leverage on standardized items.

ESCO Technologies' customers, particularly large utility companies and aerospace contractors, possess significant bargaining power due to their substantial order volumes and sophisticated procurement processes. These buyers can demand competitive pricing and specific terms, especially for less differentiated products. For instance, in 2023, ESCO's Utility Solutions, a segment serving utilities, contributed significantly to revenue, underscoring the importance of these large clients and their negotiating leverage.

While ESCO's highly engineered products can limit buyer power, the existence of alternative suppliers for many components means customers can often solicit bids from multiple qualified vendors. This competition allows buyers to negotiate favorable pricing and delivery schedules, particularly in sectors like aerospace where supplier lists are often pre-qualified. The ability to switch, though costly for critical infrastructure, remains a factor that tempers ESCO's pricing control.

| Factor | Impact on ESCO's Customer Bargaining Power | Example/Data Point |

|---|---|---|

| Customer Size & Volume | High | Large utility companies and aerospace contractors place substantial orders. |

| Product Differentiation | Low for standardized items, High for proprietary solutions | Utility Solutions segment faced competitive pricing in 2023; specialized aerospace components have fewer alternatives. |

| Availability of Alternatives | Moderate | Multiple qualified suppliers exist for many ESCO offerings. |

| Switching Costs | High for critical infrastructure | Integration of ESCO systems for smart grids or aircraft limits customer power due to disruption. |

Preview the Actual Deliverable

ESCO Technologies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details ESCO Technologies' competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive assessment provides critical insights into the strategic positioning and potential challenges faced by ESCO Technologies within its industry.

Rivalry Among Competitors

ESCO Technologies operates in specialized, high-tech sectors like utilities, aerospace, and defense, meaning competition is often fierce. These industries value advanced technology and innovation, driving companies to constantly outdo each other. For instance, in the aerospace sector, ESCO's competitors are often large, established players with significant R&D budgets, making technological advancement a key battleground for securing lucrative contracts.

ESCO Technologies operates in sectors with varying growth rates, influencing competitive rivalry. For instance, the renewable energy infrastructure segment, where ESCO has a presence, is experiencing robust growth, potentially mitigating intense head-to-head competition as the market expands.

However, in more mature segments, such as certain industrial filtration markets, ESCO might face heightened rivalry. Companies in these areas often compete on price and incremental product improvements. The pace of technological advancement is also a key driver; rapid innovation can intensify competition as firms strive to capture market share with new solutions.

ESCO Technologies operates in markets where it faces competition from both large, diversified industrial companies and smaller, specialized firms. This mix means ESCO must contend with rivals possessing broad resources as well as those with deep expertise in specific niches.

The competitive landscape is further intensified by well-funded competitors who invest heavily in research and development, giving them a technological edge. For instance, in the utility sector, where ESCO has a significant presence, major players are continuously innovating in areas like smart grid technology and advanced metering infrastructure.

Global reach and established distribution channels are critical differentiators. Competitors with extensive international networks and strong logistical capabilities can serve a wider customer base and respond more effectively to market demands, impacting ESCO's ability to capture market share.

Competitive Rivalry 4

Competitive rivalry is a significant factor for ESCO Technologies, where differentiation through highly engineered and customized solutions plays a crucial role. This focus on superior performance, reliability, and robust technical support helps ESCO sidestep intense price-based competition. Instead, the battleground shifts to unique product features, industry certifications, and the establishment of long-term service agreements.

ESCO's competitive edge is further bolstered by its strong intellectual property portfolio, which acts as a key differentiator in the market. This emphasis on innovation and specialized offerings allows ESCO to maintain its market position against competitors. For instance, in 2023, ESCO reported $563.5 million in revenue, showcasing its ability to thrive in a competitive landscape by offering specialized value.

- Product Differentiation: ESCO emphasizes highly engineered, customized solutions.

- Competitive Factors: Rivalry focuses on features, certifications, and service agreements, not just price.

- Intellectual Property: Strong IP acts as a significant competitive advantage.

- Market Performance: ESCO's 2023 revenue of $563.5 million demonstrates success in a competitive environment.

Competitive Rivalry 5

ESCO Technologies operates in markets characterized by high fixed costs, particularly in research and development, sophisticated manufacturing, and specialized equipment. For instance, in the filtration and fluid management sector, developing advanced filter media and precision manufacturing processes demands significant upfront investment. These substantial overheads incentivize companies to aggressively pursue sales and market share to ensure their facilities are operating at optimal capacity, thereby spreading these fixed costs over a larger production volume.

This dynamic intensifies competitive rivalry. Companies are often compelled to offer competitive pricing and invest heavily in market penetration strategies to maintain operational efficiency and profitability. For ESCO, this means a constant pressure to innovate and capture market demand to avoid being undercut by competitors who might be willing to operate on thinner margins to achieve economies of scale. In 2024, the capital expenditure for advanced manufacturing in ESCO's key segments remained a significant barrier to entry and a driver of existing firm competition.

- High fixed costs in R&D and manufacturing necessitate high capacity utilization.

- Companies may engage in aggressive sales tactics to spread overheads.

- This leads to intense price competition and pressure on profit margins.

- ESCO's industries require substantial capital investment, fostering rivalry among established players.

ESCO Technologies faces intense rivalry in its specialized, high-tech sectors, where innovation and technological advancement are paramount. Competitors range from large, well-funded industrial players to niche specialists, all vying for market share through superior product features, industry certifications, and service agreements.

The company's strategy of offering highly engineered, customized solutions and leveraging a strong intellectual property portfolio helps it differentiate from competitors, moving the competitive battleground beyond mere price. ESCO's 2023 revenue of $563.5 million underscores its success in navigating this competitive landscape.

High fixed costs in R&D and manufacturing compel companies in ESCO's operating segments to pursue market share aggressively to achieve economies of scale and spread overheads. This dynamic can lead to price competition, although ESCO's focus on specialized value propositions mitigates some of this pressure. Capital expenditures for advanced manufacturing in 2024 continue to be a significant factor in this rivalry.

| Competitive Factor | ESCO's Approach | Impact on Rivalry |

| Technological Advancement | Focus on innovation and R&D | Drives competition for market leadership |

| Product Differentiation | Highly engineered, customized solutions | Shifts competition from price to features and performance |

| Intellectual Property | Strong IP portfolio | Creates a barrier to entry and competitive advantage |

| Market Share Pursuit | Leveraging capacity to spread fixed costs | Can lead to price pressure, but specialization offers a buffer |

SSubstitutes Threaten

The primary threat of substitutes for ESCO's engineered products stems from alternative technologies that can perform similar functions through different means. For example, advancements in materials science or the proliferation of software-based solutions might eventually displace some of ESCO's physical filtration systems or diagnostic hardware. These emerging technologies often present distinct value propositions, potentially offering cost efficiencies or enhanced performance characteristics compared to ESCO's current offerings.

Customers, especially major defense contractors and utility companies, might choose to develop certain components internally if they have the in-house skills and resources. This make-or-buy consideration acts as a substitute threat, particularly for products that are more standardized and less unique. For instance, if a utility company can develop its own advanced metering infrastructure components at a lower cost or with greater customization, it reduces the need to purchase from ESCO Technologies.

The threat of substitutes for ESCO Technologies' highly engineered products is generally low, particularly for mission-critical applications where performance and reliability are paramount. However, for less demanding or non-mission-critical uses, lower-cost alternatives could emerge. For instance, if a customer prioritizes cost savings over peak performance in a non-essential component, simpler, less technologically advanced options might become attractive substitutes. This is a nuanced threat, as ESCO's value proposition often lies in specialized, high-performance solutions that are difficult to replicate with basic alternatives.

4

The threat of substitutes for ESCO Technologies is influenced by evolving regulations. For instance, new environmental mandates could accelerate the adoption of alternative fluid management technologies, potentially diminishing demand for ESCO's current product lines. Compliance costs associated with existing technologies might also push customers towards substitutes that offer a more streamlined regulatory pathway.

Consider the impact of shifts in industry standards. If new standards emerge that prioritize different performance metrics or material compositions, ESCO's existing solutions might become less competitive. For example, a move towards bio-based materials in certain applications could present a substitute threat if ESCO's offerings are heavily reliant on traditional petrochemicals. This dynamic was evident in the automotive sector where stricter emissions standards spurred innovation in alternative fuel systems, impacting traditional engine component suppliers.

- Regulatory Impact: New environmental regulations (e.g., related to emissions or material sourcing) can favor substitute technologies, potentially reducing demand for ESCO's current products.

- Compliance Costs: Increasing compliance burdens for existing ESCO technologies may drive customers to seek out alternative solutions with lower regulatory hurdles.

- Industry Standard Shifts: Changes in industry benchmarks or performance requirements could render ESCO's current offerings less attractive compared to emerging substitutes.

- Technological Obsolescence: Rapid advancements in substitute technologies, sometimes driven by regulatory pressures, pose a risk of making ESCO's established product lines obsolete.

5

The threat of substitutes for ESCO Technologies' products is moderate. While ESCO operates in specialized markets like fluid and thermal management, and electrical and electromagnetic products, substitutes can emerge from alternative technologies or different approaches to solving customer needs. For instance, in fluid control, advanced polymers or different sealing mechanisms could offer comparable performance at a lower cost or with added benefits like lighter weight.

The price-performance trade-off is a key driver here. If a substitute product provides similar functionality at a substantially lower price point, or offers superior performance without a significant cost increase, customers will naturally consider switching. For example, if a competitor develops a more efficient cooling system that requires less energy and maintenance than ESCO's offerings, it presents a direct challenge.

ESCO's customers are constantly assessing the overall value proposition. This includes not just the initial purchase price but also factors like installation ease, operational efficiency, and long-term reliability.

- Price-Performance: Substitutes offering comparable or better performance at a lower cost directly threaten ESCO's market share.

- Value Proposition: Customers evaluate substitutes based on total cost of ownership, including maintenance and operational efficiency.

- Technological Advancements: New materials or engineering approaches can create viable substitutes that challenge existing product lines.

The threat of substitutes for ESCO Technologies' specialized products is generally low to moderate, particularly in mission-critical applications where reliability and specific performance characteristics are essential. However, for less demanding applications, alternative technologies or even in-house development by customers can present a threat. For instance, if a customer can achieve similar functionality at a significantly lower cost through a different engineering approach or a simpler component, they may opt for the substitute.

The price-performance ratio is a critical factor. If a substitute offers comparable or superior performance with a lower total cost of ownership, including maintenance and operational efficiency, customers may switch. For example, in 2024, the increasing focus on energy efficiency across industries could drive demand for cooling solutions that consume less power than traditional systems, potentially impacting ESCO's current offerings if they are not optimized for energy savings.

Technological advancements and evolving industry standards also contribute to the threat of substitutes. New materials or innovative engineering approaches can create viable alternatives that challenge ESCO's established product lines. Regulatory shifts, such as new environmental mandates, can also accelerate the adoption of substitute technologies, potentially diminishing demand for ESCO's current products by increasing compliance costs for existing solutions.

| Factor | Impact on ESCO | Example Scenario |

|---|---|---|

| Price-Performance Trade-off | Moderate Threat | A competitor offers a fluid filtration system with 95% of ESCO's performance at 70% of the cost. |

| Technological Advancements | Low to Moderate Threat | Development of advanced composite materials reduces the need for ESCO's specialized metal components in certain aerospace applications. |

| Regulatory Changes | Moderate Threat | New emissions standards could favor alternative cooling technologies, impacting demand for ESCO's traditional thermal management solutions. |

| Customer In-house Development | Low Threat | A large utility company decides to develop its own advanced metering components, reducing its reliance on ESCO's specialized electrical products. |

Entrants Threaten

The threat of new entrants for ESCO Technologies is relatively low due to the significant capital required to enter its specialized markets. Entering the utility, aerospace, and defense sectors demands massive investments in R&D, advanced manufacturing facilities, and rigorous testing equipment, creating substantial upfront cost barriers.

The threat of new entrants for ESCO Technologies is relatively low due to significant barriers. ESCO's products often rely on proprietary technology, patents, and extensive engineering know-how built over many years. For instance, their specialized filtration and fluid handling systems require deep technical understanding and capital investment in R&D to replicate.

New competitors would face substantial hurdles in matching ESCO's established technological capabilities, demanding considerable time and financial resources for research and development. Intellectual property protection further complicates replication, making it difficult for newcomers to quickly gain a foothold in markets where ESCO operates, such as aerospace and defense.

The aerospace, defense, and utility sectors, where ESCO Technologies operates, are characterized by intense regulation. This means new companies must navigate a labyrinth of certifications, compliance requirements, and rigorous testing before their products can even be considered for market. For instance, obtaining Federal Aviation Administration (FAA) approval for aerospace components can take years and millions of dollars, a substantial deterrent for newcomers.

This lengthy and complex approval process acts as a significant barrier to entry. It ensures that only companies with the resources and commitment to meet high safety and reliability standards can compete. In 2024, the average time for new aerospace technology certification remained over 36 months, underscoring the ongoing challenge for potential entrants.

Threat of New Entrants 4

Established players like ESCO Technologies often hold a significant advantage due to their strong brand reputation and deep-rooted customer relationships. These long-standing connections, built over years of reliable service in demanding applications, create a substantial barrier for newcomers. For instance, ESCO's focus on mission-critical sectors means trust is paramount, a trust that is difficult and time-consuming to replicate.

The cost and time required to establish a comparable level of credibility and a loyal customer base present a considerable hurdle. New entrants must not only match product quality but also overcome the inertia of existing supplier relationships. This competitive moat, built on trust and proven performance, makes direct competition challenging for emerging companies.

Consider the capital investment needed to achieve ESCO's market position. While specific figures for ESCO's brand equity are not publicly itemized, the industry it operates in, particularly aerospace and defense, demands rigorous certifications and extensive testing. For example, in the aerospace sector, gaining approval for critical components can take years and millions of dollars, effectively deterring many potential entrants.

- Brand Reputation: ESCO's established name in specialized markets fosters customer loyalty.

- Customer Relationships: Long-term partnerships are difficult for new firms to penetrate.

- Track Record: Proven reliability in mission-critical applications builds a strong competitive moat.

- Barriers to Entry: The time and capital needed to build trust and market presence are substantial.

Threat of New Entrants 5

The threat of new entrants for ESCO Technologies is generally moderate due to its diversified structure across multiple segments like Filtration/Fluid Flow, Test/Measurement, and Utility Solutions. This diversification allows ESCO to achieve economies of scope and scale, leading to cost efficiencies in areas such as procurement, research and development, and sales. For instance, in 2023, ESCO reported net sales of $576.5 million, reflecting the scale of its operations.

Newer entrants, often starting with a narrower focus, may find it challenging to match these cost advantages. They might struggle to achieve similar purchasing power or spread R&D investments across a broad product portfolio, placing them at a competitive disadvantage from the outset. This broad operational base inherently creates efficiency barriers for those looking to enter ESCO's established markets.

- Economies of Scope: ESCO's presence in diverse segments allows for shared resources and knowledge, reducing costs per segment.

- Economies of Scale: Larger production volumes across its businesses lead to lower per-unit costs.

- Capital Requirements: Establishing operations comparable to ESCO's across multiple specialized sectors requires significant upfront investment, deterring smaller players.

- Brand Loyalty and Reputation: ESCO has built established relationships and a reputation for quality, which new entrants must overcome.

The threat of new entrants for ESCO Technologies is mitigated by substantial capital requirements and the need for specialized knowledge. Entering sectors like aerospace or defense necessitates significant investment in advanced manufacturing, research, and development, creating high upfront cost barriers. For instance, the average cost to develop and certify a new aerospace component in 2024 could easily run into millions of dollars, a deterrent for smaller players.

Proprietary technology, patents, and extensive engineering expertise further solidify ESCO's position. Replicating their specialized filtration and fluid handling systems, for example, requires deep technical understanding and considerable R&D investment. This intellectual property protection makes it difficult for newcomers to quickly establish a competitive presence.

Regulatory hurdles in ESCO's key markets, such as aerospace and utilities, also pose a significant barrier. Navigating stringent certifications and compliance requirements, like FAA approval which can take years and substantial funding, effectively deters many potential entrants. In 2024, the average time for new aerospace technology certification remained over 36 months, highlighting this challenge.

ESCO's established brand reputation and deep-rooted customer relationships, particularly in mission-critical sectors, are difficult for new firms to penetrate. Building comparable credibility and trust takes considerable time and financial resources, creating a substantial competitive moat. The company's 2023 net sales of $576.5 million underscore the scale of its operations and market penetration.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | High investment in R&D, advanced manufacturing, and testing. | Significant deterrent for smaller, less-funded companies. | Aerospace component certification costs: Millions of dollars. |

| Proprietary Technology & IP | Patented technologies and extensive engineering know-how. | Difficult for competitors to replicate ESCO's specialized solutions. | N/A (Proprietary information) |

| Regulatory Compliance | Navigating certifications and safety standards in key sectors. | Lengthy and costly approval processes create significant hurdles. | Aerospace tech certification time: Over 36 months. |

| Brand Reputation & Relationships | Established trust and long-term customer partnerships. | New entrants struggle to match ESCO's credibility and market access. | ESCO's 2023 Net Sales: $576.5 million. |

Porter's Five Forces Analysis Data Sources

Our ESCO Technologies Porter's Five Forces analysis is built on a foundation of comprehensive data, including annual reports, investor presentations, and industry-specific market research from reputable firms. We also incorporate insights from regulatory filings and financial news outlets to capture the full competitive landscape.