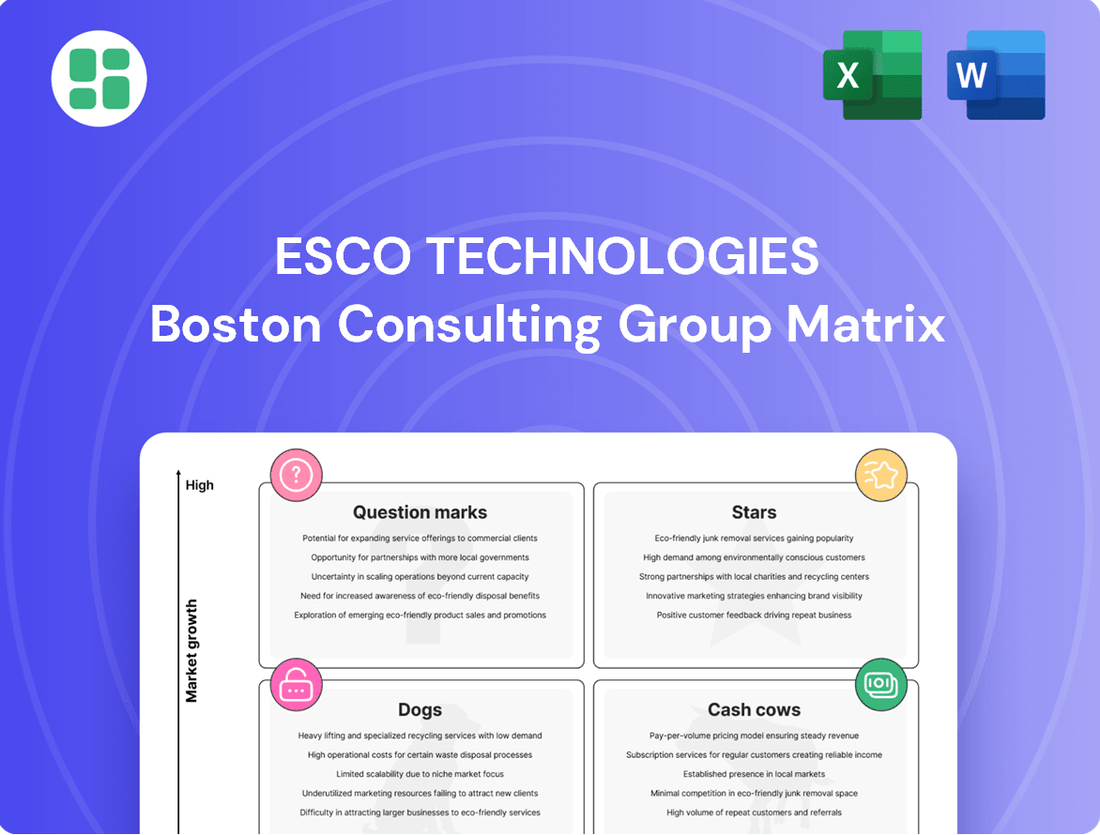

ESCO Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESCO Technologies Bundle

Curious about ESCO Technologies' product portfolio performance? This glimpse into their BCG Matrix highlights key areas of opportunity and potential challenges. To truly understand which products are driving growth, which are stable cash generators, and which require strategic re-evaluation, you need the complete picture.

Unlock the full strategic potential of ESCO Technologies by purchasing the complete BCG Matrix. This comprehensive report provides detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investment and product development strategies.

Don't miss out on the critical data that will shape your next strategic move. Acquire the full ESCO Technologies BCG Matrix today and gain the competitive clarity needed to navigate the market with confidence.

Stars

ESCO Technologies' naval platform content and solutions are a key growth driver, bolstered by the recent acquisition of ESCO Maritime Solutions. This strategic move positions ESCO to capitalize on rising defense budgets and the need for sophisticated power and signature management technologies in naval applications.

The impact of this segment is evident in ESCO's financial performance. In Q3 2025, sales from this area surged by an impressive 56%, with a particularly strong 200% increase in Navy-specific sales. This robust growth significantly contributed to the company's record backlog, underscoring the strategic importance and market demand for ESCO's naval offerings.

Commercial Aerospace Solutions represents a significant growth driver for ESCO Technologies. The company's specialized products, such as advanced filtration and fluid control systems, are experiencing robust demand within this sector. This strong performance is a key element in ESCO's overall market strategy.

The Aerospace & Defense segment, which encompasses commercial aerospace, demonstrated impressive financial growth. Sales within this segment saw a substantial increase of 21% in the first quarter of 2025 and a further 19% in the third quarter of 2025. These figures highlight both the expanding market opportunities and ESCO's effective positioning to capitalize on them.

Doble, a key player within ESCO Technologies' Utility Solutions Group, offers essential diagnostic tools and services vital for the ongoing modernization of power grids. This sector is seeing substantial expansion fueled by smart grid advancements and an increasing emphasis on grid reliability.

The demand for Doble's offerings is robust, as evidenced by a 12% sales increase in the first quarter of 2025. This growth underscores ESCO's strong market standing and the critical role Doble plays in supporting the evolving needs of the utility industry.

RF Test & Measurement for Emerging Technologies

ESCO Technologies is a dominant force in RF test and measurement systems, crucial for innovation in areas like 5G and advanced consumer electronics. This segment is experiencing significant traction.

The RF Test & Measurement for Emerging Technologies segment demonstrated robust performance, achieving a sales growth of 20.7% in Q3 2025. This growth underscores its strong market position within rapidly evolving technological landscapes.

- Market Leadership: ESCO holds a leading position in providing essential RF test and measurement solutions.

- Key Growth Driver: The segment experienced a substantial 20.7% sales increase in Q3 2025.

- Technological Relevance: Essential for R&D and compliance in fields like wireless communications and consumer electronics.

- Dynamic Environment: Operates successfully in a fast-paced, technologically advancing market.

Engineered Solutions for Renewable Energy

ESCO Technologies, through its NRG segment, is actively engaged in the high-growth renewable energy sector. This market is experiencing robust expansion, fueled by a global push towards sustainability and the necessary upgrades to energy infrastructure. ESCO's strategic emphasis on these lucrative, high-margin areas demonstrates a clear intent to capture a larger share of this critical industry.

The company's focus on renewable energy solutions aligns with significant market trends. For instance, global renewable energy capacity additions were projected to reach approximately 500 GW in 2024, a notable increase from previous years, underscoring the sector's dynamism. ESCO's positioning within this expanding market is a key element of its growth strategy.

- High-Growth Market: The renewable energy sector is a primary focus, benefiting from global sustainability initiatives.

- Strategic Focus: ESCO targets high-growth, high-margin end markets within renewables.

- Market Expansion: The company aims to increase its market share in this vital and expanding industry.

- Infrastructure Modernization: Renewables are a key component of global energy infrastructure upgrades.

The RF Test & Measurement for Emerging Technologies segment is a clear Star in ESCO Technologies' portfolio. It's a market leader, experiencing significant growth with a 20.7% sales increase in Q3 2025. This segment is vital for innovation in rapidly advancing fields like 5G and consumer electronics, demonstrating its strong technological relevance and dynamic market positioning.

What is included in the product

This BCG Matrix overview for ESCO Technologies analyzes each business unit's market share and growth potential to guide investment decisions.

Clear visualization of ESCO's business units, simplifying strategic decisions and resource allocation.

Cash Cows

ESCO Technologies' established filtration systems for industrial applications are a classic example of a Cash Cow. These products serve mature markets, meaning demand is steady and predictable, allowing ESCO to maintain a strong market position. For instance, in fiscal year 2023, ESCO's Filtration segment, which includes these industrial systems, reported a revenue of $321.1 million, demonstrating consistent performance.

The mature nature of these industrial applications means that significant investment in research and development or market expansion is often not required. This allows the filtration systems to generate substantial and consistent cash flow for ESCO. This reliable income stream can then be reinvested in other areas of the business, such as their Stars or Question Marks, to fuel future growth.

ESCO Technologies' Legacy Utility Grid Monitoring Services, housed within its Utility Solutions Group, represent a classic cash cow. This segment focuses on providing essential, ongoing services and traditional monitoring equipment vital for the upkeep of established electrical grids. The market for these services is mature, meaning growth is modest but predictable, leading to consistent, recurring revenue streams.

These operations demand minimal new investment for growth, allowing them to generate reliable cash flow. This is largely due to the critical nature of grid maintenance and a deeply entrenched, loyal customer base that relies on these established solutions. For instance, in fiscal year 2024, ESCO Technologies reported that its Utility Solutions Group, which includes these services, continued to be a significant contributor to the company's overall profitability, demonstrating the enduring value of this mature business.

ESCO Technologies' standard RF shielding products represent a classic cash cow. As an established leader, these foundational offerings hold a significant market share in mature industries, generating consistent profits and reliable cash flow without requiring substantial investment in new development or aggressive marketing campaigns.

Routine Maintenance and Spares for Aerospace & Defense

ESCO Technologies' routine maintenance and spares for Aerospace & Defense are a classic cash cow. This segment focuses on keeping existing aircraft and defense systems operational, rather than developing new ones.

This business is characterized by steady demand and high profitability. Airlines and defense departments need to maintain their fleets, creating a consistent revenue stream for ESCO. In the fiscal year 2023, ESCO's Aerospace segment, which heavily includes these MRO components, reported significant contributions to the company's overall performance.

- Stable Demand: The need for maintenance and spare parts is ongoing for a mature installed base, ensuring predictable revenue.

- High Margins: Specialized components and services for aerospace and defense typically command strong profit margins.

- Cash Flow Generation: This segment reliably generates cash, supporting other business areas or investments.

- Mature Market: While not experiencing rapid growth, it benefits from the established presence of aircraft and defense platforms.

Precision-Machined Components for Long-Cycle Programs

ESCO Technologies' precision-machined components for long-cycle programs, particularly within the defense and industrial sectors, represent a classic Cash Cow. These highly specialized parts, once integrated into complex systems, benefit from extended product lifecycles and consistent demand. For instance, ESCO's work in aerospace and defense often involves components with qualification periods that can last years, ensuring a stable revenue base.

While these markets may not exhibit rapid growth, the specialized nature of the components and the high barriers to entry—often involving stringent quality certifications and established relationships—translate into strong profit margins. This predictable revenue stream, coupled with the established market position, allows ESCO to generate significant cash flow without substantial reinvestment.

- Sustained Demand: Components for long-cycle programs in defense and industrial applications typically experience consistent demand over many years once qualified.

- High Profitability: Specialized manufacturing processes and high barriers to entry contribute to robust profit margins for these components.

- Predictable Revenue: The established nature of these programs provides ESCO with reliable and predictable revenue streams.

- Low Reinvestment Needs: Cash cows require minimal capital expenditure to maintain their market position, freeing up cash for other business areas.

ESCO Technologies' established filtration systems for industrial applications are a classic example of a Cash Cow. These products serve mature markets, meaning demand is steady and predictable, allowing ESCO to maintain a strong market position. For instance, in fiscal year 2023, ESCO's Filtration segment, which includes these industrial systems, reported a revenue of $321.1 million, demonstrating consistent performance.

The mature nature of these industrial applications means that significant investment in research and development or market expansion is often not required. This allows the filtration systems to generate substantial and consistent cash flow for ESCO. This reliable income stream can then be reinvested in other areas of the business, such as their Stars or Question Marks, to fuel future growth.

ESCO Technologies' Legacy Utility Grid Monitoring Services, housed within its Utility Solutions Group, represent a classic cash cow. This segment focuses on providing essential, ongoing services and traditional monitoring equipment vital for the upkeep of established electrical grids. The market for these services is mature, meaning growth is modest but predictable, leading to consistent, recurring revenue streams.

These operations demand minimal new investment for growth, allowing them to generate reliable cash flow. This is largely due to the critical nature of grid maintenance and a deeply entrenched, loyal customer base that relies on these established solutions. For instance, in fiscal year 2024, ESCO Technologies reported that its Utility Solutions Group, which includes these services, continued to be a significant contributor to the company's overall profitability, demonstrating the enduring value of this mature business.

ESCO Technologies' standard RF shielding products represent a classic cash cow. As an established leader, these foundational offerings hold a significant market share in mature industries, generating consistent profits and reliable cash flow without requiring substantial investment in new development or aggressive marketing campaigns.

ESCO Technologies' routine maintenance and spares for Aerospace & Defense are a classic cash cow. This segment focuses on keeping existing aircraft and defense systems operational, rather than developing new ones.

This business is characterized by steady demand and high profitability. Airlines and defense departments need to maintain their fleets, creating a consistent revenue stream for ESCO. In the fiscal year 2023, ESCO's Aerospace segment, which heavily includes these MRO components, reported significant contributions to the company's overall performance.

- Stable Demand: The need for maintenance and spare parts is ongoing for a mature installed base, ensuring predictable revenue.

- High Margins: Specialized components and services for aerospace and defense typically command strong profit margins.

- Cash Flow Generation: This segment reliably generates cash, supporting other business areas or investments.

- Mature Market: While not experiencing rapid growth, it benefits from the established presence of aircraft and defense platforms.

ESCO Technologies' precision-machined components for long-cycle programs, particularly within the defense and industrial sectors, represent a classic Cash Cow. These highly specialized parts, once integrated into complex systems, benefit from extended product lifecycles and consistent demand. For instance, ESCO's work in aerospace and defense often involves components with qualification periods that can last years, ensuring a stable revenue base.

While these markets may not exhibit rapid growth, the specialized nature of the components and the high barriers to entry—often involving stringent quality certifications and established relationships—translate into strong profit margins. This predictable revenue stream, coupled with the established market position, allows ESCO to generate significant cash flow without substantial reinvestment.

- Sustained Demand: Components for long-cycle programs in defense and industrial applications typically experience consistent demand over many years once qualified.

- High Profitability: Specialized manufacturing processes and high barriers to entry contribute to robust profit margins for these components.

- Predictable Revenue: The established nature of these programs provides ESCO with reliable and predictable revenue streams.

- Low Reinvestment Needs: Cash cows require minimal capital expenditure to maintain their market position, freeing up cash for other business areas.

ESCO's established product lines in mature markets, such as certain industrial filtration systems and legacy utility grid monitoring services, function as significant cash cows for the company. These segments benefit from consistent demand and high profit margins due to their established market share and minimal reinvestment needs.

In fiscal year 2023, the Filtration segment generated $321.1 million in revenue, while the Utility Solutions Group, encompassing grid monitoring, also showed robust profitability in fiscal year 2024, underscoring their role as reliable cash generators.

These mature businesses provide a stable income stream that ESCO can strategically allocate to support growth initiatives in other business units, such as their Star or Question Mark segments.

The predictability of revenue from these cash cows allows for effective financial planning and resource allocation, reinforcing ESCO's overall financial stability and capacity for future investment.

| Business Segment | Product Type | Fiscal Year 2023 Revenue (Millions USD) | Fiscal Year 2024 Commentary | BCG Matrix Role |

|---|---|---|---|---|

| Filtration | Industrial Filtration Systems | $321.1 | Consistent performance | Cash Cow |

| Aerospace & Defense | Routine Maintenance & Spares | N/A (Significant contribution reported) | Significant contributions to overall performance | Cash Cow |

| Utility Solutions | Legacy Grid Monitoring Services | N/A (Significant contributor) | Continued significant contributor to profitability | Cash Cow |

| Industrial & Defense | Precision-Machined Components (Long-Cycle) | N/A (Stable revenue base) | Stable revenue base from long-cycle programs | Cash Cow |

Delivered as Shown

ESCO Technologies BCG Matrix

The ESCO Technologies BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready report designed for strategic decision-making.

Dogs

Certain niche industrial filtration products from ESCO Technologies might be positioned as Dogs in the BCG matrix. These are likely found in low-growth market segments where the company holds only a small market share, leading to minimal profitability. For instance, if a specific type of filter for an aging manufacturing process sees declining demand, its contribution to revenue could be negligible.

These underperforming niche products often demand significant investment in research, development, and specialized manufacturing without generating commensurate returns. In 2024, ESCO Technologies, like many industrial conglomerates, faces pressure to optimize its product portfolio. If these niche filtration lines are consuming resources that could be better allocated to high-growth areas, they become prime candidates for strategic review, potentially leading to divestiture if they don't align with future growth strategies or if their strategic importance is limited.

Commoditized fluid control devices, such as basic valves and fittings, often represent ESCO Technologies' Dogs in the BCG Matrix. These products typically operate in mature, highly competitive markets where differentiation is minimal, leading to low market share. For instance, the global industrial valves market, while substantial, is characterized by numerous players, many offering similar functionalities.

These commoditized offerings may struggle to achieve significant growth rates, often mirroring broader industrial output. In 2024, the industrial valve market is projected to grow at a modest CAGR of around 3-4%, reflecting this maturity. Consequently, these product lines might barely cover their costs, consuming capital without offering substantial strategic advantages or future growth potential for ESCO.

Older generations of test and measurement equipment, often referred to as legacy products, are increasingly finding themselves in the Dogs quadrant of the BCG Matrix. These models have been surpassed by newer, more advanced technologies, leading to declining demand and a consequently low market share. For instance, many companies are phasing out analog oscilloscopes in favor of digital ones, which offer superior performance and features.

These legacy products typically require ongoing support and maintenance, consuming resources without contributing meaningfully to overall growth or profitability. In 2024, the market for traditional analog test equipment continued its downward trend, with many manufacturers ceasing production. Companies still relying heavily on these outdated models may face higher operational costs and reduced competitiveness as the industry rapidly innovates.

Non-Core Industrial Shielding Applications

Non-core industrial shielding applications within ESCO Technologies' portfolio might represent a Dogs category in the BCG Matrix. These segments could be characterized by mature, low-growth markets where ESCO holds a relatively small market share due to intense competition from numerous players.

Such products may function as cash traps, consuming capital and management attention without generating significant profits or contributing to ESCO's long-term strategic advantage. For instance, if a particular industrial shielding product line operates in a sector experiencing minimal technological advancement and facing price pressures from lower-cost competitors, it would fit this profile.

- Low Market Growth: Certain general industrial shielding markets may exhibit sub-3% annual growth rates, limiting revenue expansion opportunities.

- Intense Competition: These segments often feature a fragmented competitive landscape with many smaller, specialized suppliers, eroding pricing power and ESCO's market share.

- Resource Drain: Investments in these areas might divert resources from higher-potential segments, potentially yielding low returns on investment.

Legacy Products in Declining Markets

Legacy products within ESCO Technologies that serve industries facing long-term decline would be classified as Dogs in the BCG Matrix. These offerings, while perhaps once significant, now contribute very little to the company's overall growth trajectory. For instance, products designed for older telecommunications infrastructure or specific types of industrial equipment that are being phased out would fit this description.

These "Dog" products represent a drain on resources that could be better allocated to more promising areas of the business. ESCO Technologies, like many established companies, must periodically evaluate these legacy assets. The strategy often involves either a phased discontinuation, allowing existing contracts to expire, or a complete divestment to another entity that might find value in them, freeing up capital and management focus.

Consider the impact of technological obsolescence. For example, if ESCO had a significant product line for dial-up modems, this would clearly be a Dog category. In 2024, the market for such technology is virtually non-existent. Companies must be vigilant in identifying these declining segments to avoid investing further in products with limited future potential.

- Legacy Products: Offerings tied to industries with diminishing demand, such as certain legacy power transmission components or outdated industrial automation systems.

- Market Decline: Industries experiencing a long-term contraction due to technological shifts or changing consumer preferences. For example, a decline in the demand for certain types of physical media manufacturing equipment.

- Resource Allocation: These products often require ongoing support and maintenance but generate minimal revenue, diverting resources from growth areas.

- Strategic Options: Potential strategies include discontinuation, divestment, or a minimal maintenance approach to maximize remaining value.

Dogs within ESCO Technologies' portfolio represent products in low-growth markets where the company has a small share, leading to minimal profitability and often requiring significant investment without commensurate returns. These could include commoditized fluid control devices or older generations of test and measurement equipment, which face intense competition and technological obsolescence.

In 2024, ESCO Technologies, like many industrial firms, is under pressure to optimize its product lines. Products categorized as Dogs, such as legacy shielding applications in mature markets with sub-3% growth, may divert resources from higher-potential segments, yielding low returns on investment and potentially necessitating divestiture.

These underperforming products, like those serving industries with diminishing demand or facing long-term contraction due to technological shifts, often require ongoing support but generate minimal revenue. Strategic options for these "Dogs" include discontinuation or divestment to free up capital and management focus, as seen with products tied to outdated industrial automation systems.

The global industrial valves market, for example, is projected to grow at a modest CAGR of around 3-4% in 2024, highlighting the maturity of such commoditized segments where ESCO might hold a low market share, making these products prime candidates for strategic review.

Question Marks

ESCO Technologies' next-generation smart grid solutions likely represent a significant investment area, positioning them as potential future market leaders. These innovative offerings, while currently capturing a smaller slice of the market, are operating within a rapidly expanding sector, indicating substantial growth potential.

The company's commitment to R&D and marketing for these advanced grid technologies is crucial for their transition from question marks to stars. For instance, the global smart grid market was valued at approximately $25.1 billion in 2023 and is projected to reach over $70 billion by 2030, showcasing the high growth trajectory.

ESCO Technologies, through its advanced composite offerings, is exploring novel applications in emerging sectors, potentially positioning these initiatives as Stars or Question Marks within the BCG framework. These ventures into non-traditional industries, such as advanced aerospace components or next-generation energy storage solutions, represent high-growth potential but currently hold a small market share. For instance, the global advanced composites market was valued at approximately $17.7 billion in 2023 and is projected to reach $30.2 billion by 2030, indicating a robust growth trajectory for materials like those ESCO produces.

The success of these advanced composite applications hinges on significant investment in research and development to prove their technical feasibility and market demand. ESCO's strategic focus on these areas suggests a proactive approach to capturing future market opportunities, even if initial market penetration is modest. The company's commitment to innovation in materials science is crucial for transforming these speculative ventures into market-leading positions.

ESCO Technologies' strategic push into untapped international utility markets positions them squarely in the Stars quadrant of the BCG Matrix. This move is driven by a clear objective to significantly expand their global footprint, targeting regions where their current market penetration is minimal but growth potential is substantial. For instance, emerging economies in Southeast Asia and Africa are showing increased demand for advanced grid infrastructure and smart metering solutions, areas where ESCO has proven expertise.

These new ventures, while promising, represent a significant undertaking. Establishing a presence in these diverse markets requires substantial capital investment for sales infrastructure, local partnerships, and adapting products to meet varying regulatory and technical standards. The competitive landscape can also be intense, with established local players and other international firms vying for market share. However, successfully navigating these challenges can lead to considerable long-term gains and solidify ESCO's position as a global leader in utility technology solutions.

Specialized Diagnostic Equipment for Emerging Energy Sources

ESCO Technologies' involvement in specialized diagnostic equipment for emerging energy sources, such as small modular reactors (SMRs) and advanced geothermal systems, positions them in nascent, high-growth markets. These areas demand significant investment in research and development, with ESCO actively working to establish its market presence and secure share.

The market for SMR diagnostic equipment, while still developing, is projected to see substantial growth. Analysts anticipate the global SMR market could reach tens of billions of dollars by the early 2030s, indicating a significant future opportunity for companies like ESCO that can provide critical testing and monitoring solutions.

- Nascent Market: Diagnostic equipment for very new energy sources like SMRs and advanced geothermal are in early stages of development and adoption.

- High Growth Potential: These niche markets are expected to experience rapid expansion as the underlying energy technologies mature and gain traction.

- R&D Intensive: Significant investment in research and development is required to create and refine diagnostic tools for these advanced and often complex systems.

- Market Share Building: ESCO is in a phase of building its presence and capturing market share in these emerging sectors.

Integration and Optimization of Acquired Technologies within Maritime Solutions

Within ESCO Technologies' Maritime Solutions, certain recently integrated or acquired technologies from the SM&P sector might be classified as question marks. These represent high-growth potential areas, but their market adoption and revenue generation are still developing, necessitating continued strategic investment to solidify their position.

For instance, a newly acquired AI-driven predictive maintenance system for vessel engines, while promising significant operational cost reductions for clients, may still be in its initial rollout phase. Its market share is currently low, but the industry's increasing focus on efficiency and uptime suggests a strong future growth trajectory. ESCO's commitment to optimizing these acquired assets is crucial for their transition from question marks to stars.

- High Growth Potential: Acquired technologies in early integration stages possess significant market potential, mirroring the overall strong growth of ESCO Maritime Solutions.

- Strategic Investment Needed: These question marks require focused capital and resource allocation to enhance market penetration and achieve competitive advantage.

- Market Penetration Challenges: Initial adoption rates for newly integrated technologies can be slow, demanding robust go-to-market strategies and customer education.

- Future Star Potential: Successful integration and optimization can transform these question marks into key revenue drivers and market leaders for ESCO.

ESCO Technologies' ventures into new energy diagnostics, like those for small modular reactors (SMRs) and advanced geothermal, are prime examples of Question Marks. These markets are in their infancy, demanding substantial R&D to prove viability and gain traction.

The global market for SMRs, while still developing, is projected to be a multi-billion dollar opportunity by the early 2030s, highlighting the significant growth potential for specialized diagnostic equipment. ESCO's current focus is on building its share in these nascent, high-growth sectors.

ESCO Technologies' smart grid solutions represent significant investment areas, positioning them as potential future market leaders. These innovative offerings, while currently capturing a smaller slice of the market, are operating within a rapidly expanding sector, indicating substantial growth potential.

The company's commitment to R&D and marketing for these advanced grid technologies is crucial for their transition from question marks to stars. For instance, the global smart grid market was valued at approximately $25.1 billion in 2023 and is projected to reach over $70 billion by 2030, showcasing the high growth trajectory.

| Business Area | BCG Category | Market Growth | Market Share | Strategic Focus |

| Smart Grid Solutions | Question Mark | High | Low | R&D, Market Expansion |

| Advanced Composites (New Applications) | Question Mark | High | Low | R&D, Market Proving |

| Emerging Energy Diagnostics (SMRs, Geothermal) | Question Mark | Very High | Very Low | R&D, Market Penetration |

| Maritime AI Predictive Maintenance | Question Mark | High | Low | Integration, Market Rollout |

BCG Matrix Data Sources

Our ESCO Technologies BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.