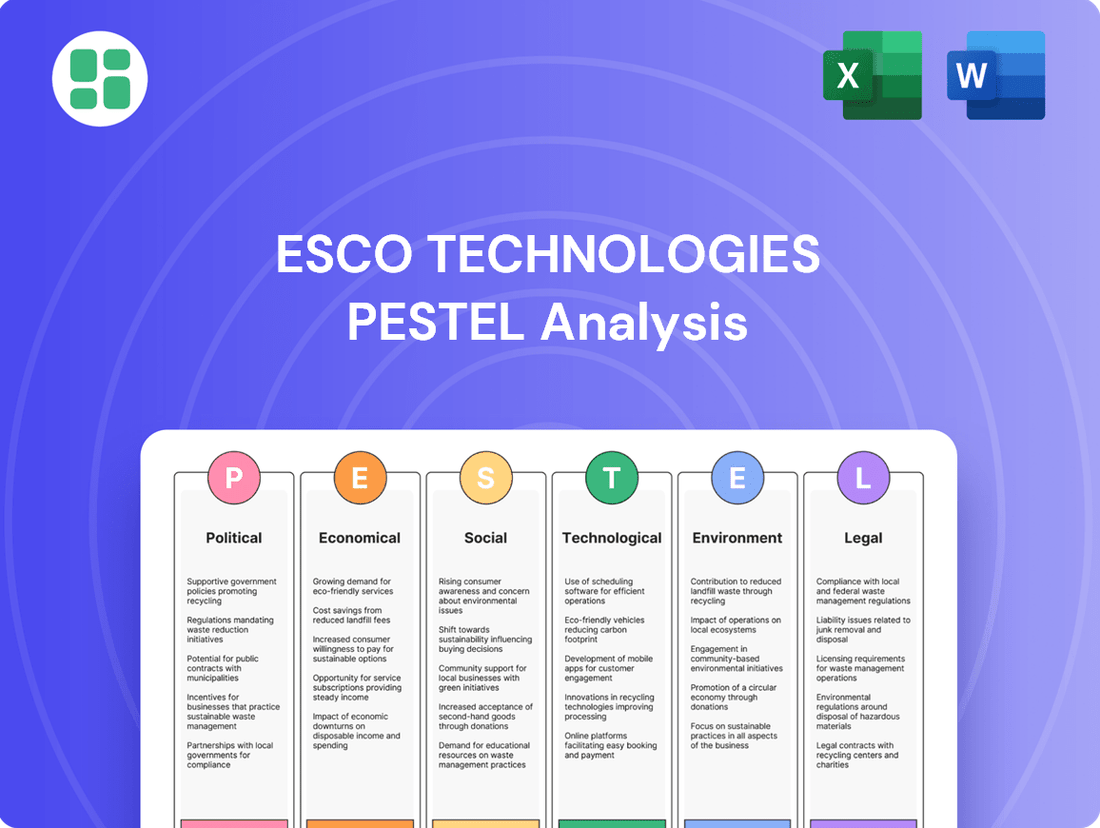

ESCO Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESCO Technologies Bundle

Unlock the strategic landscape of ESCO Technologies with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are actively shaping its market position and future trajectory. This expert-crafted report provides actionable intelligence to inform your investment decisions and competitive strategies. Download the full version now for immediate access to crucial insights.

Political factors

Government spending in defense and aerospace is a critical driver for ESCO Technologies. Increased global geopolitical tensions and a renewed focus on national security are leading to higher defense budgets. For instance, the U.S. Department of Defense's budget request for fiscal year 2025 reflects this trend, with significant allocations towards modernization and readiness across various branches, including naval programs.

These budgetary shifts directly impact ESCO's revenue streams within its Aerospace & Defense segments. As governments prioritize defense spending, companies like ESCO, which supply essential components and technologies, are likely to see increased demand. ESCO's strategic planning must therefore align with these evolving government priorities to capitalize on long-term growth prospects in this vital market.

Government initiatives and funding for critical infrastructure, particularly smart grid solutions and water systems, directly benefit ESCO Technologies. Policies aimed at modernizing electrical grids, ensuring clean water access, and enhancing utility resilience are projected to drive significant market opportunities for ESCO's Utility Solutions Group and Filtration/Fluid Flow segments. Global infrastructure spending is anticipated to reach substantial figures, with estimates suggesting trillions of dollars will be invested in these areas over the coming years, creating a robust demand for ESCO's specialized products and services.

ESCO Technologies, like many global manufacturers, navigates a complex web of international trade policies and tariffs that directly impact its operations. Shifting trade dynamics and the potential for deglobalization can disrupt its supply chain, increasing costs for raw materials and components sourced internationally. For instance, the ongoing trade tensions between major economic blocs in 2024 and early 2025 necessitate careful management of sourcing strategies to mitigate these impacts.

Trade restrictions can significantly affect manufacturing costs and market access for ESCO's products. Companies are increasingly prioritizing supply chain resilience, exploring nearshoring or reshoring options to buffer against unpredictable trade environments. This strategic shift aims to secure a more stable and cost-effective production process, even if it means higher initial investments.

Regulatory Stability and Industrial Policy

Regulatory stability is crucial for ESCO Technologies, operating in sectors like manufacturing, utilities, and defense. Predictable regulations foster a climate conducive to investment and innovation. For instance, in 2024, the US government continued to emphasize infrastructure spending, a key area for ESCO's utility solutions, signaling a stable policy environment. Conversely, unexpected regulatory changes, such as new environmental standards or trade policy shifts, could impose significant compliance costs and create market uncertainty.

Industrial policies play a vital role in shaping ESCO's strategic landscape. Policies that support domestic manufacturing and technological advancement, like those seen in the 2024 CHIPS and Science Act, directly benefit companies like ESCO involved in advanced manufacturing and critical technologies. Such initiatives can drive demand and encourage R&D investment. However, a lack of clear, long-term industrial strategy could hinder ESCO's ability to plan and allocate resources effectively.

ESCO's performance is influenced by government support for key industries. For example, defense spending, a significant revenue driver for ESCO, is subject to annual appropriations and strategic defense reviews. In fiscal year 2025, projected US defense spending remains robust, offering a degree of stability. However, shifts in geopolitical priorities could lead to reallocation of funds, impacting specific defense programs ESCO is involved in.

Key considerations for ESCO include:

- Consistency in environmental regulations impacting manufacturing processes and product lifecycles.

- Government incentives for advanced manufacturing and supply chain resilience, particularly in defense and critical infrastructure sectors.

- Trade policies and tariffs affecting the cost of raw materials and access to international markets.

- Cybersecurity mandates for critical infrastructure, a growing area of focus and potential business for ESCO.

Geopolitical Landscape and International Relations

The current geopolitical landscape, marked by ongoing regional conflicts and shifting international alliances, directly impacts defense spending globally. Heightened geopolitical tensions often translate into increased demand for advanced defense systems and components, a sector where ESCO Technologies operates. For instance, the ongoing conflict in Eastern Europe has led many NATO nations to significantly increase their defense budgets, with the US defense budget for fiscal year 2024 set at $886 billion, reflecting this trend.

These geopolitical dynamics also introduce volatility into global supply chains. Manufacturers like ESCO, which rely on a diverse international network for raw materials and components, face risks associated with trade disruptions, sanctions, and political instability in key sourcing regions. The potential for supply chain interruptions can affect production timelines and costs, necessitating robust risk management strategies and diversification of supplier bases to ensure operational continuity and meet increased demand from defense sectors.

- Increased Defense Budgets: Many countries are raising defense expenditures in response to geopolitical instability. For example, Germany announced a €100 billion special fund for its armed forces in 2022, a substantial increase in defense investment.

- Supply Chain Vulnerabilities: Geopolitical tensions can disrupt the flow of critical materials, impacting manufacturers like ESCO. The semiconductor shortage, exacerbated by geopolitical factors, highlighted these vulnerabilities across many industries.

- Demand for Advanced Technologies: Conflicts often spur demand for sophisticated defense technologies, including advanced materials and electronic components, areas where ESCO has significant expertise.

- Market Stability Concerns: Broader global economic stability can be affected by geopolitical events, influencing investment decisions and overall market sentiment, which in turn can impact ESCO's financial performance and growth opportunities.

Government spending in defense and aerospace remains a key driver for ESCO Technologies, with increased global geopolitical tensions prompting higher defense budgets. The U.S. Department of Defense's budget request for fiscal year 2025, for instance, signals substantial allocations towards modernization, directly benefiting ESCO's segments.

Government initiatives supporting critical infrastructure, particularly smart grid and water systems, create significant market opportunities for ESCO. Global infrastructure spending is projected to reach trillions, bolstering demand for ESCO's Utility Solutions Group and Filtration/Fluid Flow segments.

ESCO Technologies must navigate evolving international trade policies and tariffs, which can disrupt supply chains and increase costs. The potential for deglobalization and ongoing trade tensions in 2024-2025 necessitate careful sourcing strategies to mitigate impacts and ensure supply chain resilience.

Regulatory stability is paramount for ESCO, operating across manufacturing, utilities, and defense. While stable policies, like continued US infrastructure spending in 2024, are beneficial, unpredictable changes in environmental standards or trade policies could impose costs and create market uncertainty.

What is included in the product

This ESCO Technologies PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting ESCO Technologies.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors affecting ESCO Technologies.

Economic factors

Global economic growth directly fuels demand for ESCO Technologies' engineered products and systems. As economies expand, industrial output typically rises, leading to increased investment in infrastructure, manufacturing, and utilities, all key sectors for ESCO. For instance, the International Monetary Fund projected global growth of 3.2% for 2024, a figure that underpins the potential for increased capital expenditures by ESCO's customer base.

This economic expansion translates into higher demand for ESCO's solutions, from advanced filtration systems used in industrial processes to components for utility grid modernization and aerospace applications. A robust global economy allows ESCO's clients to undertake larger projects and upgrade their facilities, directly boosting ESCO's sales volumes and revenue. Furthermore, a healthy economic environment enhances ESCO's own capacity for strategic investments in research, development, and manufacturing capabilities.

Persistent inflationary pressures in 2024 and into 2025 directly impact ESCO Technologies' operational costs. Rising prices for raw materials, components, and energy are squeezing profit margins. For instance, the Producer Price Index (PPI) for manufactured goods saw significant increases throughout 2024, directly affecting ESCO's input expenses.

Managing these escalating costs is critical for ESCO's financial health. The company is likely employing strategies such as selective price increases on its products to offset higher expenses, a move seen across many industrial sectors. Additionally, efforts to optimize supply chains and implement internal cost-reduction initiatives are crucial to maintaining profitability amidst this challenging economic environment.

The prevailing interest rate environment significantly shapes capital expenditure decisions for ESCO Technologies' key customers. For utilities, aerospace, and defense contractors, higher borrowing costs due to elevated interest rates can delay or scale back infrastructure upgrades and new projects. For instance, if benchmark rates remain elevated throughout 2024 and into 2025, companies reliant on debt financing for large-scale investments may see their project viability scrutinized more closely.

Conversely, ESCO's own borrowing costs for strategic acquisitions and internal investments are directly impacted by interest rate fluctuations. Lower interest rates, a trend seen in certain periods leading up to 2025, can stimulate infrastructure fundraising and make debt financing more attractive for expansion. This can create opportunities for ESCO to pursue growth initiatives more cost-effectively.

Demand Trends in Key End-Markets

Demand in ESCO's key end-markets shows robust growth. The utility sector continues to invest heavily in smart grid technologies, driven by the need for grid modernization and increased efficiency. For example, the global smart grid market was valued at approximately $35 billion in 2023 and is projected to reach over $70 billion by 2028, indicating sustained demand for ESCO's related products.

The aerospace and defense industries are also experiencing strong demand. Commercial air travel has seen a significant rebound post-pandemic, boosting demand for aircraft components and related technologies. The defense sector, meanwhile, benefits from increased global security spending. In 2024, global defense spending is expected to exceed $2.4 trillion, reflecting ongoing geopolitical tensions and modernization efforts, which directly benefits companies like ESCO.

- Smart Grid Investment: Continued expansion and upgrades to electrical grids globally, driven by renewable energy integration and efficiency mandates.

- Commercial Air Travel Recovery: Rebounding passenger numbers are fueling new aircraft orders and maintenance, repair, and overhaul (MRO) activities.

- Defense Spending: Elevated geopolitical risks are leading governments worldwide to increase defense budgets, supporting demand for advanced defense systems.

Supply Chain Resilience and Global Logistics

Supply chain disruptions, a persistent economic challenge, directly impact ESCO Technologies' operational costs and efficiency. The lingering effects of global events in 2023 and 2024 have highlighted the fragility of extended supply chains, leading to increased freight costs and longer lead times. For instance, the average cost to ship a 40-foot container from Asia to Europe saw significant volatility throughout 2023, impacting import-dependent businesses.

Labor shortages across various sectors, including manufacturing and logistics, further exacerbate these issues. In the US, manufacturing employment continued to grow in early 2024, but persistent shortages in skilled trades and transportation roles remained a bottleneck. This shortage can increase labor expenses and hinder ESCO's ability to scale production or fulfill orders promptly, affecting inventory management and customer satisfaction.

Strategic shifts towards supply chain diversification and localization are becoming critical for resilience. Companies are actively exploring nearshoring and reshoring options to mitigate risks associated with geopolitical instability and transportation challenges. This move, while potentially increasing initial production costs, aims to improve reliability and reduce overall vulnerability. For ESCO, building more resilient supply chains translates to better predictability in meeting customer demand, even amidst ongoing economic uncertainties.

- Increased Operational Costs: Volatile shipping rates and higher labor expenses directly inflate the cost of goods sold.

- Inventory Management Challenges: Disruptions necessitate adjustments in inventory levels, potentially leading to higher carrying costs or stockouts.

- Demand Fulfillment Impact: Inefficient supply chains can delay product delivery, negatively impacting customer retention and sales.

- Strategic Investment Needs: Diversification and localization require upfront investment in new facilities or supplier relationships.

ESCO Technologies' performance is closely tied to global economic trends, with growth in key sectors like utilities and aerospace directly translating to increased demand for its engineered products. For instance, the International Monetary Fund projected global growth of 3.2% for 2024, a figure that supports higher capital expenditures by ESCO's customer base.

However, persistent inflation in 2024 and into 2025 is increasing ESCO's operational costs, particularly for raw materials and components, as evidenced by rising Producer Price Index figures for manufactured goods. This necessitates strategies like selective price increases and supply chain optimization to maintain profitability.

Interest rates also play a crucial role, influencing customer investment decisions and ESCO's own borrowing costs for expansion. Elevated rates can slow down large projects, while lower rates can make strategic acquisitions more attractive.

ESCO's core markets show strong demand, with the global smart grid market expected to more than double by 2028, reaching over $70 billion, and defense spending projected to exceed $2.4 trillion in 2024, both benefiting ESCO's product lines.

| Economic Factor | Impact on ESCO Technologies | Supporting Data (2024/2025) |

| Global Economic Growth | Drives demand for industrial and infrastructure products. | IMF projected 3.2% global growth for 2024. |

| Inflationary Pressures | Increases operational costs (raw materials, energy). | Rising Producer Price Index for manufactured goods. |

| Interest Rates | Affects customer capital expenditure and ESCO's borrowing costs. | Elevated rates potentially slowing project financing. |

| End-Market Demand | Robust growth in utilities (smart grid) and aerospace/defense. | Smart grid market projected to exceed $70B by 2028; defense spending over $2.4T in 2024. |

Same Document Delivered

ESCO Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ESCO Technologies delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a clear understanding of the external forces shaping ESCO Technologies' market landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis provides actionable insights into the opportunities and threats ESCO Technologies faces, crucial for competitive advantage.

Sociological factors

Many developed nations grapple with aging utility and industrial infrastructure, a significant societal challenge. This deterioration necessitates substantial investment in upgrades and modernization to ensure public safety and operational reliability.

The growing demand for these upgrades directly fuels the market for ESCO Technologies' solutions. For instance, the U.S. alone faces an estimated $1 trillion infrastructure investment gap by 2025, creating a vast opportunity for companies providing smart grid technology, diagnostic testing, and filtration systems essential for modernization efforts.

Growing environmental consciousness is a significant sociological factor impacting ESCO Technologies. Consumers and businesses increasingly prioritize eco-friendly products and sustainable practices, driving demand for solutions that minimize environmental impact.

This trend directly influences ESCO's product development, particularly in its filtration and utility segments. The company is focusing on creating energy-efficient solutions and utilizing sustainable materials. For instance, ESCO's water filtration technologies aim to reduce water waste, aligning with growing concerns about water scarcity. In 2024, global investment in clean energy technologies reached an estimated $1.7 trillion, underscoring the market's shift towards sustainability.

Demographic shifts are impacting ESCO Technologies' talent pool, with an aging workforce in manufacturing and engineering potentially leading to shortages of skilled labor. This trend could challenge ESCO's recruitment and retention efforts, potentially affecting its production capacity and innovation pipeline.

In 2024, the U.S. Bureau of Labor Statistics projected a continued demand for skilled workers in manufacturing, with an estimated 4.6 million manufacturing jobs needing to be filled by 2028. This scarcity directly influences operational costs and the pace of technological adoption for companies like ESCO.

Urbanization and Population Growth

The ongoing trend of urbanization and global population growth directly fuels demand for ESCO Technologies' core offerings. As more people move to cities, the need for clean water, dependable electricity, and efficient infrastructure intensifies. This sustained demand underpins the market for ESCO's utility and filtration solutions.

The United Nations projects that by 2050, 68% of the world's population will reside in urban areas, a significant increase from 56% in 2021. This demographic shift translates into a growing requirement for advanced water treatment and reliable power distribution systems, areas where ESCO excels.

- Urban Population Growth: The world urban population is expected to reach 6.7 billion by 2050, creating substantial demand for infrastructure.

- Water Scarcity Concerns: Over 2 billion people currently live in countries experiencing high water stress, highlighting the critical need for efficient filtration.

- Infrastructure Investment: Global spending on infrastructure is projected to reach trillions annually, with a significant portion allocated to utilities and water management.

Health and Safety Standards and Public Expectations

Societal emphasis on robust health and safety standards significantly impacts ESCO Technologies, especially given its involvement in medical diagnostics and industrial filtration. Public demand for reliable and safe products in these critical areas compels ESCO to maintain rigorous quality control and compliance. For instance, in 2024, the global medical device market saw continued scrutiny on patient safety, with regulatory bodies like the FDA issuing updated guidance on cybersecurity and device security. This translates to a need for ESCO to ensure its diagnostic testing equipment meets and exceeds these evolving safety expectations.

Public expectations directly fuel innovation and compliance efforts. As consumers and businesses become more aware of potential risks, they demand higher product quality and safety assurance. This can be seen in the growing market for advanced filtration systems, where consumers expect superior performance in air and water purification. According to industry reports from early 2025, consumer preference for products with demonstrable safety certifications and transparent manufacturing processes is a key purchasing driver, pushing companies like ESCO to invest in research and development that prioritizes both efficacy and user safety.

- Increased regulatory oversight: Growing public concern over product safety in medical and industrial applications leads to stricter government regulations, requiring ESCO to invest more in compliance and testing.

- Demand for transparency: Consumers and businesses expect clear information about product safety features and manufacturing processes, influencing ESCO's communication and product development strategies.

- Innovation driven by safety: Public demand for higher safety standards encourages ESCO to innovate, developing advanced filtration and diagnostic technologies that offer enhanced protection and reliability.

- Market competitiveness: Companies that prioritize and visibly demonstrate adherence to stringent health and safety standards gain a competitive advantage, as seen in the growing preference for certified products in 2024 and projected for 2025.

Societal trends like aging infrastructure and increasing environmental awareness directly benefit ESCO Technologies. The global infrastructure market is projected to exceed $15 trillion by 2027, with a significant portion dedicated to utility upgrades, creating a substantial opportunity for ESCO's smart grid and filtration solutions. Furthermore, the growing demand for sustainable practices, evidenced by a 2024 surge in clean energy investments, aligns with ESCO's focus on energy-efficient technologies and water conservation efforts.

Demographic shifts, particularly urbanization and an aging workforce, present both opportunities and challenges for ESCO. As cities expand, the need for reliable utilities and clean water grows, directly boosting demand for ESCO's products. However, a shortage of skilled labor in manufacturing and engineering, a trend highlighted by projections of millions of unfilled manufacturing jobs in the U.S. through 2028, could impact ESCO's production and innovation capabilities.

Heightened societal expectations for health and safety standards are a critical factor for ESCO, especially in its medical diagnostics and industrial filtration segments. The increasing regulatory scrutiny and consumer demand for transparent, safe products mean ESCO must continually invest in rigorous quality control and advanced safety features. This focus on safety is a key differentiator, as companies prioritizing it often gain a competitive edge in markets where consumer trust is paramount, a trend observed in the medical device sector throughout 2024.

| Sociological Factor | Impact on ESCO Technologies | Supporting Data (2024-2025 Projections) |

|---|---|---|

| Aging Infrastructure | Increased demand for modernization solutions. | U.S. infrastructure investment gap estimated at $1 trillion by 2025. |

| Environmental Consciousness | Growth in demand for eco-friendly products. | Global clean energy investment reached $1.7 trillion in 2024. |

| Demographic Shifts (Urbanization) | Increased demand for utilities and water management. | 68% of the world population projected to live in urban areas by 2050. |

| Demographic Shifts (Workforce) | Potential shortage of skilled labor. | 4.6 million manufacturing jobs projected to need filling in the U.S. by 2028. |

| Health & Safety Standards | Need for rigorous quality control and compliance. | Continued scrutiny on patient safety in the global medical device market (2024). |

Technological factors

The rapid evolution of Artificial Intelligence (AI) and the Internet of Things (IoT) is a significant technological driver for ESCO Technologies. AI-powered analytics are enhancing the predictive maintenance capabilities for ESCO's filtration systems, reducing downtime and operational costs for clients. For instance, by analyzing sensor data from IoT-enabled devices, ESCO can forecast potential equipment failures, allowing for proactive servicing.

Furthermore, the integration of AI and IoT is revolutionizing ESCO's diagnostic equipment and smart grid solutions. Smart controls, driven by AI algorithms, can optimize the performance of filtration systems in real-time, leading to greater energy efficiency. The company's smart grid technologies are also benefiting, with AI enabling more sophisticated grid management and load balancing, a critical factor as energy consumption patterns shift.

Breakthroughs in material science are significantly enhancing filtration capabilities. Advanced materials like specialized polytetrafluoroethylene (PTFE) and cutting-edge nanofiber technologies are enabling ESCO's filtration products to achieve higher efficiency and extended durability.

These innovations are crucial for addressing increasingly complex contaminant removal challenges across various industries. For instance, the development of novel membrane structures can improve particle capture rates by up to 20% compared to traditional materials, directly boosting performance for ESCO's advanced filtration solutions.

The ongoing evolution of smart grid technology is a significant technological driver for ESCO Technologies. The increasing deployment of smart meters and grid modernization initiatives, such as those seen in the US with over 100 million smart meters installed by 2023, directly fuels demand for ESCO's advanced metering and grid automation solutions. This transition to a more digitized and interconnected grid infrastructure is critical for managing distributed energy resources and enhancing grid reliability.

Furthermore, the rapid integration of renewable energy sources, like solar and wind power, necessitates advanced grid management technologies that ESCO provides. Global renewable energy capacity additions reached a record high in 2023, with an estimated 510 gigawatts added, highlighting the growing need for sophisticated systems to balance intermittent supply and ensure grid stability. ESCO's solutions are essential for utilities to effectively incorporate these variable energy inputs.

Advanced energy storage solutions are also a key technological factor. The global energy storage market is projected to grow substantially, with some forecasts predicting it to reach over $100 billion by 2028. ESCO's expertise in developing and implementing technologies that support the integration and management of battery storage and other advanced storage systems positions the company to capitalize on this expanding market, enabling more resilient and efficient power distribution.

Developments in Diagnostic Testing Equipment

Technological advancements in diagnostic and test/measurement equipment are significantly enhancing accuracy and speed. Innovations like miniaturization and portability are making sophisticated diagnostic tools more accessible, directly benefiting ESCO Technologies' Test/Measurement segment. For instance, the global market for medical diagnostic equipment, a key area for such technologies, was projected to reach over $300 billion by 2024, indicating substantial investment and growth in this sector.

These developments include breakthroughs in 3D/4D imaging and molecular testing, which offer deeper insights and faster results. Such capabilities are crucial for industries relying on precise testing, allowing for quicker identification of issues and improved product development cycles. The increasing demand for point-of-care diagnostics, driven by these technological leaps, is a major growth driver.

- Miniaturization and Portability: Leading to more compact and user-friendly diagnostic devices.

- 3D/4D Imaging: Enhancing visualization and diagnostic capabilities in various fields.

- Molecular Testing: Providing faster and more precise analysis at a genetic level.

- Market Growth: The medical diagnostics market is experiencing robust expansion, fueled by these technological innovations.

Cybersecurity and Data Management Technologies

Cybersecurity is paramount, especially for critical infrastructure like smart grids. ESCO Technologies' solutions are designed with advanced cybersecurity measures to shield these vital systems and the sensitive data they handle from increasingly sophisticated threats. This focus is crucial for their utility and defense sector clients.

The global cybersecurity market is projected to reach $300 billion by 2024, highlighting the immense demand for robust protection. ESCO's integration of state-of-the-art security protocols directly addresses this growing need, ensuring the integrity and safety of the data managed within their systems. This proactive approach is essential for maintaining trust and operational continuity.

ESCO's commitment to data management extends to secure cloud-based platforms and advanced encryption techniques. These technologies are vital for protecting sensitive information in an era of escalating cyberattacks. For instance, the utility sector faces unique challenges in securing distributed energy resources and customer data, areas where ESCO’s expertise is particularly relevant.

- Growing Threat Landscape: Cybersecurity threats are becoming more complex, with ransomware attacks on critical infrastructure increasing by over 100% in recent years.

- ESCO's Defense: ESCO Technologies incorporates multi-layered security, intrusion detection, and data encryption into its smart grid and defense communication products.

- Data Integrity: Ensuring the accuracy and security of data is critical for smart grid operations and defense applications, a core focus for ESCO's technological development.

The integration of AI and IoT is enhancing ESCO's predictive maintenance and real-time system optimization, leading to reduced downtime and increased energy efficiency for clients. For example, AI-driven analytics can forecast equipment failures, while smart controls optimize filtration systems. The company's smart grid solutions also benefit from AI for improved grid management.

Advancements in material science, particularly with materials like PTFE and nanofibers, are boosting the efficiency and durability of ESCO's filtration products, enabling them to tackle complex contaminant removal challenges. These innovations can improve particle capture rates by up to 20%.

The expansion of smart grid technology, driven by smart meter deployment and renewable energy integration, creates significant demand for ESCO's grid automation and management solutions. Global renewable energy capacity additions reached a record 510 gigawatts in 2023, underscoring the need for advanced grid management.

Legal factors

ESCO Technologies operates within an increasingly stringent environmental regulatory framework. Laws governing hazardous waste disposal, air emissions, and the use of substances like PFAS are constantly evolving, requiring significant investment in compliance measures. For instance, the EPA's proposed stricter limits on PFAS in drinking water, expected to be finalized in 2024, could necessitate changes in manufacturing inputs and wastewater treatment for ESCO's facilities.

Compliance with foundational legislation such as the Clean Air Act and Clean Water Act directly impacts ESCO's manufacturing processes, potentially increasing operational costs for pollution control equipment and monitoring. Furthermore, new environmental reporting requirements, like those mandated by the SEC's proposed climate disclosure rules, will demand robust data collection and transparency regarding ESCO's environmental footprint, influencing product design to meet sustainability demands.

The growing landscape of cybersecurity laws, particularly those targeting critical infrastructure, presents a significant legal factor for ESCO Technologies. Legislation like the Cyber Incident Reporting for Critical Infrastructure Act (CIRCIA) in the US mandates swift reporting of cyber incidents, impacting how ESCO's utility solutions must operate and how the company manages its own data security. This regulatory environment, coupled with directives such as the EU's NIS2 Directive, which enhances cybersecurity requirements for a broader range of entities, necessitates robust risk management and security protocols for ESCO's offerings in the utility and defense sectors.

ESCO Technologies operates within highly regulated sectors, meaning industry-specific regulations and standards are paramount. For instance, its utility segment must adhere to Environmental Protection Agency (EPA) guidelines concerning emissions and environmental impact. Similarly, the aerospace and defense divisions face stringent Federal Aviation Administration (FAA) and Department of Defense (DoD) requirements for product safety, reliability, and performance.

These regulatory frameworks directly influence ESCO's product development cycles, demanding rigorous testing and certification processes. Compliance is not merely a legal obligation but a critical enabler for market access, impacting everything from material selection to manufacturing protocols. For example, in 2024, the aerospace industry saw continued emphasis on cybersecurity regulations impacting embedded systems, a key area for ESCO.

Intellectual Property Rights and Patent Protection

Intellectual Property Rights and Patent Protection are crucial for ESCO Technologies, safeguarding its innovations in filtration, test/measurement, and smart grid sectors. Strong patent protection deters competitors from copying ESCO's unique technologies, allowing the company to maintain a significant competitive edge in its specialized markets. In 2023, ESCO reported spending $30.1 million on research and development, underscoring its commitment to innovation and the need for robust IP protection.

The legal framework surrounding intellectual property directly influences ESCO's ability to commercialize new products and secure its market position. Without adequate patent protection, the substantial investments made in R&D could be undermined by imitation, impacting profitability and future growth. For instance, the company's advancements in advanced filtration media and specialized testing equipment rely heavily on the exclusivity granted by patents.

- Patent Portfolio Strength: ESCO's ability to secure and defend patents for its core technologies in filtration and test/measurement is vital for its sustained market leadership.

- Infringement Risk Mitigation: Robust legal strategies are necessary to prevent and address any potential infringement on ESCO's patented innovations, ensuring its competitive advantage.

- R&D Investment Justification: The value derived from ESCO's significant R&D expenditure, which reached $30.1 million in 2023, is directly tied to the legal protection of its resulting intellectual property.

Product Liability and Safety Legislation

ESCO Technologies faces significant legal responsibilities concerning the safety and performance of its products, particularly those designed for demanding sectors like aerospace, defense, and healthcare. Strict product liability laws mean ESCO must ensure its offerings meet stringent quality control measures, undergo thorough testing, and consistently adhere to established safety standards throughout the entire product lifecycle, from design to deployment. For instance, in the aerospace sector, regulations like those from the Federal Aviation Administration (FAA) mandate rigorous compliance for components, impacting ESCO's ability to secure contracts and maintain market access.

Failure to meet these legal obligations can result in substantial financial penalties and reputational damage. For example, in 2023, a major automotive supplier faced a recall costing over $100 million due to a product defect, highlighting the financial risks associated with inadequate safety protocols. ESCO's commitment to quality is therefore not just a matter of good practice but a legal imperative, directly influencing its operational costs and market competitiveness.

- Regulatory Compliance: Adherence to industry-specific safety standards (e.g., AS9100 for aerospace) is critical for market entry and continued operation.

- Product Recalls: Costs associated with product recalls, including investigation, repair, and public notification, can be substantial, impacting profitability.

- Litigation Risks: Exposure to lawsuits arising from product defects, especially in high-stakes industries, necessitates robust legal defense and insurance coverage.

- Quality Management Systems: Implementing and maintaining rigorous quality management systems is essential to mitigate liability and ensure product integrity.

ESCO Technologies must navigate a complex web of evolving environmental laws, including those concerning emissions and hazardous materials, which necessitate ongoing investment in compliance. For example, the EPA's proposed stricter PFAS limits, expected in 2024, could require manufacturing process adjustments.

Cybersecurity legislation, such as the US Cyber Incident Reporting for Critical Infrastructure Act (CIRCIA) and the EU's NIS2 Directive, imposes strict data security and reporting obligations on companies like ESCO, particularly impacting its utility and defense solutions. This requires robust risk management protocols to ensure compliance and protect sensitive data.

The company's operations are heavily influenced by industry-specific regulations, such as FAA standards for aerospace and EPA guidelines for utilities, directly impacting product development, testing, and market access. For instance, continued emphasis on cybersecurity for embedded systems in aerospace in 2024 affects ESCO's product design.

Intellectual property laws are critical for protecting ESCO's innovations, with $30.1 million invested in R&D in 2023 underscoring the need for strong patent protection to maintain its competitive edge.

Environmental factors

Global and national climate change policies, such as the European Union's Fit for 55 package aiming for a 55% reduction in greenhouse gas emissions by 2030, directly impact ESCO Technologies. These regulations and targets, including net-zero commitments from numerous countries, are accelerating demand for sustainable utility infrastructure and energy-efficient solutions, which are core to ESCO's offerings.

ESCO's strategic alignment with decarbonization efforts is crucial, as incentives for renewable energy adoption and grid modernization, like the US Inflation Reduction Act's significant investments in clean energy, create substantial growth opportunities. This policy landscape supports ESCO's business model by driving the need for advanced metering, grid automation, and power quality solutions essential for integrating renewables and enhancing grid resilience.

ESCO Technologies faces growing pressure from investors, regulators, and customers to integrate strong Environmental, Social, and Governance (ESG) principles. This trend is evident globally, with a significant portion of institutional investors now considering ESG factors in their decision-making processes, aiming for sustainable long-term returns.

ESCO's proactive engagement in ESG, especially within its utility and manufacturing sectors, directly impacts its brand image and ability to attract capital. Companies demonstrating robust ESG performance often enjoy preferential access to capital markets and a stronger competitive edge, as seen in the increasing number of ESG-focused investment funds available in 2024-2025.

Global water scarcity and declining water quality are significant environmental challenges. These issues directly fuel the demand for sophisticated water filtration and treatment solutions. For ESCO Technologies, this translates into substantial market opportunities, particularly for its Filtration/Fluid Flow segment.

By 2025, projections indicate that over two-thirds of the world's population could face water shortages, according to the UN. This escalating crisis drives investment in technologies that ensure access to clean water for industrial, agricultural, and municipal uses, areas where ESCO’s expertise is crucial.

Waste Management and Circular Economy Principles

ESCO Technologies is navigating an increasingly stringent environmental landscape focused on waste reduction and the adoption of circular economy principles. This shift is driven by global initiatives aiming to minimize landfill waste and maximize resource utilization. For instance, the European Union's Circular Economy Action Plan, updated in 2020, sets ambitious targets for waste reduction and recycling, influencing manufacturing practices worldwide.

ESCO's commitment to environmental stewardship is evident in its approach to product design, prioritizing eco-friendly materials and longevity. The company actively seeks to reduce waste within its own operational footprint through efficient manufacturing processes and responsible material sourcing. Furthermore, ESCO implements robust practices for the responsible disposal of any unavoidable waste, ensuring compliance with evolving environmental regulations.

Key aspects of ESCO's environmental strategy include:

- Eco-friendly product design: Developing products with reduced environmental impact throughout their lifecycle.

- Operational waste reduction: Implementing lean manufacturing and process optimization to minimize waste generation.

- Responsible disposal practices: Adhering to strict guidelines for the safe and environmentally sound disposal of materials.

- Circular economy integration: Exploring opportunities for material reuse and recycling within its supply chain and product end-of-life management.

Supply Chain Environmental Footprint and Sustainable Sourcing

ESCO Technologies faces increasing scrutiny regarding its supply chain's environmental footprint. This includes the impact of raw material sourcing, manufacturing processes, and logistics. For instance, the global manufacturing sector's carbon emissions were estimated to be around 15.2 billion metric tons in 2023, a significant portion of which is tied to supply chains.

Sustainable sourcing is becoming paramount, pushing companies like ESCO to ensure their suppliers meet stringent environmental standards. This involves tracking emissions, waste management, and resource utilization throughout the value chain. A 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions, directly influencing corporate sourcing strategies.

Reducing carbon emissions across the entire supply chain is a key objective. This can involve optimizing transportation routes, utilizing more energy-efficient manufacturing, and exploring alternative, lower-impact materials. ESCO's commitment to environmental responsibility is directly linked to its ability to manage these factors effectively.

- Supply Chain Emissions: Global supply chain emissions are a growing concern, with the logistics sector alone accounting for a substantial percentage of worldwide greenhouse gas output.

- Sustainable Sourcing Importance: Consumer demand and regulatory pressures are driving the need for environmentally responsible sourcing of raw materials and components.

- Supplier Adherence: Ensuring suppliers meet environmental standards is crucial for ESCO's corporate responsibility and risk management.

- Corporate Responsibility: A transparent and sustainable supply chain enhances ESCO's reputation and contributes to long-term business resilience.

ESCO Technologies operates within an increasingly regulated environmental landscape, driven by global climate change initiatives and resource management concerns. Policies like the EU's Fit for 55 package and the US Inflation Reduction Act create significant demand for ESCO's sustainable utility infrastructure and energy-efficient solutions.

Water scarcity is a growing global issue, projected to affect over two-thirds of the world's population by 2025, fueling demand for ESCO's water filtration and treatment technologies. The company also faces pressure to adopt circular economy principles, minimizing waste and maximizing resource utilization in its operations and product lifecycle.

ESCO's environmental strategy focuses on eco-friendly product design, operational waste reduction, and responsible disposal practices, aligning with growing investor and consumer demand for ESG compliance. The company's supply chain is also under scrutiny for its environmental footprint, emphasizing the need for sustainable sourcing and emissions reduction.

| Environmental Factor | Impact on ESCO Technologies | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Climate Change Policies | Drives demand for sustainable utility infrastructure and energy efficiency solutions. | EU Fit for 55 aims for 55% GHG reduction by 2030; US IRA invests heavily in clean energy. |

| Water Scarcity | Increases demand for filtration and treatment solutions. | Over 2/3 of world population projected to face water shortages by 2025 (UN). |

| Circular Economy | Requires focus on waste reduction and resource utilization in operations and product design. | EU Circular Economy Action Plan updated 2020; growing consumer preference for sustainable products. |

| Supply Chain Emissions | Necessitates sustainable sourcing and emissions management across the value chain. | 70%+ consumers consider sustainability in purchasing decisions (2024 report); logistics sector significant GHG contributor. |

PESTLE Analysis Data Sources

Our ESCO Technologies PESTLE Analysis draws from a comprehensive blend of official government publications, leading economic indicators, and reputable industry analysis. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental forces impacting the company.