Ericsson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ericsson Bundle

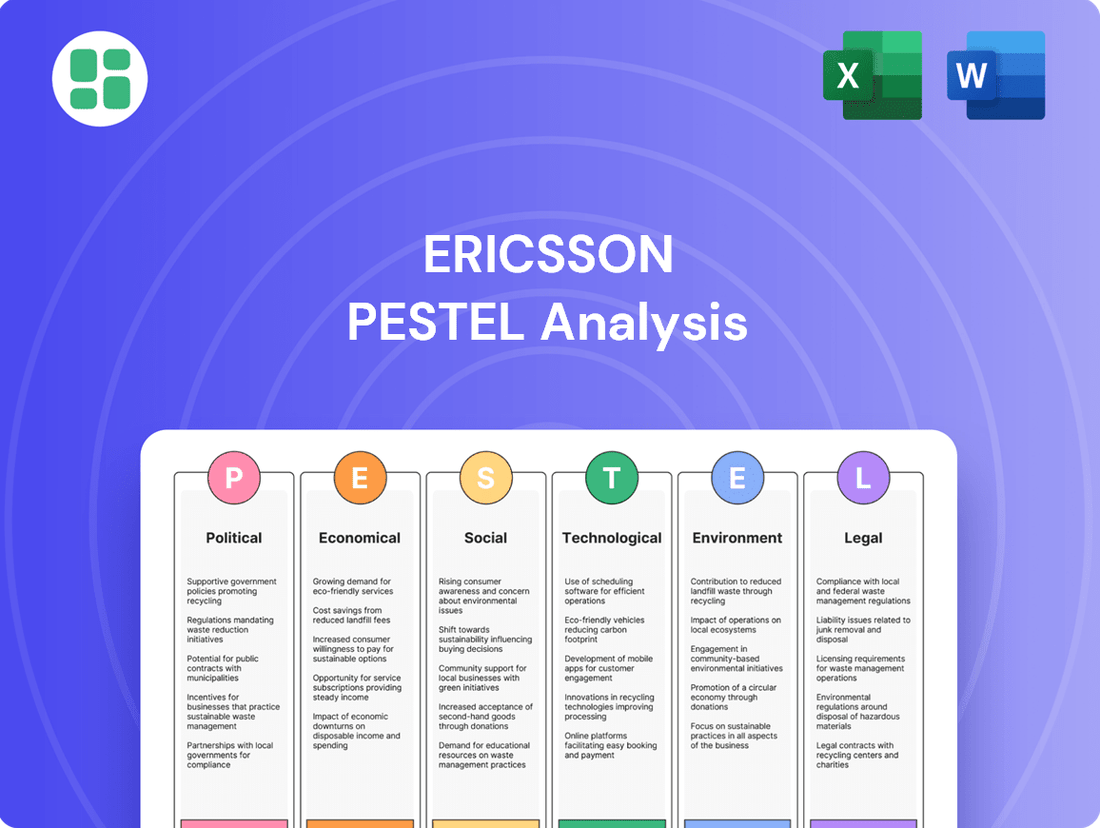

Unlock Ericsson's strategic landscape with our comprehensive PESTLE analysis. Discover how political, economic, social, technological, legal, and environmental factors are shaping its future, providing you with the critical intelligence needed to anticipate market shifts and opportunities. Download the full version now to gain actionable insights and stay ahead of the curve.

Political factors

Global trade disputes and geopolitical tensions, especially between the US and China, create significant headwinds for Ericsson's supply chain and ability to access key markets. These ongoing conflicts can disrupt the flow of components and finished goods, impacting production schedules and costs.

Ericsson is actively managing the risk of potential US import tariffs, which could increase the cost of doing business. In response, the company is strategically shifting its global production model to build a more resilient 'western ecosystem.' This involves carefully selecting manufacturing locations to better insulate operations from unpredictable political shifts and trade policy changes, aiming for greater stability in 2024 and beyond.

Governments globally are prioritizing 5G infrastructure, with many nations earmarking substantial funds for its development. For instance, the United States' National Telecommunications and Information Administration (NTIA) has allocated billions through its Broadband Equity, Access, and Deployment (BEAD) program, aiming to expand broadband access, including 5G. This strong political backing translates into significant opportunities for Ericsson, positioning it as a key partner in these national digital transformation efforts.

Growing national security concerns are driving more stringent regulations for telecommunications equipment providers like Ericsson. Governments worldwide are prioritizing the protection of their critical digital infrastructure from cyber threats, particularly state-sponsored attacks and significant data breaches. This heightened focus directly impacts vendors, requiring them to navigate and adhere to an increasingly complex web of cybersecurity protocols and data privacy legislation.

These evolving mandates can significantly influence Ericsson's operations, from product design and development to securing market access in various regions. For instance, the European Union's NIS2 Directive, which came into effect in early 2023 and will be fully implemented by October 2024, aims to bolster cybersecurity across the EU, imposing stricter security requirements on essential service providers, including those in the telecommunications sector.

Regulatory Frameworks and Spectrum Allocation

Global regulatory bodies are actively shaping the future of telecommunications, with significant discussions around spectrum allocation for 5G and beyond. These deliberations directly impact companies like Ericsson, influencing their ability to deploy and monetize new technologies. For instance, the ongoing spectrum auctions and assignments in major markets are critical for network expansion.

Security and privacy standards are also paramount in these regulatory discussions. Governments worldwide are implementing stricter data protection laws, such as the GDPR in Europe, which affects how network infrastructure handles sensitive information. Ericsson must navigate these evolving compliance requirements to ensure its solutions meet global security benchmarks.

- Spectrum Allocation: Many countries are finalizing 5G spectrum allocations, with significant auctions planned or underway in 2024 and 2025. For example, the US FCC continued its efforts to make mid-band spectrum available, crucial for 5G performance.

- Security Standards: Regulators are increasingly scrutinizing supply chain security for critical infrastructure. This has led to heightened requirements for network equipment vendors, impacting product design and testing protocols.

- Universal Access: A persistent regulatory goal is ensuring affordable and reliable telecommunications access for all citizens. Initiatives like the US Broadband Equity, Access, and Deployment (BEAD) program, with its substantial funding, underscore this commitment and drive demand for network buildouts.

Political Stability in Key Markets

Political stability in Ericsson's key markets significantly impacts its revenue streams, particularly from network infrastructure investments by mobile operators. North America, a crucial market, has seen a positive trend in operator spending, with reports indicating a rebound in capital expenditures for 5G deployment throughout 2024. This stability encourages continued investment in advanced network technologies.

However, political uncertainties in other regions can temper growth expectations. For instance, geopolitical tensions or shifts in government policy in emerging markets might lead to delayed or reduced spending by local operators. Ericsson's strategy of geographic diversification is designed to mitigate the impact of such regional instabilities, allowing it to leverage growth opportunities where political environments are more favorable.

- North American operator spending on mobile networks showed a notable increase in early 2024, driven by ongoing 5G buildouts.

- Ericsson's global footprint allows it to balance potential revenue dips in politically unstable regions with stronger performance in more secure markets.

- Political shifts can influence regulatory frameworks for telecommunications, affecting market access and investment incentives for companies like Ericsson.

Government initiatives prioritizing 5G infrastructure development, such as the US BEAD program with its multi-billion dollar allocation, create substantial market opportunities for Ericsson. Conversely, global trade disputes and geopolitical tensions, particularly US-China relations, disrupt supply chains and market access, impacting production and costs for Ericsson.

Heightened national security concerns are leading to more stringent cybersecurity regulations for telecom equipment providers, requiring adherence to complex protocols and data privacy laws like the EU's NIS2 Directive. Spectrum allocation decisions by global regulatory bodies are critical for Ericsson's deployment and monetization of new technologies, with ongoing auctions in major markets influencing network expansion strategies.

Political stability in key markets like North America supports increased operator spending on 5G, boosting Ericsson's revenue, while uncertainties in emerging markets can temper growth. Ericsson's diversification strategy aims to mitigate risks associated with regional political instabilities.

| Factor | Impact on Ericsson | 2024/2025 Relevance |

|---|---|---|

| 5G Infrastructure Funding | Drives demand for network equipment | US BEAD program billions allocated; ongoing global 5G investments |

| Geopolitical Tensions (US-China) | Supply chain disruption, market access challenges | Continued trade policy uncertainty impacting component sourcing |

| Cybersecurity Regulations | Increased compliance costs, product design adjustments | EU NIS2 Directive implementation by Oct 2024; global focus on critical infrastructure security |

| Spectrum Allocation | Enables new technology deployment and revenue | Active spectrum auctions and assignments in key markets throughout 2024-2025 |

What is included in the product

This Ericsson PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides a comprehensive understanding of the external landscape, highlighting key trends and their implications for Ericsson's future success.

Provides actionable insights into external factors impacting Ericsson, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

The global telecommunications sector is in the midst of a major 5G investment cycle, with the 5G infrastructure market poised for considerable expansion. Ericsson's financial performance is directly influenced by these investment patterns, especially as major mobile operators advance their 5G network deployments.

While 2024 presented some challenges, the 5G upgrade cycle is anticipated to stabilize, leading to an expected rebound in 2025. For instance, the global 5G services market revenue is projected to reach $600 billion by 2025, up from $300 billion in 2023, signaling continued investment in the underlying infrastructure.

Global economic conditions, characterized by varying GDP growth and inflation rates, directly shape telecommunications operators' capital expenditure plans. A more conservative approach to investment by major carriers can consequently constrain the growth avenues available to equipment manufacturers like Ericsson.

Ericsson's financial performance in 2024 reflected this dynamic, with a notable sales decline in its networks segment. However, this was significantly offset by robust growth experienced within the North American market, demonstrating regional economic resilience.

Ericsson is prioritizing cost efficiency and operational streamlining to safeguard its profit margins in a tough market. This strategy includes substantial workforce reductions and efforts to simplify its business processes.

The company's target of improving its adjusted EBITA margin to at least 15% by 2025 highlights its commitment to structural enhancements and increasing the proportion of high-margin sales in its portfolio.

Currency Fluctuations and Exchange Rates

As a global telecommunications giant, Ericsson's financial health is intrinsically linked to currency fluctuations. For instance, in Q1 2024, while reported sales were SEK 62.7 billion, the company highlighted the importance of organic sales, which exclude currency impacts, to understand underlying growth. This focus on organic figures helps investors and analysts discern true operational performance from the noise of shifting exchange rates.

Managing exposure to volatile currencies is paramount for Ericsson's stable revenue reporting. The company actively hedges its currency risks to mitigate the impact of adverse movements. For example, a stronger Swedish Krona against major currencies like the US Dollar or Euro can negatively affect reported earnings when translating foreign revenues back into SEK.

Optimizing global financial operations also plays a key role in navigating exchange rate volatility. Ericsson's strategy involves careful management of its international cash flows and intercompany transactions. This proactive approach aims to minimize the financial impact of currency swings and ensure more predictable financial outcomes for stakeholders.

- Impact on Reported Earnings: Currency movements can significantly alter reported revenues and profits. A stronger USD against the SEK, for instance, would boost the SEK value of Ericsson's US-based sales.

- Organic Sales as a Key Metric: Ericsson emphasizes organic sales growth to provide a clearer view of operational performance, stripping out the effects of currency translation.

- Hedging Strategies: The company employs financial instruments to hedge against currency risks, aiming to stabilize financial results against exchange rate volatility.

- Global Financial Management: Efficient management of international cash, debt, and investments is crucial for mitigating the financial impact of fluctuating exchange rates.

Monetization of New Technologies (e.g., APIs)

Ericsson is actively pursuing new revenue streams by monetizing technologies like network Application Programming Interfaces (APIs). This strategy allows third-party developers to access network capabilities, fostering innovation and creating new service opportunities. For instance, Ericsson's focus on enabling network-as-a-service through APIs is a key part of its 2024-2025 growth strategy.

The company's expansion into the enterprise segment, moving beyond core mobile network infrastructure, is crucial. By offering solutions tailored to specific industry needs, Ericsson aims to diversify its customer base and revenue sources. This includes leveraging its expertise in connectivity and cloud for sectors like manufacturing and logistics.

Strategic ventures, such as the Aduna joint venture, exemplify this monetization approach. These collaborations are designed to unlock new business models and capitalize on emerging market demands. The success of these initiatives is directly tied to Ericsson's ability to generate substantial future revenue and bolster its financial resilience.

Key aspects of this monetization drive include:

- Development of robust API platforms to enable seamless integration and service creation.

- Targeting enterprise verticals with specialized connectivity and digital solutions.

- Strategic partnerships and joint ventures to accelerate market penetration and revenue generation.

- Measuring the financial impact of new technology monetization through key performance indicators like enterprise segment revenue growth and new service adoption rates.

Global economic conditions significantly influence telecommunications spending. In 2024, varying GDP growth and inflation rates prompted many operators to adopt a more cautious approach to capital expenditure, impacting equipment vendors like Ericsson. For example, while the global 5G services market is projected to reach $600 billion by 2025, the pace of infrastructure investment can be sensitive to economic downturns.

Ericsson's 2024 performance saw a sales decline in its networks segment, partly due to these economic headwinds. However, strong performance in North America, which experienced more robust economic activity, helped offset these challenges, highlighting regional economic disparities.

The company is actively managing its financial health through cost efficiencies. By targeting an adjusted EBITA margin of at least 15% by 2025, Ericsson is focused on streamlining operations and improving profitability amidst economic uncertainty.

Currency fluctuations remain a key economic factor for Ericsson. In Q1 2024, reported sales were SEK 62.7 billion, but the company stressed the importance of organic sales, which exclude currency impacts, to gauge true operational performance. This highlights how exchange rate volatility can distort reported financial results.

What You See Is What You Get

Ericsson PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ericsson PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into market trends, competitive landscapes, and potential challenges and opportunities for Ericsson.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of external forces shaping the telecommunications industry and Ericsson's position within it.

Sociological factors

Societal reliance on seamless connectivity is rapidly increasing, with digitalization permeating every aspect of industry and daily life. This escalating demand directly fuels the market for mobile broadband, 5G, the Internet of Things (IoT), and cloud technologies – all core areas for Ericsson. For instance, the global mobile data traffic is projected to reach 300 exabytes per month by 2026, a significant jump from 77 exabytes per month in 2021, highlighting this insatiable need.

Ericsson's strategic vision is built around the concept of a wirelessly connected world, where virtually any device or service can leverage wireless technology. This aligns perfectly with the societal shift towards greater interconnectedness and the expectation of instant access to information and services. The company's investment in 5G technology, for example, is directly addressing this societal trend, with 5G subscriptions expected to surpass 1.5 billion by the end of 2025, according to industry forecasts.

Ericsson actively promotes digital inclusion, acknowledging that an estimated 2.7 billion individuals globally still lack internet access. This commitment is demonstrated through initiatives like Connect to Learn, which provides crucial digital learning and skills development opportunities, specifically targeting the bridging of the digital divide in underserved regions.

The company's efforts in this area are increasingly aligned with broader societal expectations for technology firms to play a significant role in socio-economic development. By expanding connectivity and digital literacy, Ericsson not only addresses a critical global challenge but also enhances its brand reputation and long-term market potential.

Consumer behavior is increasingly leaning towards 5G adoption, with projections indicating that nearly a third of all mobile subscriptions will be 5G by the close of 2025. This significant shift from 4G to 5G is a key driver for escalating data consumption on smartphones.

This evolving consumer preference directly fuels the demand for enhanced mobile experiences, such as immersive gaming and high-definition streaming, which are hallmarks of 5G capabilities. As more users migrate to 5G networks, the average data traffic per smartphone is set to climb substantially.

Ericsson's portfolio of network infrastructure and services plays a pivotal role in facilitating this societal transition to advanced mobile connectivity. By providing the necessary technology, Ericsson is instrumental in enabling the enhanced digital experiences consumers are seeking, thereby supporting the growth of the 5G ecosystem.

Workforce Dynamics and Talent Development

The telecommunications sector, including Ericsson, is navigating significant shifts in workforce dynamics, necessitating ongoing investment in talent development. Key areas demanding upskilling and reskilling include artificial intelligence, cloud computing, and the rapidly expanding 5G infrastructure. Attracting and retaining highly skilled professionals is paramount for driving innovation and ensuring the consistent delivery of critical services.

Ericsson's strategic approach to talent management is crucial for its competitive edge. The company has actively engaged in workforce optimization, which has involved restructuring and, at times, job reductions. For instance, in early 2024, Ericsson announced plans to reduce its workforce by approximately 1,200 roles, primarily in sales and administration, as part of a cost-saving initiative. This focus on an agile and skilled workforce is directly linked to its ability to adapt to technological advancements and market demands.

- Talent Focus: Ericsson emphasizes continuous learning and development in emerging technologies like AI and 5G to maintain a competitive workforce.

- Workforce Optimization: The company has implemented restructuring and job cuts, such as the ~1,200 roles reduced in early 2024, to streamline operations.

- Innovation Driver: Retaining top talent is critical for Ericsson's capacity to innovate and deliver advanced telecommunications solutions.

Societal Expectations for Responsible Business

Societal expectations are increasingly pushing multinational corporations like Ericsson to demonstrate a strong commitment to responsible business practices. This includes not only ethical conduct in all operations but also active contributions to community development and environmental sustainability. Stakeholders, from consumers to investors, demand transparency and accountability, holding companies to higher standards of corporate citizenship.

Ericsson actively addresses these expectations through its robust corporate governance framework, comprehensive ethics and compliance programs, and public reporting on sustainability initiatives. For instance, in 2023, Ericsson reported that 99% of its employees had completed mandatory ethics training, reflecting a focused effort on embedding responsible conduct throughout the organization.

- Growing Demand for Ethical Operations: Consumers and investors are more likely to support businesses that demonstrate ethical sourcing, fair labor practices, and transparent financial reporting.

- Community Engagement: Societal pressure mounts for companies to invest in and uplift the communities where they operate, through job creation, social programs, and local partnerships.

- Sustainability as a Core Value: Beyond environmental impact, societal expectations now encompass a broader view of sustainability, including social equity and long-term economic viability.

- Accountability and Transparency: Businesses are expected to openly communicate their efforts and progress in responsible business, often through detailed sustainability reports and public disclosures.

Societal reliance on seamless connectivity continues to grow, driving demand for Ericsson's core technologies like 5G and IoT. This trend is underscored by the projected surge in global mobile data traffic, expected to reach 300 exabytes monthly by 2026. Ericsson's focus on enabling a wirelessly connected world directly addresses this societal shift, with 5G subscriptions anticipated to exceed 1.5 billion by the end of 2025.

Technological factors

The ongoing evolution of 5G technology, particularly the shift towards standalone (SA) deployments, is a significant technological driver. SA 5G unlocks true 5G capabilities like ultra-low latency and network slicing, crucial for advanced applications. Ericsson is a key player, actively developing and deploying these next-generation networks.

By the end of 2024, it's projected that over 300 operators globally will have launched commercial 5G services, with a growing number focusing on SA architectures. This advancement is foundational for enabling transformative use cases such as real-time control for autonomous vehicles and sophisticated industrial automation, areas where Ericsson holds substantial expertise and market presence.

Artificial intelligence and automation are fundamentally reshaping network management, cybersecurity, and overall operational efficiency within the telecommunications industry. Ericsson is actively pushing the boundaries of AI innovation, recently introducing generative AI-powered solutions such as NetCloud Assistant and establishing dedicated AI labs in collaboration with partners like AWS.

These advancements are strategically designed to revolutionize how networks are operated and how customer service is delivered, promising significant improvements in performance and user experience. By leveraging AI, Ericsson aims to provide more intelligent, proactive, and efficient network solutions for its clients.

The telecommunications industry is rapidly adopting cloud-native and virtualized network architectures. This transition is driven by the need for enhanced flexibility, scalability, and cost savings. Ericsson is a key player in this shift, investing significantly in Cloud RAN solutions.

Ericsson's strategic collaborations with technology leaders like Intel and NVIDIA are crucial for developing these advanced, next-generation infrastructures. These partnerships enable the creation of more agile and efficient networks, essential for meeting future demands.

This move towards virtualized and cloud-native systems directly supports the escalating demand for software-defined networks (SDN) and the expansion of edge computing capabilities. By 2025, it's projected that over 70% of new enterprise workloads will be deployed on cloud-native platforms, underscoring the market's direction.

Internet of Things (IoT) Expansion

The Internet of Things (IoT) market is experiencing significant expansion, with projections indicating a substantial increase in connected devices globally. Telecom operators like Ericsson are central to enabling this growth by providing essential connectivity and infrastructure. By 2025, the number of IoT-connected devices is expected to reach over 27 billion, a considerable leap from previous years.

Ericsson's strategic emphasis on IoT and its emerging business solutions positions the company to leverage this burgeoning market. This includes developing and supporting applications across various sectors such as smart cities, which rely heavily on interconnected sensors and data for efficient urban management, and industrial IoT (IIoT) for optimizing manufacturing processes and supply chains.

- Market Growth: The global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, reaching several trillion dollars.

- Connectivity Demand: This expansion fuels a massive demand for robust and reliable network infrastructure, a core offering for telecommunications companies like Ericsson.

- Sectoral Applications: Key growth areas include smart homes, connected vehicles, healthcare IoT, and enterprise solutions, all requiring specialized connectivity and platform capabilities.

Research and Development (R&D) Investment

Ericsson's commitment to research and development is a cornerstone of its strategy, enabling it to navigate and lead in the fast-paced telecommunications sector. This continuous investment fuels innovation, ensuring the company stays ahead of technological shifts and customer needs. For instance, Ericsson's significant R&D expenditure in 2023, amounting to SEK 37.7 billion (approximately $3.6 billion USD), underscores its dedication to advancing key areas like 5G, artificial intelligence, and cloud-native solutions.

The company strategically directs its R&D focus towards critical growth areas that define the future of connectivity and digital services. These include the ongoing development and deployment of 5G Advanced, the integration of artificial intelligence to optimize network performance and create new services, and the expansion of cloud-native technologies for greater flexibility and efficiency. Furthermore, Ericsson is heavily invested in network Application Programming Interfaces (APIs), which are crucial for enabling developers to build innovative applications on top of its network infrastructure.

This proactive approach to innovation is vital for Ericsson's sustained competitiveness. By consistently pushing the boundaries of technology, Ericsson not only strengthens its existing market position but also positions itself to capitalize on emerging opportunities. The company's R&D pipeline is designed to anticipate and meet future technological demands, ensuring its solutions remain relevant and valuable in an ever-evolving digital ecosystem.

Key R&D focus areas for Ericsson include:

- 5G Advanced and future generations of mobile technology

- Artificial Intelligence and Machine Learning for network automation and optimization

- Cloud-native software and edge computing solutions

- Network APIs for enhanced service creation and monetization

The continuous advancement of 5G, especially Standalone (SA) deployments, is a major technological force, enabling ultra-low latency and network slicing. By the close of 2024, over 300 operators worldwide are expected to have launched 5G services, with a growing emphasis on SA architectures, which are critical for applications like real-time autonomous vehicle control.

AI and automation are transforming network management and cybersecurity. Ericsson's investment in AI, including solutions like NetCloud Assistant, aims to enhance network operations and customer service, making them more intelligent and efficient.

The industry's shift to cloud-native and virtualized networks, supported by Ericsson's Cloud RAN solutions and partnerships with Intel and NVIDIA, is driven by the need for flexibility and scalability. Projections suggest that by 2025, over 70% of new enterprise workloads will be on cloud-native platforms.

The Internet of Things (IoT) market is expanding rapidly, with the number of connected devices anticipated to exceed 27 billion by 2025. Ericsson is vital in supporting this growth through its connectivity infrastructure and IoT solutions, particularly for smart cities and industrial applications.

| Technology Area | 2023/2024 Focus | Future Outlook (2025+) |

|---|---|---|

| 5G Evolution | Standalone (SA) deployments, 5G Advanced | Enhanced network slicing, ultra-low latency applications |

| Artificial Intelligence | Network automation, generative AI solutions | Proactive network management, AI-driven customer service |

| Cloud & Virtualization | Cloud RAN, virtualized network functions | Software-defined networks (SDN), edge computing expansion |

| Internet of Things (IoT) | Connectivity infrastructure, IoT solutions | Massive device connectivity, smart city and IIoT growth |

Legal factors

Ericsson, like all telecom giants, navigates a complex web of data privacy laws. Regulations such as the General Data Protection Regulation (GDPR) and the forthcoming EU AI Act impose strict requirements on how user data is collected, processed, and stored. Failure to adhere can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Ericsson's commitment to secure hosting of AI components is crucial for maintaining user trust and avoiding these significant financial and reputational risks.

Intellectual property rights are paramount in the telecommunications sector, and patent disputes can heavily influence a company's financial performance. Ericsson's business model relies significantly on licensing revenue generated from its vast patent portfolio.

In 2023, Ericsson reported that its intellectual property (IP) licensing segment generated approximately SEK 26.4 billion (around $2.5 billion USD at the time of reporting), highlighting its importance. The successful resolution of patent disputes can unlock substantial financial gains for the company, as seen in past settlements.

Ericsson navigates a global telecom landscape where antitrust and competition laws are paramount. These regulations, enforced by bodies like the European Commission and the US Department of Justice, scrutinize market dominance and mergers to ensure fair play. For instance, in 2024, ongoing investigations into potential anti-competitive practices in certain regional markets continue to shape strategic decisions for major players, including Ericsson.

The company's significant market share in network infrastructure means its actions are often under a microscope. Strategic alliances and acquisitions, crucial for growth and innovation, must pass rigorous competition reviews. Failure to comply can result in substantial fines and operational restrictions, impacting Ericsson's ability to expand its footprint and technological offerings in key markets.

Telecommunications Licensing and Spectrum Regulations

Operating in the telecommunications sector means Ericsson must navigate a complex web of national and international licensing and spectrum regulations. These rules are crucial for deploying and managing network infrastructure, directly influencing market access and operational capabilities.

Regulatory bodies worldwide, such as the FCC in the United States and Ofcom in the UK, meticulously manage spectrum allocation and usage. For instance, in 2024, various countries continued their 5G spectrum auctions, with nations like Germany allocating additional mid-band spectrum, impacting deployment strategies for infrastructure providers like Ericsson.

- Spectrum Allocation: Governments grant licenses for specific radio frequency bands, essential for wireless communication services.

- Licensing Requirements: Companies need operating licenses to provide telecommunications services, often involving fees and compliance with service quality standards.

- Regulatory Compliance: Adherence to these evolving regulations is paramount for Ericsson's legal operation and market participation, with penalties for non-compliance.

Compliance with International Trade Laws

Ericsson operates within a complex web of international trade laws, covering areas like tariffs, sanctions, and export controls. The company's extensive global supply chain and manufacturing sites are meticulously managed to ensure adherence to these varied and often country-specific regulations.

Recent geopolitical developments and evolving trade policies, such as the potential for renewed US import tariffs on certain goods, demand constant legal vigilance and strategic adaptation from Ericsson. For instance, in 2024, global trade disputes continued to create uncertainty, impacting supply chain costs and market access for telecommunications equipment manufacturers.

- Tariff Compliance: Ericsson must track and comply with tariffs imposed by various nations, which can fluctuate based on trade agreements and disputes.

- Sanctions and Export Controls: Adherence to international sanctions regimes and export control laws is critical for maintaining market access and avoiding legal penalties.

- Geopolitical Impact: Changes in trade policies, like those seen with the US and China, directly affect Ericsson's global operations and require proactive legal and strategic adjustments.

- Regulatory Monitoring: Continuous monitoring of evolving international trade laws and their implications is essential for Ericsson's ongoing business continuity and risk management.

Ericsson's legal landscape is shaped by stringent data protection laws, like GDPR, with potential fines reaching 4% of global annual turnover, impacting its AI initiatives. Intellectual property rights are also critical, with Ericsson's IP licensing revenue contributing significantly, as evidenced by approximately SEK 26.4 billion generated in 2023. Antitrust and competition laws, enforced globally, scrutinize market dominance, affecting strategic moves like mergers and acquisitions, with ongoing investigations in 2024 highlighting this pressure.

Environmental factors

The telecommunications industry is under growing pressure to minimize its environmental impact, prompting significant efforts from companies like Ericsson to cut greenhouse gas emissions. This focus is critical as global awareness of climate change intensifies.

Ericsson has established forward-thinking goals, aiming for Net Zero emissions throughout its entire value chain by 2040. Furthermore, the company is committed to reducing its direct carbon footprint (Scope 1 and 2) by 55% compared to its 2020 levels, a target that underscores its dedication to sustainability.

Ericsson is heavily focused on enhancing the energy efficiency of its network equipment, understanding that the operational phase of its products contributes substantially to its overall environmental impact. This commitment is evident in their pursuit of innovations such as 'deep sleep' modes for base stations, which significantly reduce power consumption when not actively transmitting data. By 2025, Ericsson aims to achieve a 40% reduction in energy consumption for its new radio base stations, a tangible goal reflecting their dedication to sustainability and meeting customer needs for lower operating costs.

Ericsson is actively addressing the growing challenge of electronic waste (e-waste) by integrating circular economy principles into its operations. This commitment is evident in initiatives such as their move towards plastic-free packaging, aiming to significantly reduce the environmental footprint of their product delivery.

Furthermore, Ericsson is pioneering solutions like Ericsson Connected Recycling, a digital platform designed to streamline and enhance reverse supply chains. This technology not only facilitates the efficient management of returned products but also seeks to identify opportunities for monetizing waste streams, thereby transforming discarded materials into valuable resources and contributing to a more sustainable economic model.

Sustainable Supply Chain Practices

Ericsson is actively pushing for sustainability throughout its supply chain, a crucial element in its 2024-2025 strategy. This includes encouraging suppliers to adopt science-based targets for emissions reduction. The company focuses on responsible sourcing and material efficiency, aiming to cut emissions from manufacturing and logistics for its telecom gear.

A significant part of this effort involves working with suppliers on developing and implementing innovative sustainable packaging solutions. For instance, Ericsson reported a 10% reduction in packaging waste in 2023 through these initiatives, with a target of a further 15% reduction by the end of 2025.

- Supplier Engagement: Ericsson aims to have 80% of its key suppliers committed to science-based emissions targets by 2025.

- Material Efficiency: The company is targeting a 25% increase in the use of recycled materials in its product packaging by 2025.

- Logistics Emissions: Ericsson is exploring and implementing lower-emission transportation methods, with a goal to reduce Scope 3 emissions from logistics by 20% by 2026.

Regulatory Pressure for Environmental Sustainability

Governments worldwide are intensifying their focus on environmental sustainability, leading to stricter regulations for the Information and Communications Technology (ICT) sector. These regulations often target carbon emissions reduction and the promotion of circular economy principles. For instance, the European Union's Ecodesign for Sustainable Products Regulation, which came into full effect in 2024, mandates stricter requirements for product durability, repairability, and recyclability, directly impacting ICT hardware manufacturers like Ericsson.

Ericsson's proactive approach to these regulatory pressures is a key strategic element. By aligning its operations and product development with evolving environmental standards, the company positions itself favorably. This includes adhering to guidelines for responsible e-waste management and implementing circularity strategies in its supply chain. For example, in 2024, Ericsson reported a 10% increase in the use of recycled materials in its network equipment, demonstrating a commitment to circularity ahead of many mandates.

- Regulatory Landscape: Increasing global mandates on carbon footprint reduction and circular economy practices in ICT.

- Compliance and Strategy: Environmental sustainability is a core business strategy, not just a compliance measure for Ericsson.

- Circular Economy Focus: Emphasis on product durability, repairability, and e-waste management, with Ericsson increasing recycled material usage by 10% in 2024.

- Competitive Advantage: Strong environmental performance enhances brand reputation and market competitiveness.

Environmental factors are increasingly shaping the telecommunications landscape, pushing companies like Ericsson to prioritize sustainability. Stricter global regulations, such as the EU's Ecodesign for Sustainable Products Regulation, are compelling ICT manufacturers to enhance product durability and recyclability, directly influencing Ericsson's operational and product development strategies.

Ericsson's commitment to Net Zero emissions by 2040, coupled with a 55% reduction target for Scope 1 and 2 emissions by 2040 from 2020 levels, demonstrates a proactive stance. The company is also actively working to minimize its environmental footprint through initiatives like improving network equipment energy efficiency, aiming for a 40% reduction in energy consumption for new radio base stations by 2025, and integrating circular economy principles to manage e-waste.

Supplier engagement is a critical component of Ericsson's 2024-2025 environmental strategy, with a goal to have 80% of key suppliers committed to science-based emissions targets by 2025. Furthermore, the company is focused on material efficiency, targeting a 25% increase in the use of recycled materials in product packaging by 2025, and exploring lower-emission logistics solutions.

| Environmental Goal | Target Year | Current Status/Progress | Key Initiatives |

| Net Zero Emissions (Value Chain) | 2040 | Ongoing | Supplier engagement, circular economy principles |

| Scope 1 & 2 Emissions Reduction | 2040 (vs. 2020) | Target: 55% reduction | Energy efficiency improvements, renewable energy sourcing |

| Radio Base Station Energy Consumption | 2025 | Target: 40% reduction | 'Deep sleep' modes, optimized hardware design |

| Supplier Science-Based Targets | 2025 | Target: 80% of key suppliers | Supplier collaboration and incentives |

| Recycled Materials in Packaging | 2025 | Target: 25% increase | Sustainable packaging solutions, waste reduction efforts |

PESTLE Analysis Data Sources

Our Ericsson PESTLE analysis is meticulously constructed using data from reputable sources including the International Telecommunication Union (ITU), GSMA, market research firms specializing in the telecommunications sector, and official government reports on digital infrastructure and policy.