Ericsson Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ericsson Bundle

Ericsson's marketing prowess is built on a robust 4Ps strategy, from their cutting-edge product portfolio to their strategic pricing and expansive distribution networks. Discover how their promotional efforts amplify their market leadership.

Uncover the intricate details of Ericsson's Product innovation, Price competitiveness, Place accessibility, and Promotion effectiveness. This comprehensive analysis is your key to understanding their success.

Save invaluable time and gain actionable insights into Ericsson's marketing mix. Our ready-made, editable report provides the strategic depth you need for your own business planning or academic pursuits.

Product

Ericsson's Network Infrastructure Solutions, a core component of their Product offering, encompasses advanced radio access network (RAN) equipment, including 4G and 5G base stations and antennas, alongside robust core network solutions like 5G Core and Cloud Core. These offerings are designed to equip Communication Service Providers (CSPs) with the tools to construct and manage highly efficient mobile networks.

The company's commitment to innovation is evident in its continuous hardware design advancements, exemplified by products like the AIR 3266. These innovations focus on enhancing spectral efficiency and uplink performance, crucial for maximizing network capacity and user experience. Ericsson's 2024 financial reports highlight significant investment in R&D for these infrastructure solutions, aiming to reduce energy consumption by up to 20% in newer deployments.

Ericsson's Managed Services and Support are vital components of its offering, extending beyond hardware to ensure optimal network performance and client efficiency. These services encompass network design, deployment, and continuous optimization, allowing telecom operators to manage their infrastructure reliably. For instance, in 2024, Ericsson reported a significant portion of its revenue stemming from these service areas, reflecting the critical need for expert network management in the evolving telecommunications landscape.

Ericsson’s 5G Advanced Software and Platforms are central to its product strategy, offering Communications Service Providers (CSPs) enhanced network capabilities and enabling innovative services. These solutions, including AI-powered RAN and intent-driven networks, are designed to boost performance and user experience. For instance, Ericsson's focus on service-aware RAN aims to optimize network operations, a critical factor as the global 5G infrastructure market is projected to reach $147.3 billion by 2027, according to recent industry forecasts.

The introduction of new software products as subscriptions underscores a shift towards programmability and automation within networks. This subscription model allows CSPs to access cutting-edge features and updates more flexibly, fostering agility in network management. This aligns with the increasing demand for dynamic network slicing and edge computing, key enablers for advanced 5G use cases across various industries.

IoT and Enterprise Solutions

Ericsson's Product strategy for IoT and Enterprise Solutions centers on delivering robust connectivity platforms and specialized software. These offerings cater to a wide array of IoT applications, from smart cities to industrial automation. The company also provides private mobile networks, giving businesses dedicated, high-performance wireless infrastructure. This includes tailored solutions for critical sectors like automotive, utilities, and manufacturing, ensuring reliable and secure operations.

The company's enterprise solutions are designed to offer businesses and application developers unparalleled connectivity and advanced network functionalities. This strategic focus is evident in their development of cellular-optimized Secure Access Service Edge (SASE) solutions, which are crucial for the security and efficiency of distributed enterprises. By late 2024, the global IoT market was projected to reach over $1.1 trillion, with enterprise solutions forming a significant portion of this growth, driven by demand for private networks and edge computing.

Key aspects of Ericsson's IoT and Enterprise Solutions product offering include:

- IoT Connectivity Platforms: Enabling seamless connection and management of vast numbers of devices across diverse use cases.

- Private Mobile Networks: Delivering dedicated, high-capacity, and low-latency wireless networks for enterprise operations.

- Industry-Specific Solutions: Addressing the unique connectivity and digital transformation needs of sectors like automotive, utilities, and manufacturing.

- SASE Solutions: Providing secure and optimized network access for distributed workforces and applications.

Cloud and Digital Services

Ericsson's Cloud and Digital Services focus on empowering Communication Service Providers (CSPs) with advanced digital solutions. This includes their digital business support systems (BSS) for streamlined operations and enhanced customer engagement, alongside robust digital experience platforms. These offerings are crucial for CSPs navigating the complexities of the modern digital landscape.

A key initiative is 'Ericsson On-Demand,' a core network as-a-service solution developed in partnership with Google Cloud. This innovative service provides CSPs with a flexible, consumption-based pricing model and fully managed operations, significantly reducing upfront investment and operational burden. This strategic move aligns with the industry's shift towards agile and scalable network infrastructure.

These cloud-native solutions are engineered for rapid deployment and elastic scaling, allowing CSPs to adapt quickly to evolving market demands and technological advancements. For instance, by mid-2024, the global public cloud services market was projected to reach over $600 billion, highlighting the significant demand for such flexible infrastructure. Ericsson's strategy capitalizes on this trend, aiming to provide efficient and cost-effective digital transformation for its clients.

- Digital BSS and Experience Platforms: Ericsson provides comprehensive digital business support systems and digital experience platforms to enhance CSP operations and customer interactions.

- Ericsson On-Demand: A core network as-a-service solution, co-created with Google Cloud, offering consumption-based pricing and managed services.

- Cloud-Native Architecture: Solutions are built on cloud-native principles for rapid deployment and elastic scalability to meet dynamic market needs.

- Market Alignment: This strategy aligns with the growing global demand for cloud services, which saw significant expansion throughout 2024.

Ericsson's product portfolio is a comprehensive suite of advanced telecommunications solutions. This includes cutting-edge network infrastructure like 5G RAN and core network components, designed for high spectral efficiency and reduced energy consumption, with newer deployments aiming for up to 20% energy savings as reported in 2024. The company also offers robust managed services and support, crucial for network optimization and client efficiency, which contributed a significant portion to their revenue in 2024.

Furthermore, Ericsson is heavily invested in 5G Advanced Software and Platforms, incorporating AI for enhanced network performance and user experience, supporting a global 5G infrastructure market projected to reach $147.3 billion by 2027. Their IoT and Enterprise Solutions provide specialized connectivity platforms and private mobile networks for industries like automotive and manufacturing, tapping into an IoT market exceeding $1.1 trillion by late 2024. Finally, their Cloud and Digital Services, including 'Ericsson On-Demand' with Google Cloud, offer flexible, consumption-based core network solutions, aligning with the public cloud services market's growth to over $600 billion by mid-2024.

What is included in the product

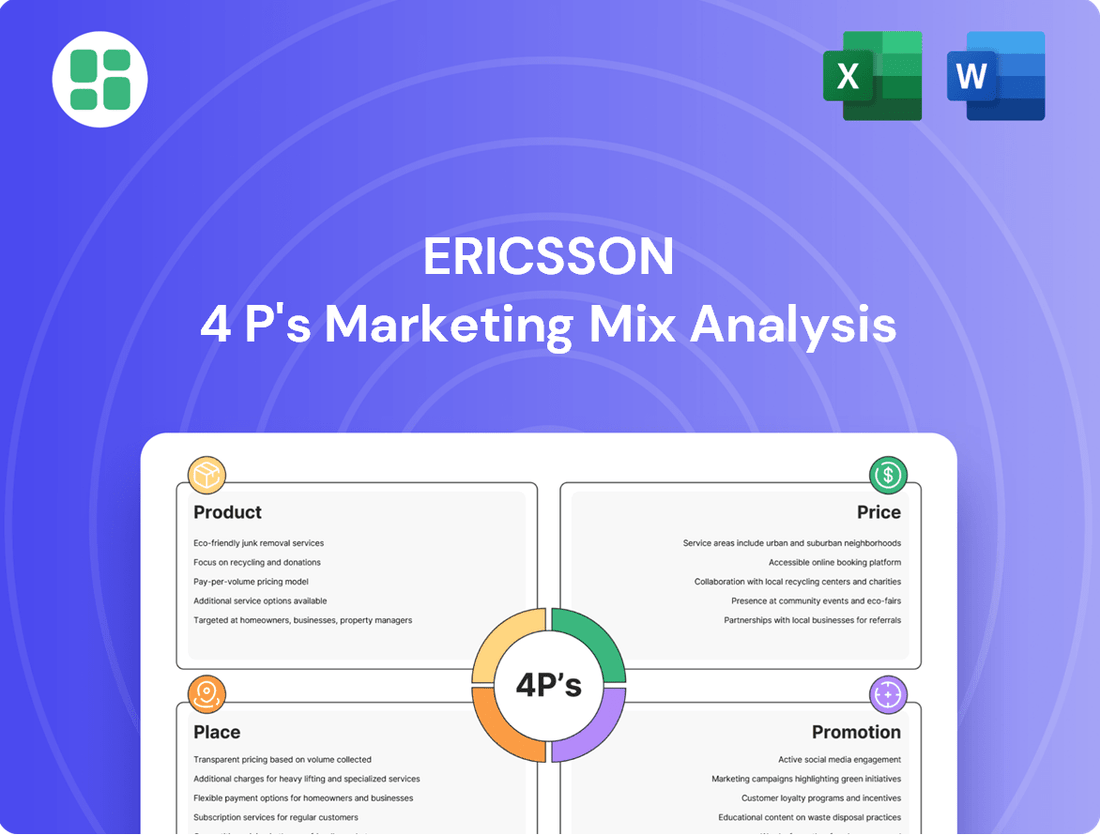

This analysis provides a comprehensive overview of Ericsson's marketing strategies, examining its Product, Price, Place, and Promotion tactics within the competitive telecommunications landscape.

It offers actionable insights into Ericsson's market positioning and strategic choices, making it a valuable resource for understanding their approach to reaching and serving customers.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for strategic decision-making.

Provides a clear, concise framework for understanding Ericsson's market approach, easing the burden of deciphering intricate product, price, place, and promotion elements.

Place

Ericsson's primary distribution strategy centers on direct sales to global telecom operators. This approach allows for highly tailored solutions and deep engagement with clients, crucial for the complex infrastructure projects they undertake. Dedicated sales teams work closely with operators to understand their evolving network requirements and offer comprehensive packages of equipment, software, and services.

This direct channel is fundamental to Ericsson's business model, reflecting the significant capital expenditure and intricate planning involved in building and upgrading telecommunications networks. Direct negotiation of contracts for these large-scale deployments ensures that Ericsson can effectively manage customer relationships and deliver on the specific technical and commercial terms required. For instance, in 2023, Ericsson secured significant deals with major operators worldwide, underscoring the importance of this direct sales channel for its revenue generation and market presence.

Ericsson's commitment to customer proximity is evident in its expansive global network, reaching over 180 countries. This vast presence is supported by strategically located regional offices and support centers designed to offer immediate assistance and technical expertise to a diverse clientele.

This extensive global footprint is crucial for ensuring timely support and maintenance, a key aspect of their service offering. The company's recent restructuring, consolidating three market areas into two, further underscores their focus on enhancing customer experience and operational efficiencies across these regions.

Ericsson actively cultivates strategic partnerships with telecom operators, system integrators, and major cloud providers such as Google Cloud. These collaborations are crucial for extending market reach and delivering integrated, end-to-end solutions to customers.

Through these alliances, Ericsson facilitates the seamless integration of its technologies into client networks and service offerings, enhancing value propositions. For instance, initiatives like the Aduna platform aim to aggregate network APIs, thereby fostering innovation and enabling new business opportunities within the telecommunications ecosystem.

Digital Platforms for Engagement

Ericsson leverages digital platforms extensively to connect with its B2B audience, acting as a crucial extension of its direct sales force. These channels are vital for disseminating information about its cutting-edge solutions, including 5G, IoT, and network slicing, thereby fostering lead generation and reinforcing its image as an industry innovator.

The company’s digital engagement strategy is designed to build brand recognition and establish thought leadership within the telecommunications sector. This online presence is particularly important for reaching key decision-makers and stakeholders globally, ensuring Ericsson remains at the forefront of technological advancements and market trends.

- Digital Presence for Thought Leadership: Ericsson uses its digital platforms to share insights and expertise on emerging technologies.

- Lead Generation via Online Channels: Online engagement is a primary driver for identifying and nurturing potential business opportunities.

- Brand Recognition in B2B: A strong digital footprint is essential for maintaining and enhancing brand visibility among industry peers and clients.

- Showcasing Innovation: Digital channels effectively highlight Ericsson's advancements in areas like 5G and IoT.

Channel Partners and Resellers

Ericsson leverages a robust network of channel partners and resellers to significantly expand its market reach and customer engagement, especially for its enterprise-focused wireless solutions, exemplified by Cradlepoint. This strategy is crucial for accessing diverse customer segments and geographic regions that might be challenging to penetrate directly.

The company actively invests in empowering these partners with the necessary tools and expertise. This includes comprehensive training, sales enablement resources, and technical support, ensuring they can effectively present and deploy Ericsson's advanced solutions, such as private 5G and edge networking technologies, to their respective customer bases.

- Market Expansion: Channel partners allow Ericsson to tap into new markets and customer segments, particularly for specialized enterprise solutions.

- Partner Enablement: Ericsson provides training and resources to ensure partners possess the technical competency to sell and support advanced technologies like private 5G.

- Joint Sales Efforts: Collaboration on sales initiatives aims to drive growth and effectively reach target customers in key enterprise sectors.

- Growth Focus: The strategy is geared towards accelerating adoption of new technologies, with partners playing a vital role in driving revenue for areas like edge networking.

Ericsson's place strategy emphasizes a direct sales model to major telecom operators, complemented by a global network of offices and support centers. This ensures close customer relationships and immediate technical assistance worldwide, crucial for large-scale infrastructure projects. Strategic partnerships and digital platforms further extend their reach and engagement, while channel partners, like Cradlepoint for enterprise solutions, amplify market penetration.

| Distribution Channel | Key Focus | Examples/Data (2023-2024) |

|---|---|---|

| Direct Sales | Major telecom operators, tailored solutions | Secured significant deals with global operators; direct engagement for complex network upgrades. |

| Global Network | Customer proximity, immediate support | Operations in over 180 countries; regional offices for technical expertise. |

| Strategic Partnerships | Integrated solutions, market reach | Collaborations with Google Cloud for integrated offerings; Aduna platform for API aggregation. |

| Digital Platforms | Information dissemination, lead generation | Showcasing 5G, IoT, and edge solutions; building thought leadership. |

| Channel Partners | Enterprise solutions, market expansion | Cradlepoint for enterprise wireless; partner enablement for private 5G and edge networking. |

What You Preview Is What You Download

Ericsson 4P's Marketing Mix Analysis

The preview you see here is the actual, complete Ericsson 4P's Marketing Mix Analysis you’ll receive instantly after purchase. This document is fully prepared and ready for your immediate use, ensuring no surprises and full confidence in your acquisition.

Promotion

Ericsson leverages B2B content marketing and thought leadership to solidify its position in key technology areas. By producing insightful content like the Ericsson Mobility Report, which projected 5G subscriptions to reach 1.5 billion by the end of 2023, the company educates its audience of telecom operators and enterprises.

This strategy focuses on building credibility and trust by offering valuable information on 5G, IoT, cloud, and network slicing. Publications such as the Ericsson Technology Review further underscore this commitment to sharing expertise and influencing industry direction.

Ericsson actively participates in major industry events like Mobile World Congress (MWC), a crucial promotional strategy. These gatherings are vital for showcasing new products and technologies, like their 5G advancements, and for direct engagement with key stakeholders. In 2024, MWC Barcelona saw significant announcements from Ericsson regarding their cloud-native 5G core and RAN solutions.

Ericsson's promotional efforts heavily emphasize the ongoing global 5G rollout and its benefits, positioning the company as a key infrastructure provider. This strategy educates the market on 5G's potential to revolutionize smart cities and industries, driving adoption among telecom operators. By mid-2024, over 200 commercial 5G networks were live worldwide, with Ericsson playing a significant role in many of these deployments.

Direct Marketing and Sales Support Materials

Ericsson's direct marketing and sales support materials are crucial for its global B2B sales efforts. These resources are crafted to address the specific needs of CTOs and network operations managers, highlighting how Ericsson's solutions enhance network efficiency and reduce operational costs.

The company's promotional content emphasizes tangible benefits such as future-proofing infrastructure and achieving significant cost savings. For instance, in 2024, Ericsson reported substantial growth in its managed services segment, driven by demand for network optimization, a key area addressed by their sales support materials.

- Targeted B2B Engagement: Materials are tailored for complex sales cycles, focusing on solving specific client challenges.

- Benefit-Driven Communication: Emphasis is placed on network efficiency, cost reduction, and infrastructure longevity.

- Lead Generation: Marketing efforts directly fuel the pipeline for Ericsson's direct sales force.

- Brand Visibility: Promotional activities aim to reinforce Ericsson's position as a leading technology provider.

Public Relations and Investor Relations

Ericsson actively cultivates its public image and investor confidence through a robust Public Relations (PR) and Investor Relations (IR) strategy. This involves consistent communication via press releases, detailed annual reports, and dedicated investor briefings. These channels are crucial for conveying Ericsson's financial health, strategic roadmap, and ongoing commitment to sustainability, thereby fostering transparency and trust among its diverse stakeholder base.

The company places a strong emphasis on its sustainability initiatives and broader corporate responsibility, often detailing these efforts in specialized reports. For instance, Ericsson's 2023 Sustainability and Corporate Responsibility Report highlighted progress in areas such as reducing its own operational emissions and enabling emission reductions for its customers. This proactive disclosure aims to solidify its reputation as a responsible corporate citizen.

- Financial Transparency: Ericsson's Q1 2024 report showed net sales of SEK 62.4 billion, with a focus on profitability improvements and cash flow generation, key metrics for investor confidence.

- Strategic Communication: The company's investor day in November 2024 is expected to provide further insights into its long-term strategy, particularly concerning 5G advancements and AI integration.

- Sustainability Reporting: Ericsson consistently publishes its sustainability performance, aligning with global ESG (Environmental, Social, and Governance) frameworks to attract socially conscious investors.

- Stakeholder Engagement: Through regular earnings calls and participation in industry forums, Ericsson actively engages with analysts and investors to address concerns and share its vision.

Ericsson's promotional strategy is deeply rooted in educating its B2B audience through thought leadership and detailed market analysis. The Ericsson Mobility Report, a cornerstone of this approach, consistently provides forward-looking data, projecting 5G subscriptions to exceed 2 billion by the end of 2024, thereby guiding industry investment and strategy.

These efforts are complemented by active participation in pivotal industry events like Mobile World Congress (MWC). At MWC 2024, Ericsson showcased its latest cloud-native 5G solutions, directly engaging with key decision-makers and reinforcing its technological leadership. This direct engagement is crucial for demonstrating innovation and building relationships within the competitive telecom landscape.

Furthermore, Ericsson utilizes targeted sales support materials that articulate the tangible benefits of its offerings, such as network efficiency and cost savings for operators. By highlighting these advantages, the company effectively addresses the specific pain points of its B2B clientele, driving demand for its advanced network infrastructure and services.

Ericsson's public relations and investor relations are also integral, ensuring transparent communication about its financial performance and strategic direction. For example, the company's Q1 2024 earnings report detailed net sales of SEK 62.4 billion, emphasizing profitability improvements and cash flow generation, which are critical for maintaining investor confidence and attracting capital for ongoing R&D and market expansion.

| Promotional Tactic | Description | Key Data/Impact |

|---|---|---|

| Thought Leadership & Content Marketing | Publishing insightful reports (e.g., Mobility Report) and technical reviews. | Mobility Report projected over 2 billion 5G subscriptions by end of 2024. |

| Industry Event Participation | Showcasing new technologies and engaging directly at events like MWC. | MWC 2024 featured Ericsson's cloud-native 5G core and RAN advancements. |

| Direct Sales Support & Benefit Communication | Creating materials focused on network efficiency, cost reduction, and future-proofing. | Managed services growth in 2024 driven by network optimization demand. |

| PR & Investor Relations | Transparent communication on financial health, strategy, and sustainability. | Q1 2024 net sales: SEK 62.4 billion; focus on profitability and cash flow. |

Price

Ericsson leans heavily into value-based pricing, aligning solution costs with the significant advantages they offer communication service providers. This means customers pay for the technological edge, enhanced network efficiency, and sustained long-term gains Ericsson delivers, rather than just the production cost.

This strategy highlights the substantial return on investment customers can expect from Ericsson's advanced infrastructure and software. For instance, in 2024, network upgrades powered by Ericsson's 5G technology are projected to boost operator revenues by an average of 10-15% through improved capacity and new service enablement.

For substantial undertakings like extensive network rollouts, Ericsson provides pricing structures that are specifically designed for each client. This approach acknowledges the intricate demands and sheer scope of major telecommunications projects.

This adaptability enables the creation of unique solutions, factoring in the distinct specifications, magnitude, and integration challenges faced by leading telecom providers. For instance, during 2024, major 5G infrastructure upgrades often involved multi-year contracts where pricing was directly tied to deployment milestones and service level agreements, reflecting the customized nature of these deals.

Such tailored arrangements guarantee that customers receive exactly what they need, ensuring alignment with their financial planning and budgetary timelines, a critical aspect for projects often valued in the hundreds of millions or even billions of dollars.

Ericsson's focus on long-term contracts and service-based models, like its subscription offerings for software and managed services, builds stable, predictable revenue. This approach ensures customers receive continuous support, maintenance, and essential product updates, strengthening client loyalty.

The 'Ericsson On-Demand' core network solution exemplifies this strategy, providing a consumption-based billing model that eliminates significant upfront capital expenditure for clients. For the fiscal year 2023, Ericsson reported a notable portion of its revenue derived from services and managed solutions, underscoring the success of these long-term engagements.

Competitive Positioning and Market Dynamics

Ericsson's pricing strategy is designed to underscore its technological leadership and innovative capabilities in the global telecom infrastructure arena. This approach balances premium positioning with the need to remain competitive, especially as 5G deployment accelerates.

The company actively monitors competitor pricing and market demand, which is significantly shaped by the pace of 5G network rollouts. For instance, in 2024, the ongoing expansion of 5G infrastructure across major markets continues to be a key driver of demand, influencing price points for Ericsson's solutions.

Ericsson emphasizes the superior quality and reliability of its products and services to justify its pricing structure. This focus on value proposition is crucial for customers making substantial investments in network upgrades.

- Market Share: Ericsson maintained a strong position in the global RAN market, estimated to be around 25-30% in early 2024.

- 5G Revenue Growth: The company reported significant revenue contributions from its 5G-related segments, reflecting market acceptance of its advanced solutions.

- Competitor Pricing Benchmarks: Ericsson's pricing is benchmarked against key competitors like Nokia and Huawei, ensuring its offerings are perceived as valuable within the competitive landscape.

Intellectual Property (IPR) Licensing Revenue

Ericsson's intellectual property rights (IPR) licensing is a cornerstone of its revenue strategy, providing consistent, high-margin income. This stream is vital for maintaining profitability, especially as it complements hardware and service sales. The company actively manages and monetizes its vast patent portfolio.

The recurring nature of IPR licensing offers significant margin resilience for Ericsson. In 2023, the company continued to see substantial contributions from this segment, underscoring its importance to overall financial health. This revenue isn't just supplementary; it's a key driver of Ericsson's profitability.

- Recurring High-Margin Income: IPR licensing generates predictable revenue with typically lower associated costs compared to product sales.

- Portfolio Monetization: Ericsson leverages its extensive patent portfolio, built over years of R&D, to secure licensing agreements.

- Financial Resilience: This revenue stream helps buffer the company's financial performance against fluctuations in hardware and service markets.

- Profitability Driver: IPR licensing is a critical component that boosts Ericsson's overall profit margins.

Ericsson employs a value-based pricing strategy, aligning costs with the significant benefits customers receive, such as enhanced network efficiency and long-term gains. This approach is particularly evident in their customized pricing for large-scale projects like 5G network rollouts, where contracts are often milestone-based and tied to service level agreements.

The company also leverages its intellectual property rights (IPR) licensing for consistent, high-margin income, a strategy that proved vital in 2023 for maintaining profitability. This recurring revenue stream, generated from a robust patent portfolio, provides financial resilience and acts as a key profitability driver.

| Pricing Strategy Component | Description | 2023/2024 Relevance |

| Value-Based Pricing | Aligning costs with customer benefits and ROI. | Key for justifying premium pricing on advanced 5G solutions. |

| Customized Project Pricing | Tailored structures for large network deployments. | Essential for multi-year, high-value 5G infrastructure contracts in 2024. |

| IPR Licensing | Monetizing patent portfolio for recurring revenue. | Provided significant high-margin income, boosting profitability in 2023. |

4P's Marketing Mix Analysis Data Sources

Our Ericsson 4P's Marketing Mix Analysis is meticulously constructed using a blend of official Ericsson communications, including annual reports, investor presentations, and press releases. We also incorporate data from industry analysis firms and market research reports to provide a comprehensive view of their product, price, place, and promotion strategies.