Ericsson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ericsson Bundle

Ericsson faces intense competition, with rivals constantly innovating and new entrants posing a potential threat. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this dynamic market.

The complete report reveals the real forces shaping Ericsson’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The telecommunications sector, including companies like Ericsson, often faces a concentrated supplier base for highly specialized components. Think about semiconductors and advanced chipsets; only a handful of companies globally produce these cutting-edge items. This limited competition means these suppliers can wield considerable influence.

For instance, the development and rollout of 5G technology, and indeed future network advancements, depend heavily on these proprietary technologies. Ericsson's need for these specific, often patented, components from a select few dominant players inherently strengthens the bargaining power of those suppliers. This reliance means suppliers can dictate terms, affecting costs and availability for Ericsson.

Many components and software solutions for telecom infrastructure are highly specialized, like custom-designed baseband units or advanced network management software. These inputs often possess unique performance characteristics that are difficult for Ericsson to replicate internally or find elsewhere. For instance, a supplier holding patents on a critical 5G signal processing algorithm can wield considerable leverage.

Switching from one major supplier for core network components or software can represent extremely high switching costs for Ericsson. These costs encompass redesigning products, rigorous re-certification of equipment, extensive testing phases, and the potential for significant delays in product rollouts, impacting market competitiveness.

These substantial switching costs effectively solidify existing supplier relationships, granting those suppliers considerable leverage. This leverage allows them to dictate terms more favorably, as Ericsson faces significant hurdles and expenses in exploring alternative providers for critical infrastructure.

Threat of Forward Integration by Suppliers

While less common due to the significant capital and established customer relationships needed, highly specialized suppliers might contemplate forward integration into Ericsson's core business. This threat, though often subtle, can empower suppliers by suggesting they could offer more comprehensive, integrated solutions, potentially competing directly with Ericsson.

This potential for suppliers to move into Ericsson's market underscores the importance of maintaining robust and collaborative relationships. For instance, in 2023, the telecommunications infrastructure market saw continued consolidation, with some component manufacturers exploring broader service offerings, indirectly increasing their leverage.

- Forward Integration Risk: Specialized suppliers may consider entering Ericsson's market by offering integrated solutions, thereby increasing their bargaining power.

- Capital and Relationship Barriers: The high capital investment and deep customer relationships required make direct forward integration by suppliers a less frequent, though still present, threat.

- Strategic Importance: Ericsson's need to manage this threat reinforces the value of strong supplier partnerships and collaborative innovation.

Importance of Supplier's Products to Ericsson's Business

The quality, reliability, and technological advancement of components supplied are paramount to Ericsson's ability to deliver high-performance and competitive network solutions. For instance, in 2024, Ericsson's continued focus on 5G advanced technologies relies heavily on specialized chipsets and advanced materials from its key component providers.

Any disruption or inferior quality from these key suppliers can directly impact Ericsson's product integrity and market reputation, as seen in past supply chain challenges affecting network deployment timelines. This dependency grants suppliers a strong position in negotiations, as Ericsson requires consistent innovation and dependable delivery to maintain its market edge.

- Component Dependency: Ericsson's reliance on specialized 5G components makes it vulnerable to supplier-driven price increases or delivery delays.

- Technological Innovation: Suppliers offering cutting-edge technology, such as next-generation processors or advanced antenna systems, hold significant leverage.

- Market Impact: A single critical supplier failure could halt production, impacting Ericsson's ability to meet customer demand and competitive deadlines in 2024.

Suppliers of specialized telecommunications components, such as advanced chipsets for 5G infrastructure, often possess significant bargaining power. This is due to the limited number of manufacturers capable of producing these high-technology inputs. For example, in 2024, the demand for cutting-edge semiconductors for 5G Advanced networks continues to be met by a concentrated group of global suppliers.

Ericsson's dependence on these few suppliers for critical, often proprietary, technology means these suppliers can influence pricing and supply terms. The high switching costs associated with re-engineering and certifying new components further solidify this supplier leverage. In 2023, the semiconductor industry experienced supply constraints, which further empowered key component providers in their negotiations with equipment manufacturers like Ericsson.

The strategic importance of these specialized components to Ericsson's product performance and innovation pipeline grants suppliers considerable sway. A failure to secure these vital inputs could directly impact Ericsson's competitive standing and ability to meet market demand in 2024.

| Supplier Characteristic | Impact on Ericsson | Example Data/Trend (2023-2024) |

|---|---|---|

| Concentration of Suppliers | High leverage, potential for price increases | Limited number of key semiconductor manufacturers for 5G chipsets. |

| Switching Costs | Reduced supplier choice, increased supplier power | High costs for re-certification and redesign of network equipment. |

| Product Differentiation | Supplier ability to dictate terms based on unique technology | Proprietary algorithms for signal processing in 5G Advanced. |

| Threat of Forward Integration | Potential for supplier competition | Some component manufacturers exploring broader integrated solutions. |

What is included in the product

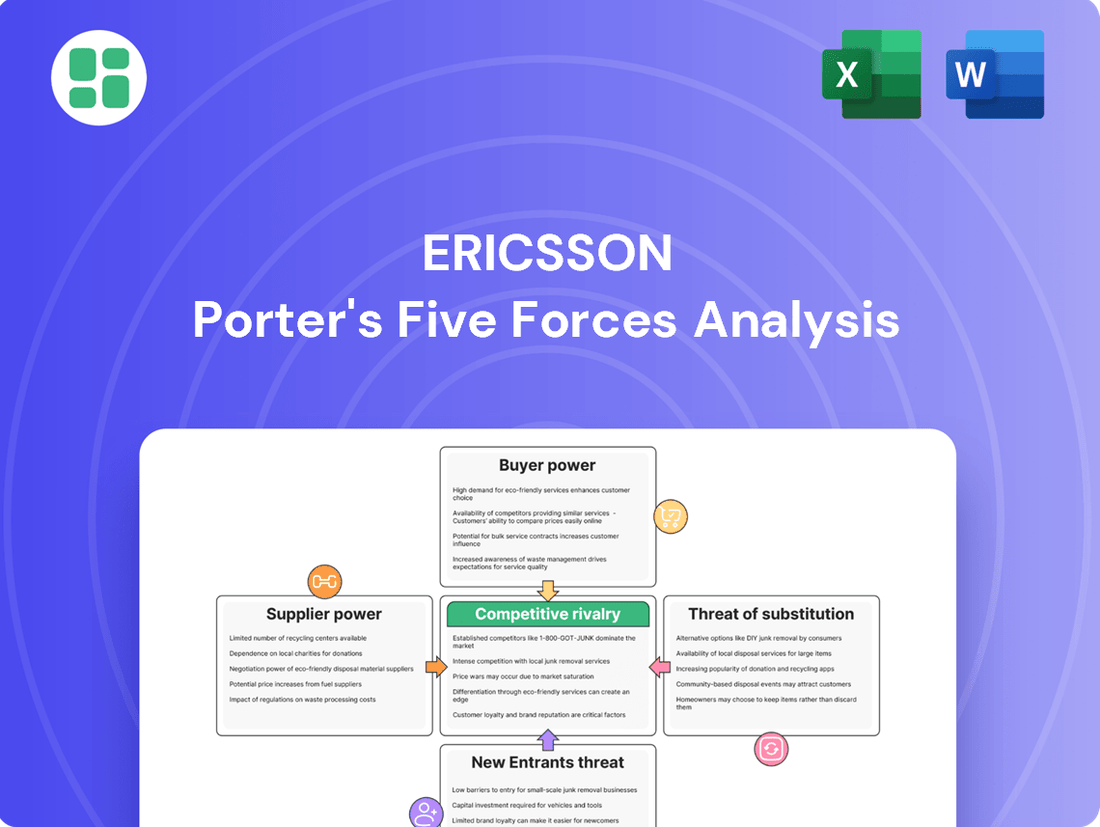

This analysis dissects the competitive forces impacting Ericsson, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications equipment sector.

Pinpoint competitive threats and opportunities with a dynamic, interactive model that visualizes the impact of each force on Ericsson's profitability.

Customers Bargaining Power

Ericsson's primary customers, telecommunications operators, represent a concentrated market. This means a few large entities, often national or multinational, drive a substantial portion of Ericsson's sales. For instance, in 2023, major operators like AT&T, Verizon, and Deutsche Telekom are key clients, and their collective purchasing power significantly influences contract terms.

The limited number of these powerful buyers grants them considerable leverage. They can negotiate for lower prices, more favorable service level agreements, and demand specific customization of Ericsson's network equipment and services. This concentrated customer base directly strengthens their bargaining power.

While telecom operators are concentrated, switching from Ericsson to competitors like Nokia or Huawei involves substantial capital investment, operational disruptions, and intricate integration processes. These high switching costs can temper a customer's immediate bargaining leverage once a service agreement is established.

However, the bargaining power of these customers significantly increases during periods of new network deployment or major infrastructure upgrades. For instance, the global 5G infrastructure market, projected to reach hundreds of billions of dollars by 2028, presents critical decision points where operators can exert considerable influence on pricing and terms.

Telecommunications operators, facing their own intense market competition, are deeply focused on minimizing both capital and operational expenditures. This inherent drive for cost optimization makes them exceptionally sensitive to the prices of network equipment and services. Consequently, they exert considerable pressure on suppliers like Ericsson to offer highly competitive pricing structures.

For instance, in 2024, many major telecom operators reported significant investments in 5G infrastructure, often exceeding billions of dollars. This substantial outlay amplifies their need to secure favorable terms for network components and deployment services, directly impacting their bargaining power with Ericsson.

Threat of Backward Integration by Customers

While a full-scale backward integration into manufacturing Ericsson's complex network equipment is improbable for telecom operators, they might consider developing specific software components or certain network functions internally. This potential, even if limited, grants them leverage in price negotiations with Ericsson.

This threat compels Ericsson to continuously innovate and provide compelling value propositions. For instance, in 2024, major telecom operators globally continued to invest heavily in digital transformation, often seeking greater control over their software-defined networks, which could indirectly fuel interest in in-house development for specific functionalities.

- Limited In-House Development: Large telecom operators may explore developing proprietary software or specific network functions to gain more control.

- Negotiating Leverage: The potential for in-house development acts as a bargaining chip for customers during contract discussions with Ericsson.

- Driving Competitive Pricing: This threat encourages Ericsson to offer more cost-effective and feature-rich solutions to retain its customer base.

Customers' Access to Market Information

Customers' access to market information significantly bolsters their bargaining power. Large telecommunications operators, for instance, are highly sophisticated buyers. They possess extensive market knowledge and often conduct thorough evaluations across multiple vendors, including Ericsson.

These operators have access to competitive bids and performance data from various suppliers. This allows them to effectively leverage one provider against another, driving down prices and improving terms. In 2024, the increasing availability of real-time market intelligence platforms further amplifies this transparency, giving customers a stronger hand in negotiations.

- Sophisticated Buyers: Major telecom companies possess deep market understanding and conduct multi-vendor assessments.

- Information Leverage: Access to competitive pricing and performance metrics enables customers to play vendors against each other.

- Transparency Impact: Enhanced market data availability in 2024 strengthens customer negotiating positions.

Ericsson's customers, primarily large telecommunications operators, wield significant bargaining power due to their concentrated nature and focus on cost optimization. These sophisticated buyers, armed with market intelligence and the potential for limited in-house development, can negotiate favorable terms and pricing, especially during large infrastructure projects. For instance, in 2024, major operators' substantial 5G investments amplified their leverage in securing competitive deals for network equipment and services.

| Customer Characteristic | Impact on Bargaining Power | Example/Data Point (2024 Focus) |

|---|---|---|

| Concentrated Customer Base | High leverage due to few large buyers | Major operators like AT&T, Verizon, Vodafone are key clients |

| Cost Sensitivity | Strong pressure for competitive pricing | Operators' significant 5G infrastructure investments (billions USD) |

| Market Information Access | Ability to compare vendors and negotiate effectively | Increased transparency via real-time market intelligence platforms |

| Potential for In-House Development | Leverage in software/specific network functions | Growing interest in software-defined networks and control |

Preview the Actual Deliverable

Ericsson Porter's Five Forces Analysis

This preview showcases the comprehensive Ericsson Porter's Five Forces Analysis, detailing the competitive landscape within the telecommunications sector. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. You can be confident that this preview accurately represents the complete, ready-to-use analysis that will be instantly available to you upon completing your transaction.

Rivalry Among Competitors

The telecommunications infrastructure sector is a battleground dominated by a handful of global titans like Nokia, Huawei, and Samsung. This oligopolistic landscape naturally fuels aggressive competition as these major players fiercely contest market share in significant network rollout initiatives across the globe.

Rivalry is particularly acute in the fast-paced development of 5G and forthcoming network technologies. For instance, in 2023, the global telecom infrastructure market was valued at approximately $190 billion, with these key players capturing a substantial portion of this value through their extensive R&D and global reach.

The telecom network equipment industry, where Ericsson operates, is characterized by extremely high fixed costs. Developing cutting-edge technology requires massive investments in research and development, with companies like Ericsson dedicating billions annually. For instance, in 2023, Ericsson reported R&D expenses of SEK 50.7 billion (approximately $4.8 billion USD). These upfront expenditures create a significant barrier to entry and necessitate achieving substantial economies of scale to spread costs and ensure profitability.

To be competitive, companies must secure large, long-term contracts to maintain high production volumes and utilize their specialized manufacturing facilities efficiently. This intense drive for scale means that market share is crucial, leading to aggressive pricing and strategic maneuvers to win major deals. For example, the race to deploy 5G infrastructure globally has seen intense competition among a few key players, including Ericsson, Nokia, and Huawei, all vying for significant portions of national network build-outs.

While core network functions are largely standardized, the competitive rivalry in the telecommunications equipment sector is fierce, with companies like Ericsson differentiating through advanced features, sophisticated software capabilities, and enhanced energy efficiency. This constant push for innovation, particularly in 5G deployment and the integration of AI and cloud-native solutions, necessitates significant research and development investment, creating substantial competitive pressure. For instance, in 2023, Ericsson reported R&D expenses of SEK 51.7 billion (approximately $4.9 billion USD), underscoring the commitment required to maintain a competitive edge.

Market Growth Rate and Strategic Importance

The telecommunications infrastructure market is experiencing robust growth, fueled by the ongoing 5G deployments, the expanding Internet of Things (IoT), and the accelerating digitalization efforts within enterprises. This dynamic growth presents substantial opportunities for companies like Ericsson.

However, the very strategic importance of this infrastructure to national economies introduces a layer of complexity beyond typical market competition. Governments often play a significant role, leading to geopolitical considerations and potential interventions that shape the competitive environment.

- Market Growth Drivers: 5G expansion, IoT adoption, and enterprise digitalization are key factors driving market expansion.

- Strategic Importance: Telecommunications infrastructure is considered critical national infrastructure, influencing government policy.

- Geopolitical Influence: National security concerns and trade policies can impact market access and competitive dynamics.

- Non-Market Rivalry: Government regulations, subsidies, and international relations introduce a form of rivalry beyond direct commercial competition.

Exit Barriers for Competitors

The telecommunications infrastructure sector, where Ericsson operates, presents substantial exit barriers for its competitors. The sheer scale of capital required for research, development, and manufacturing, often running into billions of dollars annually, makes it incredibly difficult for companies to divest their operations without significant financial penalties. For instance, in 2023, major players continued substantial R&D investments, with companies like Nokia reporting €2.1 billion in R&D spending, highlighting the ongoing commitment needed to remain competitive and the cost associated with exiting.

Furthermore, the specialized nature of network equipment, from base stations to core network components, often means assets are not easily repurposed or sold on the open market. Long-term contracts with mobile network operators, frequently spanning five to ten years, also tie competitors to the market, discouraging premature exits. These factors contribute to a scenario where companies are compelled to remain in the market, intensifying rivalry even when profitability is challenged.

- High Capital Investment: Continued massive R&D and manufacturing outlays, such as Nokia's €2.1 billion in 2023, create significant financial hurdles to leaving the market.

- Specialized Assets: Network equipment is highly specific, limiting resale value and increasing the cost of exiting.

- Long-Term Contracts: Existing agreements with telecom operators lock companies into the market, discouraging early withdrawal.

- Sustained Rivalry: These barriers ensure that even during economic slowdowns, competition remains fierce as firms cannot easily exit.

Competitive rivalry in the telecommunications infrastructure sector is intense, driven by a few dominant global players like Ericsson, Nokia, and Huawei. This oligopoly means companies constantly battle for market share, especially in the crucial 5G rollout. The high cost of R&D, exemplified by Ericsson's 2023 R&D spend of approximately $4.9 billion USD, necessitates large-scale operations and long-term contracts to remain profitable.

Differentiation occurs through advanced features and software capabilities, but the core technology race is relentless. The strategic importance of this infrastructure to nations also introduces non-market rivalry, with governments influencing competitive dynamics through policy and security concerns.

Exit barriers are exceptionally high due to massive capital investments and specialized assets, forcing companies to maintain competitive operations even during challenging periods. This sustained rivalry ensures a dynamic and aggressive market landscape.

SSubstitutes Threaten

The rise of cloud-native network functions (CNFs) and software-defined networking (SDN) poses a significant threat of substitution for traditional, hardware-heavy network infrastructure. Operators can increasingly deploy network functions on generic cloud platforms or commercial off-the-shelf (COTS) hardware, diminishing the need for specialized vendor equipment.

This shift offers operators greater flexibility and potentially lower costs, but it also introduces new competitive forces. For instance, hyperscale cloud providers entering the telecommunications infrastructure space could offer alternative solutions, challenging established vendors like Ericsson. Ericsson's own investment in cloud-native technologies, as seen in its Cloud RAN offerings, is a strategic response to this evolving landscape, aiming to retain market share by adapting to these new deployment models.

The emergence of private 5G networks and dedicated enterprise connectivity solutions presents a growing threat of substitution for traditional public mobile broadband. These tailored, localized networks can bypass the extensive infrastructure of public operators, offering businesses greater control and customization for specific industrial or campus needs. For instance, in 2024, many enterprises explored private 5G to enhance operational efficiency in manufacturing and logistics, potentially reducing their reliance on public networks for critical data transfer.

Satellite-based communication, particularly with the rise of Low Earth Orbit (LEO) constellations, presents a growing threat of substitutes for traditional terrestrial mobile broadband. For instance, Starlink, by SpaceX, aims to provide global internet coverage, offering an alternative for remote regions where terrestrial infrastructure is lacking or uneconomical to deploy. This expansion of connectivity options could impact demand for traditional mobile services in specific market segments.

Wi-Fi 6E/7 and Other unlicensed spectrum technologies

The increasing capabilities of Wi-Fi 6E and the emerging Wi-Fi 7 standards, along with other unlicensed spectrum technologies, present a significant threat of substitutes for cellular connectivity, particularly within indoor enterprise and consumer environments. These advancements offer high-bandwidth and low-latency performance, directly competing with the core value proposition of mobile networks for many use cases. For instance, in office buildings or homes, robust Wi-Fi can effectively handle data-intensive applications, potentially diminishing the reliance on cellular data plans and infrastructure for indoor connectivity needs.

This trend necessitates that Ericsson view these unlicensed spectrum technologies not just as competitors but as complementary solutions. By integrating and optimizing for these technologies, Ericsson can offer more comprehensive connectivity solutions that leverage the strengths of both cellular and Wi-Fi. For example, a unified network strategy could seamlessly hand off devices between cellular and Wi-Fi networks based on availability and performance requirements. The global Wi-Fi market is projected to reach significant figures, with some estimates placing its value well over $50 billion by 2024, underscoring the scale of this substitute threat and opportunity.

- Wi-Fi 6E and Wi-Fi 7 Capabilities: These standards offer multi-gigabit speeds and reduced latency, making them viable alternatives for demanding indoor applications.

- Substitution Impact: Enterprises and consumers may opt for enhanced Wi-Fi over cellular for indoor data usage, reducing demand for mobile network capacity.

- Ericsson's Strategy: Integration and complementarity with unlicensed spectrum technologies are crucial for Ericsson to maintain its market position and offer holistic connectivity solutions.

Open-Source and Disaggregated Network Solutions

The rise of open-source software and disaggregated network solutions, such as Open RAN, presents a significant substitute threat. These alternatives enable network operators to source components from multiple vendors, breaking away from traditional, vertically integrated models. This trend could erode the market dominance of established players like Ericsson by fostering a more competitive landscape where interoperability is key.

For instance, the Open RAN market is projected to grow substantially, with some analysts predicting it could reach tens of billions of dollars by the early 2030s. This growth directly challenges the business model of companies that offer end-to-end, proprietary network solutions. Ericsson's strategy must therefore adapt to embrace these more open architectures to remain competitive.

- Open RAN adoption: Increased operator interest in Open RAN, driven by cost savings and vendor diversity, directly challenges integrated network solutions.

- Component disaggregation: The ability to mix and match hardware and software from different suppliers reduces reliance on single vendors.

- Market impact: This shift could lead to price pressures and a potential reduction in market share for traditional, integrated network providers.

The threat of substitutes for Ericsson primarily stems from the increasing adoption of cloud-native network functions and open, disaggregated architectures like Open RAN. These alternatives allow operators to leverage generic hardware and software from multiple vendors, reducing reliance on traditional, integrated solutions. Additionally, advancements in Wi-Fi technology and the rise of private 5G networks offer alternative connectivity options for enterprises, potentially impacting demand for public mobile broadband services.

The growing capabilities of Wi-Fi 6E and Wi-Fi 7 offer high-speed, low-latency performance, directly competing with cellular connectivity for indoor use. This trend means enterprises and consumers might opt for enhanced Wi-Fi over cellular for data-intensive applications, thereby decreasing the need for mobile network capacity. Ericsson's approach to integrate and complement these unlicensed spectrum technologies is vital for offering comprehensive connectivity.

The Open RAN market is experiencing significant growth, with projections indicating substantial expansion in the coming years. This expansion directly challenges the business models of companies like Ericsson that provide end-to-end, proprietary network solutions. Adapting to these open architectures is crucial for Ericsson to maintain its competitive edge.

| Substitute Technology | Key Advantage | Potential Impact on Ericsson |

|---|---|---|

| Cloud-Native Network Functions (CNFs) | Flexibility, potential cost savings | Reduced demand for specialized hardware |

| Open RAN | Vendor diversity, interoperability | Price pressure, market share erosion |

| Wi-Fi 6E/7 | High indoor performance | Decreased cellular data usage indoors |

| Private 5G Networks | Enterprise control, customization | Reduced reliance on public mobile networks |

Entrants Threaten

Entering the telecommunications infrastructure market demands substantial capital for research and development, manufacturing, and establishing global sales and support. For instance, the ongoing evolution of 5G and the development of future network technologies like 6G involve billions in R&D, making it a significant hurdle.

The telecommunications sector is a minefield of intricate regulations and evolving standards, both nationally and globally. These include stringent licensing requirements, data privacy laws, and critical security mandates, all of which demand substantial investment and specialized knowledge to navigate effectively. For instance, the ongoing spectrum auctions and 5G deployment regulations in major markets like the US and Europe represent significant hurdles for any newcomer seeking to establish a foothold.

Telecommunications operators often commit to lengthy contracts with their existing infrastructure suppliers, fostering strong bonds built on trust, dependability, and a track record of successful operations. For instance, many major operators have multi-year agreements extending well into the late 2020s for 5G network build-outs.

Newcomers must overcome the significant hurdle of displacing these deeply rooted connections and establishing credibility with operators who are inherently cautious about performance and reliability. A strong brand reputation, honed over years of service, acts as a powerful deterrent.

Need for Technical Expertise and Talent Pool

The telecommunications industry, particularly in advanced network development, requires a deep bench of specialized talent. This includes experts in radio frequency engineering, complex network software, and robust cybersecurity. For a new player, assembling such a skilled team represents a substantial barrier to entry, as this expertise is both scarce and highly sought after.

Ericsson, having operated in this space for decades, has cultivated a significant advantage through its established and extensive talent pool. This existing workforce provides a ready-made foundation for innovation and deployment, something a newcomer would struggle to replicate quickly. For instance, in 2024, the demand for skilled 5G engineers saw an estimated 30% increase year-over-year, highlighting the competitive talent landscape.

- Scarcity of Specialized Skills: High demand for RF engineers, network software developers, and cybersecurity professionals in 2024.

- Talent Acquisition Costs: Significant investment required for new entrants to attract and retain top talent.

- Ericsson's Advantage: Decades of experience have built a large, experienced workforce, reducing recruitment challenges and costs.

- Impact on Entry: The need for specialized expertise and the difficulty in acquiring it acts as a considerable deterrent for potential new competitors.

Intellectual Property and Patent Portfolios

The telecommunications sector is heavily reliant on intellectual property, and companies like Ericsson possess extensive patent portfolios covering core technologies. For instance, as of early 2024, Ericsson continued to actively manage and license its vast patent portfolio, a key component of its strategy to generate revenue and protect its innovations.

New companies entering this market would confront substantial hurdles in creating competitive products without infringing on these established patents. Alternatively, they would face considerable expenses for licensing these essential technologies. This intellectual property landscape acts as a significant barrier, effectively defending established players like Ericsson.

Consider these points regarding intellectual property:

- Ericsson's patent portfolio is a critical asset, covering fundamental telecom technologies.

- New entrants face high costs or legal risks from existing patent portfolios.

- Licensing fees for essential patents can be a significant barrier to entry.

The threat of new entrants into the telecommunications infrastructure market, where Ericsson operates, is generally low due to several formidable barriers. These include the immense capital required for R&D, manufacturing, and global operations, as well as the complex web of regulations and standards that necessitate significant investment and expertise. Furthermore, established customer loyalty with existing suppliers, the scarcity of specialized talent, and extensive intellectual property portfolios held by incumbents like Ericsson create substantial hurdles for any potential newcomer. For example, the global telecom equipment market, valued at over $100 billion in 2024, indicates the scale of investment required.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | Billions needed for R&D, manufacturing, and sales infrastructure. | Very High |

| Regulatory Hurdles | Complex licensing, data privacy, and security standards. | High |

| Customer Loyalty | Long-term contracts and trust with existing operators. | High |

| Intellectual Property | Extensive patent portfolios protecting core technologies. | Very High |

| Talent Scarcity | High demand for specialized engineers, increasing acquisition costs. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ericsson leverages data from Ericsson's annual reports, investor presentations, and financial statements. We also incorporate insights from reputable industry research firms specializing in telecommunications and IT infrastructure.