Ericsson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ericsson Bundle

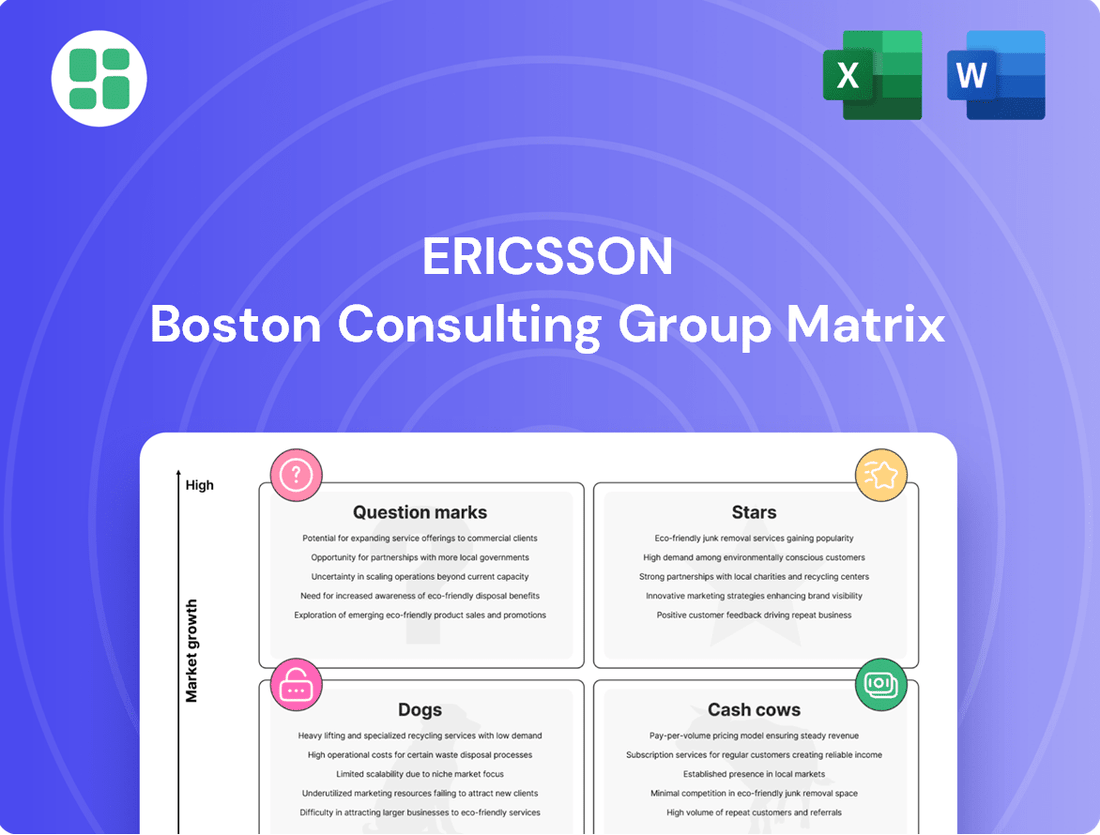

This preview offers a glimpse into how the Ericsson BCG Matrix categorizes its product portfolio into Stars, Cash Cows, Dogs, and Question Marks. Understand your company's strategic positioning and identify areas for growth or divestment. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your resource allocation and drive future success.

Stars

Ericsson's 5G Radio Access Network (RAN) business outside of China is a strong contender, holding a significant 36% market share in 2024. This leadership is bolstered by continuous deal wins and expanding global reach, positioning it as a key player in the rapidly evolving telecommunications landscape.

The market for 5G RAN outside China is experiencing robust growth, fueled by the widespread deployment of 5G networks worldwide. Ericsson's consistent performance and increasing market share in this segment underscore its dominant position and ability to capitalize on these expansionary trends.

The market for private 5G networks is booming, with businesses worldwide deploying these dedicated wireless solutions for enhanced control and performance. Ericsson is a prominent player in this rapidly expanding sector. In 2023, the global private LTE and 5G market was valued at over $8 billion and is projected to reach $20 billion by 2028, with private 5G networks driving a significant portion of this growth.

Ericsson's commitment to this high-growth area is evident in its strong sales performance and consistent recognition from industry analysts. The company's comprehensive portfolio, encompassing everything from core network solutions to radio access and edge computing, positions it favorably to capture a substantial share of this lucrative market. This strategic focus is a key driver of Ericsson's future revenue potential.

Ericsson's Massive MIMO and energy-efficient radio products are a cornerstone of their Stars category in the BCG matrix. These advanced solutions, including their cutting-edge Massive MIMO technology, are industry-leading in their scope, power savings, and innovative features. They are essential for building robust 5G networks and are a major driver of Ericsson's substantial share in the Radio Access Network (RAN) market.

The ongoing need for networks that are both more efficient and capable directly fuels the growth of these critical product lines. For instance, in 2024, Ericsson continued to see strong demand for its 5G RAN solutions, which are heavily reliant on these advanced radio technologies, contributing significantly to their overall revenue growth in the mobile networks segment.

North American Market 5G Deployments

North America stands out as a key growth engine for Ericsson, fueled by aggressive 5G network build-outs. The company secured significant contracts, including a multi-billion-dollar agreement with AT&T, underscoring its strong market position.

Ericsson's technological prowess and deep-seated customer ties in this region have enabled it to capture substantial market share. This strategic advantage translates directly into robust sales figures and a significant contribution to Ericsson's global revenue streams.

- 5G Deployment Momentum: North America is leading global 5G adoption, with major carriers investing heavily in infrastructure upgrades.

- Ericsson's Market Share: Ericsson has consistently been a top-tier vendor in North America, competing effectively for major network contracts.

- Revenue Contribution: The North American market is a critical revenue driver for Ericsson's Networks segment, reflecting the scale of deployment projects.

- AT&T Deal Impact: The multi-billion dollar deal with AT&T, announced in late 2023, significantly bolsters Ericsson's revenue and market presence in the US.

5G Core Network Deployments

As 5G networks mature, the deployment of advanced 5G Core infrastructure is crucial for operators to unlock new revenue streams and innovative services. Ericsson is a significant contributor in this area, offering a robust portfolio that supports the global shift towards next-generation mobile connectivity.

Ericsson's 5G Core solutions are designed to be cloud-native and service-based, enabling greater flexibility and efficiency for operators. This technological advancement is key to realizing the full potential of 5G, including enhanced mobile broadband, massive machine-type communications, and ultra-reliable low-latency communications.

- Market Growth: The global 5G core network market is projected to experience substantial growth, with some estimates suggesting a compound annual growth rate (CAGR) of over 30% through the mid-2020s.

- Ericsson's Position: Ericsson consistently ranks among the top vendors in the 5G core network market, recognized for its comprehensive end-to-end solutions and strong customer relationships.

- Key Enablers: Core network advancements are fundamental for enabling new 5G use cases such as network slicing, edge computing, and private 5G networks, which are vital for enterprise adoption.

- Operator Investments: Telecommunications operators worldwide are making significant investments in upgrading their core networks to 5G, driven by the need to improve network performance and create new business opportunities.

Ericsson's advanced Massive MIMO and energy-efficient radio products are classified as Stars in the BCG matrix. These technologies are critical for building high-performance 5G networks, driving significant market share in the Radio Access Network (RAN) segment. The ongoing demand for enhanced network capabilities directly fuels the growth of these innovative solutions.

The company's 5G RAN business outside China is a prime example, holding a substantial 36% market share in 2024. This strong position is reinforced by continuous deal wins and expanding global reach, solidifying Ericsson's leadership in the dynamic telecommunications sector.

North America, with its rapid 5G network build-outs, is a key growth driver for Ericsson. The multi-billion dollar deal with AT&T, announced in late 2023, highlights Ericsson's strong market presence and revenue contribution from this region.

Ericsson's 5G Core solutions are also Stars, characterized by their cloud-native and service-based architecture. This enables operators to unlock new revenue streams and innovative services, supporting the global transition to next-generation mobile connectivity.

The global 5G core network market is projected to grow at a CAGR exceeding 30% through the mid-2020s. Ericsson consistently ranks among the top vendors, recognized for its comprehensive end-to-end solutions and strong customer relationships, essential for enabling new 5G use cases.

| Business Unit | BCG Category | Key Products/Services | 2024 Market Position | Growth Drivers |

|---|---|---|---|---|

| 5G Radio Access Network (RAN) - Ex-China | Stars | Massive MIMO, Energy-Efficient Radios | 36% Market Share | Global 5G Deployment, Network Efficiency Needs |

| 5G Core Network | Stars | Cloud-Native, Service-Based Architecture | Top Vendor Ranking | New Revenue Streams, Advanced 5G Use Cases |

What is included in the product

The Ericsson BCG Matrix provides a strategic framework to analyze its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which areas to grow, maintain, or divest for optimal resource allocation.

The Ericsson BCG Matrix provides a clear, actionable overview, alleviating the pain of strategic uncertainty.

Cash Cows

Ericsson's managed services for telecommunications operators represent a significant Cash Cow within its portfolio. This segment consistently generates stable, recurring revenue by managing and operating network infrastructures for clients globally. The mature market for these services, coupled with long-term contracts, ensures predictable cash flow, vital for network performance and uptime.

In 2024, Ericsson's commitment to managed services continues to be a cornerstone of its financial stability. The company reported substantial revenue from these operations, reflecting its deep expertise and established global presence. This segment benefits from the essential nature of network management, providing a reliable income stream even in evolving market conditions.

Ericsson's legacy 2G/3G/4G network equipment maintenance and support represents a classic Cash Cow. Despite the industry's push towards 5G, a substantial installed base of these older networks still demands continuous upkeep, software patches, and expert technical assistance. This ongoing need translates into a reliable and substantial revenue stream for Ericsson, a direct benefit of its long-standing market presence and existing service contracts with mobile operators worldwide.

Ericsson holds a strong position in Fixed Wireless Access (FWA) solutions, providing essential broadband connectivity, especially in underserved regions. This segment is crucial for their revenue stream, leveraging their extensive network expertise.

The FWA market, while experiencing growth with 5G advancements, is generally maturing. Ericsson's established footprint and comprehensive product portfolio in FWA translate into consistent revenue and robust cash flow generation for the company.

Traditional Business Support Systems (BSS) and Operations Support Systems (OSS)

Ericsson's traditional Business Support Systems (BSS) and Operations Support Systems (OSS) represent established software offerings crucial for telecom operators. These systems manage billing, customer service, and network performance, forming a bedrock for their clients' operations.

These mature products, with their widespread adoption, act as significant cash cows for Ericsson. They consistently generate revenue through licensing fees, ongoing maintenance contracts, and essential support services, contributing to a stable and predictable cash flow for the company.

As of 2024, the demand for robust BSS/OSS solutions remains high, driven by the ongoing expansion and complexity of telecommunications networks globally. Ericsson's long-standing presence and comprehensive feature sets in this segment solidify its position as a reliable provider.

- Market Penetration: Ericsson's BSS/OSS solutions are deployed by a substantial number of telecommunications operators worldwide.

- Revenue Stability: These offerings provide a consistent revenue stream through recurring licensing and support agreements.

- Operational Efficiency: They are vital for operators in managing complex network operations and customer interactions efficiently.

- Industry Adoption: The continued reliance on these systems by major telecom players underscores their value and Ericsson's strong market standing.

Intellectual Property Rights (IPR) Licensing

Ericsson's intellectual property rights (IPR) licensing is a prime example of a cash cow within its business. The company possesses a vast collection of crucial patents related to mobile communication technologies, which it then licenses to other companies operating in the same sector.

This strategic licensing of its essential patents generates significant and highly profitable recurring revenue for Ericsson. It’s a mature business segment where the heavy lifting of R&D has already been done, meaning ongoing investment needs are minimal.

- Dominant Market Position: Ericsson holds a leading position in licensing essential patents for mobile communication standards.

- High Profitability: IPR licensing contributes substantially to Ericsson's profitability due to high margins and recurring revenue streams.

- Low Investment Needs: As a mature business, it requires minimal ongoing capital expenditure, maximizing cash generation.

- 2024 Revenue Insight: While specific licensing revenue figures fluctuate, in 2024, Ericsson continued to benefit from its strong patent portfolio, contributing significantly to its overall financial health and enabling continued investment in future technologies.

Ericsson's managed services continue to be a stable revenue generator, reflecting its deep expertise in operating and maintaining telecommunications networks. This mature segment benefits from long-term contracts, ensuring predictable cash flow crucial for network performance and operator stability.

In 2024, Ericsson's legacy network equipment maintenance, particularly for 2G/3G/4G, remains a significant cash cow. The substantial installed base necessitates ongoing upkeep, providing a reliable income stream that leverages Ericsson's long-standing market presence and existing service agreements.

Ericsson's Business Support Systems (BSS) and Operations Support Systems (OSS) are mature software offerings that consistently generate revenue through licensing, maintenance, and support. Their widespread adoption by telecom operators worldwide makes them vital for network management and customer interactions, contributing to stable cash flow.

The company's intellectual property rights (IPR) licensing, particularly for mobile communication standards, is a highly profitable cash cow. With minimal ongoing R&D investment required, this segment leverages Ericsson's extensive patent portfolio to generate significant recurring revenue, contributing to overall financial health.

| Segment | Role in BCG Matrix | Key Characteristics | 2024 Relevance |

| Managed Services | Cash Cow | Stable, recurring revenue; long-term contracts; mature market | Cornerstone of financial stability; deep expertise |

| Legacy Network Maintenance (2G/3G/4G) | Cash Cow | Substantial installed base; ongoing demand for upkeep | Reliable income stream; leverages existing presence |

| BSS/OSS Solutions | Cash Cow | Widespread adoption; recurring licensing and support revenue | Vital for network management; consistent cash flow |

| IPR Licensing | Cash Cow | High profitability; minimal investment needs; strong patent portfolio | Significant recurring revenue; contributes to financial health |

Preview = Final Product

Ericsson BCG Matrix

The Ericsson BCG Matrix document you are previewing is the identical, fully polished report you will receive immediately after your purchase. This means you'll get the complete strategic analysis, free of any watermarks or placeholder content, ready for immediate application in your business planning.

Dogs

Ericsson has been actively divesting non-core businesses, a strategy exemplified by the sale of iconectiv. This move allows Ericsson to sharpen its focus on its core telecommunications equipment and services, shedding assets that may not align with its future growth trajectory.

These divested businesses are often categorized as 'dogs' in a BCG matrix because they might be in mature or declining markets, or simply don't offer the same growth potential as the company's primary offerings. For instance, in 2020, Ericsson completed the sale of iconectiv for $1.1 billion, a significant transaction that freed up capital and management attention.

Ericsson's exit from Russia, driven by geopolitical shifts and strategic decisions, exemplifies a 'dog' in the BCG matrix. This move signifies a deliberate reduction of presence in markets deemed challenging, contributing little to the company's growth or profitability.

The company completed the divestiture of its Russian operations in late 2022, impacting its financial performance. For the full year 2022, Ericsson reported a net loss of SEK 22.9 billion, partly influenced by restructuring charges and the Russia exit.

This strategic withdrawal from Russia aligns with a broader portfolio management approach, where underperforming or strategically misaligned assets are divested to focus resources on more promising areas.

Within Ericsson's portfolio, the legacy Vonage assets, particularly those outside the high-growth network API segment, are exhibiting characteristics of a "dog." These traditional components of Vonage's business have encountered slower-than-expected market growth, leading to significant financial write-downs. For instance, in Ericsson's Q1 2024 results, a substantial impairment charge was recognized, largely attributed to the legacy Vonage operations, underscoring their capital consumption without commensurate returns.

Older, Niche Hardware Supporting Dwindling Technologies

Older, niche hardware supporting dwindling technologies often fall into the Dogs category of the BCG Matrix. These products, designed for superseded or specialized communication systems, experience a significant drop in market demand as newer, more advanced technologies take over. For instance, hardware exclusively supporting 2G or early 3G networks, while still functional for some legacy applications, sees very little new investment or growth. In 2023, the global market for 2G-only mobile devices was estimated to be less than 1% of the total smartphone market, highlighting a shrinking user base.

These hardware components typically possess a low market share and minimal growth potential, making them unattractive for further development or significant capital allocation. Companies often consider divesting or phasing out such products to reallocate resources towards more promising areas. For example, a company that once manufactured specialized base station components for a now-obsolete mobile standard might find its market share has dwindled to near zero, with no foreseeable resurgence.

- Low Market Share: Hardware for niche, outdated technologies often serves a very small, declining customer base.

- Minimal Growth Prospects: The rapid evolution of mobile communication means these technologies are unlikely to see renewed demand.

- Declining Relevance: As newer standards like 5G and beyond become dominant, demand for older hardware diminishes.

- Resource Reallocation: Companies often shift R&D and marketing budgets away from these products to focus on growth areas.

Unsuccessful or Deprioritized Incubation Projects

Ericsson, like many large tech firms, invests in many internal innovation projects. When these ventures don't find a strong market fit, aren't profitable, or are sidelined for better opportunities, they can become 'dogs' in the BCG matrix. These projects have used up resources without generating substantial market share or growth.

By the end of 2023, Ericsson reported a significant decline in its legacy product segments, which often house these less successful incubation efforts. For instance, its Media Solutions segment, which has seen divestments and restructuring, can be seen as an example of areas where previous incubation efforts did not yield expected returns, contributing to its 'dog' status within the broader portfolio.

- Deprioritized R&D: Projects that don't meet internal performance metrics or strategic alignment are often cut.

- Market Mismatch: Innovations that fail to resonate with customer needs or face intense competition fall into this category.

- Resource Reallocation: Capital and talent are shifted from underperforming projects to those with higher growth potential.

Ericsson's strategic divestitures and exits from challenging markets, such as the sale of iconectiv and withdrawal from Russia, highlight its management of 'dog' assets. These are typically business units or products in mature or declining markets with low growth potential and market share.

The legacy Vonage assets, outside of the core network API business, are also exhibiting 'dog' characteristics, as evidenced by significant impairment charges in Ericsson's Q1 2024 results. Similarly, hardware supporting superseded technologies like 2G and early 3G networks represents a shrinking market, with 2G-only devices making up less than 1% of the smartphone market in 2023.

Internal innovation projects that fail to gain traction or become unprofitable also fall into the 'dog' category, leading to resource reallocation. Ericsson's Media Solutions segment, for instance, shows how past incubation efforts that didn't yield expected returns can become dogs within the portfolio.

These 'dog' assets, characterized by low market share and minimal growth, are managed through divestment or phasing out to free up capital and focus on more promising ventures.

Question Marks

Ericsson's Global Network Platform, significantly boosted by the Vonage acquisition, is positioned to capture substantial growth by offering open APIs that monetize 5G capabilities. This strategic move targets a high-growth market, promising new revenue streams by making network functions accessible to developers.

Despite the promising market outlook, this venture is in its nascent phase. The substantial write-downs associated with the Vonage acquisition highlight significant cash consumption as Ericsson works to establish market share and validate the long-term economic viability of this platform.

The global Cloud RAN market is experiencing significant growth, projected to reach USD 13.5 billion by 2028, a compound annual growth rate of 21.5%. Ericsson, a dominant player in traditional RAN, is actively investing in its Cloud RAN and Open RAN solutions to capitalize on this shift towards disaggregated and virtualized network architectures.

While Ericsson holds a strong position in the overall RAN market, its specific share within the emerging multi-vendor Open RAN ecosystem is still solidifying. The company’s strategy involves continued R&D and strategic collaborations to enhance its competitiveness in this dynamic and rapidly evolving segment.

Ericsson's investment in AI for network automation and orchestration positions it within a high-growth segment of the telecommunications industry. This focus on intelligent network management addresses the increasing complexity and demand for efficiency, with AI expected to drive significant advancements in operational performance and energy savings. For instance, by 2024, the global AI in telecommunications market was projected to reach over $10 billion, highlighting the substantial opportunity.

Quantum Communications Research

Ericsson's commitment to quantum communications research positions it in a nascent, high-potential market. While currently holding a negligible market share due to the technology's early stage, these significant R&D investments are crucial for future leadership in a potentially transformative field.

The company's strategic focus on quantum communications aligns with its long-term vision for network evolution. For instance, in 2023, Ericsson continued to allocate substantial resources to advanced research, though specific figures for quantum communications R&D are often bundled within broader innovation budgets, underscoring the long-term, speculative nature of this investment.

- Nascent Market: Quantum communications is an emerging technology with no established commercial market, meaning current market share for any player, including Ericsson, is minimal.

- High R&D Investment: Significant upfront investment in research and development is required to explore and develop the foundational technologies for quantum communications.

- Future Potential: This area represents a long-term bet on a technology that could revolutionize secure communication and computing.

- Strategic Positioning: Early investment aims to secure a leading position in what is anticipated to be a future critical infrastructure technology.

Emerging 5G Advanced/6G Applications

Ericsson is actively investing in the future of mobile communication, focusing on 5G Advanced and the upcoming 6G standards. This strategic push aims to unlock innovative applications that go beyond what current 5G networks can offer, such as truly immersive extended reality (XR) experiences and advanced industrial automation.

These emerging technologies are currently in their infancy, representing significant growth opportunities but also carrying considerable risk. Ericsson's substantial R&D spending in these areas, estimated to be in the billions of dollars annually for advanced technologies, reflects their potential, yet market adoption and monetization strategies are still being solidified. For instance, early 6G research is exploring terahertz frequencies, a significant leap from current 5G spectrum, requiring entirely new infrastructure and device development.

- 5G Advanced Capabilities: Enhanced mobile broadband, ultra-reliable low-latency communication (URLLC), and massive machine-type communication (mMTC) will see further refinement, enabling new use cases like real-time holographic communication and advanced AI-driven services.

- 6G Vision: The envisioned 6G networks aim for peak data rates of 1 terabit per second, sub-millisecond latency, and integrated sensing and AI capabilities, opening doors to applications like digital twins of the physical world and pervasive intelligent systems.

- Investment and Risk: Significant capital is required for research, standardization, and infrastructure build-out for these next-generation technologies, with market success dependent on ecosystem development and compelling consumer and enterprise demand.

- Market Formation: While the potential is vast, the specific applications and business models that will drive widespread adoption of 5G Advanced and 6G are still being defined, making them classic 'question marks' in a strategic portfolio.

Ericsson's ventures into 5G Advanced and 6G represent classic question marks. These are areas with immense future potential but are currently in their early stages, requiring substantial investment with uncertain returns.

The company is actively shaping these future standards, but the market adoption and the specific applications that will drive revenue are still being developed. This means significant R&D spending is occurring without immediate, guaranteed commercial success.

For example, the development of 6G is projected to involve entirely new spectrum bands, such as terahertz frequencies, necessitating massive infrastructure and device innovation. The global market for 6G research and development is expected to grow significantly in the coming years, though specific figures for 2024 are still emerging as the technology matures.

These initiatives are high-risk, high-reward propositions, crucial for Ericsson's long-term competitive positioning in the evolving telecommunications landscape.

| Initiative | Current Stage | Market Potential | Investment Focus | Key Uncertainties |

|---|---|---|---|---|

| 5G Advanced | Early deployment & standardization | Enhanced mobile broadband, URLLC, mMTC | R&D, infrastructure development | Monetization of new use cases, ecosystem buy-in |

| 6G | Research & conceptualization | Terabit speeds, sub-millisecond latency, integrated sensing | Fundamental research, spectrum exploration | Standardization, technological feasibility, market demand |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial performance data, detailed market share analysis, and expert industry forecasts to provide a comprehensive strategic overview.