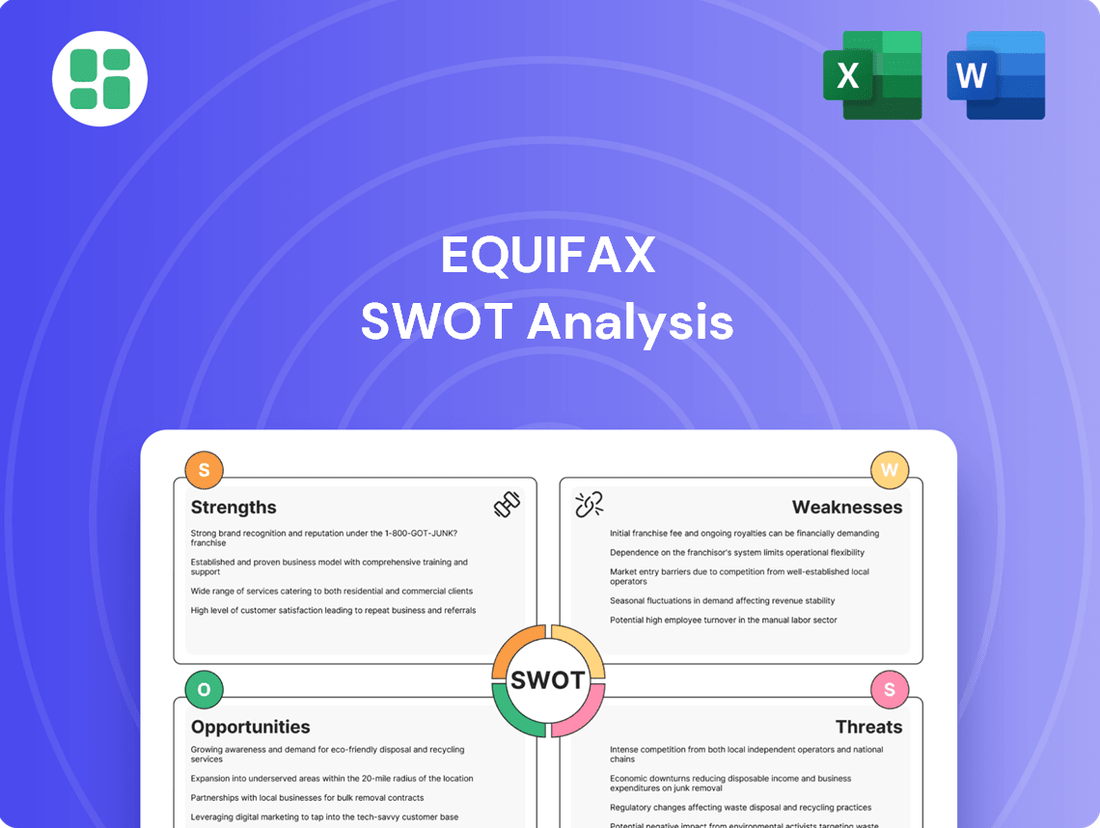

Equifax SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equifax Bundle

Equifax, a titan in credit reporting, faces a complex landscape where its robust data infrastructure (Strength) is challenged by evolving data privacy regulations (Threat). While its established brand offers significant market leverage (Strength), the lingering impact of past data breaches presents a considerable reputational hurdle (Weakness).

Want the full story behind Equifax’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Equifax stands as a titan in the global credit reporting industry, alongside Experian and TransUnion. This dominance is built on its vast repository of consumer financial data, making its credit reports and scores indispensable for lenders. In 2023, Equifax reported total revenue of $5.0 billion, underscoring its substantial market footprint and the critical nature of its services.

Equifax has significantly advanced its technology, with roughly 85% of its revenue now operating on the Equifax Cloud. This substantial investment in cloud transformation is a key strength, streamlining operations and accelerating new product launches.

The successful migration to its proprietary cloud infrastructure enhances Equifax's ability to process vast amounts of data and deliver advanced analytics. This positions the company for continued innovation and a stronger competitive standing in the market.

Equifax's strengths lie in its extensive and unique data assets, notably The Work Number database, which holds 188 million active records. This is powerfully augmented by its advanced analytics and AI platform, EFX.AI, enabling the development of sophisticated predictive models and innovative solutions.

These capabilities translate into deeper insights for risk management, marketing, and decision-making, benefiting both businesses and consumers. The company's commitment to innovation is further evidenced by securing 35 new patents in the first half of 2025, with a strong focus on responsible AI, machine learning, and cybersecurity.

Strong Financial Performance & Shareholder Returns

Equifax has shown impressive financial results, with Q4 2024 revenue climbing 7% year-over-year to $1.39 billion, and projections for Q1 and Q2 2025 indicating continued growth. The company generated $1.7 billion in free cash flow in 2024, underscoring its operational efficiency.

Further solidifying its financial prowess, Equifax announced a 15% increase in its quarterly dividend for 2025 and a commitment to a $1.5 billion share repurchase program. This financial strength allows for strategic investments and shareholder value enhancement.

- Robust Revenue Growth: Reported 7% YoY revenue increase in Q4 2024, with expectations for continued positive trends in early 2025.

- Significant Free Cash Flow Generation: Achieved $1.7 billion in free cash flow during 2024.

- Shareholder Capital Return: Announced a 15% dividend hike and a $1.5 billion share buyback program for 2025.

- Financial Flexibility: Strong cash position enables ongoing investment in growth initiatives and strategic acquisitions.

Enhanced Cybersecurity Posture

Equifax has made substantial improvements to its cybersecurity, a critical strength following past data breaches. The company's 2024 Security Annual Report highlights a robust defense against millions of daily cyber threats. This enhanced posture is a key factor in rebuilding stakeholder trust.

Key initiatives include the transition of nearly all employees to passwordless authentication, a significant step in reducing vulnerability. Equifax also consistently surpasses industry averages in security maturity assessments, demonstrating a proactive and effective approach to safeguarding sensitive information.

- Millions of daily cyber threats defended against.

- Nearly all employees utilizing passwordless authentication.

- Outperforming industry benchmarks in security maturity.

Equifax's core strength lies in its unparalleled data assets, including The Work Number database with 188 million active records, augmented by its advanced EFX.AI platform. This combination fuels sophisticated analytics and AI-driven solutions, providing deep insights for risk management and decision-making. The company's commitment to innovation is further demonstrated by securing 35 new patents in the first half of 2025, focusing on responsible AI and cybersecurity.

| Key Strength | Description | Supporting Data |

| Data Assets & Analytics | Vast proprietary data combined with advanced AI capabilities. | The Work Number: 188 million active records. EFX.AI platform. 35 new patents (H1 2025). |

| Cloud Transformation | Streamlined operations and accelerated innovation through cloud migration. | ~85% of revenue operating on Equifax Cloud. |

| Financial Performance | Consistent revenue growth, strong cash flow, and shareholder returns. | Q4 2024 Revenue: $1.39 billion (+7% YoY). 2024 Free Cash Flow: $1.7 billion. 2025 Dividend Increase: 15%. |

| Cybersecurity Enhancement | Proactive and robust defense against cyber threats. | Defends millions of daily cyber threats. Nearly all employees use passwordless authentication. Outperforms industry security benchmarks. |

What is included in the product

Analyzes Equifax’s competitive position through key internal and external factors, including its strong brand reputation and data security vulnerabilities.

Helps identify and mitigate Equifax's critical vulnerabilities by highlighting weaknesses and threats.

Weaknesses

The significant data breach in 2017 remains a persistent weakness for Equifax, casting a long shadow over public trust and its brand image. Despite substantial investments in cybersecurity and remediation, the memory of over 147 million affected individuals and the subsequent $1.38 billion settlement continues to influence perception.

This historical event means Equifax faces ongoing heightened scrutiny from both consumers and regulatory bodies. Such scrutiny can impede efforts to attract new customers and potentially erode loyalty among existing ones, as the company works to rebuild its reputation in the sensitive data management sector.

Equifax faces significant regulatory scrutiny as a custodian of sensitive financial data, a situation amplified by global data privacy laws like GDPR and CCPA. This oversight translates into substantial ongoing expenses for compliance, legal counsel, and adapting to evolving regulations. For instance, the company has historically incurred significant costs related to data breach remediation and compliance efforts, impacting its operational budget and strategic flexibility.

Equifax's reliance on U.S. Information Solutions (USIS) and mortgage-related services makes it particularly vulnerable to economic downturns. For instance, a projected decrease in U.S. hard mortgage credit inquiries for 2025 signals a potential slowdown in a key revenue driver.

This sensitivity to macroeconomic cycles, including interest rate shifts and employment trends, can significantly impact Equifax's overall business performance. Even with ongoing innovation, these external factors pose a challenge to consistent revenue growth.

Complexity of Global Operations and Data Management

Equifax's global footprint, spanning operations in 24 countries, introduces significant complexities in managing diverse regulatory landscapes and varying data standards. This intricate operational environment can hinder consistent service delivery and data integration across its international markets.

The inherent complexity of managing data and operations across so many different jurisdictions can slow down the rollout of new products and services globally. For instance, navigating the nuances of data privacy laws in Europe versus those in the United States requires tailored approaches, potentially impacting the speed of innovation and market penetration.

- Global Regulatory Fragmentation: Equifax must adhere to a patchwork of data protection and privacy regulations, such as GDPR in Europe and CCPA in California, each with unique compliance requirements that add operational overhead.

- Data Standardization Challenges: Integrating and standardizing data from disparate global sources, each with its own format and quality, is a continuous challenge that can impact the accuracy and timeliness of analytics.

- Resource Allocation Strain: Maintaining efficient resource allocation across 24 countries, each with distinct market needs and operational demands, can strain management capacity and potentially lead to inefficiencies.

Dependence on Third-Party Data Contributors

Equifax's reliance on third-party data, like that from employers for its Work Number service, presents a significant vulnerability. A disruption in these data feeds, or a reduction in submissions, could directly impact the completeness and accuracy of the information Equifax provides. This dependency means that changes in data contributor behavior or external factors affecting data collection could weaken Equifax's core value proposition to its customers.

For instance, if a large number of employers decide to reduce or halt their participation in data-sharing agreements, Equifax's employment verification data would be less robust. In 2023, Equifax reported that its Information Services segment, which includes data from various sources, is crucial to its revenue. Any significant decline in the quality or quantity of this sourced data could therefore have a material impact on its financial performance and competitive standing.

The potential for data contributors to withdraw or limit their participation is a constant risk. This could be due to competitive pressures, changing privacy regulations, or dissatisfaction with Equifax's services. Such a scenario would directly affect the breadth and depth of Equifax's databases, potentially diminishing its ability to offer comprehensive and reliable credit and employment information.

Equifax's significant reliance on the U.S. mortgage market, a sector sensitive to interest rate fluctuations, poses a notable weakness. For example, a projected 10% to 15% decline in U.S. mortgage credit inquiries for 2025, as indicated by industry forecasts, directly impacts a key revenue stream for Equifax's USIS segment.

Preview the Actual Deliverable

Equifax SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear snapshot of Equifax's strategic position. Purchase unlocks the complete, in-depth analysis for your business needs.

Opportunities

Equifax is strategically broadening its reach beyond core credit reporting into high-growth areas like income verification for government social services. Products such as Complete Income™ exemplify this move, utilizing their robust data and cloud infrastructure to streamline processes.

This expansion into new market segments is a significant opportunity, as it taps into needs for automated verification in sectors like social programs, potentially unlocking substantial new revenue. For instance, the demand for efficient income verification solutions is growing, and Equifax's established data capabilities position them well to capture this market.

The escalating need for thorough credit evaluations and broader financial inclusion presents a significant opportunity for Equifax to enhance its use of alternative data. By integrating non-traditional data streams with sophisticated AI and machine learning, Equifax can create more accurate and inclusive risk assessments, thereby expanding its reach to more consumers and improving lending decisions.

Equifax's 2024 and 2025 outlook highlights a strategic focus on leveraging these advanced analytics. For instance, the company's investments in AI are projected to yield more nuanced credit scoring models, potentially increasing the credit access for millions of individuals previously underserved by traditional metrics. This expansion into alternative data, like rent and utility payments, is crucial for achieving greater financial equity.

Equifax is seeing robust international revenue growth, with Latin America being a particularly strong performer, signaling a prime opportunity for deeper global market penetration. This momentum suggests that the company is well-positioned to expand its reach into new territories.

By utilizing its advanced cloud infrastructure and EFX.AI capabilities, Equifax can effectively tailor its cutting-edge products and services. This localization is crucial for meeting the unique demands and navigating the specific regulatory landscapes of various international markets, ensuring greater adoption and success.

Strategic Partnerships & Bolt-on Acquisitions

Equifax actively pursues strategic alliances, exemplified by its collaboration with Workday, to broaden its data acquisition channels and refine its service portfolio. This focus on partnerships is crucial for staying competitive in a data-driven market.

Furthermore, Equifax's robust financial health, underscored by a strong balance sheet and consistent free cash flow, enables it to engage in strategic bolt-on acquisitions. These acquisitions are designed to bolster its data repositories, technological capabilities, and overall market presence, ensuring continued growth and innovation.

- Strategic Partnerships: Equifax's partnership with Workday aims to integrate HR and workforce data, enhancing its identity and employment verification services.

- Bolt-on Acquisitions: The company's financial flexibility allows for targeted acquisitions to expand its data assets and technological infrastructure, as seen in its acquisition history.

- Market Reach Expansion: These strategic moves are designed to broaden Equifax's customer base and deepen its penetration in key markets, particularly within the financial services and HR sectors.

Increasing Demand for Identity Theft and Fraud Prevention

The escalating threat of cyberattacks and identity theft fuels a significant increase in demand for advanced protection services. Consumers and businesses alike are actively seeking more sophisticated solutions for identity monitoring and fraud prevention. This trend presents a substantial opportunity for Equifax, given its established capabilities in data security and analytics.

Equifax is strategically positioned to benefit from this growing market. By enhancing its consumer-facing identity protection products and expanding its business-to-business fraud prevention tools, the company can meet this rising demand. For instance, the global identity and access management market was valued at approximately $32.5 billion in 2023 and is projected to reach $85.2 billion by 2030, growing at a CAGR of 14.7%. This growth trajectory underscores the immense potential for players like Equifax.

- Growing Market Size: The global identity and access management market is expanding rapidly, indicating strong demand for fraud prevention services.

- Consumer and Business Needs: Both individuals and organizations are increasingly prioritizing robust identity protection and fraud mitigation.

- Equifax's Strengths: Equifax's expertise in data security and analytics allows it to effectively address these evolving market needs.

- Service Expansion: Opportunities exist for Equifax to broaden its portfolio of consumer and B2B fraud prevention solutions.

Equifax's strategic expansion into new market segments, such as government social services income verification, represents a significant growth avenue. The increasing demand for efficient, automated verification processes in these sectors offers substantial new revenue streams, leveraging Equifax's robust data infrastructure.

The company's focus on integrating alternative data sources, powered by AI and machine learning, allows for more inclusive and accurate credit assessments. This approach not only expands access to credit for underserved populations but also enhances the precision of risk evaluations, aligning with the growing need for financial inclusion.

Equifax is experiencing strong international revenue growth, particularly in Latin America, presenting a prime opportunity for further global market penetration. Leveraging its advanced cloud infrastructure and AI capabilities, the company can tailor its offerings to diverse international markets, ensuring greater adoption and success.

The escalating threat of cyberattacks and identity theft is driving a surge in demand for advanced protection services. Equifax is well-positioned to capitalize on this trend by enhancing its consumer-facing identity protection products and expanding its business-to-business fraud prevention tools, tapping into a rapidly growing market.

| Opportunity Area | Description | Market Potential/Growth Driver | Equifax's Advantage |

|---|---|---|---|

| New Market Segments | Expansion into government social services and other non-traditional verification needs. | Growing demand for automated verification in public sector programs. | Established data infrastructure and cloud capabilities. |

| Alternative Data Integration | Utilizing AI/ML to incorporate non-traditional data for credit scoring. | Increasing need for financial inclusion and more accurate risk assessment. | Expertise in data analytics and AI development. |

| International Expansion | Deepening penetration in high-growth international markets like Latin America. | Robust international revenue growth indicating strong market receptiveness. | Advanced cloud infrastructure and localized service tailoring. |

| Identity Protection & Fraud Prevention | Enhancing services to combat rising cyber threats and identity theft. | Rapid growth in the global identity and access management market (projected to reach $85.2B by 2030). | Strong capabilities in data security and analytics. |

Threats

Equifax continues to be a prime target for sophisticated cyberattacks, given its extensive repository of sensitive consumer data. Despite bolstering its defenses, the sheer volume and nature of information held means the threat of a breach remains a significant concern.

A future data breach, even a minor one, could trigger substantial financial penalties and further tarnish Equifax's already damaged reputation. This would undoubtedly lead to a renewed loss of confidence among both individual consumers and its business partners.

The global data privacy landscape is a constant flux, with new regulations like the California Privacy Rights Act (CPRA), which became fully effective in 2023, building on the foundation of the CCPA. These evolving rules, alongside international frameworks such as the EU's GDPR, place increasing demands on how companies like Equifax handle consumer data.

Compliance with these stringent data privacy laws, including potential future updates or expansions in 2024 and 2025, presents a significant operational challenge. Failure to adhere can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher, creating a direct financial threat.

These regulations can also limit Equifax's ability to leverage vast datasets for product development and service enhancement, potentially impacting revenue streams. For example, restrictions on data sharing and consent management require significant investment in technology and processes, increasing operational costs and legal exposure.

Equifax operates in a highly competitive landscape, facing pressure not only from established rivals like Experian and TransUnion but also from agile fintech startups and major technology firms. These disruptors are increasingly employing cutting-edge technologies such as AI and blockchain, alongside alternative data sources, to challenge traditional credit reporting methodologies. For instance, the rise of buy now, pay later (BNPL) services, often integrated into e-commerce platforms, presents a new data stream and a potential alternative for assessing consumer creditworthiness, directly impacting Equifax's core business.

Economic Volatility and Credit Market Contractions

Economic volatility, marked by persistent inflation and aggressive interest rate hikes throughout 2024, presents a substantial threat to Equifax. These macroeconomic headwinds can dampen consumer spending and business investment, directly impacting the volume of credit inquiries and new account originations, which are key revenue drivers for Equifax's core services.

Furthermore, a potential credit market contraction, as indicated by tightening lending standards observed in late 2024 and early 2025, could significantly reduce demand for Equifax's credit reporting and verification solutions. This environment also heightens the risk of increased loan defaults and delinquencies, which, while potentially creating demand for certain data services, can also lead to a more challenging operating landscape and increased provisioning needs across the financial sector.

- Inflationary Pressures: Global inflation remained elevated in 2024, forcing central banks to maintain higher interest rates, impacting borrowing costs and credit demand.

- Interest Rate Hikes: The Federal Reserve continued its hawkish stance through much of 2024, with rates hovering near multi-decade highs, increasing the cost of capital for businesses and consumers.

- Recession Fears: Persistent concerns about a potential recession in major economies during 2024-2025 could lead to a significant slowdown in credit activity.

- Credit Delinquencies: An anticipated rise in consumer and corporate delinquencies as economic conditions tighten could affect the overall health of the credit ecosystem Equifax serves.

Negative Public Perception and Consumer Backlash

A pervasive negative public perception surrounding data privacy, credit scoring, or a perceived lack of consumer control over personal financial information represents a significant threat to Equifax. This general distrust can fuel consumer advocacy groups and spur legislative actions aimed at increasing data protection and transparency. For instance, ongoing public concern about data security, amplified by past breaches, could lead to a greater demand for alternative credit assessment methods that bypass traditional bureaus, potentially impacting Equifax's market position and long-term relevance.

Such sentiment can translate into tangible business risks. A strong consumer backlash, potentially driven by widespread dissatisfaction with data handling practices, could result in reduced reliance on Equifax's services by lenders and even direct consumer avoidance. This erosion of trust poses a direct threat to Equifax's core business model, which relies heavily on the widespread acceptance and use of its credit data and reporting services.

- Growing distrust in data privacy: Public surveys consistently show increasing consumer concern over how their personal data is collected, stored, and used by companies like credit bureaus.

- Potential for regulatory action: Negative public perception can accelerate regulatory scrutiny and the implementation of stricter data privacy laws, impacting how Equifax operates.

- Shift towards alternative data sources: Consumers and businesses may seek out alternative credit scoring methods that offer greater transparency or perceived fairness, bypassing traditional credit reporting agencies.

The persistent threat of sophisticated cyberattacks remains a critical vulnerability for Equifax, given its vast holdings of sensitive consumer data. Despite ongoing security enhancements, the sheer volume and nature of information make it a prime target, with any future breach, however minor, risking substantial financial penalties and further erosion of trust, as evidenced by the ongoing cybersecurity landscape in 2024-2025.

Evolving global data privacy regulations, such as the CPRA and GDPR, present significant compliance challenges and operational costs, potentially limiting data utilization for product development. Failure to adhere to these increasingly stringent rules, which are expected to see further updates in 2024 and 2025, could lead to substantial fines, with GDPR penalties reaching up to 4% of global annual revenue.

Intensifying competition from fintech startups and tech giants employing AI and alternative data sources, like those from buy now, pay later services, directly challenges Equifax's traditional credit reporting model. Economic volatility, including sustained inflation and high interest rates throughout 2024, dampens credit demand and increases the risk of delinquencies, impacting Equifax's core revenue streams.

A pervasive public distrust in data privacy and credit scoring practices fuels advocacy for stricter regulations and a potential shift towards alternative credit assessment methods, directly threatening Equifax's market position and reliance on its core services.

SWOT Analysis Data Sources

This Equifax SWOT analysis is built upon a foundation of robust data, including publicly available financial reports, comprehensive market research, and insights from industry experts and news outlets to ensure a well-rounded and informed perspective.