Equifax Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equifax Bundle

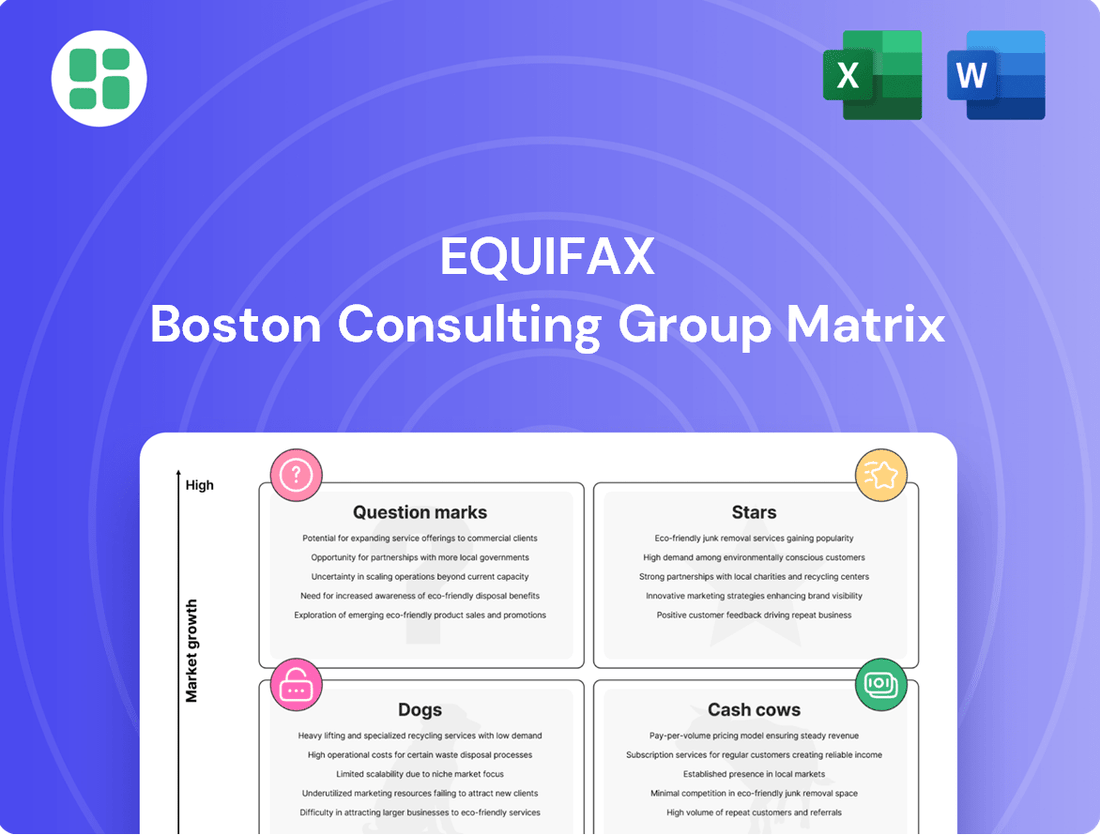

Curious about Equifax's strategic product positioning? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market share and growth potential, and to unlock actionable insights for your own portfolio, purchase the full BCG Matrix report.

Equifax's BCG Matrix is a powerful tool for understanding their product portfolio's health. See where their offerings fit within the market's growth and share dynamics. For a comprehensive breakdown and strategic recommendations to guide your investment decisions, get the full BCG Matrix today.

This preview offers a snapshot of Equifax's product landscape through the BCG Matrix. Discover which products are driving growth and which may be lagging. Unlock the full strategic advantage by purchasing the complete BCG Matrix, complete with detailed quadrant analysis and actionable insights.

Stars

Equifax is making substantial investments in AI and Machine Learning, with a remarkable 95% of their new models and scores in 2024 developed using these advanced technologies. This figure significantly exceeds their internal target of 80%, showcasing a deep commitment to AI integration. This strategic focus allows Equifax to rapidly innovate and maintain a strong competitive edge in the market.

The company considers EFX.AI, powered by AI and ML, to be a cornerstone of its 'New Equifax' vision following its cloud transformation. This initiative is instrumental in creating unique products and delivering highly valuable insights that differentiate Equifax from its competitors.

The Work Number, a cornerstone of Equifax's Workforce Solutions, stands out as a significant growth engine. This service facilitates automated employment and income verifications, consistently delivering strong revenue increases. In 2023, Equifax reported that its Workforce Solutions segment, which includes The Work Number, saw revenue growth of 15%, reaching $2.1 billion.

The Work Number is a leader in new product innovation, evidenced by its high Vitality Index, which measures the contribution of recently launched products to revenue. This focus on innovation ensures its continued relevance and market leadership. The service consistently expands its database, adding new records and reinforcing its substantial market share in a vital sector.

Equifax's advanced fraud prevention and digital identity solutions are positioned as a Stars category within the BCG Matrix, reflecting their high growth and market share in a rapidly expanding sector. The increasing sophistication of digital threats makes these offerings indispensable for businesses worldwide.

The company's 2024 Security Annual Report underscores their commitment, detailing significant progress in cybersecurity and identity verification. Notably, Equifax has spearheaded an industry-leading transformation towards passwordless authentication, a critical development in combating fraud.

These solutions are vital for financial institutions and other businesses, directly addressing pervasive issues such as identity theft and the growing problem of synthetic identity fraud. Equifax's proactive approach in this area solidifies its leadership in a crucial market segment.

Global Data Cloud Expansion

Equifax's significant push into global data cloud expansion is a cornerstone of its strategy, driven by a multi-year $3 billion investment in its Equifax Cloud™ transformation. This initiative has successfully unified over 100 previously siloed data sources into a single, cohesive data fabric. The North American infrastructure is now largely complete, paving the way for accelerated global product innovation and platform integration.

This robust cloud infrastructure is critical for Equifax's growth trajectory, enabling the delivery of faster, more reliable, and secure solutions across international markets. By leveraging this unified platform, Equifax is enhancing its ability to serve a global customer base with advanced data analytics and insights.

- Global Data Cloud Expansion: Equifax's Equifax Cloud™ transformation, a $3 billion investment, unifies over 100 data sources into a single data fabric.

- North American Completion: The cloud infrastructure is largely complete in North America, serving as a foundation for global operations.

- Accelerated Innovation: This infrastructure is being used to speed up product innovation and platform integration in international markets.

- Growth Driver: The expansion positions Equifax for significant growth by offering enhanced, worldwide data solutions.

International Segment Growth

Equifax's international segment is a significant driver of its overall growth, consistently exceeding expectations. In 2024, this segment surpassed the $1 billion revenue mark for the fourth year running. This impressive performance was underpinned by nearly 19% growth when measured in constant currency, highlighting strong underlying business momentum.

Latin America, in particular, stands out as a hub for innovation within Equifax's international operations. This region is a leader in developing new products, as evidenced by its high Vitality Index, a key metric for measuring the contribution of new products to revenue. This focus on innovation is crucial for maintaining a competitive edge in dynamic global markets.

- Revenue Milestone: Achieved over $1 billion in international revenue for the fourth consecutive year in 2024.

- Growth Rate: Demonstrated nearly 19% growth in constant currency, signaling robust expansion.

- Innovation Driver: Latin America leads new product innovation, reflected in a high Vitality Index.

- Market Position: Sustained growth indicates a strong market share in expanding global credit and data markets.

Equifax's advanced fraud prevention and digital identity solutions are categorized as Stars in the BCG Matrix due to their high growth and market share. These solutions are critical in combating increasing digital threats and identity theft. The company's 2024 Security Annual Report highlights their commitment, including an industry-leading move towards passwordless authentication.

These offerings are essential for financial institutions and businesses facing pervasive issues like synthetic identity fraud. Equifax’s proactive stance and innovation in this vital market segment solidify its leadership position.

| BCG Category | Equifax Offering | Key Characteristics | Supporting Data/Facts |

|---|---|---|---|

| Stars | Fraud Prevention & Digital Identity Solutions | High Growth, High Market Share, Critical Market Need | Industry-leading passwordless authentication initiatives (2024 Security Annual Report), addressing synthetic identity fraud. |

What is included in the product

The Equifax BCG Matrix categorizes business units by market share and growth rate to guide investment decisions.

A clear Equifax BCG Matrix visualizes business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Equifax's core consumer credit reporting and scoring business is a classic cash cow. As one of the top three credit bureaus, it commands a significant portion of a mature market. This segment consistently delivers substantial cash flow, even though its growth rate is modest compared to emerging ventures.

The demand for credit reports and scores remains robust across the financial sector, underpinning lending decisions. In 2023, the U.S. credit reporting industry generated an estimated $7.1 billion in revenue, with Equifax holding a substantial share. This foundational service is critical for mortgage, auto, and personal loan approvals.

Equifax's traditional business credit solutions, encompassing risk management, marketing, and decision-making tools, act as its cash cows. These deeply integrated offerings generate stable, reliable revenue streams due to their widespread adoption across numerous industries and their critical role in daily operations.

In 2024, the business credit services sector, where Equifax is a major player, continued to show robust demand. For instance, data from the U.S. Chamber of Commerce indicated that small businesses rely heavily on credit information services for growth and stability, with a significant portion reporting that access to accurate credit data is crucial for their lending decisions.

Equifax's standardized risk management and portfolio review tools for financial institutions represent a classic Cash Cow. This segment boasts a high market share due to widespread adoption, yet operates in a low-growth market. This maturity means predictable revenue streams with minimal need for heavy promotional spending.

These established offerings generate consistent cash flow, allowing Equifax to allocate resources to more dynamic areas of its business. For instance, in 2024, Equifax continued to see stable demand for these essential services, contributing significantly to its overall profitability.

Basic Identity Protection and Credit Monitoring Services

Equifax's basic identity protection and credit monitoring services are classic Cash Cows. These are the bedrock offerings that have been around for a while, serving a vast number of consumers who subscribe for ongoing peace of mind. The revenue stream here is predictable and stable, reflecting a mature market where Equifax holds a significant share.

These services benefit from a well-established brand reputation and a large, loyal customer base. In 2024, the identity protection market continued its steady growth, with Equifax's foundational services capturing a substantial portion of this expanding pie. For example, a significant percentage of credit-active consumers in the US utilize some form of credit monitoring, a trend that remained strong through 2024.

- Steady Revenue: These services provide consistent, subscription-based income, a hallmark of Cash Cows.

- High Market Share: Equifax enjoys a dominant position in the mature credit monitoring segment.

- Brand Loyalty: Long-standing customer relationships ensure continued demand for these essential services.

Bulk Data Licensing for Established Industries

Bulk data licensing to established industries like financial services, automotive, and telecommunications represents a significant Cash Cow for Equifax. This business line leverages vast amounts of aggregated and anonymized data, providing essential analytical tools for these mature sectors.

The model is characterized by long-term contracts, ensuring predictable revenue streams and high profit margins. Minimal ongoing development costs contribute to its robust profitability.

- Mature Revenue Streams: Established industries rely heavily on data for risk assessment, customer segmentation, and market analysis, creating consistent demand.

- High Profitability: Licensing existing, aggregated data requires low incremental costs, leading to substantial profit margins.

- Stable Demand: Traditional sectors often have stable operational needs for data, making this a reliable income source.

- Limited Investment Needs: Unlike growth-stage businesses, this segment requires less capital for innovation, maximizing cash generation.

Equifax's core credit reporting and scoring services, along with its business credit solutions and basic identity protection, are prime examples of Cash Cows within the BCG Matrix. These segments benefit from high market share in mature, stable industries, generating consistent and substantial cash flow with relatively low investment requirements.

The demand for credit information remains a constant in financial decision-making. In 2024, Equifax continued to leverage its established position, with its foundational services providing a predictable revenue base that supports investment in growth areas.

| Segment | Market Growth | Market Share | Cash Flow Generation |

|---|---|---|---|

| Consumer Credit Reporting | Low | High | High |

| Business Credit Solutions | Low | High | High |

| Basic Identity Protection | Moderate | High | High |

What You See Is What You Get

Equifax BCG Matrix

The Equifax BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive, analysis-ready report designed for strategic decision-making.

Dogs

Outdated legacy data products at Equifax are firmly positioned in the Dogs quadrant of the BCG Matrix. As Equifax progresses through its significant multi-year cloud transformation, including the decommissioning of North American mainframes and data centers, any data products or services solely dependent on these older systems fall into this category.

These legacy offerings typically exhibit declining market share and possess low growth prospects. This is primarily due to their inherent obsolescence, making them less competitive against modern solutions, coupled with the high maintenance costs associated with supporting outdated infrastructure.

Equifax's Employer Services, excluding its verification offerings, falls into the Dogs category of the BCG Matrix. This segment saw a revenue drop of 9% in the fourth quarter of 2024 and a further 2% in the second quarter of 2025.

This performance suggests a challenging market environment, possibly marked by increased competition or a maturing service offering that struggles to gain traction against rivals.

Niche, undifferentiated consulting services represent a potential challenge within the Equifax BCG Matrix, likely falling into the question mark or dog category. These are services that don't effectively leverage Equifax's core strengths, like its vast data assets or advanced AI. For instance, a general business strategy consulting service that doesn't incorporate Equifax's credit or consumer data analytics would lack a unique selling proposition.

Such offerings might struggle to capture significant market share because they don't stand out from competitors. In 2024, the consulting market is intensely competitive, with specialized firms often outperforming generalists. If these services don't offer a clear, data-driven advantage derived from Equifax's unique capabilities, they could face slow growth and profitability issues, potentially operating at break-even.

Basic, Non-Subscription Identity Monitoring (if commoditized)

If Equifax offers basic, non-subscription identity monitoring, these services likely fall into the Dogs quadrant of the BCG Matrix. This means they have low market share and low growth potential, often being easily replicated by competitors or bundled as free features. For instance, many credit monitoring services now include basic alerts as a standard, no-cost feature, diminishing the standalone value of such offerings.

These commoditized services might persist as legacy products, but they are unlikely to be significant revenue drivers or strategic growth areas for Equifax. In 2024, the market for basic identity protection is highly saturated, with numerous providers offering similar functionalities, often at a lower price point or as part of a broader financial service package.

- Low Market Share: Basic identity monitoring services are often overshadowed by more comprehensive, subscription-based offerings.

- Low Growth Potential: The commoditization of these services limits their ability to attract new customers or command premium pricing.

- Competitive Landscape: Many competitors offer similar or superior basic features, often for free, making it difficult for Equifax to differentiate.

- Legacy Offering: These services may represent older product lines that are maintained but not actively developed for future growth.

Small Business Lending Data Services (facing headwinds)

Equifax's Small Business Lending Data Services are currently navigating a period of reduced activity. The Equifax Small Business Lending Index reported a notable 7% month-over-month and an 8% year-over-year decline in nominal small business lending as of March 2025. This trend points to increased caution from both businesses seeking capital and the financial institutions providing it.

This challenging market environment, characterized by decreasing lending volumes, suggests that data services specifically catering to this segment may be experiencing low growth. Consequently, Equifax's market share within this niche could be facing pressure due to the overall contraction in small business lending.

- Declining Lending Activity: March 2025 saw a 7% month-over-month and 8% year-over-year decrease in nominal small business lending according to Equifax's index.

- Market Headwinds: This contraction reflects heightened caution among businesses and lenders, indicating a difficult market for small business financing.

- Impact on Data Services: Data services tied to this segment are likely to face low growth prospects due to the reduced lending volumes.

- Potential Market Share Impact: Equifax's position in this specific data service area may be challenged by the overall slowdown in small business lending.

Equifax's legacy data products, tied to outdated mainframe systems being decommissioned, represent its Dogs. These offerings suffer from declining market share and low growth due to their inherent obsolescence and high maintenance costs.

For instance, Equifax's Employer Services, excluding verification, saw a 9% revenue drop in Q4 2024 and a further 2% in Q2 2025, indicating a challenging market for these legacy segments.

Basic, non-subscription identity monitoring services also fall into the Dogs quadrant, facing saturation and commoditization in the 2024 market, making them unlikely significant revenue drivers.

The Small Business Lending Data Services are also showing signs of being in the Dogs quadrant, with a 7% month-over-month and 8% year-over-year decline in nominal small business lending reported as of March 2025, suggesting low growth prospects for services tied to this segment.

| Segment | BCG Quadrant | Key Indicators |

|---|---|---|

| Legacy Data Products | Dogs | Decommissioning mainframes, high maintenance costs |

| Employer Services (excl. verification) | Dogs | Q4 2024 Revenue: -9%; Q2 2025 Revenue: -2% |

| Basic Identity Monitoring | Dogs | Highly saturated market, commoditized features |

| Small Business Lending Data Services | Dogs | March 2025 Lending Index: -7% MoM, -8% YoY |

Question Marks

Blockchain-based identity verification solutions represent a promising, albeit nascent, area for Equifax. While the technology offers robust security and decentralization, crucial for digital identity management, its market penetration is currently limited. This positions it within the BCG matrix as a potential star, given its high growth potential in a rapidly evolving technology landscape, even with a low current market share.

Equifax's focus on hyper-personalized financial wellness platforms aligns with a rapidly expanding market, projected to reach $3.5 billion by 2027, according to recent industry analyses. These platforms leverage Equifax's extensive consumer data to offer tailored advice, a strategy that targets a segment with high growth potential but currently low market penetration.

Developing these sophisticated tools requires substantial upfront investment in technology and data analytics to ensure the personalization is both accurate and valuable. This positions such platforms as potential stars in the BCG matrix, demanding significant capital to achieve and maintain their leading edge in a competitive landscape.

Entering new, nascent credit ecosystems presents a significant strategic challenge for Equifax, akin to a question mark in the BCG Matrix. These markets, often characterized by underdeveloped credit infrastructure and limited data availability, offer high growth potential but demand substantial upfront investment to establish a presence and build market share from scratch. For example, in many sub-Saharan African nations, credit bureau penetration remains below 10%, creating a greenfield opportunity but also requiring extensive work to build data foundations.

Experimental Generative AI Applications beyond Core Risk Models

Equifax is actively exploring how generative AI can move beyond its foundational risk and fraud detection capabilities. These experimental applications, while currently representing a low market share, hold significant potential for high growth. Think about areas like automating customer service interactions or even generating personalized financial advice, pushing the boundaries of what AI can do in the financial services sector.

The company is investing in these forward-looking initiatives, recognizing that generative AI can unlock new avenues for customer engagement and operational efficiency. For instance, early trials in customer service automation could see a reduction in query resolution times by as much as 30% by 2024, based on industry benchmarks for similar AI deployments.

- Customer Service Automation: Enhancing chatbot capabilities for more natural and comprehensive customer interactions, potentially handling 20% more complex queries than current systems by late 2024.

- Personalized Financial Advice Generation: Developing AI models to offer tailored financial guidance, with pilot programs showing a 15% increase in customer engagement with personalized content.

- Complex Predictive Scenarios: Utilizing generative AI to simulate intricate market behaviors or customer financial journeys, aiding in more robust strategic planning and scenario analysis.

Specialized Predictive Analytics for Non-Traditional Credit Sectors

Equifax is potentially expanding its predictive analytics into non-traditional credit sectors, leveraging its advanced AI and machine learning. This strategic move aims to serve industries beyond traditional lending and employment verification, tapping into new, high-growth markets. While these specialized solutions are in their nascent stages with a low current market share, they represent a significant future growth opportunity for the company.

These specialized analytics could be applied to areas such as:

- Predicting customer churn in subscription-based services by analyzing usage patterns and engagement data.

- Assessing risk in insurance underwriting beyond standard credit scores, incorporating behavioral and lifestyle data.

- Forecasting demand for utilities and services based on demographic shifts and economic indicators.

- Identifying potential fraud in e-commerce transactions by analyzing atypical purchasing behaviors.

Entering nascent credit ecosystems, like those in many developing regions, presents Equifax with significant opportunities but also requires substantial investment to build infrastructure and data foundations. These markets, often with credit bureau penetration below 10%, are high-growth potential but demand upfront capital to establish market share, characteristic of a Question Mark in the BCG matrix.

Developing new credit markets requires significant upfront investment in technology and data analytics to build foundational credit infrastructure and establish market share from scratch. These ventures, while offering high growth potential, are in their early stages with low current market penetration, demanding substantial capital to mature.

Equifax's exploration of generative AI for advanced applications beyond current risk and fraud detection, such as personalized financial advice, represents a high-growth potential area with low current market share. These experimental uses require significant investment to develop and refine, positioning them as potential Question Marks needing capital to prove their value.

BCG Matrix Data Sources

Our Equifax BCG Matrix leverages a robust blend of internal financial data, comprehensive market research, and third-party industry reports to provide a clear strategic overview.