Equifax Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equifax Bundle

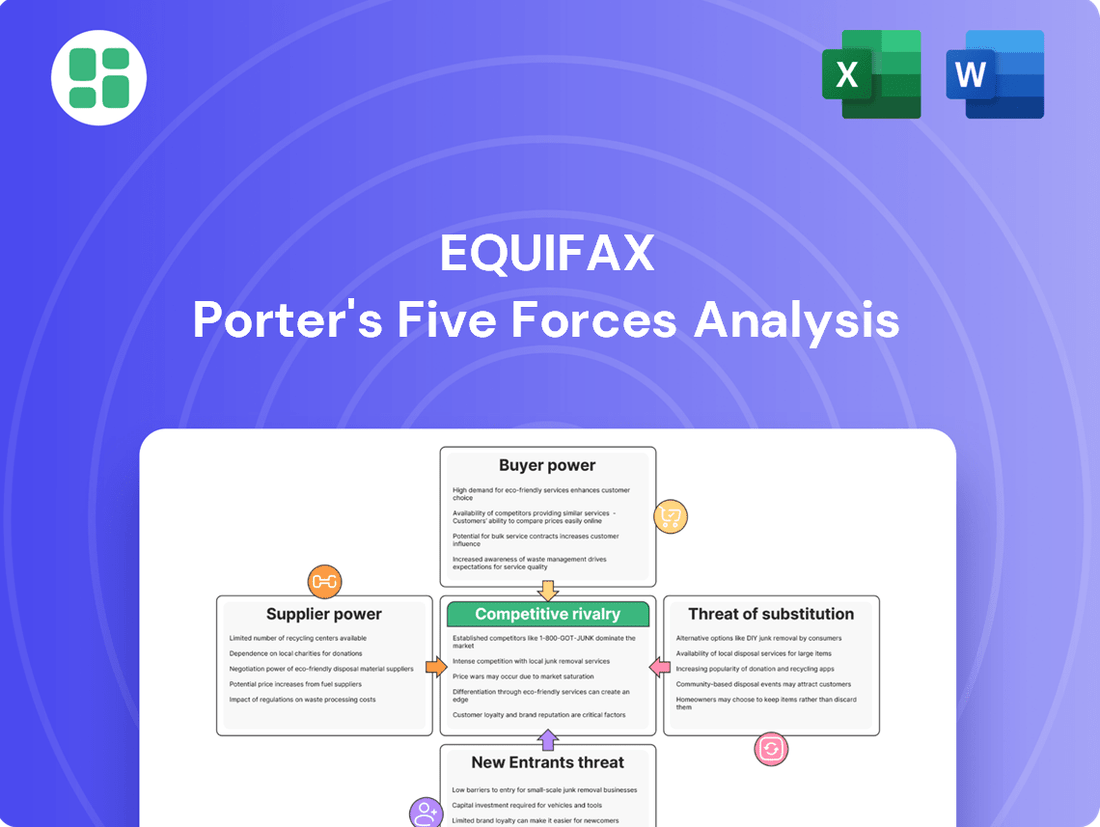

Equifax operates in a highly competitive landscape, significantly shaped by the bargaining power of its customers and the constant threat of new entrants. Understanding these forces is crucial for navigating the credit reporting industry.

The full analysis reveals the strength and intensity of each market force affecting Equifax, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Equifax's bargaining power of suppliers is significantly weakened by its access to diverse data sources. The company draws information from a wide array of financial institutions, public records, and employers, creating a broad and deep data pool. This extensive network means no single supplier can exert substantial leverage, as Equifax can readily substitute or supplement data from one source with another.

Suppliers of specialized technology, software, and cloud infrastructure services hold moderate bargaining power over Equifax. This is particularly true for proprietary or highly integrated solutions that are crucial for Equifax's advanced analytics and secure data management platforms. For instance, in 2024, the global cloud computing market, a key area for infrastructure, was valued at over $600 billion, indicating significant investment and reliance on these providers.

Equifax's dependence on these critical tech suppliers means that any disruptions or unfavorable contract terms could potentially impact its operational efficiency and data processing capabilities. While the broader technology market offers some vendor diversity, the specialized nature of certain platforms can still grant suppliers leverage.

Data aggregators and niche data providers can exert significant bargaining power over Equifax, particularly when they offer unique or exclusive datasets, such as specialized rental history or utility payment information. The value these niche data sets add to Equifax's core credit reporting products can make them indispensable, increasing supplier leverage. For instance, if a particular aggregator controls a substantial portion of verifiable rental payment data, a key component for assessing individuals with thin credit files, Equifax might face higher costs to access it.

Regulatory Compliance Vendors

Vendors specializing in regulatory compliance, particularly in areas like cybersecurity and data privacy, wield considerable bargaining power over Equifax. The critical nature of these services, coupled with substantial penalties for non-compliance, makes them indispensable. For instance, in 2023, the global cybersecurity market was valued at over $200 billion, highlighting the scale and importance of these specialized services.

Equifax's operations are deeply embedded within a highly regulated landscape, demanding unwavering adherence to standards set by bodies like the GDPR and CCPA. This necessity amplifies the leverage of vendors providing robust, compliant solutions. Failure to meet these stringent requirements can result in significant financial penalties, as seen with Meta's €1.2 billion GDPR fine in May 2023, underscoring the high stakes involved.

- Criticality of Services: Cybersecurity and data privacy compliance are non-negotiable for Equifax, directly impacting its reputation and legal standing.

- High Switching Costs: Implementing and integrating new compliance systems can be complex and costly, deterring frequent vendor changes.

- Limited Alternatives: The specialized expertise required for advanced regulatory compliance often means a limited pool of qualified vendors, increasing their negotiating strength.

- Regulatory Penalties: The severe financial repercussions of non-compliance empower vendors who can guarantee adherence, allowing them to command premium pricing.

Human Capital and Expertise

The bargaining power of suppliers for Equifax, particularly concerning human capital, is significantly influenced by the demand for highly skilled professionals in data science, cybersecurity, and advanced analytics. These individuals represent critical intellectual capital, and their expertise is foundational to Equifax's operations and innovation.

The scarcity of top-tier talent in these specialized fields directly translates into increased bargaining power for employees and consulting firms. This means they can negotiate more favorable compensation packages and project terms, impacting Equifax's labor costs and resource acquisition.

For instance, in 2024, the demand for data scientists with expertise in AI and machine learning remained exceptionally high, with average salaries for experienced professionals often exceeding $150,000 annually in major tech hubs. Similarly, cybersecurity experts commanded premium compensation due to the escalating threat landscape.

- High Demand for Specialized Skills: Professionals in data science, cybersecurity, and advanced analytics are in high demand across industries.

- Talent Scarcity: The limited supply of top talent in these niche areas empowers individuals and firms to negotiate better terms.

- Compensation Leverage: Skilled professionals can leverage their expertise to secure higher salaries and more attractive benefits.

- Strategic Importance: Attracting and retaining these key personnel is crucial for Equifax's competitive advantage and future growth.

Equifax's bargaining power of suppliers is generally moderate, with significant variations depending on the type of supplier. While Equifax benefits from a vast network of data sources, limiting the power of any single data provider, specialized technology and niche data aggregators can exert considerable influence due to the criticality and uniqueness of their offerings.

What is included in the product

This analysis unpacks the competitive forces impacting Equifax, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the credit reporting industry.

Instantly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model, allowing for proactive strategic adjustments.

Customers Bargaining Power

Major banks and financial institutions are a cornerstone of Equifax's client base, driving a substantial portion of its income. Their sheer size and the immense volume of transactions they process equip them with significant leverage when negotiating terms.

These sophisticated clients often employ rigorous procurement strategies, allowing them to negotiate for better pricing, bespoke service packages, or integrated solutions. For instance, in 2023, major financial services firms accounted for a significant percentage of Equifax's total revenue, underscoring their bargaining strength.

Furthermore, these large customers can diversify their credit reporting needs by engaging with multiple credit bureaus. This ability to multi-source provides them with an additional avenue to exert pressure and secure more advantageous agreements.

Individual consumers, despite their sheer numbers, exert minimal bargaining power over credit reporting agencies like Equifax. This is largely because credit reports and scores are fundamental to nearly all financial dealings, from securing a mortgage to obtaining a credit card. Consumers generally have no say in which credit bureau's data a lender uses, and their options for directly accessing essential credit monitoring or identity protection services from these bureaus are often limited, restricting their ability to negotiate terms or prices.

Fragmented business customers, particularly small and medium-sized enterprises (SMEs), typically possess less individual bargaining power. Their smaller transaction volumes and often simpler data requirements mean they are more inclined to accept Equifax's standard pricing and service agreements. For instance, in 2024, the vast majority of businesses globally fall into the SME category, representing a significant portion of Equifax's customer base, yet their collective influence on pricing is diluted due to their sheer number and individual scale.

Government Agencies and Regulators

Government agencies and regulators, while not direct customers, wield substantial influence over Equifax. Their power lies in establishing and enforcing compliance standards, data privacy regulations, and security protocols that Equifax must meticulously follow. Failure to adhere to these mandates, such as those outlined by the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC), can result in significant financial penalties and reputational damage.

These entities dictate the operational landscape for credit reporting agencies. For instance, the **Fair Credit Reporting Act (FCRA)**, a cornerstone of consumer data protection in the US, imposes strict rules on how Equifax collects, uses, and shares consumer information. The **General Data Protection Regulation (GDPR)** in Europe, and similar emerging data privacy laws globally, further amplify this regulatory power, requiring substantial investments in compliance and data management. In 2023, Equifax reported that its compliance and legal costs related to regulatory matters were a significant factor in its operating expenses.

- Regulatory Oversight: Agencies like the CFPB and FTC set the rules for data accuracy, security, and consumer access.

- Compliance Costs: Adhering to regulations like FCRA and GDPR necessitates ongoing investment in technology and personnel.

- Enforcement Actions: Non-compliance can lead to substantial fines and legal repercussions, impacting profitability.

- Data Security Mandates: Stringent requirements for protecting sensitive consumer data directly influence operational procedures and infrastructure.

Availability of Alternative Data and Fintech Solutions

The increasing availability of alternative data and the rise of sophisticated fintech solutions are subtly shifting the bargaining power towards customers, especially larger enterprises. These customers are actively seeking and integrating diverse data sets and advanced analytics platforms to refine their risk assessment and decision-making processes. For instance, the global fintech market was projected to reach over $1.1 trillion in 2024, indicating a significant investment in new technological solutions that can offer alternatives to traditional data providers.

While Equifax's vast and established data repositories remain a cornerstone for many businesses, the proliferation of these new data analytics platforms and proprietary scoring models provides some customers with greater leverage and choice. This competitive landscape compels Equifax to continuously innovate and demonstrate its value proposition through enhanced services and more insightful data offerings.

- Customer Leverage: The growing accessibility of alternative data sources and advanced fintech platforms empowers customers, particularly large corporations, to conduct more independent risk assessments.

- Market Dynamics: With the fintech sector experiencing substantial growth, projected to exceed $1.1 trillion in 2024, a wider array of data analytics tools and scoring models are becoming available.

- Competitive Pressure: Equifax faces pressure to differentiate its offerings, moving beyond raw data to provide value-added insights and services that its competitors may not match.

- Innovation Imperative: The trend necessitates continuous investment in technology and data science by established players like Equifax to maintain their competitive edge and customer loyalty.

Major banks and financial institutions, as significant clients, wield considerable bargaining power due to their transaction volume and sophisticated procurement strategies. Their ability to engage with multiple credit bureaus also provides leverage. In contrast, individual consumers have minimal power, as credit reporting is essential and options for negotiation are limited. Small and medium-sized businesses, while numerous, have diluted collective influence due to their individual scale and simpler needs, often accepting standard terms.

| Customer Segment | Bargaining Power | Reasoning |

|---|---|---|

| Major Banks/Financial Institutions | High | Large transaction volumes, sophisticated procurement, multi-sourcing capability. |

| Individual Consumers | Low | Essential service, limited negotiation options, no choice in data source. |

| Small & Medium Enterprises (SMEs) | Low to Moderate | Smaller transaction volumes, less individual leverage, acceptance of standard terms. |

What You See Is What You Get

Equifax Porter's Five Forces Analysis

This preview showcases the complete Equifax Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the credit reporting industry. The document you see here is precisely what you'll receive immediately after purchase, providing actionable insights without any surprises or placeholders. You're looking at the actual, professionally formatted analysis, ready for your immediate download and use.

Rivalry Among Competitors

The U.S. credit reporting landscape is a classic oligopoly, with Equifax, Experian, and TransUnion holding sway. This concentration means competition is fierce, but it typically plays out in areas like data accuracy, cutting-edge technology, and unique service offerings, rather than outright price slashing. In 2023, the combined revenue for these three giants exceeded $15 billion, underscoring their market dominance and the significant barriers to entry for new competitors.

The competition among credit bureaus like Equifax is incredibly intense when it comes to data accuracy, completeness, and the sheer breadth of information they provide. This data is the bedrock of their entire business, and clients rely on it heavily for making crucial decisions.

Companies in this space are constantly pouring resources into acquiring new data and meticulously cleaning existing datasets to ensure their reports are the most dependable available. For instance, in 2024, the credit reporting industry saw significant investments in AI and machine learning for data validation, aiming to reduce error rates to fractions of a percent.

A perceived weakness in data quality or a lack of comprehensive coverage can cause clients, such as lenders or employers, to look elsewhere or to use multiple data providers. This underscores the critical importance of maintaining a superior data offering to retain market share and attract new business.

Competitive rivalry in the credit reporting industry, particularly for firms like Equifax, is intensely fueled by ongoing innovation in advanced analytics, artificial intelligence, and cutting-edge technology. Companies are constantly striving to develop and deploy superior insights, accelerate data processing speeds, and build more sophisticated predictive models to better serve their business clients in areas like risk management, targeted marketing, and fraud prevention.

This relentless pursuit of technological advancement necessitates continuous and significant investment in research and development (R&D), as well as the formation of strategic partnerships. For instance, Equifax has been actively investing in its data and analytics capabilities, with a significant portion of its capital expenditures directed towards technology and innovation. In 2024, the company continued to emphasize its commitment to leveraging AI and machine learning to enhance its product offerings and operational efficiency, aiming to provide clients with more actionable intelligence.

Global Expansion and Diversification

Major credit bureaus are aggressively pursuing global expansion and diversification, a key driver of competitive rivalry. This strategy involves entering new geographic markets and broadening service portfolios beyond core credit reporting. For instance, Equifax has been actively expanding its presence in regions like Europe and Latin America, aiming to capture growth in emerging economies.

This expansion often takes the form of strategic acquisitions and joint ventures. In 2023, Equifax completed the acquisition of Efficienti, a Brazilian leader in digital onboarding and identity verification, further solidifying its position in the Latin American market. Such moves not only increase market share but also bring in new technologies and customer bases, intensifying competition.

- Global Footprint: Companies like Equifax, Experian, and TransUnion operate in dozens of countries, creating a complex competitive landscape.

- Diversification of Services: Beyond credit reports, competition is fierce in areas like fraud prevention, identity verification, and data analytics for various industries.

- Acquisition Strategy: The pursuit of smaller, innovative companies is a common tactic to gain market access and technological capabilities, as seen in Equifax's 2023 Brazilian acquisition.

- Revenue Growth: This global push contributed to significant revenue growth for major players; Equifax reported total revenue of $5.2 billion in 2023, with international operations playing an increasingly vital role.

Regulatory Scrutiny and Reputation

The credit reporting industry operates under intense regulatory oversight, a factor that significantly influences competitive dynamics. Past incidents, such as the 2017 Equifax data breach impacting approximately 147 million consumers, have amplified both public concern and governmental attention. This heightened awareness means companies must not only comply with existing regulations but also anticipate and adapt to evolving data privacy and security standards.

Competition therefore hinges on maintaining an impeccable reputation for data security and earning consumer trust. Firms actively differentiate themselves by showcasing robust compliance frameworks and ethical data management. For instance, in 2023, the U.S. Federal Trade Commission (FTC) continued its focus on data security, issuing enforcement actions and guidance that underscore the critical nature of these practices for all industry players.

Negative publicity stemming from security lapses or regulatory non-compliance can have swift and severe consequences. Market share erosion and a loss of client confidence are direct results of such events. Companies are thus incentivized to invest heavily in cybersecurity and transparent communication, understanding that their brand's integrity is a paramount competitive asset.

- Regulatory Focus: Increased government scrutiny post-breaches like Equifax's 2017 incident (affecting ~147 million consumers).

- Reputation as a Differentiator: Competition centers on demonstrating superior data security and ethical consumer data handling.

- Compliance Investment: Firms vie to prove advanced compliance with evolving privacy laws, such as those influenced by ongoing FTC actions in 2023.

- Reputational Risk: Negative publicity can lead to significant market share loss and diminished client trust.

Competitive rivalry among credit bureaus like Equifax is intense, driven by innovation in data analytics and AI to provide superior insights for clients. This necessitates substantial R&D investment, with Equifax focusing on AI and machine learning in 2024 to enhance its offerings and efficiency. Companies also compete through global expansion and service diversification, often using acquisitions to gain market access and technology, as seen with Equifax's 2023 acquisition in Brazil. Reputation for data security and regulatory compliance is paramount, with firms actively differentiating themselves through robust cybersecurity and ethical data handling, especially given increased government scrutiny following past breaches.

| Competitor | 2023 Revenue (USD Billions) | Key Competitive Focus Areas |

|---|---|---|

| Equifax | 5.2 | AI/ML investment, Global Expansion, Data Security |

| Experian | 6.7 (approx.) | Data Analytics, Digital Transformation, Consumer Services |

| TransUnion | 4.0 (approx.) | Data Intelligence, Fraud Prevention, Emerging Markets |

SSubstitutes Threaten

The emergence of fintech lenders and their innovative credit scoring methods presents a significant threat of substitutes for traditional credit bureaus like Equifax. These platforms leverage non-traditional data, such as utility payments, rental history, and even social media activity, to assess creditworthiness, particularly for individuals with limited credit histories.

This shift means that for certain lending decisions, particularly for subprime or thin-file borrowers, these alternative data sources can offer a more inclusive and potentially faster assessment of risk, bypassing the need for traditional credit reports. For instance, some alternative lenders reported approval rates significantly higher than traditional banks for applicants with no prior credit history in 2024.

Emerging blockchain-based identity and credit systems present a significant threat of substitutes for traditional credit bureaus like Equifax. These decentralized systems aim to give consumers more control over their data, potentially offering enhanced security and transparency. While adoption is still in its early stages, with challenges in regulation and widespread implementation, the underlying technology could fundamentally alter how creditworthiness is assessed and managed.

Large financial institutions, like major banks and insurance companies, are increasingly building robust in-house data analytics teams. These teams leverage proprietary customer data, often combined with Equifax's core credit information, to create sophisticated risk models and customer insights. For instance, in 2024, many large banks reported significant investments in AI and machine learning for credit scoring, aiming to reduce reliance on third-party analytics.

This internal capability acts as a substitute for some of Equifax's more advanced analytics services. While Equifax remains a crucial source for foundational credit data, these institutions can now perform complex analyses internally, potentially limiting Equifax's opportunities to sell higher-margin analytics solutions to these clients.

Direct Lender-to-Lender Information Sharing

The threat of substitutes for credit bureau reporting, particularly in niche lending markets, is a growing concern. Direct lender-to-lender information sharing, where institutions exchange borrower performance data directly, could bypass traditional credit bureaus. This is especially relevant in specialized sectors where lenders may have a deeper understanding of borrower behavior than a general credit report can capture.

While direct sharing faces significant hurdles in terms of scalability and regulatory compliance, its potential to offer a more tailored and immediate view of creditworthiness for specific transaction types cannot be ignored. For instance, in the burgeoning fintech lending space, consortia of lenders might establish private data-sharing agreements to streamline underwriting for unique loan products. The US private credit market alone reached an estimated $1.3 trillion in 2023, highlighting the scale of these specialized niches.

- Niche Market Focus: Direct sharing is most potent in specialized lending areas like equipment finance or specific types of commercial real estate where lenders have deep industry knowledge.

- Data Aggregation Bypass: Such exchanges could reduce reliance on third-party aggregators for certain types of credit assessments, potentially lowering costs and increasing speed.

- Regulatory Challenges: Widespread adoption faces significant regulatory hurdles related to data privacy, standardization, and anti-trust concerns.

- Growing Private Credit: The substantial growth in private credit markets, estimated at over $1.3 trillion in 2023, indicates a fertile ground for alternative data-sharing arrangements.

Government-backed Credit Reporting Initiatives

Government-backed credit reporting initiatives, while less prevalent in mature markets like the U.S., pose a potential threat of substitution. These public utility-style systems could offer universal access to credit data at reduced costs, directly challenging private bureaus. For instance, some European countries have explored or implemented more centralized public credit registries, aiming to increase financial inclusion and transparency. This regulatory shift could disintermediate existing players like Equifax by providing a lower-cost, government-sanctioned alternative for credit information access.

The emergence of such government-backed systems could pressure private credit bureaus to lower their fees or enhance their service offerings to remain competitive. In 2024, the global credit reporting market was valued at approximately $50 billion, indicating a substantial industry that could be disrupted by public alternatives. A move towards public credit reporting could significantly alter the competitive landscape, especially if these initiatives gain traction in major economies.

- Potential for Lower Cost: Government systems may operate with a public service mandate, allowing them to offer services at a lower price point than profit-driven private entities.

- Universal Access Mandate: Public initiatives often aim for broader financial inclusion, potentially serving segments of the population that private bureaus might find less profitable.

- Regulatory and Political Influence: The threat is amplified by potential government policy shifts favoring public data infrastructure over private sector dominance in credit reporting.

- Data Standardization and Accessibility: Public systems could enforce greater data standardization, making information more accessible and potentially reducing the value proposition of proprietary data formats used by private bureaus.

Fintech lenders and their innovative credit scoring methods are a significant substitute, particularly for subprime borrowers. These platforms use alternative data, leading to higher approval rates for those with no credit history in 2024.

Blockchain-based identity systems offer enhanced security and consumer data control, potentially disrupting traditional credit assessment. Additionally, large financial institutions are building in-house analytics capabilities, reducing reliance on third-party services like Equifax.

Direct lender-to-lender information sharing, especially in niche markets like the $1.3 trillion US private credit market in 2023, bypasses traditional bureaus. Government-backed credit reporting initiatives also pose a threat by offering universal, lower-cost access to credit data, potentially impacting the global $50 billion credit reporting market.

Entrants Threaten

The credit reporting industry, exemplified by companies like Equifax, presents a formidable barrier to new entrants due to exceptionally high capital investment requirements. Building the robust IT infrastructure, secure data centers, and, crucially, acquiring the vast datasets of historical and real-time consumer financial information demands billions of dollars. For instance, maintaining and updating the immense databases necessary for accurate credit scoring is an ongoing, substantial expense that deters smaller players.

The credit reporting industry faces substantial regulatory hurdles, significantly deterring new entrants. In the U.S., the Fair Credit Reporting Act (FCRA) mandates stringent protocols for data accuracy, consumer privacy, and security. For instance, FCRA violations can result in significant penalties, with statutory damages potentially reaching $1,000 per violation, alongside actual damages and attorney fees. This complex legal framework necessitates substantial investment in compliance infrastructure and expertise from the outset.

Navigating these intricate regulations requires considerable legal and operational resources, creating a steep learning curve for any newcomer. The sheer volume of compliance requirements, from data handling to consumer dispute resolution processes, acts as a formidable barrier to entry. Companies must demonstrate an immediate and robust commitment to these standards, a costly endeavor for emerging businesses.

Equifax, alongside its primary rivals, has invested decades in cultivating a strong reputation for trustworthiness among lenders, businesses, and consumers. This deep-seated credibility is a significant barrier for newcomers.

In an industry where data accuracy and robust security are non-negotiable, new entrants struggle to match the established credibility Equifax and its competitors possess. This trust is essential when handling sensitive personal financial information.

The sheer time and resources required to build this level of trust represent a substantial hurdle, making it difficult for new companies to gain a foothold and compete effectively in the credit reporting market.

Network Effects and Data Moats

The threat of new entrants in the credit bureau space is significantly dampened by powerful network effects and data moats. A credit bureau's value escalates with the sheer volume and richness of its data. Lenders naturally gravitate towards the bureau with the most extensive information, which, in turn, incentivizes more data providers to contribute. This creates a self-reinforcing cycle, building a formidable barrier for newcomers.

This virtuous cycle effectively establishes a 'data moat' around established players like Equifax. For new entrants, the challenge of accumulating a comparable dataset and achieving competitive analytical quality is immense. In 2024, the sheer scale of data handled by major credit bureaus underscores this moat; for instance, Experian reported processing over 1 billion credit data transactions in the US annually, a testament to the data accumulation required to compete.

- Network Effects: The more data a credit bureau possesses, the more valuable its services become to lenders, attracting more data sources and further enhancing its data pool.

- Data Moats: Incumbents benefit from a 'data moat,' a significant competitive advantage built on the vastness and depth of their historical data, making it difficult for new entrants to replicate.

- Barriers to Entry: The cost and time required to build a comparable data infrastructure and achieve the analytical sophistication of established bureaus are prohibitive for most new entrants.

- Lender Preference: Lenders' reliance on comprehensive data for risk assessment solidifies the position of bureaus with the largest and most detailed datasets.

Incumbent Relationships and Switching Costs

Equifax benefits from deeply entrenched relationships with a vast network of financial institutions, businesses, and government entities. These established ties are often characterized by highly integrated systems and bespoke solutions tailored to client needs.

The integration of Equifax's services into clients' existing workflows creates substantial switching costs. Migrating data, retraining staff, and reconfiguring operational processes represent significant investments of time and capital for any client considering a change.

For a new entrant to disrupt this market, they would need to present a compelling value proposition, likely involving substantially lower pricing or demonstrably superior technology and service offerings, to overcome the inertia and expense associated with client migration.

- Established Client Base: Equifax serves over 800 million individuals and 90 million businesses globally, underscoring the breadth of its existing relationships.

- High Integration: Many clients utilize Equifax's data and analytics platforms as critical components of their risk management and customer onboarding processes, making seamless integration a key barrier to entry.

- Data Security and Compliance: The sensitive nature of credit and financial data means clients prioritize providers with proven track records in security and regulatory compliance, a significant hurdle for new entrants.

The threat of new entrants in the credit reporting industry, including for companies like Equifax, is significantly low due to immense capital requirements for data infrastructure and acquisition. Building the necessary IT systems and securing vast datasets of consumer financial information demands billions of dollars, a prohibitive cost for most newcomers.

Regulatory compliance, particularly under frameworks like the Fair Credit Reporting Act (FCRA), adds another substantial barrier. The FCRA's stringent requirements for data accuracy, consumer privacy, and security, with potential penalties for violations reaching $1,000 per violation, necessitate significant investment in legal and operational resources from day one.

Established players like Equifax benefit from decades of built trust and strong network effects, creating data moats. Lenders prefer bureaus with the most extensive data, reinforcing a cycle where more data attracts more data providers, making it incredibly difficult for new entrants to amass comparable datasets and analytical quality. For instance, in 2024, major credit bureaus like Experian process over a billion credit data transactions annually in the US alone.

Furthermore, deeply entrenched client relationships and high integration costs for existing customers present a significant hurdle. Clients are hesitant to switch due to the expense and complexity of migrating data and reconfiguring operational processes, requiring new entrants to offer exceptionally compelling value propositions to overcome this inertia.

| Factor | Description | Impact on New Entrants | Example/Data (2024) |

| Capital Requirements | Building IT infrastructure and acquiring vast datasets | Very High Barrier | Billions of dollars required for data centers and data acquisition. |

| Regulatory Hurdles | Compliance with FCRA and other data privacy laws | High Barrier | Potential penalties of $1,000+ per FCRA violation. |

| Network Effects & Data Moats | Value increases with data volume; lenders prefer extensive data | Very High Barrier | Experian processes over 1 billion US credit data transactions annually. |

| Customer Relationships & Switching Costs | Integrated systems and bespoke solutions create high switching costs | High Barrier | Equifax serves over 800 million individuals and 90 million businesses globally. |

Porter's Five Forces Analysis Data Sources

Our Equifax Porter's Five Forces analysis is built upon a robust foundation of data, including Equifax's own investor relations disclosures, SEC filings, and credit bureau industry reports. We also integrate insights from financial analysts, market research firms, and regulatory bodies to provide a comprehensive view of the competitive landscape.