Equifax PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equifax Bundle

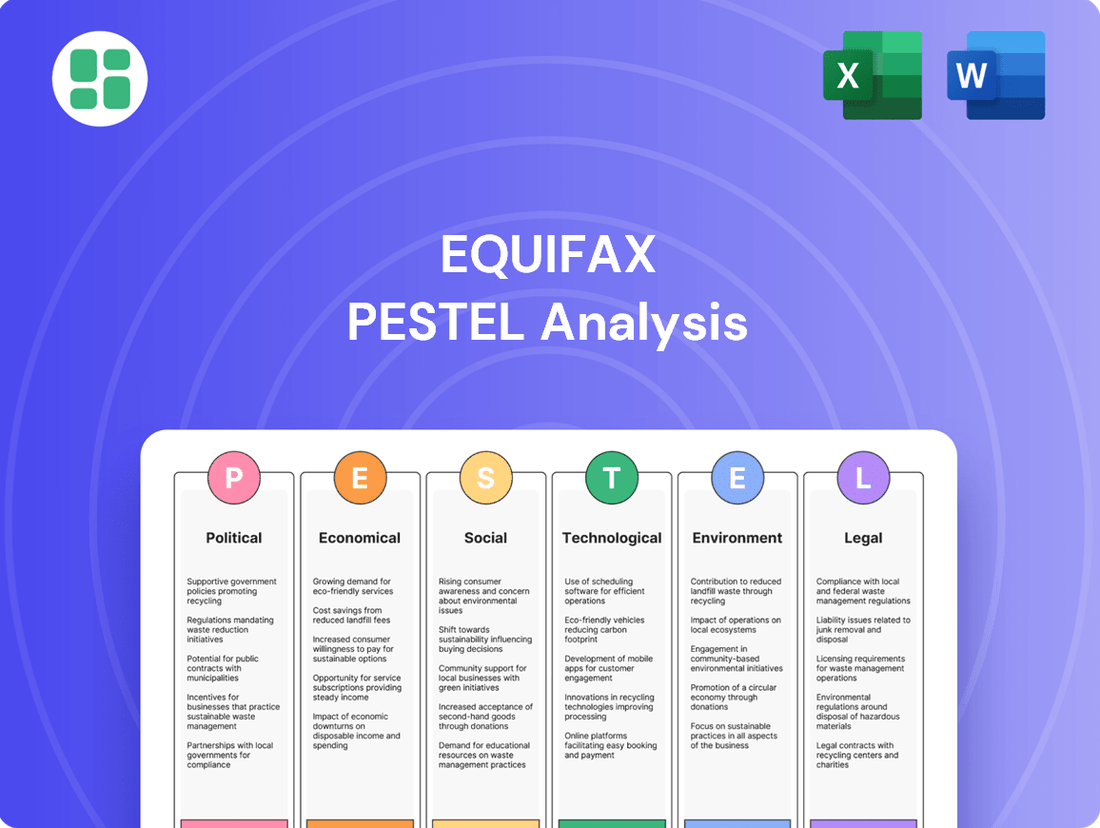

Navigate the complex external forces impacting Equifax with our detailed PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the credit reporting giant. Equip yourself with actionable intelligence to refine your market strategy and anticipate future challenges. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Equifax faces significant governmental regulatory scrutiny, operating under the watchful eyes of agencies like the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC). These bodies are actively shaping the credit reporting landscape. For instance, the CFPB's proposed ban on certain contractual terms in consumer financial products and the recent vacating of the medical debt rule directly influence Equifax's compliance obligations and operational strategies, aiming to foster greater fairness and transparency.

The political environment is actively shaping data privacy through a series of federal and state-level legislative efforts focused on consumer protection. States are notably pushing forward with their own 'fair access' statutes, while federal discussions continue regarding robust data breach prevention and remediation measures.

For instance, the California Consumer Privacy Act (CCPA), as amended by the California Privacy Rights Act (CPRA), effective January 1, 2023, significantly expanded consumer rights over their personal data, impacting how companies like Equifax handle information. This trend of state-specific legislation creates a complex compliance mosaic that Equifax must navigate.

The ongoing dialogue around potential federal data privacy legislation, such as proposals aiming to establish national standards for data breach notification and consumer compensation, underscores the dynamic nature of this regulatory space. Equifax's ability to adapt its data handling and security protocols to these evolving mandates is critical for maintaining trust and operational continuity.

Global political stability and evolving trade policies directly shape economic landscapes and, by extension, the credit market. For Equifax, shifts in presidential administrations or alterations to international trade agreements, like potential tariffs, can impact consumer spending and business lending, thereby influencing overall economic growth and Equifax's revenue.

For instance, the ongoing trade tensions between major economies and the potential for new tariffs in 2024-2025 could lead to increased costs for businesses and consumers, potentially affecting credit utilization and default rates. The US trade deficit with China, a persistent factor, continues to be a point of negotiation that could see policy changes impacting various sectors.

International Regulatory Harmonization Challenges

Equifax's global operations are significantly impacted by the challenge of international regulatory harmonization, particularly concerning data protection and credit reporting. As of early 2025, the company must contend with a patchwork of evolving regulations, including GDPR in Europe and various national data privacy laws, each with unique compliance demands. This complexity necessitates substantial investment in legal expertise and technology to ensure adherence across all operating regions, preventing potential fines and reputational damage.

Navigating these differing legal frameworks presents a continuous operational hurdle. For instance, the varying consent mechanisms and data breach notification periods across jurisdictions require tailored compliance strategies. Equifax's ability to effectively manage these diverse requirements directly influences its operational efficiency and market access.

- GDPR fines: Companies can face penalties up to 4% of annual global turnover or €20 million, whichever is higher, for non-compliance with GDPR.

- Data Localization Laws: Several countries are implementing laws requiring data to be stored within their borders, adding complexity to global data management.

- Credit Reporting Standards: Differences in how credit information is collected, used, and shared internationally create compliance burdens for a global credit bureau like Equifax.

Government Agency Partnership and Dependence

Equifax's relationship with government agencies is multifaceted. The company's data and analytics are vital for numerous public sector entities, aiding in critical functions like employment verification and eligibility determination for social programs. For instance, in 2024, government contracts often represent a significant portion of revenue for data analytics firms, though specific figures for Equifax's government partnerships are proprietary.

This deep integration makes Equifax an indispensable partner in public administration. However, it also places the company under intense public scrutiny. Concerns frequently arise regarding the accuracy of the data provided and the ethical considerations surrounding its use in public policy and citizen services. This dynamic creates a delicate balance for Equifax, where its utility is matched by the need for transparency and accountability.

- Government reliance on Equifax for social program eligibility verification.

- Equifax's role in public sector employment verification processes.

- Increased public scrutiny on data accuracy and usage by government partners.

- The strategic importance of government contracts for data analytics firms.

Political factors significantly shape Equifax's operational landscape, with regulatory bodies like the CFPB and FTC actively influencing data handling and consumer protection. The ongoing evolution of data privacy laws at both state and federal levels, exemplified by the CCPA/CPRA, necessitates constant adaptation of Equifax's compliance strategies. Furthermore, global political stability and trade policies, such as potential tariffs in 2024-2025, can directly impact credit markets and Equifax's revenue streams.

What is included in the product

This Equifax PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategy.

It provides a comprehensive understanding of the external landscape, enabling informed decision-making and proactive risk management.

A clear, actionable summary of Equifax's PESTLE analysis, highlighting key external factors that can be leveraged to mitigate risks and inform strategic decision-making.

Economic factors

Consumer credit demand remains a key economic driver, and Equifax's 2024 Global Consumer Credit Trends Report indicates this demand is steady globally, though not uniform. For example, Canada's mortgage market showed signs of recovery, suggesting increased demand for that specific type of credit.

Conversely, India experienced a notable rise in non-mortgage debt, pointing to a different pattern of consumer borrowing. These diverse regional trends directly impact Equifax's business by shaping the volume and nature of credit data they process and the scoring models they employ.

The trajectory of interest rates and inflation significantly shapes consumer borrowing and credit market health. For instance, persistent inflation can lead consumers to favor unsecured credit, while anticipated central bank rate cuts in late 2025 could influence mortgage origination volumes and overall loan affordability.

Mortgage and lending market volatility significantly impacts Equifax, especially its U.S. Information Solutions segment, which relies on lending activity for revenue. As of early 2024, while some indicators suggested a potential mortgage market recovery, persistent economic uncertainties continue to temper lending volumes and the demand for related credit products.

For instance, the U.S. housing market experienced fluctuating mortgage rates throughout 2024, impacting both new originations and refinancing activities. This directly influences the volume of credit data that Equifax processes and analyzes, a core component of its business model. Analysts anticipate continued, albeit moderate, growth in lending in 2025, but the overall pace will remain sensitive to inflation and interest rate decisions.

Consumer Spending and Debt Levels

Despite ongoing economic uncertainties, U.S. consumers demonstrated remarkable resilience through continued spending into 2025. This robust consumer activity has been a significant driver for industries reliant on consumer behavior and credit. For Equifax, this trend directly impacts the demand for its core services, as businesses increasingly need reliable credit reporting and sophisticated fraud prevention tools to navigate a dynamic market. The surge in credit card balances, for instance, underscores the heightened need for accurate risk assessment.

The sustained consumer spending, coupled with rising debt levels, creates a complex environment for businesses. As of early 2025, U.S. credit card balances have seen a notable increase, reflecting both continued purchasing power and potential financial strain for some households. This dynamic necessitates Equifax's data-driven solutions, enabling clients to make informed decisions regarding lending, customer acquisition, and risk mitigation. The volume of transactions and the associated credit data generated provide Equifax with valuable insights.

- Consumer Spending Resilience: U.S. consumers maintained strong spending patterns throughout early 2025, defying some economic forecasts.

- Credit Card Balance Growth: Credit card balances experienced a significant surge in 2025, indicating increased consumer borrowing.

- Demand for Equifax Services: This spending and debt environment directly boosts demand for Equifax's credit reporting and fraud prevention solutions.

- Data-Driven Decision Making: Businesses rely on Equifax's accurate data for effective risk management and strategic planning amidst these trends.

Student Loan Delinquency Resumption

The resumption of U.S. federal student loan payments and delinquency reporting in early 2025 has significantly impacted consumer credit. Data from the U.S. Department of Education indicates a rise in delinquency rates, with millions of borrowers now facing repayment obligations after an extended pause. This re-emergence of student loan debt as a factor in credit reports directly affects Equifax's core business.

This uptick in delinquencies means more consumers will have negative marks on their credit files, potentially increasing the demand for credit monitoring and identity protection services. As individuals navigate these new financial challenges, they are more likely to seek tools to understand and manage their credit health. For instance, early 2025 reports showed a notable percentage of federal student loan borrowers entering delinquency shortly after repayment resumed.

- Increased Delinquency Rates: Federal student loan delinquency saw a significant jump in early 2025 following the end of the payment pause.

- Impact on Credit Profiles: Millions of borrowers now have these delinquencies reflected in their credit histories, affecting their credit scores.

- Demand for Credit Services: This trend is expected to drive higher demand for credit monitoring and identity theft protection from companies like Equifax.

Economic factors significantly influence Equifax's operational landscape, with consumer spending and credit demand acting as primary indicators. The U.S. economy, for instance, saw continued consumer resilience into early 2025, marked by robust spending and a notable increase in credit card balances. This environment directly fuels demand for Equifax's core services, as businesses require accurate credit reporting and fraud prevention to manage risk in a dynamic market.

The resumption of U.S. federal student loan payments in early 2025 introduced a new dynamic, with delinquency rates rising for millions of borrowers. This directly impacts credit profiles and is anticipated to increase demand for credit monitoring and identity protection services, areas where Equifax operates.

Global credit trends also present varied opportunities and challenges. While Canada's mortgage market showed recovery signs in 2024, India experienced a rise in non-mortgage debt, highlighting the diverse regional impacts on Equifax's data processing and scoring models.

Interest rate and inflation trajectories remain critical. Persistent inflation could encourage unsecured credit use, while potential central bank rate adjustments in late 2025 could affect overall loan affordability and origination volumes, impacting Equifax's revenue streams tied to lending activity.

Preview the Actual Deliverable

Equifax PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Equifax PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Equifax's strategic landscape.

Sociological factors

Societies worldwide are placing a greater emphasis on financial health and ensuring everyone has access to financial services. This trend directly supports Equifax's mission to empower individuals to reach their financial potential.

Equifax is actively contributing to this by using alternative data sources and artificial intelligence to extend credit opportunities to individuals who might not have traditional credit histories. For instance, by the end of 2024, Equifax reported that its initiatives had helped to improve credit access for an estimated 30 million previously unscoreable consumers in the US alone, fostering greater financial inclusion.

Public awareness and anxieties surrounding identity theft and fraud are at an all-time high, amplified by numerous large-scale data breaches in recent years. This persistent concern directly fuels consumer and business demand for robust identity protection, credit monitoring, and fraud prevention solutions, areas where Equifax plays a significant role.

In 2024, reports indicated that over 1.1 billion records were compromised across various data breaches, underscoring the ongoing threat landscape. This environment makes Equifax's services crucial for individuals seeking to safeguard their personal information and for businesses aiming to protect their customers and operations from financial and reputational damage.

Consumers are increasingly vocal about their desire for control and transparency regarding their personal data. This societal shift means companies like Equifax face mounting pressure to demonstrate strong cybersecurity and clear data handling policies. For instance, a 2024 survey indicated that over 70% of consumers are more concerned about their data privacy than they were a year prior.

Addressing Economic Abuse and Vulnerable Populations

Equifax is making strides in addressing economic abuse, a critical issue impacting vulnerable populations. Their involvement with initiatives like the Economic Abuse Evidence Form demonstrates a commitment to helping victims rectify their credit histories. This collaboration underscores a societal shift towards recognizing and mitigating the financial fallout of such abuse.

The increasing awareness of economic abuse highlights the need for robust support systems for those affected. For instance, the UK's Financial Conduct Authority (FCA) has been working with lenders and credit reference agencies to improve how financial abuse is handled, with guidance issued in 2023. This focus is crucial for protecting individuals who may have had their credit compromised due to coercive control.

- Societal Recognition: Growing awareness of economic abuse as a significant issue affecting consumer financial well-being.

- Victim Support: Equifax's participation in programs like the Economic Abuse Evidence Form aids victims in credit file correction.

- Regulatory Focus: Financial regulators, like the FCA, are increasingly emphasizing the need for fair treatment of consumers experiencing financial abuse.

- Vulnerable Segments: Addressing the unique challenges faced by economically abused individuals is a key area of focus for consumer protection.

Shifting Workforce Dynamics and Employment Verification

Societal shifts towards flexible work arrangements and the burgeoning gig economy are fundamentally altering traditional employment structures. This creates a persistent need for reliable and immediate verification of income and employment for various stakeholders. Equifax's Workforce Solutions is instrumental in navigating these evolving dynamics, offering essential services to employers and social service agencies alike.

The rise of the gig economy means more individuals are piecing together income from multiple sources, making traditional employment verification challenging. For instance, by the end of 2023, the U.S. Bureau of Labor Statistics reported that temporary and contract workers represented a significant portion of the labor force, highlighting this trend. Equifax's solutions help streamline the process of confirming these varied income streams.

- Gig Economy Growth: The freelance and contract workforce continues to expand, demanding flexible verification methods.

- Income Volatility: Workers in these sectors often have fluctuating incomes, requiring real-time data access.

- Employer Needs: Businesses need efficient ways to onboard and manage a diverse workforce, including contingent workers.

- Social Services Support: Agencies rely on accurate employment data for eligibility determination and benefit administration.

Societies are increasingly prioritizing financial inclusion, driving demand for Equifax's services in extending credit to underserved populations. By the close of 2024, Equifax reported facilitating improved credit access for approximately 30 million previously unscoreable consumers in the U.S., a testament to this societal trend.

Heightened concerns over identity theft and data breaches, with over 1.1 billion records compromised in breaches during 2024, amplify the need for Equifax's fraud prevention and identity protection solutions. Consumers are also demanding greater data transparency, with over 70% expressing increased concern about data privacy in 2024.

The growing recognition of economic abuse is leading to initiatives like the Economic Abuse Evidence Form, in which Equifax participates, to help victims rectify credit issues. This aligns with regulatory efforts, such as the UK FCA's 2023 guidance to financial institutions on handling cases of financial abuse.

The expanding gig economy and flexible work arrangements necessitate robust income and employment verification, a core offering of Equifax Workforce Solutions. By the end of 2023, temporary and contract workers constituted a significant portion of the U.S. labor force, underscoring the demand for Equifax's services in this area.

| Sociological Factor | Impact on Equifax | Supporting Data (2023-2024) |

|---|---|---|

| Financial Inclusion Drive | Increased demand for credit access solutions. | 30 million unscoreable consumers in US gained credit access by end of 2024. |

| Data Privacy & Security Concerns | Growth in demand for identity protection and fraud prevention. | Over 1.1 billion records compromised in breaches during 2024; 70% consumers more concerned about data privacy. |

| Awareness of Economic Abuse | Opportunity for specialized services and partnerships. | UK FCA issued guidance on financial abuse in 2023. |

| Gig Economy & Flexible Work | Need for advanced employment and income verification. | Significant portion of US labor force in temporary/contract roles by end of 2023. |

Technological factors

Equifax has significantly invested over $1.5 billion in its cloud transformation strategy over multiple years. This extensive investment is a cornerstone of their technological advancement, aiming to modernize their data infrastructure.

The company has successfully migrated more than 100 previously siloed data sources into a unified data fabric. This consolidation is crucial for creating a more cohesive and accessible data environment.

This technological shift empowers Equifax to accelerate the development of its data and analytics solutions, ensuring they are both faster and more dependable. The enhanced security and reliability of these solutions are vital for supporting Equifax's extensive global operations and maintaining customer trust.

Equifax is aggressively embedding AI and ML into its operations, with a substantial portion of its new credit models and scoring systems now leveraging these advanced technologies. This strategic integration is designed to enhance the accuracy and efficiency of its data analysis.

The company’s commitment to ‘explainable AI’ is particularly noteworthy. By focusing on transparency in AI-driven credit decisions, Equifax aims to foster greater financial inclusion and bolster fraud prevention efforts, making credit more accessible and secure for consumers.

Equifax invests heavily in robust cybersecurity, a critical factor given the highly sensitive personal and financial data it handles. The company is constantly innovating to defend against millions of daily cyber threats, implementing advanced measures like industry-leading passwordless authentication to bolster its defenses.

This commitment to continuous innovation in security programs is paramount for protecting against increasingly sophisticated and evolving cyber threats. Maintaining customer trust and data integrity is directly tied to Equifax's ability to stay ahead of these threats, ensuring the protection of its vast data repositories.

Development of Differentiated Data and Analytics Products

Equifax is actively developing advanced data and analytics products, leveraging its robust cloud infrastructure and artificial intelligence (AI) capabilities. This focus on innovation is crucial for staying competitive in the evolving data services market.

These new offerings aim to provide deeper insights and more personalized solutions. For instance, 'Optimal Path' helps consumers plan their credit score development, while 'Affordability 360' assists lenders in making more informed decisions. These tools highlight Equifax's strategy to create value-added services beyond traditional credit reporting.

- Data-driven innovation: Equifax's investment in AI and cloud technology fuels the creation of new analytics products.

- Enhanced decision-making: Products like 'Optimal Path' and 'Affordability 360' empower both consumers and businesses.

- Market differentiation: These specialized products help Equifax stand out by offering tailored solutions for specific financial needs.

Strategic Use of Big Data and Data Fabric

Equifax leverages its custom data fabric to integrate a wide array of proprietary datasets, significantly enhancing AI model performance and enforcing robust data governance. This strategic approach allows for the efficient processing of massive information volumes, which in turn fuels more thorough risk assessments and the development of novel solutions for its clients.

The technological infrastructure empowers Equifax to unlock deeper insights from its data, a crucial advantage in the rapidly evolving financial services landscape. For instance, by Q4 2024, Equifax reported that its enhanced data analytics capabilities, powered by its data fabric, contributed to a notable increase in the accuracy of its fraud detection models.

- Data Unification: Equifax's data fabric integrates diverse, proprietary datasets to maximize AI performance.

- AI Enhancement: This unified data environment is key to improving the accuracy and efficiency of AI-driven analytics.

- Data Governance: The fabric facilitates critical data governance measures, ensuring compliance and data integrity.

- Efficiency Gains: Processing vast information volumes enables more comprehensive assessments and innovative product development.

Equifax's technological advancements are central to its strategy, with over $1.5 billion invested in cloud transformation, unifying over 100 data sources into a data fabric. This infrastructure supports accelerated development of AI and ML-driven credit models, enhancing accuracy and efficiency. The company prioritizes 'explainable AI' for financial inclusion and robust cybersecurity, investing in advanced defenses against millions of daily threats.

| Technology Area | Investment/Focus | Impact |

|---|---|---|

| Cloud Transformation | $1.5 billion+ | Modernized data infrastructure, unified data fabric |

| AI/ML Integration | Substantial portion of new credit models | Enhanced accuracy, efficiency, and explainability |

| Cybersecurity | Continuous innovation, advanced measures | Protection against evolving threats, customer trust |

Legal factors

Equifax navigates a stringent legal landscape, heavily shaped by data privacy and consumer protection mandates like the Fair Credit Reporting Act (FCRA). These regulations are not static; they evolve with new interpretations and legislative actions, directly impacting how Equifax handles sensitive consumer data. For instance, the vacating of the Consumer Financial Protection Bureau's (CFPB) medical debt rule in late 2023 and the introduction of new consumer rights under various statutes underscore this dynamic environment.

The 2017 Equifax data breach, a landmark cybersecurity event, continues to cast a long shadow, with ongoing legal and financial obligations. The company's settlement agreement, finalized in 2019, mandates significant payouts and the provision of identity restoration services that extend through 2029, demonstrating the enduring financial burden of such incidents.

These lingering effects highlight the severe legal liabilities companies face in the wake of data security failures. Equifax's experience serves as a stark reminder of the critical need for proactive and robust data protection measures to mitigate both reputational damage and substantial financial penalties.

Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) and various state attorneys general are intensifying their oversight of credit reporting agencies. This heightened scrutiny translates into more rigorous enforcement actions and a greater focus on compliance.

Recent legal actions underscore the financial and reputational risks. For instance, New York's settlement with Equifax concerning inaccurate credit scores, amounting to $15 million in 2024, demonstrates the tangible consequences of data errors and failure to adhere to regulations.

Compliance with State-Specific Consumer Laws

Beyond federal mandates, Equifax must navigate a diverse array of state-specific consumer protection laws impacting credit reporting and data handling. For instance, California's Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), enacted in 2023, grant consumers significant rights over their personal information, including data access and deletion requests, which directly affect how Equifax manages consumer credit data.

The emergence of new state legislation, particularly concerning medical debt reporting and fair access to financial services, adds layers of compliance complexity. As of late 2024, several states are considering or have enacted laws that limit the inclusion of medical debt on credit reports, impacting Equifax's data inclusion policies and potentially altering credit scoring models for millions of Americans.

- State-Specific Data Privacy Laws: California's CPRA, effective January 1, 2023, imposes stringent requirements on data handling, impacting Equifax's operational procedures.

- Medical Debt Reporting Regulations: Emerging state laws in 2024 and 2025 are restricting or prohibiting the reporting of medical debt, affecting Equifax's data sets.

- Fair Access to Financial Services: State-level initiatives are scrutinizing credit reporting practices to ensure equitable access to financial products, potentially influencing Equifax's algorithms and data utilization.

- Compliance Costs: Adhering to a patchwork of state laws necessitates significant investment in legal counsel, technology upgrades, and policy revisions for Equifax.

Whistleblower Protections and Corporate Accountability

The legal landscape is placing a stronger emphasis on safeguarding whistleblowers and holding corporations accountable, fostering greater transparency in how businesses operate. This trend means companies like Equifax must be vigilant about their internal compliance and ethical conduct to avoid legal repercussions. For instance, the SEC's whistleblower program has seen significant activity, awarding over $700 million to whistleblowers since its inception, highlighting the critical nature of these protections.

Equifax's proactive approach to security and ethical operations is therefore paramount. By ensuring robust internal controls and adhering to ethical standards, Equifax can significantly reduce its exposure to legal risks. Recent regulatory actions, such as the substantial fines levied against companies for data breaches, underscore the financial and reputational consequences of failing to maintain adequate safeguards and ethical practices.

- Increased regulatory scrutiny on data privacy and security.

- Potential for significant fines and legal penalties for non-compliance.

- Importance of transparent reporting and ethical business conduct.

- Growing role of whistleblower programs in uncovering corporate misconduct.

Equifax operates under a complex web of legal frameworks, with data privacy and consumer protection laws like the FCRA being central. The company faces ongoing obligations from the 2017 data breach settlement, which extends through 2029 and involves substantial financial commitments. Heightened oversight from bodies like the CFPB and state attorneys general means increased enforcement and compliance demands.

Navigating a patchwork of state laws, such as California's CPRA, requires significant investment in compliance infrastructure. Emerging state legislation in 2024 and 2025, particularly around medical debt reporting, directly influences Equifax's data inclusion policies and credit scoring models.

| Legal Factor | Impact on Equifax | Data/Example |

|---|---|---|

| Data Privacy Laws | Strict adherence to consumer data handling and rights. | California's CPRA (effective 2023) mandates data access and deletion rights. |

| Consumer Protection | Ensuring accuracy and fairness in credit reporting. | New York settlement for $15 million in 2024 over inaccurate credit scores. |

| Data Breach Liability | Long-term financial and operational consequences. | 2017 breach settlement obligations extend through 2029. |

| Medical Debt Reporting | Adapting to evolving state regulations on debt inclusion. | Several states considering or enacting bans on medical debt reporting in 2024-2025. |

Environmental factors

Equifax has committed to reaching net-zero Greenhouse Gas (GHG) emissions by 2040. This significant environmental target is underpinned by near-term, science-based targets that have been validated by the Science-Based Targets initiative (SBTi). This commitment is a core driver for the company's environmental strategy and influences day-to-day operational choices.

Equifax's strategic shift to the cloud is a significant driver of its environmental sustainability efforts, directly impacting its carbon footprint. By moving away from traditional, energy-intensive on-site data centers, the company is embracing more efficient, scalable cloud infrastructure.

This cloud migration allows Equifax to benefit from the optimized energy management practices of major cloud providers, leading to reduced energy consumption per unit of computing power. For instance, the U.S. Environmental Protection Agency's ENERGY STAR program highlights that data centers can be up to 65% more energy-efficient than typical enterprise data centers, a benefit Equifax is poised to leverage.

Furthermore, by decommissioning older hardware and reducing the need for frequent on-site equipment upgrades, Equifax actively minimizes electronic waste (e-waste). This transition aligns with global initiatives to promote circular economy principles and reduce the environmental impact of technology obsolescence.

Equifax is making significant strides in cutting down its greenhouse gas emissions. In 2024, a key move was decommissioning 10 data centers, adding to the 36 closures since 2019, which directly lowers their Scope 1 and 2 emissions.

This effort is further bolstered by their commitment to sustainable operations, evidenced by achieving green building certifications for their office spaces, demonstrating a holistic approach to environmental responsibility.

Supply Chain Engagement for Scope 3 Emissions

Equifax recognizes its wider environmental footprint and has launched a Scope 3 supplier engagement initiative. This program focuses on a substantial percentage of its suppliers, based on spending, to encourage the adoption of science-based targets. The goal is to foster a collective reduction in emissions throughout Equifax's entire value chain.

This strategic move aligns with growing investor and regulatory pressure for companies to manage and report on their indirect emissions. For instance, in 2024, many companies are setting ambitious Scope 3 reduction goals, with some aiming for 30-50% cuts by 2030. Equifax's engagement is crucial as Scope 3 emissions often represent the largest portion of a company's carbon impact.

- Supplier Engagement Focus: Equifax is actively engaging suppliers representing a significant portion of its procurement spend to drive emissions reductions.

- Science-Based Targets: The initiative encourages suppliers to set and commit to science-based targets, aligning with global climate goals.

- Value Chain Impact: By collaborating with suppliers, Equifax aims to achieve meaningful reductions in its indirect (Scope 3) emissions.

- Industry Trend: This approach reflects a broader industry trend where companies are increasingly held accountable for their entire value chain's environmental performance.

Transparent Environmental Reporting and Risk Assessment

Equifax is stepping up its environmental reporting, releasing annual climate reports that detail its performance. These reports are crucial for stakeholders wanting to grasp the company's approach to climate change. They include important elements like climate scenario analyses, which help in understanding potential future impacts.

The company's commitment extends to providing expanded responses to the CDP (formerly the Carbon Disclosure Project) survey. This detailed disclosure allows for a clearer view of Equifax's climate-related risks and opportunities. For instance, in their 2023 climate report, Equifax highlighted progress in reducing Scope 1 and 2 greenhouse gas emissions by 22% compared to their 2019 baseline, demonstrating tangible action alongside reporting.

- Transparent Reporting: Equifax publishes annual climate reports detailing environmental performance.

- Climate Scenario Analysis: Inaugural analyses are included to assess future climate risks.

- CDP Survey: Expanded responses provide deeper insights into environmental impact.

- Emission Reduction: A 22% reduction in Scope 1 and 2 GHG emissions was achieved by 2023 against a 2019 baseline.

Equifax's environmental strategy is deeply intertwined with its operational shifts, particularly its move to the cloud. This transition not only reduces energy consumption by leveraging more efficient data center infrastructure, potentially mirroring the 65% energy efficiency gains noted by the EPA's ENERGY STAR program for data centers, but also minimizes electronic waste through hardware consolidation.

The company is actively pursuing science-based targets, aiming for net-zero GHG emissions by 2040, with validated near-term goals. This commitment is demonstrated through actions like decommissioning data centers; by the end of 2024, 10 data centers were closed, adding to the 36 closures since 2019, directly impacting their Scope 1 and 2 emissions.

Furthermore, Equifax is focusing on its Scope 3 emissions by engaging suppliers, encouraging them to adopt science-based targets. This reflects a broader industry trend where companies are increasingly accountable for their entire value chain's environmental performance, with many aiming for 30-50% Scope 3 cuts by 2030.

Equifax's commitment to transparency is evident in its annual climate reports, which detail performance and include climate scenario analyses. Notably, by 2023, the company achieved a 22% reduction in Scope 1 and 2 GHG emissions compared to its 2019 baseline, showcasing tangible progress.

| Environmental Metric | 2023 Performance | Target Year | Notes |

| Scope 1 & 2 GHG Emissions Reduction | 22% reduction vs. 2019 baseline | Net-zero by 2040 | Achieved through data center closures and cloud migration. |

| Data Center Closures | 10 closed in 2024 (36 since 2019) | Ongoing | Contributes to emission reduction and e-waste minimization. |

| Supplier Engagement | Focus on significant spend suppliers | Ongoing | Encouraging science-based targets for Scope 3 reduction. |

| Climate Reporting | Annual reports, CDP disclosure | Ongoing | Includes climate scenario analysis and performance details. |

PESTLE Analysis Data Sources

Our Equifax PESTLE analysis draws from a comprehensive range of data sources, including government economic indicators, regulatory updates from financial bodies, and industry-specific market research. We incorporate insights from reputable news outlets and academic studies to ensure a well-rounded view of the macro-environment.