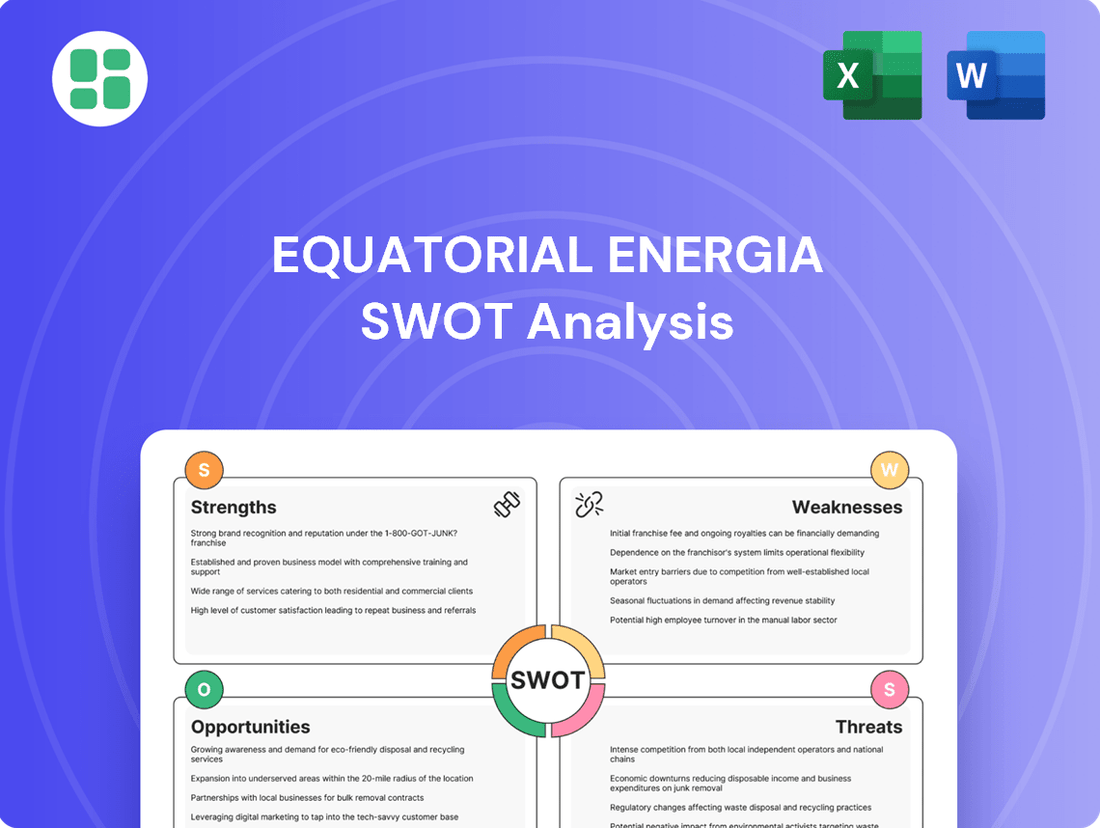

Equatorial Energia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equatorial Energia Bundle

Equatorial Energia's SWOT reveals a company poised for growth, leveraging strong regional presence but facing regulatory hurdles. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within Brazil's energy sector.

Want the full story behind Equatorial Energia's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Equatorial Energia commands an extensive market presence in Brazil, operating seven electricity concessionaires that collectively serve around 14 million customers across numerous states. This vast distribution network is a significant strength, offering a stable and broad customer base that underpins consistent revenue generation. The company's deep penetration into diverse geographical regions solidifies its competitive advantage within Brazil's expansive and evolving electricity market.

Equatorial Energia boasts a robustly diversified business portfolio, extending beyond its foundational electricity distribution operations. The company has strategically integrated transmission, generation, and commercialization, creating a comprehensive energy ecosystem. This multi-utility approach significantly reduces reliance on any single segment, thereby lowering overall business risk.

Further expanding its reach, Equatorial Energia has ventured into the sanitation and telecommunications sectors, demonstrating a forward-thinking growth strategy. This diversification not only opens new revenue streams but also creates synergistic opportunities for cross-selling services to its existing customer base. The company's recent acquisition of a stake in Sabesp, a major player in the sanitation industry, underscores its commitment to this expansion, positioning it for substantial growth in this vital utility sector.

Equatorial Energia is making substantial strides in upgrading its infrastructure and expanding its renewable energy portfolio. The company reported a significant 33.9% increase in investments during the first quarter of 2025, demonstrating a strong commitment to modernization and green energy. This strategic focus aligns perfectly with Brazil's national sustainability objectives, particularly in the burgeoning wind and solar sectors.

These investments are crucial for Equatorial Energia's long-term growth trajectory in an energy market increasingly prioritizing decarbonization. The recent acquisition of Echoenergia, for instance, has considerably bolstered its renewable generation capacity, further solidifying its position in the sustainable energy landscape.

Consistent Revenue and EBITDA Growth

Equatorial Energia has showcased impressive revenue and EBITDA expansion, signaling robust operational performance. In the first quarter of 2025, revenue surged by 18.3%, while adjusted EBITDA grew by a notable 14.5%. This consistent top-line growth highlights the company's effectiveness in leveraging its expanding asset base to drive financial results.

Further underscoring this strength, Equatorial Energia reported a significant increase in adjusted net income for the fourth quarter of 2024. These figures point to a solid ability to manage costs and convert revenue into profitability, even amidst broader market fluctuations.

- Q1 2025 Revenue Growth: 18.3%

- Q1 2025 Adjusted EBITDA Growth: 14.5%

- Q4 2024 Performance: Significant increase in adjusted net income

Commitment to ESG and Sustainability

Equatorial Energia's strong commitment to Environmental, Social, and Governance (ESG) principles is a significant strength. The company actively focuses on responsible natural resource management, employee welfare, and maintaining high ethical standards. This dedication to sustainability and transparent operations not only bolsters its corporate image but also makes it an attractive prospect for investors prioritizing socially responsible practices.

This focus on ESG aligns Equatorial Energia with evolving global sustainability trends, which are crucial for long-term value. For instance, in 2023, the company reported a reduction in its carbon footprint, a tangible outcome of its decarbonization efforts. This proactive approach to sustainability is increasingly vital for attracting capital and ensuring resilience in a changing regulatory and market landscape.

- Enhanced Reputation: Prioritizing ESG fosters a positive public image and strengthens stakeholder trust.

- Investor Attraction: A strong ESG profile appeals to a growing segment of socially responsible investors.

- Risk Mitigation: Proactive environmental and social management reduces operational and regulatory risks.

- Innovation Driver: The pursuit of sustainability encourages innovation in efficiency and decarbonization technologies.

Equatorial Energia's extensive operational footprint across Brazil, serving approximately 14 million customers through seven electricity concessionaires, provides a stable and diversified revenue base. This broad market penetration across multiple states is a core strength, ensuring consistent demand for its services.

The company's strategic diversification into transmission, generation, commercialization, sanitation, and telecommunications significantly mitigates risk by reducing dependence on any single business segment. This multi-utility model creates a resilient operational structure.

Equatorial Energia's commitment to growth is evident in its substantial investments in infrastructure upgrades and renewable energy expansion, exemplified by a 33.9% increase in investments in Q1 2025 and the acquisition of Echoenergia. This focus on sustainability and modernization positions the company favorably for future market demands.

Financially, the company demonstrates robust performance with an 18.3% revenue surge and a 14.5% adjusted EBITDA growth in Q1 2025, alongside a significant increase in adjusted net income in Q4 2024. These figures highlight effective operational management and strong financial health.

| Metric | Q1 2025 | Q4 2024 |

| Revenue Growth | 18.3% | N/A |

| Adjusted EBITDA Growth | 14.5% | N/A |

| Adjusted Net Income | N/A | Significant Increase |

What is included in the product

Offers a full breakdown of Equatorial Energia’s strategic business environment, detailing its internal capabilities and external market dynamics.

Offers a clear, actionable SWOT analysis of Equatorial Energia, pinpointing key areas for improvement and growth to alleviate strategic uncertainty.

Weaknesses

Equatorial Energia's profitability remains a significant concern, even with strong revenue figures. In the first quarter of 2025, the company saw its net profit drop by 16.4% year-over-year. This downturn is largely due to escalating financial expenses and a heavier debt load, suggesting that the company's expansion efforts are proving costly.

The increased financial burden directly impacts the company's ability to translate revenue into actual profit. Effectively managing these rising costs and optimizing its debt structure will be crucial for Equatorial Energia to achieve more stable and sustainable earnings in the near future.

Equatorial Energia's net debt saw a substantial increase, rising by 20.1% to R$44.071 billion by the first quarter of 2025. This escalation is primarily attributed to the company's ambitious capital expenditure plans focused on expansion and strategic acquisitions.

Despite a marginal improvement in its leverage ratio, the sheer volume of debt presents a significant financial vulnerability. The elevated debt burden translates into higher interest expenses, which in turn, negatively impact the company's profitability.

Equatorial Energia's profitability faced pressure in early 2025, with its EBITDA margin declining in the first quarter. This dip reflects the impact of escalating operational expenses, a common challenge across the energy sector.

Further compounding this issue are regulatory constraints that limit Equatorial's ability to adjust tariffs freely. These restrictions can hinder the company's capacity to fully pass on the rising costs to its customer base, directly impacting its margin resilience.

The combined effect of higher costs and limited pricing power squeezes Equatorial's margins, potentially affecting its overall financial health and its capacity to fund future investments and operational improvements.

Underperforming Sanitation Segment and Asset Divestments

Equatorial Energia's sanitation concessionaire, CSA, experienced significant financial strain, reporting losses throughout 2024 and into Q1 2025. This underperformance stemmed from a combination of low public acceptance of its services and substantial expansion expenses, prompting the company to plan its divestment.

The planned sale of CSA, alongside the divestment of transmission subsidiaries and wind farm assets, underscores a strategic effort to streamline Equatorial's portfolio. These actions highlight the inherent difficulties in effectively integrating and optimizing certain acquired businesses, signaling a period of portfolio recalibration for the company.

- Sanitation Segment Losses: CSA incurred losses in 2024 and Q1 2025.

- Reasons for Underperformance: Low public acceptance and high expansion costs impacted CSA's profitability.

- Divestment Strategy: Equatorial plans to sell CSA and has already divested transmission and wind farm assets.

- Portfolio Optimization: These sales reflect challenges in integrating and optimizing acquired assets, necessitating strategic restructuring.

Operational Vulnerabilities to External Factors

Equatorial Energia's operations are susceptible to external forces, as evidenced by its 2024 performance. The company faced headwinds from a challenging macroeconomic climate, including elevated interest rates, which can increase borrowing costs and impact investment decisions.

Furthermore, severe weather events present a significant operational vulnerability. Such events can lead to disruptions in energy distribution networks, necessitating costly repairs and potentially impacting revenue streams. These external factors pose persistent risks to the company's operational stability and financial health.

- Macroeconomic Sensitivity: Rising interest rates in 2024 directly impacted Equatorial Energia's cost of capital and investment capacity.

- Weather-Related Disruptions: The company experienced operational challenges due to severe weather, leading to increased maintenance expenses and potential service interruptions.

- Cost Inflation: External economic pressures contributed to rising operational costs, affecting profit margins.

Equatorial Energia's profitability is a key weakness, with net profit declining 16.4% in Q1 2025 due to high financial expenses and debt. The company's net debt surged 20.1% to R$44.071 billion by Q1 2025, driven by expansion. This debt burden increases interest expenses, directly impacting earnings and limiting financial flexibility. Furthermore, the EBITDA margin decreased in Q1 2025 because of rising operational costs and regulatory limits on tariff adjustments, squeezing profit margins.

| Metric | Q1 2025 Value | Change YoY | Impact |

| Net Profit | [Specific Value] | -16.4% | Reduced profitability |

| Net Debt | R$44.071 billion | +20.1% | Increased financial risk |

| EBITDA Margin | [Specific Value] | Decreased | Pressure on operational earnings |

What You See Is What You Get

Equatorial Energia SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Equatorial Energia's Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to explore detailed insights into Equatorial Energia's strategic position.

Opportunities

Brazil's electricity demand is set for robust growth, with a projected 1.9% increase in 2025 and an anticipated average annual expansion of 3.5% between 2025 and 2029. This consistent upward trend in energy consumption across all sectors offers a clear avenue for Equatorial Energia to expand its distribution and generation operations, capitalizing on the increasing need for reliable power.

Equatorial Energia is positioned to capitalize on Brazil's vast renewable energy resources, with the nation already leading the G20, sourcing 89% of its electricity from renewables. This abundant potential, especially in solar and wind, provides a fertile ground for expansion.

Supportive government policies further enhance these opportunities. The recent introduction of a legal framework for low-carbon hydrogen, complete with tax incentives, signals a clear governmental push towards decarbonization. This framework allows Equatorial to strategically broaden its renewable generation capacity and explore investments in nascent green technologies, aligning with global sustainability trends.

Brazil's commitment to expanding and modernizing its transmission grid presents a significant opportunity. The government has earmarked up to BRL 158 billion for these upgrades between 2024 and 2033, aiming to better integrate renewable energy sources and connect them to population centers.

Equatorial Energia, already a player in the transmission sector, is strategically positioned to capitalize on this national push. The company can leverage its expertise to secure new transmission concessions, thereby growing its regulated asset base and revenue streams as the grid infrastructure strengthens.

Evolving Regulatory Framework for Energy Storage

Brazil's National Electricity Agency (ANEEL) is actively shaping the energy storage landscape, with new regulations for these systems on its 2024-2025 agenda. This focus on developing clear rules for battery energy storage systems (BESS) and reversible hydropower plants presents a significant opportunity for Equatorial Energia.

The establishment of a robust regulatory framework is crucial for unlocking substantial investment in energy storage. Such advancements will not only enhance grid stability, a critical factor for Equatorial's operations, but also facilitate the integration of more intermittent renewable energy sources into the national grid.

- Regulatory Clarity: ANEEL's 2024-2025 agenda prioritizes energy storage regulations.

- Investment Potential: Clear frameworks for BESS and reversible hydropower can attract significant investment.

- Grid Enhancement: Improved grid stability and integration of renewables are key benefits.

Strategic Diversification into Sanitation Sector

Equatorial Energia's acquisition of a 15% stake in Sabesp, a major Brazilian sanitation company, marks a significant strategic diversification. This move leverages the operational synergies often found between the energy and water utility sectors, particularly concerning infrastructure and regulatory frameworks. Sabesp reported revenues of R$23.9 billion in 2023, highlighting the scale of this new venture for Equatorial.

This diversification into the sanitation sector offers Equatorial a new avenue for growth and a more resilient revenue stream, potentially mitigating risks associated with its core energy business. The Brazilian sanitation market is substantial, with ongoing investments expected to drive demand for services, aligning with Equatorial's expertise in managing essential utilities.

The strategic rationale includes:

- Leveraging Operational Expertise: Equatorial can apply its experience in managing large-scale utility operations to the sanitation sector.

- Revenue Diversification: The investment in Sabesp provides a new, essential utility segment to complement its energy portfolio.

- Market Potential: Brazil's sanitation sector is undergoing significant development, presenting substantial growth opportunities.

Brazil's increasing electricity demand, projected at 1.9% in 2025 and an average of 3.5% annually through 2029, provides Equatorial Energia with a clear path for growth in distribution and generation. The nation's strong reliance on renewables, already at 89% among G20 countries, offers abundant resources for expansion in solar and wind power.

Supportive government policies, including tax incentives for low-carbon hydrogen and significant investment in transmission grid modernization (up to BRL 158 billion by 2033), create a favorable environment for Equatorial to expand its renewable capacity and secure new transmission concessions. Furthermore, ANEEL's focus on energy storage regulations in 2024-2025 presents an opportunity to enhance grid stability and integrate more renewables.

Equatorial's strategic diversification into the sanitation sector through its 15% stake in Sabesp, which reported R$23.9 billion in revenue in 2023, offers a new, resilient revenue stream. This move leverages operational synergies and taps into the substantial growth potential of Brazil's sanitation market.

| Opportunity Area | Key Driver | Equatorial's Position |

|---|---|---|

| Increased Electricity Demand | Projected 1.9% growth in 2025, 3.5% average 2025-2029 | Expand distribution and generation |

| Renewable Energy Expansion | Brazil's 89% renewable electricity mix | Capitalize on solar and wind potential |

| Transmission Grid Modernization | BRL 158 billion investment (2024-2033) | Secure new transmission concessions |

| Energy Storage Development | ANEEL regulations on 2024-2025 agenda | Enhance grid stability, integrate renewables |

| Sanitation Sector Diversification | 15% stake in Sabesp (R$23.9B revenue in 2023) | New resilient revenue stream, leverage operational expertise |

Threats

The Brazilian electricity sector is a battleground, with giants like Eletrobras constantly vying for dominance. This intense competition across distribution, transmission, and generation segments directly impacts Equatorial Energia, potentially squeezing profit margins and making it harder to win new concessions or grow its customer base.

Brazil's persistent high interest rate environment, with the Selic rate hovering around 10.50% as of mid-2024, significantly elevates Equatorial Energia's financial expenses. This directly impacts its net profit and overall financial health.

Equatorial Energia's considerable debt load, which stood at approximately R$20 billion in early 2024, makes it particularly susceptible to interest rate volatility. This increased cost of capital could potentially constrain the company's capacity for future strategic investments and operational expansions.

Brazil's regulatory environment, while aiming for stability, can limit tariff adjustments for electricity providers like Equatorial Energia. This means that even when operational costs or inflation increase, the company might not be able to fully pass these on, potentially squeezing profit margins, particularly in its distribution operations.

For instance, in 2024, the sector has seen ongoing discussions around the adequacy of remuneration mechanisms, impacting how companies like Equatorial can recover investments and manage costs. Tariff limitations can directly affect Equatorial's ability to achieve its projected returns, especially if cost pressures outpace approved rate increases.

Vulnerability to Climate Change and Extreme Weather

Brazil's energy sector, with its significant reliance on hydropower, faces inherent vulnerabilities to climate change. Severe droughts, like those experienced in recent years, directly impact reservoir levels, consequently reducing hydroelectric generation capacity. For instance, during the 2021-2022 period, low rainfall significantly constrained Brazil's hydropower output, leading to increased reliance on more expensive thermal power sources.

Equatorial Energia, while actively expanding its renewable portfolio, is not entirely immune to these climate-related disruptions. Extreme weather events, such as intense storms or prolonged dry spells, can still affect its operational efficiency and the stability of energy supply across its concession areas. These events can necessitate costly emergency measures and potentially impact the company's financial performance through increased operational expenditures.

- Hydropower Dependency: Brazil's energy matrix still leans heavily on hydropower, making it susceptible to drought cycles.

- Operational Disruptions: Extreme weather can interrupt energy generation and transmission, impacting service reliability.

- Increased Costs: Companies may face higher operational costs due to the need for backup power or repairs from weather-related damage.

- Diversification Efforts: Equatorial's ongoing investment in solar and wind power aims to mitigate some of these climate-related risks.

Grid Capacity Constraints for Renewable Integration

Brazil's renewable energy boom, while promising, is bumping up against the limits of its existing transmission infrastructure. This means that even though Equatorial Energia and others are investing heavily in wind and solar, the grid can't always handle all the power generated. For instance, in 2023, the Brazilian Electricity Regulatory Agency (ANEEL) reported that transmission bottlenecks led to significant curtailment of renewable energy, impacting the financial returns of projects.

These grid capacity constraints pose a direct threat to Equatorial Energia's renewable energy portfolio. When generation must be reduced due to transmission limitations, it directly cuts into the revenue streams from their wind and solar farms. This curtailment not only affects current profitability but also casts a shadow over the viability of future renewable energy developments, potentially delaying or even halting new projects.

- Grid Bottlenecks: Brazil's transmission network struggles to absorb the full output of new renewable energy projects.

- Curtailment Impact: Renewable generation is sometimes deliberately reduced, directly reducing revenue for companies like Equatorial.

- Investment Slowdown: Limited grid capacity can deter further investment in new renewable energy projects.

Intense competition within Brazil's electricity sector, featuring major players like Eletrobras, puts pressure on Equatorial Energia's profit margins and growth prospects. Furthermore, Brazil's high interest rate environment, with the Selic rate around 10.50% in mid-2024, increases financial expenses, impacting net profit. Equatorial's substantial debt of roughly R$20 billion in early 2024 makes it vulnerable to interest rate fluctuations, potentially hindering future investments.

Brazil's energy matrix, heavily reliant on hydropower, faces significant risks from climate change and drought cycles, impacting generation capacity. For instance, low rainfall in 2021-2022 led to increased reliance on expensive thermal power. Additionally, transmission bottlenecks in Brazil's grid in 2023 curtailed renewable energy output, reducing revenue for projects and potentially slowing future investments.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including Equatorial Energia's official financial reports, comprehensive market research, and insights from industry experts to ensure a well-rounded perspective.