Equatorial Energia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equatorial Energia Bundle

Equatorial Energia faces significant competitive forces, including the substantial bargaining power of its customers and the constant threat of substitutes in the energy sector. Understanding these dynamics is crucial for navigating its market landscape. The complete report reveals the real forces shaping Equatorial Energia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Equatorial Energia sources inputs from various suppliers, including power generators, equipment makers, and service providers. Brazil's energy sector, heavily reliant on hydropower (54.34% of installed capacity in May 2024), also sees increasing contributions from wind (15.08%) and solar (6.74%).

This varied energy generation landscape, bolstered by significant new solar and wind capacity additions in 2024, tends to dilute the bargaining power of individual supplier groups. The availability of alternative generation sources means Equatorial Energia can often switch or negotiate more effectively.

The quality and reliability of electricity from generators are paramount for Equatorial Energia, directly influencing their capacity to deliver consistent service to a vast customer base. In 2024, Equatorial Energia's operational efficiency hinges on securing dependable power sources to meet the demands of its millions of consumers across Brazil.

Specialized equipment such as transformers, cables, and advanced smart meters are indispensable for Equatorial Energia's transmission and distribution infrastructure. These components are vital for network maintenance and future expansion, with their availability and cost impacting Equatorial's capital expenditure plans throughout 2024.

Any disruptions or price hikes from these crucial suppliers can substantially increase Equatorial Energia's operational expenses and potentially compromise the quality of service provided to end-users. For instance, fluctuations in global commodity prices for copper, a key component in cables, could present a challenge for Equatorial in managing its procurement costs in 2024.

Switching electricity generation suppliers for Equatorial Energia can involve significant hurdles. These include navigating complex contractual terms and securing necessary regulatory approvals, which collectively contribute to moderate switching costs. These administrative and legal processes can be time-consuming and resource-intensive, making a swift change difficult.

For specialized equipment, while global alternatives exist, transitioning to new suppliers presents its own set of challenges. Compatibility issues with existing infrastructure, the need for retraining personnel on new systems, and the potential for project delays all add to the overall switching costs for Equatorial Energia.

Equatorial Energia's substantial, long-term investments in its infrastructure create a deep reliance on specific technologies and their associated suppliers. This capital commitment inherently raises the barriers to switching, as it would necessitate significant reinvestment or write-offs of existing assets, further solidifying supplier relationships.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Equatorial Energia's business, specifically into electricity distribution, is exceptionally low. This is primarily due to the immense capital expenditures required, coupled with the highly regulated nature of the electricity distribution sector in Brazil, where concessions often operate as regional monopolies.

Furthermore, equipment manufacturers, a key supplier group, are unlikely to venture into operating utility services. This strategic move would represent a significant departure from their core competencies and established business models, making forward integration an improbable threat to Equatorial Energia's market position.

- Low Likelihood of Forward Integration: Suppliers of power generation equipment or fuel sources are highly unlikely to integrate forward into electricity distribution due to the substantial capital investment and complex regulatory landscape in Brazil's energy sector.

- Capital Intensity: Establishing and operating electricity distribution networks requires massive upfront investment, a barrier that suppliers are generally not equipped or incentivized to overcome.

- Regulatory Hurdles: Brazil's electricity distribution is heavily regulated, with concessions often granted on a regional monopoly basis, making it difficult for new entrants, including suppliers, to gain market access.

- Core Business Focus: Equipment manufacturers typically focus on product development and sales, not on the operational and service-oriented aspects of utility provision.

Regulatory Influence on Supplier Power

The bargaining power of suppliers for Equatorial Energia is significantly shaped by regulatory frameworks. Agencies like ANEEL, Brazil's electricity regulator, set the rules for power purchase agreements and infrastructure projects, directly impacting supplier terms.

ANEEL's 2024 and 2025 regulatory agenda, focusing on market monitoring and energy storage, will influence supplier leverage. For instance, new rules for energy storage could create opportunities for technology suppliers but might also impose stricter conditions, potentially reducing their individual bargaining power if the market becomes more competitive.

- Regulatory Oversight: ANEEL's mandates on pricing, contract terms, and operational standards for electricity generation and distribution limit suppliers' ability to dictate unfavorable terms to Equatorial Energia.

- Market Structure: The degree of competition among suppliers of key inputs, such as fuel for thermal plants or specialized equipment, directly correlates with their bargaining power.

- Contractual Agreements: Long-term power purchase agreements (PPAs) often lock in prices and volumes, reducing the immediate bargaining power of suppliers within those specific contracts.

- Technological Dependence: Equatorial Energia's reliance on specific technologies or proprietary equipment from certain suppliers can increase those suppliers' bargaining power.

The bargaining power of Equatorial Energia's suppliers is generally moderate. While some specialized equipment providers might hold some leverage, the diverse energy generation mix in Brazil, with increasing renewables, provides Equatorial with alternatives.

Switching costs for essential inputs like power generation are present but not prohibitive, especially with the growth of alternative energy sources. However, reliance on specific, high-quality equipment can give certain manufacturers more influence.

Regulatory oversight by ANEEL plays a crucial role in moderating supplier power by setting terms for contracts and market operations. This structure limits suppliers' ability to unilaterally impose unfavorable conditions on Equatorial Energia.

The threat of suppliers integrating forward into distribution is minimal due to the high capital requirements and strict regulatory environment in Brazil's energy sector.

| Factor | Assessment | Impact on Equatorial Energia |

| Supplier Concentration | Moderate; diverse energy sources dilute power of individual generators. | Reduces supplier leverage, allowing for negotiation. |

| Switching Costs (Generation) | Moderate; contractual terms and regulatory approvals. | Limits immediate supplier power, but not zero. |

| Switching Costs (Equipment) | Higher; compatibility and retraining needs. | Grants some power to specialized equipment suppliers. |

| Forward Integration Threat | Very Low; high capital and regulatory barriers. | Minimal threat to Equatorial Energia's market position. |

| Regulatory Influence (ANEEL) | High; sets contract terms and market rules. | Significantly moderates supplier bargaining power. |

What is included in the product

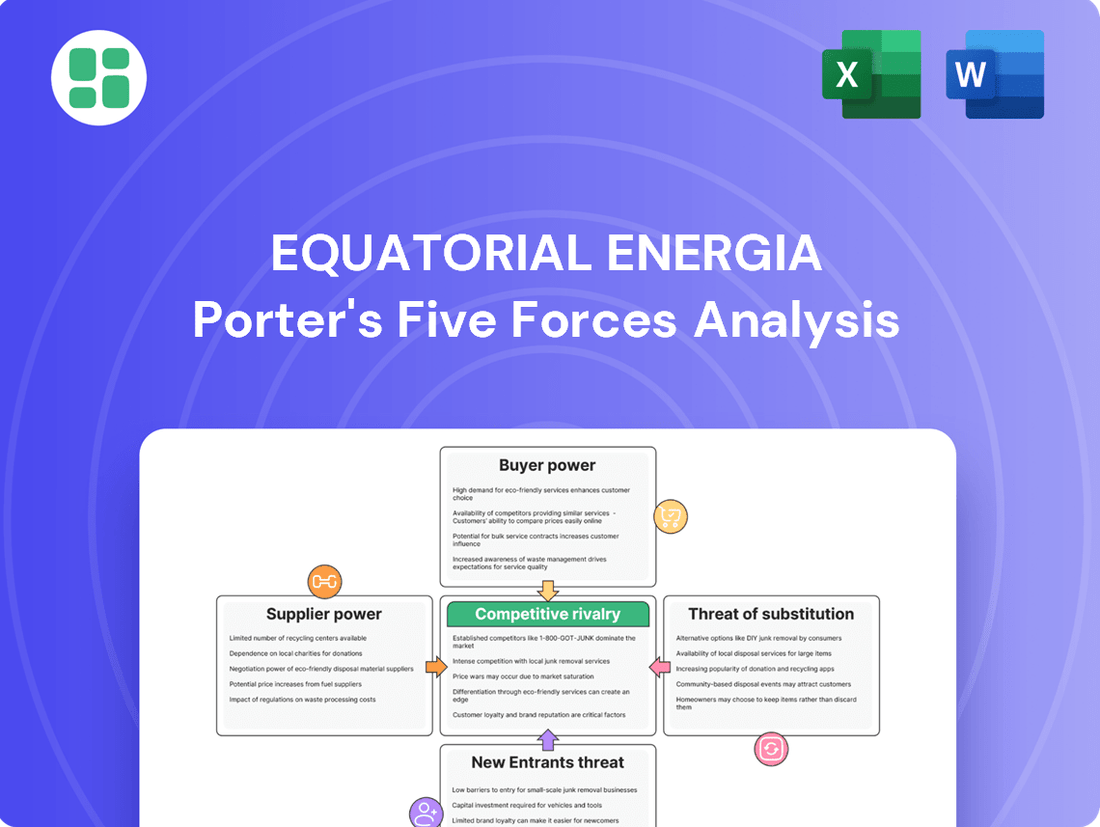

This analysis of Equatorial Energia reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within the energy distribution sector.

Instantly visualize Equatorial Energia's competitive landscape with a dynamic Five Forces analysis, revealing key threats and opportunities for strategic advantage.

Customers Bargaining Power

Equatorial Energia's customer base is extensive, reaching around 14 million users across residential, commercial, and industrial sectors in various Brazilian states. This broad reach means customer power varies significantly depending on the segment and market conditions.

For most residential and small commercial clients within Equatorial's regulated distribution concessions, individual bargaining power is quite limited. This is largely due to the nature of these concessions, which often operate as regional monopolies, leaving customers with few alternative electricity providers.

However, the landscape is shifting, particularly for larger industrial and commercial clients. The ongoing liberalization of Brazil's electricity market is granting these significant energy consumers more options and thus greater leverage to negotiate terms and prices.

The bargaining power of customers for Equatorial Energia has significantly increased since January 2024. This is due to the liberalization of the electricity market in Brazil, allowing all high-tension consumer units to switch from the regulated to the free market. This change empowers larger consumers to negotiate directly with power generators and trading companies.

This newfound ability to negotiate directly means customers can secure more competitive pricing and tailored service agreements. For Equatorial Energia, this translates to a potential reduction in revenue from these previously captive customer segments. For instance, a large industrial consumer that previously had no choice in its electricity provider can now shop around, potentially forcing Equatorial to offer more attractive terms to retain their business.

The growing adoption of distributed generation, especially rooftop solar, significantly boosts customer bargaining power. By generating their own power, customers reduce their dependence on traditional utilities like Equatorial Energia. This shift transforms them into prosumers, able to choose where their electricity comes from.

With projected investments of BRL 25 billion (US$4.3 billion) in distributed generation by 2025 and installed capacity expected to grow by 20% to 25%, this trend presents a substantial threat. Customers can effectively bypass utility distribution services, directly impacting revenue streams and increasing their leverage in negotiations.

Price Sensitivity and Regulatory Oversight

Customers in Equatorial Energia's regulated market exhibit significant price sensitivity, directly impacting the company due to ANEEL's tariff oversight. ANEEL, the National Electric Energy Agency, sets and monitors electricity tariffs, acting as a consumer advocate and thereby amplifying customer bargaining power.

This regulatory environment means that Equatorial's ability to adjust prices is constrained, as ANEEL's decisions are paramount. The agency's focus on consumer protection means that any proposed tariff increases are rigorously scrutinized, giving customers an indirect but powerful voice in pricing decisions.

- ANEEL's Role: The regulator directly influences pricing, limiting Equatorial's pricing freedom and enhancing customer leverage.

- Price Sensitivity: End-users are highly attuned to tariff changes, making price a critical factor in their engagement with Equatorial.

- Performance Metrics: Key indicators like DEC (duration of interruptions) and FEC (frequency of interruptions) are closely watched by ANEEL and affect customer satisfaction and regulatory compliance, further empowering customers.

Information Availability and Switching Costs

In Brazil's energy sector, the bargaining power of customers is significantly influenced by information availability and switching costs. As the market becomes more transparent, especially with the expansion of the free energy market, customers gain better access to comparative data on pricing and service offerings from various suppliers. This increased knowledge empowers them to negotiate more effectively.

For residential customers, the practicalities of changing electricity providers often involve higher switching costs, making them less inclined to switch frequently. However, for eligible consumers in the free market, the process of migrating to a different supplier is streamlined, substantially lowering these barriers. This ease of movement directly strengthens their negotiating leverage.

For instance, by mid-2024, the Brazilian free energy market continued its expansion, with estimates suggesting over 30% of the total energy consumption could potentially migrate. This growth signifies a substantial increase in customer choice and a corresponding boost in their bargaining power, as suppliers compete more intensely for these mobile consumers.

- Informed Customers: Increased market transparency allows customers to easily compare energy tariffs and service quality across different providers.

- Free Market Migration: For eligible consumers, the ability to switch suppliers with minimal hassle significantly reduces costs and enhances their bargaining position.

- Competitive Pressure: The growing free energy market in Brazil, projected to encompass a larger share of national consumption by 2024, intensifies competition among energy suppliers, further empowering customers.

The bargaining power of customers for Equatorial Energia has seen a notable increase, particularly for larger consumers as Brazil's electricity market liberalizes. This shift allows them to negotiate directly with suppliers, potentially securing better terms and impacting Equatorial's revenue from these segments.

The rise of distributed generation, like solar power, further empowers customers by reducing their reliance on traditional utilities. With significant investments projected in this area, customers are increasingly able to bypass established providers, enhancing their negotiating leverage.

Regulatory oversight by ANEEL, which scrutinizes tariff increases and monitors performance metrics, also amplifies customer bargaining power. This regulatory environment limits Equatorial's pricing flexibility and gives customers an indirect but substantial voice in price determination.

| Factor | Impact on Customer Bargaining Power | Equatorial Energia Relevance |

|---|---|---|

| Market Liberalization | Increased choice for large consumers | Potential revenue loss from large clients |

| Distributed Generation | Reduced dependence on utility | Threat to distribution revenue |

| Regulatory Oversight (ANEEL) | Price sensitivity amplified | Constrained pricing flexibility |

Preview the Actual Deliverable

Equatorial Energia Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Equatorial Energia, detailing the competitive landscape and strategic implications for the company. The document you see here is precisely the same professionally formatted and ready-to-use analysis that you will receive immediately after purchase, ensuring no surprises or placeholder content.

Rivalry Among Competitors

Equatorial Energia operates within a Brazilian electricity sector characterized by a unique blend of concentrated distribution and more fragmented upstream markets. In distribution, its primary area of operation, the company benefits from regional monopolies within its concession areas, meaning it faces limited direct competition for its captive customer base.

However, the broader electricity landscape, encompassing transmission, generation, and commercialization, is considerably more competitive. Major entities such as Eletrobras, following its privatization, Neoenergia, CPFL Energia, Enel Brasil, and Engie Brasil actively compete in these segments. Equatorial Energia distinguishes itself as the third-largest distribution group in Brazil based on the sheer number of customers it serves.

The Brazilian electricity market is a hotbed of activity, with electricity consumption projected to rise by 1.9% in 2025. This growth is expected to average 3.5% annually in load from 2025 through 2029, signaling a robust and expanding sector.

Brazil's power market is poised for substantial expansion, with an estimated 115 GW of new capacity to be added by 2034. This surge is largely fueled by demand in the free market, creating a highly dynamic environment for both investment and competition.

The industry witnessed record new capacity additions in 2024, especially from solar and wind power, which reached 10.9 GW. This rapid expansion intensifies the competition as companies vie for greater market share in this growing sector.

In Equatorial Energia's distribution segment, competitive rivalry is shaped by a focus on service quality since tariffs are regulated. Differentiation hinges on reliability, efficiency, and customer satisfaction. For instance, Equatorial Energia reported improvements in its distribution companies' performance in 2024, with decreasing DEC (Duration of Equivalent Interruption) and FEC (Frequency of Equivalent Interruption) indices, showcasing their commitment to enhancing service dependability.

Exit Barriers and Industry Stability

High capital investments in infrastructure, like transmission lines and power plants, coupled with long-term concession contracts, create substantial exit barriers in the electricity sector. For Equatorial Energia, this means significant sunk costs are difficult to recoup if a company decides to leave the market.

These substantial exit barriers encourage existing players to remain committed to the market, fostering continued and often intense rivalry. Companies like Equatorial must therefore focus on efficiency and market share to thrive, rather than expecting easy exits.

- High Capital Intensity: The electricity sector demands massive upfront investments in generation, transmission, and distribution networks, making it difficult for firms to exit without significant losses.

- Long-Term Concessions: Concession agreements often span decades, binding companies to their operational commitments and reducing the flexibility to divest.

- Regulatory Lock-in: Specialized assets and regulatory frameworks can further complicate divestment, as potential buyers or alternative uses may be limited.

Competitive Strategies and Acquisitions

The Brazilian energy sector is characterized by intense rivalry, with companies actively pursuing strategic acquisitions and participating in competitive auctions for new concessions and transmission projects. This dynamic environment means that firms are constantly vying for market share and operational efficiency.

Equatorial Energia's own strategy underscores this competitive pressure. The company is focused on expanding its presence through acquisitions and significant investments across the energy value chain, including transmission, generation, and commercialization. This proactive approach highlights a direct rivalry for market expansion and the development of integrated energy solutions.

- Acquisition-driven growth: Companies like Equatorial Energia actively seek to acquire other energy assets to bolster their market position.

- Auction participation: Bidding in government auctions for new energy concessions and transmission lines is a key battleground for market entry and expansion.

- Investment in infrastructure: Significant capital is deployed into transmission and generation assets, reflecting a race to secure and upgrade critical energy infrastructure.

- Comprehensive solutions: The rivalry extends to offering a full suite of energy services, from generation to distribution and commercialization, to capture greater customer value.

In Equatorial Energia's distribution segment, competition centers on operational efficiency and service quality, as tariffs are regulated. The broader Brazilian electricity market, however, sees intense rivalry among major players like Eletrobras and Neoenergia, especially in generation and transmission, fueled by significant capacity additions and projected load growth. Companies actively pursue acquisitions and participate in auctions, demonstrating a fierce battle for market share and integrated energy solutions.

The Brazilian electricity sector is highly competitive, particularly in generation and transmission, with substantial new capacity being added. For instance, 10.9 GW of new capacity, primarily from solar and wind, was added in 2024, intensifying the competition as firms vie for market dominance.

Equatorial Energia, as the third-largest distribution group by customer numbers, faces this rivalry by focusing on improving operational metrics like DEC and FEC, as evidenced by their performance improvements in 2024, to differentiate itself in regulated markets.

The intense competition is further highlighted by the projected addition of 115 GW of new capacity by 2034, largely driven by demand in the free market, creating a dynamic environment where strategic acquisitions and efficient operations are paramount for success.

| Metric | 2024 (Equatorial Energia) | Industry Trend |

|---|---|---|

| New Capacity Additions (GW) | N/A (Sector: 10.9 GW) | Strong growth, especially solar/wind |

| Projected Load Growth (2025) | N/A (Sector: 1.9%) | Positive and increasing |

| Key Competitors | Eletrobras, Neoenergia, CPFL Energia | Major integrated energy companies |

SSubstitutes Threaten

The threat of substitutes for Equatorial Energia is significant, primarily driven by distributed generation (DG). Consumers increasingly adopting solar photovoltaic systems to generate their own electricity directly challenges the traditional utility model.

This trend is substantial, with projections indicating investments in DG could reach BRL 25 billion (approximately US$4.3 billion) by 2025. The installed capacity for DG is also expected to see robust growth, estimated between 20% and 25%.

Such widespread adoption of DG allows customers, particularly in the residential and small commercial segments, to substantially reduce or even entirely bypass their reliance on power supplied by Equatorial's grid infrastructure.

The threat of substitutes for Equatorial Energia is significantly influenced by energy efficiency measures. Continuous advancements in technologies like smart appliances and industrial process optimization allow consumers to lower their electricity usage. For instance, in 2024, the global smart home market saw continued growth, with energy management solutions being a key driver.

While these measures don't entirely replace the need for electricity, they effectively substitute for the volume of purchased electricity. This reduced demand directly impacts Equatorial's sales volumes and revenue potential, acting as a persistent competitive pressure.

The increasing viability of battery energy storage systems (BESS), especially when paired with distributed generation, presents a significant threat. These systems enable consumers and businesses to store self-generated power or capitalize on grid price arbitrage, thereby reducing their reliance on a constant grid supply. This growing trend directly challenges the traditional utility model.

Brazilian regulators are actively shaping new frameworks for energy storage, underscoring its burgeoning role as a substitute for conventional grid reliability services. For instance, by mid-2024, several pilot projects exploring BESS integration for grid services were underway, indicating a clear shift towards decentralized solutions that can offer alternatives to utility-provided stability.

Off-Grid and Microgrid Solutions

Off-grid and microgrid solutions represent a significant threat of substitution for traditional utility providers like Equatorial Energia. For remote areas or large industrial complexes seeking energy independence, these systems offer a complete alternative to relying on the national grid. Brazil's regulatory framework, particularly Law No. 14,300/2022, is actively fostering the growth of microgrids, positioning them as direct, localized substitutes for conventional utility services.

The expansion of microgrids in Brazil is notable. By the end of 2023, the installed capacity of distributed generation, a key component of microgrids, reached approximately 36.4 GW, with solar photovoltaic systems dominating this segment. This growth indicates a tangible shift towards decentralized energy, directly challenging the market share of established utility companies.

- Energy Independence: Off-grid and microgrid solutions provide users with complete control over their power supply, reducing reliance on centralized grids.

- Regulatory Support: Brazil's Law No. 14,300/2022 specifically regulates distributed generation and microgrids, encouraging their development and adoption.

- Market Growth: The distributed generation market in Brazil has seen substantial growth, with solar PV being a major contributor, indicating increasing consumer interest in alternative energy sources.

Direct Energy Procurement (Free Market)

For large industrial and commercial customers, the option to directly purchase electricity from generators or energy trading firms in the free market presents a significant substitute. This bypasses Equatorial Energia's traditional regulated distribution model, offering an alternative way to secure power. The demand within this free market is projected for substantial growth, with expectations of more than a 100% increase over the coming decade, underscoring its increasing relevance as a competitive force.

This shift towards direct procurement directly impacts Equatorial Energia by potentially reducing its customer base within the regulated segment. As more large consumers opt for free market arrangements, the volume of electricity distributed through Equatorial's network could diminish. For instance, in 2024, the Brazilian free market for energy saw significant expansion, with new participants entering and existing ones increasing their contracted volumes, indicating a clear trend away from solely relying on distribution utilities.

- Direct Procurement as an Alternative: Large consumers can bypass regulated distribution by sourcing electricity directly from generators or trading companies.

- Impact on Equatorial Energia: This trend can lead to a reduction in the volume of electricity distributed through Equatorial's regulated network.

- Market Growth Projection: The free market for electricity is anticipated to grow by over 100% in the next ten years, highlighting its increasing importance.

- 2024 Market Activity: The Brazilian free energy market demonstrated robust growth in 2024, with increased participation and contracted volumes.

The threat of substitutes for Equatorial Energia is substantial, driven by distributed generation (DG) and energy efficiency. Consumers adopting solar photovoltaic systems, with projected investments reaching BRL 25 billion by 2025, directly challenge the utility model. Energy efficiency measures, like smart appliances, reduce overall electricity consumption, impacting sales volumes.

Battery energy storage systems (BESS), especially when paired with DG, offer consumers greater energy independence and reduce reliance on grid supply. Off-grid and microgrid solutions also present a complete alternative, with Brazil's Law No. 14,300/2022 encouraging their growth. The distributed generation market in Brazil reached approximately 36.4 GW by the end of 2023, primarily solar PV.

Large industrial and commercial customers can bypass Equatorial by purchasing electricity directly from generators or energy trading firms in the free market. This market is projected to grow by over 100% in the next decade. In 2024, the Brazilian free energy market showed significant expansion with increased participation and contracted volumes.

| Substitute Category | Key Characteristics | Impact on Equatorial Energia | Market Trend/Data (as of mid-2024 or latest available) |

|---|---|---|---|

| Distributed Generation (DG) | Self-generation of electricity (e.g., solar PV) | Reduces reliance on grid supply, lowers sales volumes | Projected BRL 25 billion investment by 2025; DG capacity growth 20-25% |

| Energy Efficiency | Reduced electricity consumption through technology | Decreases demand for purchased electricity | Global smart home market growth in 2024, with energy management as a key driver |

| Battery Energy Storage Systems (BESS) | Storing self-generated power, grid price arbitrage | Reduces need for constant grid supply, challenges utility reliability services | Brazilian regulators actively shaping energy storage frameworks; pilot projects underway mid-2024 |

| Off-grid/Microgrids | Complete energy independence from national grid | Offers localized alternatives to conventional utility services | Brazil's Law No. 14,300/2022 fosters microgrid growth; DG capacity ~36.4 GW by end-2023 |

| Free Market Procurement | Direct purchase from generators/traders | Reduces customer base in regulated segment, diminishes distributed volumes | Free market projected to grow >100% in next decade; robust expansion in 2024 |

Entrants Threaten

Entering the electricity distribution and transmission sectors demands substantial upfront capital for infrastructure like power lines and substations. For instance, Equatorial Energia allocated R$2.6 billion to Equatorial Pará's distribution network in 2024, highlighting the immense financial commitment needed to establish a competitive presence.

The Brazilian electricity sector, overseen by the National Electric Energy Agency (ANEEL), presents significant barriers to new entrants due to its intricate web of regulations. Companies must navigate complex licensing procedures and adhere to rigorous operational standards, which can be a substantial hurdle for those unfamiliar with the landscape.

Securing long-term government concessions for distribution and transmission services is another critical entry requirement. These concessions are essential for operating within the sector, and their acquisition process is often lengthy and demanding, effectively limiting the number of potential new players and reinforcing the position of established entities like Equatorial Energia.

Existing players like Equatorial Energia benefit from significant economies of scale, achieved through their extensive customer base of approximately 14 million clients and integrated network operations across multiple states. As the 3rd largest distribution group in Brazil, Equatorial's established infrastructure and operational efficiencies create a substantial cost advantage.

New entrants would face considerable challenges in replicating these economies of scale and network effects. Achieving comparable cost efficiencies and market reach would necessitate massive initial investments, making it difficult for newcomers to compete effectively on price or service quality against an incumbent with such a strong operational footprint.

Established Reputation and Customer Loyalty

Established reputation and customer loyalty pose a significant barrier for new entrants into Equatorial Energia's market. In the critical electricity sector, Equatorial, founded in 1999, has cultivated years of operational experience, building trust and a strong brand presence. New companies would struggle to replicate this level of recognition and reliability, especially given the paramount importance of service continuity for consumers.

Equatorial Energia's consistent performance and consolidation efforts in the energy distribution sector further solidify its market position. For instance, in 2023, the company reported a net revenue of R$29.1 billion, demonstrating its substantial operational scale and financial strength. This financial muscle allows for significant investment in infrastructure and customer service, making it difficult for newcomers to compete on a comparable level.

The threat of new entrants is therefore mitigated by the deep-seated customer loyalty and established reputation Equatorial Energia enjoys. This is further evidenced by their operational efficiency, which is crucial in a regulated industry where service quality directly impacts customer retention. For example, Equatorial Energia consistently aims to reduce energy losses, a key metric for operational success and customer satisfaction.

Access to Technology and Expertise

Operating and expanding a modern electricity grid, particularly with the integration of renewable energy sources and smart grid solutions, requires significant, highly specialized technical expertise and substantial investment in advanced technologies. New entrants face a considerable hurdle in developing or acquiring this knowledge and the necessary technological infrastructure, which directly increases the cost and complexity associated with entering the market.

Equatorial Energia's strategic focus on enhancing operational efficiency and grid reliability necessitates continuous and substantial technological investment. For instance, in 2023, the company allocated R$3.7 billion towards investments, with a significant portion directed towards grid modernization and expansion, underscoring the high capital requirements for staying competitive.

- Technological Sophistication: Modern electricity grids demand expertise in areas like advanced metering infrastructure (AMI), grid automation, and cybersecurity, which are costly to develop and maintain.

- Renewable Integration: Integrating intermittent renewable sources requires sophisticated grid management systems and forecasting capabilities, adding another layer of technological complexity.

- Capital Intensity: The sheer scale of investment needed for network upgrades, smart technology deployment, and skilled workforce development acts as a significant barrier to entry for potential new players.

- Regulatory Hurdles: Beyond technology, navigating complex regulatory frameworks governing electricity distribution and supply chains further complicates market entry for newcomers.

The threat of new entrants for Equatorial Energia is significantly low due to the immense capital required for infrastructure development and the complex regulatory environment in Brazil's electricity sector. High upfront investments, such as Equatorial Pará's R$2.6 billion distribution network allocation in 2024, coupled with stringent licensing and concession requirements overseen by ANEEL, create substantial barriers.

| Barrier Type | Description | Impact on New Entrants | Equatorial Energia's Advantage |

|---|---|---|---|

| Capital Requirements | Substantial investment in infrastructure (power lines, substations) | Very High Barrier | Established, extensive network and financial strength (R$29.1 billion net revenue in 2023) |

| Regulatory Hurdles | Complex licensing, operational standards, government concessions | High Barrier | Proven track record navigating ANEEL regulations and securing concessions |

| Economies of Scale | Cost advantages from large customer base and integrated operations | High Barrier | Serves ~14 million clients, 3rd largest distributor in Brazil |

| Technological Sophistication | Expertise in grid automation, renewables integration, smart grids | High Barrier | Continuous investment in grid modernization (R$3.7 billion in 2023) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Equatorial Energia is built upon a foundation of publicly available financial reports, regulatory filings from ANATEL and ANEEL, and industry-specific market research from reputable sources like EPE and local energy sector consultancies.