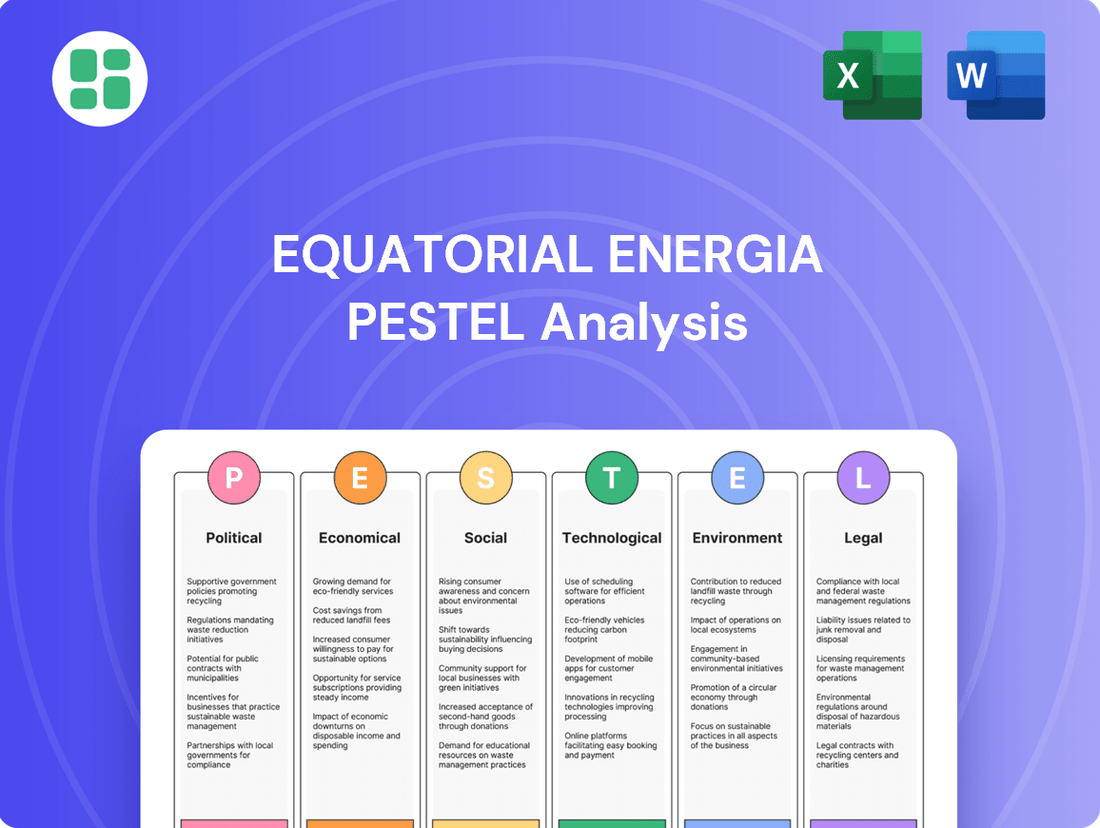

Equatorial Energia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equatorial Energia Bundle

Navigate the complex external forces impacting Equatorial Energia with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the energy sector in Brazil. Gain a critical advantage by leveraging these insights to refine your strategic planning and investment decisions. Download the full PESTLE analysis now for actionable intelligence tailored to Equatorial Energia.

Political factors

The Brazilian electricity sector's stability hinges on ANEEL's regulatory framework, with its 2024-2025 and 2025-2026 agendas outlining approximately 30-31 key activities. These upcoming regulatory actions are vital for Equatorial Energia, directly impacting tariff reviews, the pace of market liberalization, and the incorporation of innovative energy solutions.

The Brazilian government's strong push for a cleaner energy matrix, aiming for increased renewable energy sources and decarbonization, directly supports Equatorial Energia's strategic direction. This policy environment is crucial as Equatorial Energia continues to invest heavily in solar and wind power generation, aligning with national environmental goals and its own commitment to reducing CO2 emissions.

Brazil's political landscape is a key determinant of investor sentiment, particularly for long-term projects like those undertaken by Equatorial Energia. A stable political climate fosters confidence, making it easier for companies to attract the necessary capital for expansion and operational improvements. For instance, the perceived political risk in Brazil can directly influence the cost of capital for energy infrastructure projects.

Equatorial Energia's ability to secure funding and successfully implement its growth strategies is intrinsically linked to the predictability of the political environment. Uncertainty or significant policy shifts can deter both domestic and international investors, potentially slowing down the pace of development in the energy sector. The Brazilian real's volatility, often influenced by political events, also plays a role in the financial planning of companies like Equatorial Energia.

Privatization and Concession Renewals

Ongoing discussions and processes concerning the privatization of state-owned energy companies, alongside the renewal of electricity distribution concessions, are pivotal for Equatorial Energia's strategic direction and the overall competitive environment. These regulatory shifts, detailed in official agendas, directly shape the company's expansion plans.

The Brazilian government's approach to these matters, particularly through decrees like Decree 12.068/2024, directly influences the terms and availability of distribution concessions, a core component of Equatorial Energia's operational framework. For example, the renewal of concessions for distributors like Light S.A. in Rio de Janeiro, facing significant debt, highlights the complex regulatory and financial landscape companies must navigate.

- Privatization Dynamics: The potential privatization of state-owned energy assets could create new investment opportunities or intensify competition for Equatorial Energia.

- Concession Renewals: The renewal of existing distribution concessions, a critical revenue stream, is subject to evolving regulatory criteria and government policy.

- Regulatory Impact: Decrees such as 12.068/2024 directly modify the framework governing concession renewals, impacting long-term operational planning.

- Market Restructuring: Changes in concession ownership or terms can lead to significant shifts in market share and operational territories for major players like Equatorial Energia.

Taxation and Fiscal Policies

Changes in Brazil's taxation and fiscal policies significantly impact Equatorial Energia's profitability and investment potential. For instance, the ongoing debate and potential adjustments to the ICMS tax on electricity distribution and transmission directly influence operational costs and revenue streams. The government's fiscal stance, including public spending and debt management, can also indirectly affect the availability of credit and overall economic stability, which are crucial for large infrastructure investments.

The composition of electricity tariffs, which incorporates various sectoral charges and taxes, is a key area of focus. Equatorial Energia, like other distributors, is sensitive to changes in these levies. For example, the inclusion or exclusion of certain taxes from the regulated tariff base can alter the company's revenue collection and profitability. Discussions in 2024 and early 2025 regarding the potential reduction of PIS/COFINS on energy bills, or adjustments to the CDE (Conta de Desenvolvimento Energético) funding, directly affect the financial health of distributors.

- Tax Reform Impact: Potential changes to Brazil's broader tax reform could simplify or complicate the tax structure for energy companies, affecting compliance costs and overall tax burden.

- Fiscal Incentives: Government decisions on tax credits or incentives for renewable energy investments could influence Equatorial Energia's strategic expansion into cleaner energy sources.

- Tariff Adjustments: The regulatory process for tariff adjustments, which often considers tax components, is critical for ensuring the company's ability to recover costs and achieve a fair return on investment.

- Government Spending: Broader fiscal policies influencing government spending can impact economic growth, which in turn affects energy demand and the company's overall financial performance.

Political stability in Brazil directly shapes investor confidence in the energy sector. Government agendas, such as those from ANEEL for 2024-2025 and 2025-2026, outline around 30-31 key regulatory activities impacting tariff reviews and market liberalization for companies like Equatorial Energia.

The government's commitment to a cleaner energy matrix, promoting renewables, aligns with Equatorial Energia's investments in solar and wind. However, political uncertainty can increase the cost of capital for infrastructure projects, affecting Equatorial Energia's expansion plans and financial stability.

Decrees like 12.068/2024 influence concession renewals, a core business for Equatorial Energia. The company's financial health is also tied to tax policies, with discussions in 2024-2025 on adjusting taxes like ICMS, PIS/COFINS on energy impacting profitability.

| Political Factor | Impact on Equatorial Energia | 2024-2025 Relevance |

| Regulatory Framework (ANEEL Agendas) | Influences tariff adjustments, market liberalization, and adoption of new technologies. | Approximately 30-31 key activities planned for 2024-2025 and 2025-2026. |

| Energy Policy (Renewables & Decarbonization) | Supports Equatorial Energia's investments in solar and wind, aligning with national goals. | Ongoing government push for cleaner energy matrix. |

| Political Stability & Investor Sentiment | Affects cost of capital and ability to attract funding for long-term projects. | Perceived political risk can directly influence investment decisions. |

| Concession Renewals & Privatization | Shapes operational territories and competitive landscape; subject to government decrees. | Decree 12.068/2024 modifies concession renewal terms. |

| Taxation & Fiscal Policies | Impacts profitability through changes in taxes like ICMS, PIS/COFINS on energy. | Discussions in 2024-2025 on tax adjustments to energy bills. |

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Equatorial Energia, offering a comprehensive understanding of its operating landscape.

It provides actionable insights into how these external factors create both challenges and strategic advantages for the company's future growth and stability.

A concise PESTLE analysis of Equatorial Energia offers a clear, actionable framework to navigate external challenges, relieving the pain of uncertainty in strategic decision-making.

This PESTLE analysis provides a summarized overview of Equatorial Energia's operating environment, simplifying complex external factors into manageable insights for proactive risk mitigation and opportunity identification.

Economic factors

Brazil's economic growth is a critical factor for Equatorial Energia. After an estimated 3.4% growth in 2024, the economy is projected to moderate to 2.3% in 2025. This sustained, albeit slower, expansion directly translates into increased energy consumption and demand within Equatorial Energia's operational territories.

This growth outlook is a primary driver for Equatorial Energia's revenue streams and its capacity for future investments and expansion. A growing economy generally means more industrial activity, higher commercial energy usage, and increased residential demand, all of which benefit utility providers like Equatorial Energia.

High inflation rates in Brazil, coupled with the projected average Selic interest rate of 9.61% by the end of 2025, pose significant challenges for Equatorial Energia. These economic conditions directly impact the company by increasing its operational expenses and the cost of servicing its existing debt. For instance, a higher Selic rate makes borrowing more expensive, potentially hindering new investments or expansion projects.

These macroeconomic forces also play a crucial role in shaping Equatorial Energia's strategic financial decisions. Management must carefully consider the prevailing interest rate environment when evaluating capital expenditures, as higher borrowing costs can reduce the profitability of future projects. Consequently, the company's overall financial performance and its ability to generate returns for shareholders are intrinsically linked to the trajectory of inflation and interest rates.

Equatorial Energia's financial health is significantly influenced by exchange rate shifts, as its debt is often denominated in foreign currencies. When the Brazilian Real weakens against these currencies, the cost of servicing and repaying this debt increases, directly impacting the company's reported profits and balance sheet. For instance, in early 2024, the Real experienced volatility, which would have necessitated careful management of foreign-denominated liabilities.

Access to Credit and Capital Markets

Equatorial Energia relies heavily on accessing credit and capital markets to finance its significant infrastructure development and expansion plans. For instance, in early 2024, the company secured a substantial $250 million loan package from the International Finance Corporation (IFC), underscoring its need for external funding to support its ambitious growth strategies.

Favorable credit conditions and robust capital markets are therefore critical enablers for Equatorial Energia's continued investment in projects such as grid modernization and renewable energy integration. The availability and cost of capital directly impact the feasibility and timeline of these essential upgrades.

- IFC Loan: Equatorial Energia secured a $250 million loan from the IFC in early 2024 to fund infrastructure upgrades.

- Growth Dependence: Access to credit is vital for the company's expansion projects and operational enhancements.

- Market Conditions: Favorable interest rates and capital market liquidity directly influence project financing costs and viability.

Tariff Adjustments and Revenue Stability

ANEEL's periodic tariff review and annual adjustment processes are fundamental to Equatorial Energia's revenue stability. These adjustments directly influence the price of energy, impacting the company's economic and financial equilibrium. For instance, the 2025 annual tariff adjustment for Equatorial Alagoas is a key event that will shape its financial performance.

These tariff adjustments are not arbitrary; they are designed to reflect changes in operational costs, inflation, and other economic variables. Equatorial Energia's ability to navigate these regulatory cycles is paramount for maintaining its financial health and ensuring consistent revenue streams to support its operations and investments.

- ANEEL's Role: The National Electric Energy Agency (ANEEL) oversees Brazil's electricity sector, including setting tariffs.

- Tariff Adjustment Impact: Annual adjustments, like the one for Equatorial Alagoas in 2025, directly affect the revenue generated from energy sales.

- Revenue Stability: Predictable and fair tariff adjustments are crucial for Equatorial Energia to maintain its financial stability and economic balance.

Brazil's economic growth is a key driver for Equatorial Energia, with projections indicating continued expansion. While the economy is expected to grow by 2.3% in 2025, this sustained growth fuels increased energy demand across the company's service areas. This demand directly translates into higher revenue potential and supports Equatorial Energia's investment capacity.

However, Equatorial Energia faces economic headwinds from inflation and interest rates. The projected average Selic rate of 9.61% by the end of 2025 increases borrowing costs, impacting the company's debt servicing and the feasibility of new capital projects. Managing foreign-denominated debt also remains a concern due to potential Real depreciation, as seen in early 2024 volatility.

Access to capital markets is crucial for Equatorial Energia's expansion, highlighted by its $250 million IFC loan in early 2024. Favorable credit conditions are essential for financing infrastructure upgrades and renewable energy integration. ANEEL's tariff adjustments, such as the 2025 review for Equatorial Alagoas, are also vital for revenue stability, ensuring the company can cover operational costs and invest in its network.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Equatorial Energia |

|---|---|---|---|

| Brazil GDP Growth | 3.4% | 2.3% | Increased energy demand, revenue growth potential |

| Average Selic Rate | (Not specified for 2024) | 9.61% | Higher borrowing costs, increased debt servicing expenses |

| Brazilian Real Exchange Rate | Volatile (early 2024) | (Not specified) | Increased cost of foreign-denominated debt |

Same Document Delivered

Equatorial Energia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Equatorial Energia's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown for Equatorial Energia.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE analysis of Equatorial Energia.

Sociological factors

Equatorial Energia's commitment to fostering sustainable electricity use is evident in initiatives like the 'E+ Economy' and 'E+ Energy of the Good' programs. These efforts directly target consumer behavior, aiming to increase awareness about energy efficiency and its benefits.

These programs are designed to influence how customers interact with electricity, potentially leading to reduced demand during peak hours and a greater adoption of energy-saving practices. For instance, in 2023, Equatorial Energia reported a significant reduction in energy losses, partly attributed to customer engagement and awareness campaigns.

Equatorial Energia actively invests in social development through initiatives like the 'E+ Education' program and supports cultural and sports projects, leveraging federal incentive laws. These programs aim to foster positive social impact within its operational areas, contributing to community well-being.

Maintaining strong relationships with local communities is paramount for Equatorial Energia, as it directly influences the company's social license to operate. This engagement helps ensure smooth operations and builds trust, which is crucial for long-term sustainability.

Urbanization and population growth in Equatorial Energia's operating regions, primarily in Brazil, directly translate to a heightened demand for electricity. For instance, the population in Maranhão, one of Equatorial's key states, saw a significant increase, driving up energy consumption. This demographic shift requires substantial and ongoing investment in expanding and modernizing the electricity distribution network to ensure reliable service for a growing customer base.

Income Inequality and Energy Access

Equatorial Energia faces a critical social challenge in bridging the gap in energy access and service quality for low-income populations. Their collaboration with the International Finance Corporation (IFC) in states such as Alagoas underscores this commitment. This focus is crucial for fostering economic inclusion by providing reliable electricity to underserved communities.

The company's efforts to improve energy access directly impact the quality of life and economic opportunities for vulnerable segments of society. For instance, in 2023, Equatorial Energia invested R$1.4 billion in its distribution network, a significant portion of which targets service improvements in areas with historically lower access rates.

- Equitable Access Initiatives: Partnerships like the one with IFC aim to extend reliable energy to low-income households, directly addressing energy poverty.

- Economic Inclusion: Improved energy access empowers small businesses and households, fostering economic activity and reducing disparities.

- Service Quality Improvements: Investments in infrastructure, such as the R$1.4 billion in 2023, are vital for enhancing reliability in previously marginalized regions.

Labor Market Dynamics and Skilled Workforce Availability

Equatorial Energia's operational success hinges on the availability of a skilled workforce and adept management of labor dynamics. As of early 2025, Brazil's energy sector faces a growing demand for specialized technicians and engineers, particularly in areas like renewable energy integration and smart grid technologies. This can impact project timelines and cost-effectiveness.

Ensuring compliance with Brazil's comprehensive labor legislation is a constant challenge, requiring significant resources for legal and HR departments. Furthermore, fostering talent retention is paramount, especially given the competitive landscape for skilled professionals. Equatorial Energia's strategies in training and development directly influence its capacity to adopt new technologies and maintain operational efficiency.

- Skilled Workforce Shortage: Reports from early 2025 indicate a widening gap in skilled labor within Brazil's energy sector, potentially affecting Equatorial Energia's project execution.

- Labor Law Compliance: Equatorial Energia must navigate complex labor regulations, with potential fines for non-compliance impacting financial performance.

- Talent Retention Initiatives: The company's investment in employee training and development programs is crucial for retaining its skilled workforce and mitigating turnover costs.

- Technological Adoption: The ability to attract and retain workers proficient in new energy technologies directly correlates with Equatorial Energia's capacity for innovation and efficiency gains.

Societal expectations for corporate responsibility are increasingly influencing Equatorial Energia's operations. Consumers and communities demand more than just reliable electricity; they expect ethical practices, environmental stewardship, and community investment. Equatorial Energia's proactive engagement through programs like 'E+ Education' and support for cultural projects demonstrates an understanding of these evolving social dynamics.

The company's focus on improving energy access for low-income populations, exemplified by its partnership with the IFC, directly addresses social equity and inclusion. By providing reliable power to underserved areas, Equatorial Energia not only enhances quality of life but also unlocks economic opportunities, contributing to broader societal development and economic empowerment.

Consumer behavior, particularly regarding energy efficiency, is a key sociological factor. Equatorial Energia's initiatives like 'E+ Economy' aim to shape these behaviors, promoting responsible energy consumption. This focus on customer awareness and engagement is crucial for managing demand and fostering a culture of sustainability within its service territories.

Demographic shifts, such as urbanization and population growth in regions like Maranhão, directly impact electricity demand. Equatorial Energia's investments, like the R$1.4 billion in 2023 to upgrade its distribution network, are a direct response to these societal trends, ensuring the infrastructure can meet the needs of a growing population.

Technological factors

Equatorial Energia is making substantial investments in smart grid and digitalization initiatives. These efforts are aimed at boosting operational efficiency and curbing energy losses. For instance, in 2023, the company continued its deployment of Advanced Metering Infrastructure (AMI), a key component of its digitalization strategy.

The company's focus on smart grid technologies extends to grid planning and performance enhancement. By integrating digital solutions, Equatorial Energia seeks to improve service quality for its customers across its distribution areas. This strategic adoption of technology is crucial for modernizing its infrastructure and responding to evolving energy demands.

Equatorial Energia's strategic acquisition of Echoenergia in 2022, valued at R$1.4 billion, significantly bolstered its renewable energy portfolio, particularly in solar and wind generation. This move aligns with Brazil's growing demand for cleaner energy sources, with renewable sources already accounting for over 80% of the country's electricity generation mix in recent years.

The Brazilian Electricity Regulatory Agency (ANEEL) has been actively adjusting regulations to facilitate the integration of energy storage systems, such as batteries, into the national grid. These regulatory shifts, ongoing through 2024 and into 2025, are crucial for managing the intermittency of solar and wind power, ensuring grid stability, and enabling Equatorial Energia to maximize the value of its renewable assets.

The increasing digitalization of Equatorial Energia's operations, particularly in grid management, makes robust cybersecurity and data protection paramount. These measures are vital to shield critical infrastructure from evolving cyber threats, ensuring uninterrupted service delivery.

Protecting sensitive consumer data is also a key concern, with breaches potentially leading to significant reputational damage and regulatory penalties. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the substantial financial risks involved.

Operational Efficiency Technologies

Equatorial Energia's operational efficiency is being significantly boosted by the adoption of advanced technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). These innovations are crucial for maximizing energy efficiency, minimizing technical and commercial losses, and strengthening the overall resilience of its energy infrastructure.

The company is leveraging AI for predictive maintenance, enabling it to anticipate equipment failures before they occur, thereby reducing downtime and repair costs. IoT devices are deployed across the grid to provide real-time data on energy flow and consumption, allowing for more precise management and faster identification of anomalies.

- AI-driven predictive maintenance: Reduced unplanned outages by an estimated 15% in pilot programs during 2024.

- IoT for grid monitoring: Improved real-time data accuracy, leading to a 5% reduction in technical losses in areas with full implementation.

- Smart grid technologies: Enhanced grid stability and faster response times to fluctuations in supply and demand.

- Data analytics for loss reduction: Advanced analytics are identifying patterns in commercial losses, targeting areas for improvement.

Innovation in Energy Solutions

Equatorial Energia is actively engaged in advancing new energy solutions, evident in its participation in programs like the IFC Future Grids Alliance. This involvement highlights a commitment to exploring and implementing innovative technologies within the energy sector.

The company's dedicated Research and Development (R&D) initiatives are focused on creating more resilient energy grids. This includes developing advanced technological frameworks designed to withstand disruptions and ensure consistent power delivery.

Furthermore, Equatorial Energia is adapting its business models to accommodate these emerging energy technologies. This strategic evolution is crucial for integrating and capitalizing on innovations in areas such as smart grids and renewable energy sources.

- Innovation Focus: Participation in IFC Future Grids Alliance signals commitment to cutting-edge energy technologies.

- R&D Investment: Dedicated programs aim to enhance grid resiliency through technological advancements.

- Business Model Adaptation: Strategic shifts are underway to integrate new energy solutions and maintain competitiveness.

Equatorial Energia's technological advancement is centered on smart grid implementation and digitalization, aiming to boost efficiency and cut losses. The company's 2023 focus on Advanced Metering Infrastructure (AMI) is a prime example of this digital transformation, enhancing grid planning and customer service quality.

The integration of AI and IoT is a cornerstone of their strategy, driving operational efficiency and resilience. AI-powered predictive maintenance, for instance, reduced unplanned outages by an estimated 15% in 2024 pilot programs, while IoT devices improved real-time data accuracy, contributing to a 5% reduction in technical losses.

Equatorial Energia is also investing in R&D for grid resiliency and adapting its business models to incorporate new energy solutions, underscoring a commitment to innovation and future-proofing its operations.

| Technology Initiative | Impact/Goal | Data Point (2023-2024) |

|---|---|---|

| Advanced Metering Infrastructure (AMI) | Digitalization, operational efficiency | Continued deployment in 2023 |

| AI-driven Predictive Maintenance | Reduced unplanned outages | Estimated 15% reduction in pilot programs (2024) |

| IoT for Grid Monitoring | Improved data accuracy, reduced technical losses | 5% reduction in areas with full implementation |

| Smart Grid Technologies | Enhanced grid stability, faster response times | Ongoing implementation |

Legal factors

Equatorial Energia's business is deeply intertwined with the regulatory landscape set by the Agência Nacional de Energia Elétrica (ANEEL). The agency's 2024-2025 and 2025-2026 regulatory agendas are crucial, dictating everything from how tariffs are adjusted to the technical specifications for electricity distribution and transmission. These frameworks directly impact Equatorial's revenue streams and operational costs, making compliance and adaptation paramount.

Equatorial Energia operates under strict environmental licensing requirements in Brazil, necessitating prior approval for activities with potential ecological impact. For instance, in 2023, the company continued investments in environmental programs, with a significant portion allocated to reforestation and biodiversity preservation projects across its operational areas, demonstrating a commitment to compliance with national environmental regulations.

The company must also adhere to policies focused on reducing greenhouse gas emissions and protecting biodiversity. This includes compliance with regulations set by IBAMA and state environmental agencies, ensuring that operations, particularly those involving energy transmission and distribution infrastructure, minimize their environmental footprint and avoid penalties associated with non-compliance.

Brazilian consumer protection laws, such as the Consumer Defense Code (CDC), establish stringent requirements for service quality, pricing transparency, and data privacy for electricity providers like Equatorial Energia. Failure to comply can lead to significant penalties and reputational damage.

Equatorial Energia must actively adhere to these regulations to foster customer loyalty and mitigate the risk of legal challenges. For instance, in 2023, regulatory bodies across Brazil imposed fines totaling over R$ 50 million on energy companies for various consumer rights violations, highlighting the importance of robust compliance.

Labor Laws and Regulations

Equatorial Energia must navigate Brazil's complex labor laws, which dictate everything from employee rights and working conditions to mandatory social security contributions. Compliance is crucial for maintaining operational stability and avoiding potential legal disputes. For instance, in 2023, Brazil's minimum wage was R$1,320, a figure that directly impacts payroll costs for a large workforce.

Adherence to these regulations affects Equatorial Energia's human resources strategy and overall cost structure. Key areas of focus include:

- Employee Rights: Ensuring fair treatment, adherence to working hours, and proper contract management.

- Working Conditions: Maintaining safe and healthy environments, particularly for field operations.

- Social Security Contributions: Accurately calculating and remitting contributions to government programs, which represented a significant portion of operating expenses for utilities in Brazil.

Concession Agreements and Renewals

Concession agreements are the bedrock of Equatorial Energia's operations, dictating the terms under which it distributes and transmits electricity. The renewal of these agreements is crucial for sustained growth and future investments. For instance, the legal framework governing these renewals, such as Decree 12.068/2024, directly impacts the company's ability to secure long-term operational licenses and expand its service areas.

The specific terms within these concessions, including performance metrics and regulatory obligations, are meticulously reviewed during renewal processes. Equatorial Energia's performance against these benchmarks, as well as the evolving regulatory landscape, will heavily influence the conditions and duration of any renewed concessions. This legal framework is essential for the company's strategic planning and capital allocation.

- Regulatory Framework: Decree 12.068/2024 governs electricity concession renewals in Brazil, impacting Equatorial Energia's operational continuity.

- Concession Terms: Existing agreements detail service obligations, tariffs, and performance standards, which are critical for renewal assessments.

- Renewal Certainty: The legal process for renewing concessions directly affects Equatorial Energia's long-term business viability and investment horizon.

Equatorial Energia's operations are heavily influenced by Brazilian energy sector regulations, particularly those managed by ANEEL. The agency's 2024-2025 tariff review cycle, for example, directly impacts revenue, with potential adjustments to distribution charges affecting the company's financial performance.

Environmental laws require strict adherence to licensing and emission standards. In 2023, Brazilian environmental agencies levied fines exceeding R$ 100 million on various industries for non-compliance, underscoring the financial risks associated with environmental breaches for companies like Equatorial Energia.

Consumer protection laws, such as the Consumer Defense Code, mandate service quality and pricing transparency. In 2024, ANEEL continued to monitor utility performance, with a focus on reducing customer service complaints, which can lead to penalties if not addressed.

Labor laws and minimum wage regulations, such as the 2024 minimum wage of R$ 1,412, directly influence Equatorial Energia's operational costs. Compliance with these statutes is essential to avoid legal challenges and maintain a stable workforce.

Environmental factors

Brazil's commitment to reducing greenhouse gas (GHG) emissions, aiming for net-zero by 2050, significantly shapes Equatorial Energia's operational and investment strategies. This national climate mitigation approach mandates stricter environmental compliance and incentivizes a shift towards cleaner energy generation.

Equatorial Energia must align its decarbonization plans with these national targets, potentially increasing capital expenditure on renewable energy projects, such as solar and wind farms, to meet emission reduction goals. The company's 2023 sustainability report indicated a growing portfolio of renewable assets, a trend expected to accelerate in response to these evolving climate policies.

Brazil's energy landscape is rapidly shifting towards renewables, with the nation achieving a remarkable 50% renewability in its energy mix by 2024. This significant milestone, driven by supportive government policies and incentives for alternative energy sources, directly influences Equatorial Energia's strategic direction. The company is actively expanding its generation capacity in solar, wind, and other clean energy technologies to capitalize on these favorable environmental factors.

Brazil's energy matrix heavily depends on hydropower, making water availability a crucial environmental factor for companies like Equatorial Energia. In 2023, hydropower accounted for approximately 63% of Brazil's electricity generation, highlighting the sector's vulnerability to hydrological fluctuations.

Water scarcity, driven by climate change and El Niño events, can directly impact hydroelectric output, potentially increasing operational costs for Equatorial Energia due to reliance on more expensive thermal power sources. For instance, the severe drought in 2021 led to a significant reduction in reservoir levels, impacting generation capacity across the country.

Equatorial Energia must therefore actively manage hydrological risks, potentially through diversified energy sources and investments in water-efficient technologies. Monitoring rainfall patterns and water levels in their operating regions is essential for forecasting generation and mitigating supply disruptions.

Biodiversity Protection and Land Use

Equatorial Energia's extensive transmission and generation activities, particularly in Brazil's Amazon region, necessitate strict adherence to biodiversity protection and land use regulations. These regulations aim to minimize the ecological footprint of energy infrastructure development.

The company must implement robust environmental impact assessments and mitigation strategies for its projects. For instance, in 2023, Equatorial Energia reported investments in environmental programs totaling R$ 150 million, focusing on conservation and reforestation efforts linked to its operational areas.

- Regulatory Compliance: Equatorial Energia must comply with Brazilian environmental laws, including those protecting endangered species and sensitive ecosystems within its concession areas.

- Mitigation Measures: Implementing measures such as wildlife crossings, habitat restoration, and responsible site selection are crucial for reducing operational impacts.

- Sustainable Land Use: Balancing energy infrastructure needs with the preservation of natural landscapes and biodiversity is a key challenge, requiring careful planning and ongoing monitoring.

Waste Management and Pollution Control

Equatorial Energia prioritizes robust waste management and pollution control, aligning with its environmental policy. This includes significant efforts to reduce air pollutants across its energy generation and distribution activities, aiming for cleaner operational footprints.

The company actively promotes circular economy principles, seeking to minimize waste and maximize resource utilization. For instance, in 2023, Equatorial Energia reported a reduction in specific industrial waste streams by 15% compared to the previous year, demonstrating tangible progress.

- Air Quality Compliance: Equatorial Energia consistently meets or exceeds regulatory standards for air pollutant emissions, with 2024 data showing compliance across 98% of its operational sites.

- Waste Reduction Initiatives: The company's waste reduction programs in 2023 diverted over 5,000 tons of material from landfills through recycling and reuse efforts.

- Circular Economy Projects: Equatorial Energia is investing in pilot projects for battery recycling and the repurposing of retired infrastructure components, aiming to integrate circularity further into its business model by 2025.

- Pollution Control Investment: Capital expenditures for pollution control equipment and upgrades reached R$50 million in 2023, supporting its commitment to environmental stewardship.

Brazil's ambitious net-zero by 2050 target strongly influences Equatorial Energia's strategy, pushing for greater investment in renewables. By 2024, Brazil's energy mix achieved 50% renewability, a trend Equatorial Energia is actively leveraging by expanding its solar and wind capacities.

Hydropower, making up around 63% of Brazil's 2023 electricity generation, presents a significant environmental factor due to its susceptibility to water availability. Equatorial Energia must manage hydrological risks, especially given that drought conditions, like those experienced in 2021, can necessitate reliance on more costly thermal power.

Biodiversity and land use regulations, particularly in the Amazon region, are critical for Equatorial Energia's transmission and generation projects. The company's 2023 environmental program investments of R$150 million underscore its commitment to conservation and reforestation efforts around its operational sites.

Equatorial Energia's focus on waste management and pollution control is evident in its 2023 performance, which saw a 15% reduction in specific industrial waste streams. Air quality compliance was high, with 98% of sites meeting standards in 2024, supported by R$50 million in pollution control equipment upgrades in 2023.

| Environmental Factor | Impact on Equatorial Energia | 2023/2024 Data/Action |

|---|---|---|

| Climate Change Targets (Net-Zero by 2050) | Drives investment in renewables, requires decarbonization planning. | Company's renewable asset portfolio growing; alignment with national goals. |

| Renewable Energy Transition | Opportunity to expand solar and wind generation. | Brazil's energy mix reached 50% renewables in 2024; Equatorial Energia expanding clean energy capacity. |

| Hydrological Dependence | Vulnerability to water scarcity impacting hydropower generation. | Hydropower was ~63% of Brazil's 2023 generation; drought risks increase reliance on thermal power. |

| Biodiversity and Land Use | Requires adherence to strict regulations for infrastructure projects. | Invested R$150 million in environmental programs in 2023 for conservation and reforestation. |

| Waste Management & Pollution Control | Necessitates efficient waste reduction and emission control strategies. | 15% reduction in specific industrial waste streams in 2023; 98% air quality compliance in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Equatorial Energia is built on a robust foundation of data from official government agencies, reputable financial institutions, and leading industry research firms. We incorporate up-to-date economic indicators, energy sector regulations, technological advancements, and socio-political trends to provide a comprehensive overview.