Equatorial Energia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equatorial Energia Bundle

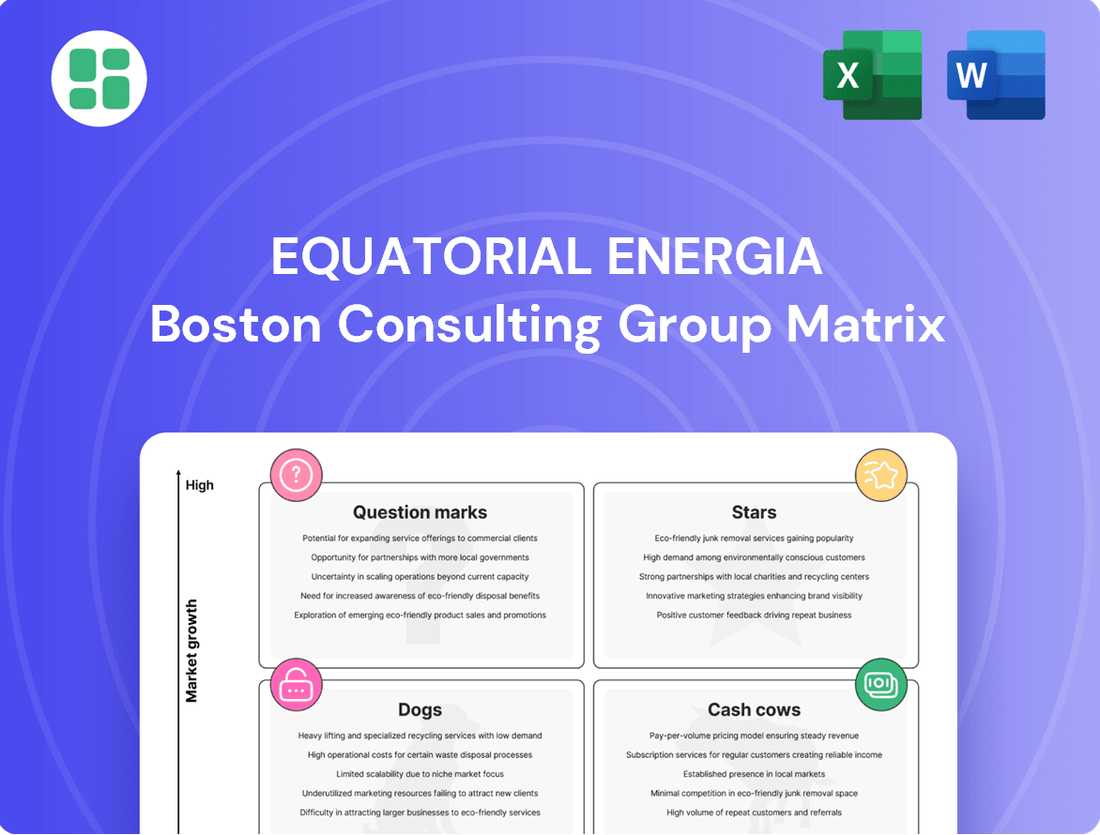

Unlock the strategic potential of Equatorial Energia's product portfolio with our comprehensive BCG Matrix analysis. This preview offers a glimpse into how their offerings are performing in the market, highlighting areas of growth and potential challenges.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Equatorial Energia's electricity distribution in the North and Northeast of Brazil represents a prime example of a Star in the BCG Matrix. These regions are experiencing robust economic development, leading to a surge in electricity demand. For instance, in 2024, Equatorial reported significant growth in its energy sold in these areas, driven by industrial expansion and increased residential consumption.

The company's strategic focus on these high-growth markets is evident through its ongoing investments in infrastructure upgrades and expansion projects. This proactive approach allows Equatorial to capture a larger share of the increasing demand, reinforcing its strong market position. By capitalizing on these favorable market dynamics, Equatorial aims to further solidify its leadership in these crucial territories.

Newly energized and high-performing solar generation complexes, like the UFV Ribeiro Gonçalves in Piauí, exemplify Equatorial Energia's Stars. These assets are positioned within Brazil's rapidly expanding renewable energy sector, a market anticipating substantial solar and wind capacity increases. For instance, Brazil's solar capacity alone was projected to reach over 35 GW by the end of 2024, showcasing the market's dynamism.

Equatorial Energia's significant investments in digitalization and smart grid technologies across its distribution networks are a key driver for its potential Star status. These initiatives, aimed at enhancing operational efficiency and reducing energy losses, align with the high-growth trajectory of Brazil's energy sector modernization. For instance, in 2023, the company reported a substantial portion of its capital expenditures were allocated to grid improvements, contributing to a reduction in technical and commercial losses.

Luz Para Todos Program Expansions

The Luz Para Todos program's substantial expansion, especially in Pará, positions it as a Star for Equatorial Energia. This initiative is injecting billions into connecting hundreds of thousands of new customers, tapping into a market with immense unmet demand and high growth potential.

- Significant Investment: Equatorial Energia is investing billions in the Luz Para Todos program.

- Customer Reach: The program aims to connect hundreds of thousands of new customers.

- Market Dynamics: It targets underserved areas with high unmet demand, indicating a high-growth market.

- Market Share Growth: Equatorial is actively increasing its market share by expanding electricity access.

Integrated Energy Solutions Development

Integrated Energy Solutions Development represents Equatorial Energia's strategic pivot towards becoming a holistic energy provider, extending services beyond traditional distribution. This initiative leverages their vast customer network and existing infrastructure to introduce new, value-added offerings in a dynamic energy market.

The company aims to capture significant market share in emerging energy segments by bundling diverse solutions. For instance, in 2024, Equatorial Energia continued its expansion into distributed generation and energy efficiency services, targeting residential and commercial clients seeking integrated energy management.

- Focus on Customer Integration: Developing bundled energy packages that combine electricity supply with services like solar panel installation and smart home energy management systems.

- Market Expansion: Targeting new customer segments and geographic areas with these integrated offerings, aiming to replicate successes from their core distribution business.

- Technological Advancement: Investing in digital platforms and smart grid technologies to facilitate the delivery and management of these new energy solutions.

- Revenue Diversification: Creating new revenue streams beyond regulated distribution tariffs, capitalizing on the growing demand for comprehensive energy services.

Equatorial Energia's electricity distribution in the North and Northeast of Brazil is a prime example of a Star in the BCG Matrix. These regions boast robust economic development, driving significant electricity demand. In 2024, Equatorial reported substantial growth in energy sold in these areas, fueled by industrial expansion and increased residential consumption.

The company's strategic investments in infrastructure upgrades and expansion projects in these high-growth markets underscore its commitment to capturing a larger share of rising demand. This proactive approach solidifies Equatorial's strong market position and leadership in these vital territories.

Newly energized solar generation complexes, such as UFV Ribeiro Gonçalves in Piauí, represent Equatorial Energia's Stars. Operating within Brazil's rapidly expanding renewable energy sector, these assets benefit from market anticipation of substantial solar and wind capacity increases. Brazil's solar capacity alone was projected to exceed 35 GW by the end of 2024, highlighting the market's dynamism.

Equatorial Energia's investments in digitalization and smart grid technologies across its distribution networks are key drivers for its Star status. These initiatives enhance operational efficiency and reduce energy losses, aligning with Brazil's energy sector modernization. In 2023, a significant portion of the company's capital expenditures supported grid improvements, leading to reduced technical and commercial losses.

The expansion of the Luz Para Todos program, particularly in Pará, positions it as a Star for Equatorial Energia. This initiative involves billions in investment to connect hundreds of thousands of new customers, tapping into a market with substantial unmet demand and high growth potential.

Equatorial Energia's integrated energy solutions development marks a strategic shift towards becoming a comprehensive energy provider, extending services beyond traditional distribution. This initiative leverages its extensive customer network and infrastructure to introduce new, value-added offerings in a dynamic energy market.

The company aims to secure significant market share in emerging energy segments by offering bundled solutions. In 2024, Equatorial Energia continued its expansion into distributed generation and energy efficiency services, targeting residential and commercial clients seeking integrated energy management.

| Business Segment | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Electricity Distribution (North/Northeast Brazil) | High | High | Star |

| Renewable Energy Generation (Solar) | High | High | Star |

| Luz Para Todos Program Expansion | High | High | Star |

| Integrated Energy Solutions | High | Growing | Star (Potential) |

What is included in the product

The Equatorial Energia BCG Matrix offers a strategic overview, identifying which business units are Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting units to grow, maintain, or divest for optimal portfolio performance.

The Equatorial Energia BCG Matrix offers a clear, one-page overview, simplifying complex business unit performance for strategic decision-making.

Cash Cows

Equatorial Energia's established electricity distribution concessions in mature Brazilian states, like Equatorial Maranhão and Equatorial Pará, largely function as Cash Cows. These segments benefit from high market share in stable, yet still growing, markets, consistently generating substantial cash flow. Their established customer bases and regulated revenue streams mean they require less investment for promotion compared to newer, faster-growing areas.

Prior to its divestment, Equatorial Energia's mature transmission assets, primarily commissioned between 2019 and 2021, functioned as cash cows. These assets generated stable, predictable revenues with limited need for further investment, contributing substantial cash flow to the company's finances.

Equatorial Energia's dedication to enhancing operational efficiency and reducing losses within its distribution network solidifies its position as a Cash Cow. This relentless focus has demonstrably improved key performance indicators like DEC (Duration of Interruption Equivalent per Customer) and FEC (Frequency of Interruption Equivalent per Customer) across multiple concessions.

By streamlining existing operations, Equatorial effectively boosts profit margins and maximizes cash generation from its established business segments. This strategy is particularly effective in areas with slower market growth, as cost minimization and service quality improvements directly translate into higher profitability.

For instance, in 2024, Equatorial reported a significant reduction in energy losses, contributing to a more robust financial performance. This operational excellence allows the company to generate substantial cash flow, which can then be reinvested in growth opportunities or returned to shareholders.

Stable Customer Base in Core Markets

Equatorial Energia's extensive and stable customer base, serving around 14 million consumers across its distribution concessions, firmly places it in the Cash Cow quadrant of the BCG Matrix. This significant market penetration in essential utility services guarantees a predictable and robust revenue stream.

This dependable cash flow acts as a vital engine, not only covering operational and administrative expenses but also providing the financial flexibility to invest in growth opportunities or support other business units. For instance, in 2023, Equatorial Energia reported net revenue of R$37.1 billion, underscoring the sheer scale of its operations and the consistent income generated from its core customer base.

- 14 million consumers represent a substantial and loyal customer base.

- Stable revenue generation is a hallmark of this segment, ensuring predictable income.

- Utility sector dominance provides a defensive moat against economic downturns.

- R$37.1 billion in net revenue (2023) highlights the financial strength derived from these core operations.

Regulatory Tariff Adjustments

Equatorial Energia's distribution and transmission businesses are considered Cash Cows, largely due to the predictable revenue streams generated by periodic regulatory tariff adjustments. These adjustments, approved by regulatory bodies, are crucial for cost recovery and maintaining profitability. For instance, in 2024, Equatorial Energia's distribution segment continued to benefit from these mechanisms, ensuring a stable financial footing within a regulated, albeit low-growth, sector. The company's ability to pass through operational costs and earn a regulated return on its asset base is a key driver of this Cash Cow status.

These tariff adjustments provide a stable financial foundation, allowing Equatorial Energia to reliably generate cash. This stability is particularly important in the energy sector, where significant capital investments are required for infrastructure maintenance and upgrades. The predictable nature of these revenues supports the company's ability to fund ongoing operations and potentially invest in other business areas.

- Regulatory Tariff Adjustments: Periodic adjustments ensure cost recovery and profitability for Equatorial Energia's distribution and transmission segments.

- Predictable Revenue Streams: These adjustments create a stable and reliable income source, characteristic of Cash Cow businesses.

- Low-Growth Environment: The regulated nature of these operations often means lower growth potential but higher stability.

- Financial Foundation: The consistent cash flow supports ongoing operations and financial health.

Equatorial Energia's established electricity distribution concessions, particularly in mature Brazilian states, function as significant Cash Cows. These segments benefit from a high market share within stable, yet still growing, markets, consistently generating substantial cash flow. Their established customer bases and regulated revenue streams mean they require less investment for promotion compared to newer, faster-growing areas.

The company's focus on operational efficiency, evidenced by reductions in energy losses and improvements in service quality metrics like DEC and FEC, further solidifies its Cash Cow status. This efficiency boost directly enhances profit margins and maximizes cash generation from these core operations.

Equatorial Energia's extensive customer base, serving around 14 million consumers, provides a predictable and robust revenue stream, further supported by regulatory tariff adjustments that ensure cost recovery and profitability. In 2023, this translated into a net revenue of R$37.1 billion.

| Segment | BCG Category | Key Characteristics | 2023 Net Revenue Contribution (Implied) |

|---|---|---|---|

| Distribution Concessions (Maranhão, Pará, etc.) | Cash Cow | High market share, stable growth, regulated revenue, low investment needs. | Significant portion of R$37.1 billion |

| Transmission Assets (Mature) | Cash Cow | Stable, predictable revenues, minimal further investment required. | Contributes to overall stable cash flow |

What You’re Viewing Is Included

Equatorial Energia BCG Matrix

The Equatorial Energia BCG Matrix preview you see is the definitive, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready strategic document designed for immediate application in your business planning.

Dogs

The Amapá Sanitation Concessionaire (CSA), acquired by Equatorial Energia in 2021, is a clear example of a Dog in their BCG Matrix. Despite significant upfront investment and a long concession period, CSA has struggled to gain traction.

CSA has experienced low public acceptance and high expansion costs, leading to substantial financial losses. In 2024, the company reported a net loss of R$ 55 million, with Q1 2025 showing a continued downward trend with a loss of R$ 15 million. These figures reflect a low market share and negative returns in a market with limited growth potential.

Equatorial Energia's decision to actively seek a buyer for CSA further solidifies its status as a divestment candidate. The company is looking to offload this underperforming asset to reallocate resources to more promising ventures within its portfolio.

Specific Echoenergia wind farms, like Ventos de São Clemente and Ventos de Tianguá, are showing characteristics of Dogs in the BCG Matrix. These assets are experiencing significant operational challenges, including curtailment, which directly impacts their revenue generation and asset value. For instance, curtailment events can lead to substantial lost revenue opportunities for wind farm operators.

These underperforming wind farms, despite being acquired to bolster Equatorial Energia's renewable portfolio, are now struggling with low profitability and market share within a sector that is otherwise experiencing robust growth. This situation is prompting Equatorial Energia to evaluate divestment strategies for these particular assets, reflecting their Dogs status.

Non-core legacy assets with low utilization represent parts of Equatorial Energia's portfolio that are no longer strategically important or are operating inefficiently. These might include older infrastructure or business units that don't align with the company's current growth objectives.

In 2023, Equatorial Energia continued its strategy of optimizing its asset base. While specific figures for "non-core legacy assets with low utilization" aren't publicly itemized in this way, the company's ongoing divestment of non-essential assets, such as certain distribution concessions or smaller generation units, reflects a proactive approach to shedding underperforming or non-strategic components to focus capital on core, high-growth areas.

Unprofitable Niche Commercialization Ventures

Unprofitable niche commercialization ventures within Equatorial Energia’s portfolio represent projects that, despite operating in potentially promising areas, have struggled to secure a meaningful market presence. These initiatives are characterized by low market share, meaning they haven't attracted a significant customer base or revenue stream. For instance, a hypothetical venture into specialized solar panel installation for agricultural use might have seen limited uptake, capturing less than 1% of the target market in its initial years.

These ventures are resource-intensive, consuming capital and operational capacity without delivering commensurate financial returns. This situation is akin to a small, unproven energy technology service that requires substantial investment in research and development, sales teams, and infrastructure, yet generates minimal revenue. By the end of 2024, such ventures might represent a small fraction of Equatorial Energia's overall investment, perhaps less than 2% of total capital expenditure, but their negative contribution to profitability can be disproportionately high.

- Low Market Share: Ventures like a niche biogas production project might have only secured contracts with a handful of industrial clients, representing a market share well below 5%.

- Resource Drain: Significant operational costs, including maintenance and specialized personnel, continue to accrue without offsetting revenue generation.

- Poor Profitability: These ventures often operate at a loss, negatively impacting the company's overall financial performance. For example, a pilot program for smart grid optimization in a specific district might have incurred $5 million in costs by mid-2024 while generating only $1 million in revenue.

- Discontinuation Candidates: Given their inability to gain traction and their drain on resources, these ventures are prime candidates for strategic review and potential divestment or closure.

Outdated or Inefficient Infrastructure

Equatorial Energia's infrastructure portfolio includes segments of older, outdated, or highly inefficient distribution and transmission assets. These require disproportionately high maintenance costs and do not contribute significantly to market share or revenue growth.

These aging assets often act as cash traps, with operational expenses exceeding their strategic value or cash generation potential. For instance, in 2024, Equatorial Energia continued its focus on modernizing its network, with significant investments directed towards replacing older infrastructure in regions like Maranhão and Pará, where legacy systems are more prevalent.

- High Maintenance Costs: Older infrastructure often necessitates more frequent and costly repairs, diverting capital from growth initiatives.

- Low Revenue Contribution: Inefficient assets may struggle to meet demand or suffer from high energy losses, limiting their revenue-generating capacity.

- Strategic Review: Such segments are prime candidates for decommissioning or substantial overhaul if a viable turnaround strategy can be identified and executed.

- Investment Focus: Equatorial Energia's capital allocation in 2024 prioritized upgrading these inefficient segments to improve reliability and reduce operational expenditures.

Equatorial Energia's Dogs represent business units with low market share and low growth potential, draining resources without significant returns. These include underperforming concessions like the Amapá Sanitation Concessionaire (CSA), which reported a R$ 55 million net loss in 2024, and specific wind farms facing operational challenges such as curtailment.

The company is actively seeking to divest these assets, as seen with CSA, to reallocate capital towards more promising ventures. Non-core legacy assets and unprofitable niche commercialization ventures also fall into this category, characterized by low utilization, high operational costs, and poor profitability, often representing less than 2% of total capital expenditure but disproportionately impacting overall financial performance.

Aging infrastructure segments, requiring high maintenance and offering low revenue contribution, are also being strategically reviewed for decommissioning or overhaul. Equatorial Energia's 2024 capital allocation prioritized upgrading these inefficient segments to enhance reliability and reduce operational expenditures, underscoring their Dogs status.

| Asset Category | BCG Status | Key Characteristics | 2024 Financial Impact (Illustrative) | Strategic Action |

|---|---|---|---|---|

| Amapá Sanitation Concessionaire (CSA) | Dog | Low public acceptance, high expansion costs, low market share | Net Loss: R$ 55 million | Seeking divestment |

| Underperforming Wind Farms (e.g., Ventos de São Clemente) | Dog | Operational challenges (curtailment), low profitability | Revenue impact from curtailment | Evaluating divestment |

| Non-core Legacy Assets | Dog | Low utilization, not strategically important | Minimal revenue, ongoing maintenance costs | Divesting non-essential assets |

| Unprofitable Niche Commercialization Ventures | Dog | Low market share, resource-intensive, poor profitability | Negative contribution to profitability (e.g., < 2% of CAPEX but high loss) | Potential divestment or closure |

| Aging Distribution/Transmission Assets | Dog | High maintenance costs, low revenue contribution, inefficient | Disproportionately high maintenance costs | Prioritizing modernization/overhaul |

Question Marks

Equatorial Energia's acquisition of a 15% stake in Sabesp positions Sabesp as a Question Mark within Equatorial's BCG Matrix. This move signifies a strategic diversification into the sanitation sector, a market exhibiting robust growth projections.

The sanitation sector's high growth potential, driven by increasing demand for water and wastewater services, presents an attractive opportunity. However, for Equatorial, this represents a relatively new primary focus, suggesting a lower current market share in its consolidated sanitation operations compared to its established energy businesses.

As of early 2024, the Brazilian sanitation sector is projected to see substantial investment, with estimates suggesting over R$100 billion in necessary upgrades and expansions over the next decade. Equatorial's investment in Sabesp, a major player in this expanding market, reflects a calculated risk to capture future growth.

Equatorial Energia's foray into distributed generation (DG), especially solar DG, positions it as a Question Mark within the BCG matrix. Brazil's DG sector is booming, projected to grow significantly, with solar leading the charge.

While the overall distributed generation market in Brazil is expanding rapidly, Equatorial's footprint in this specific niche is likely small compared to its established utility operations. For instance, by the end of 2023, Brazil had over 30 GW of installed distributed generation capacity, primarily from solar PV, but Equatorial's contribution to this figure was nascent.

This segment demands substantial capital investment to scale up operations, build brand recognition, and secure market share. Without aggressive investment and strategic execution, this promising growth area could fail to mature into a market-leading Star for Equatorial.

Equatorial Energia's strategic approach to new geographic distribution concessions centers on acquiring opportunities in regions with low energy penetration or those facing significant distress. These nascent markets, while offering high growth potential, demand substantial upfront investment to establish infrastructure and improve service quality. For instance, in 2024, Equatorial continued to explore expansion avenues, aiming to replicate its success in established markets within these developing territories.

Advanced Energy Storage Solutions

Investments in advanced energy storage solutions, like large-scale battery systems, fall into the Question Mark category for Equatorial Energia. The global energy storage market is projected to reach over $300 billion by 2028, driven by renewable energy growth and grid modernization efforts. Equatorial's current position in this burgeoning sector is likely in its early stages, necessitating significant investment and strategic planning.

These ventures offer substantial growth potential, aligning with the increasing demand for grid stability and the integration of intermittent renewable sources. However, they also demand considerable capital expenditure and ongoing technological innovation to compete effectively. For instance, the cost of lithium-ion battery packs, a dominant technology, has fallen by over 90% since 2010, making these projects increasingly viable but still capital-intensive.

- Market Growth: The global energy storage market is experiencing rapid expansion, with forecasts indicating significant growth through 2030.

- Renewable Integration: Advanced storage is crucial for managing the intermittency of solar and wind power, a key driver for market expansion.

- Capital Intensity: Projects require substantial upfront investment for technology acquisition and deployment, classifying them as high-risk, high-reward.

- Nascent Involvement: Equatorial Energia's current market share and operational experience in advanced storage are likely limited, requiring strategic development.

Green Hydrogen Initiatives

Equatorial Energia's ventures into green hydrogen would likely be categorized as Question Marks within a BCG Matrix. These are areas with high growth potential, particularly in Brazil, which has been actively promoting green hydrogen through initiatives like the National Hydrogen Program.

The nascent stage of Equatorial's involvement, requiring significant capital for exploration and pilot projects, positions these efforts as Question Marks. The Brazilian government's commitment to decarbonization, aiming to become a global leader in green hydrogen by 2030, underscores the sector's future promise.

- Nascent Exploration: Any initial studies or small-scale production tests for green hydrogen by Equatorial Energia.

- High Growth Potential: The global green hydrogen market is projected to reach hundreds of billions of dollars in the coming decades, with Brazil aiming for a significant share.

- Substantial Investment Needed: Developing green hydrogen infrastructure requires considerable upfront capital for electrolyzers, renewable energy sources, and distribution networks.

- Strategic Positioning: Equatorial must make strategic investments to secure a foothold in a rapidly evolving and competitive market.

Equatorial Energia's strategic investments in new geographic distribution concessions represent a Question Mark. These are typically regions with lower energy penetration, requiring substantial upfront investment to build infrastructure and improve service. For example, in 2024, Equatorial continued to pursue expansion in these developing territories, aiming to replicate its success in more established markets.

These nascent markets offer high growth potential but also demand significant capital expenditure and a long-term commitment to operational improvement. The success of these ventures hinges on Equatorial's ability to effectively manage these investments and navigate the unique challenges of developing regions.

The company's focus on these areas reflects a strategy to capture future market share in underserved regions, a classic characteristic of Question Mark investments seeking to become future Stars.

Equatorial Energia's investment in advanced energy storage solutions, such as large-scale battery systems, places them in the Question Mark category. The global energy storage market is projected to exceed $300 billion by 2028, driven by renewable energy integration and grid modernization. Equatorial's current involvement in this sector is likely in its early stages, requiring significant capital and strategic planning to gain market share.

These ventures offer substantial growth potential due to the increasing demand for grid stability and the management of intermittent renewable sources. However, they also demand considerable capital expenditure and continuous technological innovation to remain competitive. For instance, the cost of lithium-ion battery packs, a dominant technology, has seen a dramatic decrease of over 90% since 2010, making these projects more viable but still capital-intensive.

Equatorial Energia's ventures into green hydrogen are also likely classified as Question Marks. Brazil has been actively promoting green hydrogen through initiatives like the National Hydrogen Program, indicating high growth potential. The company's initial exploration and pilot projects in this area require significant capital, positioning these efforts as Question Marks.

The Brazilian government's commitment to decarbonization, with a goal to become a global leader in green hydrogen by 2030, highlights the sector's future promise. Equatorial must make strategic investments to secure a foothold in this rapidly evolving and competitive market.

Equatorial Energia's acquisition of a 15% stake in Sabesp positions Sabesp as a Question Mark within Equatorial's BCG Matrix. This move signifies a strategic diversification into the sanitation sector, a market exhibiting robust growth projections.

The sanitation sector's high growth potential, driven by increasing demand for water and wastewater services, presents an attractive opportunity. However, for Equatorial, this represents a relatively new primary focus, suggesting a lower current market share in its consolidated sanitation operations compared to its established energy businesses.

As of early 2024, the Brazilian sanitation sector is projected to see substantial investment, with estimates suggesting over R$100 billion in necessary upgrades and expansions over the next decade. Equatorial's investment in Sabesp, a major player in this expanding market, reflects a calculated risk to capture future growth.

Equatorial Energia's foray into distributed generation (DG), especially solar DG, positions it as a Question Mark within the BCG matrix. Brazil's DG sector is booming, projected to grow significantly, with solar leading the charge.

While the overall distributed generation market in Brazil is expanding rapidly, Equatorial's footprint in this specific niche is likely small compared to its established utility operations. For instance, by the end of 2023, Brazil had over 30 GW of installed distributed generation capacity, primarily from solar PV, but Equatorial's contribution to this figure was nascent.

This segment demands substantial capital investment to scale up operations, build brand recognition, and secure market share. Without aggressive investment and strategic execution, this promising growth area could fail to mature into a market-leading Star for Equatorial.

| Business Unit/Initiative | Market Growth | Relative Market Share | BCG Category | Strategic Rationale |

|---|---|---|---|---|

| New Geographic Distribution Concessions | High (Underserved regions) | Low | Question Mark | Capture future market share in developing territories. |

| Advanced Energy Storage Solutions | High (Global market > $300B by 2028) | Low (Nascent involvement) | Question Mark | Support renewable integration and grid stability. |

| Green Hydrogen Ventures | High (Brazil's National Hydrogen Program) | Low (Initial exploration) | Question Mark | Position for future decarbonization opportunities. |

| Sabesp Stake (Sanitation) | High (R$100B+ investment projected) | Low (New focus area) | Question Mark | Diversify into a growing essential service sector. |

| Distributed Generation (Solar DG) | High (Brazil DG > 30 GW by end 2023) | Low (Nascent contribution) | Question Mark | Capitalize on the booming renewable energy trend. |

BCG Matrix Data Sources

Our BCG Matrix for Equatorial Energia is built on a foundation of official company financial disclosures, comprehensive market research reports, and industry growth forecasts to provide a clear strategic view.