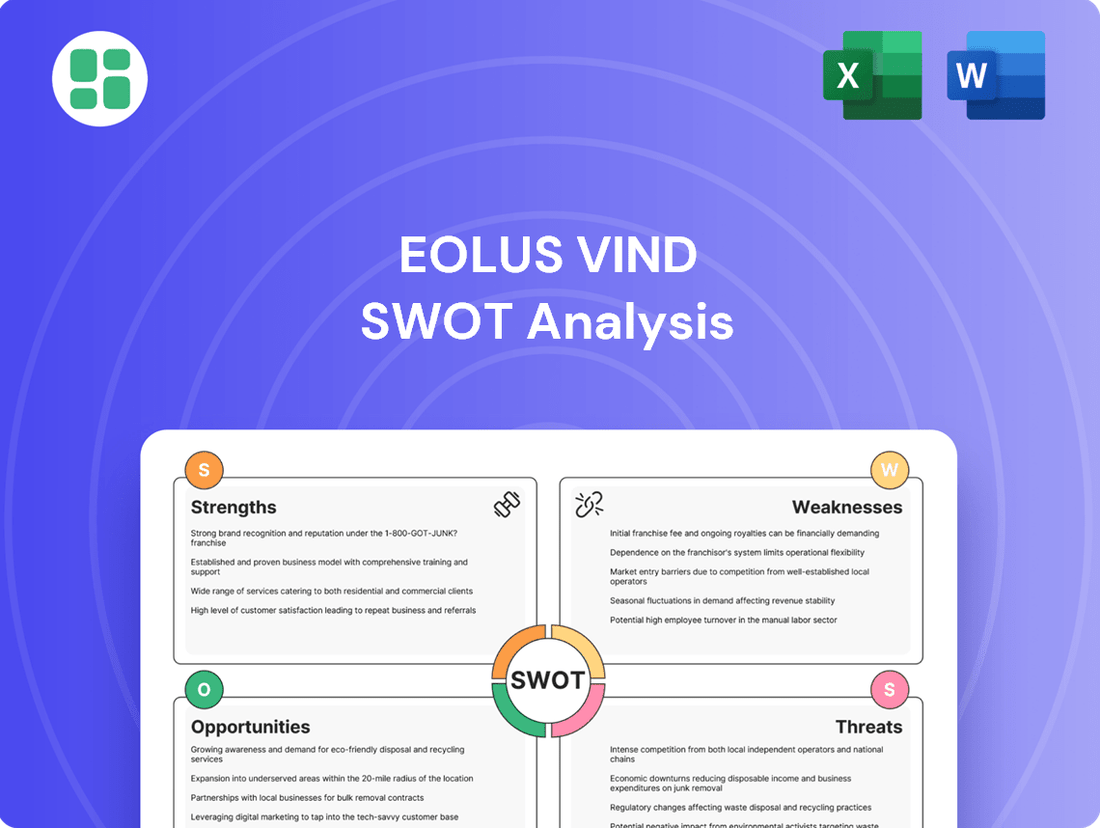

Eolus Vind SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eolus Vind Bundle

Eolus Vind is a significant player in the renewable energy sector, leveraging its established market presence and expertise in wind power development. However, understanding the full scope of their competitive advantages, potential challenges, and strategic opportunities requires a deeper dive.

Discover the complete picture behind Eolus Vind's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Eolus Vind AB excels in managing the complete project lifecycle for renewable energy facilities. This comprehensive oversight spans from initial site assessments and securing permits to the actual construction, arranging financing, and overseeing long-term operations and maintenance. This end-to-end control is a significant strength, ensuring efficiency and high quality throughout the development process.

By managing the entire value chain, Eolus Vind can capture more value and offer integrated, turnkey solutions to its investors and partners. This integrated approach was evident in their 2023 performance, where they successfully brought several projects online, contributing to a robust project pipeline and demonstrating their capability to execute complex developments from conception to operational status.

Eolus Vind's strength lies in its highly diversified renewable energy portfolio, encompassing both wind and solar power development. This strategic breadth is further enhanced by a significant and growing investment in energy storage projects, positioning the company to address the intermittency challenges inherent in renewables. As of early 2025, Eolus boasts a project pipeline exceeding 25 GW across these complementary technologies.

Eolus Vind showcased robust financial performance in Q1 2025, with sales climbing to SEK 1,098 million, a notable increase from SEK 463 million in Q1 2024. This growth was underpinned by strategic asset sales, including the successful divestment of the Pome battery project in the United States.

The company's operating profit also saw a substantial jump to SEK 234 million in Q1 2025, compared to SEK 31 million in the prior year's quarter. This surge highlights Eolus Vind's proficiency in converting its development portfolio into tangible financial gains.

Further strengthening its financial position, Eolus Vind completed the Stor-Skälsjön wind project, contributing positively to cash flow and demonstrating effective project execution. These strategic moves underscore the company's capacity to generate significant capital through its development and sales activities.

Established Presence Across Multiple Geographies

Eolus Vind boasts a robust operational presence across several key markets, including the Nordics, Baltics, Poland, and the United States. This international footprint is a significant strength, allowing the company to tap into diverse renewable energy landscapes and regulatory frameworks.

This geographical diversification serves to buffer against localized economic downturns or policy shifts, providing a more stable platform for growth. For instance, in 2023, Eolus Vind reported a significant increase in its project pipeline in the US, complementing its established Nordic operations.

- Geographic Diversification: Operations span the Nordics, Baltics, Poland, and the USA, reducing reliance on any single market.

- Market Access: Benefits from access to varied regulatory environments and expanding renewable energy demands in these regions.

- Risk Mitigation: The broad operational base helps to mitigate risks associated with regional market volatility.

Adaptability and Forward-Looking Strategy

Eolus Vind demonstrates remarkable adaptability by actively navigating shifts in both the offshore wind sector and broader financial markets. This proactive approach is crucial for maintaining competitiveness in a dynamic industry.

The company is exploring innovative financing avenues, such as the potential issuance of green bonds. This move aims to bolster financial flexibility and align with growing investor demand for sustainable investments. For instance, the green bond market saw significant growth in 2024, with issuance reaching record levels, indicating a favorable environment for such initiatives.

Furthermore, Eolus has strategically embedded a new sustainability strategy within its 2025-2027 business plan. This integration underscores a deep commitment to sustainable growth and a keen awareness of market trends and stakeholder expectations.

- Market Responsiveness: Eolus is actively adjusting its strategies in response to evolving offshore wind and financial market conditions.

- Financial Innovation: The company is investigating the issuance of green bonds to enhance its financial flexibility.

- Sustainability Integration: A new sustainability strategy has been incorporated into the 2025-2027 business plan, emphasizing long-term responsible growth.

Eolus Vind's core strength is its comprehensive project management capability, overseeing the entire renewable energy project lifecycle from inception to operation. This integrated approach ensures quality and efficiency, allowing the company to deliver turnkey solutions. Their Q1 2025 financial results, with sales at SEK 1,098 million and operating profit at SEK 234 million, demonstrate their ability to translate development into financial success.

The company's diversified portfolio, spanning wind, solar, and increasingly energy storage, positions it well for future growth. As of early 2025, Eolus has a project pipeline exceeding 25 GW. This diversification, coupled with a strong geographical presence across the Nordics, Baltics, Poland, and the US, mitigates market-specific risks.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Sales (SEK million) | 463 | 1,098 |

| Operating Profit (SEK million) | 31 | 234 |

| Project Pipeline (GW) | N/A | > 25 (as of early 2025) |

What is included in the product

Analyzes Eolus Vind’s competitive position through key internal and external factors, highlighting its strengths in project development and market opportunities in renewable energy expansion, while also considering potential financial risks and competitive threats.

Offers a clear, actionable framework to identify and address Eolus Vind's strategic challenges, turning potential roadblocks into opportunities.

Weaknesses

Eolus Vind's financial performance is highly sensitive to the timing of project sales and milestone achievements. For instance, the company reported a negative operating profit in Q2 2024, directly attributed to a lack of project transactions during that period. This highlights a core weakness: revenue generation is not consistent and depends heavily on securing deals and receiving payments as scheduled.

The reliance on these project-specific events means that any delays in sales or conditional payments on major projects can lead to significant fluctuations in earnings. This volatility makes it harder to predict short-term income, creating a degree of uncertainty for investors and stakeholders who rely on predictable financial results.

Eolus Vind faces significant challenges due to regulatory and permitting uncertainties, as evidenced by the rejection of key offshore wind projects like its own Skidbladner and the Arkona project in the Baltic Sea. These governmental decisions underscore the substantial hurdles the company navigates in securing project approvals.

Such setbacks can result in considerable financial write-downs and outright project cancellations, directly impacting Eolus Vind's future development pipeline and overall profitability. For instance, the delays and potential cancellations stemming from these regulatory issues can freeze capital and delay revenue generation for extended periods.

Developing large-scale wind farms, Eolus Vind's core business, demands significant upfront capital. For instance, a single large offshore wind project can easily cost billions of euros, a considerable sum that requires robust financial planning and access to substantial funding sources.

While Eolus is actively exploring avenues like green bond issuances for refinancing its projects, a heavy reliance on external financing inherently exposes the company to the volatility of interest rates and broader market liquidity. Changes in these financial conditions can directly impact the cost of capital and project profitability.

Market Competition and Price Pressure

The renewable energy landscape is fiercely competitive, with many companies vying for the same projects. This intense rivalry often translates into significant price pressure, squeezing profit margins for developers like Eolus. For instance, in the Nordic region, a key market for Eolus, the auction prices for renewable energy capacity have seen a downward trend in recent years due to oversubscription and aggressive bidding.

Eolus faces challenges in securing prime project sites and attracting investor capital in these competitive environments. This can impact their ability to negotiate favorable terms for power purchase agreements and financing, potentially hindering growth and profitability. The company's reliance on securing new projects means that market dynamics directly influence its pipeline and future revenue streams.

- Intense Competition: Numerous developers actively seek projects, intensifying rivalry.

- Price Pressure: Competition drives down project prices and profit margins.

- Site & Capital Scarcity: Prime locations and investor funding are highly sought after.

- Nordic Market Trends: Auctions in Eolus's core markets have shown decreasing price levels.

Analyst Sentiment and Stock Performance Volatility

Recent analyst sentiment for Eolus Vind AB has shown a mixed, and at times negative, trend. For instance, in late 2023 and early 2024, some analysts issued 'Sell' recommendations, with specific price targets that suggested a downward valuation. This cautious outlook can directly influence investor perception and trading activity.

Eolus Vind AB's stock performance has also reflected these concerns, notably underperforming its sector over the past year leading up to mid-2024. While the company's long-term revenue growth prospects are acknowledged by some analysts, this positive outlook is often tempered by more immediate worries.

Key weaknesses stem from the company's struggle to consistently meet earnings expectations. Furthermore, the inherent uncertainty surrounding the timing of project income realization creates a volatile environment for stock valuation, making it a less predictable investment for some.

- Analyst Downgrades: Several financial analysts have issued 'Sell' ratings for Eolus Vind AB stock, citing specific price targets that have not been met, impacting investor confidence.

- Sector Underperformance: Eolus Vind's stock has lagged behind its industry peers over the preceding 12-month period leading into mid-2024.

- Earnings Misses: The company has faced challenges in meeting projected earnings expectations, a recurring concern that weighs on its financial standing.

- Project Income Uncertainty: The unpredictable timing of revenue generation from ongoing projects introduces a significant element of risk, affecting the stock's valuation stability.

Eolus Vind's reliance on project sales creates revenue volatility, as seen with a negative operating profit in Q2 2024 due to a lack of transactions. This dependence on deal timing makes earnings unpredictable.

Regulatory hurdles, such as project rejections like Skidbladner, pose significant risks, potentially leading to financial write-downs and project cancellations, impacting the development pipeline.

The company's substantial capital requirements for large-scale projects expose it to financing risks, particularly interest rate and market liquidity fluctuations, affecting the cost of capital.

Intense competition in the renewable energy sector, particularly in the Nordic markets, leads to price pressures and can make securing prime sites and investor capital challenging, impacting profit margins and growth.

| Financial Metric | Q2 2024 | Full Year 2023 |

|---|---|---|

| Operating Profit (MSEK) | -38.8 | 185.4 |

| Revenue (MSEK) | 289.5 | 1,789.0 |

| Net Financial Items (MSEK) | -105.2 | -230.1 |

Full Version Awaits

Eolus Vind SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Eolus Vind SWOT analysis is comprehensive, covering all key internal and external factors. Upon purchase, you'll gain access to the complete, detailed report.

Opportunities

The global drive towards decarbonization and energy independence is fueling a substantial increase in demand for renewable energy sources. Projections indicate that solar and wind power will spearhead new capacity additions through 2025 and continue this trend thereafter, creating a robust environment for growth.

This overarching market trend directly benefits Eolus Vind by providing a strong foundation to expand its project pipeline and enhance its market presence. For instance, the International Energy Agency (IEA) reported in early 2024 that renewable energy sources are set to account for over 90% of global electricity capacity expansion in the coming years, a clear indicator of the opportunity.

Ongoing innovations are making wind turbines larger and more efficient, while solar panel technology and battery storage are also seeing significant improvements. These advancements are crucial for reducing costs and boosting the profitability of renewable energy projects.

Eolus Vind is well-positioned to capitalize on these trends. With its strategic focus on both wind and solar power, complemented by its investments in battery storage, the company can effectively integrate and leverage these technological leaps to enhance its project performance and market competitiveness.

Governments globally are increasingly prioritizing renewable energy, with many nations enacting supportive policies. For instance, the EU's Renewable Energy Directive aims for 42.5% renewables by 2030, with a push for 45%. Eolus Vind can capitalize on these initiatives, such as tax credits and streamlined permitting, to boost project profitability and expand into regions with robust policy backing.

Expansion into Emerging Renewable Energy Markets

Emerging markets in South America and the Middle East and North Africa (MENA) are experiencing rapid growth in renewable energy adoption, presenting significant opportunities for Eolus Vind. These regions boast considerable untapped wind and solar potential, with countries like Brazil and Saudi Arabia actively investing in large-scale projects. For instance, Saudi Arabia aims to generate 50% of its power from renewables by 2030, a substantial increase from its current levels.

Eolus Vind can leverage its established international expertise to strategically enter these high-growth territories. This expansion would serve to diversify the company's project portfolio and revenue streams, mitigating risks associated with over-reliance on existing markets. The global renewable energy market is projected to reach over $2 trillion by 2030, with emerging economies playing a crucial role in this expansion.

- South America's renewable energy capacity is rapidly expanding, with countries like Brazil leading the charge.

- The MENA region is increasingly focused on diversifying its energy mix away from fossil fuels, creating demand for wind and solar projects.

- Eolus Vind's international experience provides a solid foundation for navigating the complexities of these new markets.

- Diversifying into these regions can enhance Eolus Vind's long-term growth prospects and market position.

Growth in Energy Storage and Hybrid Projects

The burgeoning demand for energy storage solutions offers a substantial avenue for growth. Eolus Vind's successful sale of its Pome battery project underscores the market's appetite for these technologies. This segment is projected to see significant expansion, with the global energy storage market expected to reach hundreds of billions of dollars by the late 2020s, driven by renewable energy integration needs.

Furthermore, the industry is witnessing a pronounced shift towards hybrid energy projects. These integrated systems, which combine wind, solar, and battery storage, provide enhanced grid stability and operational flexibility. This trend allows developers like Eolus to offer more comprehensive and valuable solutions to the market, capitalizing on the synergy between different renewable sources and storage capabilities.

These hybrid models are increasingly favored for their ability to address the intermittency of renewables, ensuring a more reliable power supply.

- Growing market for battery storage: Global energy storage market expected to reach over $300 billion by 2030.

- Eolus's successful project: Demonstrated capability in developing and divesting battery storage assets.

- Hybrid project advantage: Combines wind, solar, and storage for improved grid stability.

- Increased value proposition: Integrated solutions command higher market prices due to enhanced reliability.

The increasing global demand for renewable energy, driven by decarbonization efforts and energy independence goals, presents a significant opportunity for Eolus Vind. The International Energy Agency (IEA) projected in early 2024 that renewables would account for over 90% of global electricity capacity expansion in the coming years, highlighting the favorable market conditions.

Technological advancements in wind turbine efficiency, solar panel technology, and battery storage are continuously reducing costs and improving project profitability. Eolus Vind's strategic focus on wind, solar, and battery storage allows it to leverage these innovations effectively.

Supportive government policies and incentives worldwide, such as the EU's Renewable Energy Directive targeting 42.5% renewables by 2030, create a conducive environment for Eolus Vind's expansion and project development.

Emerging markets in South America and the MENA region offer substantial untapped potential and rapid growth in renewable energy adoption, with countries like Saudi Arabia aiming for 50% renewable power by 2030. Eolus Vind's international experience positions it well to capitalize on these high-growth territories, diversifying its portfolio and revenue streams.

The growing demand for energy storage solutions, evidenced by Eolus Vind's successful Pome battery project sale, offers a significant growth avenue. The global energy storage market is projected to exceed hundreds of billions of dollars by the late 2020s, driven by the need to integrate renewables.

The industry trend towards hybrid energy projects, combining wind, solar, and battery storage, enhances grid stability and offers a more valuable, reliable power supply. Eolus Vind is well-placed to develop and offer these integrated solutions.

Threats

Adverse regulatory and political shifts present a significant threat to Eolus Vind. For instance, the Swedish government's rejection of offshore wind projects, a critical area for expansion, directly impacts future development pipelines. This type of policy reversal creates considerable uncertainty for investors and can lead to project cancellations, as seen with potential impacts on Eolus Vind's planned offshore developments.

Furthermore, political headwinds, such as anti-wind executive orders in the United States, can stall or entirely halt projects, leading to substantial financial losses and project delays. The ongoing evolution of energy policies globally means Eolus Vind must constantly navigate a complex and sometimes unpredictable political landscape, where shifts can have immediate and severe consequences on its strategic objectives and financial performance.

Eolus Vind, like many in the renewable energy sector, faces ongoing challenges from global supply chain snags and escalating costs for essential materials like steel, copper, and semiconductors. These pressures directly impact project budgets, potentially increasing capital expenditure by 10-20% for wind turbine components in 2024, as reported by industry analysts. Such cost inflation can squeeze profit margins and delay the financial returns on new developments.

While the renewable energy sector, particularly wind power, sees robust demand growth, mature markets are experiencing a significant uptick in competition. This intensified rivalry can lead to market saturation, potentially driving down wholesale electricity prices. For instance, in 2024, several European markets saw increased bidding activity for new wind farm developments, which can compress project margins.

This competitive pressure poses a direct threat to Eolus Vind, especially in its established operational regions where new entrants and existing players are vying for prime locations and grid connections. The challenge lies in differentiating offerings and securing profitable power purchase agreements (PPAs) amidst an oversupplied market. By the end of 2024, the average PPA price for new onshore wind projects in key Western European markets showed a downward trend compared to previous years.

Financing Challenges and Interest Rate Volatility

Financing large renewable energy projects like those Eolus Vind undertakes is sensitive to economic conditions. Economic downturns can make investors more risk-averse, potentially slowing down project development. For instance, a significant global recession could lead to reduced capital availability for infrastructure projects.

Rising interest rates directly impact the cost of borrowing for Eolus. As of early 2024, central banks in many major economies have maintained higher benchmark rates than in previous years, increasing the expense of debt financing for capital-intensive ventures. This elevated cost of capital can compress profit margins on new developments.

Tighter credit markets, often a consequence of economic uncertainty or increased regulatory scrutiny, can also pose a threat. This means that even if Eolus has strong project fundamentals, securing the necessary loans or bonds might become more difficult and come with stricter terms. For example, a reduction in the appetite for corporate bonds could make it harder for Eolus to issue new debt to fund its expansion plans.

- Increased Cost of Capital: Higher interest rates, such as the European Central Bank's policy rates which have remained elevated through 2024, directly increase the cost of debt for Eolus's projects.

- Reduced Investor Appetite: During periods of economic uncertainty, investors may shy away from large, long-term infrastructure projects, making it harder to secure equity financing.

- Project Viability Impact: The combination of higher financing costs and potentially tighter credit conditions can make some projects less profitable or even unviable, impacting Eolus's growth pipeline.

Public Opposition and Environmental Concerns

Public opposition, often fueled by environmental concerns and NIMBY sentiments, poses a significant threat to renewable energy projects like those undertaken by Eolus Vind. These concerns can manifest as local resistance, leading to delays or even complete halts in development, particularly for large-scale wind farms. For instance, in 2023, several wind energy projects across Europe faced significant community pushback, with some local governments citing visual impact and noise pollution as primary objections, impacting project timelines and increasing development costs.

Negative public perception and community resistance create substantial social and political hurdles. Navigating these challenges requires proactive engagement and transparent communication to address valid concerns and build trust. In Sweden, where Eolus Vind operates, community benefit agreements have become increasingly important in mitigating local opposition, with some projects offering direct financial contributions or local job opportunities to gain social license to operate.

- Local Opposition: Community resistance can lead to prolonged permitting processes and increased legal challenges for wind farm developments.

- Environmental Concerns: Worries about wildlife impact, noise pollution, and visual aesthetics are common drivers of public opposition.

- NIMBYism: The 'Not In My Backyard' phenomenon can significantly impede the deployment of necessary renewable energy infrastructure.

- Project Delays: Public and environmental objections can add months or even years to project timelines, increasing overall costs and delaying clean energy transitions.

Intensified competition in mature renewable energy markets, particularly in Europe, is a significant threat. This increased rivalry can lead to market saturation and downward pressure on wholesale electricity prices. By late 2024, average Power Purchase Agreement (PPA) prices for new onshore wind projects in key Western European markets saw a notable decline compared to previous years, impacting project profitability.

The escalating cost of capital due to sustained higher interest rates, as evidenced by central bank policies through 2024, directly increases debt financing expenses for Eolus Vind's capital-intensive projects. This financial pressure can compress profit margins on new developments and potentially impact project viability.

Global supply chain disruptions and rising material costs, projected to increase capital expenditure for wind turbine components by 10-20% in 2024, pose a direct threat. These cost escalations can squeeze profit margins and delay the financial returns on new developments, impacting Eolus Vind's overall financial performance.

| Threat Category | Specific Example/Data | Impact on Eolus Vind |

| Market Competition | Declining PPA prices in Western Europe (late 2024) | Reduced project profitability and margin compression |

| Cost of Capital | Elevated interest rates through 2024 | Increased debt financing expenses, lower project returns |

| Supply Chain & Costs | 10-20% projected CAPEX increase for turbine components (2024) | Higher project budgets, delayed financial returns |

SWOT Analysis Data Sources

This Eolus Vind SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence, and authoritative industry reports. These sources provide the essential data for a thorough and accurate assessment of the company's strategic position.