Eolus Vind Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eolus Vind Bundle

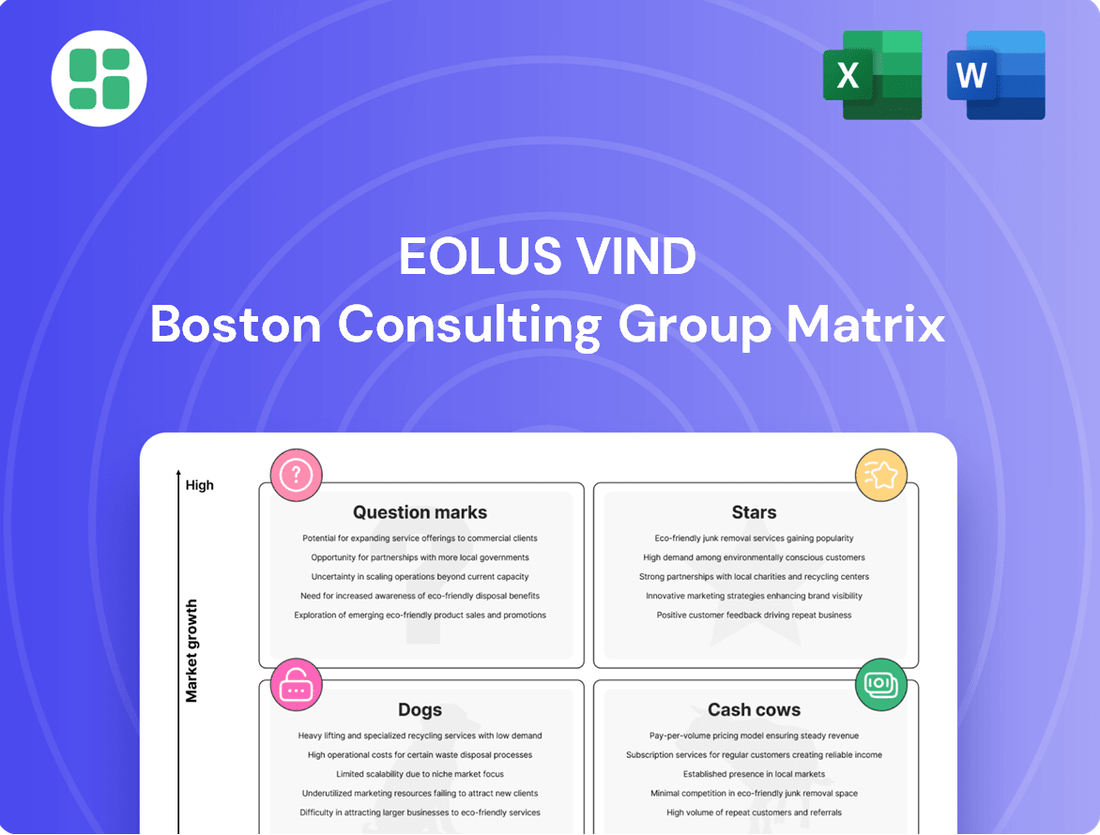

Curious about Eolus Vind's strategic positioning? This glimpse into their BCG Matrix reveals how their portfolio stacks up, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their competitive edge and unlock actionable strategies, dive into the full BCG Matrix report.

Gain a comprehensive understanding of Eolus Vind's product portfolio with the complete BCG Matrix. This essential tool provides detailed quadrant placements and data-backed recommendations, empowering you to make informed investment and product decisions for future growth.

Don't miss out on the full strategic picture! Purchase the complete Eolus Vind BCG Matrix to uncover detailed insights into each product's market share and growth potential, equipping you with the knowledge to optimize resource allocation and drive success.

Stars

Eolus Vind is making significant strides in the burgeoning US solar and battery storage sector. Their successful sale of the Pome battery project, a key development, underscores their growing influence. This is complemented by a substantial milestone payment received from the Centennial Flats project, indicating robust project execution and market penetration.

These achievements place Eolus at the forefront of a high-growth market. The US solar and battery storage market is projected to see continued expansion, with significant investment anticipated in renewable energy infrastructure. Eolus’s strategic positioning and demonstrated success in delivering projects like Centennial Flats are key drivers of their strong financial performance in recent periods.

Eolus Vind is strategically expanding its large-scale onshore wind development beyond its core Nordic region, targeting high-growth emerging markets. A prime example is the 158 MW Pienava project in Latvia, showcasing their commitment to these new territories. This move aims to capture significant market share in areas experiencing substantial renewable energy demand.

The company's investment in new Swedish projects like Fågelås, Boarp, and Dållebo underscores a continued dedication to strengthening its position within specific onshore wind segments. These developments highlight Eolus's balanced approach to growth, combining international expansion with continued domestic investment.

Eolus Vind's full value chain project development approach, encompassing everything from initial site studies to construction and securing financing, is a key differentiator. This end-to-end management allows them to deliver projects that are either ready for construction or fully operational, solidifying their leadership in the renewable energy sector.

By controlling the entire project lifecycle, Eolus captures substantial value and maintains a robust market position, especially in the development of intricate renewable energy projects. This integrated model is a significant contributor to their high market share in project delivery, demonstrating the effectiveness of their comprehensive strategy.

High-Capacity Onshore Wind Project Construction and Divestment

Eolus Vind's high-capacity onshore wind projects, like the recently completed and handed-over Stor-Skälsjön, showcase their robust construction and divestment capabilities. This successful execution translates into significant revenue and profit streams, reinforcing Eolus's role in expanding renewable energy infrastructure.

The demand for new wind capacity remains strong, a favorable market condition for these large-scale projects. Eolus's ability to manage the entire lifecycle, from construction to divestment, positions them advantageously.

- Stor-Skälsjön project completion: Eolus successfully completed and handed over the Stor-Skälsjön onshore wind project.

- Revenue generation: Completed projects like Stor-Skälsjön are designed to generate substantial revenue and profit.

- Market demand: The renewable energy sector, particularly onshore wind, continues to experience growing demand.

- Eolus's market position: These successes solidify Eolus's standing as a key developer of new wind energy capacity.

Strategic Shift to Value-Focused Growth

Eolus Vind's strategic pivot for 2025-2027 centers on a value-focused growth model, moving away from sheer volume. This means prioritizing projects that offer higher sales value, signaling a commitment to enhancing profitability and market leadership in profitable renewable energy segments.

This strategic shift is designed to bolster Eolus Vind's market standing by concentrating on high-value opportunities. For instance, their 2024 project pipeline continues to show an increasing average project size, with new developments in offshore wind aiming for capacities exceeding 500 MW, a significant leap from earlier onshore projects.

- Value Over Volume: The new business plan prioritizes higher sales value per project, indicating a focus on profitability.

- Market Leadership: This strategy aims to strengthen Eolus Vind's position in lucrative renewable energy market segments.

- Enhanced Profitability: By focusing on high-potential projects, the company expects to maximize returns.

- 2024 Performance Indicators: Early 2024 data suggests an upward trend in average project capacity, with offshore wind projects averaging over 500 MW.

Stars within the Eolus Vind BCG Matrix represent high-growth, high-market-share ventures. Eolus Vind's expansion into the US solar and battery storage market, marked by successful project sales like Pome and milestone payments from Centennial Flats, exemplifies this category. The company's strategic focus on high-capacity offshore wind projects, with capacities exceeding 500 MW in their 2024 pipeline, also firmly places them in the Stars quadrant, indicating significant growth potential and a strong competitive position.

What is included in the product

The Eolus Vind BCG Matrix analyzes their wind farm portfolio, categorizing assets as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Eolus Vind BCG Matrix provides a clear, one-page overview, instantly clarifying which business units require strategic attention.

Cash Cows

Eolus Vind's operational asset management services are a prime example of a Cash Cow within the BCG matrix. By the close of Q1 2025, the company was managing an impressive 1,180 MW of operational wind assets. This scale generates a steady and reliable revenue stream, underpinned by long-term operation and maintenance (O&M) contracts.

These services benefit from a high market share in asset management, reflecting their maturity and Eolus's established position. The predictable cash flow generated by these mature operations is crucial, providing the financial stability needed to fund investments in other, more dynamic parts of the business.

Eolus Vind's established onshore wind farms, particularly those divested in mature Nordic markets, represent significant cash cows. These projects, often operating under long-term power purchase agreements, generate consistent, low-risk revenue streams with minimal ongoing capital expenditure requirements. For instance, Eolus's historical portfolio includes numerous operational assets that continue to contribute positively to its financial performance, even after a majority stake has been sold.

Eolus Vind's completed project sales, particularly those with recurring revenue streams, function as powerful cash cows. The structured nature of these sales, often involving milestone payments or long-term agreements, guarantees a steady cash inflow from projects that have already been developed and constructed. This approach effectively transforms completed projects into dependable cash generators, lessening the reliance on constant, substantial investments in those particular assets.

For instance, the sale of projects like Pome, which anticipates final milestone payments, clearly illustrates this cash cow strategy. These ongoing payments from established projects provide a stable financial foundation, allowing Eolus to allocate resources more strategically across its portfolio, potentially funding growth initiatives or strengthening its financial position.

Long-Term Partnerships and Investor Services

Eolus's long-term partnerships and investor services are a cornerstone of its business, acting as a stable cash cow. These established relationships with investors and landowners are crucial for the successful development and ongoing management of renewable energy projects.

This service line generates consistent, albeit low-growth, revenue through recurring fees and profit-sharing agreements with a mature client base. Eolus's three decades of experience in the renewable energy sector have solidified its reputation and fostered these valuable, enduring partnerships.

- Stable Revenue Stream: Recurring fees and profit-sharing from established investor and landowner relationships provide predictable income.

- Low-Growth, High-Profitability: Mature client base and operational efficiency contribute to consistent, reliable profits with minimal reinvestment needs.

- Decades of Experience: Over 30 years in the industry have built trust and expertise, reinforcing client loyalty and service demand.

- Facilitation of Asset Realization: Expertise in navigating project development and management ensures successful, ongoing operation of renewable assets.

Dividend Distribution from Stable Earnings

Eolus Vind's consistent dividend policy, exemplified by the SEK 2.25 per share proposal for 2024, highlights its status as a cash cow. This steady distribution signals robust and predictable earnings, a hallmark of mature businesses generating more cash than they need for reinvestment. The company's commitment to returning value to shareholders through dividends underscores its financial stability.

The ability to consistently pay dividends indicates a business model characterized by stable and predictable cash flows, a defining trait of a cash cow. This financial strength allows Eolus to reward its investors reliably, even as it manages its operations efficiently. The proposed dividend for 2024 reflects this ongoing financial health.

- Consistent Dividend Proposal: SEK 2.25 per share for 2024.

- Financial Health Indicator: Demonstrates stable and predictable cash flows.

- Shareholder Value: Commitment to returning earnings to investors.

- Prudent Financial Management: Dividend distribution in two installments.

Eolus Vind's operational asset management services are a prime example of a Cash Cow within the BCG matrix. By the close of Q1 2025, the company was managing an impressive 1,180 MW of operational wind assets. This scale generates a steady and reliable revenue stream, underpinned by long-term operation and maintenance (O&M) contracts.

These services benefit from a high market share in asset management, reflecting their maturity and Eolus's established position. The predictable cash flow generated by these mature operations is crucial, providing the financial stability needed to fund investments in other, more dynamic parts of the business.

Eolus Vind's established onshore wind farms, particularly those divested in mature Nordic markets, represent significant cash cows. These projects, often operating under long-term power purchase agreements, generate consistent, low-risk revenue streams with minimal ongoing capital expenditure requirements. For instance, Eolus's historical portfolio includes numerous operational assets that continue to contribute positively to its financial performance, even after a majority stake has been sold.

Eolus Vind's completed project sales, particularly those with recurring revenue streams, function as powerful cash cows. The structured nature of these sales, often involving milestone payments or long-term agreements, guarantees a steady cash inflow from projects that have already been developed and constructed. This approach effectively transforms completed projects into dependable cash generators, lessening the reliance on constant, substantial investments in those particular assets.

For instance, the sale of projects like Pome, which anticipates final milestone payments, clearly illustrates this cash cow strategy. These ongoing payments from established projects provide a stable financial foundation, allowing Eolus to allocate resources more strategically across its portfolio, potentially funding growth initiatives or strengthening its financial position.

Eolus's long-term partnerships and investor services are a cornerstone of its business, acting as a stable cash cow. These established relationships with investors and landowners are crucial for the successful development and ongoing management of renewable energy projects.

This service line generates consistent, albeit low-growth, revenue through recurring fees and profit-sharing agreements with a mature client base. Eolus's three decades of experience in the renewable energy sector have solidified its reputation and fostered these valuable, enduring partnerships.

- Stable Revenue Stream: Recurring fees and profit-sharing from established investor and landowner relationships provide predictable income.

- Low-Growth, High-Profitability: Mature client base and operational efficiency contribute to consistent, reliable profits with minimal reinvestment needs.

- Decades of Experience: Over 30 years in the industry have built trust and expertise, reinforcing client loyalty and service demand.

- Facilitation of Asset Realization: Expertise in navigating project development and management ensures successful, ongoing operation of renewable assets.

Eolus Vind's consistent dividend policy, exemplified by the SEK 2.25 per share proposal for 2024, highlights its status as a cash cow. This steady distribution signals robust and predictable earnings, a hallmark of mature businesses generating more cash than they need for reinvestment. The company's commitment to returning value to shareholders through dividends underscores its financial stability.

The ability to consistently pay dividends indicates a business model characterized by stable and predictable cash flows, a defining trait of a cash cow. This financial strength allows Eolus to reward its investors reliably, even as it manages its operations efficiently. The proposed dividend for 2024 reflects this ongoing financial health.

- Consistent Dividend Proposal: SEK 2.25 per share for 2024.

- Financial Health Indicator: Demonstrates stable and predictable cash flows.

- Shareholder Value: Commitment to returning earnings to investors.

- Prudent Financial Management: Dividend distribution in two installments.

Eolus Vind's operational asset management services and mature onshore wind farms act as significant cash cows. These segments generate stable, predictable revenue streams, often supported by long-term contracts and minimal capital expenditure. For instance, by Q1 2025, the company managed 1,180 MW of operational wind assets, a testament to their established revenue-generating capacity.

The company's consistent dividend policy, with a proposed SEK 2.25 per share for 2024, further underscores its cash cow status. This indicates strong, reliable earnings that allow for shareholder returns, a key characteristic of mature, profitable business units that require less reinvestment.

These mature operations, bolstered by over 30 years of industry experience, provide the financial backbone for Eolus Vind. They ensure a steady cash inflow, enabling strategic allocation of resources to other growth-oriented areas of the business.

| Business Segment | BCG Matrix Category | Key Characteristics | Supporting Data |

|---|---|---|---|

| Operational Asset Management | Cash Cow | High market share, stable revenue, low growth | 1,180 MW managed (Q1 2025) |

| Mature Onshore Wind Farms | Cash Cow | Consistent, low-risk revenue, minimal capex | Divested projects with ongoing revenue |

| Investor & Landowner Partnerships | Cash Cow | Recurring fees, profit-sharing, mature client base | 30+ years of experience, enduring partnerships |

| Dividend Policy | Indicator of Cash Cow Status | Predictable earnings, shareholder returns | SEK 2.25 per share proposed for 2024 |

What You See Is What You Get

Eolus Vind BCG Matrix

The Eolus Vind BCG Matrix preview you're examining is the identical, fully polished document you'll receive upon purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally formatted strategic analysis ready for immediate application within your business planning.

Dogs

Eolus Vind faced a significant setback in 2024 when the Swedish government rejected key offshore wind projects, including Skidbladner and Arkona, citing defense concerns. This decision led to substantial write-downs for the company, reflecting the loss of invested development capital.

These rejected projects, which absorbed considerable resources and time from Eolus, now represent a low-growth, low-return segment for the company within the Swedish offshore wind market. The lack of any market share or anticipated future revenue from these endeavors highlights their problematic classification.

Consequently, these stalled projects can be accurately categorized as "Dogs" within the BCG Matrix framework. They are capital-intensive ventures that are currently generating no returns and show little promise for future growth, effectively tying up valuable company resources without a clear path to profitability.

Older, smaller wind farms with declining efficiency and rising operational costs can be categorized as underperforming legacy assets. These assets, often early renewable energy installations, may struggle to compete in today's market, leading to diminishing returns. For instance, a 2024 analysis of the European onshore wind sector highlighted that turbines installed before 2010 often exhibit significantly lower capacity factors compared to newer models, sometimes by as much as 10-15%.

These legacy assets can become cash traps, demanding substantial investment for maintenance and upgrades without offering comparable returns. In 2023, the average operation and maintenance (O&M) costs per megawatt for wind farms over 15 years old were reported to be 20% higher than for those under 10 years old, according to industry benchmarks.

Early-stage renewable energy projects, particularly in the burgeoning offshore wind sector, that struggle with permitting are increasingly falling into the Dogs category. These ventures, often in their initial development phases, face significant regulatory roadblocks and delays. For instance, the European offshore wind industry has seen several projects experience multi-year permitting processes, leading to increased development costs and uncertainty.

When projects consistently fail to secure necessary permits or encounter protracted regulatory challenges, they become liabilities. This situation is particularly acute in the wind energy sector where environmental impact assessments and maritime spatial planning can be complex and time-consuming. Such projects are essentially stuck in a low-growth, low-market share limbo, consuming valuable resources with diminishing prospects of ever generating revenue.

Divested or Non-Strategic Business Lines

Divested or non-strategic business lines represent ventures that Eolus Vind has moved away from, no longer fitting its core strategy. These might include past minor projects or discontinued operations that generated minimal revenue, effectively becoming cash traps. The company's strategic repositioning means these areas receive negligible investment and are actively being phased out to concentrate resources on more promising opportunities.

Eolus Vind's divestment strategy, as seen in its portfolio management, aims to streamline operations and enhance focus. For instance, if Eolus had a small subsidiary involved in a niche renewable technology that proved unprofitable or outside its main wind power development scope, it would likely be classified here. Such moves are common when a company refines its business model to maximize efficiency and return on investment.

- Divested Assets: Eolus Vind has historically managed and sometimes divested smaller, non-core renewable energy assets to sharpen its strategic focus on large-scale wind power projects.

- Minor Revenue Streams: Business activities generating less than 1% of total group revenue are often candidates for divestment or strategic review.

- Strategic Realignment: The company's ongoing strategy prioritizes expansion in core wind energy markets, leading to the de-prioritization of ancillary or legacy business segments.

Exploratory Ventures Without Clear Market Adoption

Exploratory Ventures Without Clear Market Adoption represent Eolus Vind's early-stage projects with uncertain commercial viability. These ventures, often in niche renewable energy technologies, have yet to secure significant market share or a clear profitability roadmap. For instance, if Eolus invested in a novel tidal energy concept that, as of Q2 2024, has only secured pilot project funding and lacks widespread industry adoption, it would fit this category.

These segments are characterized by Eolus's minimal market presence and dim growth outlook. The company must closely monitor their development, with a potential divestiture strategy if they fail to demonstrate tangible progress towards market acceptance and profitability. For example, a hypothetical project in advanced geothermal energy storage, which in early 2024 had only a few small-scale trials and faced regulatory hurdles, would be a prime candidate for such a review.

- Low Market Share: Eolus Vind's involvement in these ventures is typically minimal, reflecting their nascent stage.

- Uncertain Growth Prospects: Future market demand and competitive landscape are highly speculative.

- Divestiture Potential: Projects lacking promising development may be considered for sale or discontinuation.

- R&D Focus: Often represent significant research and development investment with no guaranteed return.

Eolus Vind's "Dogs" segment includes projects like the rejected Swedish offshore wind ventures, which consumed resources without generating returns. Legacy assets, such as older wind farms with lower efficiency and higher maintenance costs, also fall into this category. For instance, turbines installed before 2010 in Europe showed 10-15% lower capacity factors in 2024 compared to newer models.

These underperforming assets often become cash traps, with O&M costs for wind farms over 15 years old being 20% higher than for newer ones as of 2023. Additionally, early-stage projects facing significant permitting delays, common in offshore wind, are also classified as Dogs due to their low growth and market share, consuming resources with diminishing revenue prospects.

Divested or non-strategic business lines, generating minimal revenue and no longer fitting the core strategy, are also considered Dogs. These are areas Eolus is phasing out to concentrate resources on more promising opportunities. Exploratory ventures with uncertain commercial viability and minimal market presence also fit this classification, with a potential for divestiture if progress is not demonstrated.

| Category | Description | Example/Data Point |

| Rejected Projects | Capital-intensive ventures with no current or anticipated revenue. | Swedish offshore wind projects (Skidbladner, Arkona) rejected in 2024 due to defense concerns. |

| Legacy Assets | Older, less efficient assets with rising operational costs. | Wind farms with turbines installed pre-2010, showing 10-15% lower capacity factors (2024 analysis). |

| Permitting Challenges | Projects stalled by regulatory hurdles, leading to increased costs and uncertainty. | Early-stage offshore wind projects experiencing multi-year permitting processes. |

| Divested/Non-Strategic | Business lines no longer aligned with core strategy, generating minimal revenue. | Minor renewable technology subsidiaries or discontinued operations. |

| Exploratory Ventures | Early-stage projects with uncertain market adoption and low market share. | Novel renewable energy concepts awaiting widespread industry adoption or regulatory approval. |

Question Marks

Eolus Vind's acquisition of full ownership in SeaSapphire positions them squarely in the floating offshore wind sector, a burgeoning area with substantial global expansion prospects. This strategic move indicates a commitment to a segment poised for significant future development, though it remains in its early stages.

Given that floating offshore wind is a relatively new and capital-intensive technology, Eolus's current market share in this specific niche is likely minimal. The company faces the challenge of substantial upfront investment to establish a foothold and demonstrate the commercial viability of these advanced projects.

The floating offshore wind market is projected to grow significantly, with estimates suggesting a potential capacity of over 200 GW globally by 2050, requiring hundreds of billions in investment. Eolus’s investment in SeaSapphire places them at the forefront of this emerging, albeit high-risk, high-reward, energy frontier.

Eolus Vind's extensive solar project pipeline, exceeding 6 GW, spans numerous early-stage developments in new geographical markets. While the company has achieved success in the US solar sector, these emerging ventures require significant capital infusion to establish a strong market foothold.

The global solar energy market is experiencing robust growth, with projections indicating continued expansion. However, Eolus's market share in these nascent regions is currently modest, necessitating strategic investment to transition these early-stage projects into dominant positions.

Eolus's strategic move into markets like Poland for end-to-end project development signifies a significant pursuit of high-growth potential. This expansion, however, requires substantial capital for local infrastructure, forging key partnerships, and gaining deep market insights to build a strong competitive footing.

These ventures are inherently high-risk, given the complexities of new regulatory environments and established competitors, but they also present substantial reward opportunities. For instance, Poland's renewable energy sector saw a significant increase in installed capacity in 2023, with wind power playing a crucial role, making it an attractive, albeit challenging, market for full-lifecycle developers.

Utility-Scale Battery Energy Storage Systems (New Concepts)

Eolus Vind is expanding its utility-scale battery energy storage systems (BESS) beyond integrated projects like Pome. This burgeoning market, projected to see significant growth, presents an opportunity for Eolus to solidify its position. However, achieving long-term leadership necessitates ongoing investment in cutting-edge technologies and a robust project pipeline to capture market share.

The global BESS market is indeed expanding rapidly. For instance, by the end of 2023, the United States alone had over 15 gigawatts (GW) of operational battery storage capacity, with significant additions expected in 2024 and beyond. Eolus's strategic focus on standalone and integrated BESS solutions positions them to capitalize on this trend.

- Market Growth: The global energy storage market is forecast to grow substantially, with projections indicating tens of gigawatts of new capacity being added annually in the coming years.

- Competitive Landscape: Eolus faces established players and emerging innovators, making continuous technological advancement and strategic partnerships crucial for maintaining a competitive edge.

- Investment Needs: Securing market leadership requires substantial capital investment in research and development, grid integration technologies, and the development of a diverse project portfolio.

- Eolus's Strategy: By offering both standalone BESS and integrated solutions, Eolus aims to cater to a broader range of customer needs and project types within this dynamic sector.

Hybrid Renewable Energy Project Concepts

Eolus Vind's hybrid renewable energy projects, integrating wind, solar, and storage, are positioned as innovative, high-growth solutions crucial for grid stability and energy optimization. These complex, integrated offerings are still carving out their market share, requiring substantial initial investment in research and development, alongside pilot projects, to achieve scalability.

The market for hybrid renewable energy solutions is experiencing rapid expansion. For instance, the global renewable energy market was valued at approximately USD 1.2 trillion in 2023 and is projected to grow significantly. Hybrid projects, in particular, are gaining traction due to their ability to mitigate the intermittency of individual renewable sources, offering a more reliable power supply.

- Innovation in Integration: Eolus's focus on combining wind, solar, and battery storage addresses the need for consistent renewable energy generation.

- Growth Potential: While market share is developing, the demand for grid-scale energy storage and hybrid solutions is a key driver for future growth.

- Investment Needs: Significant upfront capital is necessary for developing and deploying these advanced, integrated renewable energy systems.

- Grid Modernization: These projects are vital for modernizing energy grids, enhancing resilience and efficiency in the face of increasing renewable penetration.

Eolus Vind's ventures into floating offshore wind, new solar markets, and standalone battery storage systems can be viewed through the lens of the BCG matrix, specifically identifying potential "Question Marks." These are areas with low market share but high growth potential, requiring significant investment to determine if they can become stars.

Floating offshore wind, for example, is a high-growth sector but Eolus's current market share is minimal. Similarly, their expansion into new solar markets and standalone BESS ventures represent high-growth opportunities where their market share is still developing. These segments demand substantial capital and strategic focus to navigate the inherent risks and capitalize on the substantial future rewards.

The success of these "Question Marks" hinges on Eolus's ability to secure significant investment, develop proprietary technology or strong partnerships, and effectively scale their operations. Without these elements, these high-potential areas could fail to gain traction and become "Dogs" or simply remain underdeveloped.

The inherent uncertainty and high investment requirements for these emerging sectors place them firmly in the "Question Mark" quadrant of the BCG matrix. Eolus must carefully allocate resources to nurture these ventures, aiming to convert their high growth potential into market leadership.

BCG Matrix Data Sources

Our Eolus Vind BCG Matrix leverages robust data from annual reports, market research, and industry growth forecasts to accurately assess business unit performance.