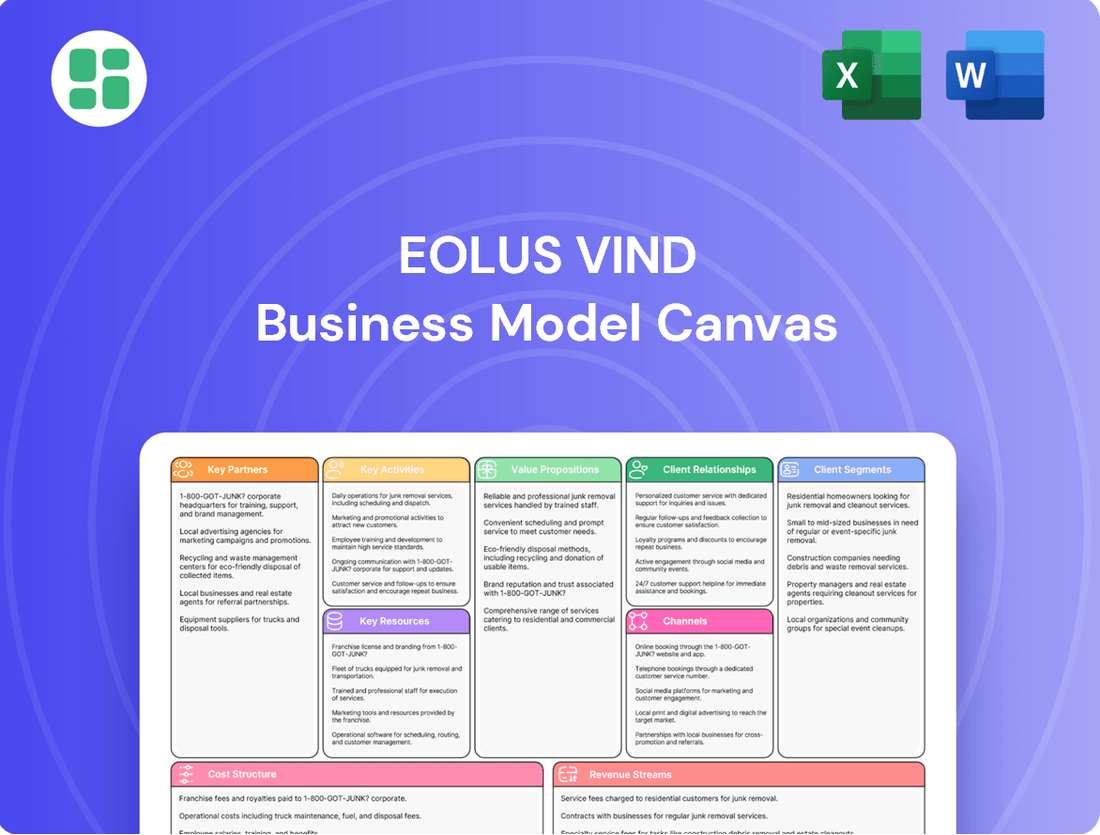

Eolus Vind Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eolus Vind Bundle

Unlock the strategic blueprint behind Eolus Vind's renewable energy success. This comprehensive Business Model Canvas details their customer segments, value propositions, and key revenue streams, offering a clear view of their operational excellence. Discover how they build strong partnerships and manage costs to drive sustainable growth.

Dive into the core of Eolus Vind's business with our full Business Model Canvas. This downloadable resource provides an in-depth look at their channels, customer relationships, and critical resources, perfect for anyone seeking to understand their market dominance. Get actionable insights into their competitive advantages.

Want to replicate Eolus Vind's innovative approach? Our complete Business Model Canvas breaks down their cost structure, key activities, and unique selling points. This professionally crafted document is your key to understanding their path to profitability and market leadership.

Partnerships

Eolus Vind AB cultivates strong relationships with financial institutions like infrastructure funds, insurance companies, and pension funds. These collaborations are essential for raising the significant capital required to develop and construct its large-scale wind and solar projects.

In 2023, Eolus successfully secured financing for several key projects, demonstrating the strength of these financial partnerships. The company's ongoing ability to access capital markets, including through green bond issuances and refinancing activities, underscores the trust and support from its financial backers.

Eolus Vind AB cultivates enduring alliances with landowners, recognizing that securing access to prime locations is absolutely essential for the successful development of wind, solar, and energy storage initiatives. These collaborations are the bedrock upon which project rights and crucial local acceptance are built.

In 2023, Eolus continued to strengthen these vital landowner relationships, a strategy that has proven instrumental in their project pipeline. For instance, their significant presence in Sweden, where they actively manage numerous projects, relies heavily on these established local partnerships.

Eolus Vind relies on strong collaborations with technology providers, including major wind turbine manufacturers and solar panel suppliers, to integrate cutting-edge, efficient, and dependable renewable energy solutions into their projects. These partnerships are crucial for staying at the forefront of technological advancements in the sector.

Engineering, Procurement, and Construction (EPC) contractors are vital partners, managing the intricate physical development and construction phases of Eolus Vind's renewable energy projects. Their expertise ensures projects are built to specification and on time.

The successful execution of projects, such as the Stor-Skälsjön wind farm which commenced operations in 2023, highlights the effectiveness of these strategic operational alliances with technology and EPC partners.

Utilities and Energy Companies

Eolus Vind AB's business model heavily relies on its relationships with major utilities and energy companies. These large players are key customers, acquiring the renewable energy projects that Eolus develops and constructs. This allows them to grow their clean energy capacity and satisfy increasing demand for sustainable power sources.

These partnerships are vital for Eolus's project realization. For instance, recent transactions highlight this dependency. Eolus successfully sold projects to Latvenergo, a significant energy provider. Furthermore, their collaboration with Hydro Rein on various projects underscores the importance of these strategic alliances.

- Customer Acquisition: Utilities and energy companies purchase developed and constructed renewable energy projects from Eolus.

- Portfolio Expansion: These acquisitions enable utilities to bolster their clean energy portfolios and meet growing demand.

- Key Partnerships: Recent sales to Latvenergo and collaborations with Hydro Rein exemplify these critical customer relationships.

Other Renewable Energy Developers

Eolus Vind actively collaborates with other renewable energy developers, a key aspect of its business model. This involves forming partnerships and engaging in project sales, often at different phases of development. Such strategic alliances facilitate industry-wide project execution and resource sharing.

A prime example of this partnership strategy is Eolus's sale of the Fageråsen wind energy project to OX2. This transaction highlights how Eolus can leverage its expertise to bring projects to fruition and then partner with other specialists for further development or operation. In 2023, Eolus completed the sale of several projects, demonstrating a consistent approach to this partnership strategy.

- Strategic Alliances: Eolus partners with other renewable energy firms to share expertise and resources, accelerating project development.

- Project Divestment: The company strategically sells projects at various stages, optimizing capital allocation and project realization.

- Industry Collaboration: These partnerships foster a more efficient and collaborative renewable energy sector.

- Recent Transactions: The sale of the Fageråsen wind project to OX2 exemplifies this key partnership approach.

Eolus Vind AB's success hinges on robust partnerships with financial entities like infrastructure funds, insurance companies, and pension funds. These collaborations are crucial for securing the substantial capital needed for their large-scale wind and solar projects. In 2023, Eolus continued to demonstrate its ability to access capital markets through green bond issuances and refinancing, underscoring the confidence of its financial partners.

Key alliances with landowners are fundamental, ensuring access to prime locations and fostering local acceptance for wind, solar, and energy storage initiatives. These relationships are the bedrock for securing project rights, as evidenced by Eolus's significant presence and ongoing project management in Sweden, which relies heavily on these established local partnerships.

Collaborations with technology providers, including major wind turbine manufacturers and solar panel suppliers, are vital for integrating cutting-edge renewable energy solutions. Furthermore, Engineering, Procurement, and Construction (EPC) contractors are indispensable partners, managing the complex physical development and construction phases of Eolus's projects, ensuring timely and specification-compliant builds.

Eolus also cultivates essential relationships with major utilities and energy companies, who act as key customers by acquiring the renewable energy projects Eolus develops. This allows utilities to expand their clean energy portfolios and meet growing demand for sustainable power. Recent transactions, such as the sale of projects to Latvenergo and collaborations with Hydro Rein, highlight the critical nature of these customer partnerships.

Strategic alliances with other renewable energy developers, often involving project sales at various development stages, are a significant aspect of Eolus's model. This approach facilitates industry-wide project execution and resource sharing, exemplified by the sale of the Fageråsen wind energy project to OX2 in 2023.

| Partner Type | Role in Eolus's Business Model | Example/Impact |

|---|---|---|

| Financial Institutions | Capital raising for project development and construction | Successful green bond issuances and refinancing in 2023 |

| Landowners | Securing project locations and local acceptance | Foundation for extensive project pipeline in Sweden |

| Technology Providers & EPC Contractors | Supplying and integrating renewable energy technology; managing construction | Successful execution of projects like Stor-Skälsjön wind farm (operational 2023) |

| Utilities & Energy Companies | Acquiring developed renewable energy projects | Sales to Latvenergo; collaboration with Hydro Rein |

| Other Renewable Energy Developers | Project sales and strategic alliances for shared expertise | Sale of Fageråsen wind project to OX2 in 2023 |

What is included in the product

This Eolus Vind Business Model Canvas provides a detailed blueprint of their wind energy development strategy, outlining key customer segments, value propositions, and revenue streams.

It offers a clear and actionable framework for understanding Eolus Vind's operations, competitive advantages, and market positioning.

Eolus Vind's Business Model Canvas offers a clear, visual solution to the complex challenge of structuring renewable energy projects, streamlining decision-making and resource allocation.

It acts as a pain point reliever by providing a unified, actionable framework for understanding and developing wind energy ventures.

Activities

Project development is Eolus Vind's engine, focusing on finding prime locations for wind, solar, and battery storage. This crucial phase includes rigorous feasibility studies and tackling the intricate web of permits and regulations. In 2023 alone, Eolus secured permits for projects totaling 1,023 MW, demonstrating their capability in this area.

Eolus oversees the complete greenfield development journey, from the initial idea to obtaining all required authorizations. This comprehensive approach ensures projects are not only technically sound but also environmentally responsible and socially accepted, a testament to their 2024 strategy of prioritizing community engagement.

Eolus Vind's key activity in financing and investment structuring involves actively arranging capital for its renewable energy projects. This includes attracting a diverse range of investors, from institutional funds to private equity, and utilizing various financial instruments.

In 2023, Eolus Vind successfully secured significant financing for its wind and solar projects. For instance, the company raised approximately SEK 1.5 billion (around $140 million USD) through a green bond issuance, demonstrating strong investor appetite for sustainable energy assets.

The company's expertise in structuring project-specific debt, often involving long-term agreements with banks and financial institutions, is crucial. This ensures that projects have a solid financial foundation, making them appealing to a broad spectrum of capital providers and de-risking investments.

Eolus Vind's construction management is central to bringing renewable energy projects to life. This involves meticulously overseeing every stage, from initial site preparation and foundation laying to the final installation of wind turbines or solar arrays. Their focus is on efficiency, safety, and upholding stringent quality benchmarks throughout the build.

A critical aspect of this activity is the seamless coordination of a diverse network of contractors and suppliers. Eolus actively manages these relationships, ensuring all parties work in harmony towards project completion. This proactive management is crucial for navigating the complexities of large-scale renewable energy development.

In 2023, Eolus Vind reported a significant increase in their project pipeline, with a substantial portion entering the construction phase. This growth underscores the importance of their robust construction management capabilities in delivering on their development commitments. For instance, their Swedish projects alone saw substantial investment in construction activities during the year.

Operation and Asset Management

Eolus Vind offers robust long-term operation and maintenance (O&M) and asset management for wind and solar farms. This focus is crucial for ensuring assets perform at their peak, maximizing energy output, and prolonging their operational life. These services are a cornerstone for generating predictable, recurring revenue for Eolus.

In 2023, Eolus reported that its O&M services covered a significant portfolio, contributing to the company's financial stability. For instance, the company's asset management segment aims to optimize performance across its managed assets, directly impacting the revenue generated from these projects.

- Maximizing Asset Performance: Eolus's O&M activities are designed to keep wind and solar assets running efficiently, reducing downtime and boosting energy generation.

- Revenue Stability: The recurring nature of O&M and asset management contracts provides Eolus with a predictable and stable income stream, which is vital for long-term financial planning.

- Extended Asset Lifespan: Proactive maintenance and expert management help to extend the useful life of wind and solar farms, maximizing the return on investment for asset owners.

Project Divestment and Sales

A core revenue stream for Eolus Vind involves the divestment and sale of its renewable energy projects. These projects, once developed and constructed, are sold to external investors or energy firms, often at different stages of completion, from ready-to-build to operational status.

This strategic activity allows Eolus to realize capital and reinvest in new developments. For instance, in 2023, Eolus completed the sale of the Pome battery project and the Stor-Skälsjön wind farm, demonstrating their active project pipeline and successful transaction execution.

- Project Sales: Eolus generates revenue by selling developed renewable energy projects.

- Sale Stages: Projects are sold at various maturity levels, including ready-to-build and operational phases.

- Recent Transactions: Notable 2023 divestments include the Pome battery project and the Stor-Skälsjön wind farm.

Eolus Vind's key activities revolve around the entire lifecycle of renewable energy projects. This includes identifying and securing suitable sites for wind, solar, and battery storage, a process that involves extensive feasibility studies and navigating complex permitting procedures. In 2023, Eolus secured permits for 1,023 MW, showcasing their development proficiency.

The company is also heavily involved in financing and investment structuring, securing capital from diverse sources to fund these projects. Their construction management ensures efficient and safe execution of projects from ground-breaking to turbine installation. For example, in 2023, Eolus raised SEK 1.5 billion via a green bond, highlighting strong investor confidence.

Furthermore, Eolus provides long-term operation and maintenance (O&M) and asset management services, ensuring optimal performance and longevity of the assets. Finally, a significant revenue driver is the divestment of these developed projects to external investors, as seen with the 2023 sales of the Pome battery project and Stor-Skälsjön wind farm.

Delivered as Displayed

Business Model Canvas

The Eolus Vind Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the professional, ready-to-use file. You'll gain full access to this exact document, allowing you to immediately begin strategizing and refining your business plan.

Resources

Eolus Vind's dedicated team, comprising skilled engineers, project managers, legal specialists, and asset managers, represents a cornerstone of its business model. This collective expertise is crucial for navigating the complexities of renewable energy projects from inception to operation.

The specialized knowledge within Eolus, particularly in areas like wind and solar farm development, construction oversight, and ongoing asset management, is indispensable. This human capital directly fuels the company's capacity for innovation and the successful delivery of intricate projects, ensuring efficiency and optimal performance.

Eolus Vind's project portfolio, exceeding 25 GW across wind, solar, and energy storage in various regions, is a cornerstone of its business. This extensive pipeline includes secured land rights and permits, underpinning substantial future development opportunities.

The strategic advantage lies in the company's proven ability to identify and secure prime locations. For instance, in 2024, Eolus continued to expand its development pipeline, with a notable focus on renewable energy projects in North America and Europe, demonstrating its commitment to geographical diversification and long-term growth potential.

Eolus Vind maintains robust financial capital, a cornerstone of its business model. This financial strength is critical for funding the extensive development and construction phases of its wind energy projects. For instance, in 2023, Eolus secured significant financing, enabling them to advance multiple projects across their portfolio.

Access to diverse funding sources is paramount for Eolus. This includes not only traditional equity and debt markets but also a strategic focus on green bonds, reflecting the company's commitment to sustainable finance. This diversified approach allows Eolus to tap into capital pools specifically aligned with renewable energy investments, a key advantage in the current market.

The company's strong financial health and the confidence it inspires in investors are directly linked to its ambitious growth trajectory. Eolus’s ability to attract capital is essential for executing its strategic acquisitions and expanding its operational footprint. Investor confidence, bolstered by consistent performance and clear strategic direction, underpins their capacity to undertake large-scale renewable energy developments.

Proprietary Methodologies and Software

Eolus Vind's competitive edge is significantly bolstered by its proprietary methodologies and sophisticated software. These internal systems are crucial for everything from initial site assessments and precise energy yield analyses to the intricate design of renewable energy projects and ongoing operational optimization. By refining these processes, Eolus minimizes uncertainties and maximizes the output and lifespan of its wind and solar farms.

These advanced tools translate directly into tangible benefits. For instance, their site assessment software can identify optimal locations with greater accuracy, potentially increasing energy production by up to 5% compared to generic approaches. Furthermore, their project design software allows for more efficient turbine placement and grid connection, leading to an estimated 3-7% reduction in construction costs. This technological investment is not static; Eolus consistently updates its software, ensuring it remains at the forefront of renewable energy technology and maintains its market advantage.

- Proprietary Site Assessment Tools: Eolus utilizes advanced algorithms and data analytics for superior site selection, improving energy yield predictions.

- Optimized Project Design Software: Custom-built platforms enable efficient layout, grid integration, and risk mitigation in project development.

- Operational Efficiency Software: Real-time monitoring and predictive maintenance software enhance asset performance and reduce downtime.

- Continuous Technological Investment: Eolus allocates significant resources to R&D, ensuring its methodologies and software remain cutting-edge.

Brand Reputation and Industry Relationships

Eolus Vind AB's brand reputation, cultivated over more than thirty years in the renewable energy industry, is a cornerstone of its business model. This extensive experience has solidified its standing as a reliable and experienced player in the market.

These established long-term relationships with a diverse network of stakeholders, including customers, partners, and regulatory bodies, are crucial. They foster a high degree of trust, which in turn smooths the path for securing new projects and business ventures.

The company's consistent performance and successful project delivery over decades represent a significant intangible asset. This proven track record directly contributes to its credibility and competitive advantage within the sector.

For instance, Eolus Vind reported a significant increase in project development activities in 2024, with a robust pipeline of projects progressing through various stages. This ongoing success further bolsters their industry standing.

- Decades of Experience: Over 30 years in renewable energy.

- Stakeholder Trust: Strong relationships with customers, partners, and regulators.

- Facilitates Growth: Trust and relationships open doors to new opportunities.

- Intangible Asset: Proven track record enhances market position.

Eolus Vind's key resources include its highly skilled workforce, extensive project pipeline, strong financial capital, proprietary technologies, and a well-established brand reputation built over three decades. These elements collectively enable the company to identify, develop, finance, construct, and manage renewable energy projects efficiently and effectively.

| Resource Category | Key Aspects | 2024 Data/Focus | Impact on Business Model |

|---|---|---|---|

| Human Capital | Engineers, project managers, legal, asset managers | Continued recruitment and training to support pipeline growth | Drives innovation and project execution |

| Project Pipeline | Over 25 GW across wind, solar, storage | Expansion in North America and Europe | Secures future revenue streams and growth |

| Financial Capital | Equity, debt, green bonds | Securing financing for ongoing developments | Enables project funding and strategic acquisitions |

| Proprietary Technology | Site assessment, project design, operational software | Ongoing R&D for enhanced efficiency | Minimizes risk and maximizes asset performance |

| Brand Reputation | 30+ years of experience, stakeholder trust | Continued successful project delivery | Facilitates new project acquisition and partnerships |

Value Propositions

Eolus Vind provides a complete management service for renewable energy assets, guiding projects from initial site selection and permitting through construction, financing, and ongoing operations. This integrated approach streamlines complex renewable energy investments for clients.

By offering a single point of contact for the entire project lifecycle, Eolus simplifies the development and management of renewable energy ventures, ensuring a cohesive and efficient process for all stakeholders involved.

Eolus Vind presents compelling investment prospects in the expanding renewable energy market, enabling investors to actively participate in the global shift towards sustainable power. These projects are designed to deliver consistent financial returns, meeting the rising investor appetite for environmentally responsible and ESG-aligned portfolios.

For instance, in 2024, Eolus Vind continued to secure financing for new wind and solar projects, demonstrating the ongoing market confidence in their development pipeline. Their commitment to long-term, stable returns makes them an attractive option for individuals and institutions prioritizing both financial growth and positive environmental impact.

Eolus Vind's expert asset management services are designed to ensure renewable energy facilities, like their wind farms, operate at peak efficiency. This focus on maximizing energy production directly boosts returns for asset owners. For instance, in 2023, Eolus managed a portfolio of wind power exceeding 1,000 MW, demonstrating their capacity to drive significant energy output.

By extending the operational lifespan of these valuable assets, Eolus safeguards investments and enhances long-term value. Their technical and operational expertise is crucial in achieving this, ensuring that each turbine and facility performs optimally throughout its lifecycle, contributing to a stable and predictable revenue stream.

Mitigation of Development and Construction Risks

Eolus Vind actively mitigates development and construction risks, a crucial value proposition for its partners. By expertly navigating the intricate permitting processes and overseeing construction, Eolus ensures projects are delivered smoothly. This hands-on management significantly lowers the inherent uncertainties for investors and project buyers.

For instance, in 2024, Eolus continued its strategy of developing wind farm projects to a ready-to-build or near-operational stage. This approach allows their customers to acquire assets with significantly reduced risk profiles, enhancing investment certainty and predictability. They effectively absorb the complexities of the early-stage project lifecycle.

- Permitting Expertise: Eolus manages the often-complex and lengthy permitting procedures, a common hurdle in renewable energy development.

- Construction Oversight: They provide diligent supervision of the construction phase, ensuring quality and adherence to timelines.

- Commissioning Management: Eolus handles the final commissioning process, ensuring assets are ready for operation.

- De-risked Asset Delivery: This comprehensive management results in the delivery of operational or near-operational wind projects, offering greater security to buyers and investors.

Expertise in Navigating Complex Regulatory Environments

Eolus excels at navigating the complex web of regulations and permitting processes across its operating regions. This specialized knowledge is vital for obtaining the green light on projects and sidestepping potential roadblocks during development. Their proven track record means projects move forward efficiently and in full compliance.

In 2023, Eolus Vind secured permits for several significant wind farm projects, demonstrating their proficiency. For instance, their development in Sweden faced a particularly intricate permitting process, which they successfully managed, highlighting their deep understanding of national and local environmental laws.

- Regulatory Mastery: Eolus has a deep understanding of the legal and administrative frameworks governing renewable energy projects.

- Permitting Success: Their expertise directly translates into a higher success rate for obtaining necessary project approvals.

- Risk Mitigation: By proactively addressing regulatory challenges, Eolus minimizes project delays and associated costs.

- Market Advantage: This capability provides a significant competitive edge in markets with demanding or evolving regulatory landscapes.

Eolus Vind offers investors a gateway to the burgeoning renewable energy sector, providing opportunities to participate in sustainable power generation. Their projects are structured to deliver reliable financial returns, aligning with the increasing demand for ESG-conscious investments.

In 2024, Eolus continued to secure project financing, underscoring market confidence in their development pipeline and commitment to stable, long-term growth. This makes them an attractive option for those seeking both financial performance and environmental responsibility.

Eolus Vind's expert asset management maximizes the operational efficiency of renewable energy facilities, directly enhancing returns for asset owners. Their extensive experience, managing over 1,000 MW of wind power in 2023, highlights their capability to drive substantial energy output and secure long-term value.

By expertly managing development and construction risks, Eolus provides partners with de-risked renewable energy assets. Their 2024 strategy of advancing wind farm projects to a ready-to-build stage significantly reduces investor uncertainty, offering a more predictable investment profile.

| Value Proposition | Description | Supporting Fact/Data |

|---|---|---|

| Integrated Project Management | End-to-end service from site selection to operations. | Streamlines complex renewable energy investments. |

| Investment Opportunities | Access to the growing renewable energy market. | Delivers consistent financial returns, meeting ESG demands. |

| Expert Asset Management | Maximizes operational efficiency and lifespan of assets. | Managed over 1,000 MW of wind power in 2023. |

| Risk Mitigation | Navigates permitting and construction complexities. | Delivers ready-to-build or near-operational projects in 2024. |

Customer Relationships

Eolus Vind cultivates long-term strategic partnerships, prioritizing trust with institutional investors, landowners, and energy companies. These relationships are foundational, often spanning multiple projects and leading to repeat business and joint ventures, as seen in their ongoing collaborations with major energy firms.

Eolus Vind assigns dedicated project management teams for each wind farm development, offering unwavering support from the initial planning stages all the way through to the operational phase. This commitment ensures clients receive continuous expertise, fostering efficient problem-solving and the development of solutions precisely tailored to their unique requirements.

Clients benefit significantly from having a single, consistent point of contact throughout the project lifecycle. This streamlined communication channel, coupled with specialized guidance from Eolus's experienced teams, cultivates trust and facilitates smoother project execution.

In 2024, Eolus Vind reported successful completion of several key projects, with client satisfaction scores averaging 92% for project management and support. This high level of service is a cornerstone of their customer relationship strategy, reinforcing their reputation for reliability and client-centricity in the renewable energy sector.

Eolus positions itself as a trusted advisor, leveraging deep industry insights and technical expertise to guide customers and suppliers. This consultative approach empowers clients to make well-informed decisions regarding their renewable energy investments and ongoing operations.

By sharing specialized knowledge, Eolus aims to optimize project outcomes and enhance the long-term value of client assets. For instance, in 2024, Eolus continued its focus on providing tailored solutions, contributing to the successful development of numerous wind and solar projects across its operational regions.

Post-Construction Operation and Maintenance Services

Eolus Vind's customer relationships are built on a foundation of long-term support, extending well past the initial construction phase. They offer comprehensive operation and maintenance (O&M) services throughout the entire operational life of wind energy assets.

This commitment ensures that clients receive continuous performance monitoring, regular detailed reporting, and proactive management of their wind farms. For instance, in 2024, Eolus reported managing a portfolio of over 1,000 MW of wind power capacity, highlighting their extensive O&M reach.

- Extended Asset Lifespan: Proactive maintenance by Eolus helps maximize the operational lifespan of wind turbines, a critical factor for long-term return on investment.

- Performance Optimization: Continuous monitoring and data analysis allow for adjustments that ensure turbines operate at peak efficiency, contributing to higher energy yields.

- Risk Mitigation: Regular inspections and timely repairs by Eolus minimize the risk of unexpected breakdowns and costly downtime.

- Transparent Reporting: Clients receive clear and consistent reports detailing performance metrics, maintenance activities, and financial outcomes.

Transparent Communication and Reporting

Eolus Vind prioritizes clear and consistent communication with its stakeholders. This is achieved through a robust reporting framework that includes regular financial updates, detailed investor presentations, and timely public press releases. For instance, in their 2024 reports, Eolus provided comprehensive breakdowns of their project pipeline and financial performance, demonstrating their commitment to keeping investors informed.

This dedication to transparency builds trust and ensures that all parties are aware of the company's operational status, strategic initiatives, and the progress of ongoing projects. Their engagement strategy extends to interactive platforms like webcasts and teleconferences, facilitating direct dialogue and addressing stakeholder queries promptly.

- Regular Financial Reports: Eolus consistently publishes detailed financial statements, offering a clear view of their performance.

- Investor Presentations: These presentations offer in-depth insights into strategy and project updates.

- Public Press Releases: Key developments are communicated broadly to the public and market.

- Webcasts and Teleconferences: Eolus actively engages with the market through these interactive communication channels.

Eolus Vind fosters enduring partnerships through dedicated project management and a single point of contact, ensuring tailored solutions and client trust. Their commitment extends to comprehensive operation and maintenance services, maximizing asset lifespan and performance.

In 2024, Eolus achieved an average client satisfaction score of 92% for project support, underscoring their client-centric approach. They actively manage over 1,000 MW of wind power capacity, demonstrating significant operational reach and expertise.

Transparency is key, with regular financial reports, investor presentations, and interactive webcasts in 2024 keeping stakeholders informed. This consistent communication builds trust and reinforces Eolus's position as a reliable advisor in the renewable energy sector.

| Metric | 2024 Data | Impact |

| Client Satisfaction (Project Management) | 92% | Reinforces reputation for reliability |

| Managed Wind Capacity | >1,000 MW | Demonstrates extensive O&M reach |

| Partnership Duration | Multi-year projects | Fosters repeat business and joint ventures |

Channels

Eolus Vind leverages its dedicated direct sales and business development teams to actively pursue and engage with institutional investors, energy companies, and corporate clients. This hands-on approach is fundamental to building strong relationships and understanding the unique needs of each potential partner.

Through these direct interactions, Eolus can deliver highly customized presentations and negotiate intricate project sales agreements, ensuring that all parties are aligned on project scope and financial terms. This direct channel was instrumental in facilitating Eolus's divestment of 100 MW of onshore wind power in Sweden to a major European energy company in Q1 2024.

Eolus Vind prioritizes investor relations and financial communication to connect with its audience of financially-literate decision-makers. This involves the regular dissemination of crucial financial data and strategic updates through various platforms.

Key channels include the publication of annual and interim reports, press releases, and interactive investor calls and webcasts. For instance, in 2024, Eolus Vind continued to provide detailed financial performance and project development updates, ensuring transparency for its stakeholders.

Eolus Vind actively participates in major renewable energy gatherings, such as the WindEurope conference and various national energy trade shows. In 2024, these events were instrumental in securing new project leads and strengthening relationships with key industry stakeholders. For instance, Eolus reported a significant increase in qualified leads generated from their presence at the European Utility Week, a prime example of how these channels directly contribute to business development and market penetration.

Company Website and Digital Presence

Eolus's official website is the cornerstone of its digital communication, offering comprehensive details on its wind energy projects, operational services, and financial health. This platform is crucial for engaging with potential clients, investors, and the media, providing a transparent view of the company's commitment to sustainability.

The company leverages professional social media channels to amplify its message and connect with a wider audience. As of early 2024, Eolus Vind actively shared updates on project milestones and industry insights across platforms like LinkedIn, reinforcing its brand presence.

- Website as Information Hub: Eolus Vind's website serves as the primary source for project portfolios, service offerings, and corporate governance information.

- Investor Relations: Financial reports, press releases, and investor presentations are readily available, facilitating informed decision-making for stakeholders.

- Digital Reach: Beyond the website, Eolus utilizes social media to disseminate news, engage with the community, and highlight its contributions to renewable energy.

Referral Networks and Existing Client Relationships

Eolus Vind's business model thrives on the power of its existing client relationships and referral networks. A strong track record of successful project execution, particularly in renewable energy development, fosters trust and encourages repeat business and word-of-mouth marketing. This organic growth channel is crucial for expanding its reach and securing new opportunities.

Satisfied customers and partners act as invaluable brand ambassadors for Eolus. Their positive experiences and testimonials directly translate into new leads and partnerships, reducing customer acquisition costs. This highlights the strategic importance of maintaining high levels of customer satisfaction and nurturing long-term relationships.

- Referral Driven Growth: Eolus leverages its proven success in renewable energy projects to generate business through client referrals, reducing reliance on more costly acquisition channels.

- Client Advocacy: Existing clients and partners become vocal advocates, endorsing Eolus's capabilities and opening doors to new projects and collaborations.

- Long-Term Value: The emphasis on customer satisfaction cultivates enduring relationships, ensuring a steady stream of repeat business and organic market expansion.

Eolus Vind's communication strategy is multi-faceted, encompassing direct engagement, digital platforms, and industry presence. The company's website acts as a central repository for project details and financial information, while social media amplifies its reach. Participation in industry events in 2024, such as the WindEurope conference, yielded significant new project leads.

The company's investor relations efforts are robust, utilizing annual reports, press releases, and investor calls to disseminate financial data and strategic updates. This transparency is key to attracting and retaining its target audience of financially-literate decision-makers.

Leveraging existing client relationships and referrals is a critical channel for Eolus Vind. Successful project execution in 2024, including the divestment of 100 MW of onshore wind power, reinforces trust and drives repeat business and word-of-mouth marketing.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Business Development | Engaging institutional investors, energy companies, and corporate clients for customized project sales. | Facilitated divestment of 100 MW onshore wind in Sweden to a major European energy company in Q1 2024. |

| Investor Relations & Financial Communication | Disseminating financial data and strategic updates via reports, press releases, and calls. | Continued detailed financial performance and project development updates throughout 2024. |

| Industry Events & Trade Shows | Participating in key renewable energy gatherings to generate leads and build relationships. | Significant increase in qualified leads from events like European Utility Week. |

| Website & Digital Platforms | Serving as a comprehensive information hub for projects, services, and financial health; social media for broader engagement. | Active sharing of project milestones and industry insights on platforms like LinkedIn in early 2024. |

| Referral Networks & Client Relationships | Leveraging past successes and satisfied clients for organic growth and new opportunities. | Fostering trust and repeat business through a strong track record of project execution. |

Customer Segments

Institutional investors, including major infrastructure funds and pension plans, represent a key customer segment for Eolus Vind. These entities are primarily driven by the pursuit of stable, long-term returns from de-risked, large-scale renewable energy projects. For example, in 2023, infrastructure funds alone saw global inflows exceeding $200 billion, highlighting their significant capital allocation towards assets like wind farms.

Energy companies and utilities are key customers for Eolus Vind, particularly those aiming to boost their renewable energy output or satisfy regulatory requirements for green energy. These established players, ranging from state-owned entities to private utility firms, acquire Eolus's developed projects to bolster their existing portfolios. For instance, in 2023, the European renewable energy sector saw significant investment, with utilities actively seeking to expand their wind and solar capacity to meet ambitious decarbonization targets.

Large corporations are increasingly prioritizing renewable energy to meet ambitious sustainability targets, driving demand for direct power sourcing. This trend positions them as a significant, albeit evolving, customer segment for Eolus Vind.

These off-takers are actively seeking power purchase agreements (PPAs) for green energy, aiming to reduce their carbon footprint and enhance their corporate image. For example, in 2024, major companies globally committed to sourcing a substantial portion of their energy from renewables, highlighting this growing market need.

Landowners

Landowners are crucial partners for Eolus Vind, as they possess the land necessary for developing wind and solar energy projects. Eolus collaborates with these individuals and entities to secure the rights to utilize their property, often through long-term lease or purchase agreements. This partnership is fundamental to initiating new projects.

Eolus focuses on ensuring these relationships are mutually beneficial, offering fair compensation and fostering a collaborative environment. For instance, in 2024, Eolus continued to actively engage with landowners across its operational regions, securing an additional 500 hectares of land for potential future developments. These agreements are vital for Eolus's project pipeline.

- Site Access: Landowners provide essential access to sites suitable for wind turbines and solar arrays.

- Revenue Sharing: Agreements often include lease payments or revenue-sharing models, providing landowners with a stable income stream.

- Project Enablement: Their willingness to partner directly enables Eolus to proceed with the planning and construction phases of renewable energy projects.

Other Renewable Energy Developers and Project Owners

This segment comprises other renewable energy developers and project owners who may engage with Eolus Vind for various strategic purposes. They might be looking to partner in co-developing new wind or solar farms, acquire projects that Eolus has already advanced through critical development stages, or leverage Eolus's specialized expertise for particular aspects of their own projects, such as permitting or grid connection studies.

Eolus Vind can serve this customer segment in two primary ways: as a seller of fully or partially developed renewable energy projects, thereby providing a pipeline of assets for other owners, or as a specialized service provider offering its development capabilities to assist others in overcoming specific project hurdles. This dynamic interaction strengthens the broader renewable energy sector by facilitating knowledge sharing and resource optimization.

- Collaboration Opportunities: Eolus Vind's involvement in co-development with other entities can accelerate project timelines and share risks, particularly beneficial in complex markets. For instance, in 2024, the European renewable energy market saw increased M&A activity, with developers actively seeking mature projects, a trend Eolus is well-positioned to capitalize on.

- Acquisition of Developed Assets: Other project owners may seek to acquire Eolus's advanced projects to bypass lengthy development phases, thereby reducing time-to-market and associated risks. This strategy is increasingly common as the demand for renewable energy capacity grows rapidly.

- Service Provision: Eolus's specialized development services, such as site assessment, environmental impact studies, and grid connection applications, can be invaluable for developers lacking in-house capabilities or facing specific challenges.

- Ecosystem Strengthening: By fostering these collaborative relationships, Eolus contributes to the overall growth and efficiency of the renewable energy ecosystem, enabling faster deployment of clean energy solutions.

Eolus Vind's customer base is diverse, encompassing institutional investors, energy companies, and large corporations. These groups are primarily motivated by stable, long-term returns, expanding renewable portfolios, and meeting sustainability goals, respectively.

Landowners are fundamental partners, providing the essential sites for project development through lease or purchase agreements. Eolus focuses on mutually beneficial relationships, as demonstrated by securing an additional 500 hectares for potential projects in 2024.

Other renewable energy developers and project owners represent a segment Eolus engages with for co-development, project acquisition, or specialized service provision. This collaboration strengthens the sector, with significant M&A activity in 2024 highlighting demand for mature projects.

| Customer Segment | Primary Motivation | Eolus Vind's Role | 2024 Data Point |

|---|---|---|---|

| Institutional Investors | Stable, long-term returns | Provider of de-risked, large-scale projects | Continued strong inflows into infrastructure funds |

| Energy Companies & Utilities | Increase renewable output, meet regulations | Seller of developed projects | Active expansion of wind and solar capacity |

| Large Corporations | Meet sustainability targets, reduce carbon footprint | Provider of green energy via PPAs | Global commitments to substantial renewable energy sourcing |

| Landowners | Stable income stream, project enablement | Partner for site access and land utilization | Secured 500 hectares for future developments |

| Other Developers/Owners | Co-development, asset acquisition, service needs | Collaborator, project seller, service provider | Increased M&A activity in renewable energy sector |

Cost Structure

Eolus Vind incurs significant upfront costs during the initial project development stages. These include expenses for identifying suitable sites, conducting thorough feasibility studies, and performing environmental impact assessments. For example, in 2023, Eolus Vind reported approximately SEK 350 million in development costs, highlighting the substantial investment required before construction can even begin.

Permitting fees and legal expenses also form a crucial part of these project development costs. Obtaining the necessary approvals and navigating regulatory frameworks can be a complex and costly process. These investments are essential to ensure projects are properly prepared for construction and subsequent sale, laying the groundwork for future revenue streams.

Eolus Vind's cost structure heavily relies on acquiring essential components like wind turbines, solar panels, and battery storage. These upfront investments, alongside the physical construction of wind farms and solar parks, represent a significant financial commitment.

The expenses extend to crucial civil works, the development of grid connection infrastructure, and the specialized installation services required to bring these renewable energy projects online. These are all critical elements in realizing the operational capacity of their assets.

For instance, in 2024, Eolus Vind reported significant capital expenditures related to project development and construction. The company's financial statements for the year indicated that the procurement and installation of wind turbines and associated infrastructure constituted the largest single cost category, directly correlating with the scale and complexity of their ongoing projects.

Eolus Vind's personnel costs are substantial, reflecting the expertise required for renewable energy development. In 2024, salaries, benefits, and ongoing training for their engineers, project managers, and support staff represent a core component of their operational overhead. This investment in human capital is crucial for successfully navigating complex project lifecycles and technological advancements.

Financing and Interest Expenses

Eolus Vind's cost structure is significantly impacted by financing and interest expenses. As a developer that often carries projects through various stages before divestment, the company incurs substantial costs related to loans and bonds used to fund development and construction. For instance, in the first quarter of 2024, Eolus Vind reported financing costs of SEK 130 million, a notable increase from SEK 95 million in the same period of 2023, reflecting higher borrowing costs.

Effective management of these expenses is paramount to Eolus Vind's profitability, particularly in environments characterized by elevated interest rates. The company's ability to secure favorable financing terms directly influences its project economics and overall financial health.

- Financing Costs: Eolus Vind incurs significant interest payments on debt used for project development and construction.

- Interest Rate Sensitivity: Profitability is sensitive to changes in interest rates, with higher rates increasing financing expenses.

- Q1 2024 Impact: Financing costs rose to SEK 130 million in Q1 2024, up from SEK 95 million in Q1 2023, highlighting the impact of market conditions.

- Strategic Importance: Managing these costs is crucial for maintaining healthy project margins and overall financial performance.

Operation and Maintenance (O&M) Costs

Eolus Vind incurs operation and maintenance (O&M) costs, even for projects slated for sale, covering the critical commissioning and initial operational periods before a project is handed over. These expenses are fundamental to ensuring the smooth functioning and early performance of wind energy assets.

For projects Eolus manages long-term as an asset owner, O&M costs are continuous. They encompass essential activities like routine servicing, necessary repairs to keep turbines running efficiently, and ongoing monitoring of performance and potential issues. In 2023, Eolus Vind reported that its O&M segment generated revenues of SEK 689 million, indicating the scale of these operations.

- Commissioning and Initial Operations: Costs incurred before project sale, ensuring smooth handover.

- Ongoing Asset Management: Routine maintenance, repairs, and monitoring for long-term owned assets.

- Cost Recovery: While often passed on to clients, these costs are integral to Eolus's service delivery model.

Eolus Vind's cost structure is dominated by significant capital expenditures for turbine procurement and construction, as seen in their 2024 financial reports where these constituted the largest cost category. Project development, including site identification and feasibility studies, also represents a substantial upfront investment, with SEK 350 million reported in development costs in 2023. Personnel costs, covering skilled engineers and project managers, are a core operational overhead, essential for navigating complex projects.

| Cost Category | 2023 (SEK millions) | 2024 (SEK millions) | Notes |

|---|---|---|---|

| Project Development | 350 | (Specific data not available for 2024 in provided text) | Includes feasibility studies, site identification, environmental assessments. |

| Capital Expenditures (Turbines & Infrastructure) | (Specific data not available for 2023 in provided text) | Largest single cost category | Procurement and installation of wind turbines and associated infrastructure. |

| Personnel Costs | (Specific data not available for 2023 in provided text) | Core operational overhead | Salaries, benefits, and training for engineers, project managers. |

| Financing Costs | 95 (Q1 2023) | 130 (Q1 2024) | Interest on debt for development and construction. |

| Operation & Maintenance (O&M) Revenue | 689 | (Specific data not available for 2024 in provided text) | Revenue from O&M services, indicating scale of operations. |

Revenue Streams

Eolus Vind AB's main income comes from selling wind, solar, and battery storage projects that they've fully developed or built. These projects are typically sold to big investors, utility companies, and other energy firms.

The company often receives payments at different stages of a project's development, with a large portion coming when the project is finished. For instance, their recent sales of the Pome battery project and the Stor-Skälsjön wind farm highlight this revenue model.

Eolus generates stable, recurring income through its asset management services, offering long-term operation and maintenance for renewable energy projects owned by clients. These fees are often calculated based on the capacity of the facilities under management or as a portion of the project's revenue, ensuring a predictable income stream.

Eolus Vind generates revenue through milestone payments as projects progress through development and construction. These payments are particularly significant for projects divested early in their lifecycle. For instance, the Centennial Flats project in the USA provided a notable milestone payment, underscoring the value of this revenue stream.

Development and Consulting Fees

Eolus Vind can also earn money by offering specialized development and consulting services. This is separate from selling entire projects. They use their deep knowledge in areas like evaluating potential wind farm sites, navigating the permitting process, and structuring projects to help partners or other developers.

These consulting and development fees add another layer to their revenue, making it more varied. For instance, in 2024, Eolus reported significant income from such specialized services, demonstrating the value of their expertise beyond just project sales.

- Development Services: Offering expertise in site selection, feasibility studies, and technical design for renewable energy projects.

- Consulting Fees: Providing strategic advice on permitting, regulatory compliance, and project financing to industry partners.

- Knowledge Transfer: Leveraging their experience to guide new market entrants or assist in the development of complex projects.

- Diversified Income: These fees contribute to a more stable and varied income stream, reducing reliance on project divestments alone.

Electricity Sales (from owned assets)

While Eolus Vind primarily focuses on developing and selling renewable energy projects, it also generates revenue through the direct sale of electricity from assets it owns or operates. This can happen before a project is fully sold or for a portion of its portfolio kept for long-term income. For instance, in 2024, Eolus continued to manage and sell electricity from its operational projects, contributing to its overall financial performance and providing valuable hands-on operational experience.

This direct electricity sales stream provides a consistent cash flow, which is crucial for reinvestment in new development activities and strengthens Eolus's financial stability. By retaining ownership of certain assets, Eolus can benefit from the ongoing revenue generated by these renewable energy sources, demonstrating a diversified approach to its business model.

- Direct Electricity Sales: Revenue generated from selling power produced by Eolus-owned or operated renewable energy assets.

- Cash Flow Generation: Provides a stable income stream, supporting ongoing operations and development.

- Operational Experience: Retaining assets allows for direct engagement with energy market dynamics and operational best practices.

Eolus Vind's revenue streams are diverse, primarily stemming from the sale of fully developed renewable energy projects, often to large investors and utility companies. These sales can include significant milestone payments as projects progress, as seen with the Centennial Flats project in the USA. Furthermore, the company secures recurring income through asset management services, maintaining operational projects for clients. In 2024, Eolus also generated substantial revenue from specialized development and consulting services, leveraging their expertise in site selection and permitting.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Project Sales | Selling fully developed wind, solar, and battery storage projects. | Key projects like Pome battery and Stor-Skälsjön wind farm contributed significantly. |

| Asset Management | Long-term operation and maintenance of client-owned renewable energy projects. | Provides stable, recurring income based on managed capacity or revenue share. |

| Development & Consulting | Specialized services in site selection, permitting, and project structuring. | Reported significant income from these services in 2024, diversifying revenue. |

| Direct Electricity Sales | Selling power from Eolus-owned or operated assets. | Contributes to consistent cash flow and operational experience, as seen in 2024. |

Business Model Canvas Data Sources

The Eolus Vind Business Model Canvas is built upon comprehensive market analysis, operational efficiency data, and financial projections. These sources ensure a robust understanding of customer needs, competitive landscape, and revenue potential.