Eolus Vind Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eolus Vind Bundle

Eolus Vind operates in a dynamic energy sector where buyer power and the threat of substitutes significantly influence profitability. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Eolus Vind’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global wind turbine manufacturing market is notably concentrated. In 2024, Chinese firms such as Goldwind, Envision, Mingyang, and Windey held the top four global market share positions. Vestas is the sole non-Chinese company within this top tier, meaning Eolus Vind likely deals with a very limited number of primary suppliers for its essential wind turbine technology.

This limited supplier base grants significant leverage to these dominant manufacturers. For Eolus Vind, this concentration translates into reduced options when sourcing turbines, potentially increasing costs and impacting contract terms. This supplier power is particularly pronounced when Eolus Vind undertakes large-scale wind farm developments requiring substantial turbine orders.

The renewable energy sector, and wind power specifically, continues to grapple with significant supply chain hurdles for critical components and efficient logistics. These ongoing issues mean that securing necessary parts on time and at predictable costs remains a challenge for developers like Eolus Vind.

Furthermore, the intricate web of permitting processes, which can often stretch beyond five years, coupled with persistent grid connection delays, introduces substantial project timelines and escalates costs for renewable energy developers. These complexities can inadvertently bolster the bargaining power of suppliers, as they might also encounter increased expenses or delivery setbacks, potentially passing these onto Eolus Vind.

Eolus Vind's reliance on specialized Engineering, Procurement, and Construction (EPC) firms and skilled labor for its wind and solar projects significantly influences supplier power. These specialized entities possess unique expertise crucial for project execution.

The renewable energy sector is experiencing a notable shortage of skilled labor, a trend that began intensifying in the early 2020s and continued through 2024. This scarcity directly translates to increased labor costs and bolsters the negotiating leverage of specialized construction companies and their workforces.

This dependence on a finite pool of specialized expertise and a constrained workforce grants considerable bargaining power to suppliers, potentially impacting Eolus Vind's project timelines and overall development costs.

Land Availability and Landowner Influence

Securing suitable land is absolutely critical for Eolus Vind's wind and solar projects. Without it, there are no projects. This makes landowners a key factor in their success.

In areas where good land is scarce, or where there's local pushback against wind farms, landowners can wield considerable influence. This is especially true in 2024, as the demand for renewable energy sites continues to grow, putting pressure on available land resources.

The sheer amount of land required for large-scale wind and solar developments means that Eolus Vind might face increased costs for acquiring or leasing these sites. For instance, in Sweden, land lease agreements can range from SEK 3,000 to SEK 8,000 per hectare annually, depending on the location and the specific terms of the agreement.

- Land Availability: Limited desirable locations for wind and solar farms increase landowner leverage.

- Local Opposition: Community sentiment can significantly impact land acquisition costs and project timelines.

- Leasing Costs: The substantial land needs of renewable projects can drive up annual lease payments for Eolus Vind, impacting project economics.

Financing Institutions and Capital Providers

Financiers, including banks and capital providers, hold significant bargaining power over Eolus Vind. The company relies on these institutions for project financing, and the terms they offer directly impact project viability and profitability. For instance, in 2023, global interest rates saw continued increases, affecting the cost of capital for renewable energy projects.

While the green finance sector is expanding, with a growing appetite for renewable energy investments, access to capital can still be influenced by broader economic conditions and lender risk assessments. The sheer volume of capital required for Eolus Vind's wind farm developments means that financiers can often negotiate favorable terms, potentially increasing Eolus Vind's financing costs.

- Availability and Cost of Capital: The willingness of banks and other financial institutions to fund Eolus Vind's projects, and the interest rates they charge, are key determinants of their supplier power.

- Market Conditions: Fluctuations in global financial markets and macroeconomic volatility can affect the availability and cost of capital, thereby influencing financier bargaining power.

- Project Scale: The substantial capital requirements for large-scale renewable energy projects amplify the leverage of capital providers in negotiating financing terms.

The bargaining power of suppliers for Eolus Vind is significant, primarily stemming from the concentrated nature of the wind turbine manufacturing market. In 2024, the top four global market share holders were Chinese firms, with Vestas being the only non-Chinese entity. This limited supplier pool means Eolus Vind has fewer options for sourcing critical turbine technology, potentially leading to higher costs and less favorable contract terms.

The renewable energy sector also faces ongoing supply chain challenges for components and logistics, further empowering suppliers. Additionally, shortages in skilled labor, a trend noted through 2024, increase costs and negotiation leverage for specialized EPC firms and their workforce, impacting Eolus Vind's project execution and development expenses.

Landowners also exert considerable bargaining power, especially in desirable locations or where local opposition exists. The substantial land needs for wind farms mean Eolus Vind may face increased acquisition or leasing costs, with Swedish land lease agreements potentially ranging from SEK 3,000 to SEK 8,000 per hectare annually.

Financiers, such as banks, also hold significant sway due to Eolus Vind's reliance on them for project funding. Despite the growth in green finance, the cost of capital, influenced by global interest rates as seen with increases in 2023, can be negotiated favorably by lenders, impacting project profitability.

| Factor | Impact on Eolus Vind | Supporting Data (2023-2024) |

| Turbine Manufacturers Concentration | Reduced negotiation options, potential cost increases | Top 4 global turbine manufacturers in 2024 are Chinese firms (Goldwind, Envision, Mingyang, Windey); Vestas is the only non-Chinese in top tier. |

| Supply Chain Disruptions | Increased costs and delivery delays for components | Ongoing challenges in renewable energy sector for critical components and logistics. |

| Skilled Labor Shortage | Higher labor costs, increased leverage for EPC firms | Intensified since early 2020s, continuing through 2024. |

| Land Availability & Opposition | Higher land acquisition/leasing costs, project delays | Swedish land lease costs: SEK 3,000-SEK 8,000 per hectare annually. |

| Financier Bargaining Power | Higher financing costs, less favorable terms | Global interest rates saw continued increases in 2023, affecting cost of capital. |

What is included in the product

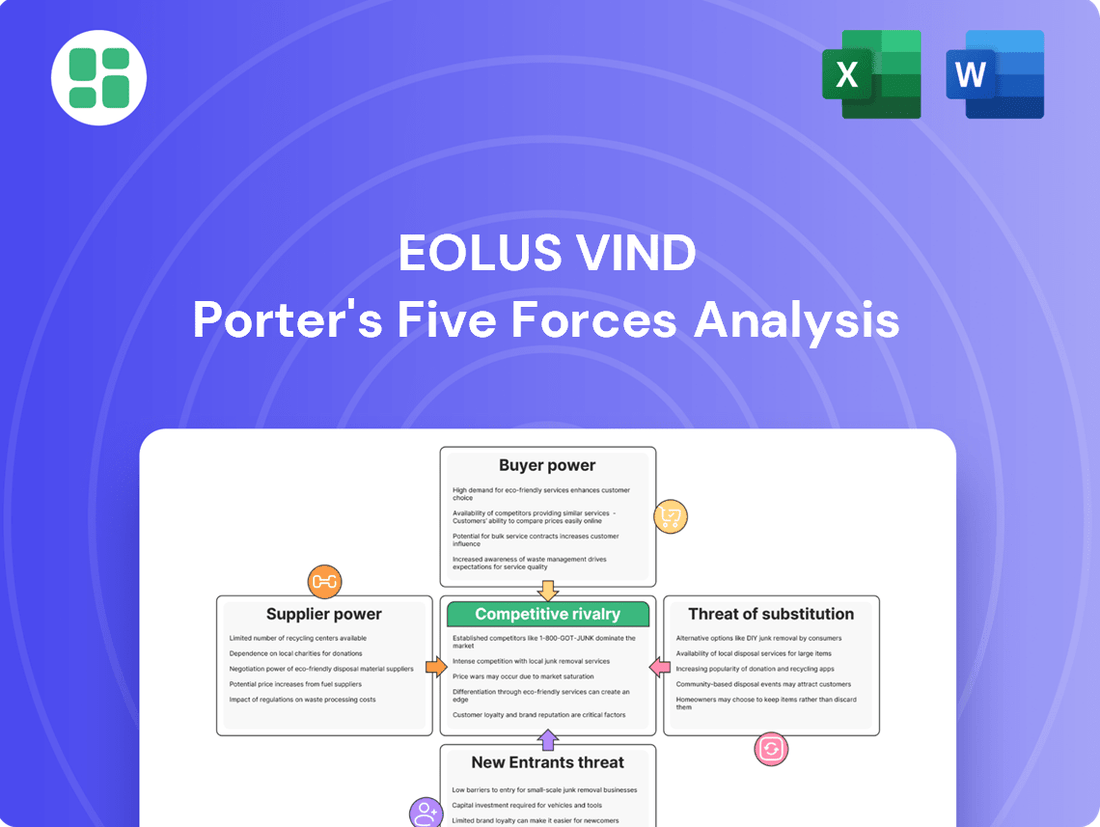

Tailored exclusively for Eolus Vind, analyzing its position within its competitive landscape by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and existing industry rivalry.

Instantly visualize competitive pressures with a dynamic, interactive Eolus Vind Porter's Five Forces model, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Eolus Vind's key customers are typically institutional investors, private equity firms, and utility companies that purchase complete renewable energy projects. This concentrated customer base, while significant, is balanced by the increasing demand for clean energy solutions.

The corporate procurement of renewable energy reached record levels in 2023, with tech giants and data centers leading the charge, seeking substantial volumes of clean power. This trend is expected to continue into 2024, creating a seller's market.

This strong and growing demand, often exceeding the available supply of developed projects, inherently diminishes the bargaining power of these large corporate and institutional customers. They are more inclined to accept terms that reflect the high demand for Eolus Vind's offerings.

Eolus Vind frequently enters into long-term Power Purchase Agreements (PPAs) with energy buyers, or it sells projects that already have these agreements in place. This strategy is crucial for securing predictable revenue and reducing the financial risks associated with fluctuating energy prices or sales volumes.

These PPAs are structured to protect project cash flows from broader economic instability. For instance, in 2023, Eolus Vind reported that 90% of its contracted production was covered by PPAs, highlighting the significant reliance on these long-term agreements for financial stability.

The customer's demand for such long-term contracts indicates a priority on energy security and stable pricing over immediate price negotiation advantages. This suggests customers possess considerable bargaining power, as they can dictate terms that ensure their long-term energy needs are met reliably and predictably.

Eolus Vind's strategy of developing projects to a mature stage before divesting them means its customers are often acquiring operational or near-operational assets. This reduces customer bargaining power as the most complex development risks have already been mitigated by Eolus. For instance, the sale of the Pome battery project and the Fageråsen wind project to investors highlights this model, where buyers are purchasing de-risked, advanced assets.

Focus on Green Investments and ESG Mandates

Many of Eolus Vind's potential customers, particularly large corporations and investment funds, are increasingly driven by Environmental, Social, and Governance (ESG) mandates. These commitments often translate into a strong preference for renewable energy sources, influencing their purchasing decisions. This focus on sustainability can lead to customers being less sensitive to price and more attuned to the long-term value and reliability of green energy projects.

This customer focus on ESG strengthens Eolus Vind's bargaining position. For instance, in 2024, the global sustainable investment market continued its upward trajectory, with ESG-focused funds attracting significant inflows. Companies actively seeking to meet their renewable energy targets, often spurred by regulatory pressures and investor demands, are more likely to engage with developers like Eolus Vind who can demonstrably meet these criteria.

- ESG Mandates Drive Demand: Corporate and investment fund clients prioritize renewable energy to meet ESG goals.

- Reduced Price Sensitivity: Customers focused on sustainability may be less concerned with short-term price fluctuations.

- Long-Term Value Focus: Emphasis shifts to the reliability and environmental benefits of clean energy projects.

- Strengthened Negotiation Position: Eolus Vind's alignment with ESG trends enhances its leverage with these customers.

Diverse Geographic Market Presence

Eolus Vind's operation across diverse geographies, including the Nordics, Baltics, Poland, and the USA, significantly dilutes customer bargaining power. This broad market footprint means that no single customer or regional market segment holds substantial sway over the company's pricing or terms. For instance, Eolus Vind's 2024 project pipeline across these regions offers a wide array of potential buyers, preventing any one customer from dictating terms due to their importance.

The ability to engage with customers in multiple distinct markets provides Eolus Vind with considerable flexibility. If one region experiences a downturn or increased customer demands, the company can shift its focus and resources to other, more favorable markets. This strategic diversification reduces the concentration of customer power, as the threat of losing a single customer is less impactful when numerous alternatives exist.

- Geographic Diversification: Eolus Vind operates in the Nordics, Baltics, Poland, and the USA.

- Reduced Customer Dependence: Diversified markets lessen reliance on any single customer base.

- Market Flexibility: Ability to sell projects in various regions mitigates concentrated customer power.

- 2024 Pipeline Strength: A robust project pipeline across these areas in 2024 underscores this diversification.

Eolus Vind's customer base, primarily large institutional buyers, has limited bargaining power due to the escalating demand for renewable energy projects. The company's strategic focus on developing projects to an advanced, de-risked stage further consolidates its negotiating position.

The increasing emphasis on ESG mandates among corporate clients and investors also diminishes their price sensitivity, as the priority shifts towards securing sustainable energy solutions. This trend, evident in the continued growth of sustainable investments throughout 2024, strengthens Eolus Vind's leverage.

Furthermore, Eolus Vind's diversified geographic presence across multiple markets, including the Nordics, Baltics, Poland, and the USA, prevents any single customer or region from exerting significant influence over the company's terms.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Demand for Renewables | Decreased | Record corporate procurement in 2023, continuing into 2024, creates a seller's market. |

| Project Development Stage | Decreased | Customers purchase de-risked, advanced assets, reducing their need to negotiate on development risks. |

| ESG Mandates | Decreased | ESG focus reduces price sensitivity; global sustainable investment market growth in 2024 reinforces this. |

| Geographic Diversification | Decreased | Operations in multiple regions (Nordics, Baltics, Poland, USA) dilute concentrated customer power. |

Preview Before You Purchase

Eolus Vind Porter's Five Forces Analysis

This preview showcases the complete Eolus Vind Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the wind energy sector. The document you see here is precisely what you will receive immediately after purchase, ensuring transparency and immediate access to valuable strategic insights. This professionally formatted analysis is ready for your immediate use, providing a comprehensive understanding of industry rivalry, buyer and supplier power, the threat of new entrants, and the menace of substitute products.

Rivalry Among Competitors

The renewable energy sector is incredibly dynamic, boasting over 145,000 companies and 8,100 startups worldwide as of early 2025. This sheer volume of players fuels intense competition, creating a fragmented yet rapidly expanding landscape.

While global wind turbine installations reached a record high in 2024, with significant contributions from emerging markets, growth outside of China experienced a slowdown. This suggests that while the overall market is expanding, competitive pressures may be more pronounced in certain regions, impacting Eolus Vind's market share and pricing power.

Eolus Vind navigates a highly competitive landscape, facing established large utility companies that possess significant in-house development expertise and capital. These giants often have existing infrastructure and strong relationships, making it challenging for Eolus Vind to compete for prime locations and resources.

Beyond utilities, numerous specialized renewable energy developers actively vie for market share, creating a crowded field. This includes both global players and other regional firms, all striving to secure the most promising wind and solar farm sites, crucial permits, and essential grid connection agreements.

The urgency to secure these critical project components fuels a fierce bidding environment for land, permits, and grid access. For instance, in 2024, the average lead time for obtaining permits for new wind farm projects in key European markets often exceeded 2-3 years, highlighting the bottleneck and competitive pressure.

Despite strong policy backing for renewable energy, developers like Eolus Vind frequently encounter significant regulatory and permitting bottlenecks across Europe and globally. These complexities can lead to extended project timelines, with some onshore wind projects facing average permitting durations of 2-4 years in key markets. This creates intense competition for the finite pool of projects that successfully navigate these often lengthy and intricate approval processes, directly impacting the pace of development and market entry.

Technological Advancements and Efficiency Race

The wind energy sector is in a perpetual race driven by rapid technological advancements. Companies are heavily investing in research and development to create larger, more efficient wind turbines and to innovate in energy storage solutions, such as advanced battery technologies. For instance, Vestas, a leading wind turbine manufacturer, reported a significant increase in its R&D spending in 2023, aiming to enhance turbine performance and reduce the levelized cost of energy (LCOE). This constant push for innovation creates immense competitive pressure, compelling firms to adopt the newest technologies to maintain market viability and cost-effectiveness.

This efficiency race is directly impacting competitive rivalry. Companies that fail to invest in and implement cutting-edge technology risk falling behind in terms of energy output and operational costs. The ongoing development of direct drive turbines, for example, promises higher reliability and lower maintenance, further intensifying the need for technological adoption. By 2024, the average capacity of newly installed onshore wind turbines globally is expected to continue its upward trend, reflecting this technological evolution and the competitive need to deploy more powerful units.

- Technological Advancements: Continued improvements in turbine design, including larger rotor diameters and taller towers, are increasing energy capture efficiency.

- Energy Storage Integration: Innovations in battery storage are becoming crucial for grid stability and maximizing the value of wind power, leading to increased investment in hybrid projects.

- R&D Investment: Companies like Siemens Gamesa and GE Renewable Energy are prioritizing R&D to drive down LCOE and improve the performance of their wind turbine portfolios.

- Cost Reduction Pressure: The drive for lower manufacturing and operational costs necessitates the adoption of the latest, most efficient technologies to remain competitive.

Geographic Market Focus and Specialization

Eolus Vind's strategic focus on wind and solar power development, spanning the entire value chain, positions it with a degree of specialization. Its operational footprint in key regions such as the Nordics, Baltics, Poland, and the USA allows for concentrated expertise and market understanding.

However, this specialization faces direct competition. Many other renewable energy developers also cultivate strong regional presences or concentrate on specific technologies, leading to intense rivalry within these specialized niches. For instance, in 2024, the Nordics continued to see significant investment in offshore wind, a sector where multiple international players compete with Eolus Vind.

- Regional Specialization: Eolus Vind's presence in the Nordics, Baltics, Poland, and USA allows for targeted market strategies and operational efficiencies.

- Technological Focus: Concentration on wind and solar power development across the value chain offers specialized expertise.

- Competitive Landscape: Other developers with similar regional strengths or technology specializations create direct competitive pressure.

- Market Dynamics: The 2024 offshore wind market in the Nordics exemplifies areas where Eolus Vind faces established, specialized competitors.

Competitive rivalry in the renewable energy sector, particularly for wind power, is fierce due to a vast number of players and rapid technological advancements. Eolus Vind faces competition from large utilities with established infrastructure and specialized developers vying for prime project sites, permits, and grid connections.

The drive for efficiency through technological innovation, such as larger turbines and improved storage, intensifies this rivalry, forcing companies to adopt the latest technologies to remain cost-effective. For example, global wind turbine installations saw significant growth in 2024, with many regions experiencing increased competition for available projects.

Eolus Vind's specialization in wind and solar development in regions like the Nordics and USA also means it competes directly with other developers possessing similar regional strengths or technological focuses, intensifying rivalry within these niches.

| Metric | 2023 Data | 2024 Projection/Trend | Impact on Rivalry |

|---|---|---|---|

| Global Renewable Energy Companies | ~145,000+ | Continued growth, fragmentation | Increased competition for market share |

| Global Wind Turbine Installations | Record high | Continued expansion, regional variations | Intensified competition for projects and resources |

| Average Onshore Wind Turbine Capacity | Increasing | Further upward trend expected | Need for investment in latest technology to compete |

| Permitting Duration (Key European Markets) | 2-4 years (onshore wind) | Persistent bottleneck | Heightened competition for projects that clear hurdles |

SSubstitutes Threaten

While the cost-competitiveness of renewables is undeniable, with 91% of new projects in 2024 being cheaper than fossil fuels, the threat of substitutes for wind energy isn't entirely eliminated. Natural gas, for instance, continues to hold a substantial portion of the electricity generation mix in many regions. This means that for certain industrial processes or in markets with existing, low-cost natural gas infrastructure, it can still present a viable alternative to large-scale wind projects.

The rise of distributed energy systems, like rooftop solar and localized mini-grids, poses a significant threat of substitution for traditional utility-scale wind and solar projects. These decentralized solutions are particularly appealing in emerging markets, with the Global South seeing substantial growth. For instance, installations of distributed solar in Africa have been rapidly expanding, offering a more accessible entry point for energy generation compared to massive centralized farms.

Significant breakthroughs in battery energy storage systems (BESS) are revolutionizing the power grid. For instance, by the end of 2023, global BESS capacity reached approximately 33 GW, a substantial increase from previous years, making decarbonization more economically viable and boosting off-grid distributed energy systems.

Enhanced energy efficiency measures and sophisticated demand-side management strategies are also playing a crucial role. These advancements can significantly reduce overall energy consumption, thereby lessening the demand for new, large-scale generation capacity, which directly impacts the threat of substitutes for traditional energy providers.

Other Renewable Energy Technologies

Beyond wind and solar, other renewable energy sources present a threat of substitution for Eolus Vind. Hydropower, geothermal, biomass, and developing technologies like green hydrogen can fulfill similar energy needs. A substantial reallocation of capital or favorable policy shifts towards these alternatives could diminish the market demand for Eolus Vind's core wind and solar projects.

For instance, global investment in renewable energy sources other than wind and solar is substantial. In 2023, investments in solar power reached approximately $320 billion, while wind power attracted around $190 billion. However, other renewables like hydropower and battery storage also saw significant funding, indicating a competitive landscape where Eolus Vind must remain adaptable.

- Hydropower's Enduring Role: Hydropower continues to be a major contributor to global renewable energy generation, often providing a stable baseload power source that can substitute for intermittent wind and solar.

- Geothermal Potential: Geothermal energy, though geographically dependent, offers a consistent and reliable power supply, acting as a direct substitute in regions with suitable geological conditions.

- Biomass and Biofuels: Biomass and biofuels can substitute for fossil fuels in electricity generation and transportation, presenting an alternative pathway to decarbonization that could divert investment from wind and solar.

- Emerging Technologies: Green hydrogen, in particular, is gaining traction as a versatile energy carrier and fuel, with potential applications in sectors currently dominated by fossil fuels, thereby posing a future substitution threat.

Regulatory and Policy Shifts Favoring Alternatives

Government policies and incentives are powerful drivers in the energy sector. A significant shift in regulatory frameworks or increased subsidies for other energy sources, including traditional fossil fuels or different renewable technologies, could elevate their appeal. This would consequently heighten the threat of substitutes to wind and solar projects.

For instance, in 2024, several countries continued to adjust their renewable energy support mechanisms. Some nations reduced feed-in tariffs for solar, while others introduced new tax credits for hydrogen production, potentially drawing investment away from wind and solar. The Inflation Reduction Act in the United States, for example, while bolstering renewables, also includes significant incentives for other clean energy technologies, creating a more competitive landscape.

- Policy Uncertainty: Changes in government subsidies or tax credits for renewable energy can alter the economic viability of wind and solar projects, making alternatives more attractive.

- Emerging Technologies: Increased government support for nascent technologies like advanced nuclear or green hydrogen can divert capital and focus from established wind and solar markets.

- Carbon Pricing: The implementation or modification of carbon pricing mechanisms can influence the relative cost-competitiveness of various energy sources, impacting the threat of substitutes.

- Grid Modernization: Investments in grid infrastructure that favor certain energy sources over others can also indirectly increase the threat of substitutes.

The threat of substitutes for wind energy is multifaceted, encompassing not only other renewable sources but also advancements in energy efficiency and distributed generation. While wind power is increasingly cost-competitive, with 91% of new projects in 2024 being cheaper than fossil fuels, alternatives like natural gas still hold sway in specific industrial applications due to existing infrastructure. Furthermore, distributed energy systems, such as rooftop solar, are gaining traction, particularly in emerging markets, offering a decentralized energy solution.

Breakthroughs in battery energy storage systems (BESS) are also critical, with global capacity reaching approximately 33 GW by the end of 2023, enhancing the viability of off-grid solutions. Energy efficiency measures and demand-side management further reduce the overall need for new generation capacity. Other renewables like hydropower, geothermal, and biomass, alongside emerging technologies like green hydrogen, also present viable alternatives that could divert investment and market share.

Government policies significantly influence this landscape. Shifts in subsidies or tax credits, such as those seen in 2024 with adjustments to solar tariffs and hydrogen production incentives, can alter the competitive balance. For example, while the US Inflation Reduction Act supports renewables broadly, it also incentivizes other clean energy technologies, creating a more dynamic market for Eolus Vind.

| Substitute Energy Source | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Natural Gas | Established infrastructure, lower upfront cost in some regions | Continues to hold a substantial share in electricity generation mix globally. |

| Distributed Solar | Decentralized generation, accessible entry point | Rapid expansion in emerging markets, particularly Africa. |

| Battery Energy Storage Systems (BESS) | Grid stability, enables off-grid solutions | Global capacity reached ~33 GW by end of 2023. |

| Hydropower | Baseload power, stable generation | Major contributor to global renewable energy. |

| Geothermal Energy | Consistent and reliable power, geographically dependent | Offers direct substitution in suitable regions. |

| Biomass/Biofuels | Decarbonization pathway for various sectors | Can divert investment from wind and solar. |

| Green Hydrogen | Versatile energy carrier, future applications | Gaining traction with government support (e.g., US IRA incentives). |

Entrants Threaten

Entering the large-scale renewable energy sector, particularly wind and solar farm development, necessitates massive upfront capital. Eolus Vind's own projects, like a 100 MW battery storage facility with an enterprise value between USD 230 million and USD 235.5 million, clearly illustrate the immense financial commitment involved. This high capital intensity acts as a significant deterrent for potential new competitors.

The lengthy and complex permitting processes for renewable energy projects, particularly wind and solar, present a substantial threat of new entrants. These processes can take several years, demanding thorough environmental impact assessments and extensive engagement with local communities. For instance, Eolus Vind itself faced significant delays and potential rejections with its offshore wind projects in Sweden, highlighting the bureaucratic hurdles.

The need for specialized expertise and experience is a significant barrier for new entrants into the wind and solar power sector, particularly for companies like Eolus Vind that manage the entire project lifecycle. Eolus Vind's deep knowledge in site studies, permitting, construction, financing, and ongoing operations and maintenance across the full value chain requires substantial investment and time to replicate.

Access to Land and Grid Interconnection

Securing suitable land with favorable wind or solar resources and obtaining grid connection capacity are critical and often challenging aspects of renewable energy development. New entrants may find it difficult to acquire prime sites and secure the necessary grid infrastructure, especially as competition intensifies.

Grid access remains a primary bottleneck for scaling renewable energy, particularly in Europe. For instance, in 2023, the European Union faced significant delays in grid connection applications, with some projects waiting years. This situation can deter new companies from entering the market due to the uncertainty and cost associated with grid integration.

- Land Acquisition Challenges: Prime renewable energy sites are becoming scarcer, leading to higher acquisition costs and increased competition for land rights.

- Grid Interconnection Bottlenecks: Many regions, including parts of the US and Europe, have substantial backlogs of renewable energy projects awaiting grid connection approval, delaying or preventing new entrants from operationalizing their assets.

- Infrastructure Costs: The expense and time required to upgrade or build new transmission infrastructure to accommodate new renewable energy capacity can be prohibitive for smaller or newer companies.

- Regulatory Hurdles: Navigating complex permitting processes and securing grid connection agreements can be a significant barrier, favoring established players with existing relationships and expertise.

Existing Players' Scale and Established Relationships

Established players like Eolus Vind leverage significant economies of scale, resulting in lower per-unit production costs for wind energy. For instance, in 2024, major wind farm developers often operate projects exceeding 200 MW, allowing for bulk purchasing of turbines and components, a feat difficult for smaller, newer entrants to replicate. Their existing project pipelines also provide a predictable revenue stream and operational expertise, making them more attractive to financiers.

Furthermore, Eolus Vind and similar companies have cultivated deep, long-standing relationships with key suppliers, financiers, and local stakeholders, including landowners and regulatory bodies. These established connections are crucial for securing favorable contract terms, accessing capital efficiently, and navigating permitting processes smoothly. A new entrant would face a considerable challenge in replicating this network of trust and influence, potentially leading to higher initial costs and longer development timelines.

- Economies of Scale: Larger project sizes lead to reduced per-unit costs in turbine acquisition and installation.

- Established Relationships: Strong ties with suppliers, financiers, and local communities facilitate smoother operations and better terms.

- Project Pipeline Advantage: Existing projects offer predictable revenue and operational experience, enhancing financial attractiveness.

- Barriers to Entry: Newcomers must overcome significant capital requirements and the need to build comparable networks.

The threat of new entrants in the renewable energy sector, particularly for wind power development like Eolus Vind, is moderate. While the sector offers attractive growth prospects, significant barriers to entry exist, including high capital requirements and complex regulatory landscapes.

New companies must contend with substantial upfront investment, as demonstrated by Eolus Vind's large-scale projects, and navigate lengthy permitting processes that can span years. Building specialized expertise across the entire project lifecycle, from site assessment to operations, also presents a considerable challenge for newcomers.

Established players benefit from economies of scale, with larger projects in 2024 often exceeding 200 MW, allowing for cost advantages in procurement. Furthermore, Eolus Vind's established relationships with suppliers, financiers, and stakeholders create a competitive moat that new entrants would struggle to replicate quickly.

| Barrier | Description | Impact on New Entrants |

| Capital Intensity | Massive upfront investment required for projects. Eolus Vind's projects often involve hundreds of millions of dollars. | High; limits the number of potential entrants. |

| Permitting & Regulation | Lengthy and complex approval processes, environmental assessments, and community engagement. | High; requires significant time, resources, and expertise. |

| Specialized Expertise | Need for deep knowledge in site selection, construction, financing, and operations. | High; difficult and time-consuming to build. |

| Economies of Scale | Larger project sizes reduce per-unit costs for established players. | Moderate; new entrants can potentially partner or focus on niche markets. |

| Established Relationships | Strong ties with suppliers, financiers, and regulators. | Moderate; can be built over time but requires initial effort. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eolus Vind is built upon a foundation of publicly available financial reports, industry-specific market research, and regulatory filings. We also incorporate data from reputable energy sector publications and macroeconomic indicators to provide a comprehensive view of the competitive landscape.