Entegris PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Entegris Bundle

Navigate the complex external forces shaping Entegris's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements create both opportunities and challenges for the company. Download the full version to gain actionable intelligence and refine your strategic approach.

Political factors

Government policies like the U.S. CHIPS and Science Act, signed into law in August 2022, and similar initiatives in Europe are injecting billions into domestic semiconductor manufacturing and R&D. These acts offer substantial incentives, including tax credits and grants, to bolster local supply chains and reduce dependence on overseas production. For Entegris, a key supplier of advanced materials and solutions for chip manufacturing, this translates into significant growth opportunities as the industry invests heavily in new facilities and expanded capacity.

Ongoing geopolitical tensions, especially between the U.S. and China, continue to shape the semiconductor landscape. Export controls and trade restrictions imposed by the U.S. on advanced technology to China directly affect companies like Entegris, which supplies critical materials and equipment to the sector. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) has implemented measures that limit the sale of certain semiconductor manufacturing equipment and technologies to Chinese entities, impacting global demand and supply chains.

These trade disputes create significant disruptions for Entegris's global supply chain. Restrictions can hinder the movement of specialized chemicals, advanced materials, and manufacturing equipment necessary for semiconductor fabrication. This necessitates strategies like geographical diversification of manufacturing and sourcing to build resilience. In 2024, many companies are actively reassessing their reliance on single regions, seeking to establish more robust and geographically dispersed operations to navigate these complex trade environments.

Export controls on advanced semiconductor materials and equipment, particularly those impacting China, present a significant challenge for Entegris. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has implemented regulations restricting the export of certain advanced technologies and manufacturing equipment. These controls can directly affect Entegris's ability to supply its products to key markets, potentially impacting revenue streams and requiring strategic adjustments to its global supply chain and customer base.

The imposition of import tariffs by various nations can also escalate Entegris's operational costs. For example, tariffs on raw materials or finished goods could increase the cost of production or the price of products for customers. This necessitates careful financial planning and potentially a reassessment of sourcing strategies to mitigate the impact on profitability and competitiveness in a globalized market.

Political Stability in Key Regions

Political stability in regions where Entegris operates, such as the United States, China, South Korea, and Taiwan, is crucial for maintaining smooth operations. For instance, in 2024, the United States continues to be a major hub for Entegris, with its political landscape directly influencing trade policies and R&D investments. Any significant political upheaval in these key areas could disrupt Entegris's supply chains, affect manufacturing output, and introduce considerable uncertainty regarding future investments.

Entegris's extensive global presence means that monitoring political climates across various countries is a continuous necessity. Unforeseen political events or regional conflicts can have immediate repercussions on business continuity. For example, tensions in the Asia-Pacific region, where several critical Entegris facilities and customer bases are located, require constant vigilance. The company's reliance on international markets underscores the importance of stable geopolitical environments for its overall performance and strategic planning.

- United States: Entegris has significant manufacturing and R&D operations in the US, making its political stability a primary concern for supply chain resilience and market access.

- China: As a major market and manufacturing location, political stability in China directly impacts Entegris's access to customers and its production capabilities.

- South Korea & Taiwan: These nations are vital for semiconductor supply chains, and any political instability could severely disrupt Entegris's ability to serve its key semiconductor customers.

- Global Impact: Entegris's diversified operational footprint necessitates a proactive approach to understanding and mitigating risks associated with political instability in all operating regions.

Government R&D Funding

Government investment in advanced materials and semiconductor research is a significant tailwind for Entegris. For instance, the CHIPS and Science Act, enacted in 2022, allocated substantial funding, with over $52 billion earmarked for semiconductor manufacturing and R&D in the United States. This directly benefits companies like Entegris that provide critical materials and solutions for the semiconductor industry, accelerating the development of new technologies.

These government initiatives create a more fertile ground for innovation. By supporting foundational research and development, governments encourage the creation of next-generation purification, protection, and transport solutions essential for advanced manufacturing processes. This aligns perfectly with Entegris's strategic focus on enabling technological progress through its specialized product offerings.

The impact of this funding can be seen in several key areas:

- Accelerated Innovation: Increased R&D funding directly fuels the development of advanced materials and processes that Entegris specializes in.

- Market Expansion: Government support for domestic semiconductor manufacturing incentivizes the adoption of cutting-edge solutions, creating new market opportunities for Entegris.

- Favorable Policy Environment: Policies promoting technological advancement and domestic production foster a supportive ecosystem for companies operating in critical technology sectors.

- Enhanced Competitiveness: Government backing helps to bolster the overall competitiveness of the domestic semiconductor supply chain, benefiting all its participants.

Government incentives like the U.S. CHIPS and Science Act, with over $52 billion for semiconductor R&D and manufacturing, directly benefit Entegris by stimulating investment in domestic chip production. This creates a robust demand for Entegris's advanced materials and solutions. Furthermore, ongoing geopolitical tensions, particularly U.S.-China trade restrictions, necessitate supply chain diversification, a trend Entegris is actively addressing to ensure resilience and continuity in its global operations.

Political stability in key regions like the United States, China, South Korea, and Taiwan is paramount for Entegris's business continuity and strategic planning. For instance, the company's significant presence in these areas means that any political instability could disrupt its supply chains and manufacturing output. The company actively monitors these climates to mitigate risks associated with its diversified operational footprint.

The political landscape significantly influences Entegris's operational costs and market access. Import tariffs can escalate expenses, while export controls, such as those impacting advanced semiconductor materials to China, directly affect Entegris's ability to supply critical markets. This necessitates strategic adjustments to its global supply chain and customer base to maintain competitiveness.

Government support for advanced materials and semiconductor research, exemplified by initiatives like the CHIPS Act, acts as a significant tailwind for Entegris. This funding accelerates innovation, expands markets for cutting-edge solutions, and fosters a favorable policy environment, enhancing the overall competitiveness of the domestic semiconductor supply chain where Entegris plays a vital role.

What is included in the product

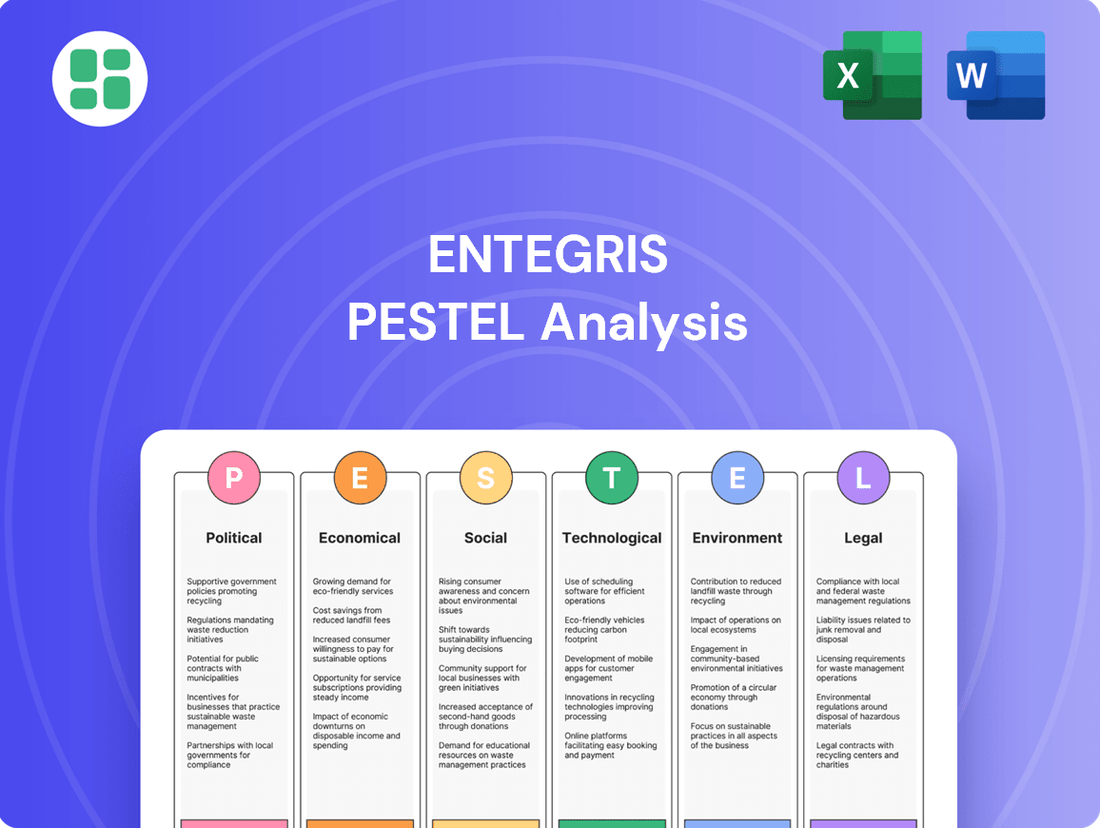

This PESTLE analysis meticulously examines the external macro-environmental factors influencing Entegris, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within Entegris's operating landscape.

Provides a concise PESTLE analysis of Entegris, offering a clear overview of external factors impacting the semiconductor industry, thus alleviating the pain point of information overload for strategic decision-making.

Economic factors

The global semiconductor market is inherently cyclical, experiencing boom and bust periods that significantly influence demand for specialized materials. For Entegris, this means that periods of high chip production translate to increased need for their advanced filtration, purification, and handling solutions. Conversely, downturns can lead to reduced capital expenditure by chip manufacturers, impacting Entegris's order volumes.

Despite the cyclical nature, the semiconductor industry demonstrated strong resilience and growth through 2024. Projections for 2025 indicated continued expansion, with market research firms forecasting global semiconductor revenue to reach approximately $700 billion, building on a strong rebound from earlier periods. This sustained demand highlights the ongoing need for the critical components and materials Entegris provides.

Entegris's financial performance is therefore intrinsically linked to the broader health and investment cycles within the microelectronics and high-tech industries. As chipmakers invest heavily in new fabrication plants and advanced process technologies, Entegris benefits from the demand for its high-purity materials and sophisticated equipment essential for cutting-edge semiconductor manufacturing.

Inflationary pressures continue to be a significant concern for Entegris, impacting key operational areas. For instance, the cost of critical raw materials, essential for semiconductor manufacturing, saw notable increases throughout 2024. Logistics expenses also remained elevated, driven by higher fuel prices and ongoing supply chain disruptions, directly affecting Entegris's ability to deliver products efficiently and at predictable costs.

Entegris must therefore focus on robust supply chain management and dynamic pricing strategies to counter these rising expenses. The company's ability to pass on increased costs to customers, while maintaining competitive positioning, will be crucial for preserving its profit margins in a high-inflation environment. This is particularly important as semiconductor demand can be sensitive to broader economic conditions influenced by inflation.

Sustained inflation can also dampen consumer and business spending, potentially leading to reduced demand in Entegris's end markets. For example, if inflation erodes purchasing power for electronics, this could indirectly impact the demand for the advanced materials and solutions Entegris provides to semiconductor manufacturers. The US Consumer Price Index (CPI) showed a year-over-year increase of 3.4% in April 2024, indicating persistent inflationary trends.

Entegris, as a global player with operations and sales spanning multiple regions, is inherently exposed to the volatility of currency exchange rates. These fluctuations can significantly impact its reported financial performance, affecting everything from revenue and the cost of goods sold to overall profitability when foreign currency transactions are converted into its primary reporting currency.

For instance, in the first quarter of 2024, Entegris reported that foreign currency headwinds had a negative impact on its net sales, contributing to a slight dip compared to the previous year's comparable period. Effective currency risk management strategies, such as hedging, are therefore crucial for maintaining financial stability and predictability in its earnings.

Interest Rate Changes

Changes in global interest rates directly affect Entegris's cost of capital. For instance, if the U.S. Federal Reserve maintains its restrictive monetary policy, as it has signaled through 2024 with elevated rates, Entegris's borrowing costs for significant investments in new manufacturing capacity or research and development will likely remain elevated.

Higher interest rates can dampen overall economic activity, which in turn impacts Entegris's customers. If economic growth slows due to tighter credit conditions, semiconductor manufacturers and other clients may reduce their capital expenditures, leading to decreased demand for Entegris's advanced materials and process solutions.

Conversely, a scenario where central banks begin to lower interest rates, perhaps in response to moderating inflation, could provide a tailwind for Entegris. This would reduce borrowing expenses and potentially stimulate greater investment across the technology sector, boosting demand for Entegris's products.

- Impact on Borrowing Costs: Elevated interest rates, such as those maintained by the Federal Reserve through much of 2024, increase the cost for Entegris to finance capital expenditures, R&D, and potential acquisitions.

- Customer Spending and Investment: Higher rates can lead to reduced economic activity and customer spending, potentially slowing down investment in new facilities and technology upgrades by Entegris's clients in the semiconductor industry.

- Potential Benefits of Moderating Rates: A decrease in interest rates could lower Entegris's financing costs and stimulate broader industry investment, positively impacting demand for its specialized products.

Global Economic Health and Consumer Demand

Entegris's performance is closely tied to the global economic climate and the resulting consumer demand for sophisticated technology. A robust global economy generally fuels increased spending on semiconductors and the advanced materials Entegris provides, directly benefiting its revenue streams.

Conversely, economic downturns can dampen demand, leading to fewer orders and potentially impacting Entegris's financial results. For instance, while global GDP growth was projected to moderate in 2024, the underlying demand drivers for advanced technologies remain strong.

- Semiconductor Market Growth: The global semiconductor market is anticipated to see significant growth, with forecasts suggesting a rebound and expansion through 2025, driven by AI, high-performance computing, and automotive electronics.

- Consumer Spending Trends: Consumer confidence and discretionary spending on electronics, while subject to economic fluctuations, show resilience driven by technological innovation and essential digital services.

- Industry Investment: Major investments in advanced manufacturing capabilities and research and development by key players in the semiconductor and biopharmaceutical sectors signal continued demand for Entegris's specialized products and solutions.

The economic landscape significantly shapes Entegris's operational environment. Persistent inflation, as evidenced by the US CPI at 3.4% year-over-year in April 2024, increases raw material and logistics costs. Elevated interest rates, maintained by the Federal Reserve through 2024, raise Entegris's cost of capital and can dampen customer investment in new semiconductor facilities. Despite these pressures, the semiconductor market is projected for continued growth, with global revenues expected to approach $700 billion in 2025, offering a strong demand base for Entegris's specialized materials.

| Economic Factor | Impact on Entegris | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Inflation | Increased operational costs (raw materials, logistics) | US CPI: 3.4% YoY (April 2024) |

| Interest Rates | Higher cost of capital, potential dampening of customer investment | Federal Reserve maintaining elevated rates through 2024 |

| Global Economic Growth | Influences consumer and business spending on technology | Semiconductor market projected to reach ~$700B in 2025 |

What You See Is What You Get

Entegris PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Entegris delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Entegris's market landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of each PESTLE element, offering a robust framework for understanding Entegris's business environment.

Sociological factors

The semiconductor industry is grappling with a pronounced global shortage of skilled professionals, impacting roles from specialized engineers to manufacturing technicians and construction crews. This talent scarcity directly challenges Entegris's ability to recruit effectively and expand its operations, potentially slowing down the introduction of new technologies and the ramp-up of production capacity.

To address this critical issue, Entegris is actively investing in programs designed to cultivate talent from an early stage. These initiatives, often in collaboration with educational institutions, aim to build a robust pipeline of future employees, ensuring a steady supply of the expertise needed to drive innovation and growth in the coming years.

Consumer demand for advanced electronics is rapidly evolving, with technologies like artificial intelligence (AI), 5G, and the Internet of Things (IoT) at the forefront. This shift means consumers expect more powerful, faster, and more connected devices, pushing the boundaries of what's possible in semiconductor technology. For instance, the global AI chip market was projected to reach $100 billion by 2026, highlighting the significant investment and consumer interest in AI-powered devices.

Entegris's success hinges on its capacity to innovate and adapt its semiconductor materials and processes to meet these demands for next-generation device architectures and miniaturization. The increasing complexity and smaller form factors of these advanced electronics require specialized materials that can ensure performance and reliability. The market for advanced semiconductor materials, crucial for these innovations, is expected to see substantial growth, with some segments potentially doubling in value by 2028.

Societal expectations for corporate social responsibility (CSR) are significantly shaping how companies like Entegris operate and are perceived. Investors and the public increasingly demand ethical business practices, pushing firms to demonstrate tangible commitments to environmental sustainability, robust corporate governance, and genuine diversity and inclusion initiatives. Entegris’s 2023 CSR report, for instance, details their progress in reducing greenhouse gas emissions by 15% compared to 2020 and achieving a 30% representation of women in leadership roles, directly responding to these evolving societal values.

Demographic Shifts and Labor Pool

Demographic shifts significantly shape Entegris's labor pool. For instance, the aging workforce in many developed nations, including the US and parts of Europe, presents challenges in finding experienced talent for specialized manufacturing and R&D roles. This trend contrasts with emerging markets where a younger population offers a larger potential workforce, but may require more extensive training.

The availability and cost of labor are directly impacted by these demographic trends. In 2024, the global semiconductor industry, where Entegris operates, faced a notable talent shortage, with estimates suggesting millions of unfilled positions by 2030. This scarcity drives up labor costs and necessitates strategic workforce planning, including investments in training and development programs.

- Aging Population Impact: In 2023, the median age in Japan, a key market for advanced manufacturing, was around 49 years, highlighting the challenge of a shrinking, aging workforce.

- Youthful Demographics: Conversely, countries like India, a growing hub for tech talent, had a median age of approximately 29 years in 2023, indicating a large pool of younger workers.

- Skills Gap: The demand for highly specialized skills in areas like materials science and advanced manufacturing outpaces supply, a situation exacerbated by demographic changes affecting the pipeline of qualified professionals.

Public Perception of Industry Environmental Impact

Public and regulatory scrutiny regarding the environmental impact of the semiconductor industry, especially concerning chemical usage, waste, and energy consumption, directly influences Entegris. As a key supplier of materials and process solutions, Entegris faces increasing expectations to champion more sustainable manufacturing practices throughout the supply chain. Addressing these environmental concerns is paramount for maintaining its social license to operate and safeguarding its brand reputation in a market increasingly sensitive to ecological footprints.

For instance, in 2024, the industry continued to grapple with the significant water usage in chip fabrication, with some estimates suggesting that producing a single advanced chip can require thousands of gallons of ultrapure water. Furthermore, the disposal of hazardous chemicals used in semiconductor manufacturing remains a persistent challenge, driving demand for innovative recycling and waste reduction technologies. Entegris's commitment to developing and providing solutions that mitigate these impacts is therefore crucial for its continued success and acceptance.

- Growing pressure for reduced chemical waste: The semiconductor sector is a major consumer of specialty chemicals, leading to significant waste streams that require careful management and disposal.

- Demand for energy-efficient solutions: Chip manufacturing is highly energy-intensive, creating a market for suppliers like Entegris who can offer products and services that lower energy consumption.

- Water conservation initiatives: With water scarcity becoming a global concern, the semiconductor industry's substantial water requirements are under intense scrutiny, favoring companies with water-saving technologies.

- Enhanced corporate social responsibility reporting: Stakeholders, including investors and consumers, increasingly demand transparency and accountability regarding environmental performance, pushing companies like Entegris to demonstrate tangible sustainability efforts.

Societal expectations for corporate social responsibility are increasingly influencing Entegris's operations. Consumers and investors alike demand ethical practices, pushing companies to demonstrate commitments to sustainability, governance, and diversity. Entegris's 2023 CSR report highlights a 15% reduction in greenhouse gas emissions from 2020 levels and 30% women in leadership, reflecting these evolving values.

Demographic shifts present a dual challenge and opportunity for Entegris's talent acquisition. An aging workforce in developed nations strains the supply of experienced professionals, while younger populations in emerging markets offer a larger, albeit less experienced, labor pool. This necessitates strategic workforce planning and investment in training to bridge the skills gap.

The semiconductor industry, including Entegris, faces a critical shortage of skilled labor, with millions of positions projected to be unfilled by 2030. This scarcity drives up labor costs and emphasizes the need for robust talent development programs to ensure future operational capacity and innovation.

| Demographic Factor | Impact on Entegris | Relevant Data (2023/2024) |

|---|---|---|

| Aging Workforce (Developed Nations) | Challenges recruitment for specialized roles; potential loss of institutional knowledge. | Median age in Japan: ~49 years. |

| Youthful Workforce (Emerging Markets) | Offers a larger labor pool but requires significant training investment. | Median age in India: ~29 years. |

| Global Skills Gap | Exacerbates talent scarcity, increasing labor costs and impacting production ramp-up. | Millions of unfilled semiconductor jobs projected by 2030. |

Technological factors

The semiconductor industry's relentless innovation, particularly in advanced nodes and chiplet designs, directly fuels demand for Entegris's specialized materials. For instance, the push towards 2nm and beyond requires novel chemical mechanical planarization (CMP) slurries and advanced deposition materials, areas where Entegris holds significant expertise. This rapid evolution, with new process technologies emerging every few years, necessitates continuous R&D investment by Entegris to stay ahead.

Entegris's ability to develop and supply materials that enable these cutting-edge advancements, such as those for EUV lithography or advanced packaging techniques like 2.5D and 3D integration, is critical. The market for advanced semiconductor manufacturing materials is projected to grow significantly; for example, the global semiconductor materials market was valued at approximately $60 billion in 2023 and is expected to reach over $100 billion by 2030, showcasing the substantial opportunity driven by technological progress.

The relentless pursuit of advanced materials like graphene and carbon nanotubes is reshaping industries, promising leaps in device performance and manufacturing efficiency. Entegris, with its deep roots in material science and a commitment to purity, is strategically positioned to capitalize on this trend.

In 2024, the global advanced materials market was valued at approximately $120 billion, with projections indicating substantial growth driven by demand in electronics and clean energy sectors. Entegris's ability to develop and supply these cutting-edge chemical and material solutions represents a significant competitive edge, directly impacting its capacity to serve these expanding markets.

The increasing adoption of automation and AI in semiconductor manufacturing directly influences Entegris's product demand. As chipmakers implement more sophisticated automated processes, the need for advanced materials and solutions that ensure precision and yield, like Entegris's advanced process materials and fluid handling systems, grows. For instance, AI-driven process control in wafer fabrication requires highly pure and consistent consumables, a core offering for Entegris.

Furthermore, AI's role in chip design is spurring demand for next-generation memory and processing solutions. This technological shift necessitates materials that can support higher densities and faster speeds, areas where Entegris's innovation in materials science is critical. The global AI chip market is projected to reach hundreds of billions of dollars in the coming years, underscoring the significant market opportunity for companies like Entegris that enable these advancements.

R&D Investment Trends

Research and development (R&D) spending is a critical driver for Entegris, directly influencing its ability to meet the evolving demands of the semiconductor industry. As chip manufacturers push the limits of Moore's Law and explore new architectures, their R&D investments soar, creating a need for advanced materials and process technologies that Entegris provides. For instance, the global semiconductor R&D spending was projected to reach over $100 billion in 2024, a significant increase from previous years, highlighting the intense focus on innovation.

Entegris strategically aligns its own R&D efforts with these customer-driven advancements. By investing heavily in developing next-generation purification, delivery, and specialty materials, Entegris ensures it can offer solutions that enable breakthroughs in areas like advanced lithography, novel packaging techniques, and next-generation memory technologies. This proactive approach allows them to capitalize on emerging opportunities and maintain a competitive edge.

- Semiconductor R&D Spending Growth: Global semiconductor R&D expenditure is on an upward trajectory, with projections indicating continued robust investment through 2025.

- Customer-Driven Innovation: Increased R&D by semiconductor firms necessitates more sophisticated materials and process solutions from suppliers like Entegris.

- Entegris's Strategic R&D: The company prioritizes R&D to develop cutting-edge materials that support advancements in critical semiconductor manufacturing processes.

Disruptive Technologies

The emergence of disruptive technologies such as quantum computing and advanced bio-manufacturing presents significant opportunities for Entegris. These fields often demand materials with extreme purity and highly precise handling capabilities, areas where Entegris excels. For instance, the development of quantum computers relies on highly purified silicon and specialized materials for qubit fabrication, a market segment Entegris is well-positioned to serve.

Monitoring advancements in next-generation communication, like the anticipated rollout of 6G, is also crucial. 6G networks are expected to require new semiconductor materials and advanced packaging solutions to support higher frequencies and increased data transfer speeds. Entegris's expertise in advanced materials for semiconductor manufacturing directly aligns with these evolving technological needs, potentially opening new revenue streams.

These long-term trends necessitate continuous adaptation of Entegris's product portfolio. By staying ahead of technological shifts, Entegris can proactively develop and supply the specialized materials required for these nascent industries. For example, the bio-manufacturing sector's growth, projected to reach hundreds of billions of dollars by the late 2020s, will likely increase demand for high-purity consumables and filtration solutions.

- Quantum Computing: Requires ultra-pure materials for qubit stability and fabrication.

- Advanced Bio-manufacturing: Growing demand for sterile, high-purity consumables and filtration.

- 6G Communication: Needs novel semiconductor materials and advanced packaging for higher frequencies.

- Market Potential: These disruptive sectors represent significant future growth opportunities for advanced material suppliers.

The semiconductor industry's rapid advancement, particularly in areas like 2nm process nodes and chiplet designs, directly drives demand for Entegris's specialized materials. For instance, the global semiconductor materials market was valued at approximately $60 billion in 2023 and is projected to exceed $100 billion by 2030, underscoring the significant opportunities stemming from technological progress.

Entegris's ability to develop materials enabling cutting-edge technologies such as EUV lithography and advanced packaging is crucial. The increasing integration of AI in chip design also spurs demand for next-generation memory and processing solutions, areas where Entegris's material science innovations are vital. The global AI chip market is expected to reach hundreds of billions of dollars in the coming years.

The company's strategic R&D investments are closely aligned with customer-driven innovation in semiconductor manufacturing, with global R&D spending projected to surpass $100 billion in 2024. Entegris focuses on developing advanced purification, delivery, and specialty materials to support breakthroughs in critical areas like advanced lithography and novel packaging techniques.

Emerging technologies like quantum computing and advanced bio-manufacturing present substantial growth avenues for Entegris, as these fields require materials with extreme purity and precise handling. The bio-manufacturing sector alone is projected to reach hundreds of billions of dollars by the late 2020s, indicating a growing need for high-purity consumables and filtration solutions.

| Technological Trend | Impact on Entegris | Market Data/Projection |

|---|---|---|

| Advanced Semiconductor Nodes (e.g., 2nm) | Increased demand for novel CMP slurries and deposition materials. | Global semiconductor materials market projected to exceed $100 billion by 2030. |

| AI in Chip Design & Manufacturing | Demand for materials supporting higher density, faster speeds, and AI-driven process control. | Global AI chip market to reach hundreds of billions of dollars. |

| EUV Lithography & Advanced Packaging | Need for specialized materials enabling these cutting-edge manufacturing processes. | N/A (Specific data not readily available for this sub-segment) |

| Quantum Computing & Bio-manufacturing | Opportunity for ultra-pure materials and high-purity consumables/filtration. | Bio-manufacturing sector projected to reach hundreds of billions of dollars by late 2020s. |

Legal factors

Entegris heavily relies on its intellectual property, particularly patents covering advanced materials and process solutions critical to semiconductor manufacturing. In 2023, the company continued to invest in R&D, allocating $531.6 million, underscoring the importance of protecting these innovations. Strong patent enforcement is vital for maintaining its competitive edge and recouping these substantial investments in a highly innovative industry.

Entegris operates under a stringent environmental regulatory landscape, particularly concerning chemical handling, waste management, emissions, and water usage. Compliance with global directives such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is crucial for market access and avoiding significant penalties. For instance, non-compliance with REACH can lead to substantial fines and product recalls, impacting revenue streams.

The company's manufacturing processes, which involve specialized chemicals and materials for the semiconductor industry, are directly affected by these regulations. Adherence to local environmental agency requirements is also paramount for maintaining operational licenses and a positive corporate image. Entegris's commitment to sustainability is further demonstrated through its alignment with reporting frameworks like SASB (Sustainability Accounting Standards Board) and TCFD (Task Force on Climate-related Financial Disclosures), aiming for transparency in its environmental impact.

Entegris must meticulously adhere to a web of international trade laws, encompassing export controls, sanctions, and customs regulations. These legal frameworks are crucial for managing its extensive global supply chain and sales operations. For instance, in 2023, the United States continued to refine its export control regulations, impacting advanced technology sectors where Entegris operates.

Navigating these complex and often shifting legal landscapes, particularly given current geopolitical tensions, is paramount for maintaining the unimpeded flow of materials and finished products across borders. Failure to comply can result in significant financial penalties and severely restrict market access, directly impacting Entegris's revenue streams and operational efficiency.

Labor Laws and Employment Regulations

Entegris navigates a complex web of labor laws and employment regulations across its global operations, impacting everything from wages to workplace safety. For instance, in 2023, the average manufacturing wage in the United States, a key operational region for Entegris, was approximately $24.50 per hour, highlighting the wage floor considerations. Adherence to these diverse legal frameworks is critical for fostering positive employee relations and mitigating the risk of costly legal challenges.

Compliance with these regulations is not merely a legal obligation but a strategic imperative for Entegris. The company must ensure its practices align with varying national and regional standards concerning working conditions, health and safety protocols, and anti-discrimination policies. Failure to do so can lead to significant penalties and reputational damage.

- Global Workforce Management: Entegris must comply with labor laws in all countries where it has employees, affecting hiring, compensation, and termination practices.

- Health and Safety Standards: Adherence to occupational health and safety regulations, such as those enforced by OSHA in the US, is paramount to employee well-being and operational continuity.

- Non-Discrimination and Equal Opportunity: Entegris is bound by laws prohibiting discrimination based on race, gender, age, religion, and other protected characteristics, fostering an inclusive workplace.

- Wage and Hour Laws: Compliance with minimum wage, overtime, and other wage-related regulations is essential to avoid wage and hour disputes and ensure fair compensation.

Product Safety and Quality Standards

Entegris operates under rigorous product safety and quality mandates, especially crucial in the semiconductor and life sciences sectors where material purity is non-negotiable. The company's commitment to standards like ISO 9001 directly impacts customer confidence and its ability to penetrate key markets.

Failure to meet these exacting quality benchmarks can lead to severe financial repercussions, including product recalls, lost contracts, and substantial damage to Entegris's brand reputation. For instance, a significant quality lapse in 2024 could directly affect its reported revenue for the year, potentially impacting investor sentiment and stock performance. Adherence to these standards is not just a regulatory necessity but a core business driver.

- ISO 9001 Certification: Entegris maintains this certification, demonstrating a commitment to quality management systems.

- Industry-Specific Standards: Compliance with regulations relevant to semiconductor manufacturing (e.g., SEMI standards) and life sciences is essential.

- Impact of Non-Compliance: Potential for product recalls, fines, and loss of market access.

- Customer Trust: High quality and safety are paramount for securing and retaining business with demanding customers.

Entegris faces evolving legal frameworks impacting its global operations, from intellectual property protection to international trade. In 2023, the company invested $531.6 million in R&D, highlighting the critical need for robust patent enforcement to safeguard its innovations in the competitive semiconductor market.

The company must navigate complex environmental regulations, including REACH and RoHS, which govern chemical usage and emissions. Compliance is essential for market access and avoiding penalties, as demonstrated by the significant fines associated with REACH non-compliance, potentially impacting revenue streams.

International trade laws, including export controls and sanctions, are vital for Entegris's global supply chain and sales. In 2023, the US continued to refine export controls, directly influencing advanced technology sectors where Entegris operates, making compliance crucial for operational continuity.

Labor laws and safety standards, such as OSHA regulations in the US, are critical for Entegris's workforce management. Adherence to these diverse legal frameworks is essential for employee relations and mitigating legal risks, with average manufacturing wages in the US around $24.50 per hour in 2023.

Environmental factors

Entegris operates under a complex web of environmental regulations concerning chemical usage and disposal, a critical factor impacting its operations. For instance, the increasing scrutiny and potential bans on per- and polyfluoroalkyl substances (PFAS), which are used in some semiconductor manufacturing processes, directly affect Entegris's material science solutions. The company must navigate evolving compliance requirements, such as those outlined by the EPA, to ensure its products and processes meet environmental standards.

These stringent rules, including those governing the safe handling, storage, and disposal of chemicals like ethylene oxide, necessitate significant investment in compliance and process adaptation. Failure to adhere to these regulations, which are becoming more rigorous globally, could lead to substantial fines, operational disruptions, and damage to Entegris's reputation. For example, in 2023, the EU continued to advance its PFAS restriction proposals, signaling a tightening global regulatory landscape.

Water scarcity poses a significant challenge for semiconductor manufacturing, a core industry for Entegris's clientele. Regions like Taiwan, a major chip production hub, are increasingly vulnerable to drought, impacting operational continuity. This reality drives demand for advanced water purification and recycling solutions, areas where Entegris plays a crucial role.

Entegris itself acknowledges the importance of water conservation, aiming to reduce its own water intensity. For instance, their 2023 sustainability report highlights efforts to optimize water usage in their manufacturing processes, reflecting a broader industry trend towards more responsible resource management. This focus is essential as water is a critical input for cleaning and cooling in chip fabrication.

Entegris' manufacturing processes are energy-intensive, and the growing trend of renewable energy mandates poses both a challenge and an opportunity. By focusing on reducing energy consumption per dollar of revenue, Entegris aims to improve efficiency and potentially lower operating expenses.

The company is also exploring renewable energy sources to meet its sustainability objectives. For instance, in 2023, the semiconductor industry, a key market for Entegris, saw significant investments in green technologies, with many companies setting ambitious targets for renewable energy adoption by 2030 to support decarbonization efforts.

Supply Chain Sustainability and Ethical Sourcing

The increasing global focus on supply chain sustainability and ethical sourcing directly influences Entegris's procurement strategies. This trend means Entegris must ensure its raw materials are obtained responsibly, impacting its operational costs and supplier relationships.

Customers and stakeholders are pushing for greater transparency, demanding to know the origins and ethical treatment involved in producing the materials Entegris uses. This pressure extends across the entire value chain, from the initial extraction of resources to the final delivery of products.

Entegris's Corporate Social Responsibility (CSR) initiatives are actively being extended to its supplier network, reflecting this commitment to ethical practices. For instance, in 2023, Entegris reported that 98% of its key suppliers had undergone third-party assessments for environmental, social, and governance (ESG) factors.

- Growing Demand for Transparency: Customers increasingly scrutinize supply chains for ethical and sustainable practices.

- Impact on Procurement: Entegris faces pressure to ensure responsible sourcing of all raw materials.

- CSR Extension to Suppliers: Entegris's CSR program actively engages and assesses its supplier network for ESG compliance.

- Supplier ESG Assessments: In 2023, 98% of Entegris's key suppliers were evaluated through third-party ESG assessments.

Waste Reduction and Circular Economy Initiatives

Entegris is actively pursuing waste reduction and circular economy initiatives across its manufacturing operations. This focus is driven by a commitment to operational efficiency and cost savings, aligning with growing industry demands for sustainable production practices. By optimizing resource utilization, the company aims to minimize its environmental footprint.

These efforts contribute to Entegris's broader strategy of enhancing its environmental, social, and governance (ESG) performance. For example, in 2023, the company reported achieving a 10% reduction in hazardous waste generation per unit of production compared to its 2020 baseline. This aligns with global trends pushing for greater accountability in industrial waste management and the adoption of closed-loop systems.

- Waste Reduction Targets: Entegris has set internal goals to further decrease waste generation by an additional 15% by the end of 2025.

- Circular Economy Integration: The company is exploring partnerships for material recycling and reuse, aiming to incorporate more recycled content into its products by 2026.

- Operational Efficiency Gains: Successful waste reduction projects in 2023 led to an estimated $2 million in cost savings through reduced disposal fees and improved material yields.

- Industry Benchmarking: Entegris's waste intensity metrics are being benchmarked against leading semiconductor materials suppliers, with a focus on continuous improvement in resource management.

Stricter environmental regulations, particularly concerning PFAS and chemical handling, necessitate ongoing compliance investments for Entegris, impacting its material science solutions. Water scarcity in key semiconductor manufacturing regions like Taiwan highlights the critical need for Entegris's water purification technologies, while also driving the company to improve its own water conservation efforts, as evidenced by its 2023 sustainability report.

The increasing global push for supply chain sustainability and ethical sourcing directly influences Entegris's procurement, requiring responsible material acquisition and greater transparency. Entegris's commitment to CSR is extending to its suppliers, with 98% of key suppliers undergoing third-party ESG assessments in 2023. Furthermore, the company is actively pursuing waste reduction, achieving a 10% reduction in hazardous waste per production unit in 2023, and setting further targets for 2025.

| Environmental Factor | Impact on Entegris | Data/Example (2023/2024) |

|---|---|---|

| Chemical Regulations (PFAS, Ethylene Oxide) | Compliance costs, potential product restrictions | EU PFAS restriction proposals advanced in 2023; strict handling rules for chemicals like ethylene oxide. |

| Water Scarcity | Demand for purification solutions, operational risk | Taiwan's vulnerability to drought impacts chip production; Entegris focuses on water conservation. |

| Renewable Energy Mandates | Opportunity for efficiency, investment in green tech | Semiconductor industry invested in green tech in 2023, setting 2030 renewable energy targets. |

| Supply Chain Sustainability | Procurement strategy, supplier relationships | 98% of key suppliers assessed for ESG factors in 2023. |

| Waste Reduction & Circular Economy | Operational efficiency, cost savings | 10% reduction in hazardous waste per production unit achieved in 2023; target of 15% by end of 2025. |

PESTLE Analysis Data Sources

Our Entegris PESTLE Analysis is grounded in comprehensive data from government regulatory bodies, leading economic forecasting firms, and influential industry associations. We incorporate insights from technological innovation reports and socio-cultural trend analyses to provide a holistic view.