Entegris Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Entegris Bundle

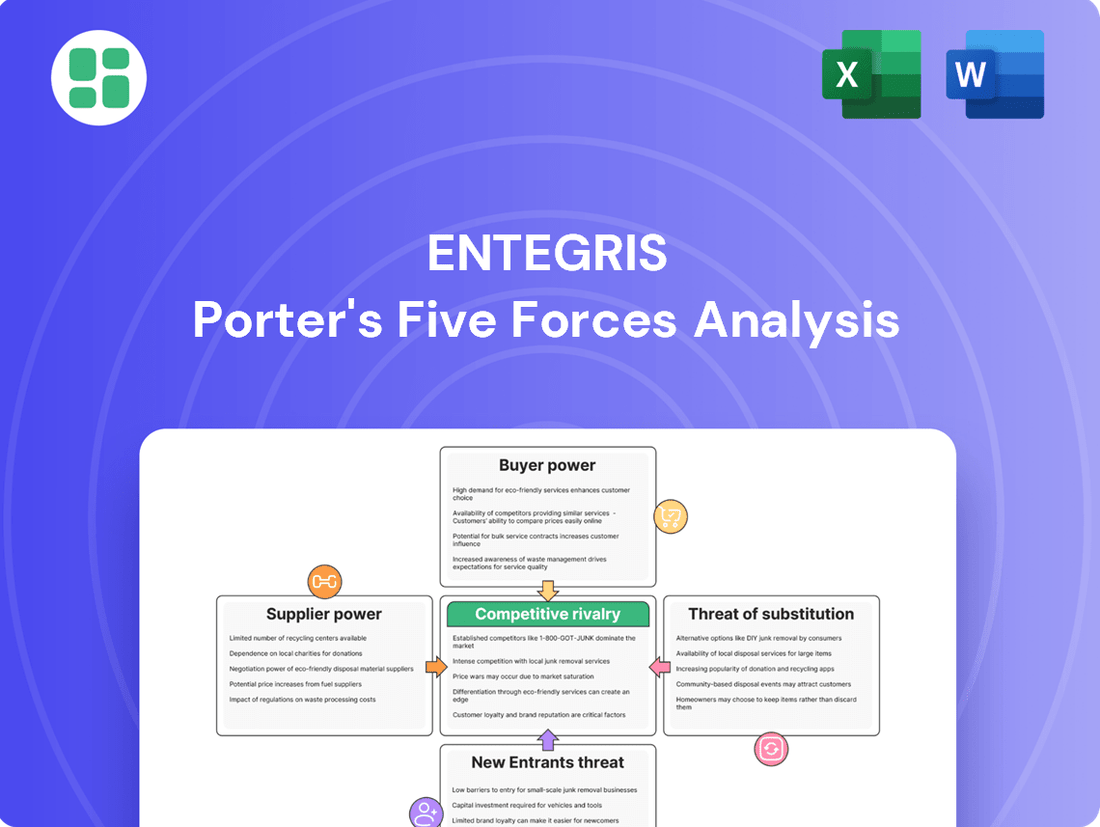

Entegris operates in a dynamic semiconductor materials market, where understanding competitive pressures is crucial for success. Our Porter's Five Forces analysis highlights the significant influence of powerful suppliers and the intense rivalry among established players, shaping the industry landscape.

The complete report reveals the real forces shaping Entegris’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Entegris' reliance on highly specialized raw materials, especially for its advanced semiconductor and life sciences products, significantly shapes supplier bargaining power. When these inputs are unique or proprietary, and few alternatives exist, suppliers gain leverage. This is particularly true for materials demanding extreme purity and performance, critical for Entegris' high-tech applications.

Supplier concentration significantly impacts Entegris's bargaining power. In specialized markets like semiconductor materials, the number of suppliers for critical, high-purity chemicals and advanced polymers is often quite low.

This limited supplier base grants those few providers considerable leverage. For instance, in 2024, the market for certain photoresist chemicals used in advanced chip manufacturing is dominated by a handful of global players, meaning Entegris has fewer alternatives if a key supplier increases prices or alters terms.

Switching suppliers for critical process solutions and advanced materials presents significant hurdles for companies like Entegris. These challenges often include extensive qualification processes, the need for re-tooling manufacturing equipment, and the potential for considerable disruption to ongoing production cycles. For instance, in the semiconductor industry, qualifying a new supplier for a specialized chemical can take upwards of 18 months and involve substantial investment in testing and validation.

These high switching costs can foster a greater reliance on existing, trusted suppliers. This dependence inherently strengthens the suppliers' position during price negotiations and contract discussions, as Entegris faces substantial financial and operational risks in attempting to change its supply base.

Threat of Forward Integration

The threat of suppliers integrating forward into Entegris's market, while not a primary concern for direct product competition, can still influence supplier leverage. If a supplier of highly specialized materials possesses the necessary technical expertise and financial resources, they might consider developing their own advanced material solutions. This possibility, even if unlikely, adds a layer of bargaining power for those suppliers.

This dynamic is particularly relevant in niche markets where specialized inputs are critical. For instance, a supplier of a unique chemical compound crucial for semiconductor manufacturing might explore developing their own formulated solutions if they see a clear path to market and profitability. While Entegris's scale and integrated offerings present significant barriers, the potential for forward integration by key suppliers remains a factor in supplier negotiations.

- Potential for Forward Integration: Suppliers of specialized inputs may integrate forward if they have the technical and financial capacity.

- Impact on Bargaining Power: Even a remote threat of forward integration can enhance a supplier's leverage.

- Industry Context: This threat is more pronounced in niche markets with critical, specialized inputs.

Importance of Entegris to Suppliers

Entegris's standing as a premier supplier to crucial sectors like semiconductor manufacturing naturally makes it a substantial customer for many of its raw material and component providers. This significant demand can translate into considerable bargaining power for Entegris, especially when a supplier relies heavily on the company for a large chunk of its business. For instance, if a supplier's revenue is predominantly derived from Entegris, the latter can leverage this dependence to negotiate more favorable terms.

Conversely, the bargaining power of suppliers can be amplified if Entegris constitutes only a minor portion of a much larger, highly diversified supplier's overall sales. In such scenarios, the supplier's reduced reliance on Entegris means they are less susceptible to Entegris's demands, thereby holding more sway in negotiations.

- Supplier Dependence: Entegris's substantial order volumes can give it leverage over suppliers who depend on its business for a significant percentage of their revenue.

- Supplier Diversification: If Entegris represents a small fraction of a large, diversified supplier's customer base, the supplier's bargaining power increases due to lower dependence.

- Criticality of Inputs: The bargaining power also hinges on how unique or critical the supplied materials are to Entegris's production processes.

- Market Conditions: Broader market conditions, such as overall demand for the supplier's products and the availability of alternative suppliers, also play a role in shaping supplier power.

The bargaining power of suppliers to Entegris is significantly influenced by the uniqueness and criticality of the materials they provide, especially in high-tech sectors like semiconductors. In 2024, the market for highly purified chemicals and specialized polymers essential for advanced chip fabrication is characterized by a limited number of qualified suppliers, granting them considerable leverage in pricing and terms. This concentration means Entegris faces fewer alternatives when sourcing these vital inputs, as demonstrated by the lengthy qualification processes, often exceeding 18 months, required for new semiconductor material suppliers.

What is included in the product

Analyzes Entegris' competitive environment by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry.

Visualize competitive intensity with a dynamic, interactive Porter's Five Forces dashboard, allowing for immediate identification of strategic leverage points.

Customers Bargaining Power

Customer concentration is a key factor influencing Entegris's bargaining power. The company primarily serves a select group of large, global semiconductor manufacturers, foundries, and biopharmaceutical companies. This concentration means a few major clients can wield significant influence.

For instance, in 2023, Entegris's top ten customers accounted for a substantial portion of its revenue, highlighting the leverage these large players possess. Their substantial purchasing volumes and strategic importance allow them to negotiate favorable pricing, demand tailored product specifications, and seek advantageous contract terms, thereby increasing their bargaining power.

Entegris's products are absolutely vital for high-tech manufacturing, directly impacting yields, purity, and performance in sensitive processes. This criticality inherently limits customer bargaining power.

The high switching costs associated with Entegris's specialized materials, often due to the risk of process disruption or contamination, further diminish customers' ability to negotiate prices or terms. For instance, in semiconductor fabrication, even minor material variations can lead to significant yield losses, making customers hesitant to switch suppliers without substantial assurance.

Customer switching costs for Entegris are exceptionally high, particularly in the semiconductor and biopharmaceutical sectors. The process of qualifying new materials and process solutions is a complex, time-consuming, and costly undertaking. This typically involves extensive testing, validation, and regulatory approvals, often taking years and millions of dollars.

For instance, a semiconductor manufacturer switching a critical material like a photoresist or a deposition chemical must re-validate its entire manufacturing process, which can lead to significant production downtime and yield losses. Similarly, in biopharmaceuticals, changing a supplier for a single critical component in a drug manufacturing process requires extensive re-validation and regulatory submissions, a process that can take upwards of two years and cost millions. These substantial barriers effectively lock customers into Entegris's offerings, greatly diminishing their bargaining power.

Price Sensitivity and Volume

While Entegris's highly specialized products are crucial for semiconductor manufacturing, large-volume customers can still exert pricing pressure. This is particularly true during industry downturns or when their own markets experience oversupply. For example, in 2024, the semiconductor industry faced some cyclical headwinds, which could have amplified customer demands for better pricing from suppliers like Entegris.

However, Entegris's offerings are often characterized by their specialized nature, high performance, and significant value-add. This typically reduces extreme price sensitivity. The cost of a component failure in semiconductor fabrication, which can lead to scrapped wafers and significant production delays, often far outweighs minor differences in the price of materials or equipment.

- Criticality of Entegris Products: Solutions are essential for advanced semiconductor processes, making outright rejection due to price difficult.

- Cost of Failure: The expense associated with production line stoppages or defective chips significantly outweighs the cost savings from minor price concessions.

- Customer Concentration: While Entegris serves many, a few very large semiconductor manufacturers represent a substantial portion of their revenue, giving them leverage.

- Industry Cycles: During periods of reduced demand in the semiconductor market, customers may increase their bargaining power for price adjustments.

Threat of Backward Integration

The threat of backward integration for Entegris's customers is notably low. Developing the highly specialized materials and solutions Entegris provides demands substantial research and development investment, alongside advanced manufacturing expertise and significant capital. For instance, the semiconductor industry, a key market for Entegris, requires billions in R&D and manufacturing infrastructure to produce advanced materials.

This high barrier to entry means customers typically find it impractical and cost-prohibitive to produce these critical components in-house. Consequently, their ability to exert bargaining power by threatening to produce these inputs themselves is greatly diminished. This low threat directly contributes to Entegris maintaining a strong position in its customer relationships.

The bargaining power of customers is therefore limited by the difficulty and cost associated with backward integration.

- High R&D Investment: Customers face immense costs to replicate Entegris's specialized material science capabilities.

- Specialized Manufacturing Expertise: The intricate processes required for semiconductor materials are not easily replicated.

- Substantial Capital Outlay: Building the necessary manufacturing facilities represents a significant financial commitment for potential integrators.

- Reduced Customer Bargaining Power: These factors collectively limit customers' ability to threaten backward integration, strengthening Entegris's market position.

While Entegris's specialized products are critical, large customers can still exert pricing pressure, particularly during industry downturns. For example, the semiconductor industry's cyclical nature in 2024 meant some customers might have sought more favorable terms. However, the high cost of failure for customers—scrapped wafers or production delays—often outweighs minor price concessions, limiting extreme price sensitivity.

The bargaining power of Entegris's customers is moderate, influenced by customer concentration and industry cycles, but significantly mitigated by high switching costs and the criticality of Entegris's specialized materials. Backward integration is also an impractical threat for most customers due to the immense R&D and capital required.

| Factor | Impact on Customer Bargaining Power | Entegris's Position |

| Customer Concentration | Moderate to High (Top 10 customers significant revenue share) | Leverage for large clients |

| Switching Costs | Very High (Process validation, risk of contamination) | Strong customer lock-in |

| Criticality of Products | Low (Essential for yields, purity) | Reduces price sensitivity |

| Cost of Failure | Low (High cost of production downtime/defects) | Limits price negotiation |

| Backward Integration Threat | Very Low (High R&D, capital, expertise needed) | Minimizes competitive threat |

Same Document Delivered

Entegris Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis of Entegris, which you are currently viewing, will detail the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the semiconductor materials industry. This professionally formatted report is ready for your immediate use.

Rivalry Among Competitors

Entegris operates in a market populated by a mix of substantial, long-standing companies and smaller, specialized firms. This diverse competitive environment means Entegris faces rivalry from both broad-based suppliers and those focusing on specific advanced material niches.

The advanced materials and process solutions sector includes major players like DuPont, 3M, and Merck KGaA, alongside many smaller, agile competitors. For instance, in the semiconductor materials segment, companies like Tokyo Ohka Kogyo (TOK) and Shin-Etsu Chemical are significant rivals, each holding substantial market share in specific product categories.

This dynamic means Entegris is constantly vying for market share, aiming for technological superiority, and working to maintain strong customer ties within demanding sectors such as semiconductors and life sciences. The presence of numerous competitors, each with their own strengths, intensifies the pressure on pricing and innovation.

The semiconductor industry, a key market for Entegris, is projected for robust growth. For instance, the global semiconductor market was valued at approximately $600 billion in 2023 and is expected to reach over $1 trillion by 2030, indicating a compound annual growth rate (CAGR) of around 10%. This strong expansion can somewhat alleviate competitive pressures as companies can focus on capturing market share in an expanding sector.

Entegris thrives on its highly differentiated, proprietary technologies and innovative solutions, crucial for enabling advanced manufacturing processes. The company's competitive edge hinges on its continuous investment in research and development, aiming to create superior materials and processes that keep it ahead.

The pace of innovation is a direct determinant of competitive standing and intensifies the rivalry among key players in the semiconductor materials sector. For instance, Entegris reported a significant 13% increase in R&D spending in 2023, reaching $715 million, underscoring its commitment to maintaining technological leadership.

High Fixed Costs and Exit Barriers

Entegris operates in an industry where substantial investments are necessary for cutting-edge manufacturing facilities, extensive R&D, and the creation of intellectual property. These considerable capital outlays represent a significant barrier to entry and, crucially, to exit.

The high fixed costs associated with specialized assets mean that companies are often reluctant to leave the market, even when faced with challenging economic conditions. This can intensify competitive rivalry as firms strive to maintain market share and cover their fixed expenses.

For instance, in the semiconductor materials sector, where Entegris is a key player, building a new fabrication plant can cost billions of dollars. These immense sunk costs make it economically unfeasible for many companies to simply shut down operations during a downturn, compelling them to continue competing, often aggressively, to utilize their capacity.

- High Capital Expenditure: The semiconductor materials industry demands significant upfront investment in advanced manufacturing and R&D.

- Specialized Assets: Facilities and intellectual property are highly specialized, limiting their resale value and increasing exit barriers.

- Competitive Persistence: High fixed costs encourage companies to remain in the market and compete fiercely, even in slow growth periods.

- Example: Building a new semiconductor fabrication facility can cost upwards of $20 billion, illustrating the scale of investment.

Strategic Alliances and Acquisitions

Strategic alliances and acquisitions are significant drivers of competitive rivalry in the semiconductor materials industry. Companies like Entegris actively engage in these activities to bolster their market position and technological capabilities. For instance, in 2024, the industry witnessed several key consolidation moves and partnerships aimed at enhancing scale and innovation.

These strategic maneuvers often result in the creation of larger, more integrated competitors. By acquiring complementary technologies or merging with rivals, companies can achieve economies of scale, expand their geographic reach, and offer a more comprehensive suite of products and services. This intensifies the competitive landscape as market participants strive to keep pace with evolving industry structures and capabilities.

- Consolidation: Mergers and acquisitions can lead to fewer, larger players, increasing the intensity of rivalry among the remaining entities.

- Technology Acquisition: Alliances and buyouts are often driven by the need to gain access to cutting-edge technologies, thereby raising the technological bar for all competitors.

- Market Share Expansion: Strategic moves are frequently designed to capture a larger share of the market, directly challenging incumbent positions and intensifying competitive pressures.

- Portfolio Enhancement: Companies acquire or partner to broaden their product offerings, creating more comprehensive solutions that can outcompete less diversified rivals.

Competitive rivalry within Entegris's market is intense, driven by a mix of large, established corporations and specialized niche players, each vying for dominance in advanced materials and process solutions. The semiconductor industry, a key focus for Entegris, is experiencing substantial growth, with projections indicating a market value exceeding $1 trillion by 2030, which can somewhat temper direct competitive pressures by offering opportunities for market share expansion.

Entegris differentiates itself through proprietary technologies and significant R&D investment, exemplified by its 13% increase in R&D spending in 2023, totaling $715 million, to maintain a technological edge. High capital expenditures and specialized assets create substantial barriers to entry and exit, compelling companies to remain competitive even during economic slowdowns, as evidenced by the multi-billion dollar cost of new semiconductor fabrication plants.

Strategic alliances and acquisitions are common, leading to industry consolidation and the emergence of larger, more formidable competitors. This dynamic reshapes the competitive landscape, as companies seek to enhance scale, acquire new technologies, and expand market share, thereby intensifying overall rivalry.

| Competitor | Primary Market Focus | 2023 Revenue (USD Billion Approx.) | Key Competitive Aspect |

|---|---|---|---|

| DuPont | Electronics & Industrial, Water & Protection | ~12.4 | Broad portfolio, strong R&D |

| 3M | Safety & Industrial, Transportation & Electronics | ~32.7 | Diversified innovation, global reach |

| Merck KGaA | Life Science, Electronics | ~22.4 (Electronics segment) | Specialized materials, strong in semiconductors |

| Tokyo Ohka Kogyo (TOK) | Semiconductor materials (photoresists) | ~2.0 | Niche leadership in specific semiconductor chemistries |

| Shin-Etsu Chemical | Silicones, Semiconductor Silicon, PVC | ~15.0 (Semiconductor materials) | Dominant in silicon wafers, significant materials supplier |

SSubstitutes Threaten

Entegris's offerings are critical for demanding sectors like semiconductor manufacturing and biopharmaceutical production, where even minute impurities can derail entire batches. These industries have incredibly high standards for performance, purity, and reliability. For example, in semiconductor fabrication, particles measured in nanometers can render chips unusable, a level of precision few substitutes can achieve. This makes direct substitution a very low threat.

Entegris's technological uniqueness acts as a significant barrier against substitutes. Many of their solutions stem from proprietary technologies and patented formulations, the result of substantial, long-term research and development investments. This deep scientific expertise is not easily replicated, making it challenging for customers to find alternative products that deliver the same level of performance and reliability.

The difficulty in finding comparable substitutes is amplified by the need for seamless integration into complex manufacturing processes. For instance, in the semiconductor industry, where Entegris is a major player, even minor deviations in material purity or delivery systems can lead to significant yield losses. Entegris reported approximately $3.2 billion in revenue for 2023, underscoring the demand for their specialized, hard-to-substitute offerings.

While cheaper alternatives might exist for some basic functions, they come with significant performance, purity, and reliability trade-offs. For instance, in semiconductor manufacturing, using a less pure chemical could lead to billions in lost revenue due to wafer scrap, making the initial cost savings negligible.

The high cost of failure in industries Entegris serves, such as semiconductor and biopharmaceutical manufacturing, makes customers extremely reluctant to consider lower-performing substitutes. The potential for contamination or process disruption, which can result in rejected batches or entire production runs, far outweighs any minor cost advantage of a substitute product.

Indirect Substitution from Process Changes

A less obvious threat to Entegris arises from significant changes in manufacturing processes or the adoption of novel technologies that diminish or remove the necessity for specific materials and solutions Entegris currently provides. For instance, advancements in additive manufacturing or entirely new material science breakthroughs could bypass the need for certain deposition or purification steps where Entegris excels.

These kinds of paradigm shifts are generally slow to materialize, demanding substantial industry-wide capital investment and often creating new avenues for Entegris to innovate and adjust its product portfolio. For example, while the semiconductor industry is constantly evolving, Entegris has historically adapted by developing new chemistries and materials to support next-generation lithography and advanced packaging techniques, demonstrating resilience to process substitution.

- Process Innovation: The semiconductor industry, a key market for Entegris, saw significant investment in advanced lithography techniques like High-NA EUV in 2024, potentially altering material demands for future chip generations.

- Material Science Advancements: Research into novel materials for quantum computing or advanced battery technologies could, over the long term, reduce reliance on some of the specialized chemicals and components Entegris currently supplies.

- Adaptability: Entegris's historical success in adapting to new manufacturing nodes, such as its development of advanced photomask solutions for sub-7nm processes, highlights its capacity to navigate process-driven substitution threats.

Customer Qualification and Risk Aversion

Customers in industries served by Entegris, such as semiconductor manufacturing, exhibit extreme risk aversion due to the critical nature of their processes. This means they invest heavily in rigorous qualification procedures for any new supplier or material. For instance, qualifying a new chemical or equipment component can take months, even years, and involve extensive testing and validation.

The high cost and complexity associated with these qualification processes create substantial barriers to entry for potential substitute solutions. Companies are reluctant to disrupt established, validated workflows with unproven alternatives, even if they offer perceived cost savings or performance improvements. This inherent customer caution significantly dampens the threat of substitutes.

- Customer Qualification Hurdles: Semiconductor manufacturers, for example, often have multi-stage qualification processes that can last 12-24 months, involving pilot runs and extensive reliability testing.

- High Switching Costs: The financial and operational costs of re-qualifying materials and equipment are prohibitive, making customers hesitant to switch from established suppliers.

- Risk Mitigation Focus: The primary concern for customers is process stability and yield, not just material cost, making them prioritize proven solutions over novel substitutes.

- Impact on Substitutes: These factors make it exceptionally challenging for new, unproven substitute products or services to gain market share in Entegris's core markets.

The threat of substitutes for Entegris's highly specialized products is notably low due to the critical nature and stringent requirements of its core markets, particularly semiconductor manufacturing and biopharmaceuticals. These industries demand unparalleled purity, performance, and reliability, where even minor deviations can lead to catastrophic failures and immense financial losses. For instance, in 2023, Entegris reported revenues of approximately $3.2 billion, reflecting the significant demand for its hard-to-substitute solutions.

Proprietary technologies and extensive R&D investments create significant barriers, making it difficult for competitors to replicate Entegris's offerings. The high cost of failure, coupled with lengthy and rigorous customer qualification processes that can take 12-24 months, further deters customers from adopting unproven alternatives. This customer risk aversion, prioritizing process stability over potential cost savings from substitutes, solidifies Entegris's market position.

While disruptive technological shifts could eventually alter material demands, Entegris has a history of adapting, as seen in its development of advanced photomask solutions for sub-7nm processes. The semiconductor industry's 2024 investment in advanced lithography, such as High-NA EUV, highlights the continuous evolution that Entegris is positioned to address through innovation.

| Factor | Impact on Entegris | Supporting Data/Example |

|---|---|---|

| Purity & Performance Demands | Very Low Threat of Substitutes | Semiconductor fabrication requires particle control at nanometer levels; contamination can render chips unusable. |

| Proprietary Technology & R&D | Very Low Threat of Substitutes | Entegris's patented formulations and deep scientific expertise are difficult to replicate. |

| Customer Qualification Costs | Very Low Threat of Substitutes | Qualification processes can take 12-24 months, making customers hesitant to switch from proven suppliers. |

| Cost of Failure | Very Low Threat of Substitutes | Wafer scrap due to less pure chemicals can lead to billions in lost revenue, outweighing minor cost savings from substitutes. |

| Process Innovation (e.g., High-NA EUV) | Low to Moderate Threat (with adaptation opportunity) | Industry investments in new lithography techniques in 2024 may alter material needs, but Entegris historically adapts to new manufacturing nodes. |

Entrants Threaten

The advanced materials and process solutions sector, where Entegris operates, demands immense upfront capital. Establishing cutting-edge research and development centers, alongside highly specialized cleanroom manufacturing facilities, requires billions of dollars. For instance, building a new semiconductor fabrication plant, a related industry requiring similar infrastructure, can easily cost upwards of $10 billion, illustrating the scale of investment needed. This substantial financial commitment acts as a formidable deterrent for any new companies looking to enter the market.

The threat of new entrants in the semiconductor materials industry is significantly dampened by the immense R&D investment and intellectual property (IP) that incumbents like Entegris possess. Developing cutting-edge materials and processes requires years of dedicated research and substantial capital, often running into hundreds of millions of dollars annually for leading firms. For instance, Entegris's commitment to innovation is reflected in its robust patent portfolio, which protects its advanced filtration, deposition materials, and specialty chemicals.

Newcomers would face a steep climb to replicate the deep scientific and engineering expertise and proprietary technologies that Entegris has cultivated. Overcoming these entrenched IP barriers and meeting the incredibly stringent quality and performance standards demanded by semiconductor manufacturers necessitates a similar, if not greater, long-term investment in R&D. This creates a formidable entry barrier, making it exceptionally difficult for new players to gain a foothold and compete effectively.

For companies like Entegris, securing trust and qualifying their products with major semiconductor and biopharmaceutical manufacturers is a significant barrier to entry for new competitors. This process is incredibly demanding, often spanning several years and requiring substantial investment. For instance, a new supplier might need to undergo extensive testing and validation cycles, which can cost millions of dollars before even being considered for a purchase order.

Economies of Scale and Experience Curve

Existing players like Entegris leverage substantial economies of scale in manufacturing, global procurement, and research and development. This allows them to achieve lower per-unit costs, making it difficult for newcomers to compete on price without substantial initial investment.

The experience curve further solidifies this advantage. As companies like Entegris produce more over time, they become more efficient, reducing costs. For instance, in 2024, the semiconductor materials market, where Entegris operates, is characterized by high capital expenditures and a steep learning curve for process optimization.

- Economies of Scale: Entegris's established global supply chains and high-volume production facilities in 2024 provide significant cost efficiencies unavailable to nascent competitors.

- Experience Curve: Years of refining manufacturing processes and material science allow Entegris to operate at a lower cost base than any new entrant could realistically achieve in the short to medium term.

- Capital Intensity: The specialized nature of semiconductor manufacturing equipment and R&D demands massive upfront capital, creating a substantial barrier to entry for new firms.

Regulatory and Compliance Hurdles

The threat of new entrants for companies like Entegris is significantly influenced by regulatory and compliance hurdles, particularly in sectors such as life sciences and advanced technology. For instance, the biopharmaceutical industry, a key area for many advanced materials suppliers, is governed by rigorous standards like those set by the U.S. Food and Drug Administration (FDA). Navigating these complex regulatory frameworks, securing necessary certifications, and establishing compliant infrastructure represent substantial investments in both time and capital for any new player aiming to enter the market.

These compliance requirements act as a significant barrier, deterring potential competitors. For example, the process of obtaining FDA approval for materials used in medical devices or drug manufacturing can take years and involve extensive testing and documentation. This lengthy and costly process inherently limits the number of new companies that can realistically challenge established players like Entegris, which have already invested heavily in building robust compliance systems and expertise.

- Regulatory Complexity: Industries like life sciences demand adherence to strict regulations (e.g., FDA, EMA) for materials used in critical applications, creating high entry barriers.

- Certification Costs: Obtaining necessary certifications for compliance can cost millions of dollars and take several years, deterring smaller or less capitalized entrants.

- Infrastructure Investment: New entrants must build specialized infrastructure to meet quality and safety standards, adding significant upfront costs and operational complexity.

The threat of new entrants in Entegris's market is low due to the massive capital requirements for R&D and specialized manufacturing facilities, with semiconductor fabrication plants alone costing over $10 billion. Incumbents also possess significant intellectual property and deep scientific expertise, making it difficult for newcomers to replicate their advanced materials and processes. Furthermore, lengthy product qualification cycles with major customers, often taking years and costing millions, create substantial hurdles for new players.

| Factor | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|

| Capital Intensity | Very High | Semiconductor fab costs >$10 billion; R&D investment in hundreds of millions annually for leaders. |

| Intellectual Property & Expertise | Very High | Entegris's robust patent portfolio for filtration, deposition materials, and specialty chemicals. |

| Customer Qualification | High | Multi-year validation cycles costing millions before purchase orders are considered. |

| Regulatory Hurdles | High | FDA approval for life science materials can take years and millions in testing and documentation. |

Porter's Five Forces Analysis Data Sources

Our Entegris Porter's Five Forces analysis is built upon a foundation of diverse data, including Entegris's own SEC filings, investor presentations, and annual reports. We also incorporate industry-specific market research from firms like Gartner and IDC, alongside macroeconomic data from sources such as the World Bank.