Entegris Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Entegris Bundle

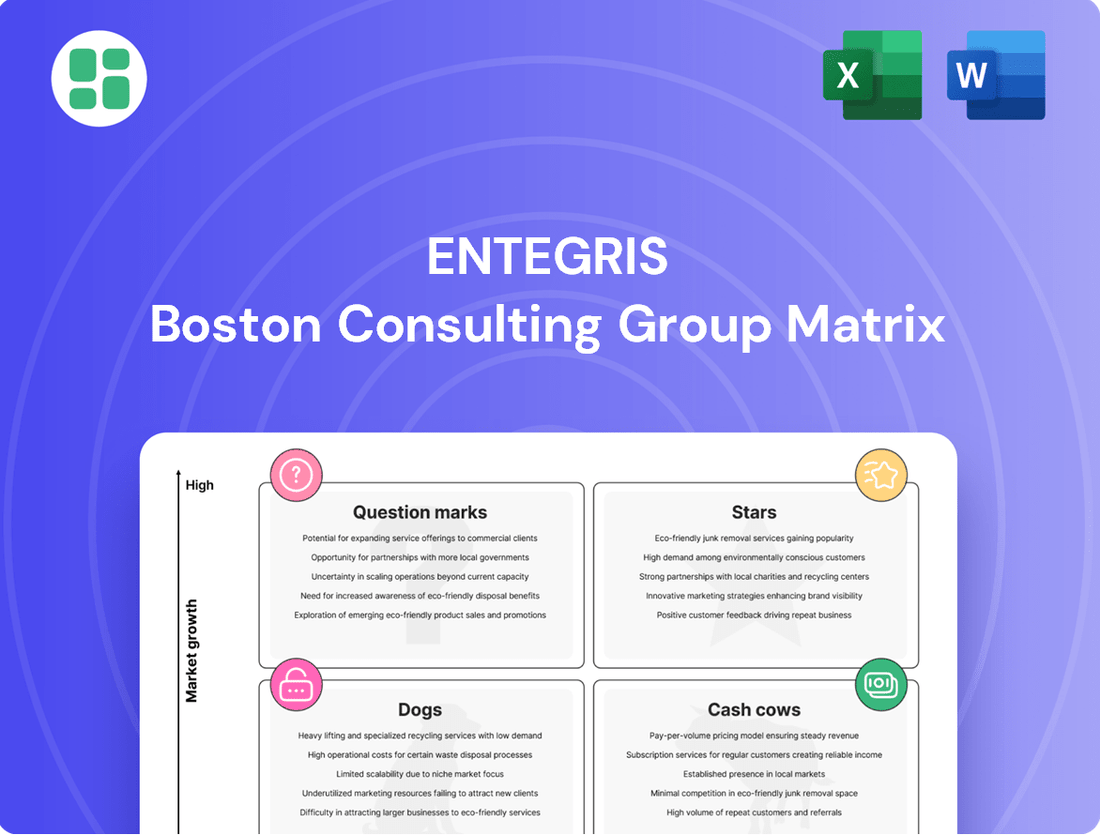

Curious about Entegris's product portfolio performance? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks, but the real strategic advantage lies within the full BCG Matrix. Purchase the complete report to unlock detailed quadrant placements and data-driven insights that will empower your investment and product development decisions.

Stars

Entegris' advanced packaging solutions, particularly moly deposition materials crucial for 3D-NAND and other sophisticated chip architectures, are demonstrating exceptional performance. The company reported a remarkable 100% year-over-year surge in its Advanced Packaging business during Q1 2025, underscoring the segment's rapid expansion.

This segment is pivotal for enabling next-generation semiconductor technologies, such as 3D stacking, and is projected to achieve over 25% revenue growth throughout 2025. The robust demand, fueled by advancements in artificial intelligence and high-performance computing (HPC), solidifies these advanced packaging solutions as a significant growth driver for Entegris.

Entegris' Chemical Mechanical Planarization (CMP) slurries and pads are showing excellent performance, significantly boosting their Materials Solutions segment. This segment saw a 4% year-on-year and sequential sales increase in Q2 2025, with CMP products being a key driver.

This strong growth underscores Entegris' leadership in the vital CMP market, a critical component for producing cutting-edge semiconductors. The demand for these advanced materials is expected to continue rising as semiconductor technology evolves.

Entegris is seeing substantial growth fueled by its specialized materials and solutions for advanced logic and High Bandwidth Memory (HBM). These components are crucial for the burgeoning AI sector, directly impacting the performance of AI-enabled applications.

The semiconductor industry's relentless pursuit of more intricate device architectures and miniaturization is creating a rapidly expanding market for these advanced materials. Entegris' commitment to materials science and ensuring extreme purity positions it as a vital player in these high-tech areas.

For instance, in 2024, the demand for HBM, particularly HBM3 and HBM3e, has surged due to its critical role in AI accelerators and high-performance computing. Entegris' advanced deposition materials and advanced process solutions are essential for manufacturing these complex memory stacks, contributing to their market leadership.

New Materials for Sub-5nm Nodes

Entegris is a key player in supplying advanced materials for semiconductor manufacturing, particularly for the cutting-edge sub-5nm nodes. This segment is experiencing significant growth, driven by the demand for more powerful and efficient chips. Entegris's investment in developing these next-generation materials positions them strongly in this high-potential market.

The company's focus on sub-5nm nodes is expected to lead to a substantial increase in the material content per wafer. For instance, the advanced lithography and deposition processes required for these nodes necessitate specialized chemicals and filters, areas where Entegris excels. This strategic focus allows Entegris to capture value from the most advanced and rapidly evolving segments of the semiconductor industry.

- Sub-5nm Node Growth: The market for chips manufactured at 5nm and below is projected to see continued expansion, with significant R&D investment from leading foundries.

- Material Content Expansion: Entegris anticipates a higher volume and value of its specialized materials being used in each wafer as process complexity increases for advanced nodes.

- Innovation Pipeline: The company is actively introducing new purity and performance materials crucial for EUV lithography and advanced etching, essential for sub-5nm fabrication.

- Market Position: Entegris's commitment to innovation in this critical area solidifies its status as a Star, poised to benefit from the increasing demand for its advanced material solutions.

Life Sciences Bioprocessing Assemblies

Entegris's Life Sciences Bioprocessing Assemblies, notably the Aramus critical fluid handling product line, represent a strategic expansion beyond its core semiconductor business. While detailed 2024-2025 growth figures for this segment are not as readily available as for semiconductors, the company's investments in expanding manufacturing capacity underscore its commitment to this high-growth market.

The life sciences sector, particularly biopharmaceutical manufacturing, is experiencing robust demand for advanced fluid handling solutions. Entegris's focus on this area positions it to capitalize on trends such as the increasing production of biologics and cell and gene therapies. The company’s investments are geared towards meeting the stringent requirements of these sensitive applications.

- Growing Market Presence: Entegris is actively building its presence in the life sciences sector, leveraging its expertise in fluid management.

- Strategic Investments: The company has made significant investments in expanding its manufacturing capabilities for bioprocessing assemblies.

- Aramus Product Line: The Aramus critical fluid handling products are a key offering in Entegris's life sciences portfolio.

- Future Growth Potential: Although specific 2024-2025 data is limited, the strategic focus indicates strong anticipated growth in this segment.

Entegris' advanced materials for sub-5nm nodes are a clear Star. The company is seeing significant growth driven by demand for more powerful chips, with a projected increase in material content per wafer. Their innovation pipeline, particularly for EUV lithography, solidifies their market leadership in this critical area.

| Segment | 2024 Performance Indicator | 2025 Projection | Key Drivers | BCG Category |

| Advanced Packaging Solutions | 100% YoY surge (Q1 2025) | >25% revenue growth | AI, HPC, 3D-NAND | Star |

| Materials Solutions (CMP) | 4% YoY & sequential sales increase (Q2 2025) | Continued robust demand | Next-gen semiconductors | Star |

| Specialized Materials for AI/HBM | Surging demand for HBM3/3e | Continued growth | AI accelerators, HPC | Star |

| Sub-5nm Node Materials | Significant growth in advanced nodes | Substantial increase in material content per wafer | EUV lithography, advanced etching | Star |

| Life Sciences Bioprocessing Assemblies | Strategic investments in capacity | Strong anticipated growth | Biologics, cell & gene therapies | Question Mark (Potential Star) |

What is included in the product

The Entegris BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear BCG Matrix overview helps Entegris strategically allocate resources, relieving the pain of uncertain investment decisions.

Cash Cows

Entegris' Standard Filtration solutions within its Microcontamination Control division are a classic cash cow. This segment, a core part of the Advanced Purity Solutions business, consistently delivers strong revenue and cash flow because filtration is absolutely critical at every stage of semiconductor manufacturing, from raw materials to final wafer processing.

Despite a year-on-year dip in Advanced Purity Solutions sales in Q2 2025, partly due to reduced capital expenditures by chipmakers, the liquid and gas filtration components within this division saw a modest sequential improvement. This resilience highlights the indispensable nature of these products, ensuring their sustained profitability even during industry downturns.

Entegris' Advanced Materials Handling (AMH) segment, featuring standard wafer carriers and fluid handling solutions, commands a significant market share within a mature yet steady industry. These essential components are critical for everyday semiconductor fabrication processes, ensuring consistent operational stability.

Despite some downturns in capital expenditures for facilities, the demand for AMH products remains robust. Their widespread adoption and Entegris' dominant market position contribute to a reliable stream of cash flow, making them a strong performer in the company's portfolio.

Established Chemical Mechanical Planarization (CMP) consumables are a cornerstone cash cow for Entegris. These products are essential for semiconductor manufacturing, ensuring consistent demand even from older, established process technologies. In Q1 2025, while demand for these legacy items saw a dip, Entegris' focus on cost control and operational adjustments helped keep the segment profitable.

The acquisition of CMC Materials in 2023 was a game-changer, significantly bolstering Entegris' capabilities and market share within the CMP consumables space. This strategic move solidified their position, allowing them to leverage a broader portfolio of established products that continue to generate substantial revenue.

Specialty Gases for Mature Processes

Specialty gases for mature processes represent Entegris' Cash Cows within the semiconductor industry. These are the standard, high-volume gases critical for established logic and memory manufacturing. Their consistent use ensures a steady revenue stream for Entegris, even during periods of slower growth in advanced chip development.

These essential consumables are vital for maintaining production in mainstream semiconductor fabrication. Their demand remains robust as long as these mature processes are operational, providing a reliable income base for the company. For instance, in 2024, the demand for these gases remained stable, supporting Entegris' financial performance.

- Consistent Revenue Generation: These gases are fundamental to existing semiconductor manufacturing, guaranteeing ongoing sales.

- Market Stability: Demand is less volatile compared to cutting-edge materials, offering predictability.

- Essential Consumables: Their non-discretionary nature ensures continued purchasing by fabs.

- Profitability Driver: Mature processes often have optimized production, leading to healthy margins on these gases.

Legacy Process Chemistries

Entegris' legacy process chemistries, including formulated cleans, represent a significant portion of their business. These are essential for current semiconductor manufacturing, holding a strong market position due to their established reliability.

These mature products, while not seeing explosive growth, generate consistent revenue and contribute substantially to Entegris' profitability. Their deep integration into existing semiconductor fabrication processes ensures their continued demand.

- Stable Revenue: Legacy chemistries provide a predictable income stream for Entegris.

- High Market Share: Proven performance secures a dominant position in their segment.

- Profitability Driver: These products are key contributors to the company's bottom line.

- Critical for Production: Essential for ongoing semiconductor manufacturing operations.

Entegris' specialty gases for mature semiconductor processes are prime examples of cash cows. These are the workhorse gases essential for established logic and memory chip production, providing a steady and reliable revenue stream. In 2024, the demand for these gases remained stable, underpinning Entegris' financial performance by supporting existing manufacturing lines.

These consumables are critical for maintaining production in mainstream semiconductor fabrication, ensuring continued purchasing by fabs as long as these mature processes are operational. Their consistent use guarantees ongoing sales, and their optimized production often leads to healthy profit margins, making them a key profitability driver for the company.

| Product Category | Entegris Segment | BCG Matrix Classification | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|---|

| Standard Filtration | Microcontamination Control | Cash Cow | Critical at all manufacturing stages, indispensable. | Modest sequential improvement in Q2 2025 despite industry capex dip. |

| Advanced Materials Handling (AMH) | Advanced Materials Handling | Cash Cow | Mature industry, significant market share, essential for daily operations. | Robust demand despite facility capex downturns. |

| Chemical Mechanical Planarization (CMP) Consumables | Advanced Materials Handling | Cash Cow | Essential for manufacturing, strong market position post-CMC Materials acquisition. | Continued substantial revenue generation from established products. |

| Specialty Gases (Mature Processes) | Advanced Materials Handling | Cash Cow | Vital for established logic/memory, stable demand. | Demand remained stable throughout 2024. |

| Legacy Process Chemistries | Advanced Materials Handling | Cash Cow | Established reliability, deep integration into existing processes. | Consistent revenue generation and substantial profitability contribution. |

Delivered as Shown

Entegris BCG Matrix

The Entegris BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means you can confidently assess the strategic insights and professional presentation of the report, knowing there are no hidden surprises or alterations. Once acquired, this comprehensive BCG Matrix analysis is immediately yours to implement for informed decision-making and strategic planning within Entegris.

Dogs

Entegris completed the sale of its Pipeline and Industrial Materials (PIM) business in March 2024. This segment, which included drag reducing agents and valve maintenance products for pipeline operations, was divested as it was not central to Entegris' core semiconductor and advanced materials focus. The sale generated $275 million in proceeds, highlighting its status as a non-strategic asset.

Older, less differentiated FOUP designs, while foundational to Entegris' business, are increasingly facing commoditization. These products, which once enjoyed strong demand, are now experiencing pressure from market shifts and reduced fab capital expenditures. For instance, Entegris reported that Advanced Purity Solutions sales declined year-on-year in Q2 2025, partly due to lower facility-based CapEx, a trend that directly impacts the demand for these legacy FOUPs.

Certain legacy filtration systems within Entegris' Microcontamination Control segment might be classified as Dogs in the BCG Matrix. These are likely older technologies or those serving less dynamic, non-semiconductor industrial markets where their market share is minimal and growth prospects are dim.

These products often operate in slow-growing segments, meaning they contribute little to Entegris' overall revenue growth and profitability. For instance, if these systems are primarily for legacy industrial applications that are declining, their strategic importance diminishes as Entegris prioritizes its high-growth semiconductor filtration solutions.

Discontinued or De-emphasized Product Lines

Discontinued or de-emphasized product lines within Entegris would represent the Dogs in a BCG Matrix. These are typically older technologies or products that have low market share and low growth potential, often due to technological obsolescence or intense competition. Entegris, operating in rapidly evolving high-tech sectors, naturally encounters this. For instance, while specific discontinued product lines aren't publicly detailed, one can infer that older generations of filtration or specialty chemical products might fall into this category as newer, more advanced solutions emerge.

These product lines require minimal investment to maintain and are often managed for cash flow or phased out entirely. Entegris's commitment to research and development, evidenced by its significant R&D spending, means it is constantly innovating and bringing new products to market. In 2023, Entegris reported $422 million in R&D expenses, a clear indicator of its focus on future growth areas rather than sustaining legacy products.

- Low Market Share: Products in this category have a small slice of the overall market.

- Low Growth Potential: The market for these products is not expanding, or is even shrinking.

- Resource Allocation: Capital and management attention are typically shifted away from these lines.

- Phased Withdrawal: Companies often manage these products for profitability until they can be profitably discontinued.

Products Impacted by Specific Trade Policy Volatility

Certain Entegris products, particularly those deeply integrated into specific global supply chains or heavily dependent on particular export markets, could be categorized as Dogs. These are items facing substantial and ongoing tariff impacts or significant geopolitical instability. Entegris's capacity to effectively offset these pressures for these particular products is limited.

For instance, products with manufacturing concentrated in regions subject to escalating trade disputes or those requiring components from countries experiencing political unrest might fall into this category. The persistent nature of these challenges, coupled with Entegris's constrained ability to pivot production or sourcing for these specific items, could lead to a situation where their growth prospects and profitability are significantly hampered.

- Products reliant on specific, volatile trade routes.

- Items facing persistent tariff impacts or geopolitical uncertainty.

- Products where Entegris has limited mitigation capabilities.

- Potential for low growth and profitability in affected segments.

Products classified as Dogs within Entegris' portfolio are those with a low market share in a low-growth or declining market. These often represent older technologies or those in less strategic business segments, such as the divested Pipeline and Industrial Materials (PIM) business. For example, legacy filtration systems serving niche industrial markets or older FOUP designs facing commoditization fit this profile. These products typically require minimal investment and are managed for cash or phased out as Entegris focuses on innovation in its core semiconductor materials business.

Entegris' strategic divestitures and focus on high-growth semiconductor markets mean that certain legacy products naturally fall into the Dog category. These are items that no longer align with the company's core strategy or face significant market headwinds. For instance, products heavily impacted by geopolitical trade disputes or those with limited mitigation capabilities for such issues could be considered Dogs due to their constrained growth and profitability. The company's substantial R&D investments, like the $422 million in 2023, underscore its commitment to future growth areas rather than sustaining these legacy offerings.

Question Marks

Entegris is actively investing in research and development for next-generation Extreme Ultraviolet (EUV) materials, targeting a high-growth sector within advanced semiconductor lithography. This strategic focus positions them to capitalize on the evolving demands of chip manufacturing.

While Entegris' current market share in some emerging EUV material segments may be modest, the overall market is experiencing substantial expansion. For instance, the global EUV lithography market was valued at approximately $4.5 billion in 2023 and is projected to reach over $10 billion by 2028, indicating a compound annual growth rate of around 18%.

These R&D investments are crucial for Entegris' potential to develop future Stars. If market adoption of their advanced EUV solutions accelerates and gains significant traction, these early investments could translate into substantial future market leadership and revenue growth.

While Entegris is a leader in materials for today's AI and high-performance computing (HPC), the field is moving incredibly fast. New architectures are constantly emerging, demanding entirely novel material solutions. These are the "question marks" in the BCG matrix – high-growth potential but currently small market share.

Entegris is actively investing in R&D for these next-generation materials, which are crucial for future advancements in AI and HPC. For instance, the company's focus on advanced deposition materials and specialized chemicals for next-generation interconnects and memory technologies positions them to capitalize on these emerging trends. Success here means capturing significant future revenue streams.

Entegris is actively investing in its life sciences sector, establishing new technology centers to bolster capacity and expertise. This strategic expansion targets emerging technologies and partnerships within the life sciences market, positioning Entegris to capture significant future growth.

Areas like advanced bioprocessing consumables and novel drug delivery systems represent nascent markets where Entegris is building its presence. These segments, characterized by high growth potential, necessitate considerable investment to secure and expand market share.

Solutions for Solving Silicon Carbide (SiC) Substrate Challenges

Entegris is actively addressing critical challenges in silicon carbide (SiC) substrate manufacturing, aiming to deliver defect-free wafers essential for the burgeoning electric vehicle (EV) and power electronics sectors. The company's focus on this area acknowledges the SiC market's robust expansion, with projections indicating continued strong growth through 2030, driven by increasing demand for efficient power management solutions.

While Entegris' overall market position is strong, its specific share in the advanced SiC substrate solutions niche is likely still solidifying, representing a significant investment opportunity. This strategic initiative, while carrying substantial R&D and capital expenditure requirements, offers high growth potential as the industry transitions to higher performance and reliability in SiC devices.

- Defect Reduction: Entegris is developing advanced purification and handling technologies to minimize crystal defects in SiC wafers, crucial for improving device yield and performance.

- Market Growth Driver: The global SiC power semiconductor market is projected to reach approximately $10.5 billion by 2027, with EVs representing a substantial portion of this growth.

- Investment & Potential: Significant investment is needed to achieve a leading market share in novel SiC substrate solutions, but the potential for high returns is considerable given the market's trajectory.

- High-Volume Production: Entegris' efforts are geared towards enabling cost-effective, high-volume production of high-quality SiC wafers, a key enabler for widespread adoption of SiC technology.

Co-optimized Solutions for Advanced Device Architectures

Entegris excels at co-optimizing solutions designed to accelerate the time to yield for customers building intricate device architectures. These highly tailored, integrated solutions address the most demanding and cutting-edge manufacturing processes, representing significant high-growth potential.

Due to their innovative and custom-built nature, these advanced solutions might begin with a smaller market share. This necessitates substantial collaborative investment alongside key customers to drive adoption and market penetration.

- High-Growth Opportunity: Focus on integrated solutions for advanced semiconductor manufacturing processes.

- Customer Collaboration: Emphasizes joint investment with lead customers for novel technologies.

- Time to Yield: Core value proposition is accelerating customer production ramp-ups.

- Customization: Solutions are highly bespoke, addressing unique and challenging device requirements.

Entegris is investing in emerging material science for next-generation semiconductor technologies, such as advanced EUV lithography and novel interconnects for AI and HPC. These represent high-growth, but currently smaller, market segments where the company is building its capabilities and customer relationships.

The company's expansion into life sciences, particularly in areas like bioprocessing consumables, also falls into the question mark category. While the overall life sciences market is robust, Entegris' specific share in these nascent segments is still developing, requiring strategic investment to gain traction.

Similarly, Entegris' focus on advanced silicon carbide (SiC) substrate solutions for the electric vehicle and power electronics industries presents a significant growth opportunity. Although the SiC market is expanding rapidly, Entegris' position in specialized defect reduction and high-purity SiC materials is an area demanding substantial investment to capture future market share.

These question mark areas are characterized by high potential returns but also significant investment requirements and market uncertainty. Entegris' strategy involves targeted R&D and customer collaboration to navigate these challenges and establish leadership in these future growth engines.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to accurately position business units.