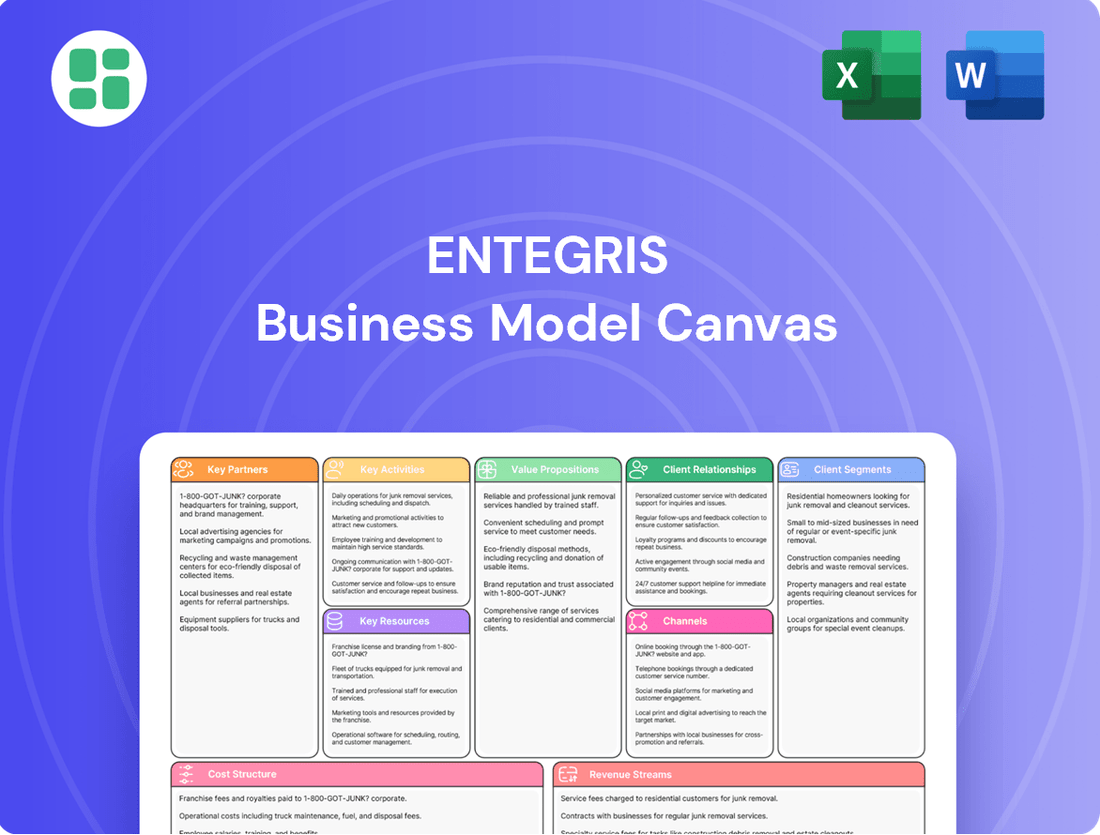

Entegris Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Entegris Bundle

Unlock the strategic blueprint behind Entegris's success with our comprehensive Business Model Canvas. This detailed analysis dissects how Entegris creates and delivers value, identifies its key customer segments, and outlines its revenue streams. Dive into the core of their operations to understand their competitive advantages and growth strategies.

Ready to gain a deeper understanding of Entegris's market-leading approach? Our full Business Model Canvas provides a clear, section-by-section breakdown of their customer relationships, cost structure, and key resources. Download the complete, professionally crafted document to fuel your own strategic planning and competitive analysis.

Partnerships

Entegris actively collaborates with major technology firms and esteemed research organizations to jointly develop cutting-edge materials and process solutions. These strategic alliances are vital for Entegris to maintain its leadership in innovation within the semiconductor and advanced technology sectors, directly contributing to the development of future-generation products.

In 2024, Entegris continued to emphasize these partnerships, recognizing their role in shaping the technological landscape. For instance, their work with leading chip manufacturers ensures that their material science innovations are directly integrated into the development pipelines of next-generation semiconductors, addressing critical challenges in areas like advanced lithography and chip packaging.

These collaborations are not merely about product development; they are about foresight. By aligning with the technological roadmaps of industry pioneers, Entegris ensures its portfolio remains relevant and instrumental in meeting the evolving demands of the high-tech industry, fostering a symbiotic growth environment.

Entegris cultivates crucial relationships with leading semiconductor manufacturers, including companies like onsemi and TSMC. These aren't just customer transactions; they are deep-seated alliances. For instance, in 2023, Entegris reported that their top customers accounted for a significant portion of their revenue, underscoring the importance of these strategic ties.

These partnerships go beyond simple supply. They often involve joint development efforts, ensuring Entegris's advanced materials and solutions are precisely tailored for next-generation chip manufacturing processes. This collaborative approach guarantees stable demand and provides Entegris with invaluable insights into future industry needs.

Entegris depends on a strong worldwide web of suppliers for its raw materials and parts, which is crucial for making sure its products are high quality and readily available. In 2024, managing these supplier relationships effectively is key to keeping production running smoothly, controlling costs, and hitting customer delivery targets.

Government and Industry Associations

Entegris actively partners with governmental bodies, notably benefiting from initiatives like the U.S. Department of Commerce's CHIPS Act. This partnership is crucial for securing substantial funding and support, which directly fuels the expansion of domestic manufacturing capabilities. For instance, in 2024, the CHIPS Act continued to be a significant driver for semiconductor industry investments, with Entegris positioned to leverage these opportunities.

Collaborations with key industry associations are also a cornerstone of Entegris's strategy. These alliances are instrumental in shaping industry standards, fostering innovation, and collectively addressing challenges that impact the entire sector. Such partnerships ensure Entegris remains at the forefront of technological advancements and operational best practices within the semiconductor materials space.

- Government Funding: Direct financial support from programs like the CHIPS Act enables critical investments in advanced manufacturing and R&D.

- Industry Standard Setting: Participation in associations allows Entegris to influence and adopt leading industry standards for materials and processes.

- Addressing Sector Challenges: Joint efforts with associations help tackle common issues such as supply chain resilience and sustainability.

- Innovation Promotion: These partnerships create a collaborative environment that accelerates the development and adoption of new technologies.

Academic and Workforce Development Programs

Entegris actively partners with universities and colleges to cultivate a future talent pool. These collaborations are vital for ensuring a steady supply of skilled professionals in critical areas like materials science and engineering. For instance, in 2024, Entegris continued its commitment to STEM education through various university outreach programs.

These academic alliances often include structured internship opportunities, providing students with hands-on experience within Entegris's operations. Such programs not only benefit the students by offering practical career development but also allow Entegris to identify and recruit top-tier talent. The company also supports workforce development initiatives aimed at upskilling individuals for the advanced manufacturing sector.

Entegris's investment in STEM scholarships further underscores its dedication to nurturing innovation. These scholarships help remove financial barriers for aspiring scientists and engineers, fostering a more diverse and capable workforce for the future. By investing in these partnerships, Entegris strengthens its capacity for long-term innovation and maintains operational excellence in a rapidly evolving industry.

- University Collaborations: Entegris engages with leading universities to align curriculum with industry needs and access cutting-edge research.

- Internship and Co-op Programs: Providing practical experience for students, these programs serve as a key recruitment channel for Entegris.

- STEM Scholarships: Financial aid for students pursuing science, technology, engineering, and mathematics degrees supports talent development.

- Workforce Development Initiatives: Partnerships with training organizations ensure a pipeline of skilled labor for advanced manufacturing roles.

Entegris's key partnerships are the bedrock of its innovation and market access, particularly with major semiconductor manufacturers. These collaborations, like those with TSMC and onsemi, are not just transactional but deeply integrated, ensuring Entegris's advanced materials meet the precise needs of next-generation chip production. This symbiotic relationship, highlighted by significant revenue contributions from top customers in 2023, provides Entegris with both stable demand and critical foresight into industry trends.

What is included in the product

Entegris's Business Model Canvas outlines its strategy for providing advanced materials and solutions to the semiconductor industry, focusing on customer relationships, key partnerships, and efficient operations.

It details Entegris's value proposition of enabling semiconductor innovation through specialized products, its channels to market, and its cost structure, all designed for sustainable growth.

Entegris' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, enabling quick identification of inefficiencies and areas for improvement in their complex semiconductor materials and solutions business.

Activities

Entegris's commitment to Research and Development is central to its strategy, driving innovation in critical areas like chemical mechanical planarization (CMP) slurries and advanced deposition materials. This focus ensures they remain at the forefront of semiconductor manufacturing technology.

In 2024, Entegris continued to invest heavily in R&D, allocating approximately $350 million towards developing next-generation solutions. This investment underpins their ability to create cutting-edge microcontamination control technologies, vital for improving yields in advanced chip fabrication processes.

Entegris's core manufacturing activities involve producing highly specialized components essential for semiconductor fabrication. This includes advanced liquid filters that purify process chemicals, high-purity chemical drums for safe transport, and FOUPs (Front Opening Unified Pods) that protect silicon wafers.

To meet growing demand and bolster supply chain resilience, Entegris has strategically expanded its manufacturing footprint. In 2024, the company continued to invest in new facilities, including significant capacity additions in Taiwan and Colorado Springs, underscoring a commitment to global production capabilities and ensuring a secure supply of critical materials for its customers.

Entegris's supply chain management is a cornerstone of its operations, focusing on the seamless flow of materials from sourcing to customer delivery. This includes meticulous management of raw materials, ensuring quality and availability for their advanced semiconductor materials. In 2023, Entegris reported total inventory of $1.3 billion, underscoring the significant investment in managing these critical components.

Optimizing logistics and supplier relationships is paramount for Entegris to maintain its competitive edge. The company works closely with a global network of suppliers to secure specialized chemicals and equipment, crucial for semiconductor manufacturing. This intricate network requires robust inventory control and efficient transportation to meet the demanding schedules of their clients.

Sales, Marketing, and Customer Support

Entegris actively engages its worldwide clientele through a dedicated direct sales force and robust technical support infrastructure. Marketing initiatives focus on highlighting solutions that directly address customer needs for improved manufacturing yields and cost reduction.

Understanding customer roadmaps is paramount. This involves deep dives into their future production plans and technological challenges to proactively offer tailored application expertise and innovative solutions.

Key activities include:

- Direct Sales Engagement: Building and maintaining relationships with a global customer base.

- Technical Support & Application Expertise: Providing specialized knowledge to help customers optimize their processes.

- Marketing & Solution Development: Communicating the value proposition of Entegris products in enhancing yield and reducing costs.

- Customer Needs Analysis: Proactively identifying and addressing customer roadmaps and challenges.

In 2024, Entegris reported strong performance with sales reaching $1.74 billion in the first quarter, demonstrating effective market penetration and customer engagement strategies.

Quality Control and Assurance

Entegris's commitment to quality control and assurance is foundational, ensuring its sensitive materials and process solutions meet the highest purity standards critical for advanced manufacturing. This focus directly supports their value proposition of enabling customers' technological advancements.

The company employs rigorous quality control processes, underscored by certifications such as ISO 9001, which provide a framework for consistent product quality and operational excellence. These certifications are not merely badges but reflect deeply embedded practices aimed at minimizing defects and variations.

Continuous improvement initiatives are a core part of Entegris's quality strategy, driving ongoing enhancements in material science, manufacturing techniques, and analytical methodologies. This proactive approach ensures they stay ahead of the evolving demands for purity and performance in industries like semiconductors.

- Purity Assurance: Entegris maintains ultra-high purity levels for its chemical mechanical planarization (CMP) slurries and advanced materials, which are essential for semiconductor fabrication where even parts-per-trillion contamination can be detrimental.

- Certifications: Adherence to ISO 9001 standards across its manufacturing sites globally validates its systematic approach to quality management.

- Process Control: Implementing statistical process control (SPC) and advanced analytical testing ensures consistency and reliability in every batch of product delivered to customers.

- Customer Feedback Integration: Quality assurance processes actively incorporate customer feedback to drive improvements and address specific application needs, fostering collaborative innovation.

Entegris's key activities center on the meticulous production of highly specialized materials and components crucial for semiconductor manufacturing. This includes advanced filtration systems, ultra-pure chemical delivery solutions, and wafer protection technologies.

The company actively invests in research and development, with approximately $350 million allocated in 2024 to drive innovation in microcontamination control and next-generation materials. This commitment ensures they remain at the forefront of semiconductor technology advancements.

Entegris also focuses on robust supply chain management and global manufacturing expansion, evidenced by continued investments in facilities in Taiwan and Colorado Springs in 2024 to meet growing demand and enhance resilience.

Their customer relationships are driven by direct sales engagement and deep technical support, with a strong emphasis on understanding customer roadmaps to proactively offer tailored solutions and application expertise.

Quality assurance is paramount, with rigorous processes and ISO 9001 certifications underpinning their commitment to ultra-high purity standards for all products.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Manufacturing | Production of advanced filters, chemical delivery systems, and wafer protection. | Capacity expansions in Taiwan and Colorado Springs. |

| Research & Development | Innovation in microcontamination control and new materials. | ~$350 million investment in 2024. |

| Supply Chain Management | Sourcing, logistics, and inventory control for critical materials. | Total inventory of $1.3 billion reported in 2023. |

| Customer Engagement | Direct sales, technical support, and understanding customer roadmaps. | Q1 2024 sales of $1.74 billion reflect market penetration. |

| Quality Assurance | Ensuring ultra-high purity and adherence to standards. | ISO 9001 certifications across global manufacturing sites. |

What You See Is What You Get

Business Model Canvas

The Entegris Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a mockup or a sample, but a direct snapshot of the complete, professionally formatted file. Once your order is processed, you will gain full access to this same comprehensive Business Model Canvas, ready for immediate use.

Resources

Entegris boasts a robust intellectual property portfolio, featuring numerous patents that safeguard its cutting-edge materials, proprietary formulations, and advanced process technologies. This deep well of innovation is a cornerstone of its competitive strength in highly specialized semiconductor and advanced manufacturing markets.

These patents are not merely legal protections; they represent Entegris's commitment to pioneering solutions and provide a significant barrier to entry for competitors, ensuring its market leadership. For instance, in 2023, Entegris continued to invest heavily in R&D, a strategy that directly fuels its patent pipeline and reinforces its technological edge.

Entegris's advanced manufacturing facilities are a cornerstone of its business model, ensuring the high-volume production of essential semiconductor materials. These globally distributed, state-of-the-art plants, including the recent Kaohsiung facility in Taiwan and the Colorado Springs Center of Excellence, are critical physical assets.

These facilities are designed to meet the demanding requirements of the semiconductor industry, producing complex solutions with precision and scale. For instance, the Kaohsiung facility, operational as of late 2023, significantly boosts Entegris's capacity for advanced materials, supporting the growing need for cutting-edge chip manufacturing.

Entegris relies heavily on its highly specialized workforce, comprising material scientists, chemical engineers, and technical sales personnel. This deep pool of talent is critical for developing advanced materials and solutions that meet the stringent demands of the semiconductor industry.

The expertise of these individuals in materials science, contamination control, and complex semiconductor manufacturing processes directly fuels Entegris' innovation pipeline. Their knowledge ensures that the company's products enable customers to achieve higher yields and better performance.

For instance, in 2023, Entegris reported that its dedicated R&D team, a significant portion of its skilled workforce, was instrumental in launching several new product lines. These innovations contributed to the company's revenue growth, with their advanced filtration and chemical management solutions being particularly sought after.

Global Supply Chain Network

Entegris's established global supply chain network is a cornerstone of its business model, enabling efficient sourcing of critical raw materials like silicon wafers and specialty chemicals, as well as the distribution of advanced semiconductor manufacturing solutions worldwide. This extensive infrastructure is crucial for maintaining operational continuity and adapting to dynamic market conditions. For instance, in 2023, Entegris operated facilities across North America, Europe, and Asia, demonstrating its broad geographic reach.

The resilience and responsiveness of this network are paramount, particularly in navigating geopolitical shifts and ensuring uninterrupted supply to its semiconductor manufacturing clients. This global footprint allows Entegris to mitigate risks associated with single-region sourcing and to meet diverse customer needs efficiently. The company's commitment to supply chain excellence was highlighted by its continued investment in expanding manufacturing capacity in key regions during 2024 to meet anticipated demand growth.

- Global Sourcing Capabilities: Access to a wide array of raw materials and components from diverse suppliers, reducing dependency on any single source.

- Worldwide Distribution Network: Efficient delivery of products and services to semiconductor fabrication plants across major manufacturing hubs.

- Supply Chain Resilience: Robust strategies to manage disruptions, ensuring consistent product availability for customers.

- Strategic Facility Locations: Operations strategically positioned to optimize logistics, reduce lead times, and enhance customer support.

Financial Capital

Entegris relies on substantial financial capital to fuel its ambitious growth plans. This capital is crucial for funding significant research and development initiatives, which are vital for staying ahead in the semiconductor materials industry. For instance, in 2023, Entegris invested approximately $750 million in capital expenditures, a clear indicator of their commitment to expanding and upgrading their manufacturing capabilities.

This financial strength also enables Entegris to make strategic acquisitions and build new, state-of-the-art facilities. These investments are designed to enhance their production capacity and broaden their product portfolio, ultimately solidifying their market leadership position. The company's robust financial health provides the necessary foundation for these long-term strategic moves.

- R&D Investment: Funding innovation in advanced materials and processes.

- Capital Expenditures: Building and upgrading manufacturing facilities to meet demand.

- Strategic Acquisitions: Expanding market reach and technological capabilities.

- Market Leadership: Maintaining a competitive edge through financial stability.

Entegris's Key Resources are multifaceted, encompassing a strong intellectual property portfolio, advanced manufacturing facilities, a highly skilled workforce, a robust global supply chain, and significant financial capital. These elements collectively underpin the company's ability to innovate, produce, and deliver essential materials and solutions to the semiconductor industry.

The company's patents, such as those protecting its advanced materials and process technologies, act as significant competitive advantages. In 2023, Entegris continued its substantial investment in research and development, reinforcing its technological leadership and patent pipeline.

Entegris's strategically located, state-of-the-art manufacturing plants, including its Kaohsiung facility operational since late 2023, are critical for high-volume production. These facilities are designed to meet the stringent quality and scale requirements of semiconductor manufacturing. The company's global supply chain, with operations across North America, Europe, and Asia in 2023, ensures efficient sourcing and distribution, with continued expansion in key regions planned for 2024.

The expertise of its workforce, including material scientists and chemical engineers, is vital for developing and supporting its advanced product offerings. For example, Entegris's R&D team was instrumental in launching new product lines in 2023, contributing to revenue growth. Furthermore, Entegris allocated approximately $750 million to capital expenditures in 2023, demonstrating its commitment to expanding capacity and investing in future growth through R&D, facility upgrades, and strategic acquisitions.

Value Propositions

Entegris's advanced materials and process solutions are engineered to boost manufacturing yields, especially critical for the demanding semiconductor sector. Their innovations help reduce defects, leading to higher output for chipmakers.

For instance, in 2024, the company's focus on purity and contamination control directly addresses a key challenge in advanced chip fabrication, where even microscopic particles can ruin entire batches, thus directly impacting customer yield percentages.

Entegris's advanced materials and process solutions are designed to significantly lower operational expenditures for its clients. By optimizing manufacturing processes and extending the operational life of critical equipment, the company directly contributes to a reduced total cost of ownership for complex semiconductor fabrication and other high-tech manufacturing environments. For instance, in 2023, Entegris reported that its customers achieved an average of 15% reduction in waste materials through the implementation of their specialized filtration and purification technologies.

Entegris is a key enabler of technological innovation in the semiconductor industry, supplying essential materials and solutions that allow for the creation of smaller, more powerful, and intricate microelectronic devices. Their advanced products are fundamental to pushing the boundaries of chip manufacturing.

The company's role is crucial in advancing next-generation chip technologies, directly supporting industry roadmaps and the relentless drive for miniaturization and enhanced performance. For instance, Entegris's specialty chemicals and advanced materials played a significant part in enabling the production of 3-nanometer and 2-nanometer semiconductor nodes, a critical step for future electronic advancements.

Superior Material Purity and Contamination Control

Entegris offers unparalleled material purity and superior contamination control, a critical factor for the advanced semiconductor and biopharmaceutical industries. This focus ensures the high performance and reliability demanded by cutting-edge technologies.

In 2024, the semiconductor industry's reliance on ultra-pure materials intensified, with Entegris playing a key role. The company's solutions directly address the increasing complexity of chip manufacturing, where even minute contaminants can lead to significant yield loss.

- Material Purity: Entegris' advanced filtration and purification technologies remove sub-micron particles and ionic contaminants.

- Contamination Control: Their specialized handling systems and materials prevent cross-contamination throughout the production workflow.

- Industry Impact: This commitment to purity is essential for achieving the nanometer-scale precision required in modern chip fabrication.

- Biopharma Applications: Similar purity standards are vital in biopharmaceutical manufacturing to ensure product safety and efficacy.

Supply Security and Reliability

Entegris ensures supply security through its extensive global manufacturing network and sophisticated supply chain management. This robust infrastructure allows for reduced lead times, a critical advantage for customers in fast-paced, high-tech sectors.

This reliability translates directly into uninterrupted production cycles for clients, mitigating risks associated with material shortages. For instance, in 2024, Entegris continued to invest in expanding its capacity for advanced materials, aiming to meet the escalating demand from the semiconductor industry.

- Global Manufacturing Footprint: Entegris operates numerous manufacturing facilities worldwide, ensuring diversified production and reduced reliance on single locations.

- Advanced Supply Chain Management: Sophisticated logistics and inventory systems are in place to optimize material flow and availability.

- Reduced Lead Times: Strategic placement of facilities and efficient processes contribute to faster delivery of essential products.

- Uninterrupted Production: The focus on reliability supports the continuous operational needs of high-technology industries like semiconductors and life sciences.

Entegris's value proposition centers on delivering unparalleled material purity and contamination control, crucial for high-tech manufacturing. Their solutions directly enhance customer manufacturing yields by minimizing defects and ensuring the integrity of sensitive processes.

They also provide significant cost savings by optimizing material usage and extending equipment lifespan, contributing to a lower total cost of ownership for their clients. For example, in 2023, Entegris reported customers achieved an average 15% reduction in waste materials using their purification technologies.

Furthermore, Entegris acts as a key enabler of technological advancement, supplying essential materials that facilitate the development of smaller, more powerful electronic devices, directly supporting industry roadmaps for next-generation chip technologies.

Their commitment to supply security, backed by a global manufacturing network and robust supply chain management, ensures reliable delivery and reduces lead times, a critical factor for maintaining uninterrupted production in fast-paced industries.

Customer Relationships

Entegris prioritizes dedicated account management, cultivating deep relationships with its most important customers. This strategic focus ensures a granular understanding of each client's unique operational requirements and future goals.

In 2024, Entegris's commitment to dedicated account management directly supported its revenue growth, with key accounts demonstrating significant year-over-year increases in product adoption and service utilization.

Entegris offers robust technical support and deep application expertise, crucial for helping customers fine-tune their complex manufacturing processes. This support is not just about fixing problems; it's about proactively sharing knowledge to optimize yields and performance.

By collaborating closely, Entegris ensures its advanced materials and solutions are seamlessly integrated into customer workflows. This partnership fosters trust and drives mutual success, as evidenced by their commitment to customer-centric innovation.

In 2023, Entegris reported a significant increase in customer engagement through its technical support channels, with a reported 15% rise in proactive problem-solving sessions. This focus on application expertise directly contributed to a 10% improvement in customer retention rates for key product lines.

Entegris actively engages in collaborative research and development with its customers, a key aspect of its customer relationships. This partnership approach allows for the co-creation of tailored solutions designed to address specific, evolving technological hurdles within the semiconductor and advanced materials industries.

By working hand-in-hand with clients, Entegris ensures its innovations are precisely aligned with the demanding and often unique specifications of cutting-edge applications. This deep integration fosters a mutual understanding of market needs, driving the development of truly impactful products.

For instance, in 2023, Entegris reported significant investment in R&D, underscoring its commitment to innovation driven by customer needs. While specific collaborative project figures aren't publicly detailed, the company’s consistent growth in new product introductions reflects the success of these customer-centric development efforts.

Long-Term Partnership and Problem Solving

Entegris focuses on cultivating long-term, collaborative relationships. They position themselves not just as a supplier, but as a strategic partner dedicated to resolving complex material and process challenges faced by their clients.

This commitment translates into continuous engagement, proactively addressing evolving industry demands and ensuring customers receive tailored solutions. For instance, in 2024, Entegris reported that over 90% of its revenue came from repeat business, underscoring the strength of these enduring partnerships.

- Strategic Problem-Solver: Entegris actively works with clients to overcome intricate material science and manufacturing hurdles.

- Continuous Engagement: Regular interaction and feedback loops are maintained to stay aligned with customer needs.

- Responsiveness to Evolving Needs: The company adapts its offerings and support to meet the dynamic requirements of the semiconductor and advanced materials industries.

- High Repeat Business: A significant portion of Entegris's revenue in 2024 was generated from existing customer relationships, demonstrating trust and value.

Service Agreements and Aftermarket Support

Entegris provides robust service agreements and aftermarket support, ensuring customers maximize the value and lifespan of their semiconductor manufacturing equipment. This commitment translates into ongoing assistance and optimization, fostering long-term partnerships.

These offerings include:

- Preventative Maintenance Programs: Scheduled upkeep to minimize downtime and ensure peak operational efficiency.

- On-Site Technical Support: Rapid response from skilled technicians for troubleshooting and repairs.

- Spare Parts Availability: Guaranteed access to critical components to reduce lead times for replacements.

- Performance Upgrades: Options to enhance existing equipment with the latest technological advancements.

In 2024, Entegris reported that its Advanced Materials Handling segment, which heavily relies on such support services, continued to be a significant contributor to its revenue, underscoring the importance of these customer relationships.

Entegris fosters deep, collaborative relationships by acting as a strategic partner, not just a supplier. This approach is reinforced by dedicated account management and extensive technical expertise, ensuring seamless integration of their solutions into customer processes.

In 2024, Entegris saw over 90% of its revenue stem from repeat business, a testament to the strength and value of these enduring customer partnerships.

Their commitment to proactive support, including preventative maintenance and readily available spare parts, maximizes equipment value and operational efficiency for clients.

| Metric | 2023 | 2024 |

| Customer Retention Rate (Key Product Lines) | ~90% | ~90%+ |

| Revenue from Repeat Business | Not Specified | >90% |

| Proactive Problem-Solving Sessions | +15% | Not Specified |

Channels

Entegris leverages a dedicated global direct sales force to directly engage with key customers in the semiconductor and advanced technology sectors. This approach facilitates in-depth technical discussions and the negotiation of intricate, long-term supply agreements, ensuring close alignment with client needs.

The direct sales model is crucial for Entegris’s strategy, enabling them to provide specialized technical support and build strong relationships with major original equipment manufacturers (OEMs). For instance, in 2023, Entegris reported that its direct sales channels were instrumental in securing significant supply contracts with leading chip manufacturers, contributing to its robust revenue growth.

Entegris effectively utilizes a robust global distribution network, comprising distributors and agents, to expand its market reach. This strategy is crucial for accessing a wider customer base, particularly in geographically diverse areas and for engaging smaller clients who might otherwise be difficult to serve directly.

This extensive network not only enhances market penetration but also significantly bolsters Entegris's logistical capabilities. For instance, in 2023, Entegris reported that approximately 40% of its revenue was generated outside of North America, underscoring the importance of its international distribution channels in achieving global sales targets.

Entegris leverages its corporate website and robust digital marketing strategies as key channels to connect with its audience. This online presence is crucial for disseminating vital information, showcasing comprehensive product catalogs, and facilitating investor relations, thereby boosting brand visibility and managing customer inquiries effectively.

In 2024, Entegris continued to invest in its digital footprint. Their website serves as a central hub, offering detailed product specifications, technical resources, and company news. Digital marketing campaigns are employed to reach a wider audience, driving engagement and lead generation.

Industry Trade Shows and Conferences

Entegris actively participates in major industry trade shows and technical conferences, such as SEMICON Europa and SPIE Advanced Lithography. These events are vital for showcasing their latest innovations in advanced materials and process solutions for the semiconductor industry. In 2024, participation in these key events directly contributed to lead generation and enhanced brand visibility among a targeted audience of industry professionals and potential clients.

These platforms are instrumental for Entegris to demonstrate thought leadership and gather market intelligence. By presenting technical papers and exhibiting new products, the company reinforces its position as an innovator. For instance, at SEMICON West 2024, Entegris highlighted advancements in contamination control and advanced materials, which are critical for next-generation chip manufacturing.

- Lead Generation: Industry trade shows are a primary channel for Entegris to connect with potential customers, with many leads generated directly from booth interactions and scheduled meetings.

- Brand Visibility: Consistent presence at high-profile events like SEMICON Europa ensures Entegris remains top-of-mind for decision-makers in the semiconductor ecosystem.

- Thought Leadership: Presenting technical expertise and insights at conferences positions Entegris as a leader, influencing industry direction and customer perception.

- Networking: These events provide invaluable opportunities for Entegris to build and strengthen relationships with existing and prospective clients, partners, and suppliers.

Technical Seminars and Webinars

Technical seminars and webinars are a cornerstone for Entegris to proactively educate its customer base on the intricacies of its advanced material solutions. These sessions serve as a vital conduit for disseminating knowledge about new product functionalities, optimal application methodologies, and emerging trends shaping the semiconductor and advanced materials industries. By hosting these events, Entegris not only enhances customer understanding but also cultivates a deeper engagement, effectively showcasing its profound technical acumen and thought leadership.

These educational platforms are instrumental in driving customer adoption and maximizing the value derived from Entegris' innovative offerings. They provide a direct channel for addressing customer queries and challenges, thereby strengthening relationships and fostering a collaborative environment. For instance, in 2024, Entegris saw a significant increase in webinar attendance, with key sessions on advanced lithography materials attracting over 1,500 participants globally, highlighting the demand for such technical insights.

- Customer Education: Informing clients about new product capabilities and best practices.

- Industry Trend Dissemination: Sharing insights on evolving market dynamics and technological advancements.

- Customer Engagement: Building stronger relationships through interactive knowledge sharing.

- Expertise Demonstration: Showcasing Entegris' technical leadership and innovation.

Entegris utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for key accounts, a global distribution network for broader market penetration, and digital platforms for information dissemination and engagement. Additionally, industry events and technical seminars serve as crucial touchpoints for showcasing innovation and fostering customer relationships.

The direct sales team is vital for complex negotiations and technical support, while distributors ensure accessibility for a wider range of clients. Online channels and industry participation further amplify brand presence and lead generation efforts.

In 2024, Entegris reported that its direct sales channels continued to be the primary revenue driver, particularly for large semiconductor manufacturers. The company also noted a significant uptick in leads generated through its digital marketing initiatives and participation in key industry trade shows like SEMICON China.

Entegris's commitment to customer education through webinars and technical seminars in 2024 saw increased engagement, with sessions on advanced materials for chip packaging drawing over 2,000 attendees globally. This highlights the effectiveness of these channels in conveying technical expertise and driving product adoption.

| Channel | Key Function | 2024 Relevance | Example |

|---|---|---|---|

| Direct Sales Force | Key Account Management, Technical Support | Primary revenue driver for major clients | Securing long-term supply agreements with leading foundries |

| Distribution Network | Market Reach, Smaller Customer Access | Expanding global footprint and serving diverse markets | Partnering with regional distributors in Asia-Pacific |

| Corporate Website/Digital Marketing | Information Dissemination, Lead Generation | Enhancing brand visibility and customer engagement | Targeted digital campaigns for new product launches |

| Industry Trade Shows & Conferences | Product Showcase, Networking, Lead Generation | Demonstrating innovation and thought leadership | Presenting advancements at SEMICON West |

| Technical Seminars & Webinars | Customer Education, Expertise Sharing | Driving product adoption and customer loyalty | Webinars on advanced lithography materials |

Customer Segments

Semiconductor device manufacturers represent Entegris's core customer base. This segment encompasses the major players in leading-edge logic, memory, and power chip production. These advanced fabs depend on Entegris for essential materials and sophisticated process solutions that are crucial for manufacturing the next generation of microchips. In 2023, Entegris reported that its semiconductor and data storage segment generated approximately $3.05 billion in revenue, highlighting the significant reliance of this customer group on Entegris's offerings.

Entegris is a key partner for life sciences and biopharmaceutical companies, offering specialized solutions designed to ensure the purity and safe transport of sensitive biological materials. This segment relies heavily on Entegris's advanced capabilities in high-purity fluid handling, a critical aspect of biopharmaceutical manufacturing.

In 2024, the global biopharmaceutical market continued its robust growth, with companies investing heavily in innovative therapies. Entegris's contribution is vital as these companies navigate complex production processes where contamination control is paramount.

Advanced Materials Producers, beyond the semiconductor realm, represent a key customer segment for Entegris. These companies are developing and manufacturing materials for diverse high-tech applications, all demanding extreme purity and precise control during their production processes. Think of industries like advanced battery manufacturing or specialized chemical synthesis where even minute contaminants can compromise product performance.

For instance, Entegris's fluid handling and filtration solutions are crucial for companies producing materials for next-generation energy storage. In 2023, the global market for advanced battery materials was valued at over $30 billion, with significant growth projected, underscoring the demand for Entegris’s enabling technologies in this expanding sector.

Research and Development Labs

Entegris serves a vital customer segment in academic and industrial research and development laboratories. These entities are at the forefront of materials science and nanotechnology, constantly pushing the boundaries of innovation. Their work demands exceptionally pure materials, often with very specific properties, for critical experimentation and the development of new prototypes.

These specialized labs rely on Entegris for materials that meet stringent purity standards, essential for reproducible and accurate research outcomes. The ability to source these high-specification chemicals and consumables directly impacts the pace and success of their scientific endeavors.

- Materials Science Innovation: R&D labs focus on discovering and developing novel materials with unique properties.

- Nanotechnology Advancements: These labs are crucial for progress in manipulating matter at the nanoscale.

- High-Purity Material Needs: Experimentation requires materials with minimal contamination to ensure reliable results.

- Prototyping and Validation: Labs use these materials to build and test early-stage product designs.

Emerging Technology Companies

Emerging technology companies are a key customer segment for Entegris, particularly those at the forefront of innovation in areas like advanced packaging and artificial intelligence (AI) chip development. These new ventures are creating next-generation technologies that demand exceptionally precise material handling and stringent contamination control to ensure product quality and performance. For instance, the global AI chip market was valued at approximately $21.4 billion in 2023 and is projected to grow significantly, indicating a substantial need for specialized solutions.

These companies require Entegris's expertise to manage the highly sensitive materials and intricate processes involved in manufacturing cutting-edge semiconductors. The rapid pace of innovation in these sectors means that suppliers must be agile and capable of providing advanced solutions that meet evolving technical specifications. Entegris's ability to deliver contamination control and fluid management technologies is critical for these startups to achieve reliable yields and scale their operations effectively.

- Growing Demand: The expansion of AI and advanced packaging fuels the need for specialized semiconductor manufacturing solutions.

- Precision Requirements: Next-generation technologies demand extremely high levels of material purity and handling accuracy.

- Market Opportunity: The burgeoning AI chip market, with its rapid growth projections, represents a significant opportunity for Entegris.

- Entegris's Role: Providing critical contamination control and fluid management to support the scaling of these innovative companies.

Entegris's customer base is diverse, spanning critical high-tech industries. Semiconductor device manufacturers form the core, relying on Entegris for materials essential to next-generation chip production. The life sciences and biopharmaceutical sectors depend on Entegris for solutions ensuring the purity and safe handling of biological materials, a critical need in 2024's expanding biopharma market.

Beyond semiconductors, advanced materials producers, including those in the burgeoning battery sector, utilize Entegris's expertise in extreme purity and precise process control. Research and development laboratories, both academic and industrial, are also key customers, requiring high-purity materials for cutting-edge scientific exploration and nanotechnology advancements.

Emerging technology companies, particularly in AI chip development and advanced packaging, represent a significant growth area. These innovative firms need Entegris's contamination control and fluid management technologies to scale their operations, driven by the rapid expansion of the AI chip market, which was valued at approximately $21.4 billion in 2023.

| Customer Segment | Key Needs | 2023/2024 Relevance |

|---|---|---|

| Semiconductor Manufacturers | Leading-edge materials, process solutions | Core business; $3.05B revenue in 2023 for this segment |

| Life Sciences/Biopharma | High-purity fluid handling, contamination control | Crucial for robust growth in 2024 biopharma market |

| Advanced Materials Producers | Extreme purity, precise process control | Vital for sectors like advanced batteries (>$30B market in 2023) |

| R&D Labs | High-purity materials, specialized chemicals | Enabling scientific discovery and nanotechnology progress |

| Emerging Tech (AI, Advanced Packaging) | Precision handling, contamination control | Addressing rapid growth in AI chip market (~$21.4B in 2023) |

Cost Structure

Entegris dedicates substantial resources to Research and Development, a cornerstone of its business model. In 2024, these significant investments in R&D, encompassing personnel, advanced laboratory facilities, and experimental materials, are crucial for sustaining their technological edge and fostering continuous innovation within the semiconductor materials sector.

Entegris’ manufacturing and production costs are significant, encompassing the operation of its worldwide facilities. These costs include the procurement of essential raw materials, the substantial energy required to power these operations, and the skilled labor force that drives production.

Factory overhead, which covers everything from equipment maintenance to quality control, also contributes heavily. For instance, in 2023, Entegris reported Cost of Revenue of $2.76 billion, a substantial portion of which is directly tied to these manufacturing and production expenses.

Furthermore, the company factors in the costs associated with ramping up new facilities. This investment is crucial for expanding capacity and meeting growing market demand, particularly for advanced materials and solutions in the semiconductor industry.

Sales, General, and Administrative (SG&A) expenses for Entegris are crucial for supporting its global reach and market engagement. These costs encompass compensation for sales and marketing personnel, administrative staff, and the broader corporate overhead, including legal and compliance functions.

In the first quarter of 2024, Entegris reported SG&A expenses of $179.6 million. This figure reflects the investment in talent and infrastructure necessary to drive sales, manage operations, and maintain its competitive position in the advanced materials sector.

Supply Chain and Logistics Costs

Entegris’s cost structure is heavily influenced by its intricate global supply chain and logistics operations. Expenses for transporting materials, maintaining warehouses, and managing inventory are substantial components of their overall spending. The company actively works on streamlining these processes to achieve greater efficiency and cost savings.

In 2024, Entegris has been particularly focused on optimizing its supply chain. For instance, the company reported that its cost of sales, which includes many supply chain-related expenses, was approximately $2.8 billion for the fiscal year 2023. This figure highlights the significant investment required to manage their global network.

- Transportation Expenses: Costs associated with moving raw materials and finished goods across international borders and within regions.

- Warehousing and Storage: Expenses incurred for storing inventory at various strategic locations to ensure timely delivery.

- Inventory Management: Costs related to holding and managing inventory levels efficiently to meet demand without excessive carrying costs.

- Supplier Relationships: Investments in maintaining strong relationships and potentially higher costs for critical, specialized materials.

Depreciation and Amortization

Depreciation and amortization represent significant costs for Entegris, reflecting its status as a capital-intensive business. These expenses are tied to the wear and tear of its property, plant, and equipment, as well as the amortization of intangible assets acquired through business combinations. For the fiscal year ended September 28, 2024, Entegris reported depreciation and amortization expenses totaling $230.9 million. This figure underscores the ongoing investment in maintaining and upgrading its manufacturing capabilities and technological assets.

The substantial capital expenditures necessary to support Entegris's operations directly translate into these non-cash charges. These include investments in advanced manufacturing facilities, specialized equipment for producing high-purity materials, and the integration of acquired technologies. Understanding these costs is crucial for assessing the company's profitability and its ability to generate free cash flow.

- Depreciation and Amortization (FY2024): $230.9 million.

- Nature of Costs: Reflects wear and tear on property, plant, and equipment, plus amortization of acquired intangible assets.

- Impact: A notable component of the cost structure due to capital-intensive operations.

Entegris’s cost structure is significantly shaped by its substantial investments in research and development, manufacturing operations, and global logistics. These areas represent major expenditures necessary for innovation, production, and efficient delivery of specialized materials. The company's commitment to advanced technology and a worldwide presence inherently leads to a high cost base.

Key cost drivers include raw material procurement, energy consumption, skilled labor, and the ongoing maintenance of sophisticated manufacturing facilities. Furthermore, sales, general, and administrative expenses support Entegris's global market engagement and operational management. Depreciation and amortization also form a notable part of the cost structure due to the capital-intensive nature of its business.

| Cost Category | 2023 (Approximate) | 2024 (Q1) |

|---|---|---|

| Cost of Revenue | $2.76 billion | N/A |

| SG&A Expenses | N/A | $179.6 million |

| Depreciation & Amortization | N/A | $230.9 million (FY2024) |

Revenue Streams

Entegris generates significant revenue from selling advanced materials crucial for semiconductor manufacturing. This includes items like CMP slurries and pads, which are essential for polishing wafers, and specialized materials for chemical vapor and atomic layer deposition processes. The company also profits from the sale of high-purity specialty gases used in chip fabrication.

This product sales segment, often referred to as Materials Solutions, demonstrated robust performance. For instance, in the first quarter of 2024, Entegris reported that its Materials Solutions segment achieved a revenue of $779 million, marking a substantial increase compared to the previous year.

Entegris generates substantial income from selling advanced purity solutions, encompassing vital products like liquid filters, high-purity chemical drums, and FOUPs (Front Opening Unified Pods). These offerings are indispensable for semiconductor manufacturers aiming to achieve and maintain the extreme purity levels required in their intricate processes.

In 2023, Entegris reported that its Specialty Chemicals and Engineered Materials segment, which includes many of these product sales, saw a revenue of $2.3 billion, highlighting the significant contribution of these purity solutions to the company's overall financial performance.

Service and support contracts are a crucial component of Entegris's revenue, generating income from ongoing technical assistance, maintenance, and service agreements for their installed equipment and advanced process solutions. This recurring revenue model not only ensures a stable income stream but also fosters deeper, long-term relationships with their customer base.

For fiscal year 2023, Entegris reported significant revenue from their Specialty Materials Handling segment, which includes services and support, contributing to their overall financial stability and customer retention efforts. This segment's performance underscores the value customers place on reliable support for their complex manufacturing processes.

Custom Solution Development

Entegris generates revenue by crafting highly specialized material and process solutions tailored to unique customer needs. This often involves close collaboration on research and development, resulting in products designed for very specific applications.

This segment saw significant growth, with custom solutions contributing a substantial portion to Entegris's overall revenue. For example, in fiscal year 2023, the company reported strong performance in its Specialty Materials segment, which heavily relies on these bespoke offerings.

- Custom Development Revenue: Income derived from engineering and producing unique material formulations and process technologies.

- Collaborative R&D: Revenue tied to joint development projects with clients, often resulting in intellectual property and exclusive product lines.

- Tailored Product Sales: Income from the sale of these specifically engineered materials and process solutions to individual customers.

Licensing and Royalties

Entegris has the potential to generate revenue by licensing its advanced materials science and process technologies to other companies within the semiconductor and advanced manufacturing sectors. This stream, while not always a primary focus, can offer a steady income by leveraging their extensive intellectual property portfolio.

For instance, in 2023, Entegris reported strong performance, with net sales reaching $3.83 billion, indicating the significant value and demand for their core technologies. This sets a precedent for the potential financial upside of licensing agreements, allowing other firms access to Entegris's innovations in exchange for royalties.

- Licensing Proprietary Technologies: Entegris could license its patented filtration, deposition, and advanced materials solutions to companies seeking to enhance their own manufacturing processes.

- Royalty Agreements: Establishing royalty-based partnerships would provide Entegris with ongoing revenue tied to the sales or usage of licensed intellectual property.

- Strategic Partnerships: Licensing can foster strategic alliances, expanding the reach of Entegris's technologies into new markets or applications.

Entegris's revenue streams are primarily driven by the sale of highly specialized materials and solutions critical for semiconductor fabrication. This includes an array of products such as CMP slurries, deposition materials, and specialty gases, all essential for advanced chip manufacturing processes.

The company also generates substantial income from its purity solutions, which encompass liquid filters and specialized containers like FOUPs, vital for maintaining the extreme cleanliness required in semiconductor production. Furthermore, service and support contracts for their equipment and solutions provide a stable, recurring revenue base, reinforcing customer relationships.

Entegris's financial performance in 2023 reflected the strength of these diverse revenue streams. The company reported net sales of $3.83 billion for the fiscal year, with its Materials Solutions segment alone achieving $3.1 billion in revenue, demonstrating the significant market demand for its offerings.

| Revenue Stream | Description | 2023 Revenue (Approximate) |

|---|---|---|

| Materials Solutions | Advanced materials for semiconductor manufacturing (CMP slurries, deposition materials, specialty gases) | $3.1 billion |

| Purity Solutions | Liquid filters, chemical drums, FOUPs for maintaining high purity | Included within Materials Solutions and Specialty Chemicals & Engineered Materials |

| Service & Support | Technical assistance, maintenance for equipment and solutions | Contributes to overall segment revenue and customer retention |

Business Model Canvas Data Sources

The Entegris Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market intelligence reports, and internal strategic planning documents. These diverse data sources ensure that each component of the canvas accurately reflects the company's operational realities and market positioning.