Enphase SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

Enphase Energy's innovative technology and strong brand reputation are significant strengths, but the company also faces intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for any investor or strategist looking to navigate the renewable energy market.

Want the full story behind Enphase's competitive advantages, market threats, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Enphase Energy stands as a clear leader in microinverter technology, a significant strength that sets it apart in the solar industry. This innovative approach optimizes each solar panel individually, directly addressing issues like shading and panel degradation which can hinder overall system output.

This proprietary technology translates into tangible benefits for consumers, enhancing both the safety and reliability of solar installations. For instance, Enphase's System Shutdown technology, activated during grid outages, offers a crucial safety feature not present in traditional string inverter systems.

The company's consistent investment in R&D has solidified its technological edge. In 2023, Enphase reported a 10% year-over-year increase in R&D spending, focusing on further advancements in microinverter efficiency and smart grid integration capabilities, reinforcing their market position.

Enphase's integrated home energy management platform is a significant strength, offering a complete ecosystem from solar production to storage and intelligent control. This seamless integration allows homeowners to maximize their energy independence and efficiency, creating a user-friendly experience.

For instance, Enphase's IQ System, which includes microinverters, batteries, and the Ensemble technology, provides a unified solution. In 2023, Enphase reported a 30% year-over-year increase in its battery attachment rate, highlighting customer adoption of its comprehensive energy management approach.

Enphase has built a formidable brand reputation, consistently recognized for its commitment to quality, cutting-edge innovation, and exceptional customer support within the competitive solar energy sector. This strong brand equity is a significant asset, resonating with consumers and industry partners alike.

Complementing its brand strength is an expansive and highly skilled global network of certified installers. This network, a result of Enphase's investment in training and certification programs, ensures efficient product installation and a superior customer experience, driving market penetration and customer loyalty.

By the end of 2024, Enphase's installer network was reported to be over 20,000 certified professionals worldwide. This vast reach allows for rapid deployment of their energy systems, contributing to their market leadership and customer satisfaction metrics, which have consistently shown high Net Promoter Scores.

Global Market Diversification

Enphase's global market diversification is a significant strength, with operations spanning North America, Europe, and Australia. This broad geographic reach helps to smooth out revenue fluctuations that might arise from economic downturns or policy changes in any single region. For instance, in the first quarter of 2024, Enphase reported that its international markets contributed a substantial portion of its revenue, demonstrating the success of this strategy.

This international presence allows Enphase to tap into diverse growth opportunities within the expanding renewable energy sector worldwide. By not being overly dependent on one market, the company builds resilience against localized challenges. This global footprint is crucial for capturing the increasing demand for solar and battery storage solutions across various economies.

- Geographic Reach: Enphase has established a strong presence in key international markets including Europe and Australia, alongside its core North American business.

- Revenue Stability: Diversification across these regions reduces reliance on any single economy, enhancing financial stability.

- Market Penetration: The company is well-positioned to capitalize on the global surge in renewable energy adoption.

- Resilience: This broad operational base offers a buffer against regional economic or regulatory headwinds.

Focus on Residential and Light Commercial Segments

Enphase's strategic concentration on the residential and light commercial markets allows for highly specialized product development and marketing efforts. This focus enables the company to deeply understand and cater to the unique needs of homeowners and small businesses, fostering stronger customer relationships and brand loyalty.

This specialization translates into optimized product-market fit, meaning Enphase's offerings are precisely aligned with what these specific customer segments are looking for. For instance, in 2023, the residential solar market saw continued robust growth, with Enphase's solutions being a key enabler for many installations.

The company's targeted approach facilitates efficient resource allocation, ensuring investments in research, development, and sales are directed towards the most impactful areas within these segments. This efficiency supports sustained growth and market penetration, as evidenced by Enphase's consistent performance in these core markets throughout 2024.

- Targeted Product Development: Enphase can create solutions specifically designed for residential and light commercial needs, enhancing user experience and system performance.

- Deep Market Penetration: A focused strategy allows for greater understanding and capture of market share within these key customer segments.

- Efficient Resource Allocation: By concentrating efforts, Enphase optimizes its spending on R&D and sales, leading to better return on investment.

- Strong Brand Loyalty: Tailored offerings and dedicated support in these segments build trust and encourage repeat business.

Enphase's proprietary microinverter technology is a cornerstone strength, optimizing individual solar panel performance and enhancing system safety and reliability. This technological leadership is bolstered by consistent R&D investment, with a 10% year-over-year increase in 2023 focused on efficiency and smart grid integration. The company's integrated home energy management platform, including batteries and Ensemble technology, drives customer adoption, evidenced by a 30% increase in battery attachment rates in 2023. A strong brand reputation built on quality and innovation, supported by a global network of over 20,000 certified installers by the end of 2024, further solidifies its market position.

| Strength | Description | Supporting Data |

| Microinverter Technology | Optimizes individual panel performance, enhances safety and reliability. | Proprietary technology, 10% YoY R&D increase in 2023. |

| Integrated Energy Management | Offers a complete ecosystem from solar to storage and control. | 30% YoY increase in battery attachment rate in 2023. |

| Brand Reputation & Installer Network | Strong brand equity and a vast global network of certified installers. | Over 20,000 certified installers worldwide by end of 2024. |

| Global Market Diversification | Operations across North America, Europe, and Australia reduce regional dependency. | International markets contributed substantially to Q1 2024 revenue. |

| Targeted Market Focus | Specialization in residential and light commercial sectors allows for tailored solutions. | Robust growth in the residential solar market in 2023. |

What is included in the product

Analyzes Enphase’s competitive position through key internal and external factors, detailing its strong brand and technology against market competition and regulatory shifts.

Offers a structured framework to identify and address Enphase's market vulnerabilities and competitive threats, enabling proactive strategic adjustments.

Weaknesses

Enphase's microinverter systems, while technologically advanced, can present a higher initial system cost compared to conventional string inverter setups. This price difference, often cited as a key concern, might deter budget-conscious customers. For instance, in the residential solar market, the upfront investment can be a significant factor influencing purchasing decisions, potentially impacting Enphase's market share in price-sensitive segments.

Enphase Energy's significant reliance on external manufacturers for its microinverters and other components, alongside complex global supply chains, presents a notable weakness. This dependence makes the company vulnerable to disruptions.

For instance, supply chain issues in 2021 and 2022 led to extended lead times for Enphase products, impacting revenue recognition. While the company has worked to diversify its manufacturing base, the inherent risks of third-party production and global logistics remain a persistent challenge, potentially affecting production volumes and cost management.

The solar inverter and energy storage sectors are incredibly crowded, featuring many long-standing companies alongside dynamic new challengers. This fierce rivalry often translates into significant pricing pressure, which can squeeze profit margins and necessitate ongoing, hefty investments in innovation to stay ahead technologically and retain market position.

Vulnerability to Regulatory and Policy Changes

Enphase Energy’s reliance on government incentives and favorable policies presents a notable weakness. Changes to tax credits, net metering rules, or the imposition of import tariffs on solar components in key markets like the United States or Europe could directly curb demand for their products. For instance, a significant reduction in the Investment Tax Credit (ITC) in the U.S. could dampen residential solar adoption, impacting Enphase’s sales volumes.

The company's profitability is also susceptible to shifts in these regulatory landscapes. Adverse policy changes can reduce the overall economic attractiveness of solar installations, leading to lower sales and potentially impacting Enphase's margins.

- Policy Dependence: Enphase’s revenue streams are significantly tied to government support mechanisms for renewable energy.

- Regulatory Risk: Changes in net metering policies or tax incentives can directly affect the financial viability of solar projects, impacting demand.

- Market Sensitivity: Adverse regulatory shifts in major markets could lead to decreased sales and profitability for Enphase.

- Tariff Impact: Import tariffs on solar equipment can increase costs, potentially making Enphase products less competitive.

Potential for Technological Disruption

Enphase, a leader in microinverter technology, faces a significant weakness in the potential for technological disruption. The renewable energy sector is a hotbed of innovation, and emerging alternative inverter technologies or integrated power electronics could challenge Enphase's current market dominance. For instance, advancements in silicon carbide (SiC) or gallium nitride (GaN) power semiconductors could lead to more efficient and cost-effective inverter solutions from competitors.

The rapid pace of change means Enphase must maintain a relentless focus on research and development to stay ahead. Failure to adapt to evolving industry standards or integrate new energy storage solutions seamlessly could erode its competitive edge. This necessitates substantial ongoing investment in R&D to anticipate and counter potential technological shifts, ensuring its product roadmap remains relevant and superior.

- Rapid Technological Advancements: The renewable energy sector is characterized by fast-paced innovation, posing a constant threat of disruption.

- Emergence of Alternative Technologies: New inverter types, advanced energy storage, or integrated power electronics could emerge, challenging Enphase's current offerings.

- Need for Continuous Innovation: Enphase must consistently invest in R&D to adapt to evolving industry standards and maintain its leadership position.

- Potential for Market Share Erosion: Failure to innovate could lead to competitors gaining market share with superior or more cost-effective technologies.

Enphase's reliance on third-party manufacturers for its core products, like microinverters, creates a significant vulnerability. This dependence exposes the company to potential supply chain disruptions and can impact production scalability. For example, in 2023, ongoing global supply chain challenges continued to affect lead times and component availability, impacting revenue recognition and customer delivery schedules.

The company's profitability is also sensitive to intense competition within the solar inverter and energy storage markets. This competitive landscape often leads to pricing pressures, which can squeeze profit margins and necessitate substantial, ongoing investments in research and development to maintain a technological edge.

Enphase's business model is considerably influenced by government incentives and supportive policies for renewable energy. Shifts in tax credits, net metering regulations, or the imposition of tariffs in key markets like the United States or Europe could directly reduce demand for its products. For instance, changes to the U.S. Investment Tax Credit (ITC) or state-level net metering policies can significantly alter the economic viability of solar installations, impacting Enphase's sales volumes and overall profitability.

The rapid pace of technological innovation in the renewable energy sector presents a notable weakness. Emerging alternative inverter technologies or advancements in power electronics could potentially challenge Enphase's current market leadership. Staying ahead requires continuous and significant investment in research and development to anticipate and counter these disruptive forces.

Full Version Awaits

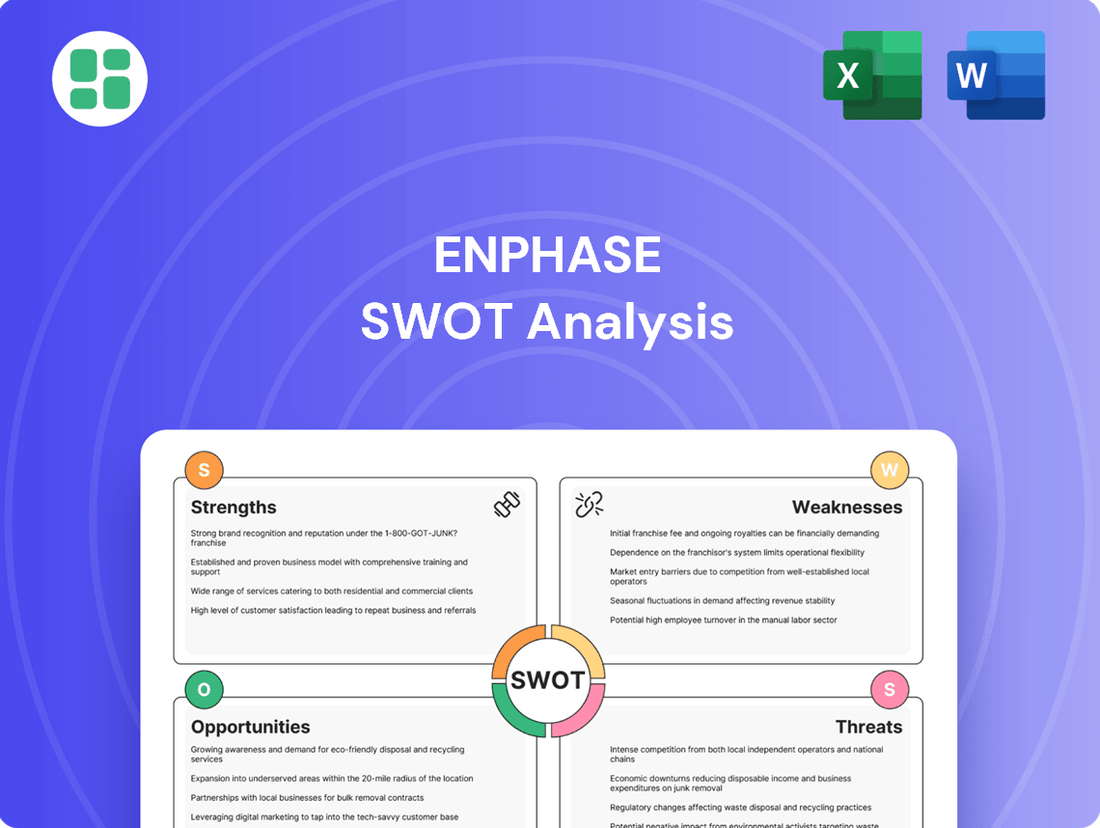

Enphase SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Enphase's Strengths, Weaknesses, Opportunities, and Threats, allowing for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Enphase's competitive landscape and market position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, empowering you to tailor the analysis to your specific needs.

Opportunities

The global push for decarbonization is a massive tailwind for renewable energy, and solar is leading the charge. With energy costs on the rise and a growing desire for energy independence, more countries and consumers are turning to solar power. This creates a huge opportunity for Enphase to reach new customers and sell more of its products worldwide.

In 2024, the International Energy Agency reported that renewable energy capacity additions are expected to grow by 11% compared to 2023, reaching nearly 510 gigawatts. This rapid expansion directly translates into a larger addressable market for Enphase's microinverter and battery storage solutions, allowing them to capture market share in this booming sector.

The market for battery energy storage solutions is experiencing a significant upswing, directly correlating with the increasing adoption of solar power. This growth is fueled by a desire for enhanced energy resilience, greater self-consumption of solar energy, and the opportunity to engage in grid services. Enphase, with its established battery storage products and integrated ecosystem, is strategically positioned to capitalize on this expanding demand.

In 2024, the global battery energy storage market was valued at approximately $150 billion, with projections indicating a compound annual growth rate (CAGR) of over 15% through 2030. Enphase's integrated approach, combining solar inverters with its IQ Battery storage systems, offers a compelling value proposition for homeowners seeking reliable and intelligent energy management, allowing them to capture a larger share of this lucrative market.

The growing intersection of home solar, battery storage, smart home tech, and EV charging offers a significant growth avenue for Enphase. By creating a unified ecosystem, Enphase can tap into the expanding EV market, which saw over 1.2 million electric vehicles sold in the US during 2023, a 40% increase from 2022.

Seamlessly integrating its products with EV chargers and offering robust home energy management solutions will not only boost Enphase's product appeal but also foster greater customer loyalty. This integration can lead to new revenue opportunities, as consumers increasingly seek consolidated energy solutions for their homes and vehicles.

Geographic Expansion into Emerging Markets

Enphase has a significant opportunity to grow by expanding into emerging markets. These regions often have rapidly increasing energy demands and a strong interest in renewable energy solutions like solar. By establishing operations and distribution in these new territories, Enphase can tap into substantial growth potential and reduce reliance on its existing markets.

Emerging markets present a chance to reach new customer segments that may be underserved by current solar providers. This geographic diversification can also help mitigate risks associated with economic downturns or regulatory changes in more established markets.

- Untapped Solar Potential: Many emerging economies are still developing their renewable energy infrastructure, offering vast opportunities for solar adoption. For instance, Southeast Asia is projected to see significant growth in solar installations, with countries like Vietnam and the Philippines leading the charge.

- Growing Energy Demand: As economies in regions like Africa and Latin America expand, so does their need for reliable and affordable energy. Solar solutions can directly address these growing demands, providing a cleaner alternative to traditional power sources.

- Favorable Policy Trends: Several emerging markets are implementing supportive policies and incentives for renewable energy, making them attractive for investment and expansion. This includes feed-in tariffs and tax credits aimed at accelerating solar deployment.

- Diversification Benefits: Expanding into diverse geographic regions allows Enphase to spread its market risk, potentially buffering against localized economic slowdowns or political instability.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions represent a significant growth avenue for Enphase. Collaborating with other technology firms, utilities, or acquiring smaller innovative companies can broaden Enphase's product offerings, secure new intellectual property, and solidify its market standing. These strategic maneuvers can accelerate expansion, reinforce market dominance, and boost the company's competitive edge.

For instance, in 2024, Enphase continued to focus on expanding its ecosystem through partnerships. While specific acquisition targets are not always publicly disclosed in advance, the company's history shows a pattern of integrating complementary technologies. This approach allows Enphase to quickly bring new solutions to market, such as advanced battery storage or smart grid technologies, without the lengthy internal development cycles.

- Ecosystem Expansion: Partnerships can integrate Enphase's core products with emerging technologies like EV charging or smart home systems.

- IP Acquisition: Acquiring smaller firms can provide access to patented technologies, accelerating product development and differentiation.

- Market Access: Collaborations with utilities can open doors to larger-scale deployments and new customer segments.

- Competitive Consolidation: Strategic acquisitions can remove competitors and consolidate Enphase's leadership in the residential and commercial solar markets.

The global transition to renewable energy, particularly solar, presents a significant opportunity for Enphase. As of 2024, the International Energy Agency projected renewable energy capacity additions to reach nearly 510 gigawatts, an 11% increase from 2023. This expansion directly fuels demand for Enphase's microinverters and storage solutions, allowing them to capture market share in a rapidly growing sector.

The battery energy storage market, valued at approximately $150 billion in 2024 with a projected CAGR exceeding 15% through 2030, offers substantial growth. Enphase's integrated solar and battery systems cater to the increasing demand for energy resilience and self-consumption, positioning them to capitalize on this lucrative market.

The convergence of home solar, battery storage, smart home technology, and EV charging creates a powerful growth avenue. With over 1.2 million EVs sold in the US in 2023, a 40% increase from 2022, Enphase can leverage its ecosystem to integrate EV charging solutions, enhancing product appeal and creating new revenue streams.

Expanding into emerging markets, which often face growing energy demands and have a strong interest in renewables, offers significant untapped potential. Regions like Southeast Asia are seeing substantial solar growth, providing Enphase with opportunities for geographic diversification and reaching new customer segments.

Threats

The solar inverter and energy storage sectors are facing significant price wars, with Chinese manufacturers and other international companies driving down costs. This aggressive competition directly impacts Enphase by pressuring its average selling prices, potentially shrinking profit margins and necessitating ongoing efficiency improvements.

For instance, in early 2024, reports indicated that some Chinese solar module manufacturers were offering prices that were 20-30% lower than their Western counterparts for comparable quality. While this doesn't directly translate to inverter pricing, it highlights the broader cost pressures within the solar supply chain that Enphase must navigate.

Changes in government policies, such as reductions in solar subsidies or unfavorable adjustments to net metering rules, present a significant threat to Enphase. For instance, a hypothetical 10% reduction in federal solar tax credits in a major market could directly impact the economic viability of solar installations, potentially dampening demand for Enphase's microinverter and battery storage solutions.

Furthermore, the introduction of new tariffs on imported solar components, a possibility that has been a recurring concern in recent years, could increase Enphase's cost of goods sold. If Enphase were to face a 5% tariff increase on key imported components, this would likely translate to higher product prices, impacting their competitive positioning and potentially reducing sales volumes.

Global economic downturns and persistently high interest rates pose a significant threat to Enphase. Inflationary pressures and recessions can shrink consumer spending power, directly impacting demand for residential solar solutions. For example, in late 2023 and early 2024, many economies experienced elevated inflation and interest rates, which increased the cost of financing for homeowners considering solar installations, potentially slowing Enphase's growth.

Rapid Technological Advancements by Competitors

The energy technology landscape is evolving at an astonishing speed. Competitors are consistently rolling out innovative inverter designs, advanced battery materials, and sophisticated energy management systems. This relentless pace means Enphase must continually adapt to avoid falling behind.

For instance, in 2024, the global solar inverter market was valued at approximately $10.5 billion, with projections indicating robust growth. Should a competitor launch a significantly more efficient or cost-effective inverter technology, Enphase's market share could be at risk.

- Disruptive Technologies: Competitors may introduce inverter architectures or energy storage solutions that offer a substantial leap in performance or a significant reduction in cost.

- Market Share Erosion: Superior competitor offerings could lead to a decline in Enphase's sales and market dominance if its own products are perceived as less advanced or more expensive.

- R&D Investment Pressure: To counter these threats, Enphase faces increased pressure to invest heavily in research and development, potentially impacting profitability.

Supply Chain Disruptions and Geopolitical Instability

Enphase Energy’s global manufacturing and distribution network, while efficient, exposes it to significant threats from supply chain disruptions and geopolitical instability. Events like the ongoing trade tensions between major economies or regional conflicts can directly impact the availability and cost of essential components, such as semiconductors and raw materials. For instance, the semiconductor shortage experienced globally in 2021-2023 significantly affected many electronics manufacturers, including those in the renewable energy sector, leading to production delays and increased component prices. Enphase, heavily reliant on these components, faced challenges in scaling production to meet the surging demand for its microinverters and battery storage systems.

These disruptions can manifest in several ways, directly impacting Enphase’s operational capacity and financial performance. Increased logistics costs due to shipping delays or rerouting, coupled with potential tariffs or trade barriers, can erode profit margins. Furthermore, unpredictable product availability can frustrate customers and installers, potentially leading to lost sales opportunities and damage to the company's reputation for reliability. In 2024, continued geopolitical flashpoints and the potential for new trade disputes remain key concerns that could exacerbate these supply chain vulnerabilities for Enphase.

- Vulnerability to Global Events: Enphase's reliance on a worldwide supply chain makes it susceptible to disruptions stemming from geopolitical tensions, trade wars, natural disasters, and pandemics.

- Impact on Operations: These disruptions can cause shortages of raw materials, manufacturing delays, and increased logistics expenses, affecting Enphase's ability to fulfill customer orders.

- Financial Ramifications: Unpredictable product availability and rising costs can negatively impact Enphase's profitability and market competitiveness.

- Market Uncertainty: Ongoing geopolitical instability in 2024 and beyond presents a persistent threat to the stability and predictability of Enphase's supply chain.

Intense price competition, particularly from Chinese manufacturers, is a major threat, potentially squeezing Enphase's profit margins. For example, by early 2024, Chinese solar module prices were reportedly 20-30% lower than Western equivalents, indicating broad cost pressures. Changes in government subsidies or net metering rules, such as a hypothetical 10% reduction in solar tax credits, could also dampen demand for Enphase products.

The rapid pace of technological advancement in the energy sector poses a constant challenge, requiring significant R&D investment to stay competitive. A competitor introducing a more efficient inverter, for instance, could erode Enphase's market share in the roughly $10.5 billion global solar inverter market of 2024. Furthermore, global economic downturns and high interest rates, as seen with elevated inflation and rates in late 2023 and early 2024, can reduce consumer spending on solar solutions.

Enphase's global supply chain is vulnerable to geopolitical instability and trade tensions, as evidenced by the semiconductor shortages of 2021-2023, which led to production delays and increased component costs. These disruptions can increase logistics expenses and impact product availability, potentially damaging Enphase's reputation for reliability. Continued geopolitical flashpoints in 2024 and beyond exacerbate these supply chain vulnerabilities.

SWOT Analysis Data Sources

This Enphase SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded and accurate strategic overview.