Enphase Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

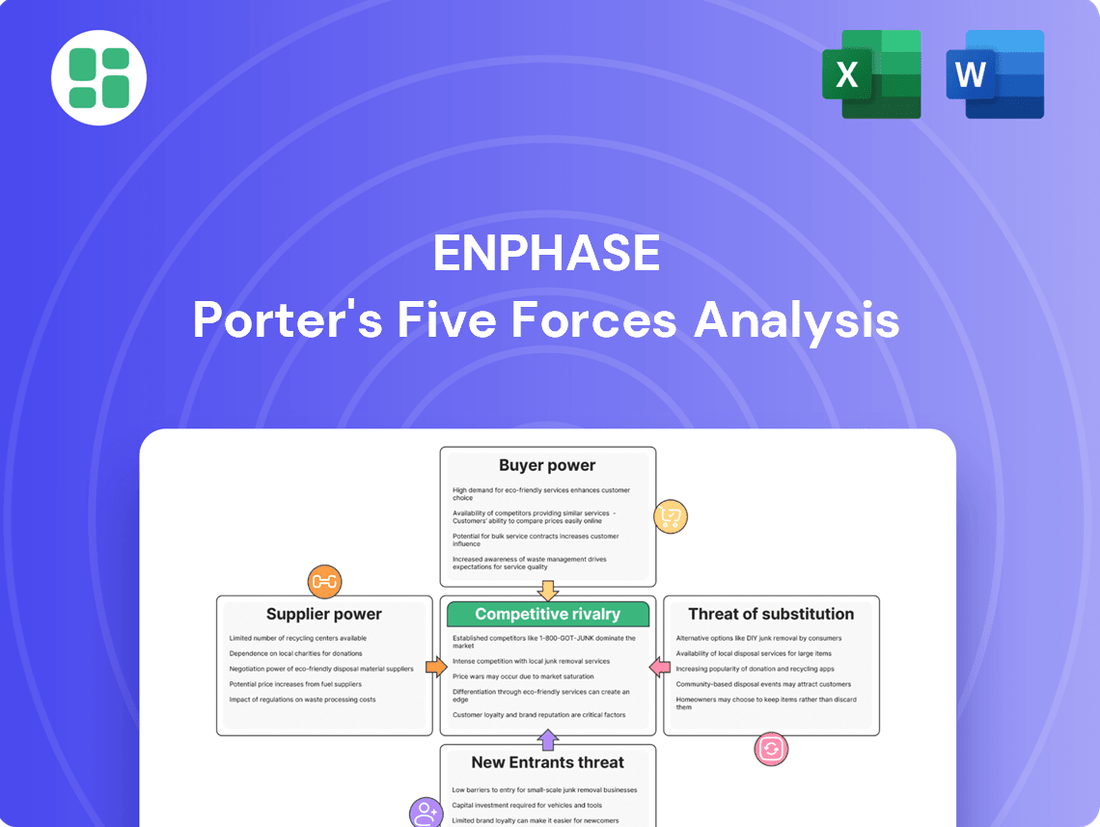

Understanding the competitive landscape for Enphase is crucial, as forces like buyer power and the threat of new entrants significantly shape its market. This brief overview hints at the pressures Enphase faces, but the full picture is far more detailed.

Unlock the complete Porter's Five Forces Analysis to gain a comprehensive understanding of Enphase's strategic positioning, market dynamics, and competitive advantages. Discover the actionable insights needed to navigate this complex industry and make informed decisions.

Suppliers Bargaining Power

Enphase Energy's reliance on a concentrated supplier base for critical components, such as semiconductor-based microinverter parts and battery cells, significantly influences its bargaining power with suppliers. This limited pool of specialized providers means suppliers hold considerable sway, especially when alternative sources for these essential materials are scarce.

For instance, disruptions or unfavorable pricing adjustments from these key suppliers can directly translate into increased production costs and potential instability within Enphase's supply chain. In 2023, Enphase reported that its largest supplier accounted for approximately 20% of its total cost of revenue, highlighting the significant impact a single supplier can have on its financial performance.

Tariffs and trade policies can dramatically shift the bargaining power of suppliers. For instance, a substantial tariff, like the reported 145% on Chinese-made battery cells, directly inflates the cost of essential components for companies like Enphase. This policy effectively strengthens the hand of suppliers in affected regions, as it limits viable, cost-effective sourcing options.

When a significant portion of a company's supply chain, such as 90-95% of Enphase's battery supply, is impacted by such tariffs, suppliers gain considerable leverage. They can dictate higher prices, knowing that the company has fewer alternatives, forcing Enphase to either absorb these increased costs, which erodes gross margins, or invest in more expensive domestic sourcing, impacting overall profitability.

Suppliers providing cutting-edge battery technologies and semiconductor components are vital for Enphase's product development and maintaining its competitive advantage. For instance, if a key supplier secures patents for a more efficient energy storage solution, their leverage over Enphase naturally grows, as Enphase relies on these advancements to stay ahead in the rapidly evolving renewable energy sector.

Switching Costs for Enphase

Enphase faces substantial switching costs when diversifying its supply chain and boosting U.S. manufacturing. The process of qualifying new suppliers, ensuring they meet rigorous quality standards, and transitioning production lines demands significant investment in time and capital.

These high switching costs inherently limit Enphase's agility in changing suppliers. Consequently, this strengthens the bargaining power of its existing suppliers, particularly those with long-standing relationships and a proven track record of delivering high-quality components. For instance, in 2023, Enphase reported that approximately 80% of its revenue came from its top five suppliers, highlighting a degree of supplier dependency.

- Supplier Qualification: The rigorous testing and validation required for new component suppliers can take many months, delaying production shifts.

- Production Line Adaptation: Modifying existing manufacturing setups or establishing new ones for components from different suppliers incurs considerable expense and downtime.

- Quality Assurance: Ensuring consistent quality from new suppliers is paramount in the solar industry, adding layers of inspection and testing that increase costs.

- Established Relationships: Suppliers with deep integration into Enphase's product development and supply chain often possess proprietary knowledge or specialized equipment, making them harder to replace.

Supplier's Financial Health and Capacity

The financial stability and production capacity of Enphase's key suppliers directly influence their bargaining power. If a supplier experiences financial difficulties or struggles to increase output to match Enphase's needs, it creates a scarcity situation. This scarcity can force Enphase to accept less favorable terms, pay higher prices, or face production delays, effectively strengthening the supplier's leverage.

- Supplier Financial Distress: A supplier facing bankruptcy or significant financial strain has less incentive to maintain favorable terms with Enphase, as their primary concern becomes survival.

- Production Capacity Constraints: If suppliers cannot scale production to meet Enphase's growing demand, particularly for critical components like microinverters or batteries, they can dictate terms due to limited availability.

- Impact on Enphase: Supply shortages can lead to delayed product launches and increased manufacturing costs for Enphase, demonstrating the suppliers' power in the value chain.

Enphase's bargaining power with suppliers is significantly challenged by the concentrated nature of its supply base for critical components like semiconductor microinverters and battery cells. This limited pool of specialized providers grants suppliers considerable leverage, especially when alternative sourcing options are scarce.

In 2023, Enphase's reliance on its top five suppliers for approximately 80% of its revenue underscores this dependency, making it difficult to negotiate favorable terms. For example, a substantial tariff, like the reported 145% on Chinese-made battery cells, directly strengthens suppliers' positions by limiting cost-effective alternatives for Enphase.

The high switching costs involved in qualifying new suppliers and adapting production lines further solidify the power of existing suppliers, who often have established relationships and integrated knowledge of Enphase's product development. This situation means suppliers can command higher prices or dictate terms, impacting Enphase's profitability and supply chain stability.

| Supplier Dependency Metric | 2023 Data Point | Implication for Bargaining Power |

|---|---|---|

| Revenue from Top 5 Suppliers | ~80% | Indicates high reliance, strengthening supplier leverage. |

| Largest Supplier Contribution to Cost of Revenue | ~20% | Highlights significant impact of a single supplier on costs. |

| Impact of Tariffs on Battery Cells | Up to 145% | Reduces Enphase's sourcing options, increasing supplier power. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Enphase's position in the solar inverter and energy management market.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

High customer acquisition costs in the residential solar market can significantly impact equipment providers like Enphase. Installers often spend considerable amounts on marketing and sales to secure new customers, which can translate into higher prices for the components they purchase.

While Enphase directly sells to installers, the end-consumer's budget ultimately dictates demand. If homeowners are less willing to absorb high installation costs, this pressure can ripple back up the supply chain, potentially affecting Enphase's pricing strategies and profit margins.

For instance, in 2024, the average cost for a homeowner to install a residential solar system in the U.S. ranged from $15,000 to $25,000, with customer acquisition being a notable component of this figure. This means installers need to recoup these upfront expenses, influencing their purchasing power with suppliers like Enphase.

The presence of alternative inverter technologies significantly bolsters the bargaining power of customers. Installers and end-users can readily choose between microinverters, string inverters, and optimized string inverters from major players such as SolarEdge, SMA, and Huawei. This diverse market offering means Enphase isn't the sole provider of essential solar technology.

The availability of these alternatives, often at more competitive price points, grants customers considerable leverage. They can negotiate pricing more aggressively and demand specific features, particularly in a market where cost-effectiveness is a primary driver for adoption. For instance, while Enphase focuses on microinverters, competitors offering robust string inverter solutions at lower price points directly challenge Enphase's market position and pricing power.

Government incentives play a crucial role in shaping customer demand for solar systems, directly impacting Enphase's market. For instance, the U.S. federal solar tax credit, Section 25D, has historically driven significant adoption. However, the uncertainty and potential reduction of such policies, like the Net Energy Metering (NEM) 3.0 changes in California, can drastically alter consumer investment decisions.

The shift in California's NEM policy, effective from April 2023, drastically reduced the export credit rates for new solar customers. This change led to a notable slowdown in residential solar installations, as the economics became less favorable for end-users. Consequently, customers facing these altered financial landscapes gain increased bargaining power when negotiating with installers, which can indirectly pressure Enphase.

Shift towards Third-Party Ownership (TPO) Models

The increasing adoption of Third-Party Ownership (TPO) models in the residential solar market, where customers lease rather than purchase systems, significantly bolsters customer bargaining power. Enphase has historically faced challenges in securing substantial market share within this TPO segment.

This trend empowers large TPO providers, such as Sunrun and Tesla, who can leverage their scale to negotiate more favorable terms and pricing with equipment manufacturers like Enphase. For instance, in 2023, Sunrun, a major TPO provider, accounted for a significant portion of the residential solar installations in the United States, giving them considerable leverage.

- Growing TPO Market Share: TPO arrangements are becoming increasingly popular, potentially representing over 60% of new residential solar installations in some key markets.

- TPO Provider Consolidation: The dominance of a few large TPO providers concentrates bargaining power, allowing them to demand lower prices and specific product features.

- Enphase's TPO Strategy: Enphase's ability to adapt its product offerings and pricing to meet the demands of these large TPO players is crucial for maintaining and growing its market share in this segment.

Customer Information and Price Transparency

Customer information and price transparency significantly impact Enphase's bargaining power of customers. Installers, a key customer segment, have access to a wealth of data online, comparing pricing, product specifications, and performance metrics across different solar component manufacturers. This readily available information empowers them to negotiate more effectively, directly influencing Enphase's pricing strategies and potentially squeezing profit margins.

The ease with which customers can compare options means that Enphase must remain competitive not only on product quality but also on price. For instance, in 2024, the average cost of solar panel installation in the US saw variations, with customers able to easily research and identify cost-saving opportunities. This transparency forces Enphase to justify its premium pricing through superior technology and reliable performance, as customers can readily identify alternatives.

- Informed Purchasing Decisions: Customers can easily research and compare Enphase products against competitors based on price, efficiency, and warranty terms.

- Negotiating Leverage: Increased transparency gives customers, particularly large installers, more power to negotiate better pricing with Enphase.

- Margin Pressure: The ability for customers to compare prices across the market can put downward pressure on Enphase's profit margins.

- Focus on Value Proposition: Enphase needs to continuously highlight its technological advantages and long-term value to justify its pricing in a transparent market.

The bargaining power of customers for Enphase is substantial, driven by the availability of substitute inverter technologies and the increasing transparency in pricing. Installers, acting as intermediaries, have access to extensive market data, enabling them to compare offerings from competitors like SolarEdge and Huawei. This empowers them to negotiate more effectively on price and features.

Furthermore, the rise of Third-Party Ownership (TPO) models concentrates purchasing power in the hands of large providers such as Sunrun and Tesla. These entities can leverage their scale to secure more favorable terms, directly impacting Enphase's pricing and market share within this growing segment. For instance, TPO arrangements are projected to represent a significant portion, potentially over 60%, of new residential solar installations in key markets.

The end-consumer's budget and sensitivity to installation costs also indirectly influence Enphase. With average U.S. residential solar installation costs ranging from $15,000 to $25,000 in 2024, homeowners' willingness to absorb these expenses can pressure installers, who in turn negotiate harder with suppliers like Enphase.

| Factor | Impact on Enphase | Supporting Data/Example |

|---|---|---|

| Alternative Inverter Technologies | Increases customer leverage, enabling price and feature negotiation. | Competitors like SolarEdge offer comparable technologies, providing choice. |

| Third-Party Ownership (TPO) | Concentrates bargaining power with large TPO providers. | TPO may exceed 60% of new installations in some markets; Sunrun and Tesla are major players. |

| Price Transparency & Information | Empowers installers to negotiate better pricing, potentially pressuring margins. | Customers can easily compare pricing and specifications online for 2024 installations. |

| End-Consumer Cost Sensitivity | Indirectly pressures Enphase through installer negotiations. | Average U.S. residential solar costs in 2024 were $15,000-$25,000. |

Full Version Awaits

Enphase Porter's Five Forces Analysis

This preview showcases the complete Enphase Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely what you'll receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You're looking at the actual, professionally formatted analysis, ready for download and immediate use the moment you buy.

Rivalry Among Competitors

Enphase faces significant competitive rivalry from established companies like SolarEdge Technologies, which reported over $3 billion in revenue in 2023, and First Solar, a leader in thin-film solar technology. The market also includes broad-based energy companies such as Generac and Canadian Solar, offering a wide range of renewable energy solutions.

Emerging microinverter manufacturers, including APsystems and Hoymiles, are also intensifying competition by offering innovative and often more affordable alternatives. These competitors provide diverse product portfolios, ranging from traditional string inverters to comprehensive energy management systems, creating a dynamic and challenging landscape for market share acquisition.

The solar industry, particularly in the residential and commercial sectors, thrives on relentless product innovation. Companies are locked in a race to introduce more efficient microinverters, advanced battery storage systems, and smarter energy management software. This constant churn means that staying competitive requires significant and ongoing investment in research and development.

Enphase Energy, a key player, has been pushing boundaries with its IQ8 microinverters, which offer reliable backup power even without a battery, and its IQ Battery 5P, designed for enhanced performance and easier installation. However, this drive for differentiation is met with equal, if not greater, efforts from competitors. For instance, SolarEdge, a major rival, has also been investing heavily in its inverter technology and storage solutions, aiming to capture market share through its own unique offerings.

The competitive landscape demands that companies like Enphase not only innovate but also differentiate their products effectively. In 2023, the global solar inverter market was valued at approximately $10.8 billion, with projections indicating continued growth. This growth is fueled by technological advancements, and companies that fail to keep pace with R&D will inevitably fall behind. The pressure to launch next-generation products is immense, as a single breakthrough can significantly alter market dynamics.

The residential solar market is intensely competitive, leading to significant price pressure. This dynamic directly impacts Enphase's ability to maintain robust gross margins, as seen in the increasing need to offer competitive pricing to capture market share.

Macroeconomic factors, including elevated interest rates and the imposition of tariffs on key components, further exacerbate margin pressure. For instance, in Q1 2024, Enphase reported a gross margin of 42.2%, a notable decrease from previous periods, reflecting these cost and pricing challenges.

Market Slowdown and Inventory Challenges

A significant market slowdown, especially in key regions like the U.S. and Europe, is currently fueling intense competitive rivalry. This downturn is largely attributed to rising interest rates, shifts in government policies such as the NEM 3.0 in California, and substantial inventory levels building up across distribution channels. Companies are now aggressively competing for a reduced customer base, leading to price pressures and a tougher sales environment.

Enphase's financial performance in 2024 clearly illustrates the impact of these market headwinds. The company reported a revenue decline, underscoring the broader challenges faced by the solar industry. This situation forces players to differentiate themselves more effectively or engage in price wars to capture market share.

- Market Slowdown: Higher interest rates and policy changes have dampened demand for solar installations in the U.S. and Europe.

- Inventory Overhang: Elevated channel inventory levels are pressuring manufacturers to move products, increasing competitive intensity.

- Revenue Impact: Enphase's revenue decline in 2024 is a direct consequence of these challenging market conditions and heightened competition.

- Intensified Rivalry: Companies are fighting harder for fewer customers, leading to potential price erosion and reduced profit margins.

Global and Regional Market Dynamics

Competitive rivalry for Enphase is a complex mosaic, with intensity shifting significantly across global and regional landscapes. While Enphase has carved out a dominant position in the United States, its competitive environment internationally presents a different set of challenges and opportunities.

In Europe, for instance, Enphase contends with a more fragmented market where local players and established inverter manufacturers often hold considerable sway. This regional variation necessitates adaptive strategies, as what proves effective in the U.S. may not translate directly to success in Germany or Australia. For example, in 2023, Enphase reported that while the U.S. remained its largest market, its international revenue, particularly from Europe, showed robust growth but also indicated the presence of strong local competition that requires careful navigation.

- U.S. Market Strength: Enphase enjoys a substantial market share in the U.S. due to its early mover advantage and strong brand recognition in the residential solar market.

- European Market Nuances: Europe presents a more diverse competitive field, with established European inverter brands and regional distributors playing a significant role.

- Asia-Pacific Challenges: In the Asia-Pacific region, competition can be even more price-sensitive, with a greater number of manufacturers vying for market share, often with lower-cost offerings.

- Strategic Differentiation: Enphase's success in varying regions hinges on its ability to differentiate its technology, service, and overall value proposition to meet local market demands and competitive pressures.

The competitive rivalry for Enphase is intense, particularly due to a recent market slowdown in key regions like the U.S. and Europe. This slowdown, driven by factors such as higher interest rates and policy shifts, forces companies to fight harder for a smaller customer base, leading to price pressures and a tougher sales environment. Enphase's revenue decline in 2024 directly reflects these challenging market conditions and the heightened competition.

Established players like SolarEdge Technologies, which reported over $3 billion in revenue in 2023, and emerging manufacturers such as APsystems and Hoymiles are actively competing. This rivalry is further fueled by the constant need for product innovation, with companies investing heavily in more efficient microinverters and advanced battery storage systems to differentiate themselves and maintain market share.

The pressure to innovate is immense, as a single technological breakthrough can significantly alter market dynamics. For instance, Enphase's IQ8 microinverters and IQ Battery 5P are met with similar advancements from competitors like SolarEdge, creating a dynamic where continuous R&D is essential for survival. The global solar inverter market, valued at approximately $10.8 billion in 2023, underscores the scale of this competition.

Price pressure is a significant factor, especially in the residential solar market, impacting Enphase's gross margins. The company's Q1 2024 gross margin of 42.2% illustrates these challenges, exacerbated by macroeconomic factors like elevated interest rates and tariffs. This environment necessitates effective product differentiation or engagement in price wars to secure market position.

| Competitor | 2023 Revenue (approx.) | Key Offerings |

|---|---|---|

| SolarEdge Technologies | $3 billion+ | Inverters, Storage Solutions |

| First Solar | N/A (Focus on Thin-Film) | Thin-Film Solar Technology |

| Generac | N/A (Broad Energy Solutions) | Home Energy Management Systems |

| Canadian Solar | N/A (Integrated Solar Solutions) | Solar Panels, Inverters |

| APsystems | N/A (Emerging Microinverter) | Microinverters |

| Hoymiles | N/A (Emerging Microinverter) | Microinverters |

SSubstitutes Threaten

The most significant substitute for Enphase's solar energy systems is traditional grid-tied electricity. While solar provides long-term savings and environmental advantages, the established infrastructure and perceived reliability of the grid, especially with unpredictable utility rate hikes, can make it a compelling option for some consumers. For instance, in 2024, the average residential electricity price in the U.S. hovered around $0.17 per kilowatt-hour, a figure that can fluctuate significantly based on region and time of day, impacting the immediate cost-benefit analysis for potential solar adopters.

Other renewable energy sources like wind, geothermal, and hydropower present a significant threat of substitution, especially for large-scale energy projects. For instance, global investment in renewable energy capacity continued its upward trend in 2023, with wind power installations seeing substantial growth, potentially diverting capital and policy focus from solar in certain utility-scale applications.

Improvements in energy efficiency and conservation present a significant threat of substitutes for solar energy providers like Enphase. For instance, advancements in smart home technology and building materials have led to a notable decrease in overall energy demand in many regions. In 2024, the global smart home market, which includes energy-saving devices, was projected to reach hundreds of billions of dollars, indicating a strong consumer interest in reducing energy consumption through these means.

More efficient appliances and HVAC systems can reduce a household's reliance on external energy sources, potentially lessening the appeal of a complete solar installation. This reduction in energy needs means some consumers might opt for these efficiency upgrades as a more cost-effective or simpler solution than adopting solar power, thus acting as a partial substitute for Enphase's core offerings.

Non-Microinverter Solar Technologies

Non-microinverter solar technologies, such as central string inverters and optimized string inverters, represent a significant threat of substitutes for Enphase. These alternatives compete by offering different value propositions, often at a lower initial cost, which can appeal to budget-conscious consumers or projects where advanced module-level monitoring and optimization are less critical.

For instance, string inverter systems, while generally less expensive upfront than microinverter-based solutions, can lead to performance losses if shading affects even a single panel in the string. Optimized string inverters, like those from SolarEdge, mitigate some of these issues by adding DC optimizers to each panel, bridging the gap in functionality but still differing in architecture and cost compared to Enphase's fully integrated microinverters.

- Cost Sensitivity: Traditional string inverters can be 10-20% cheaper in upfront hardware costs compared to microinverter systems, impacting market share in price-sensitive segments.

- Performance Differentiation: While Enphase microinverters offer superior shade tolerance and module-level monitoring, optimized string inverters provide a competitive middle ground, capturing market share from those seeking better-than-basic string performance without the full microinverter price premium.

- Installation Simplicity: For some installers, the familiarity and perceived simplicity of string inverter installations can be a draw, although microinverter installations are also designed for ease of use.

Emerging Energy Storage Technologies

The threat of substitutes for Enphase's energy storage solutions is a growing concern. While Enphase is known for its integrated solar and battery systems, advancements in alternative energy storage technologies could present viable alternatives for consumers and businesses. For instance, breakthroughs in solid-state batteries promise higher energy density and faster charging, potentially making them more attractive than current lithium-ion offerings. Similarly, sodium-ion batteries are emerging as a cost-effective alternative, especially for grid-scale storage applications. These developments could divert market share from Enphase's existing battery products.

Beyond battery chemistries, entirely different storage paradigms are gaining traction. Hydrogen storage, for example, offers long-duration energy storage capabilities and can be used for various applications, from transportation to industrial processes. Thermal energy storage, which captures heat or cold for later use, is also becoming more efficient and cost-competitive, particularly for industrial and commercial buildings. The increasing viability of these diverse substitute technologies could significantly impact Enphase's market position if they cannot adapt or innovate accordingly.

The competitive landscape is dynamic, with significant investment flowing into new energy storage research and development. For example, in 2024, global investment in clean energy technologies, including energy storage, continued to climb, with projections indicating substantial growth in the coming years. This influx of capital fuels innovation in areas that could directly compete with Enphase.

- Emerging Battery Chemistries: Solid-state and sodium-ion batteries offer potential advantages in energy density, cost, and safety over current lithium-ion technology.

- Alternative Storage Solutions: Hydrogen and thermal storage represent distinct approaches to energy storage that could serve similar needs as battery systems.

- Investment Trends: Significant global investment in clean energy, including storage, is driving rapid innovation in substitute technologies.

- Market Impact: Successful development and commercialization of these substitutes could shift customer preferences and challenge Enphase's current market share in energy storage.

The threat of substitutes for Enphase's offerings primarily stems from traditional utility power and alternative renewable energy sources. While solar provides long-term benefits, the established grid infrastructure remains a strong competitor, especially given fluctuating electricity prices. For instance, in 2024, U.S. residential electricity costs averaged around $0.17 per kWh, a figure that can influence the immediate appeal of solar versus grid power.

Energy efficiency measures and alternative storage technologies also pose significant substitution threats. Advancements in smart home technology and more efficient appliances can reduce overall energy demand, lessening the need for solar installations. Furthermore, emerging battery chemistries like solid-state and sodium-ion, alongside hydrogen and thermal storage, offer diverse alternatives that could compete with Enphase's integrated systems.

| Substitute Category | Key Characteristics | Competitive Factors for Enphase |

|---|---|---|

| Traditional Grid Power | Established infrastructure, perceived reliability | Cost-competitiveness against solar, utility rate stability |

| Other Renewables (Wind, Hydro) | Large-scale deployment potential | Policy support, capital investment diversion |

| Energy Efficiency | Reduced energy demand | Consumer preference for simpler solutions, lower upfront costs |

| Alternative Storage (Hydrogen, Thermal) | Long-duration storage, different use cases | Technological maturity, cost-effectiveness, scalability |

Entrants Threaten

Entering the solar microinverter and energy storage market demands substantial capital. Companies need to invest heavily in state-of-the-art manufacturing facilities, cutting-edge research and development, and robust supply chain infrastructure. For instance, Enphase's significant expansion of its U.S. manufacturing capabilities in 2023, involving hundreds of millions of dollars, underscores the immense financial commitment required, effectively raising the barrier for any new entrants aiming to compete.

The development of sophisticated microinverter technology and integrated energy management platforms demands significant technological expertise and substantial R&D investment. Enphase's robust patent portfolio, encompassing hundreds of issued and pending patents as of early 2024, creates a formidable barrier to entry, making it challenging for newcomers to replicate their core innovations without costly licensing or extensive independent development.

Enphase has cultivated a robust brand reputation, particularly for the reliability and performance of its microinverters. This, combined with an extensive network of certified installers, creates a significant barrier for new entrants. They would require substantial investment in marketing and sales to build comparable trust with both installers and homeowners.

Regulatory Hurdles and Certification Requirements

The solar industry, including companies like Enphase, faces significant barriers to entry due to stringent and constantly changing regulatory landscapes. Navigating these complex rules, which vary by region, requires substantial investment and expertise. For instance, in 2024, the U.S. Department of Energy continued to emphasize grid modernization and cybersecurity standards for distributed energy resources, adding layers of compliance for any new player.

New entrants must also contend with obtaining various product certifications to ensure safety and performance, a process that can be both time-consuming and costly. These certifications are critical for market access and consumer trust. For example, UL certification for solar inverters, a standard requirement in many markets, involves rigorous testing and can take months to secure.

- Regulatory Complexity: Solar markets globally are governed by intricate and evolving regulations, impacting everything from installation practices to grid integration.

- Certification Costs: Obtaining necessary safety and performance certifications, such as UL or CE, represents a significant upfront expense for new companies.

- Time to Market: The lengthy process of understanding and complying with diverse regulatory frameworks delays the market entry for potential competitors.

- Regional Variations: Disparate rules across different countries and even states within countries create a fragmented and challenging environment for new entrants.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in establishing distribution channels and securing supply chains. Enphase has cultivated strong relationships with a vast network of solar installers, a critical component of its go-to-market strategy. For instance, in 2023, Enphase reported that its products were available through over 140 distributors globally, a testament to its established network.

Replicating Enphase's integrated supply chain, which includes partnerships for critical components like semiconductor manufacturing, is also a formidable challenge. The company’s strategic investments in securing manufacturing capacity, including its agreement with Flex for manufacturing in India, highlight the capital and operational expertise required. This vertical integration provides Enphase with greater control over costs and product availability, making it difficult for newcomers to compete on scale and reliability.

- Distribution Network: Enphase's extensive global distributor and installer network, built over years, presents a significant barrier to entry.

- Supply Chain Control: Securing reliable and cost-effective access to key components, like semiconductors and battery materials, requires substantial investment and established relationships.

- Manufacturing Partnerships: Enphase's strategic manufacturing partnerships, such as those with Flex, offer economies of scale and operational efficiencies that are hard for new entrants to match quickly.

- Brand Trust: The established trust and brand recognition Enphase has with installers and end-customers further solidify its position, making it challenging for new brands to gain traction.

The threat of new entrants in the microinverter and energy storage market is generally low for Enphase. The industry demands significant capital investment for advanced manufacturing and R&D, as evidenced by Enphase's hundreds of millions invested in U.S. manufacturing in 2023. Furthermore, Enphase's extensive patent portfolio, with hundreds of patents as of early 2024, creates a substantial technological barrier.

Established brand reputation and a strong installer network also deter new players. Navigating complex and evolving global regulations, such as U.S. grid modernization standards in 2024, and securing necessary certifications like UL require considerable expertise and investment. Finally, building comparable distribution and supply chain control, like Enphase's global network of over 140 distributors in 2023, presents a formidable challenge for newcomers.

Porter's Five Forces Analysis Data Sources

Our Enphase Porter's Five Forces analysis is built upon a foundation of robust data, including Enphase's annual reports and SEC filings, alongside industry-specific market research from firms like Wood Mackenzie and BloombergNEF. We also incorporate data from renewable energy trade associations and governmental energy statistics to provide a comprehensive view of the competitive landscape.