Enphase Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

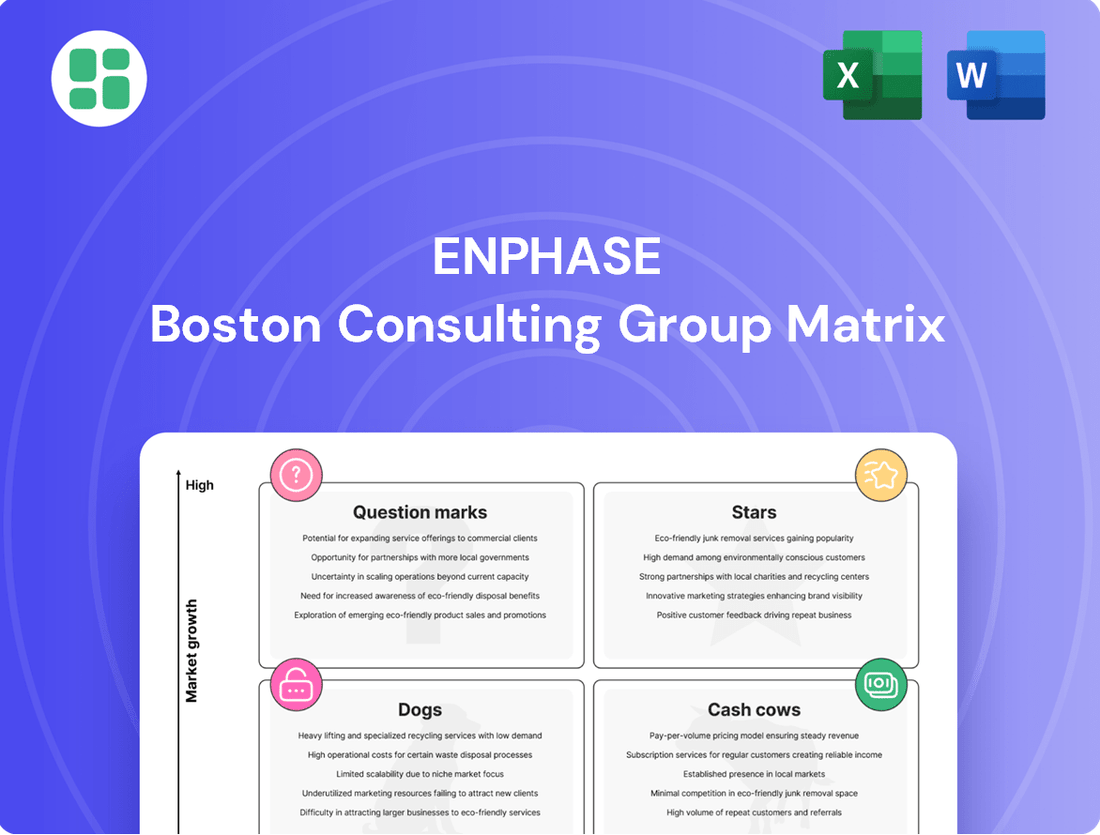

Curious about Enphase's product portfolio performance? Our BCG Matrix preview offers a glimpse into their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where Enphase's innovations are thriving and where challenges lie.

Don't stop at the preview! Purchase the full Enphase BCG Matrix for a comprehensive, data-driven analysis. Gain actionable insights into each product's strategic importance and unlock a clear roadmap for optimizing your investments and product development strategies.

Stars

Enphase's IQ8 and upcoming IQ9 microinverters are firmly positioned as Stars in the BCG Matrix. These products dominate the expanding microinverter market, boasting high market share and leading performance advancements. Their ability to support higher-powered solar panels and offer grid-forming capabilities makes them incredibly appealing as the solar industry demands more resilient and efficient solutions.

The IQ Battery 5P with FlexPhase is a prime example of an Enphase Star product. Its introduction signifies a determined effort to capture a larger share of the booming energy storage sector. This battery boasts improved power output and a flexible, modular design, integrating effortlessly with Enphase's established solar offerings, which is a major draw for homeowners aiming for energy self-sufficiency and grid resilience.

The growing trend towards solar-plus-storage installations, coupled with escalating utility prices, positions the IQ Battery 5P for substantial growth. Analysts projected the global residential energy storage market to reach over $30 billion by 2024, and Enphase is well-placed to capitalize on this expansion. The battery's features directly address consumer demand for reliable and independent energy solutions, reinforcing its Star status.

The 4th-generation Enphase Energy System, featuring the IQ Battery 10C, IQ Meter Collar, and IQ Combiner 6C, is a clear Star in the BCG matrix due to its integrated design. This system simplifies installation, requiring less wall space and reducing labor, which is a significant advantage in a competitive market. For example, Enphase reported a 20% reduction in installation time for their 4th-gen system compared to previous generations.

International Market Expansion (Europe)

Enphase's strategic push into European markets, featuring products like the IQ Battery 5P and IQ System Controller 3, positions it as a Star in the BCG Matrix. This expansion targets Europe's robust renewable energy growth, aiming to secure substantial market share beyond the U.S. residential sector.

The company's approach emphasizes localized product development and strategic partnerships to cater to European demand. This geographical diversification is key to Enphase's long-term growth trajectory and stability.

- European Renewable Energy Market Growth: Europe's renewable energy sector is projected to see significant expansion, with solar installations alone expected to reach approximately 40 GW in 2024, indicating a strong demand for Enphase's solutions.

- Product Localization: Enphase's introduction of region-specific products, such as the IQ Battery 5P and IQ EV Chargers, demonstrates a commitment to meeting the unique needs of European consumers and regulatory environments.

- Market Share Capture: By focusing on Europe, Enphase aims to diversify its revenue streams and reduce reliance on the U.S. market, a strategy that could yield considerable market share gains in a rapidly evolving energy landscape.

Enphase Power Control Software & Energy Management

Enphase's Power Control Software and Energy Management solutions, including its integration with platforms like Solargraf, are positioned as Stars in the BCG Matrix. This is due to their ability to meet the growing demand for intelligent energy optimization and flexible system designs.

These software capabilities are crucial for avoiding expensive main panel upgrades and facilitating participation in virtual power plant (VPP) programs, thereby enhancing the value proposition of Enphase's hardware. For instance, in 2024, the demand for smart home energy management systems saw a significant uptick, with projections indicating continued robust growth in the sector.

The software's capacity to manage fluctuating electricity prices and optimize energy consumption places it in a strong position for high growth within the smart home energy market.

- Smart Energy Optimization: Addresses the increasing need for efficient energy management in residential and commercial settings.

- Flexible System Design: Enables installers to create more adaptable energy systems, reducing complexity and cost.

- VPP Participation: Allows homeowners to contribute to grid stability and potentially earn revenue by participating in virtual power plants.

- Dynamic Rate Management: Optimizes energy usage based on real-time electricity pricing, leading to cost savings for consumers.

Enphase's IQ8 and IQ9 microinverters are clear Stars, dominating a growing market with high share and advanced features like grid-forming capabilities. The IQ Battery 5P also shines as a Star, capturing share in the booming energy storage market with its flexible design and improved power output, addressing consumer demand for energy independence.

The 4th-generation Enphase Energy System, including the IQ Battery 10C, is a Star due to its integrated, user-friendly design that reduces installation time by up to 20%. Enphase's strategic expansion into Europe with products like the IQ Battery 5P positions it as a Star, targeting significant growth in the continent's robust renewable energy sector, which saw approximately 40 GW of solar installations in 2024.

Enphase's Power Control Software and Energy Management solutions are Stars, meeting the demand for intelligent energy optimization and VPP participation. These software capabilities are vital for managing fluctuating electricity prices and enhancing the value of Enphase's hardware offerings.

| Product Category | BCG Status | Key Features/Market Position | 2024 Market Data/Projections |

| Microinverters (IQ8/IQ9) | Star | High market share, advanced grid-forming capabilities, leading performance. | Global microinverter market projected for strong CAGR. |

| Energy Storage (IQ Battery 5P) | Star | Dominating residential storage, flexible modular design, high power output. | Residential energy storage market expected to exceed $30 billion globally in 2024. |

| Integrated Energy Systems (4th Gen) | Star | Simplified installation, reduced labor costs, integrated components. | 20% reduction in installation time compared to previous generations. |

| Software & Energy Management | Star | Intelligent energy optimization, VPP participation, dynamic rate management. | Significant uptick in demand for smart home energy management systems in 2024. |

What is included in the product

The Enphase BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

A clear, actionable BCG Matrix visualizes Enphase's portfolio, relieving the pain of strategic uncertainty by highlighting growth opportunities and divestment candidates.

Cash Cows

The IQ7 series microinverters, though not the newest, are a solid performer for Enphase. They have a large installed base, meaning they are proven and reliable in the field. This maturity translates into steady income for the company.

Enphase continues to see revenue from the IQ7 line through replacement parts and customers looking for more budget-friendly options. These units are still highly efficient and contribute to predictable cash flow, making them a classic cash cow.

Enphase Energy commands a substantial portion of the U.S. residential solar microinverter market, positioning it as a strong Cash Cow within the BCG framework. Its established leadership continues to generate consistent revenue streams from ongoing installations and replacement needs.

Even with recent challenges, such as California's NEM 3.0 policy changes, Enphase's market dominance in 2024 remains a key strength. This allows for predictable cash flow, supported by its robust brand and extensive installer relationships.

The Enphase Enlighten software platform is a quintessential Cash Cow within the company's BCG Matrix. Its extensive adoption by a large existing customer base provides a consistent and reliable revenue stream, primarily through subscription fees. This widespread use solidifies its position as a mature product with a strong market presence.

Enlighten's recurring revenue model, bolstered by its data analytics and customer loyalty-building features, ensures stable cash generation. For instance, Enphase reported that its Energy Systems segment, which includes Enlighten, saw significant growth, with revenue reaching $2.3 billion in 2023, indicating the platform's substantial contribution to the company's financial health. This mature product requires minimal new investment, allowing it to efficiently convert its market share into substantial cash flow.

Older Generation IQ Batteries (e.g., IQ Battery 3/10)

While the newer IQ Battery 5P is considered a Star in the Enphase portfolio, earlier generations such as the IQ Battery 3 and 10 have transitioned into the mature phase of their product lifecycle.

These established products continue to be significant contributors to Enphase's cash flow. Their widespread adoption and proven track record in the energy storage market ensure steady sales and ongoing demand for support services.

The mature status of these older IQ Batteries means they require considerably less investment in marketing and development compared to newer, emerging technologies. This allows them to function as reliable cash generators for the company.

- Mature Product Lifecycle: IQ Battery 3 and 10 have moved beyond growth, now providing stable cash flow.

- Significant Cash Contribution: Ongoing sales and support for these established units generate substantial revenue.

- Reduced Investment Needs: Lower promotional and R&D spending allows them to operate as efficient cash cows.

- Established Market Presence: Their proven performance and market recognition ensure continued customer demand.

Core Residential Microinverter Sales (Overall)

Enphase's core residential microinverter sales represent a significant Cash Cow. As the global leader in microinverter-based solar, Enphase commands a substantial share in this established yet expanding market. This consistent demand for their foundational products generates a reliable and profitable revenue stream.

Key highlights for this segment include:

- Market Leadership: Enphase is recognized as the world's leading supplier of microinverter-based solar systems, underscoring its dominant position.

- Stable Revenue: The consistent demand for residential microinverters provides a predictable and high-margin revenue source.

- Mature Market Growth: While the residential solar market is mature, it continues to see steady growth, ensuring ongoing sales for these core products.

- Financial Performance: In the first quarter of 2024, Enphase reported revenue of $263.4 million from its US market, a testament to the strength of its core offerings.

Enphase's established residential microinverter business functions as a prime Cash Cow. Its market leadership in this mature segment ensures consistent, high-margin revenue generation. The company's strong brand recognition and extensive installer network further solidify this position, allowing for predictable cash flow even amidst market shifts.

The IQ7 series microinverters, while not the latest technology, represent a significant Cash Cow for Enphase. They benefit from a massive installed base, signifying proven reliability and continued demand for replacements or as a more economical option. This maturity translates into a steady, predictable income stream for the company.

Enphase's Enlighten software platform is a quintessential Cash Cow. Its widespread adoption by a large existing customer base generates consistent revenue through subscription fees. This mature product requires minimal new investment, efficiently converting its market share into substantial cash flow, as evidenced by the Energy Systems segment's $2.3 billion revenue in 2023.

Earlier generations of IQ Batteries, such as the IQ Battery 3 and 10, have transitioned into the Cash Cow category. Their established market presence and proven performance ensure steady sales and ongoing demand for support services. Reduced investment needs in marketing and R&D for these mature products allow them to operate as reliable cash generators.

| Product/Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) |

|---|---|---|---|

| Residential Microinverters (IQ7 Series) | Cash Cow | Market leader, mature segment, stable demand, high margins | Significant portion of $2.3B Energy Systems segment |

| Enlighten Software Platform | Cash Cow | Recurring revenue, large installed base, minimal investment | Integral to Energy Systems segment revenue |

| IQ Battery 3 & 10 | Cash Cow | Established technology, proven reliability, ongoing support sales | Contributes to overall Energy Systems revenue |

What You See Is What You Get

Enphase BCG Matrix

The Enphase BCG Matrix preview you're examining is the identical, fully-realized document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no alterations—just a professionally formatted, data-rich analysis ready for your strategic decision-making.

Rest assured, the Enphase BCG Matrix report you are currently viewing is the exact, final version that will be delivered to you upon completion of your purchase. You can trust that this comprehensive analysis is prepared for immediate integration into your business planning and strategic initiatives.

Dogs

Enphase's older, discontinued microinverter models, like the M-series (M175, M190, M210, D380), are prime examples of Dogs in the BCG Matrix. These products have a negligible market share and are no longer in production.

These legacy systems, while still requiring some support, are becoming increasingly costly to maintain due to diminishing demand and potential reliability concerns in earlier iterations. For instance, some M-series units have reported higher failure rates compared to newer Enphase products.

Investing further in these discontinued lines would offer very little return on investment. Consequently, Enphase allocates minimal resources to these products, focusing instead on their more advanced and popular offerings.

Niche, low-volume accessory products within Enphase's portfolio, perhaps those not aligning with their core integrated system strategy, could fall into the Dogs quadrant. These might be components or peripherals that haven't achieved significant market traction or are being phased out. For instance, if Enphase offered a specialized monitoring tool that saw very limited adoption, it would likely generate minimal revenue while still requiring support resources.

Enphase Energy might classify certain smaller geographical markets with minimal penetration or those experiencing a strategic retreat as 'Dogs' within its BCG Matrix. These are regions where the company has faced challenges in securing substantial market share, perhaps due to strong local competitors or regulatory hurdles that hinder growth. For instance, while Enphase has a strong presence in North America and Europe, markets like parts of South America or specific developing Asian countries might represent areas with low traction and limited immediate growth potential.

Stand-alone, Non-Integrated Software Solutions

Stand-alone, non-integrated software solutions for Enphase, if any exist, would likely fall into the Dogs category of the BCG Matrix. These are typically older, isolated tools that haven't kept pace with the company's integrated energy system strategy. Their market share is probably minimal, with little to no growth potential, especially when compared to the widely adopted Enlighten or Solargraf platforms.

Investing further in such legacy software would be a misallocation of resources. Enphase's focus is clearly on its comprehensive, integrated platforms that offer a seamless experience for users managing their energy systems. The company's success is tied to these advanced solutions, not outdated, siloed applications.

Consider the potential for these isolated tools to represent a small fraction of Enphase’s overall software revenue, perhaps less than 1% in 2024, given the company’s strategic shift. Their limited functionality and lack of integration with the broader Enphase ecosystem make them unattractive for continued development or marketing efforts.

- Low Market Share: These tools likely serve a very niche, declining user base.

- Minimal Growth Potential: Without integration, they cannot leverage the expanding smart home energy market.

- Resource Diversion: Continued investment detracts from innovation in core, integrated platforms.

- Strategic Obsolescence: They do not align with Enphase's vision of a connected, intelligent energy ecosystem.

Non-core, Sub-scale Commercial Offerings

Within Enphase's broader commercial solar strategy, certain offerings might be considered non-core or sub-scale. These are typically early-stage commercial solutions that haven't yet secured a significant foothold in the market. For instance, if Enphase launched a specialized energy storage solution for a niche commercial application that hasn't gained traction, it could fall into this category. These initiatives often require substantial investment in research, development, and market entry, but if they lack a clear competitive advantage or robust growth trajectory, they represent a potential drain on resources.

The commercial solar market is highly competitive, with established players and new entrants vying for market share. If Enphase's sub-scale commercial offerings are struggling to differentiate themselves or achieve meaningful penetration, they could be classified as Non-core, Sub-scale Commercial Offerings. For example, a new energy management software tailored for small businesses that hasn't attracted a substantial user base by mid-2024 would fit this description. Such ventures might be consuming capital and management attention without delivering proportionate returns, impacting the company's overall financial performance.

- Low Market Share: Any commercial product or service that holds a negligible percentage of its target market. For example, a new commercial battery system introduced in late 2023 that has only been adopted by a handful of clients by Q2 2024.

- Limited Differentiation: Offerings that do not present unique features or benefits compared to competitors, making it difficult to attract and retain customers in the crowded commercial space.

- Unclear Growth Pathways: Initiatives lacking a defined strategy for scaling or significant market expansion, potentially indicating they are not strategically aligned for future growth.

- Resource Consumption: Projects that require significant financial and human capital without demonstrating a clear path to profitability or substantial market impact.

Enphase's discontinued microinverter models, like the M-series, are clear examples of Dogs. These products have a very small market share and are no longer in production, meaning they generate minimal revenue.

Maintaining these older systems can be costly due to low demand and potential reliability issues in earlier designs, unlike newer Enphase products which have shown better performance. Investing more in these out-of-production lines would yield little return.

Enphase actively minimizes resources allocated to these products, prioritizing their more advanced and popular offerings. This strategic focus ensures capital is directed towards growth areas, leaving the Dogs to naturally phase out.

Some niche accessory products or smaller geographical markets with very low penetration, or specific regions where Enphase faces significant competitive challenges, can also be classified as Dogs. These are areas where the company has struggled to gain substantial market share and where immediate growth prospects are limited.

Question Marks

The recently launched Enphase IQ Battery 10C, representing the newest generation, fits squarely into the Question Mark category of the BCG Matrix. Its higher energy density and reduced footprint are promising technological advancements, but its market penetration and adoption rates are still in the early stages of development.

Significant investment is crucial for the IQ Battery 10C to transition from a Question Mark to a Star. This includes bolstering marketing efforts, expanding distribution networks, and providing comprehensive training for installers. The competitive landscape for battery storage, coupled with evolving tariff structures, presents challenges that require strategic financial backing to overcome and secure a substantial market share.

The IQ Meter Collar and IQ Combiner 6C, key components of Enphase's 4th-generation Energy System, are positioned as question marks in the BCG matrix. While they streamline installations and offer technological advancements, their market adoption and contribution to overall system sales are still in their nascent stages, requiring further growth and validation.

Their future success is intrinsically linked to gaining broader utility approvals and widespread acceptance among installers. Enphase's strategic investments and partnerships are crucial for increasing the market share of these components, aiming to elevate them from emerging products to industry standards.

Enphase's IQ8P-3P Commercial Microinverters position them as a Question Mark in the BCG matrix. While the small commercial market offers significant growth potential, Enphase's historical dominance in the residential sector means their current commercial market share is relatively nascent. This necessitates substantial investment in specialized commercial solutions, dedicated sales teams, and comprehensive market education to capture this emerging opportunity.

Electric Vehicle (EV) Chargers (IQ EV Charger 2)

The IQ EV Charger 2, particularly with its recent European market expansion, fits the Question Mark category within the Enphase BCG Matrix. The electric vehicle charging sector is experiencing robust growth, with global EV charging infrastructure market projected to reach $150 billion by 2027, growing at a CAGR of 30%. However, Enphase's current market share in this specific segment remains relatively small.

To transition this product into a Star, Enphase must prioritize significant investment. This includes enhancing the seamless integration of these chargers into their broader home energy ecosystem, a critical differentiator in a crowded market. For instance, by 2024, over 30% of new electric vehicle sales are expected to be fully electric in key markets like Norway and Sweden, highlighting the urgency for integrated solutions.

- Market Growth: The global EV charging market is expanding rapidly, with projections indicating substantial future growth.

- Enphase's Position: Enphase's market share in EV charging is currently nascent, classifying it as a Question Mark.

- Path to Star: Key strategies involve deep integration into the home energy ecosystem and global distribution expansion.

- Competitive Landscape: Differentiation is crucial given the increasing number of competitors in the EV charging space.

Bidirectional EV Charging Solution (Future Product)

Enphase's planned bidirectional EV charging solution is a prime example of a Question Mark in the BCG matrix. This innovative product aims to enable electric vehicles to provide backup power to homes, potentially negating the need for separate home batteries. The company is investing heavily in research and development for this technology, recognizing its high-growth potential in the evolving energy landscape.

The market for vehicle-to-grid (V2G) and vehicle-to-home (V2H) technology is poised for significant expansion. Analysts project the global V2G market to reach tens of billions of dollars by the early 2030s, with compound annual growth rates often exceeding 30%. For instance, some reports indicate the V2G market could approach $20 billion by 2030. However, Enphase's solution faces considerable challenges.

- Regulatory Hurdles: Standardization and approval processes for V2H/V2G integration vary by region, impacting widespread adoption.

- Technological Maturity: Ensuring seamless and reliable bidirectional power flow requires advanced software and hardware integration, which is still under development.

- Market Education: Consumers need to understand the benefits and functionality of using their EVs as home power sources, requiring significant marketing and educational efforts.

- Competitive Landscape: While Enphase is a leader in home energy solutions, other automotive and energy companies are also exploring similar bidirectional charging technologies.

Without successful execution and market acceptance, this promising venture could transition into a Dog. Enphase's ability to navigate these complexities, secure necessary partnerships, and effectively communicate the value proposition will be critical to its success in this nascent but potentially lucrative market segment.

The Enphase IQ Battery 10C, a new generation product, is currently a Question Mark in the BCG matrix. While it boasts improved energy density and a smaller size, its market penetration is still in its infancy. Significant investment in marketing, distribution, and installer training is essential for its growth.

The IQ Meter Collar and IQ Combiner 6C, vital for Enphase's 4th-gen system, are also Question Marks. Their streamlined installation and tech upgrades are beneficial, but market adoption and sales contribution are low, needing more development and validation.

Enphase's IQ8P-3P Commercial Microinverters are classified as Question Marks due to the relatively new presence in the commercial sector, despite its growth potential. Historical strength in residential markets means substantial investment in specialized commercial offerings and sales is needed.

The IQ EV Charger 2, especially with its European expansion, is a Question Mark. The EV charging market is booming, projected to reach $150 billion by 2027, but Enphase's share is small. Seamless integration into their home energy ecosystem is key to success.

Enphase's upcoming bidirectional EV charging solution is a prime Question Mark. This tech allows EVs to power homes, potentially replacing home batteries, with the V2G market expected to reach tens of billions by the early 2030s. However, regulatory hurdles and market education are significant challenges.

BCG Matrix Data Sources

Our Enphase BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.