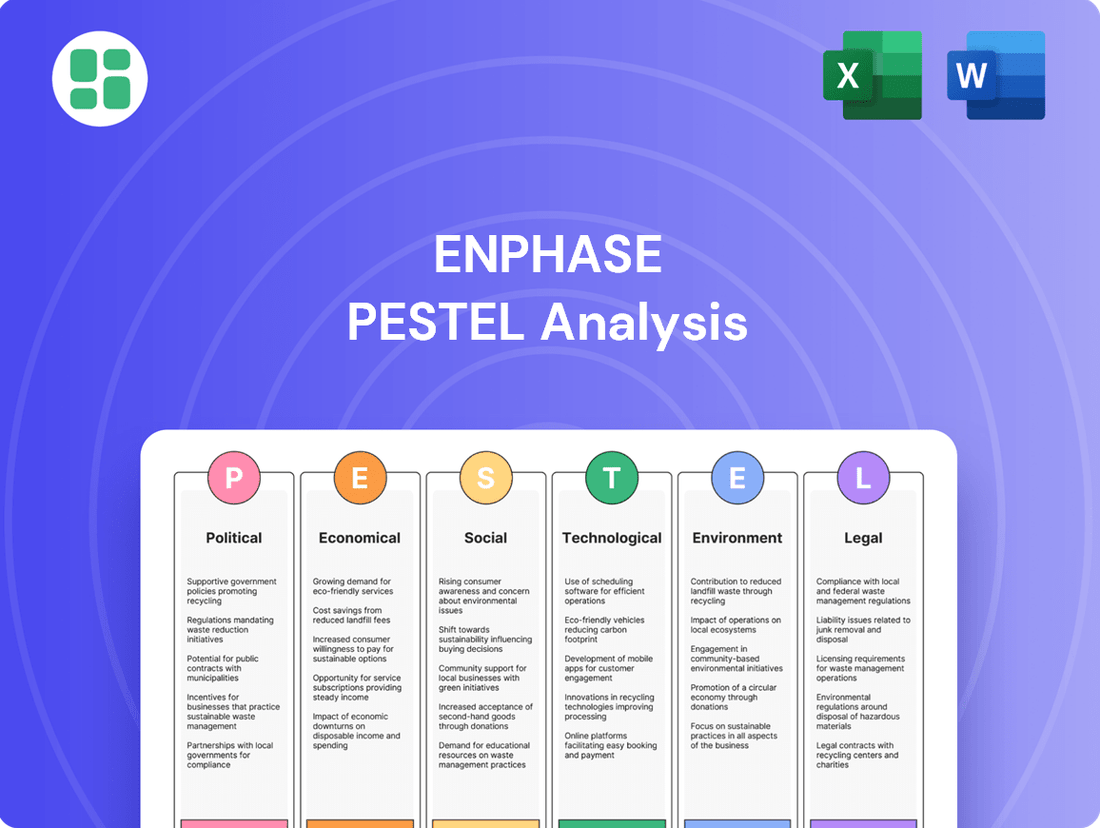

Enphase PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enphase Bundle

Discover how political shifts, economic volatility, and evolving social attitudes are directly impacting Enphase's market dominance. Our PESTEL Analysis provides the critical external context you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain the strategic foresight to outperform the competition.

Political factors

Government policies like the U.S. Investment Tax Credit (ITC) are a major driver for solar adoption, offering a 30% tax credit for eligible installations through 2032. This directly translates to more affordable solar and storage solutions for consumers and businesses.

The Inflation Reduction Act (IRA) further bolsters this with production tax credits for domestically manufactured components, a significant benefit that Enphase can utilize. These policies make solar and storage solutions more financially appealing, positively impacting Enphase's sales and overall profitability.

The European Union's commitment to renewable energy, particularly through RED III and the REPowerEU plan, is a significant political driver. These directives aim for a substantial increase in renewable energy, targeting at least 42.5% of consumption by 2030 and actively pushing for faster solar adoption.

This policy landscape directly benefits companies like Enphase by fostering a supportive regulatory environment and stimulating demand for its products. In 2023, Enphase reported a notable increase in battery sales within the European market, a trend directly linked to these proactive EU energy policies.

Global trade policies, especially tariffs on solar components, directly influence Enphase's manufacturing costs and the final price of its products. For instance, in 2023, the U.S. continued to grapple with tariffs on solar cells and modules, impacting the broader renewable energy supply chain, which Enphase operates within.

While Enphase has strategically invested in U.S.-based manufacturing, securing some supply chain stability, persistent trade disputes and import duties create ongoing uncertainty. This can affect the expense of acquiring necessary materials or components from international markets, potentially impacting Enphase's cost competitiveness against global rivals.

Local and State-Level Regulations

Variations in local and state-level regulations significantly impact Enphase's market access and project timelines. Permitting processes, grid interconnection standards, and net metering policies differ widely, creating a complex operating environment.

For instance, changes to net metering rules, such as those implemented in California, can directly affect the economics of solar installations. In 2023, California's NEM 3.0 policy, which reduced compensation for excess solar energy sent back to the grid, led to a notable slowdown in residential solar adoption, impacting Enphase's regional sales performance.

- California's NEM 3.0: Reduced export compensation, impacting residential solar economics.

- Permitting Delays: Inconsistent and lengthy permitting processes across states can hinder project deployment speed.

- Interconnection Standards: Varying utility requirements for connecting solar systems to the grid can create technical and administrative hurdles.

Geopolitical Stability and Energy Independence

Global geopolitical tensions and a strong push for energy independence are significant drivers for Enphase's business. As nations aim to lessen their dependence on volatile fossil fuel markets, the appeal of localized, self-sufficient energy systems, such as those provided by Enphase, is growing. This trend directly supports the long-term market expansion for solar and battery storage solutions.

The demand for distributed energy solutions is directly correlated with concerns over energy security. For instance, in 2023, the European Union continued to prioritize reducing its reliance on Russian gas, which spurred significant investment in renewable energy infrastructure and home energy systems. Enphase's technology, enabling homeowners to generate and store their own power, positions it favorably within this evolving energy landscape.

- Energy Security Focus: Geopolitical instability, particularly concerning energy supply chains, increases consumer and government interest in energy independence.

- Market Growth Driver: The desire to reduce reliance on imported fossil fuels directly translates into higher demand for residential solar and storage solutions.

- Policy Support: Many governments are implementing policies and incentives to promote distributed energy generation, further bolstering Enphase's market position.

- Resilience: Distributed energy systems offer greater resilience against grid disruptions, a key consideration in an unstable geopolitical climate.

Government incentives, like the U.S. Investment Tax Credit (ITC) and the Inflation Reduction Act (IRA), significantly boost solar adoption, making Enphase's products more accessible and profitable. The EU's ambitious renewable energy targets, such as RED III aiming for 42.5% renewables by 2030, create a favorable market for Enphase in Europe, evidenced by their increased battery sales there in 2023.

Trade policies and tariffs on solar components directly impact Enphase's manufacturing costs and competitiveness, as seen with U.S. tariffs in 2023. Local regulations, including permitting and net metering policies, create a complex operating environment; California's NEM 3.0 in 2023, for example, slowed residential solar growth.

Geopolitical events and the drive for energy independence are major catalysts for distributed energy solutions like Enphase's. This push, highlighted by Europe's efforts in 2023 to reduce reliance on Russian gas, directly fuels demand for localized, self-sufficient energy systems, enhancing Enphase's market position.

What is included in the product

This Enphase PESTLE analysis dissects the external macro-environmental landscape, examining how Political, Economic, Social, Technological, Environmental, and Legal factors present opportunities and challenges for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how Enphase can navigate external factors to reduce operational risks and capitalize on market opportunities.

Economic factors

Rising interest rates significantly increase the cost of financing solar projects for both homeowners and businesses. This economic headwind directly impacts consumer affordability, potentially slowing demand for new solar installations. For instance, in late 2023 and early 2024, many regions saw a slowdown in residential solar adoption, partly attributed to higher borrowing costs, which can affect Enphase's sales volumes.

Rising inflation in 2024 and 2025 directly impacts Enphase by increasing the cost of essential raw materials like silicon and aluminum, as well as manufacturing and transportation expenses. These pressures can squeeze gross margins, even for a company that has historically maintained strong profitability, as seen with their reported gross margin of 42.3% in Q1 2024.

Effectively managing these escalating input costs through strategic sourcing and operational efficiencies will be critical for Enphase to sustain its competitive pricing and profitability in the dynamic renewable energy sector throughout 2024 and into 2025.

Fluctuations in traditional grid electricity prices directly impact the economic appeal of Enphase's solar and battery storage solutions. When utility rates climb, the cost savings and energy independence offered by Enphase systems become significantly more attractive to homeowners and businesses.

For instance, in many parts of the United States, residential electricity prices saw an average increase of around 5% in 2023, with some regions experiencing even higher jumps due to increased demand and infrastructure costs. This upward trend in grid prices makes the upfront investment in an Enphase system a more compelling proposition for long-term cost competitiveness.

Consumer Discretionary Spending

Consumer discretionary spending is a critical driver for Enphase, as it directly influences demand for residential solar and energy storage solutions. When the economy is robust and consumer confidence is high, households are more likely to invest in home improvements, including solar panel installations, which are often considered discretionary purchases. For instance, in early 2024, a resilient US labor market and easing inflation contributed to a generally positive consumer sentiment, supporting spending on big-ticket items.

Conversely, economic downturns or periods of consumer uncertainty can significantly dampen spending on non-essential goods and services. A softening economy, characterized by rising unemployment or high inflation, can lead consumers to postpone or cancel discretionary purchases like solar systems. This was evident in certain regions during late 2023 where persistent inflation put pressure on household budgets, potentially impacting the adoption rate of new energy technologies.

- Economic Growth Impact: Strong GDP growth typically correlates with increased consumer confidence and willingness to spend on discretionary items like solar.

- Consumer Confidence: High consumer confidence levels in 2024, driven by factors like job security, generally support demand for home upgrades.

- Inflationary Pressures: Rising inflation, as seen in parts of 2023, can erode purchasing power, leading consumers to defer non-essential spending, potentially affecting solar installations.

- Interest Rates: Higher interest rates can increase the cost of financing for solar installations, further impacting discretionary spending decisions.

Market Competition and Pricing Pressure

The solar and energy storage sectors are intensely competitive, creating significant pricing pressure on both individual components and fully integrated systems. Enphase, like its peers, faces the challenge of constant innovation and rigorous cost management to secure its market standing and profitability. For instance, in Q1 2024, the average selling price for residential solar systems in the US saw a slight decrease year-over-year, reflecting this competitive environment.

This intense competition forces companies like Enphase to invest heavily in research and development to differentiate their offerings and maintain margins. The rapid pace of technological advancement means that staying ahead requires continuous product improvement and operational efficiency. Failure to do so can quickly lead to a loss of market share.

- Intense Competition: The global solar and energy storage markets are populated by numerous established players and emerging startups, all vying for market dominance.

- Pricing Pressure: This competition directly translates into downward pressure on the prices of solar panels, inverters, batteries, and related installation services.

- Innovation Imperative: Enphase must continuously innovate its microinverter and battery storage technology to justify premium pricing and maintain a competitive edge.

- Cost Management: Efficient supply chain management and manufacturing processes are critical for Enphase to control its cost of goods sold and protect its profit margins in this price-sensitive market.

Economic growth directly influences consumer spending on discretionary items like solar energy systems. In 2024, many regions experienced resilient economic conditions, supporting consumer confidence and demand for home upgrades, which benefited companies like Enphase.

Inflationary pressures in 2024 and projected into 2025 continue to impact the cost of raw materials and manufacturing for Enphase, potentially affecting profit margins despite strong demand. For example, Enphase reported a gross margin of 42.3% in Q1 2024, showcasing their ability to manage costs, but rising input costs remain a concern.

Interest rates significantly affect the affordability of solar installations, as many consumers finance these purchases. While interest rates remained elevated through late 2023 and into 2024, the economic outlook suggests a potential stabilization or gradual decrease, which could boost demand in the latter half of 2024 and into 2025.

The increasing cost of traditional grid electricity makes Enphase's solar and storage solutions more economically attractive. In 2023, residential electricity prices saw an average increase of approximately 5% in the US, a trend expected to continue, enhancing the value proposition of Enphase products.

| Economic Factor | Impact on Enphase | 2024/2025 Data/Trend |

|---|---|---|

| Economic Growth | Boosts consumer spending on discretionary items like solar. | Resilient economic conditions in early 2024 supported consumer confidence. |

| Inflation | Increases raw material and manufacturing costs, potentially squeezing margins. | Enphase's Q1 2024 gross margin was 42.3%, but input cost pressures persist. |

| Interest Rates | Affects financing costs for solar installations, impacting affordability. | Elevated rates through late 2023/early 2024, with potential stabilization ahead. |

| Utility Electricity Prices | Increases the economic appeal of solar and storage solutions. | US residential electricity prices rose ~5% in 2023, a trend expected to continue. |

Same Document Delivered

Enphase PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Enphase PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Growing environmental awareness is a significant sociological factor impacting Enphase. As public concern over climate change and the need for sustainability intensifies, consumer demand for clean energy solutions, like those offered by Enphase, is on the rise. This societal shift directly supports Enphase's core mission, making its smart, sustainable energy management systems particularly attractive to environmentally conscious homeowners.

Homeowners and businesses are increasingly prioritizing energy independence and resilience, driven by concerns over grid reliability and the desire for backup power during outages. This trend is particularly pronounced in areas experiencing frequent extreme weather events or facing aging power infrastructure.

Enphase's integrated solar and battery storage systems directly cater to this demand, providing a robust solution for continuous power. For instance, in 2024, the demand for home battery storage in the US saw a significant uptick, with installations growing by an estimated 25% year-over-year, reflecting this growing societal preference.

Demographic shifts significantly shape the residential solar market. For instance, the U.S. saw approximately 1.4 million new housing starts in 2023, indicating a growing base for potential solar adoption. As more households are established, especially in sunnier regions, the addressable market for Enphase's products expands considerably.

Homeownership rates also play a crucial role. In the U.S., the homeownership rate hovered around 65.7% as of the fourth quarter of 2023. A stable or increasing rate means more individuals have the autonomy to invest in home improvements like solar energy systems, directly benefiting companies like Enphase.

Public Perception and Technology Acceptance

Public perception significantly influences solar adoption, with growing trust in the reliability and safety of technologies like Enphase microinverters. Positive real-world experiences and increasing familiarity with distributed energy systems are driving broader market acceptance, a trend likely to continue through 2025.

As of early 2024, surveys indicate a substantial majority of homeowners view solar as a reliable energy source, with aesthetic concerns diminishing as panel and inverter designs improve. This positive sentiment is crucial for Enphase's market penetration.

- Growing Public Trust: Over 70% of US homeowners surveyed in 2023 expressed confidence in solar panel longevity and performance.

- Familiarity Breeds Acceptance: The increasing visibility of solar installations and positive word-of-mouth are key drivers for new customer acquisition.

- Aesthetic Integration: Manufacturers are focusing on sleeker designs, with integrated microinverters like those from Enphase often perceived as less intrusive than traditional string inverters.

Labor Market Trends and Skilled Workforce

The availability of a skilled workforce is paramount for the expansion of the solar and battery storage sectors. A deficit in trained installers directly influences project execution speed and overall expenses, presenting a significant hurdle for companies like Enphase. Addressing these potential labor shortages necessitates proactive support for installer networks and comprehensive training initiatives.

Labor market dynamics are a key consideration for Enphase. For instance, the U.S. Bureau of Labor Statistics projected that solar photovoltaic installer jobs were expected to grow 52% from 2022 to 2032, much faster than the average for all occupations. This rapid growth highlights the demand but also the potential for strain on the existing skilled labor pool.

- Skilled Labor Demand: The solar and battery installation industry requires specialized technical skills, impacting project efficiency.

- Installer Training: Companies like Enphase invest in training programs to ensure a competent and available workforce.

- Labor Shortages: Potential shortages can lead to increased project costs and extended timelines for renewable energy deployments.

- Workforce Development: Initiatives to expand the skilled labor pool are crucial for sustained industry growth.

Societal trends favor clean energy, boosting demand for Enphase's sustainable solutions. This is amplified by a growing desire for energy independence, particularly in regions prone to grid instability. Demographic shifts, like increased housing starts, expand the addressable market for home solar systems.

Homeownership rates, around 65.7% in the US by late 2023, directly correlate with Enphase's market potential, as homeowners are more likely to invest in such upgrades. Public perception is increasingly positive, with over 70% of US homeowners in 2023 expressing confidence in solar technology's longevity and performance.

Technological factors

Enphase's competitive edge is deeply tied to its ongoing advancements in microinverter technology. The company’s development of products like the IQ8HC and IQ8X microinverters, designed to handle higher wattage solar panels, directly addresses the industry's trend towards more powerful modules.

These technological leaps are crucial for maximizing energy yield and overall system efficiency. For instance, the IQ8 series, launched in 2020, marked a significant step by enabling backup power without a battery, a feature that has seen increasing adoption. By 2024, Enphase continued to refine these capabilities, ensuring seamless integration with the latest solar panel innovations.

Battery storage innovations are rapidly advancing, with new chemistries and system designs enhancing performance. Enphase's IQ Battery 5P and the upcoming IQ Battery 10C, utilizing Lithium Iron Phosphate (LFP) chemistry, are prime examples, offering improved energy density, enhanced safety, and extended lifespans.

These technological leaps are critical for satisfying the escalating demand for reliable energy storage solutions and bolstering the resilience of electrical grids. For instance, LFP batteries are known for their superior thermal stability compared to other lithium-ion chemistries, contributing to overall system safety.

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into energy management systems is a significant technological driver. This allows for smarter optimization of how energy is produced and consumed, and also enables dynamic management of electricity rates, potentially lowering costs for users.

Enphase's strategy centers on its integrated platform, designed to harness this intelligence. The goal is to enhance customer returns and shorten the time it takes for investments in their systems to pay for themselves. For instance, Enphase's IQ System, which incorporates AI, can predict energy needs and adjust system performance accordingly, aiming to maximize solar energy utilization and minimize reliance on grid power during peak, expensive hours.

Development of New Solar Cell Technologies

Emerging solar cell technologies are significantly reshaping the industry. Perovskite solar cells, for instance, are demonstrating impressive efficiency gains, with research cells reaching over 26% efficiency, and bifacial panels, which capture sunlight from both sides, are becoming increasingly common. These advancements promise higher energy yields from the same surface area.

While Enphase's core business is microinverters and battery storage, these panel-level improvements directly benefit their ecosystem. Higher efficiency panels mean more power can be generated and managed by Enphase's intelligent hardware, potentially increasing the value proposition of their integrated solutions. For example, a higher wattage panel managed by an Enphase microinverter can deliver more usable energy to the home.

- Perovskite solar cell efficiencies are nearing and, in some lab settings, exceeding 26%.

- Bifacial solar panels are projected to capture an additional 5-20% of energy compared to monofacial panels, depending on installation and albedo.

- These technological leaps can increase the total energy output of a solar system, enhancing the performance of Enphase's microinverter and battery solutions.

Cybersecurity for Energy Systems

As home energy management systems become more interconnected and sophisticated, robust cybersecurity is paramount. Enphase's reliance on connected devices for energy monitoring and control means protecting customer data and system integrity from cyber threats is a critical technological consideration.

The increasing sophistication of cyberattacks poses a significant risk to energy infrastructure. In 2023, the energy sector experienced a notable rise in ransomware attacks, with some reports indicating a 20% increase compared to the previous year, highlighting the urgency for advanced security protocols.

Protecting sensitive customer data, such as energy consumption patterns and personal information, is essential for maintaining trust and regulatory compliance. Enphase must continuously invest in and update its cybersecurity measures to safeguard against breaches and ensure the reliability of its energy solutions.

- Increased Threat Landscape: The interconnected nature of smart home energy systems expands the attack surface for cyber threats.

- Data Protection Imperative: Safeguarding customer data is crucial for regulatory compliance and maintaining brand reputation.

- System Integrity: Ensuring the uninterrupted and secure operation of energy systems prevents service disruptions and financial losses.

- Technological Advancement: Continuous investment in advanced cybersecurity technologies is necessary to stay ahead of evolving threats.

The continuous evolution of solar panel technology, particularly the rise of higher wattage modules and bifacial panels, directly enhances the performance potential of Enphase's microinverter and storage systems. For instance, bifacial panels can generate 5-20% more energy than monofacial ones, depending on installation, meaning more power for Enphase's hardware to manage.

Advancements in battery chemistry, such as the adoption of Lithium Iron Phosphate (LFP) in Enphase's IQ Battery 5P and the upcoming IQ Battery 10C, are key. LFP batteries offer improved energy density and safety, crucial for meeting the growing demand for reliable home energy storage.

The integration of AI and IoT into energy management platforms allows for smarter energy utilization and dynamic rate management, increasing customer returns. Enphase's IQ System leverages AI to optimize energy usage, aiming to maximize solar power and minimize reliance on expensive peak grid power.

Cybersecurity remains a critical technological factor, especially with the increasing sophistication of cyberattacks, which saw a 20% rise in the energy sector in 2023. Protecting customer data and system integrity is paramount for Enphase's interconnected energy solutions.

| Technological Advancement | Impact on Enphase | Key Data/Examples |

|---|---|---|

| Higher Wattage & Bifacial Solar Panels | Increased energy capture potential for Enphase systems. | Bifacial panels: 5-20% more energy. Perovskite cell efficiency nearing 26%. |

| Battery Storage Innovations (LFP) | Enhanced energy density, safety, and lifespan of storage solutions. | Enphase IQ Battery 5P and IQ Battery 10C utilize LFP. |

| AI & IoT Integration | Smarter energy management, optimized usage, and cost reduction. | Enphase IQ System uses AI for predictive energy management. |

| Cybersecurity | Ensuring system integrity and protecting customer data. | Energy sector ransomware attacks up 20% in 2023. |

Legal factors

Enphase's success hinges on navigating the intricate landscape of tax credit regulations, particularly the Residential Clean Energy Credit (Section 25D) and the Investment Tax Credit (Section 48). These credits are crucial for making solar installations financially attractive for consumers and businesses alike. For instance, the Inflation Reduction Act of 2022 extended and enhanced these credits, providing a significant tailwind for the renewable energy sector through 2032.

Staying compliant with evolving tax credit rules, especially those involving domestic content requirements, is paramount for Enphase and its network of installers. Failure to meet these stipulations can jeopardize project eligibility and, consequently, the financial returns for all parties involved. The Treasury Department's guidance on these domestic content bonuses, which offer an additional credit percentage for using domestically sourced materials, directly influences the cost-effectiveness of Enphase systems.

Enphase's success hinges on navigating local building codes and permitting. In 2024, the average solar permitting time in the US varied significantly, with some states averaging 30 days while others stretched to over 90 days, directly impacting project timelines and costs for Enphase installations.

Complex or inconsistent permitting requirements can create substantial hurdles, potentially delaying market penetration and increasing the overall expense of deploying Enphase's solar and storage solutions. Streamlined processes are crucial for efficient and cost-effective growth.

Enphase Energy must adhere to stringent product safety standards, such as those mandated by Underwriters Laboratories (UL) for its microinverters and battery storage solutions. These certifications are not just legal necessities but are crucial for building consumer confidence and ensuring the reliability of their renewable energy products.

Failure to meet these safety regulations can lead to product recalls, significant fines, and damage to brand reputation. For instance, in 2023, the renewable energy sector saw increased scrutiny on component safety, underscoring the importance of robust compliance for companies like Enphase.

Intellectual Property Rights

Intellectual property rights are fundamental to Enphase's strategy, safeguarding its innovative microinverter technology and energy management software through patents. This protection is vital for maintaining its competitive edge in the rapidly evolving renewable energy sector. For instance, as of early 2024, Enphase continued to actively defend its intellectual property portfolio, engaging in legal actions to prevent infringement and ensure market exclusivity for its core technologies.

Legal challenges related to patent infringement pose a significant risk, potentially affecting Enphase's market share and its capacity for future innovation. The company's sustained investment in R&D, often exceeding 7% of revenue in recent years, underscores the importance of defending these innovations. A successful infringement claim against a competitor, or conversely, a ruling against Enphase, could have substantial financial and strategic implications.

- Patent Portfolio Strength: Enphase holds a substantial number of patents globally, covering its unique microinverter architecture and advanced software algorithms.

- Litigation Impact: Legal disputes, such as those seen in the solar industry concerning inverter technology, can lead to significant legal costs and potential market disruptions.

- Innovation Protection: Robust IP protection allows Enphase to recoup its R&D investments and continue developing next-generation energy solutions.

- Market Exclusivity: Patents grant Enphase a period of exclusivity, enabling it to command premium pricing and solidify its market position.

Consumer Protection and Warranty Laws

Enphase Energy's commitment to consumer protection is evident in its strong warranty offerings, such as the 25-year warranty for its IQ8 Microinverters in North America. This not only fosters customer trust but also proactively mitigates legal risks tied to product performance. Consumer protection laws govern crucial aspects of business-customer interactions, mandating transparency and accountability regarding product quality and after-sales service.

These regulations are vital for maintaining market integrity and ensuring fair practices. For instance, in the US, the Magnuson-Moss Warranty Act sets standards for product warranties, requiring clear disclosure of terms and conditions. Enphase's adherence to such frameworks is essential for its reputation and legal standing.

- 25-year warranty for IQ8 Microinverters in North America, enhancing customer confidence.

- Compliance with consumer protection laws, such as the Magnuson-Moss Warranty Act in the US, ensures fair customer dealings.

- Proactive legal risk management through robust warranty provisions for product performance.

- Building customer trust by clearly outlining product quality and service guarantees.

Enphase Energy's operations are significantly influenced by government incentives and tax credits, such as the Residential Clean Energy Credit. The Inflation Reduction Act of 2022 extended these benefits, providing a substantial boost to the solar market through 2032, directly impacting Enphase's sales and installation economics.

Navigating diverse and sometimes complex local building codes and permitting processes remains a critical legal factor. In 2024, average solar permitting times in the US varied widely, from under 30 days in some states to over 90 days in others, affecting project deployment speed and costs for Enphase.

Adherence to stringent product safety standards, like UL certifications for its microinverters and storage systems, is non-negotiable. In 2023, the renewable energy sector saw heightened scrutiny on component safety, underscoring the importance of robust compliance for Enphase to maintain consumer trust and avoid regulatory penalties.

Protecting its intellectual property, particularly its microinverter technology, through patents is fundamental to Enphase's competitive edge. As of early 2024, Enphase actively defended its patent portfolio, highlighting the legal risks and financial implications of patent infringement disputes in the dynamic solar industry.

Environmental factors

Global and national commitments to reduce carbon emissions, such as the Paris Agreement, directly stimulate the market for renewable energy. Countries are setting ambitious targets, with many aiming for net-zero emissions by 2050. This regulatory push is a significant driver for companies like Enphase, whose products facilitate the adoption of clean energy.

Enphase's microinverter and battery storage solutions empower consumers to lower their carbon footprint. For instance, in 2023, the solar industry saw substantial growth, with residential solar installations in the US increasing by approximately 5% year-over-year, contributing to a cleaner energy mix. These technologies directly support individual and collective efforts to meet emission reduction goals.

The sourcing of critical raw materials like lithium for battery storage and silicon for solar panels presents significant environmental challenges for companies like Enphase. Growing global demand, particularly for renewable energy technologies, intensifies the pressure on these resources, raising concerns about extraction impacts and the long-term availability of sustainable supply chains.

Enphase must actively assess and mitigate the environmental footprint associated with its component manufacturing. This includes evaluating the energy and water intensity of material processing, as well as the waste generated. For instance, the mining of lithium, a key component in many battery technologies, can be water-intensive and impact local ecosystems.

Exploring and investing in more sustainable alternatives and responsible sourcing practices is crucial. This could involve seeking out suppliers committed to environmental stewardship, utilizing recycled materials where feasible, or developing technologies that reduce reliance on environmentally sensitive elements. As of early 2024, the price of polysilicon, a primary material for solar panels, has seen fluctuations, underscoring the importance of stable and environmentally conscious sourcing strategies.

The growing number of solar panels and batteries reaching their end-of-life presents a significant challenge, demanding effective recycling and waste management solutions. As a key player, Enphase is increasingly accountable for managing the environmental impact of its products throughout their lifecycle, potentially facing stricter regulations regarding recycling and disposal.

Land Use Considerations for Solar Projects

While Enphase Energy's core business model emphasizes rooftop solar, the broader solar industry grapples with land use for utility-scale projects. This can impact grid integration and overall renewable energy expansion. For instance, in 2023, the U.S. saw over 6 GW of utility-scale solar projects permitted, highlighting the scale of land commitment required for such installations.

For distributed energy systems like those Enphase serves, efficient space utilization is paramount. This includes maximizing energy generation from available residential and commercial rooftops, minimizing visual impact, and ensuring installations are integrated harmoniously with existing structures and landscapes. The company's focus on microinverters and energy management systems inherently supports this by optimizing performance on varied roof spaces.

Environmental considerations also extend to the lifecycle of solar components, including responsible sourcing and end-of-life management. As the solar industry matures, there's increasing emphasis on circular economy principles to mitigate the environmental footprint associated with manufacturing and disposal.

- Land Use Intensity: Utility-scale solar farms can require significant acreage, raising concerns about agricultural land conversion and habitat disruption.

- Rooftop Optimization: Enphase's technology is designed to maximize energy capture on diverse residential and commercial rooftops, reducing the need for large land allocations.

- Aesthetic Integration: The visual impact of solar installations, particularly in residential areas, is an environmental factor influencing public acceptance and project siting.

- Lifecycle Management: Growing focus on the environmental impact of solar panel manufacturing and end-of-life disposal is driving demand for sustainable practices.

Impact of Extreme Weather Events

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, underscore the critical need for robust and resilient energy infrastructure. For instance, in 2023, the United States experienced 28 separate billion-dollar weather and climate disasters, totaling over $145 billion in damages, according to NOAA.

Enphase's battery storage solutions are pivotal in addressing these challenges by providing essential backup power. This capability is crucial for households aiming to maintain essential services during grid outages, which are increasingly common during severe weather incidents like hurricanes and widespread power outages.

- Increased Demand for Backup Power: Extreme weather events directly drive consumer interest in reliable backup energy sources.

- Grid Resilience: Enphase's technology contributes to grid stability by reducing reliance on traditional power sources during disruptions.

- Climate Change Adaptation: The company's products offer a tangible solution for homeowners adapting to a changing climate and its impacts on energy security.

- Market Growth Potential: The growing awareness and impact of climate-related events are expected to fuel further market expansion for energy storage solutions.

Global commitments to reduce carbon emissions, like the Paris Agreement, are a major catalyst for renewable energy markets, directly benefiting Enphase. The increasing frequency of extreme weather events, such as the 28 billion-dollar disasters in the US in 2023 causing over $145 billion in damages, also drives demand for resilient energy solutions like Enphase's battery storage.

Enphase's products, including microinverters and battery storage, directly support the transition to cleaner energy and help consumers manage their carbon footprint. As of early 2024, the solar industry continues its growth trajectory, with residential solar installations in the US showing a steady increase, contributing to a cleaner energy mix.

The sourcing of critical materials like lithium and silicon presents environmental challenges, with growing global demand intensifying pressure on resources and supply chains. Furthermore, managing the end-of-life disposal of solar panels and batteries is becoming a significant focus, pushing companies like Enphase towards circular economy principles.

The environmental impact of manufacturing processes and the land use intensity of utility-scale solar projects are also key considerations. Enphase's focus on rooftop solar and efficient space utilization for distributed energy systems addresses some of these concerns, optimizing energy generation from available spaces.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Enphase is built on a robust foundation of data from official government publications, leading market research firms, and reputable industry associations. We meticulously gather information on energy policies, economic indicators, technological advancements, and socio-environmental trends.