Enovis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enovis Bundle

Navigate the complex external forces shaping Enovis's trajectory with our meticulously crafted PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities. Equip yourself with actionable intelligence to refine your strategy and secure a competitive advantage. Download the full report now for a comprehensive understanding.

Political factors

Government policies on healthcare spending and reimbursement rates significantly influence the demand for Enovis' products. For instance, shifts towards value-based care models, which reward quality outcomes over volume, can alter how healthcare providers budget for and procure medical devices, impacting Enovis' sales strategies.

Changes in federal funding, such as those affecting Medicare and Medicaid in the US, directly shape hospital budgets and procurement decisions for orthopedic solutions. A notable example from 2024 could be proposed adjustments to reimbursement for specific orthopedic procedures, potentially altering the financial incentives for Enovis' customers.

The medical device sector faces intense regulatory oversight from bodies like the FDA, CE Mark authorities, and the UK MHRA. Evolving regulations can directly influence Enovis's product development cycles, market entry strategies, and overall operational expenditures. For instance, the FDA's increased focus on cybersecurity for medical devices, as highlighted in its 2023 guidance, necessitates significant investment in software validation and ongoing monitoring.

Heightened scrutiny on innovative materials and advanced technologies, coupled with potential approval delays stemming from resource constraints at regulatory agencies, poses a direct threat to Enovis's new product launch timelines and market penetration efforts. In 2024, the FDA reported a backlog of premarket approval applications, a trend that continued into early 2025, impacting the speed at which companies can bring new devices to market.

Global trade policies, including tariffs and import/export restrictions, directly influence Enovis' supply chain efficiency, manufacturing expenses, and product pricing across various international markets. For instance, recent trade disputes and adjustments to import duties can significantly alter the cost of components and finished goods, impacting profitability.

Geopolitical tensions and evolving trade agreements present ongoing challenges. These shifts can escalate operational costs or create hurdles in securing essential raw materials and specialized components, as evidenced by the financial outlooks of companies facing tariff-related impacts in 2024 and projected into 2025.

Government Funding for Medical Research

Government support and funding for medical technology research and development are vital for driving innovation in the orthopedic sector, directly impacting companies like Enovis. For instance, the US National Institutes of Health (NIH) allocated approximately $47.5 billion in fiscal year 2024 for medical research, a significant portion of which could indirectly benefit orthopedic advancements.

A decrease in such governmental funding could slow the development of novel technologies and solutions that Enovis relies on for future growth. For example, a hypothetical 10% reduction in NIH funding for biomedical engineering could translate to fewer grants available for early-stage orthopedic device research.

- Increased funding for R&D stimulates innovation in medical technology.

- Government grants are crucial for early-stage research in orthopedics.

- Budgetary shifts away from medical research can impede new product development.

- Policy changes can impact the availability of public funding for innovation.

Political Stability in Key Markets

Political stability in Enovis' key operating markets significantly shapes its business landscape. For instance, the 2024 U.S. election cycle, while not directly impacting healthcare policy immediately, creates a backdrop of potential policy shifts that could influence reimbursement rates or regulatory approvals for medical devices. Similarly, ongoing geopolitical tensions in Europe could indirectly affect supply chain reliability and market access for Enovis' orthopedic and sports medicine products.

Changes in national healthcare priorities directly influence demand for Enovis' offerings. Countries prioritizing public health infrastructure or specific treatment areas, such as joint replacement or rehabilitation, present expanded market opportunities. Conversely, shifts towards austerity measures or a focus on different health challenges could temper growth prospects.

- United States: Continued focus on value-based care and potential legislative changes around healthcare spending could impact market dynamics for Enovis in 2024-2025.

- Europe: Varying national healthcare budgets and regulatory frameworks across European countries necessitate adaptive market strategies for Enovis.

- Asia-Pacific: Emerging economies in this region show increasing healthcare investment, presenting growth opportunities but also requiring navigation of diverse political and economic landscapes.

Governmental policies regarding healthcare spending and reimbursement rates are pivotal for Enovis, directly influencing demand for its orthopedic and sports medicine products. For example, the Centers for Medicare & Medicaid Services (CMS) in the U.S. sets reimbursement levels for procedures, and any adjustments in 2024 or 2025 for joint replacements could significantly impact hospital purchasing decisions.

Regulatory oversight from bodies like the FDA and European authorities dictates product development and market access. The FDA's ongoing emphasis on cybersecurity for connected medical devices, as seen in its 2023 guidance, requires substantial investment from companies like Enovis to ensure compliance, affecting R&D budgets and timelines through 2025.

Global trade policies and geopolitical stability also play a crucial role. Tariffs or import restrictions enacted in 2024, for instance, could escalate supply chain costs for components sourced internationally, impacting Enovis's manufacturing expenses and final product pricing. Political stability in key markets, such as the U.S. and Europe, is essential for predictable market conditions.

Government funding for medical research, like that provided by the NIH, indirectly supports innovation within the orthopedic sector. In fiscal year 2024, the NIH's substantial research budget, though not directly allocated to specific companies, fosters advancements that Enovis can leverage. A reduction in such funding could slow the pace of new technology development.

| Factor | Impact on Enovis | 2024-2025 Relevance |

| Healthcare Reimbursement Policies (e.g., CMS) | Influences demand and pricing of orthopedic devices. | Potential adjustments to Medicare reimbursement rates for orthopedic procedures in 2024-2025 could alter customer purchasing power. |

| Medical Device Regulations (e.g., FDA) | Affects product development cycles, market entry, and compliance costs. | Continued focus on cybersecurity and data privacy in medical devices necessitates ongoing investment in software validation and security measures. |

| Trade Policies and Tariffs | Impacts supply chain costs, manufacturing expenses, and product pricing. | Geopolitical shifts and trade disputes in 2024 could lead to increased costs for imported components, affecting Enovis's profitability. |

| Government R&D Funding (e.g., NIH) | Supports innovation and the development of new technologies. | While indirect, government investment in biomedical research fuels the pipeline of advancements that Enovis can adopt and commercialize. |

What is included in the product

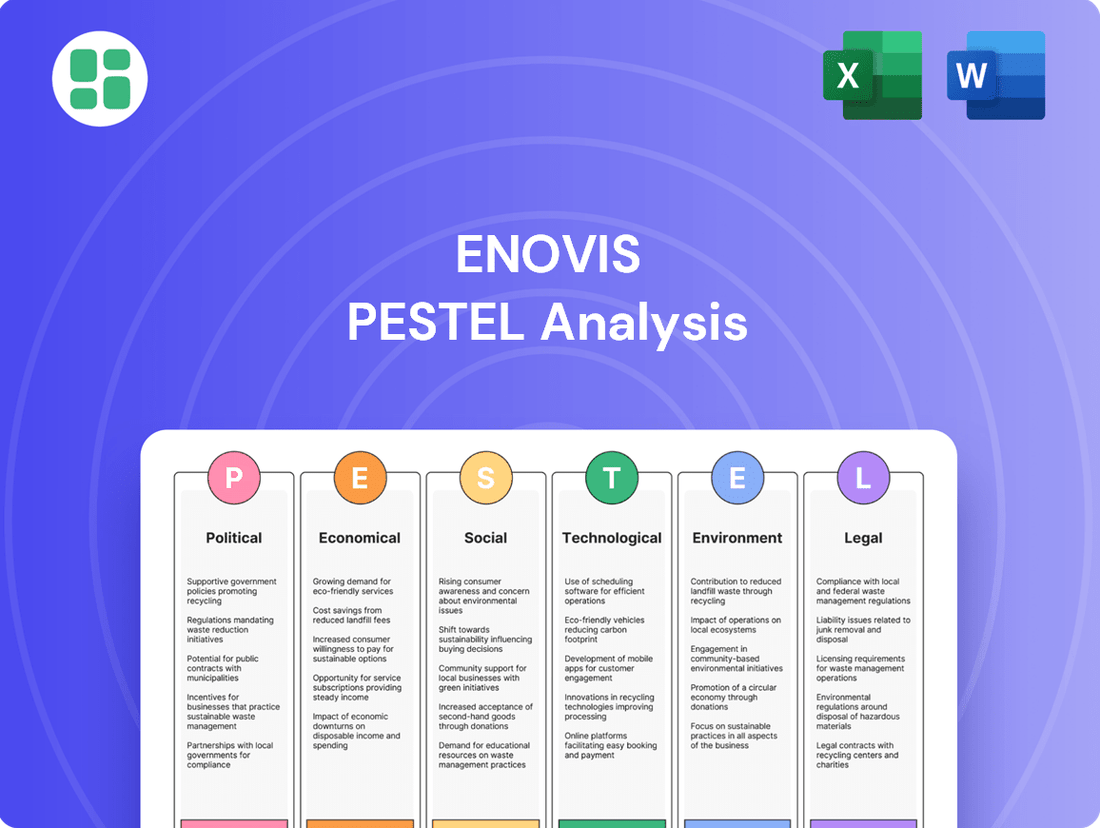

This Enovis PESTLE Analysis examines the critical external macro-environmental factors influencing the company's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Enovis PESTLE analysis provides a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic planning and team alignment.

Economic factors

National health expenditures are a significant driver for the orthopedic solutions market, directly impacting its size and growth potential. For instance, in the U.S., national health expenditures reached an estimated $4.5 trillion in 2023, representing a substantial portion of the economy.

Looking ahead, projections suggest continued robust growth in healthcare spending, with estimates indicating it will outpace GDP growth in the coming years. This trend is largely fueled by an increasing demand for healthcare services and goods, including advanced orthopedic treatments.

This general upward trajectory in healthcare spending creates a generally favorable market environment for companies like Enovis, which offer innovative orthopedic solutions. The increasing investment in healthcare infrastructure and services globally supports the expansion of markets for medical devices and treatments.

Rising inflation and increasing medical costs, particularly in areas like pharmacy spending and labor, present significant challenges for Enovis. These factors directly impact operational expenses, manufacturing costs, and ultimately, profit margins. For instance, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for medical care services rose 6.1% in the 12 months ending April 2024, a notable increase that can translate to higher input costs for Enovis.

While the medical cost trend is projected to remain elevated, Enovis' ability to manage its supply chain effectively and enhance operational efficiencies will be crucial. By optimizing procurement, streamlining manufacturing processes, and potentially passing on some increased costs through pricing strategies, Enovis can work to mitigate these pressures and safeguard its profitability in a dynamic economic environment.

Interest rate fluctuations directly influence Enovis' cost of capital for strategic investments and potential mergers or acquisitions. Higher rates increase borrowing expenses, potentially dampening enthusiasm for large-scale capital deployment. For instance, the Federal Reserve's benchmark interest rate, which saw significant increases through 2023 and into 2024, raises the hurdle rate for new projects and M&A targets.

The broader investment climate for medical technology is also sensitive to interest rate movements. An environment of rising rates can lead investors to demand higher returns, potentially lowering valuations for growth-oriented companies like Enovis. While mergers and acquisitions remain a key exit strategy in the MedTech sector, economic uncertainty driven by interest rate volatility could slow deal-making and compress valuations, impacting Enovis' growth trajectory.

Global Economic Growth and Disposable Income

The health of the global economy directly impacts demand for Enovis's products. Strong economic growth generally translates to higher disposable incomes, allowing more individuals to afford elective orthopedic procedures and advanced rehabilitation technologies. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicative of a generally expanding economy that can support consumer spending on healthcare services.

However, economic headwinds can significantly affect patient access and spending. A downturn or rising inflation can reduce discretionary income, potentially leading patients to delay or forgo non-essential medical treatments. In 2024, while inflation showed signs of moderating in many developed economies, it remained a concern, potentially squeezing household budgets and impacting healthcare expenditure. This sensitivity means Enovis must monitor global economic trends closely.

- Global economic expansion supports demand for elective procedures.

- Disposable income levels are a key determinant of patient spending on rehabilitation.

- Economic downturns can lead to delayed or reduced healthcare spending.

- Inflationary pressures can further constrain consumer spending power.

Market Competition and Pricing Pressure

The orthopedic device market is highly competitive, with established giants and emerging innovators constantly vying for market share. This intense rivalry often translates into significant pricing pressure, forcing companies like Enovis to carefully manage their cost structures and product differentiation strategies.

Enovis has demonstrated robust sales growth, particularly in its reconstructive segment, which reached $269.3 million in the first quarter of 2024, up 10.5% year-over-year. However, to sustain this momentum and maintain a strong market position, continuous innovation and clear product differentiation are crucial to justify pricing and capture customer loyalty in a crowded marketplace.

- Intense Competition: Major players in the orthopedic sector include Stryker, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, and Smith & Nephew, all investing heavily in R&D and strategic acquisitions.

- Pricing Dynamics: Hospitals and surgical centers, facing their own cost pressures, often negotiate aggressively on device pricing, impacting manufacturer margins.

- Innovation as a Differentiator: Enovis's focus on advanced technologies, such as its robotic-assisted surgery platforms and novel implant materials, is key to commanding premium pricing and securing market share.

- Market Share Battles: The company's ability to grow its reconstructive segment sales by 10.5% in Q1 2024 highlights its success in competing, but ongoing investment in product pipelines is essential.

Economic factors significantly shape Enovis' operating environment. National health expenditures, projected to continue outpacing GDP growth, provide a generally favorable backdrop for orthopedic solutions. However, rising inflation and medical costs, exemplified by a 6.1% increase in medical care services CPI in the 12 months ending April 2024, directly challenge Enovis' profitability by increasing operational and manufacturing expenses.

Interest rate fluctuations, such as the Federal Reserve's benchmark rate increases through 2023 and into 2024, elevate Enovis' cost of capital for investments and M&A, potentially slowing growth. Global economic health also plays a crucial role; while projected global growth of 3.2% in 2024 supports demand for elective procedures, persistent inflation can reduce consumer spending power, impacting patient access to treatments.

| Economic Factor | Impact on Enovis | Supporting Data/Trend (2024/2025) |

| National Health Expenditures | Favorable for demand | Projected to outpace GDP growth; U.S. expenditures reached $4.5 trillion in 2023. |

| Inflation & Medical Costs | Increased operational costs | U.S. medical care services CPI rose 6.1% (12 months ending April 2024). |

| Interest Rates | Higher cost of capital, potential M&A slowdown | Federal Reserve benchmark rate increases through 2023-2024. |

| Global Economic Growth | Supports demand for elective procedures | IMF projected 3.2% global growth for 2024. |

| Consumer Spending Power | Sensitive to economic headwinds | Inflationary pressures in 2024 potentially squeezing household budgets. |

Full Version Awaits

Enovis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Enovis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It offers a deep dive into how these external forces shape Enovis's strategic landscape and operational decisions.

The content and structure shown in the preview is the same document you’ll download after payment. You can trust that this PESTLE analysis is a complete and accurate representation of the insights you will gain.

Sociological factors

The world's population is getting older. By 2050, it's estimated that nearly 1 in 6 people globally will be over 65, a significant jump from about 1 in 11 in 2015. This demographic trend directly fuels demand for orthopedic solutions.

Older individuals are more susceptible to conditions like osteoarthritis and osteoporosis, leading to an increased need for joint replacements and other orthopedic interventions. In 2023, the global knee replacement market alone was valued at over $10 billion, with projections showing continued growth, directly benefiting companies like Enovis.

The growing number of people experiencing orthopedic issues like arthritis, osteoporosis, and sports injuries directly drives up the need for orthopedic devices and treatments. This trend is a significant factor for companies like Enovis.

Lifestyle choices, including prolonged sedentary periods and rising obesity rates, are contributing to the earlier appearance of musculoskeletal problems. This means a larger group of individuals will likely require the types of solutions Enovis offers.

For instance, the Centers for Disease Control and Prevention (CDC) reported in 2023 that over 54 million adults in the U.S. have been diagnosed with arthritis, a figure projected to rise significantly. This growing patient base underscores the increasing market demand for orthopedic care and related products.

Growing public awareness regarding joint health and preventative care is a significant sociological factor. This heightened consciousness directly translates to increased patient engagement, with individuals actively seeking out advanced orthopedic treatments. For instance, a 2024 survey indicated that over 60% of adults are more proactive about their long-term health, including musculoskeletal well-being.

Patients are increasingly informed and involved in their healthcare journeys. They are actively researching and demanding innovative, patient-centric technologies that offer effective solutions for orthopedic issues. This trend empowers them to seek out companies like Enovis, which specialize in advanced, patient-focused orthopedic care and rehabilitation products.

Demand for Minimally Invasive Procedures

There's a clear societal shift towards minimally invasive procedures, driven by patient demand for quicker recovery, less discomfort, and a generally better experience. This trend is significant for companies like Enovis, whose product portfolio often supports these advanced surgical techniques.

For instance, the global market for minimally invasive surgical instruments was valued at approximately $35 billion in 2023 and is projected to grow steadily. This growth indicates a strong and sustained patient preference for less invasive options.

Enovis' strategic emphasis on areas like orthopedics and sports medicine directly benefits from this societal preference. Many of their innovative implants and surgical tools are designed to facilitate these minimally invasive approaches, aligning perfectly with patient and physician desires.

- Growing Patient Preference: Patients increasingly seek surgical options that minimize trauma and speed up recovery.

- Market Growth: The minimally invasive surgery market is expanding, reflecting this demand. For example, projections show continued robust growth through 2030.

- Enovis Alignment: Enovis' product development and acquisition strategies are well-positioned to capitalize on this trend, offering solutions for less invasive interventions.

Shifting Care Settings

The healthcare industry is experiencing a significant move away from traditional hospital settings towards more cost-effective and patient-friendly alternatives like ambulatory surgery centers (ASCs) and physician offices. This trend is particularly pronounced in orthopedic procedures, where Enovis operates. By 2024, the ASC market was projected to reach over $50 billion globally, highlighting the growing importance of these sites.

Enovis needs to adjust its sales and distribution strategies to effectively serve these decentralized care environments. This includes ensuring product availability and providing specialized support tailored to the unique operational needs of ASCs and medical offices.

- Growing ASC Market: The global ASC market is expanding rapidly, with projections indicating continued strong growth through 2025.

- Cost-Effectiveness Driver: Both patients and payers are increasingly favoring ASCs due to their lower costs compared to hospital-based procedures.

- Patient Convenience: Shorter recovery times and easier access contribute to the appeal of outpatient settings for many patients.

- Enovis Adaptation: Enovis must align its commercial strategies to capture opportunities presented by this shift in care delivery.

Societal shifts towards proactive health management and increased awareness of musculoskeletal well-being are significant drivers for Enovis. As individuals become more informed about joint health, they actively seek advanced orthopedic solutions, boosting demand for the company's offerings. This heightened patient engagement, evidenced by a 2024 survey showing over 60% of adults being more proactive about their health, directly fuels market growth.

The aging global population is a fundamental sociological factor, with projections indicating that by 2050, nearly 1 in 6 people worldwide will be over 65. This demographic trend directly increases the incidence of age-related orthopedic conditions, such as osteoarthritis, thereby expanding the patient pool for Enovis' specialized products and treatments.

Lifestyle changes, including increased sedentary behavior and rising obesity rates, contribute to the earlier onset of musculoskeletal issues, creating a larger market for orthopedic interventions. For example, the CDC reported in 2023 that over 54 million U.S. adults have arthritis, a number expected to grow, underscoring the expanding need for Enovis' solutions.

A strong societal preference for minimally invasive procedures, driven by patient demand for faster recovery and reduced discomfort, benefits companies like Enovis. The global market for minimally invasive surgical instruments was valued at approximately $35 billion in 2023, reflecting this significant trend.

Technological factors

AI and robotics are transforming orthopedic surgery, offering unprecedented precision and improved patient outcomes. Enovis can integrate these technologies for advanced pre-surgical planning and real-time guidance, leading to more accurate and personalized procedures.

The market for surgical robotics is projected to reach $10.2 billion by 2027, growing at a CAGR of 17.3%, highlighting significant investment and adoption potential. Enovis's participation in this expanding field, particularly with robotic-assisted joint replacements, positions it to capitalize on this technological shift.

Innovation in smart orthopedic implants and connected medical devices, often incorporating IoT and AI, allows for continuous monitoring of patient health and implant condition. This trend is accelerating, with the global smart implants market projected to reach over $20 billion by 2028, indicating significant investment and adoption.

These technologies enable timely interventions and personalized rehabilitation protocols, improving patient care and potentially reducing readmissions. For instance, studies in 2024 have shown a reduction in post-operative complications by up to 15% with the use of connected monitoring systems for orthopedic patients.

Advances in biomaterials and 3D printing are revolutionizing medical device creation, enabling highly personalized implants and prosthetics. Enovis can leverage this to offer custom solutions for better patient fit and function, a significant competitive edge.

The medical 3D printing market, valued at approximately $2.5 billion in 2023, is projected to reach over $6 billion by 2028, indicating substantial growth potential for companies like Enovis adopting these technologies.

Telemedicine and Remote Monitoring

The increasing adoption of telemedicine and remote monitoring is fundamentally reshaping healthcare accessibility and efficiency. Enovis can leverage this trend by embedding digital health solutions into its rehabilitation and post-operative care services, thereby extending patient support beyond traditional clinical settings and potentially improving recovery outcomes.

This digital transformation is supported by significant market growth. For instance, the global telemedicine market was valued at approximately $100 billion in 2023 and is projected to reach over $300 billion by 2030, indicating a substantial opportunity for companies like Enovis to integrate these services. Remote therapeutic monitoring, a key component, saw a significant surge in Medicare reimbursement in 2024, further incentivizing its adoption.

- Telemedicine Market Growth: Projected to exceed $300 billion by 2030, up from around $100 billion in 2023.

- Remote Monitoring Expansion: Increased Medicare reimbursement for remote therapeutic monitoring in 2024 signals growing acceptance and integration.

- Enhanced Patient Engagement: Digital platforms can foster continuous patient engagement, crucial for long-term recovery and adherence to treatment plans.

- Operational Efficiency: Remote solutions can reduce the burden on physical clinics and allow for more scalable patient care delivery.

Data Analytics and Predictive Modeling

The surge in data analytics and predictive modeling is a significant technological driver for Enovis. The ability to analyze vast datasets using advanced techniques and machine learning offers powerful predictive insights into surgical outcomes, helping to flag potential complications and refine treatment plans. This data-driven approach can directly fuel Enovis' product innovation, bolster clinical decision-making tools, and streamline overall business operations.

For instance, the global healthcare analytics market was valued at approximately $30 billion in 2023 and is projected to grow substantially, indicating a strong industry-wide adoption of these technologies. Enovis can leverage this trend to:

- Enhance product development: By analyzing real-world patient data, Enovis can identify unmet needs and design more effective orthopedic solutions.

- Improve clinical decision support: Predictive models can assist healthcare providers in selecting the optimal treatment pathways for patients, potentially leading to better patient outcomes.

- Optimize operational efficiency: Data analytics can be used to forecast demand, manage supply chains, and improve manufacturing processes for Enovis' diverse product portfolio.

- Drive personalized medicine: Tailoring treatments based on individual patient data, enabled by advanced analytics, represents a key future growth area for medical device companies like Enovis.

Technological advancements in AI, robotics, and data analytics are fundamentally reshaping orthopedic care. Enovis can harness these innovations for enhanced surgical precision, personalized patient monitoring, and predictive treatment planning, driving improved outcomes and operational efficiency.

The integration of smart implants and connected devices, coupled with the rise of telemedicine and remote monitoring, offers new avenues for patient engagement and continuous care. These digital health solutions are supported by robust market growth, with the telemedicine sector projected to exceed $300 billion by 2030.

Furthermore, the medical 3D printing market, valued at approximately $2.5 billion in 2023, is expanding rapidly, enabling Enovis to offer customized implants. Leveraging data analytics, Enovis can also refine product development and clinical decision support, mirroring the healthcare analytics market's projected substantial growth.

| Technology Area | 2023 Market Value (Approx.) | Projected 2028/2030 Market Value (Approx.) | Enovis Opportunity |

|---|---|---|---|

| Surgical Robotics | N/A (Market growing rapidly) | $10.2 billion (by 2027) | Precision surgery, advanced pre-surgical planning |

| Smart Implants/IoT | N/A (Market growing rapidly) | >$20 billion (by 2028) | Continuous patient monitoring, personalized rehabilitation |

| Medical 3D Printing | $2.5 billion | >$6 billion (by 2028) | Customized implants and prosthetics |

| Telemedicine/Remote Monitoring | ~$100 billion | >$300 billion (by 2030) | Extended patient support, improved recovery outcomes |

| Healthcare Analytics | ~$30 billion | Substantial growth projected | Product innovation, clinical decision support, operational efficiency |

Legal factors

Enovis operates within a highly regulated medical device landscape, necessitating strict adherence to frameworks like the U.S. Food and Drug Administration (FDA), the European Union's Medical Device Regulation (MDR), and the UK's Medicines and Healthcare products Regulatory Agency (MHRA). For instance, the MDR, implemented in May 2021, significantly increased scrutiny and data requirements for medical device manufacturers, impacting market access timelines and costs.

Navigating these evolving legal requirements is paramount for Enovis's product approval, market access, and ongoing commercialization efforts. Failure to comply can lead to substantial financial penalties, product recalls, and damage to brand reputation, as seen with past instances of non-compliance in the industry that resulted in multi-million dollar fines.

Protecting Enovis's innovative orthopedic solutions through patents, trademarks, and trade secrets is paramount for maintaining its competitive advantage in the medical technology market. This robust IP strategy is vital for safeguarding its unique product designs and proprietary technologies.

The medical technology landscape is currently seeing a significant increase in intellectual property disputes. These conflicts, often involving non-practicing entities, necessitate that Enovis implement strong defensive and offensive IP strategies to navigate potential litigation effectively.

Enovis operates under stringent product liability laws, holding it accountable for any harm caused by its medical devices due to defects. This necessitates an unwavering commitment to quality control and patient safety, as demonstrated by the company's focus on rigorous testing and compliance with regulatory standards.

Minimizing litigation risk is crucial for Enovis's financial health and brand reputation. In 2023, the medical device industry saw significant settlements and jury awards related to product liability, underscoring the financial exposure. Therefore, robust safety protocols and transparent labeling are not just ethical imperatives but essential risk management strategies.

Data Privacy and Cybersecurity Regulations

Enovis operates in an environment with increasingly stringent data privacy and cybersecurity regulations. The proliferation of connected medical devices and digital health platforms necessitates strict adherence to laws like HIPAA in the US and GDPR in Europe, impacting how patient data is handled and secured. Failure to comply can result in significant fines and reputational damage, making robust data protection a critical legal obligation.

The regulatory landscape for medical device cybersecurity is also evolving rapidly. For instance, the FDA's premarket cybersecurity guidance continues to emphasize the need for manufacturers to address vulnerabilities throughout a device's lifecycle. Enovis must invest in secure design principles and ongoing monitoring to meet these evolving legal requirements and safeguard patient information.

- HIPAA Fines: Violations of HIPAA can lead to penalties ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million.

- GDPR Impact: Non-compliance with GDPR can result in fines of up to €20 million or 4% of the company's annual global turnover, whichever is higher.

- FDA Cybersecurity Focus: The FDA reported a 7% increase in medical device cybersecurity recalls in 2023 compared to the previous year, highlighting the heightened regulatory scrutiny.

Anti-Kickback and Anti-Bribery Laws

Enovis operates within a global healthcare landscape where stringent anti-kickback and anti-bribery regulations, such as the U.S. Foreign Corrupt Practices Act (FCPA), are paramount. These laws are designed to prohibit any form of improper inducement or payment intended to influence healthcare professionals or sway purchasing decisions. Failure to comply can result in substantial fines and severe reputational harm.

Maintaining unwavering ethical business conduct and rigorous compliance with these legal frameworks is not merely advisable but critical for Enovis. The potential repercussions for violations are significant, impacting financial stability and market trust. For instance, in 2023, the U.S. Department of Justice reported billions in fines collected for FCPA violations, underscoring the financial risks involved.

- FCPA Enforcement: The FCPA targets bribery of foreign officials, which can extend to healthcare professionals in many countries, leading to significant penalties for companies like Enovis.

- Reputational Risk: Allegations or findings of bribery can severely damage Enovis's brand image and erode trust among patients, providers, and investors.

- Compliance Costs: Implementing robust compliance programs, including training and due diligence, represents a necessary operational expense to mitigate legal and financial risks.

- Market Access: Strict adherence to these laws ensures Enovis can continue to operate and compete fairly in international markets, avoiding sanctions that could restrict its business.

Enovis must navigate a complex web of global regulations, including those from the FDA and EU MDR, which dictate product safety and efficacy. For example, the EU MDR, fully implemented in 2021, has increased the burden of proof for manufacturers, potentially extending approval timelines and raising compliance costs.

Intellectual property protection is crucial for Enovis, as the medical device sector sees frequent patent disputes, with litigation costs potentially reaching millions. A strong IP strategy is vital to safeguard its innovations and prevent infringement.

Product liability laws hold Enovis accountable for device defects, necessitating rigorous quality control. In 2023, the medical device industry experienced significant product liability settlements, emphasizing the financial risks associated with non-compliance.

Data privacy laws like HIPAA and GDPR are critical due to Enovis's use of connected devices. The FDA noted a 7% rise in medical device cybersecurity recalls in 2023, highlighting the increasing regulatory focus on data protection.

Compliance with anti-bribery laws, such as the FCPA, is essential for international operations. The U.S. Department of Justice collected billions in FCPA fines in 2023, underscoring the severe financial and reputational consequences of violations.

Environmental factors

Enovis' global manufacturing and supply chain operations inherently carry an environmental impact, notably through energy consumption and the procurement of raw materials. For instance, the medical device industry, which Enovis operates within, faces increasing scrutiny regarding its carbon footprint. A 2024 report highlighted that the healthcare sector's emissions are comparable to those of the aviation industry, emphasizing the need for efficiency improvements across the value chain.

By prioritizing sustainable sourcing of materials, implementing energy-efficient manufacturing processes, and adopting responsible resource management, Enovis can significantly mitigate its environmental impact. This strategic focus not only addresses regulatory pressures but also bolsters operational resilience by diversifying supply sources and reducing dependency on volatile resources. For example, companies that invest in renewable energy for their facilities saw a 15% reduction in operational costs in 2024, according to industry analyses.

The medical device industry, including companies like Enovis, faces significant environmental challenges related to waste generation. The production and lifecycle of medical devices often involve plastics, metals, and other materials that contribute to landfill burden and potential pollution. For instance, global healthcare waste is estimated to be around 5.9 million tons annually, with a substantial portion stemming from single-use devices and packaging.

Enovis can proactively address these issues by integrating circular economy principles into its operations. This includes designing products with recyclability in mind, developing robust refurbishment and remanufacturing programs for reusable medical equipment, and enhancing its waste management strategies across all facilities. By embracing these practices, Enovis can not only reduce its environmental footprint but also potentially unlock cost savings and improve its brand reputation in an increasingly eco-conscious market.

Climate change presents tangible risks for Enovis, such as potential disruptions to its global supply chains and rising energy expenses. For instance, extreme weather events can impact manufacturing and logistics, leading to increased operational costs and delays.

Enovis' proactive approach to identifying and mitigating these climate-related risks is crucial. This includes their commitment to reducing greenhouse gas (GHG) emissions across Scope 1, 2, and 3. In 2023, Enovis reported a 14% reduction in Scope 1 and 2 GHG emissions intensity compared to their 2021 baseline, demonstrating progress in environmental stewardship.

Environmental, Social, and Governance (ESG) Reporting

Growing investor and government pressure for environmental accountability is significantly impacting companies like Enovis. In 2024, a significant majority of institutional investors, estimated to be over 80%, stated that ESG factors are important in their investment decisions, a trend expected to continue. This necessitates Enovis enhancing its environmental, social, and governance (ESG) reporting to meet these demands for transparency and demonstrate a commitment to sustainability.

Publishing detailed Corporate Social Responsibility (CSR) or ESG reports is crucial for Enovis. These reports should clearly outline the company's environmental performance, such as carbon emissions reduction targets and waste management initiatives, alongside its social impact and governance structures. This proactive disclosure can attract socially responsible investors and align with evolving regulatory landscapes, which are increasingly prioritizing sustainability metrics.

Specific areas of focus for Enovis's ESG reporting will likely include:

- Environmental Performance: Quantifiable data on energy consumption, greenhouse gas emissions (Scope 1, 2, and 3), water usage, and waste reduction efforts. For instance, tracking progress against science-based targets for emissions reduction will be key.

- Social Impact: Information on labor practices, employee diversity and inclusion, supply chain ethics, and community engagement. Reporting on employee safety metrics, such as lost-time injury frequency rates, is also vital.

- Governance Practices: Details on board diversity, executive compensation linked to ESG performance, and ethical business conduct policies. Transparency in board oversight of ESG strategy is increasingly expected.

- Regulatory Compliance: Adherence to emerging ESG disclosure mandates, such as those being implemented by the SEC and European Union, will require robust data collection and reporting mechanisms.

Product Lifecycle Environmental Impact

The environmental footprint of Enovis' medical devices is a critical consideration, spanning from initial design through manufacturing, product use, and eventual end-of-life disposal. This lifecycle approach is becoming increasingly important for companies in the healthcare sector. For instance, the healthcare industry's waste, including single-use medical devices, is a significant environmental concern, with estimates suggesting it generates a substantial portion of global waste annually.

To mitigate this, Enovis can focus on integrating eco-friendly design principles into its product development. This might involve using recycled materials, designing for disassembly and recyclability, and minimizing hazardous substances. A 2024 report highlighted that companies prioritizing sustainable product design saw an average of a 15% increase in customer preference for their offerings.

Furthermore, conducting thorough lifecycle environmental impact assessments for its devices will provide valuable data for improvement. Seeking certifications for sustainable products, such as ISO 14001 for environmental management systems or specific eco-labels, can also bolster Enovis' environmental credentials and appeal to increasingly eco-conscious healthcare providers and consumers.

- Lifecycle Assessment: Evaluating the environmental impact of Enovis' products from raw material extraction to disposal.

- Eco-Design: Incorporating sustainability into product development, focusing on material selection and end-of-life considerations.

- Sustainable Certifications: Pursuing recognized eco-labels to validate environmental performance and enhance market appeal.

Enovis' operations are subject to a growing array of environmental regulations concerning emissions, waste management, and resource usage. Compliance with these evolving standards, such as those related to single-use plastics in medical devices, requires continuous investment in cleaner technologies and process optimization. Failure to adapt can lead to penalties and reputational damage.

The increasing global focus on climate change necessitates that Enovis proactively manages its carbon footprint across all operational scopes. By setting ambitious greenhouse gas reduction targets and investing in renewable energy sources, Enovis can not only meet stakeholder expectations but also potentially reduce long-term energy costs. For instance, a 2024 analysis indicated that companies with clear net-zero strategies often outperform their peers financially.

Consumer and investor demand for sustainable products and practices is a significant environmental driver for Enovis. Healthcare providers, in particular, are increasingly scrutinizing the environmental impact of the medical devices they procure. Companies demonstrating strong environmental stewardship, evidenced by transparent reporting and concrete action, are likely to gain a competitive advantage in the market.

Enovis' commitment to environmental sustainability is crucial for its long-term success and includes managing its supply chain's impact. The company's efforts in eco-design, waste reduction, and responsible sourcing are vital. For example, in 2023, Enovis reported a 14% reduction in Scope 1 and 2 GHG emissions intensity compared to their 2021 baseline, showcasing tangible progress.

| Environmental Factor | Impact on Enovis | Mitigation Strategies | Data/Trend (2023-2025) |

|---|---|---|---|

| Climate Change & Emissions | Supply chain disruption, rising energy costs, regulatory scrutiny. | Invest in renewable energy, reduce GHG emissions (Scope 1, 2, 3), implement energy-efficient processes. | 14% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2021 baseline) reported by Enovis in 2023. Growing investor pressure for net-zero commitments. |

| Waste Management & Circularity | Landfill burden, pollution, resource depletion. | Eco-design principles, product recyclability, refurbishment programs, enhanced waste management. | Global healthcare waste estimated at 5.9 million tons annually. Companies prioritizing sustainable design saw 15% increase in customer preference (2024). |

| Resource Scarcity & Sourcing | Supply chain volatility, increased material costs. | Sustainable material sourcing, supply chain diversification, responsible resource management. | Increased focus on resilient supply chains due to geopolitical factors and climate impacts. |

| Regulatory Compliance | Penalties, operational restrictions, reputational risk. | Adherence to evolving environmental standards (e.g., emissions, plastics), robust ESG reporting. | Over 80% of institutional investors consider ESG factors in decisions (2024). SEC and EU implementing new ESG disclosure mandates. |

PESTLE Analysis Data Sources

Our Enovis PESTLE Analysis is meticulously constructed using a diverse array of data sources, including reports from leading market research firms, official government publications, and reputable financial institutions. This comprehensive approach ensures that every political, economic, social, technological, legal, and environmental factor is informed by current and credible information.