Enovis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enovis Bundle

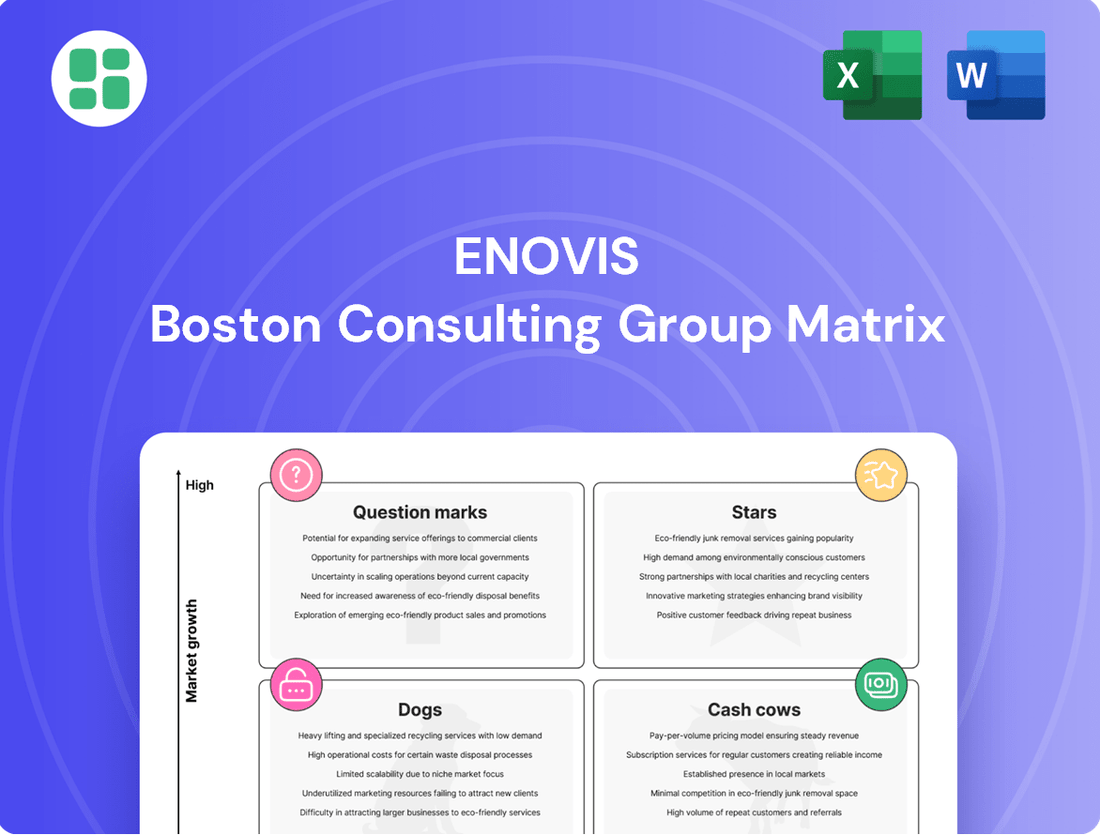

Curious about Enovis's product portfolio? This BCG Matrix preview offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks, giving you a foundational understanding of their market position.

For a comprehensive analysis that unlocks actionable strategies and detailed quadrant placements, purchase the full BCG Matrix report. It's your key to making informed investment and product decisions.

Stars

Enovis's reconstructive surgical implants, significantly enhanced by the late 2023 acquisition of LimaCorporate, are a key growth engine. This segment, encompassing hip, knee, and shoulder implants, demonstrated robust performance with 11% growth in Q1 2025 and a reported 59% increase in Q4 2024, signaling a strong market position in an expanding sector.

The integration of Lima's advanced custom 3D-printed implants further solidifies Enovis's competitive edge. The company is targeting over $1 billion in annual joint replacement sales, underscoring the substantial market share and future potential of this product line.

Enovis is aggressively expanding its presence in the foot and ankle market, a segment showing robust growth within orthopedics. Their strategic moves include introducing innovative products like the EF1 External Fixation system and the Arsenal Foot Plating System, demonstrating a commitment to capturing a larger share of this lucrative space.

The ARVIS Augmented Reality Surgical System is a cutting-edge technology that provides surgeons with real-time visual guidance during procedures. This innovation places Enovis firmly in the burgeoning market for digital surgical solutions, a sector experiencing rapid growth and technological advancement.

ARVIS is designed to enhance surgical workflows and improve patient outcomes, making it a prime candidate for a Star position within the BCG matrix. While it requires ongoing investment due to its innovative nature and market development, its significant future potential in a high-growth area is undeniable.

Manafuse® Bone Growth Stimulator

The Manafuse® Bone Growth Stimulator, launched in July 2025, is positioned as a Star within Enovis's BCG Matrix. This device leverages Low-Intensity Pulsed Ultrasound (LIPUS) technology, a field experiencing rapid advancements. The regenerative bone growth stimulation market is robust, with projections indicating continued strong growth through 2028, driven by an aging global population and increasing incidence of orthopedic injuries.

As a Star, Manafuse® requires significant investment to capitalize on its high growth potential and secure market share. The market for bone growth stimulators, valued at approximately $1.5 billion in 2024, is expected to grow at a compound annual growth rate (CAGR) of over 7% in the coming years. Manafuse's innovative LIPUS technology offers a non-invasive approach, differentiating it in a competitive landscape.

- Product: Manafuse® Bone Growth Stimulator

- Technology: Low-Intensity Pulsed Ultrasound (LIPUS)

- Market Position: Star (High Growth, High Market Share)

- Investment Strategy: Continued investment for market penetration and expansion

EMPOWR 3D Knee® System

The EMPOWR 3D Knee® System, a key offering from Enovis, is positioned as a Star within the BCG Matrix due to its innovative dual-pivot design. This system is engineered to replicate more natural knee motion, a critical factor in improving patient outcomes and satisfaction within the total knee arthroplasty market.

The total knee replacement market is substantial and continues to grow, driven by an aging population and increasing prevalence of osteoarthritis. In 2023, the global knee replacement market was valued at approximately $17.6 billion, with projections indicating continued expansion. The EMPOWR 3D Knee®'s advanced kinematics are designed to capture a significant share of this lucrative market.

- Market Position: Star in the BCG Matrix.

- Key Innovation: Dual-pivot design for natural motion.

- Market Opportunity: Addresses demand for improved patient satisfaction in knee arthroplasty.

- Growth Potential: High, given the expanding global knee replacement market valued at over $17 billion in 2023.

The EMPOWR 3D Knee® System is a prime example of a Star within Enovis's portfolio, thanks to its innovative dual-pivot design that mimics natural knee movement. This advanced technology directly addresses the growing demand for enhanced patient satisfaction in the total knee arthroplasty market, a sector valued at over $17.6 billion globally in 2023. Its potential to capture significant market share in this expanding segment solidifies its Star status.

| Product | BCG Matrix Position | Key Feature | Market Context | Growth Driver |

|---|---|---|---|---|

| EMPOWR 3D Knee® System | Star | Dual-pivot design for natural motion | Total Knee Arthroplasty Market (>$17.6B in 2023) | Improved patient outcomes and satisfaction |

| Manafuse® Bone Growth Stimulator | Star | Low-Intensity Pulsed Ultrasound (LIPUS) | Bone Growth Stimulator Market (~$1.5B in 2024) | Non-invasive approach, aging population |

| ARVIS Augmented Reality Surgical System | Star | Real-time surgical guidance | Digital Surgical Solutions Market (High Growth) | Enhanced surgical workflows, improved outcomes |

What is included in the product

The Enovis BCG Matrix analyzes product portfolio performance, guiding strategic decisions on investment, divestment, or divestment.

Enovis BCG Matrix offers a clear, quadrant-based visualization to pinpoint underperforming units, relieving the pain of strategic uncertainty.

Cash Cows

Enovis, via its DJO subsidiary, boasts a robust lineup of traditional bracing and support products, including well-known brands like Aircast® and DonJoy. These offerings are dominant players in a mature market segment, consistently delivering substantial cash flow.

The established brand recognition and widespread use of these products mean they require minimal promotional investment, allowing them to function as reliable cash cows for Enovis. For instance, the global orthopedic bracing market, which includes these traditional supports, was valued at approximately $7.5 billion in 2023 and is projected to grow at a CAGR of around 4-5% through 2030, underscoring the stability and continued demand for these established product lines.

The Chattanooga and Compex brands represent Enovis's Cash Cows within the BCG matrix. These established product lines offer a robust portfolio of rehabilitation technologies, serving a consistent and vital market in physical therapy and recovery.

Their strength lies in generating steady revenue streams and maintaining high profit margins. This financial performance is a direct result of their entrenched market position and the mature, albeit lower-growth, nature of the rehabilitation technology sector compared to more cutting-edge surgical innovations.

Prior to the Lima acquisition, Enovis’s established surgical implant lines, often referred to as the pre-Lima core, represented a stable foundation. While not experiencing the explosive growth of the newly integrated Recon segment, these mature product lines commanded substantial market share, ensuring consistent revenue streams.

These foundational implant products continue to be reliable cash cows for Enovis, generating significant and predictable cash flow. Their established market presence means they require less aggressive investment in research and development and marketing compared to newer, high-growth innovations, further contributing to their profitability.

In 2023, Enovis reported total revenue of $1.06 billion, with its Surgical segment, which includes these mature implant lines, contributing a significant portion. While specific segment breakdowns for the pre-Lima core are not separately detailed, their historical performance indicates a steady contribution to overall profitability and cash generation.

Dr. Comfort Footwear

Dr. Comfort Footwear, a key brand within Enovis's portfolio, likely represents a Cash Cow in the BCG Matrix. This classification stems from its position in a mature, stable market segment focused on therapeutic footwear, prioritizing patient comfort and long-term foot health.

This product line is characterized by a strong, established market share within its niche. It generates consistent, reliable cash flow for Enovis, requiring minimal reinvestment due to its low growth potential and established customer loyalty.

For instance, the broader therapeutic footwear market, which Dr. Comfort serves, is projected to see steady, albeit modest, growth. In 2024, the global orthopedic footwear market was valued at approximately $8.5 billion, with an anticipated compound annual growth rate (CAGR) of around 4.5% through 2030. This indicates a stable environment where established brands can thrive by maintaining their market position.

- Market Position: High Market Share in a Low-Growth Market

- Financial Contribution: Consistent Cash Flow Generation

- Investment Needs: Minimal Reinvestment Required

- Customer Base: Loyal and Stable

Prevention & Recovery Segment Overall

Enovis's Prevention & Recovery segment, encompassing bracing, rehabilitation, and footwear, functions as a stable cash cow.

This segment demonstrates consistent, low single-digit growth, with Q1 2025 reporting 5% expansion, reflecting its mature market status.

It reliably contributes to Enovis's total revenue and adjusted EBITDA, providing a steady stream of cash for the company.

- Stable Growth: The Prevention & Recovery segment generally experiences low single-digit growth, with Q1 2025 showing 5% growth.

- Revenue Contribution: This segment consistently contributes to Enovis's overall revenue.

- EBITDA Generation: It reliably generates adjusted EBITDA, solidifying its role as a cash cow.

- Mature Market: The segment operates within a mature market, indicating predictable performance.

Enovis's established brands like Aircast® and DonJoy, within the Prevention & Recovery segment, are prime examples of Cash Cows. These products hold dominant positions in mature markets, consistently generating significant cash flow with minimal need for new investment. Their established brand recognition ensures a stable customer base, contributing reliably to Enovis's financial performance.

The Chattanooga and Compex brands also fall into the Cash Cow category, offering robust rehabilitation technologies. These lines benefit from entrenched market positions and consistent demand, translating into steady revenue and high profit margins. Their contribution is vital for funding growth initiatives in other segments.

The Dr. Comfort Footwear brand is another strong Cash Cow, serving a stable niche in therapeutic footwear. Its established market share and customer loyalty generate predictable cash flow, requiring limited reinvestment. The overall orthopedic footwear market, valued at approximately $8.5 billion in 2024, supports this steady performance.

| Segment/Brand | BCG Category | Key Characteristics | 2024/2025 Data Points |

|---|---|---|---|

| Aircast®, DonJoy (Bracing) | Cash Cow | Dominant in mature market, high cash flow, low investment needs | Global orthopedic bracing market ~$7.5B (2023), projected 4-5% CAGR through 2030. |

| Chattanooga, Compex (Rehab Tech) | Cash Cow | Entrenched market, steady revenue, high profit margins | Mature rehabilitation technology sector, consistent demand. |

| Dr. Comfort Footwear | Cash Cow | Stable niche, established market share, loyal customer base | Global orthopedic footwear market ~$8.5B (2024), projected 4.5% CAGR through 2030. |

| Prevention & Recovery Segment | Cash Cow | Consistent low single-digit growth, reliable revenue and EBITDA | Q1 2025 segment growth reported at 5%. |

Delivered as Shown

Enovis BCG Matrix

The Enovis BCG Matrix preview you're currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no demo content – just a comprehensive strategic tool ready for immediate application.

Rest assured, the BCG Matrix report you see here is the final, unedited version that will be delivered to you after completing your purchase. It's a professionally designed analysis ready to be integrated into your business strategy, offering clear insights into product portfolio management.

What you're previewing is precisely the Enovis BCG Matrix file you'll download once your purchase is confirmed. This means you'll get a complete, analysis-ready document that you can immediately use for strategic planning, presentations, or internal discussions.

This preview showcases the actual Enovis BCG Matrix report that becomes yours after purchase, ensuring you know exactly what you're getting. It's a professional, data-driven tool designed for strategic decision-making, delivered in its final, usable format.

Dogs

Obsolete or legacy product versions within Enovis's offerings, while technically still available, often fall into the Dogs category of the BCG Matrix. These are products that have been surpassed by newer, more innovative models. For instance, if Enovis had a line of older orthopedic braces that have since been replaced by lighter, more effective designs, these older models would likely exhibit low market share and minimal growth potential.

These legacy products typically require a disproportionate amount of support and resources relative to their declining sales figures. Think of the ongoing costs associated with maintaining inventory, customer service for older models, or even specialized repair services. In 2024, companies often find that the cost of maintaining these older product lines outweighs the revenue they generate, making them prime candidates for phasing out or aggressive clearance strategies to free up capital and focus resources on more promising ventures.

Underperforming regional product lines within Enovis, potentially acquired or developed for niche markets, likely reside in the Dogs quadrant of the BCG Matrix. These products typically exhibit both low market share and low market growth, meaning they aren't gaining traction and the overall market isn't expanding significantly for them.

For instance, if Enovis acquired a company in 2023 with a specific orthopedic brace for a limited European market, and that product only captured 1% of its regional market by mid-2024, with the overall regional market for that specific brace type growing at a mere 2% annually, it would exemplify a Dog. Such products drain resources like marketing and R&D without generating substantial returns, impacting overall profitability.

Certain Enovis products, particularly those with substantial manufacturing in regions subject to elevated tariffs, could effectively function as cash traps within the BCG matrix. These tariffs directly erode profitability and diminish market competitiveness for these specific offerings.

Enovis itself anticipates a $20 million impact on its 2025 adjusted EBITDA due to tariffs. This figure implies that some product lines are likely bearing a disproportionate share of this cost, potentially hindering their growth and cash generation capabilities.

Non-core, Divested Assets

Non-core, Divested Assets in the Enovis BCG Matrix would encompass any minor, non-strategic assets or product lines that Enovis has divested or is actively looking to divest. These are assets that don't align with its primary focus on orthopedics and reconstruction.

These units are typically characterized by low performance, contributing minimally to overall revenue and exhibiting little to no growth potential. For example, if Enovis were to divest a small, unrelated medical device segment, it would fall into this category.

- Divested Segments: Assets or product lines sold off because they no longer fit the company's strategic direction.

- Low Growth, Low Market Share: These assets typically have minimal contribution to revenue and limited future growth prospects.

- Strategic Alignment: Enovis's core focus remains on orthopedics and reconstructive products, making non-aligned assets candidates for divestment.

Niche, Low-Demand Rehabilitation Equipment

Niche, low-demand rehabilitation equipment often falls into the Dogs category of the BCG Matrix. These are products with specialized applications that cater to very small patient populations or specific, less common conditions. Consequently, they experience low sales volumes and minimal market growth. For instance, a device designed for a rare neuromuscular disorder might only see a few hundred units sold annually, struggling to recoup development and manufacturing costs.

The financial performance of such products is typically weak. High overhead costs associated with research, regulatory compliance, and niche marketing can easily outweigh the limited revenue generated. In 2024, companies with portfolios including these items might find them contributing negligibly to overall revenue, potentially operating at a break-even point or even a slight loss. This is particularly true when considering the ongoing investment required for specialized maintenance and support.

- Low Market Share: These products typically hold a very small percentage of the overall rehabilitation equipment market.

- Minimal Growth Prospects: The demand for highly specialized equipment is inherently limited, leading to stagnant or declining sales over time.

- Profitability Challenges: High fixed costs and low sales volumes make it difficult to achieve profitability, often resulting in break-even or loss-making operations.

- Strategic Consideration: Companies often review these products for potential divestiture or discontinuation to reallocate resources to more promising segments.

Products in the Dogs quadrant of the BCG Matrix for Enovis are those with low market share and low market growth. These are often legacy items, underperforming regional offerings, or non-core assets that no longer align with the company's strategic direction. They consume resources without generating significant returns.

For instance, older orthopedic brace models superseded by newer designs, or niche rehabilitation equipment for rare conditions, fit this description. By mid-2024, such products might represent a small fraction of Enovis's market share in their respective categories, with minimal expansion potential in their target markets.

The financial burden of maintaining these "Dogs" can be substantial, including inventory costs, customer support, and specialized repairs, especially for products facing tariffs. Enovis's anticipated $20 million impact on 2025 adjusted EBITDA due to tariffs highlights how such costs can disproportionately affect underperforming product lines.

Companies like Enovis often consider divesting or discontinuing these low-performing assets to reallocate capital and focus on more promising segments within their core orthopedic and reconstructive business.

| BCG Category | Enovis Product Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Dogs | Legacy Orthopedic Braces | Low | Low | Resource drain, consider phasing out |

| Dogs | Underperforming Regional Product (e.g., specific brace in a niche European market) | Low (e.g., 1% in 2024) | Low (e.g., 2% annually) | Minimal return, potential divestment |

| Dogs | Niche Rehabilitation Equipment | Very Low | Stagnant/Declining | High overhead, low profitability |

| Dogs | Divested or Non-Core Assets | Negligible | None | No longer strategically aligned |

Question Marks

Enovis's Recon implant systems, including the augmented reverse glenoid for shoulders and the Nebula stem for hips, represent significant new product introductions in Q1 2025. These innovations target high-growth surgical segments, positioning them as potential Stars in the BCG matrix.

While currently holding a low market share, the widespread adoption of these advanced implant systems could drive substantial future growth. The orthopedic market, particularly for joint replacements, continues to expand, with the global orthopedic devices market projected to reach over $75 billion by 2028, indicating a fertile ground for these new offerings.

Enovis's advanced foot and ankle innovations, like the Tarsoplasty Percutaneous Lapidus Correction System and Arsenal Foot Plating, are positioned as potential stars in the BCG matrix. These cutting-edge products cater to a burgeoning market, indicating significant future growth potential.

Despite their innovative nature and market promise, these products are in the nascent stages of adoption. This necessitates considerable investment in sales efforts and comprehensive surgeon education to effectively penetrate the market and capture share.

Enovis is strategically investing in digital care resources and integrated technologies to revolutionize orthopedic workflows and enhance patient recovery. This expansion targets a rapidly growing digital health market within orthopedics, a sector projected to reach over $60 billion globally by 2027, with a significant portion dedicated to AI-driven solutions.

While the overall digital health market is booming, Enovis's current market share in specialized orthopedic digital solutions may be nascent. This positions these initiatives as potential question marks in the BCG matrix, requiring substantial capital infusion to capture a larger segment of this expanding market and build a competitive advantage.

Regenerative Solutions Beyond Bone Growth Stimulators

While Manafuse is a clear Star in Enovis's portfolio, the company is actively exploring other regenerative solutions that could represent future Stars. These emerging areas, though currently small in market share and unproven, hold significant growth potential. Enovis is channeling its research and development efforts into these promising fields, aiming to establish leadership positions in the evolving landscape of regenerative medicine.

These nascent regenerative solutions are positioned as Question Marks on the BCG Matrix. They represent investments in high-growth potential markets where Enovis is seeking to build a strong foundation. The success of these ventures is not yet guaranteed, but the strategic intent is to nurture them into future revenue drivers.

- Emerging Biomaterials: Development of novel scaffolds and matrices designed to promote tissue regeneration beyond bone, potentially targeting cartilage or soft tissue repair.

- Cellular Therapies: Early-stage research into the application of stem cells or other cellular components to enhance healing and regenerative processes.

- Gene Therapy Applications: Exploration of genetic approaches to stimulate endogenous repair mechanisms or introduce therapeutic genes for tissue regeneration.

- Advanced Drug Delivery Systems: Innovations in localized drug delivery to optimize the release of growth factors and other regenerative agents at injury sites.

International Expansion of Newer Technologies

Enovis's global reach is a significant asset, yet its most cutting-edge technologies are still finding their footing in emerging international markets. These regions are ripe for expansion, offering substantial growth potential that Enovis is strategically targeting.

The market share for Enovis's newest innovations in these developing economies is currently small, reflecting the early stage of adoption. Capturing a meaningful portion of these markets will necessitate dedicated investment and tailored market entry strategies.

- Emerging Market Penetration: While Enovis has a broad international presence, the adoption rate of its latest technologies in emerging markets is still in its infancy.

- High-Growth Opportunity: These regions represent significant future revenue streams, driven by increasing healthcare access and demand for advanced medical solutions.

- Nascent Market Share: For specific new products, market share in these developing economies is minimal, indicating substantial room for growth.

- Strategic Investment Focus: Enovis must allocate resources to build brand awareness, establish distribution channels, and adapt products to local needs to effectively compete and gain market share.

Enovis's nascent regenerative medicine initiatives, including early-stage research into cellular therapies and gene therapy applications, are prime examples of Question Marks. These ventures are in high-growth potential markets where Enovis is aiming to build a strong foundation, but their success is not yet guaranteed.

These areas require significant investment to develop and commercialize, with the expectation that they will mature into Stars. The company is focusing R&D on these promising fields to establish leadership in the evolving regenerative medicine landscape.

Enovis's strategic investments in digital care resources and integrated technologies for orthopedics also fall into the Question Mark category. While the digital health market is booming, Enovis's current share in specialized orthopedic digital solutions is nascent, necessitating substantial capital to gain market traction.

These digital health efforts target a sector projected to reach over $60 billion globally by 2027, with AI-driven solutions forming a significant portion. Capturing a larger segment of this expanding market requires dedicated investment to build a competitive advantage.

| BCG Category | Enovis Product/Initiative | Market Attractiveness | Enovis Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Nascent Regenerative Medicine (Cellular, Gene Therapy) | High (Growing field) | Low | Requires significant investment to develop into a Star. |

| Question Mark | Digital Care & Integrated Technologies (Orthopedics) | High (Digital Health Market > $60B by 2027) | Low (Nascent in specialized orthopedic solutions) | Needs substantial capital to capture market share and build advantage. |

BCG Matrix Data Sources

Our Enovis BCG Matrix is constructed using comprehensive market data, including financial reports, industry analyses, and competitive intelligence, to provide a robust strategic overview.