Enovis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enovis Bundle

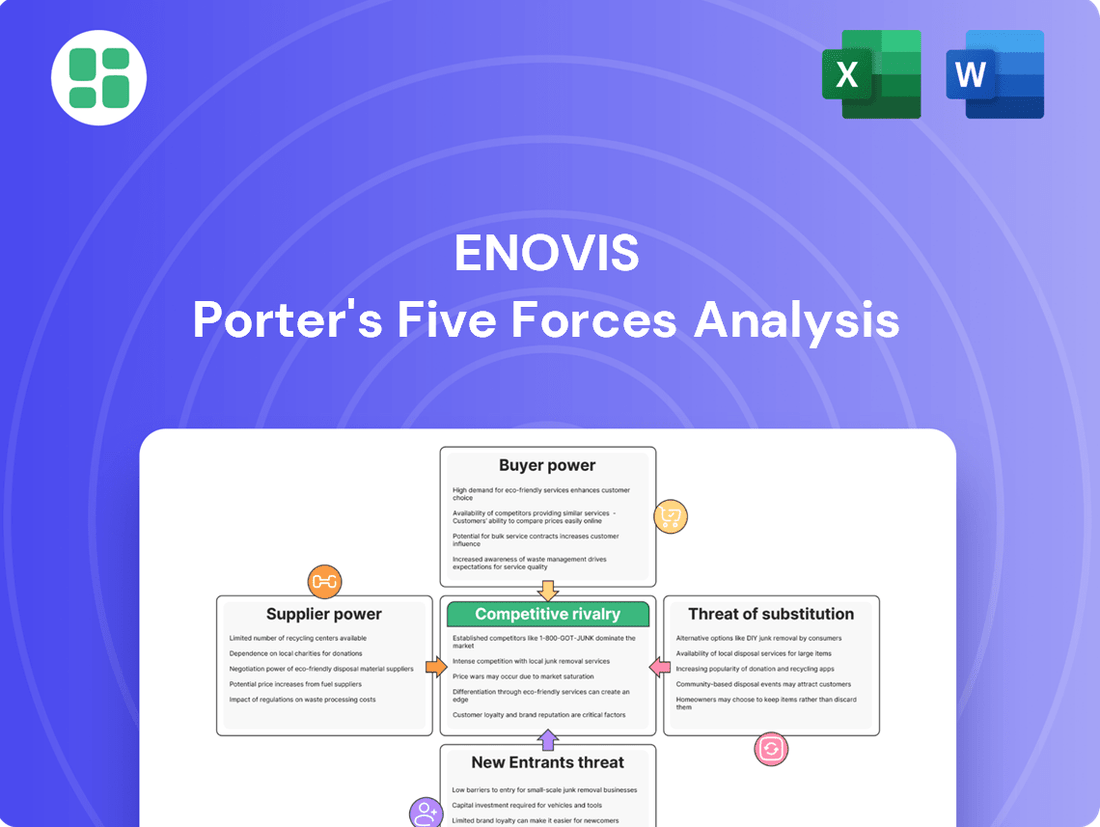

Enovis faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers playing crucial roles in its market landscape. Understanding these dynamics is key to navigating the orthopedics industry effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Enovis’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Enovis depends on suppliers for critical specialized raw materials, components, and cutting-edge technologies vital for its orthopedic solutions and medical devices. The bargaining power of these suppliers is directly tied to how unique and proprietary their products are. For instance, if a supplier offers a highly specialized component with very limited or no viable alternatives, their leverage in negotiations with Enovis escalates considerably.

Switching suppliers for Enovis in the medical technology space presents significant challenges, largely due to the intricate regulatory landscape and the rigorous validation processes inherent in the industry. These factors create substantial switching costs, directly impacting Enovis's ability to easily change its suppliers.

The complexity of re-qualifying components or materials, especially those critical to product performance and patient safety, means that Enovis faces considerable hurdles and potential production disruptions if it were to switch its supply base. This situation inherently strengthens the bargaining power of Enovis's existing suppliers.

The threat of suppliers moving into Enovis's market, known as forward integration, appears to be quite low. This is largely because creating medical devices is a highly specialized field, requiring significant investment in research, development, and navigating complex regulatory landscapes. For instance, obtaining FDA approval for a new orthopedic implant can take years and cost millions. Enovis's specialization in advanced orthopedic solutions further strengthens this position, as these products demand deep technical expertise and established relationships with healthcare professionals.

Importance of Supplier's Input to Enovis's Product Quality

The quality and reliability of inputs are crucial for Enovis, especially in the medical device sector where patient safety is paramount. Suppliers of specialized, high-quality components, like advanced polymers or intricate electronic parts, wield significant influence. For instance, a disruption in the supply of a critical biocompatible material could halt production and directly affect Enovis's ability to meet demand, as seen with supply chain challenges impacting the broader medical device industry throughout 2024.

- Supplier Dependence: Enovis relies on a select group of suppliers for specialized components, increasing supplier leverage.

- Input Criticality: The performance and safety of Enovis's orthopedic and pain management devices depend heavily on the precise specifications of supplier inputs.

- Regulatory Impact: Non-compliance of supplier materials with stringent FDA regulations could lead to costly product recalls and significant brand damage.

- Market Dynamics: In 2024, many specialized component suppliers experienced strong demand, further bolstering their bargaining position with medical device manufacturers like Enovis.

Availability of Substitute Inputs

The bargaining power of suppliers for Enovis is influenced by the availability of substitute inputs. For some of Enovis's products, alternative raw materials might be readily accessible. However, highly specialized components or patented technologies could be sourced from a limited number of suppliers, thereby increasing their leverage.

The medical device sector in 2024 has experienced ongoing supply chain disruptions, including critical shortages of certain raw materials. This environment generally amplifies supplier power, as demand outstrips supply for key inputs. For instance, reports from early 2024 indicated persistent shortages of specific plastics and electronic components vital for medical equipment manufacturing.

Enovis is actively working to counteract this by diversifying its sourcing and manufacturing operations. This strategy aims to reduce reliance on single suppliers and mitigate risks associated with tariffs and other geopolitical factors, thereby enhancing overall supply chain resilience.

- Component Specialization: Highly specialized or patented inputs can significantly increase supplier bargaining power.

- Industry-Wide Shortages: In 2024, the medical device industry faced material shortages, strengthening supplier positions.

- Diversification Strategy: Enovis is pursuing multiple sourcing and manufacturing locations to reduce supplier dependence.

- Resilience Focus: Efforts are underway to build a more robust supply chain, less vulnerable to disruptions and tariffs.

The bargaining power of Enovis's suppliers is moderate to high, primarily due to the specialized nature of many components and the critical importance of input quality in the medical device sector.

In 2024, supply chain volatility, including shortages of specific raw materials and electronic components, further bolstered supplier leverage. For example, the global shortage of semiconductor chips impacted various manufacturing sectors, including medical devices, leading to increased lead times and prices for essential electronic components used in Enovis's products.

While Enovis actively works to diversify its supplier base and build resilience, the inherent switching costs and regulatory hurdles in the medical technology industry mean that key suppliers retain significant influence over pricing and terms.

| Factor | Impact on Supplier Power | Enovis Context |

|---|---|---|

| Component Uniqueness | High | Enovis relies on specialized, often proprietary, components for its advanced orthopedic solutions. |

| Switching Costs | High | Rigorous validation and regulatory compliance for medical devices create substantial costs and time delays for changing suppliers. |

| Input Criticality | High | The performance and safety of Enovis's products are directly tied to the quality and reliability of supplier inputs. |

| Industry Supply Chain Conditions (2024) | Moderate to High | Widespread material shortages and increased demand for specialized medical components in 2024 strengthened supplier negotiating positions. |

What is included in the product

This analysis unpacks the competitive intensity within the orthopedic and extremity care market, detailing Enovis's strategic positioning against rivals, supplier/buyer power, and the threat of new entrants or substitutes.

Effortlessly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model that visually highlights pain points.

Customers Bargaining Power

Enovis primarily serves healthcare providers like hospitals, ambulatory surgical centers, and clinics. These customers can be highly concentrated, particularly within large purchasing groups or integrated delivery networks. This concentration amplifies their influence.

Customers with substantial purchasing volumes, such as those buying many orthopedic implants or rehabilitation equipment, wield considerable bargaining power. For instance, a major hospital system purchasing thousands of joint replacement implants annually can negotiate more aggressively on price and terms.

This significant leverage allows these high-volume clients to demand preferential pricing, tailored product configurations, and advantageous contract conditions. Such demands directly affect Enovis's profitability and revenue streams, as seen in competitive bidding processes for large healthcare contracts.

Customer switching costs for Enovis are a significant factor in their bargaining power. For specialized medical devices like surgical implants and advanced rehabilitation systems, these costs can be quite substantial. Healthcare providers invest heavily in training their staff on specific Enovis technologies and integrating them into existing workflows. For instance, a hospital might have surgeons deeply familiar with Enovis's joint replacement systems, making a switch to a competitor a complex and potentially disruptive process that could impact patient care and surgical efficiency.

The compatibility of Enovis's products with a facility's current medical equipment and established surgical protocols also creates a barrier to switching. This technical integration and the need to re-validate procedures can represent significant time and financial investment for customers. This inertia, built on familiarity and operational integration, effectively reduces the immediate power of customers to easily demand lower prices or better terms from Enovis for these higher-end product categories.

Conversely, for Enovis's bracing and supports segment, switching costs are generally much lower. These are often less complex products with wider availability across multiple manufacturers. A customer needing a knee brace, for example, can readily find comparable alternatives from various brands. This ease of substitution means customers in this market segment hold more bargaining power, as they can more readily shift their purchases to competitors if Enovis’s pricing or offerings are not competitive.

Healthcare providers, a key customer segment for Enovis, are highly informed about product performance and pricing. This knowledge stems from readily available industry data, peer comparisons, and competitive tender processes, allowing them to effectively gauge value and negotiate terms.

The growing emphasis on value-based care and overall cost containment within healthcare systems significantly amplifies customer price sensitivity. This trend compels providers to actively seek out solutions that offer both cost-effectiveness and strong patient outcomes, directly impacting Enovis's ability to set prices.

Threat of Backward Integration by Customers

The threat of healthcare providers integrating backward to produce their own orthopedic solutions or rehabilitation technologies is exceptionally low for Enovis. This is primarily due to the substantial capital requirements, the need for specialized research and development, and the complex manufacturing processes involved in creating medical devices.

Healthcare institutions are fundamentally service-oriented, focusing on patient care rather than the intricate and high-risk business of medical device manufacturing. The extensive regulatory hurdles and the need for deep technical expertise further deter such backward integration attempts, thereby limiting their leverage against companies like Enovis.

- Low Capital Allocation for Manufacturing: Healthcare providers typically allocate capital towards patient care infrastructure and technology, not large-scale manufacturing facilities for medical devices.

- R&D Intensity: Developing innovative orthopedic solutions requires significant investment in specialized R&D, a core competency of medical technology firms, not healthcare providers.

- Regulatory Compliance Burden: Navigating the rigorous FDA approval processes for medical devices is a complex and costly undertaking, which most healthcare systems are not equipped to handle.

Product Differentiation and Importance to Customer

Enovis strives to distinguish its offerings through innovation, demonstrated clinical effectiveness, and enhancements in patient results. This strategy directly counters the bargaining power of customers, as highly valued, differentiated solutions are less susceptible to price pressures. For instance, advanced surgical implants or cutting-edge rehabilitation technologies that deliver superior patient outcomes are particularly sought after by healthcare providers.

The company's commitment to these differentiated solutions allows it to sustain pricing power and foster strong customer loyalty. In 2024, Enovis continued to invest in R&D, with a significant portion of its budget allocated to developing next-generation products in areas like orthopedic implants and sports medicine, aiming to solidify its market position.

- Product Differentiation: Enovis focuses on innovation and clinical efficacy to set its products apart.

- Customer Value: Clinically differentiated solutions offering better patient outcomes are highly valued by healthcare providers.

- Pricing Power: This differentiation helps Enovis maintain its ability to set prices and build customer loyalty.

- R&D Investment: In 2024, the company prioritized R&D spending to enhance its product pipeline, particularly in orthopedics and sports medicine.

The bargaining power of Enovis's customers is moderate, influenced by customer concentration and purchasing volume. Large hospital systems and purchasing groups can negotiate favorable terms due to their significant buying power, impacting Enovis's pricing and profitability, especially in competitive bidding scenarios.

Switching costs are a key differentiator; high for specialized orthopedic and rehabilitation products due to training and integration needs, but low for simpler items like braces. This variation means customers for complex solutions have less immediate leverage, while those buying basic items can more easily switch brands if pricing is unfavorable.

Customer awareness of pricing and performance, coupled with the healthcare industry's focus on cost containment and value-based care, heightens price sensitivity. However, the threat of backward integration by healthcare providers is minimal due to the high capital, R&D, and regulatory barriers in medical device manufacturing.

What You See Is What You Get

Enovis Porter's Five Forces Analysis

This preview displays the complete Enovis Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the industry. The document you see here is precisely the same professionally compiled report you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently expect instant access to this detailed analysis, ready to inform your strategic decision-making.

Rivalry Among Competitors

The orthopedic devices market is on a strong growth trajectory. Projections indicate the global market size will expand from $51.45 billion in 2024 to $55.08 billion in 2025, representing a 7.1% compound annual growth rate. This robust expansion generally tempers the intensity of competitive rivalry, as companies can pursue growth by tapping into market expansion rather than solely by aggressively capturing share from competitors.

Looking further, the market is expected to reach $67.05 billion by 2029, with a projected CAGR of 5.0% for the period. While overall industry growth is healthy, it is important to note that specific segments within the broader orthopedics sector might exhibit different growth patterns, potentially influencing competitive dynamics in those particular niches.

The orthopedic medical technology market is intensely competitive and quite fragmented. Major players like Stryker, Johnson & Johnson MedTech, Zimmer Biomet, and Medtronic command significant market share, but they also face competition from many smaller, specialized firms. This broad range of competitors means Enovis must contend with both large-scale, diversified offerings and highly focused, innovative solutions.

Enovis's own growth is a testament to the dynamic nature of this sector. By crossing the $1 billion sales threshold in 2024, Enovis has solidified its position among the larger entities in the industry. This scaling up suggests that rivalry is not just about product breadth but also about the ability to innovate and capture market share across various orthopedic segments.

Competitive rivalry in the orthopedic sector is intensely fueled by product differentiation and a relentless pursuit of innovation. This includes the development of smart orthopedic devices, the integration of robotics in surgical procedures, and the increasing demand for customized patient solutions. Companies are heavily investing in research and development to create clinically superior offerings that not only enhance patient outcomes but also streamline surgical workflows.

The orthopedic market saw significant investment in R&D, with companies like Enovis dedicating substantial resources to innovation. For instance, the global orthopedic devices market was valued at approximately $50 billion in 2023 and is projected to grow, driven by these technological advancements. This competitive landscape is further intensified by rapid technological shifts, such as the emergence of robotic-assisted surgery and advanced 3D printing techniques, compelling firms to constantly offer cutting-edge products to maintain market share.

Exit Barriers

Exit barriers in the medical technology sector, including companies like Enovis, are notably high. These are driven by substantial capital outlays for advanced manufacturing, dedicated research and development, and the rigorous costs associated with regulatory approvals. For instance, bringing a new medical device to market can cost tens of millions of dollars and take many years.

Furthermore, established distribution channels and deep-rooted relationships with healthcare providers create significant switching costs for customers, making it challenging for new entrants and difficult for existing players to divest. These entrenched ties mean that even if a company wishes to exit, its specialized assets and customer base are not easily transferable.

The confluence of these factors—high fixed costs, specialized assets, and strong customer relationships—effectively traps companies within the industry. This commitment to long-term operation, rather than facilitating an easy exit, inherently intensifies competitive rivalry as firms are compelled to compete vigorously to justify their ongoing investments.

- High Capital Investment: Medical technology firms often invest billions in specialized R&D and manufacturing, such as the advanced robotics used in surgical systems.

- Regulatory Hurdles: The lengthy and expensive process of gaining FDA or EMA approval for medical devices acts as a significant barrier to both entry and exit.

- Established Networks: Companies like Stryker or Medtronic have spent decades building relationships with hospitals and surgeons, creating loyalty that is hard to break.

- Specialized Assets: The unique machinery and intellectual property developed for specific medical applications have limited value outside the medical technology industry.

Market Share and Acquisition Activity

Enovis has been actively pursuing strategic acquisitions, notably the purchase of LimaCorporate, to bolster its reconstructive segment and broaden its international reach. This move is part of a larger ambition to achieve $1 billion in reconstructive sales for 2024.

While established giants such as Medtronic and Stryker command substantial market shares, Enovis's proactive acquisition strategy signals a clear intent to capture a larger piece of the market and solidify its competitive standing. This dynamic approach fuels the intensity of rivalry within the industry.

- Strategic Acquisitions: Enovis's acquisition of LimaCorporate is a key example of its strategy to gain market share and expand its reconstructive business.

- Market Share Dynamics: Major competitors like Medtronic and Stryker currently hold significant market shares, creating a competitive landscape that Enovis aims to disrupt.

- Competitive Intensity: Enovis's M&A activities directly contribute to a more intense competitive rivalry as it seeks to enhance its position against larger players.

- Growth Targets: The company's goal of reaching $1 billion in reconstructive sales in 2024 underscores the aggressive nature of its competitive strategy.

Competitive rivalry in the orthopedic devices market is intense, driven by a fragmented industry structure and a constant race for innovation. Enovis, a significant player, faces competition from established giants like Stryker, Johnson & Johnson MedTech, Zimmer Biomet, and Medtronic, as well as numerous specialized firms. This means Enovis must contend with broad product portfolios and highly focused, niche solutions.

The market's robust growth, projected to reach $55.08 billion in 2025, generally tempers rivalry by offering avenues for expansion. However, companies like Enovis are actively pursuing growth through strategic acquisitions, such as the LimaCorporate purchase, to expand their reconstructive segment and international reach, further intensifying competition as they challenge larger incumbents.

The orthopedic sector is characterized by high exit barriers due to substantial capital investments in R&D and manufacturing, coupled with rigorous regulatory approval processes. For example, bringing a new medical device to market can cost tens of millions of dollars and take many years. These factors, along with established distribution networks and strong customer relationships, create high switching costs, trapping firms in the industry and compelling them to compete vigorously.

| Key Competitors | Market Presence | Strategic Focus |

| Stryker | Global leader, broad product portfolio | Innovation, acquisitions, robotic surgery |

| Johnson & Johnson MedTech | Diversified medical technology | Advanced surgical solutions, digital integration |

| Zimmer Biomet | Strong in joint reconstruction | Data-driven insights, personalized solutions |

| Medtronic | Extensive range of medical devices | Minimally invasive techniques, technological advancements |

| Enovis | Growing player, focus on reconstructive | Strategic acquisitions (e.g., LimaCorporate), international expansion |

SSubstitutes Threaten

The threat of substitutes for Enovis's musculoskeletal solutions is significant, as numerous non-surgical alternatives exist. For many conditions, patients can opt for physiotherapy, drug therapies, or various alternative treatments instead of surgical interventions or specialized rehabilitation equipment.

The growing popularity of digital musculoskeletal solutions further intensifies this threat. Apps offering independent exercise programs and tech-assisted assessment tools provide accessible and often more affordable alternatives, potentially diverting demand from Enovis's offerings.

For instance, the global digital health market, which includes these types of apps, was valued at over $200 billion in 2023 and is projected to grow substantially. This expansion means more patients will have access to self-managed treatment options, reducing their reliance on traditional rehabilitation methods and equipment.

The threat of substitutes for Enovis's products is moderate. While non-surgical alternatives are often cheaper, they frequently don't provide the same effectiveness or lasting results as surgical implants and advanced rehabilitation for serious conditions. For instance, while physical therapy can be a substitute for certain orthopedic procedures, it may not fully address severe joint degeneration.

However, the increasing adoption of GLP-1 medications for weight management presents a potential, albeit indirect, substitute threat. By addressing obesity, a significant contributor to joint problems, these drugs could reduce the demand for orthopedic surgeries in the future. In 2024, the global obesity market, encompassing weight-loss drugs, is projected to reach substantial figures, indicating a growing trend that could influence healthcare demand.

Customer switching costs to substitutes for Enovis can be a mixed bag. For patients, choosing non-surgical alternatives might mean lifestyle adjustments and a commitment to therapy, potentially leading to a slower recovery compared to surgical options. For instance, physical therapy for knee osteoarthritis, a substitute for knee replacement surgery, requires consistent patient engagement and can take months to show significant results.

Healthcare providers also face hurdles when switching from surgical procedures to conservative management. This involves altering established practice patterns and navigating different reimbursement structures, which can be a significant barrier. The immediate cost savings offered by some non-invasive treatments, however, can sometimes lower the perceived switching cost for both patients and providers.

Innovation in Substitute Technologies

The threat of substitutes for Enovis is amplified by rapid innovation in alternative treatment modalities. For instance, advancements in non-invasive and minimally invasive techniques are continuously emerging, offering patients less disruptive options. This trend is particularly evident in the orthopedic sector, where new technologies are challenging traditional surgical approaches.

Key areas of innovation that introduce substitutes include regenerative medicine and digital health solutions. These fields are rapidly developing alternatives that can potentially reduce the need for Enovis's current product offerings. The market is seeing a surge in technologies that promise comparable or even superior outcomes with less patient intervention.

Examples of these disruptive substitutes include advanced robotics utilized in minimally invasive surgeries, showcasing a shift towards precision and reduced recovery times. Furthermore, nanotechnology is finding applications in orthopedics, offering novel ways to address joint issues. Telemedicine platforms are also expanding their reach into orthopedic care, providing remote consultations and monitoring that can substitute for in-person visits and certain procedures.

- Robotic Surgery: The global surgical robotics market was valued at approximately $7.5 billion in 2023 and is projected to grow significantly, indicating a strong adoption of less invasive alternatives.

- Regenerative Medicine: Investment in regenerative medicine technologies, including stem cell therapies and tissue engineering, continues to rise, with market forecasts suggesting substantial growth in the coming years.

- Digital Health: The digital health market, encompassing telemedicine and AI-driven diagnostics, is experiencing rapid expansion, with projections indicating continued double-digit growth through 2030.

Patient Preference and Awareness

Patient preferences are a significant factor, with a growing demand for less invasive procedures and quicker recovery periods. This trend is fueled by increased patient awareness of alternative treatment options and a desire for personalized care. For instance, advancements in regenerative medicine and non-surgical interventions are gaining traction, potentially diverting patients from traditional Enovis offerings.

The broader shift towards holistic well-being and preventive healthcare strategies encourages patients to first consider non-surgical or less aggressive treatment pathways. This can reduce the perceived need for Enovis's products if alternative solutions are readily available and effectively marketed. For example, a 2024 survey indicated that 65% of patients undergoing orthopedic consultations expressed a preference for non-operative treatments when viable alternatives existed.

To counter this, Enovis needs to proactively communicate the distinct advantages and enduring value of its clinically differentiated solutions. This involves clearly articulating how their products offer superior long-term outcomes and patient satisfaction compared to substitute treatments. Highlighting clinical trial data, such as improved functional recovery rates in 2024 studies, will be crucial in solidifying preference among both patients and physicians.

- Growing patient awareness of less invasive alternatives

- Increased demand for faster recovery times and personalized care

- Shift towards holistic well-being and preventive healthcare

- Enovis must emphasize long-term value and clinical differentiation

The threat of substitutes for Enovis's offerings is moderate, with a growing number of non-surgical and digital alternatives available. While these substitutes may be more affordable, they often don't provide the same level of effectiveness or long-term results for serious conditions compared to Enovis's specialized solutions.

Advancements in regenerative medicine and minimally invasive techniques are creating new substitutes, potentially reducing the demand for traditional surgical implants. For instance, the global surgical robotics market was valued at approximately $7.5 billion in 2023, highlighting the increasing adoption of less invasive alternatives.

Patient preference for less invasive procedures and quicker recovery times further fuels the threat of substitutes. Enovis must emphasize the long-term value and clinical differentiation of its products to maintain its market position against these evolving alternatives.

| Substitute Category | Examples | Market Trend/Data Point (2023/2024) |

|---|---|---|

| Non-Surgical Therapies | Physical Therapy, Drug Therapies | Physical therapy for knee osteoarthritis requires months of engagement; effectiveness varies for severe conditions. |

| Digital Health Solutions | Exercise Apps, Tech-Assisted Assessment | Global digital health market valued over $200 billion in 2023, with substantial projected growth. |

| Minimally Invasive Techniques | Robotic Surgery, Regenerative Medicine | Surgical robotics market ~ $7.5 billion in 2023; regenerative medicine investment continues to rise. |

Entrants Threaten

Entering the medical technology sector, particularly in specialized areas like orthopedic solutions, presents a formidable hurdle due to exceptionally high capital requirements. Companies like Enovis, which focus on intricate surgical implants and advanced rehabilitation technologies, must commit significant upfront investment to research, rigorous clinical trials, and the establishment of sophisticated manufacturing capabilities. For instance, the development of a single new orthopedic implant can easily cost tens of millions of dollars, a sum that naturally discourages many potential new players from even attempting to enter the market.

The medical device industry, where Enovis operates, is characterized by a highly stringent regulatory landscape. Agencies like the U.S. Food and Drug Administration (FDA) and Europe's CE Mark mandate rigorous approval processes for new products. These pathways are not only lengthy but also incredibly costly, involving extensive testing and clinical validation.

For any new company looking to enter this market, navigating these complex regulatory hurdles presents a significant challenge. The time delays and financial investments required to gain product approval act as a formidable barrier, effectively favoring established players like Enovis who have already mastered these processes and have existing relationships with regulatory bodies.

Established brand loyalty and robust distribution channels present a significant barrier for new entrants looking to challenge companies like Enovis. For instance, Enovis's long-standing relationships with orthopedic surgeons, built through decades of product development and support, are difficult for newcomers to replicate. These established networks are crucial for product adoption and market penetration, making it a steep climb for any new player to gain traction.

Intellectual Property and Patents

The orthopedic solutions market heavily relies on intellectual property, with established companies like Enovis holding a substantial number of patents covering their product designs, innovative materials, and surgical methodologies. This extensive patent portfolio acts as a formidable barrier to entry for potential new competitors, forcing them to either invest heavily in developing novel, non-infringing technologies or incur significant costs through licensing agreements.

For instance, in 2023, the global orthopedic devices market was valued at approximately $55 billion, with a significant portion of this value tied to proprietary technologies and patented innovations. Companies that have successfully navigated the patent landscape, such as those with strong R&D pipelines, demonstrate a clear advantage.

- High R&D Investment: Companies like Enovis invest significantly in research and development, leading to the creation of proprietary technologies and a robust patent portfolio.

- Patent Protection: Existing patents on designs, materials, and surgical techniques create substantial hurdles for new entrants seeking to offer similar solutions.

- Licensing Costs: New companies may face substantial costs if they need to license existing intellectual property to enter the market.

- Innovation as a Barrier: The continuous innovation by established players necessitates new entrants to develop truly disruptive technologies to compete effectively.

Economies of Scale and Experience Curve

Established companies like Enovis benefit significantly from economies of scale in manufacturing, procurement, and research and development. This means they can produce goods at a lower cost per unit compared to smaller, newer players. For instance, in 2023, Enovis reported revenues of $1.3 billion, indicating a substantial operational footprint that likely translates into cost advantages.

Furthermore, Enovis leverages an experience curve advantage. Over time, they have refined their production processes and supply chain management, leading to greater efficiency and reduced waste. This accumulated knowledge allows for optimized operations that new entrants would struggle to replicate quickly.

New entrants, conversely, would face considerably higher initial costs and operational inefficiencies. Without the established scale and years of process optimization, they would find it challenging to compete on price or achieve comparable profitability margins.

- Economies of Scale: Larger production volumes lead to lower per-unit costs for Enovis.

- Experience Curve: Enovis has refined processes over time, improving efficiency.

- Barriers to Entry: Newcomers face higher initial investment and operational hurdles.

- Competitive Disadvantage: Entrants struggle to match Enovis's cost structure and efficiency.

The threat of new entrants for Enovis is relatively low due to significant capital requirements for research, development, and manufacturing in the specialized orthopedic sector. Navigating the complex and costly regulatory approval processes, such as those overseen by the FDA, further deters new players. Established brand loyalty, strong distribution networks, and extensive patent portfolios protecting proprietary technologies also create substantial barriers, making it difficult for newcomers to gain market traction and compete on price or innovation.

For instance, the U.S. medical device market alone saw approximately $200 billion in revenue in 2023, with a substantial portion attributed to established players with deep R&D investments and regulatory expertise.

New entrants must also contend with the economies of scale enjoyed by incumbent firms like Enovis, which reported $1.3 billion in revenue for 2023. This scale allows for lower per-unit production costs and greater operational efficiency, creating a competitive disadvantage for smaller, less capitalized new companies.

| Barrier Type | Impact on New Entrants | Example for Enovis |

| Capital Requirements | Very High | Tens of millions for new implant development |

| Regulatory Hurdles | High | Lengthy and costly FDA approval processes |

| Brand Loyalty/Distribution | High | Decades of established surgeon relationships |

| Intellectual Property | High | Extensive patent portfolio on designs and materials |

| Economies of Scale | High | Lower per-unit costs due to $1.3 billion 2023 revenue |

Porter's Five Forces Analysis Data Sources

Our Enovis Porter's Five Forces analysis is built upon a foundation of robust data, drawing from company annual reports, investor presentations, and industry-specific market research reports.