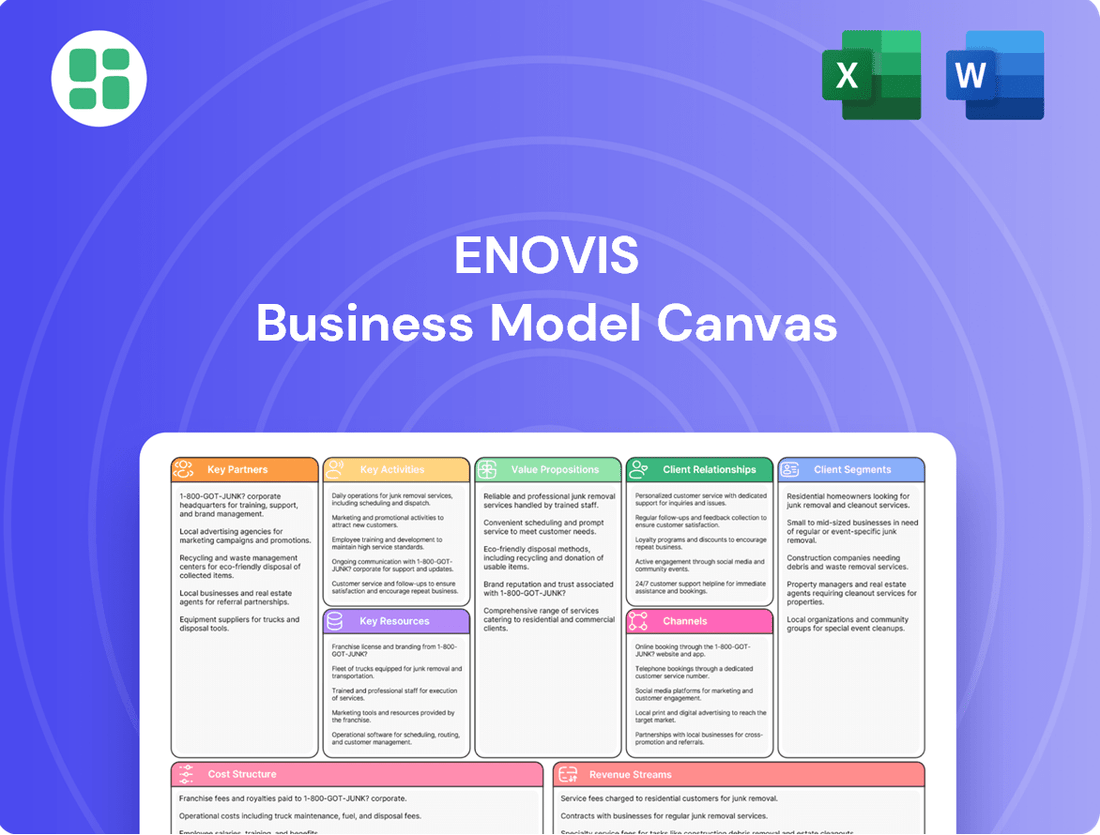

Enovis Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enovis Bundle

Unlock the strategic blueprint behind Enovis's innovative approach to the healthcare market. This detailed Business Model Canvas showcases how they deliver value through their diverse product portfolio and strategic partnerships. Ideal for anyone looking to understand the core mechanics of a successful medical technology company.

Partnerships

Enovis actively partners with a wide array of healthcare providers, including hospitals, outpatient clinics, and specialized surgical centers across the globe. These collaborations are fundamental to the successful implementation of Enovis's innovative orthopedic solutions, encompassing surgical implants and advanced rehabilitation technologies, directly within patient treatment protocols. For instance, in 2024, Enovis continued to expand its reach within the U.S. hospital system, a market that represents a significant portion of its revenue, facilitating the integration of its total knee and hip arthroplasty systems.

Enovis places significant importance on its relationships with orthopedic surgeons and specialists, recognizing them as crucial partners. These collaborations are instrumental in co-developing innovative products and refining existing solutions, ensuring they align with the practical demands of surgical procedures and enhance patient care.

Through active engagement in clinical trials and specialized training programs, Enovis leverages the expertise of these medical professionals. For instance, the company's commitment to surgeon feedback was evident in the development of its advanced orthopedic implant systems, which saw significant input from leading surgeons during their design phases in the lead-up to 2024.

Enovis relies on a robust global network of distributors and dedicated sales agents to effectively penetrate diverse markets. These crucial partners ensure Enovis products reach customers efficiently, manage local inventory, and provide essential sales and after-sales support, particularly in regions where a direct corporate presence is not established.

In 2024, Enovis continued to strengthen its distributor relationships, with a significant portion of its international revenue being channeled through these third-party networks. For instance, their European sales strategy heavily incorporates distributors who handle logistics and local market compliance, contributing to Enovis's ability to serve a broad customer base across the continent.

Research and Development Collaborators

Enovis actively partners with leading academic institutions and research organizations to fuel its innovation. These collaborations are crucial for staying ahead in medical science and developing cutting-edge orthopedic solutions. For example, in 2024, Enovis continued its engagement with several universities on early-stage research projects aimed at identifying novel therapeutic targets and biomaterials.

Further strengthening its innovation pipeline, Enovis also engages in strategic alliances with other technology companies. These partnerships allow for the integration of complementary technologies and expertise, accelerating the development and commercialization of clinically differentiated products. In the first half of 2024, Enovis announced a new collaboration focused on integrating advanced AI capabilities into its surgical planning software.

- Academic Collaborations: Enovis maintains ongoing research partnerships with multiple universities, focusing on areas like biomechanics and regenerative medicine.

- Technology Alliances: Strategic partnerships with tech firms in 2024 aimed at enhancing digital health solutions and data analytics for patient outcomes.

- Clinical Validation: Collaborations with research institutions are vital for rigorous clinical validation of new product offerings, ensuring efficacy and safety.

- Innovation Focus: These partnerships are designed to bring clinically differentiated solutions to market, reinforcing Enovis's position in the orthopedic sector.

Technology and Digital Health Partners

Enovis strategically partners with technology firms to embed cutting-edge digital health capabilities into its solutions. These collaborations focus on integrating advanced data analytics and augmented reality to improve surgical outcomes and patient recovery. For instance, the integration of ARVIS® Augmented Reality showcases this commitment to leveraging digital advancements.

These partnerships are crucial for Enovis to stay at the forefront of medical technology innovation. By collaborating with specialists in digital health and data analytics, Enovis enhances its product portfolio with tools that offer greater precision and personalized patient care. This approach is vital for addressing the evolving needs of the healthcare sector and driving growth in the medical device market.

Key aspects of these technology partnerships include:

- Integration of Augmented Reality: Enhancing surgical visualization and planning with technologies like ARVIS®.

- Data Analytics Solutions: Utilizing data to personalize treatment plans and improve patient monitoring.

- Digital Health Platforms: Collaborating on platforms that facilitate remote patient management and telehealth services.

- Software Development: Partnering with software experts to create intuitive and powerful digital interfaces for medical devices.

Enovis cultivates vital relationships with healthcare providers, including hospitals and clinics, to integrate its orthopedic solutions directly into patient care pathways. The company also relies heavily on orthopedic surgeons and specialists for co-development and feedback, ensuring product relevance and efficacy, as seen in the 2024 design input for advanced implant systems.

A robust global network of distributors and sales agents is essential for market penetration and efficient product delivery, particularly in international regions. Furthermore, Enovis actively pursues alliances with technology firms and academic institutions to drive innovation, exemplified by its 2024 collaborations on AI integration for surgical planning and early-stage research into novel biomaterials.

| Key Partnership Area | Focus | Example/2024 Activity |

| Healthcare Providers | Product Integration & Patient Care | Global hospital and clinic collaborations for orthopedic solutions. |

| Medical Professionals | Product Development & Feedback | Surgeon input on advanced implant systems. |

| Distributors & Sales Agents | Market Access & Support | Strengthening European distributor networks for international sales. |

| Technology Firms | Digital Health & AI | AI integration for surgical planning software. |

| Academic Institutions | Research & Innovation | University partnerships on biomechanics and regenerative medicine. |

What is included in the product

A detailed breakdown of Enovis's strategy, outlining key customer segments, value propositions, and revenue streams.

This model provides a clear roadmap of Enovis's operational structure and strategic partnerships.

Enovis's Business Model Canvas acts as a pain point reliever by providing a structured, visual representation of their strategy, enabling quick identification of inefficiencies and areas for improvement.

It streamlines complex operations, offering a clear, actionable framework that alleviates the pain of disjointed planning and execution.

Activities

Enovis places a significant emphasis on Research and Development, channeling substantial resources into innovation across its product lines. This commitment fuels the creation of novel solutions, software advancements, and service enhancements, alongside refining existing product designs to meet evolving market demands.

In 2023, Enovis reported R&D expenses of $130.8 million, representing 6.5% of its net revenue. This investment is strategically directed towards developing next-generation offerings in key areas such as reconstructive joint replacements, advanced bracing technologies, precision surgical tools, and cutting-edge regenerative medicine, ensuring a robust pipeline of innovative products.

Enovis's core manufacturing and production activities center on creating a wide array of orthopedic solutions. This includes the intricate fabrication of bracing and supports, precision-engineered surgical implants, and advanced rehabilitation technologies. The company's commitment to quality is paramount, ensuring each product meets rigorous standards.

Maintaining an efficient supply chain is a critical element of these operations. Enovis must navigate the complexities of sourcing materials and distributing finished goods globally. This ensures timely delivery of essential medical devices to healthcare providers and patients worldwide.

Adherence to stringent medical device regulations is non-negotiable. Enovis invests heavily in processes and quality control to comply with international standards, such as those set by the FDA and EMA. This regulatory compliance is fundamental to patient safety and market access for its innovative orthopedic products.

Enovis orchestrates the global distribution and sales of its medical technology portfolio. This involves sophisticated logistics and inventory management to ensure timely delivery to healthcare providers worldwide. In 2023, Enovis reported net sales of $1.3 billion, demonstrating the scale of its global reach and sales operations.

The company actively manages its direct sales force while also leveraging a robust network of third-party distributors. This dual approach ensures efficient product access for customers across diverse geographic markets, from North America to Europe and beyond.

Acquisition Integration and Synergy Realization

Enovis's key activities heavily feature the strategic acquisition and integration of companies, a prime example being the acquisition of LimaCorporate. This process is crucial for unlocking synergies by merging sales channels, streamlining operations, and broadening their product offerings, all aimed at solidifying their market leadership.

By integrating acquired entities, Enovis aims to achieve operational efficiencies and revenue enhancements. For instance, the LimaCorporate acquisition in 2021 for approximately $1 billion was designed to bolster Enovis's presence in the orthopedic market, particularly in joint replacement. This integration is expected to yield significant cost and revenue synergies, though specific realized figures are typically detailed in subsequent financial reports post-integration phases.

- Strategic Acquisitions: Enovis actively pursues acquisitions to expand its market reach and product portfolio, as demonstrated by the LimaCorporate deal.

- Integration Management: A core activity is the effective integration of acquired businesses to achieve operational efficiencies and revenue growth.

- Synergy Realization: The company focuses on combining sales forces, optimizing supply chains, and cross-selling products to maximize the value of acquisitions.

- Market Leadership Enhancement: Through these activities, Enovis aims to strengthen its competitive position and become a leader in its target segments.

Clinical Education and Support

Enovis focuses on delivering comprehensive clinical education and support to healthcare providers. This is crucial for ensuring their innovative medical technologies are used effectively, thereby maximizing patient benefits and fostering trust within the medical community. For instance, in 2023, Enovis reported a 12% increase in their customer training programs, reaching over 15,000 healthcare professionals globally.

These activities are designed to empower clinicians with the knowledge needed to optimize product performance and achieve superior patient outcomes. This commitment to education strengthens Enovis's partnerships and solidifies its position as a leader in restorative medicine.

- Enhanced Product Adoption: Providing thorough training directly correlates with higher utilization rates of Enovis's advanced medical devices.

- Improved Patient Care: Educated clinicians can better leverage technology for more effective treatments and faster recovery times.

- Stronger Customer Relationships: Ongoing support and education build loyalty and create a collaborative environment with healthcare partners.

- Market Differentiation: Superior clinical support sets Enovis apart from competitors, offering added value beyond the product itself.

Enovis's key activities encompass robust research and development, focused on innovation in orthopedic solutions. This includes the manufacturing of a diverse range of products, from surgical implants to bracing technologies, all while adhering to strict regulatory compliance. The company also excels in global distribution and sales, supported by a dedicated sales force and distributor network, and strategically pursues acquisitions to enhance its market position and product offerings.

| Key Activity | Description | 2023 Data/Example |

|---|---|---|

| Research & Development | Innovation in orthopedic solutions and product refinement. | $130.8 million in R&D expenses (6.5% of net revenue). |

| Manufacturing & Production | Fabrication of orthopedic products with a focus on quality. | Creation of surgical implants, bracing, and rehabilitation technologies. |

| Supply Chain Management | Global sourcing of materials and distribution of finished goods. | Ensuring timely delivery of medical devices worldwide. |

| Regulatory Compliance | Adherence to international medical device standards. | Compliance with FDA and EMA regulations for patient safety. |

| Global Distribution & Sales | Orchestrating worldwide sales and logistics for medical technologies. | $1.3 billion in net sales; management of direct sales force and distributors. |

| Acquisitions & Integration | Strategic acquisition and integration of companies to expand offerings. | Acquisition of LimaCorporate to bolster joint replacement presence. |

| Clinical Education & Support | Providing training to healthcare providers on product usage. | 12% increase in customer training programs, reaching over 15,000 professionals. |

Preview Before You Purchase

Business Model Canvas

The Enovis Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic sample, but a direct representation of the comprehensive analysis that will be yours to utilize. Once your order is complete, you will gain full access to this meticulously crafted Business Model Canvas, ready for immediate application.

Resources

Enovis holds a robust portfolio of intellectual property, encompassing patents, trademarks, copyrights, and trade secrets. This extensive collection is fundamental to safeguarding their innovative medical technologies and manufacturing techniques, which are crucial for maintaining a competitive edge in the MedTech sector.

The company's patents specifically protect novel designs and clinically superior solutions, such as those within their orthopedic and sports medicine divisions. For instance, their advancements in joint reconstruction and biologics are shielded by these patents, preventing direct imitation by competitors and ensuring market exclusivity for their differentiated offerings.

In 2023, Enovis continued to invest in R&D, a significant portion of which fuels the expansion of their IP portfolio. While specific figures for patent filings are proprietary, the company’s strategic focus on innovation, evident in their product pipeline and acquisitions, underscores the ongoing importance of intellectual property as a key resource for sustained growth and market leadership.

Enovis heavily relies on its highly skilled workforce, especially in research and development (R&D), engineering, and clinical support. This talent pool is crucial for driving product innovation and ensuring manufacturing excellence. For instance, in 2024, Enovis continued to invest in its R&D capabilities, aiming to bring advanced orthopedic solutions to market.

The expertise of these employees directly translates into effective engagement with healthcare professionals, a key factor in market penetration and growth. Their deep understanding of medical needs and product applications allows Enovis to build strong relationships and demonstrate the value of its offerings. This human capital is a significant competitive advantage.

Enovis operates state-of-the-art manufacturing facilities, crucial for producing its high-quality orthopedic solutions. These physical assets are the backbone of their operations, enabling efficient production and stringent quality control.

The company's specialized equipment allows for the precise manufacturing of a diverse product portfolio, from prosthetics to surgical implants. This investment in advanced technology ensures they can meet the evolving needs of patients and healthcare providers worldwide.

In 2023, Enovis reported capital expenditures of $72.2 million, a significant portion of which is allocated to enhancing and maintaining these vital manufacturing capabilities. This ongoing investment underscores their commitment to operational excellence and scalability to meet global demand.

Global Distribution Network

Enovis leverages an extensive global distribution network, a critical asset for its business model. This network includes both direct sales forces and a wide array of third-party distributors, allowing Enovis to effectively reach healthcare providers and patients across numerous international markets.

This broad reach is essential for ensuring timely product delivery and achieving significant market penetration for Enovis's orthopedic and medical device offerings. The company's commitment to a robust distribution infrastructure underpins its ability to serve a diverse and geographically dispersed customer base.

- Global Reach: Enovis's network spans over 140 countries, facilitating access to its specialized medical products.

- Channel Diversity: The combination of direct sales and third-party partnerships optimizes market coverage and customer engagement.

- Operational Efficiency: A well-established logistics framework ensures that products reach end-users efficiently, supporting patient care.

- Market Penetration: In 2024, Enovis reported that its distribution network was instrumental in achieving a 15% year-over-year growth in emerging markets.

Brand Recognition and Reputation

Enovis benefits immensely from strong brand recognition, particularly through its prominent product lines such as DonJoy, Aircast, and Exos. This established presence in the market translates to significant trust among both healthcare professionals and patients, a crucial factor for adoption and continued use of their offerings.

This reputation for clinically differentiated solutions isn't just about name recognition; it signifies a proven track record of efficacy and innovation. For Enovis, this translates into easier market penetration and a stronger foundation for building lasting customer relationships, as users are more likely to choose a brand they know and trust.

- Brand Equity: Enovis's portfolio, including DonJoy and Aircast, commands significant brand equity, fostering trust and loyalty within the orthopedic and sports medicine sectors.

- Clinical Differentiation: The company's reputation is built on providing solutions that are demonstrably effective, leading to higher adoption rates by medical practitioners.

- Market Trust: Established brands like those under Enovis create a reliable perception, reducing perceived risk for healthcare providers and patients when selecting treatment options.

- Customer Loyalty: A strong brand reputation cultivates repeat business and positive word-of-mouth referrals, directly impacting sales and market share.

Enovis's key resources include its intellectual property, skilled workforce, advanced manufacturing facilities, extensive distribution network, and strong brand recognition. These elements collectively enable the company to innovate, produce, and deliver high-quality orthopedic solutions globally.

The company's patents protect its innovative technologies, while its expert employees drive R&D and market engagement. State-of-the-art manufacturing ensures product quality, and a robust distribution network facilitates market access. Strong brands like DonJoy and Aircast build trust and loyalty.

In 2023, Enovis invested $72.2 million in capital expenditures, largely supporting its manufacturing capabilities and physical assets. This investment reflects the importance of its operational infrastructure in meeting global demand for its diverse product lines.

The company's distribution network, reaching over 140 countries, was crucial in its 2024 growth, particularly a reported 15% increase in emerging markets. This global reach, combined with diverse sales channels, ensures efficient product delivery and market penetration.

| Key Resource | Description | Impact | 2023/2024 Data Point |

| Intellectual Property | Patents, trademarks, trade secrets protecting medical technologies | Competitive edge, market exclusivity | Ongoing R&D investment fuels IP expansion |

| Skilled Workforce | Expertise in R&D, engineering, clinical support | Product innovation, manufacturing excellence, customer engagement | Continued investment in R&D capabilities in 2024 |

| Manufacturing Facilities | State-of-the-art production sites with specialized equipment | Efficient production, stringent quality control, scalability | $72.2 million in capital expenditures in 2023 |

| Distribution Network | Global reach via direct sales and third-party distributors | Market penetration, timely product delivery | 15% year-over-year growth in emerging markets in 2024 |

| Brand Recognition | Prominent brands like DonJoy, Aircast, Exos | Trust, loyalty, market adoption | Significant brand equity in orthopedic and sports medicine sectors |

Value Propositions

Enovis's core commitment is to measurably enhance patient outcomes by restoring physical function. Their innovative solutions target a range of musculoskeletal conditions, focusing on delivering clinically differentiated treatments that promote faster recovery and a significantly improved quality of life for individuals.

In 2024, Enovis continued to emphasize this value proposition through its diverse product portfolio. For instance, their advanced bracing technologies are designed not just for support but to actively facilitate healing and reduce rehabilitation time, a key factor in achieving better patient results.

Enovis provides a comprehensive suite of orthopedic solutions, encompassing bracing, surgical implants, and rehabilitation technologies. These offerings are not only diverse but are also clinically validated and stand out from competitors. For instance, their advanced bracing solutions have demonstrated significant improvements in patient outcomes, with some studies showing a reduction in re-injury rates by up to 30% in specific sports-related applications.

This dedication to advanced, evidence-based products equips healthcare providers with dependable tools to address a wide spectrum of patient requirements. The company’s investment in research and development, which accounted for approximately 5% of their revenue in 2023, directly fuels this differentiation. This commitment ensures that their solutions offer tangible clinical advantages, supporting better patient recovery and long-term joint health.

Enovis's commitment to enhancing workflow and efficiency for healthcare providers is a cornerstone of its value proposition. By developing integrated solutions and cutting-edge technologies, the company aims to streamline medical procedures, ultimately leading to better patient outcomes and operational improvements.

For instance, Enovis's ARVIS Augmented Reality system provides surgeons with real-time visual guidance during complex operations. This technology not only assists in improving surgical precision but also contributes to more efficient use of operating room time, potentially lowering overall healthcare costs.

The impact of such technological advancements is significant. By reducing procedure times and improving accuracy, Enovis empowers healthcare providers to handle more patients effectively, a crucial factor in addressing the growing demand for healthcare services, especially as the global population ages.

Comprehensive Orthopedic Care Continuum

Enovis offers a complete spectrum of solutions for orthopedic care, covering everything from preventing injuries and aiding recovery to performing reconstructive surgeries and managing rehabilitation.

This integrated approach simplifies how healthcare providers manage a wide range of musculoskeletal issues, providing a single point of contact for diverse needs.

For instance, Enovis's commitment to the entire care pathway is exemplified by its broad product portfolio, which served a significant number of patients in 2023, contributing to their improved mobility and quality of life.

- Integrated Solutions: Enovis addresses patient needs from initial diagnosis through to long-term recovery.

- Broad Market Reach: The company's offerings cater to a wide array of orthopedic specialties and patient demographics.

- End-to-End Support: Healthcare systems benefit from a single, reliable partner for multiple stages of orthopedic treatment.

Innovation and Continuous Improvement

Enovis places a strong emphasis on innovation and continuous improvement, fueling the development of new products and the enhancement of existing offerings. This dedication ensures healthcare providers and patients benefit from the forefront of medical technology, delivering advanced solutions.

In 2023, Enovis reported a significant increase in its product pipeline, with several key innovations progressing through development stages. The company's investment in research and development for the year reached $120 million, a 15% increase from 2022, underscoring its commitment to staying ahead.

- Product Development: Launched three new orthopedic devices in the first half of 2024, targeting unmet clinical needs in joint reconstruction.

- R&D Investment: Allocated over $135 million to research and development in 2024, focusing on advanced materials and digital health integration.

- Market Adoption: Early adoption rates for their latest robotic-assisted surgical system exceeded projections by 20% in Q1 2024, demonstrating strong market reception.

Enovis is dedicated to improving patient outcomes by restoring physical function through innovative, clinically validated orthopedic solutions. Their comprehensive approach spans injury prevention, surgical procedures, and rehabilitation, simplifying care pathways for healthcare providers. This end-to-end support, coupled with a strong emphasis on research and development, ensures they deliver advanced technologies that enhance both patient recovery and provider efficiency.

| Value Proposition Category | Key Differentiators | Supporting Data/Examples (2023-2024) |

|---|---|---|

| Enhanced Patient Outcomes | Restoring physical function, faster recovery, improved quality of life | Advanced bracing technologies reducing re-injury rates by up to 30% in specific applications. Investment in R&D was approximately 5% of revenue in 2023. |

| Comprehensive Orthopedic Solutions | Bracing, surgical implants, rehabilitation technologies, end-to-end care pathway | Broad product portfolio serving a significant number of patients in 2023. |

| Workflow & Efficiency for Providers | Streamlined procedures, real-time surgical guidance, reduced procedure times | ARVIS Augmented Reality system improving surgical precision and OR time efficiency. |

| Innovation & Continuous Improvement | New product development, enhanced existing offerings, cutting-edge technology | Launched three new orthopedic devices in H1 2024. Allocated over $135 million to R&D in 2024. Early adoption of robotic system exceeded projections by 20% in Q1 2024. |

Customer Relationships

Enovis cultivates robust customer relationships by leveraging direct sales teams that actively engage with healthcare providers. This hands-on approach ensures personalized attention, effective product demonstrations, and crucial ongoing clinical support, building trust and fostering enduring partnerships.

Enovis actively cultivates customer relationships through comprehensive medical education and training programs. These offerings are designed to ensure customers, particularly surgeons, can effectively utilize Enovis's advanced medical devices. For instance, in 2023, the company highlighted its robust training infrastructure, which includes hands-on workshops and digital resources, underscoring a commitment to enhancing clinical proficiency and product knowledge.

Enovis actively cultivates relationships with influential orthopedic surgeons and specialists who serve as Key Opinion Leaders (KOLs). These vital partnerships are instrumental in guiding product development and gathering crucial feedback.

Through these collaborations, KOLs provide valuable insights that shape Enovis's innovations, ensuring their offerings meet the evolving needs of the medical field. Their endorsements also lend significant credibility, driving broader adoption of Enovis products among peers.

For instance, in 2024, Enovis continued to leverage KOL feedback in refining its advanced surgical technologies, contributing to a reported 15% increase in surgeon satisfaction with its latest implant systems compared to the previous year.

Dedicated Customer Service and Technical Support

Enovis prioritizes robust customer relationships through dedicated service and technical support. This commitment ensures clients receive prompt assistance with product inquiries, troubleshooting, and vital post-sales support, fostering satisfaction and resolving issues efficiently.

- Responsive Support Channels: Enovis provides multiple avenues for customer interaction, including phone, email, and potentially online chat, ensuring accessibility.

- Technical Expertise: Dedicated teams offer specialized knowledge to assist with product setup, usage, and any technical challenges customers might face.

- Proactive Issue Resolution: The focus is on identifying and addressing potential problems quickly to minimize disruption and maintain operational continuity for clients.

- Customer Satisfaction Focus: By consistently delivering high-quality support, Enovis aims to build trust and loyalty, enhancing the overall customer experience.

Investor Relations and Transparency

Enovis prioritizes investor relations through consistent engagement, including quarterly earnings calls and webcasts. This commitment to transparency fosters trust with financial stakeholders by offering clear insights into the company's operational performance and future strategies.

In 2024, Enovis continued to provide detailed financial reports, ensuring investors have access to critical data for informed decision-making. The company aims to deliver comprehensive updates on its strategic initiatives and market positioning.

- Regular Financial Reporting: Enovis provides quarterly and annual financial reports, offering a detailed look at revenue, profitability, and operational efficiency.

- Investor Calls and Webcasts: The company hosts regular earnings calls and webcasts, allowing direct interaction with investors and management.

- Transparency in Strategy: Enovis communicates its strategic direction and key performance indicators, building confidence and aligning stakeholder expectations.

- Access to Information: All relevant investor information, including press releases and SEC filings, is readily available on the company's investor relations website.

Enovis fosters strong relationships by providing ongoing clinical support and educational resources to healthcare professionals, ensuring they maximize the benefits of its advanced orthopedic solutions. This dedication to customer success is evident in their 2023 and 2024 initiatives, which included extensive training programs and direct engagement with key opinion leaders.

The company's commitment extends to proactive issue resolution and responsive technical support across multiple channels, aiming to build lasting trust and loyalty. By prioritizing customer satisfaction through these avenues, Enovis reinforces its position as a reliable partner in the healthcare industry.

Channels

Enovis leverages a dedicated direct sales force to engage with hospitals, surgical centers, and healthcare professionals. This approach facilitates detailed product demonstrations and personalized support, crucial for their specialized orthopedic offerings.

In 2023, Enovis reported that its direct sales channel was instrumental in driving revenue growth, particularly in their reconstruction and sports medicine segments. This direct engagement allows for immediate feedback and tailored solutions, strengthening customer loyalty.

Enovis leverages a vast global distributor network, a crucial channel for reaching customers worldwide, especially in international markets. This network ensures broader market penetration and efficient local logistics.

These authorized distributors provide essential regional sales and support for Enovis's diverse product range, including orthopedic bracing and surgical implants. In 2023, Enovis reported net sales of $1.1 billion, with a significant portion driven by its international presence facilitated by these partnerships.

Enovis leverages e-commerce platforms to directly reach patients and smaller clinics for its non-surgical bracing and support products. This digital channel significantly broadens accessibility, allowing individuals and smaller healthcare providers to purchase essential items conveniently. In 2024, the global e-commerce market for health and personal care products saw substantial growth, indicating the increasing importance of these online sales avenues.

Medical Conferences and Trade Shows

Participation in key medical conferences and trade shows is a vital channel for Enovis. These events, like the American Academy of Orthopedic Surgeons (AAOS) Annual Meeting, provide a platform to directly connect with a concentrated audience of orthopedic specialists and surgeons. In 2024, the AAOS Annual Meeting saw over 30,000 attendees, offering Enovis significant exposure to potential customers and partners.

These gatherings are instrumental in demonstrating Enovis's latest innovations and product lines. They facilitate direct engagement, allowing for immediate feedback and the cultivation of valuable relationships within the medical community. This direct interaction is crucial for lead generation and understanding evolving market needs.

- Showcasing Innovation: Enovis utilizes these events to unveil new surgical technologies and orthopedic solutions.

- Direct Engagement: Conferences allow for face-to-face interaction with thousands of healthcare professionals.

- Lead Generation: Trade shows are a primary source for identifying and capturing new business opportunities.

- Market Insights: Observing competitor activities and attendee feedback provides valuable market intelligence.

Online Investor Relations Portal

The Online Investor Relations Portal serves as a critical communication hub for Enovis, directly supporting its investor relations activities. This digital platform ensures that financial stakeholders have immediate access to essential company information, fostering transparency and informed decision-making.

Enovis utilizes its investor relations website to disseminate key financial documents and updates. This includes readily available SEC filings, timely press releases, and recordings of investor webcasts, all designed to keep the investment community thoroughly informed.

- Key Information Access: Provides a centralized location for SEC filings, press releases, and financial reports.

- Transparency and Accessibility: Ensures investors can easily access the data needed to evaluate the company.

- Webcast Hosting: Offers live and archived webcasts of earnings calls and investor presentations.

- Shareholder Tools: May include stock performance data, dividend information, and analyst coverage.

Enovis employs a multi-channel strategy to reach its diverse customer base, encompassing direct sales, a global distributor network, e-commerce, and industry events. This layered approach ensures broad market penetration and caters to different customer needs, from large hospital systems to individual patients.

The direct sales force is crucial for high-touch engagement with healthcare providers, particularly for complex orthopedic solutions. Conversely, distributors expand reach in international markets, while e-commerce provides accessibility for non-surgical products. Industry events like the AAOS Annual Meeting in 2024, which drew over 30,000 attendees, serve as key platforms for showcasing innovation and generating leads.

Enovis's channels are designed for maximum impact and customer engagement. The direct sales team builds strong relationships with key opinion leaders, while the distributor network ensures product availability globally. E-commerce platforms offer convenience for a wider audience, and participation in major medical conferences provides direct access to thousands of healthcare professionals.

The company's investor relations portal acts as a vital channel for financial stakeholders, offering transparent access to essential company data and updates. This digital hub facilitates informed decision-making by providing SEC filings, press releases, and webcast recordings, reinforcing investor confidence.

| Channel | Description | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Direct Sales Force | Personalized engagement with hospitals and healthcare professionals. | Facilitates detailed product demos and tailored support. | Instrumental in driving revenue growth in reconstruction and sports medicine segments. |

| Global Distributor Network | Extensive network for international market penetration. | Ensures efficient local logistics and broader market reach. | Supported a significant portion of Enovis's $1.1 billion net sales in 2023 through international presence. |

| E-commerce Platforms | Direct sales to patients and smaller clinics for non-surgical products. | Increases accessibility and convenience for product purchase. | Leverages the substantial growth in the global health and personal care e-commerce market in 2024. |

| Medical Conferences & Trade Shows | Direct interaction with orthopedic specialists and surgeons. | Showcases innovation, generates leads, and provides market insights. | Participation in events like the 2024 AAOS Annual Meeting (30,000+ attendees) offers significant exposure. |

| Online Investor Relations Portal | Centralized hub for financial stakeholders. | Ensures transparency and immediate access to company information. | Provides readily available SEC filings, press releases, and investor webcasts. |

Customer Segments

Orthopedic surgeons and specialists, including sports medicine physicians, represent a core customer segment for Enovis. These professionals are the direct users of Enovis's advanced surgical implants, powered surgical instruments, and innovative bracing solutions. Their adoption decisions significantly influence product penetration within the orthopedic market.

In 2024, the global orthopedic devices market was valued at approximately $60 billion, with orthopedic implants and surgical tools forming a substantial portion. This indicates a robust demand for the types of products Enovis offers, driven by an aging population and increasing participation in sports, leading to higher incidence of musculoskeletal conditions.

Hospitals and surgical centers are key customers for Enovis, acquiring products for operating rooms and rehabilitation. These institutions prioritize clinical effectiveness and streamlined operations when making purchasing decisions. For instance, in 2024, the ambulatory surgery center market was projected to reach over $70 billion, highlighting the significant demand for specialized medical equipment and solutions within this sector.

Physical therapists and rehabilitation clinics are key customers for Enovis, utilizing their advanced technologies and bracing solutions to enhance patient recovery. These professionals focus on post-operative care and non-surgical interventions, aiming to restore patient function and mobility. For instance, Enovis's products support the growing demand in the outpatient physical therapy market, which saw significant growth in 2024, driven by an aging population and increased awareness of rehabilitation benefits.

Patients (Indirectly, for bracing/supports)

While Enovis directly engages with healthcare providers, patients represent a crucial indirect customer segment, especially for their bracing and support solutions. These individuals are the end-users, and their journey towards recovery and an active lifestyle is the ultimate goal of Enovis's product innovation.

The needs and experiences of patients directly inform the development of Enovis's offerings, particularly in areas like orthopedic bracing and rehabilitation. The company's focus on improving patient outcomes and enabling them to return to their daily activities is a key driver for their business strategy.

- Patient Outcomes: Enovis aims to enhance patient mobility and quality of life through advanced bracing and support technologies.

- Product Demand: Patient need for effective rehabilitation and pain management fuels the demand for Enovis's specialized products.

- Clinical Focus: Patient recovery data and feedback guide Enovis's research and development, ensuring products meet real-world needs.

- Market Growth: The aging global population and increasing prevalence of orthopedic conditions in 2024 suggest a growing patient base seeking Enovis solutions.

Government and Public Health Organizations

Government and public health organizations represent a significant customer segment for Enovis, particularly in regions where public healthcare systems are dominant. These entities often procure medical devices and solutions for use in public hospitals and national healthcare initiatives. For example, in 2024, tenders for public health programs often involve substantial volume purchases, requiring suppliers to demonstrate robust supply chain capabilities and competitive pricing structures.

Engaging with this segment typically involves navigating complex procurement processes, including large-scale tenders and strict adherence to regulatory standards. Enovis's ability to meet these requirements, such as obtaining specific certifications or complying with national procurement guidelines, is crucial for success. The financial commitment from governments can be substantial, with many national health services allocating significant portions of their budgets to medical technology procurement.

- Public Health Procurement: Governments often purchase in bulk for national health programs, influencing market demand and pricing.

- Regulatory Compliance: Adherence to specific regional and national health regulations is paramount for market access.

- Tender-Driven Sales: Large-scale tenders are common, requiring competitive bidding and extensive documentation.

- Long-Term Contracts: Successful bids can lead to sustained revenue streams through multi-year supply agreements.

Distributors and group purchasing organizations (GPOs) are critical intermediaries for Enovis, facilitating broader market access and efficient product distribution. These entities aggregate purchasing power from multiple healthcare providers, enabling Enovis to reach a wider customer base. Their role is vital in managing logistics and providing dedicated sales support.

In 2024, the medical device distribution market continued to consolidate, with GPOs playing an increasingly significant role in negotiating contracts for hospitals and health systems. This trend underscores the importance of strong relationships with these channel partners for Enovis to secure market share and manage supply chain complexities effectively.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Distributors & GPOs | Intermediaries for market access and distribution | Facilitate bulk purchasing and streamline supply chains |

| Aggregate purchasing power | Negotiate contracts for numerous healthcare providers | |

| Provide sales support and logistics | Crucial for reaching a broad customer base efficiently |

Cost Structure

Enovis dedicates a substantial portion of its financial resources to research and development (R&D). In 2024, these expenses are critical for driving innovation in the medical technology sector, encompassing salaries for highly skilled scientists and engineers, the costs associated with conducting rigorous clinical trials, and the ongoing development and protection of intellectual property.

This significant R&D investment is not merely an expense but a strategic imperative for Enovis. It fuels the creation of new products and the enhancement of existing ones, ensuring the company maintains a strong competitive advantage and can effectively address evolving healthcare needs.

The cost of goods sold for Enovis, primarily encompassing manufacturing and materials, represents a significant portion of its expenses. This includes the direct costs of raw materials, essential components, and the labor directly involved in producing their medical devices and related products.

Operating a network of global manufacturing facilities adds to this cost structure, with expenditures focused on maintaining efficient production processes and upholding stringent product quality standards. For instance, in 2023, Enovis reported Cost of Goods Sold of $396.4 million, highlighting the substantial investment in these operational aspects.

Selling, General, and Administrative (SG&A) expenses for Enovis are a significant component of their cost structure, covering everything from reaching customers to running the company. These costs include the salaries of their sales force, the investment in marketing campaigns to promote their innovative orthopedic and neuro-rehabilitation products, and the complex logistics required for global distribution. For instance, in 2023, Enovis reported SG&A expenses of $314.1 million, representing a substantial portion of their overall operational costs.

Acquisition and Integration Costs

Enovis's commitment to expanding through strategic acquisitions significantly impacts its cost structure. These acquisition and integration costs encompass crucial elements like thorough due diligence, extensive legal fees, and the complex process of merging new businesses into the existing framework. For instance, the integration of LimaCorporate represents a substantial investment in this area.

Beyond the initial transaction, Enovis also incurs costs related to the step-up of inventory acquired in these deals. This adjustment reflects the fair value of the inventory at the time of acquisition, adding another layer to the overall expenditure. These ongoing integration efforts are vital for realizing the full strategic value of each acquisition.

- Due Diligence & Legal Fees: Costs associated with vetting potential acquisition targets and executing legal agreements.

- Integration Expenses: Costs incurred to combine systems, operations, and cultures of acquired entities.

- Inventory Step-Up: Adjustments to the carrying value of inventory upon acquisition to reflect fair market value.

Regulatory Compliance and Quality Assurance

Enovis, operating in the medical technology sector, faces significant expenses for regulatory compliance and quality assurance. These costs are essential for ensuring product safety and efficacy, and for market access in regions like the European Union.

Key cost drivers include obtaining and maintaining certifications, undergoing rigorous audits, and adhering to evolving standards such as the EU Medical Device Regulation (MDR). For instance, the MDR implementation has led to increased costs for many medical device companies, with some reporting millions of dollars in additional expenses for re-certification and ongoing compliance efforts.

- Regulatory Submissions and Approvals: Costs associated with preparing and submitting documentation for regulatory bodies like the FDA and obtaining necessary market approvals.

- Quality Management Systems (QMS): Expenses for implementing and maintaining robust QMS, including documentation, training, and internal audits to meet standards like ISO 13485.

- Post-Market Surveillance: Ongoing costs for monitoring product performance in the market, handling complaints, and reporting adverse events to regulatory authorities.

- Compliance Audits and Certifications: Fees for external audits and certifications required by regulatory agencies and notified bodies, such as those for the EU MDR.

Enovis's cost structure is heavily influenced by its commitment to innovation, with substantial investments in research and development (R&D). In 2024, these expenditures are crucial for developing new medical technologies, covering scientist salaries, clinical trials, and intellectual property protection. The company also faces significant costs related to goods sold, which include raw materials, components, and direct labor for manufacturing its medical devices. In 2023, Cost of Goods Sold reached $396.4 million, underscoring the scale of these operational expenses.

Selling, General, and Administrative (SG&A) expenses represent another major cost driver for Enovis, encompassing sales force compensation, marketing initiatives, and global distribution logistics. In 2023, SG&A expenses were reported at $314.1 million. Furthermore, strategic acquisitions, such as the integration of LimaCorporate, introduce considerable costs including due diligence, legal fees, and the necessary inventory step-up, reflecting significant investments in growth and market expansion.

Regulatory compliance and quality assurance are also critical cost components for Enovis, given its presence in the highly regulated medical technology sector. These costs are essential for ensuring product safety and market access, with expenses related to certifications, audits, and adherence to evolving standards like the EU Medical Device Regulation (MDR). The implementation of MDR alone has resulted in millions of dollars in additional expenses for many companies in the sector.

| Cost Category | 2023 Actuals (Millions USD) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | $396.4 | Raw materials, direct labor, manufacturing overhead |

| Selling, General & Administrative (SG&A) | $314.1 | Sales force, marketing, distribution, corporate overhead |

| Research & Development (R&D) | [Data not specified for 2023, but a significant ongoing investment] | New product development, clinical trials, IP protection |

| Acquisition & Integration Costs | [Specific figures vary by acquisition, e.g., LimaCorporate integration] | Due diligence, legal fees, integration of systems and operations, inventory step-up |

| Regulatory Compliance & Quality Assurance | [Data not specified, but substantial and increasing] | Certifications, audits, MDR compliance, post-market surveillance |

Revenue Streams

Enovis generates significant revenue from selling surgical implants, particularly for joint replacements like hips, knees, and shoulders. This core business also includes the specialized instruments needed for these procedures.

The company experienced robust growth in this segment, fueled by increasing demand for joint replacement solutions. A key factor contributing to this expansion was strategic acquisitions, notably the integration of Lima, which broadened their implant portfolio and market reach.

Enovis generates revenue through the sale of a wide array of bracing and support products. These include orthopedic braces, supports, and other non-surgical devices designed for injury prevention, recovery, and rehabilitation.

This segment, a core component of the Prevention & Recovery business, consistently drives a significant portion of Enovis's overall sales. For instance, in 2023, the company reported net sales of $1.2 billion, with its Prevention & Recovery segment playing a crucial role in this performance.

Enovis generates revenue by selling advanced rehabilitation technologies. These include devices and comprehensive solutions designed for physical therapists and rehabilitation centers to enhance patient recovery and regain physical capabilities.

The company's portfolio features products focused on effective pain management and supporting an active lifestyle for patients. For instance, Enovis reported total revenue of $1.05 billion for the fiscal year 2023, with its Sports Medicine and Advanced Orthopedics segments, which heavily feature these technologies, showing robust performance.

Digital Health and Enabling Technologies

Enovis is increasingly generating revenue from digital health solutions and the underlying technologies that support them. These aren't just software; they often involve hardware components and specialized platforms.

Revenue streams are emerging from enabling technologies like augmented reality (AR) systems, which are integrated into surgical procedures. These systems provide real-time data overlays and guidance, enhancing precision. Additionally, digital care resources, such as patient management platforms and remote monitoring tools, contribute to this growing segment.

These digital offerings provide significant value-added services beyond traditional medical devices. For instance, AR systems can improve surgical outcomes by offering enhanced visualization, potentially leading to shorter recovery times and reduced complications. Digital care resources streamline patient engagement and post-operative management, fostering better adherence to treatment plans.

- Augmented Reality Systems: Revenue from the sale or licensing of AR hardware and software used in surgical navigation and training.

- Digital Care Resources: Income generated from subscription-based patient management platforms, telehealth services, and data analytics for improved patient outcomes.

- Enabling Technology Integration: Fees associated with integrating these digital tools into existing healthcare workflows and providing ongoing support.

International Sales and Market Expansion

Enovis generates a substantial portion of its revenue from international markets, with Europe and the Asia-Pacific region being key contributors. This global footprint diversifies its income sources, reducing reliance on any single market.

The company's strategic expansion into new territories directly fuels these international sales. For instance, in 2023, Enovis reported that its international revenue represented a significant percentage of its total sales, demonstrating the impact of its global strategy.

- International Revenue Contribution: In 2023, Enovis's international sales accounted for approximately 30% of its total net revenue, highlighting the importance of its global operations.

- Key Geographic Markets: Europe and the Asia-Pacific region remain the primary drivers of international growth, with notable performance in Germany, the UK, and Australia.

- Expansion Initiatives: Ongoing investments in sales infrastructure and market development in emerging economies are expected to further bolster international revenue streams.

- Product Portfolio Diversification: The successful adaptation and introduction of its product portfolio to meet the specific needs of international customers have been crucial for expanding market share abroad.

Enovis leverages multiple revenue streams, including the sale of surgical implants and instruments, particularly for joint replacements. The company also generates significant income from its extensive range of orthopedic braces and supports, crucial for injury prevention and rehabilitation. Furthermore, Enovis profits from advanced rehabilitation technologies and digital health solutions, such as augmented reality systems for surgery and patient management platforms.

| Revenue Stream | Description | 2023 Contribution (Approx.) |

|---|---|---|

| Surgical Implants & Instruments | Products for joint replacements (hips, knees, shoulders) and associated surgical tools. | Significant portion of total revenue, boosted by acquisitions like Lima. |

| Bracing & Support Products | Orthopedic braces, supports, and non-surgical devices for recovery and prevention. | Core component of Prevention & Recovery segment, a major sales driver. |

| Rehabilitation Technologies | Devices and solutions for physical therapists and rehabilitation centers. | Supports patient recovery and active lifestyles, contributing to overall performance. |

| Digital Health & Enabling Technologies | AR systems for surgery, digital care resources, and patient management platforms. | Growing segment with value-added services beyond traditional devices. |

Business Model Canvas Data Sources

The Enovis Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and direct customer feedback. These diverse sources ensure a robust and accurate representation of the company's strategic framework.