ENN Energy Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Energy Holdings Bundle

ENN Energy Holdings, a leader in China's natural gas distribution, boasts significant strengths in its extensive infrastructure and growing customer base. However, understanding the full scope of its market position, including potential weaknesses and emerging threats, is crucial for informed decision-making.

Want the full story behind ENN Energy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

ENN Energy Holdings stands as a titan in China's clean energy sector, boasting one of the largest market shares in natural gas distribution. This leadership is underpinned by an impressive operational footprint, encompassing 261 city gas projects spread across 21 provinces, serving a substantial customer base.

As of the first half of 2024, ENN Energy reported a 10% year-on-year increase in natural gas sales volume, reaching 14.5 billion cubic meters, a testament to its leading market position and growing demand for cleaner energy sources.

ENN Energy Holdings has built a robust and expanding portfolio of integrated energy solutions, moving beyond its foundational natural gas distribution. This strategic diversification encompasses offerings like distributed energy systems, energy engineering services, and other value-added services, creating a more comprehensive energy offering for its customers.

The success of this diversification is evident in its financial performance. Integrated energy sales volumes saw significant growth in 2024, and this upward trend continued into Q1 2025, demonstrating strong market adoption and execution. This segment is increasingly becoming a key driver of the company's overall profitability.

Looking ahead, the integrated energy solutions segment is projected to be a substantial contributor to ENN Energy's gross profit. This indicates a shift towards higher-margin services and a more resilient business model, less dependent on traditional utility-like revenue streams.

ENN Energy boasts a remarkably strong customer base, serving upwards of 31 million residential households and over 270,000 commercial and industrial clients. This extensive reach signifies a stable and diverse revenue stream, providing a solid foundation for continued growth and operational resilience.

The company's strength is further amplified by its vast infrastructure network. With 261 city gas projects and 356 integrated energy projects operational as of recent reports, ENN Energy possesses a significant capacity to deliver energy services efficiently across numerous geographical areas, reinforcing its market position.

Strategic Access to LNG Supply and Competitive Sourcing

ENN Energy Holdings, through its parent ENN Natural Gas, leverages a significant strategic advantage with access to China's first privately owned LNG receiving terminal located in Zhoushan. This facility is crucial for securing a stable and cost-effective supply of Liquefied Natural Gas, a key component in its energy distribution network.

The Zhoushan terminal's growing annual capacity, projected to reach 5 million tons per annum by 2025, directly translates into ENN Energy's ability to source gas competitively. This reduces reliance on potentially volatile international spot markets and mitigates risks associated with supply disruptions.

- Strategic Asset: Ownership of the Zhoushan LNG receiving terminal.

- Capacity Growth: Increasing annual capacity to 5 million tons by 2025.

- Competitive Sourcing: Enables stable and cost-effective procurement of LNG.

- Supply Chain Resilience: Reduces vulnerability to supply bottlenecks.

Strong Commitment to Decarbonization and ESG Leadership

ENN Energy Holdings stands out with its significant dedication to decarbonization and Environmental, Social, and Governance (ESG) leadership. This commitment is underscored by its Green Finance Framework achieving a 'Dark Green' certification, the highest possible rating, reflecting a deep integration of sustainability into its financial operations. The company has set ambitious goals, aiming for net-zero emissions by 2050, aligning itself with global climate objectives.

The company's proactive approach to sustainability is evident in its operational strategies. ENN Energy is actively implementing methane emission control measures across its facilities, a crucial step in reducing greenhouse gas impact from natural gas operations. Furthermore, it is exploring the development of natural-gas-based hydrogen projects, positioning itself at the forefront of China's energy transition towards lower-carbon alternatives.

- Green Finance Framework Certification: Achieved 'Dark Green' rating, indicating robust ESG integration.

- Net-Zero Target: Committed to reaching net-zero emissions by 2050.

- Methane Emission Control: Implementing advanced technologies to minimize methane leaks.

- Hydrogen Exploration: Actively pursuing natural-gas-based hydrogen projects to support decarbonization.

ENN Energy's expansive operational network, covering 261 city gas projects and 356 integrated energy projects across China, forms a significant competitive advantage.

Its integrated energy solutions segment is a key growth driver, with strong sales volume increases reported through Q1 2025, contributing increasingly to overall profitability.

The company's substantial customer base, exceeding 31 million residential and 270,000 commercial/industrial clients, provides stable and diversified revenue streams.

Strategic ownership of the Zhoushan LNG receiving terminal, with capacity growing to 5 million tons per annum by 2025, ensures cost-effective and stable gas procurement.

| Metric | H1 2024 | 2025 Target | Significance |

|---|---|---|---|

| Natural Gas Sales Volume | 14.5 billion cubic meters (YoY +10%) | N/A | Demonstrates market leadership and demand growth. |

| Zhoushan LNG Terminal Capacity | N/A | 5 million tons per annum | Enhances supply security and cost competitiveness. |

| Integrated Energy Projects | 356 | N/A | Indicates broad service delivery capabilities. |

What is included in the product

This SWOT analysis offers a comprehensive breakdown of ENN Energy Holdings's internal capabilities and external market challenges, highlighting key growth drivers and potential weaknesses.

Identifies key strengths and weaknesses in ENN Energy's operations for targeted improvement, relieving the pain of inefficient resource allocation.

Uncovers potential threats and opportunities, offering strategic solutions to mitigate risks and capitalize on growth for ENN Energy.

Weaknesses

ENN Energy Holdings, despite securing diverse gas sources, still faces challenges due to the inherent volatility of international natural gas prices. This sensitivity directly impacts its profitability, making it susceptible to market swings.

The wholesale gas segment felt this impact acutely in 2024, with a notable drop in its gross profit margin. This decline underscores the segment's vulnerability to shifts in market prices, directly affecting ENN Energy's overall earnings performance.

The ongoing slowdown in China's real estate sector presents a significant headwind for ENN Energy Holdings. This market deceleration directly impacts the company's ability to secure new residential gas connections, a key driver of customer base expansion and revenue growth.

Projections indicate that the rate of new residential gas connections will likely decelerate from 2025 through 2029, a noticeable shift from historical trends. This slower pace of new installations will inevitably dampen revenue generated from these connections and constrain the growth of ENN's residential customer base, thereby affecting its long-term growth trajectory.

ENN Energy's infrastructure development is incredibly capital intensive. Building and maintaining its vast network of gas pipelines, LNG terminals, and other integrated energy projects demands significant ongoing financial investment. For instance, in 2023, ENN Energy reported capital expenditures of RMB 13.3 billion, highlighting the scale of these investments.

Furthermore, China's national objective to bolster its gas storage capacity to meet energy security needs presents a continuous demand for substantial capital. This means ENN Energy will likely need to allocate considerable resources to expand its storage infrastructure, potentially placing a strain on its financial flexibility in the coming years.

Decreased Profit Attributable to Owners in Recent Periods

ENN Energy Holdings experienced a notable downturn in its profitability, with a 12.2% decrease in profit attributable to owners reported for 2024. This dip occurred even as certain operational areas showed expansion, highlighting the impact of broader economic headwinds on the company's financial performance.

Several factors contributed to this decline, primarily the softening of international gas prices and a less robust performance in the real estate sector. These external pressures underscore a critical weakness in the company's ability to fully insulate its bottom line from fluctuating global commodity markets and domestic property market conditions.

- Profit Attributable to Owners Decline: 12.2% decrease in 2024.

- Contributing Factors: Reduced international gas prices and subdued real estate market performance.

- Impact: Indicates challenges in managing external economic pressures effectively.

- Strategic Need: Focus on improving bottom-line results despite market volatility.

Potential for Increased Competition in the Evolving Energy Market

While ENN Energy benefits from exclusive operating rights in specific Chinese city gas markets, the overall clean energy sector is experiencing a significant surge in competition. The Chinese government's strong push for renewable energy development and ongoing market liberalization are paving the way for numerous new entrants and a diversification of energy sources.

This evolving landscape presents a potential weakness for ENN Energy. As alternative and renewable energy technologies mature and gain traction, they could directly challenge ENN's established position in the gas market. For instance, the rapid growth of solar and wind power, coupled with advancements in energy storage, could reduce reliance on natural gas for certain applications, thereby intensifying competitive pressures.

By the end of 2024, China's installed renewable energy capacity had surpassed 1,500 GW, with solar and wind power leading the charge. This aggressive expansion, supported by favorable government policies, creates a dynamic market where ENN Energy must continually adapt to remain competitive. The increasing availability and decreasing costs of these cleaner alternatives pose a direct threat to traditional gas distribution businesses.

Key competitive threats include:

- Emergence of new energy providers: The liberalization of the energy market allows for new companies to enter, offering diverse energy solutions.

- Advancements in renewable technologies: Innovations in solar, wind, and battery storage are making these alternatives more viable and cost-effective.

- Government policy shifts: Continued emphasis on decarbonization may favor renewable sources over natural gas in certain sectors.

- Diversification of energy consumption: End-users are increasingly exploring a mix of energy sources to optimize costs and environmental impact.

ENN Energy's profitability is susceptible to the volatility of international natural gas prices, as evidenced by the 12.2% decrease in profit attributable to owners in 2024. This sensitivity, coupled with the slowdown in China's real estate market, directly impacts customer acquisition and revenue growth, with projections indicating a deceleration in new residential gas connections from 2025 through 2029.

The company's extensive infrastructure development, including pipelines and LNG terminals, is highly capital intensive, with 2023 capital expenditures reaching RMB 13.3 billion. This necessitates continuous significant financial investment, potentially straining financial flexibility, especially with China's national objective to bolster gas storage capacity.

The competitive landscape is intensifying due to government support for renewables and market liberalization, with China's installed renewable energy capacity exceeding 1,500 GW by the end of 2024. Advancements in solar, wind, and battery storage technologies present a direct challenge to ENN's established gas market position, as end-users increasingly diversify their energy sources.

| Metric | 2023 | 2024 | Trend |

|---|---|---|---|

| Capital Expenditures (RMB billion) | 13.3 | N/A | High ongoing investment required |

| Profit Attributable to Owners | N/A | -12.2% decrease | Profitability impacted by external factors |

| Installed Renewable Energy Capacity (GW) | N/A | >1,500 GW (China) | Increasing competition from renewables |

What You See Is What You Get

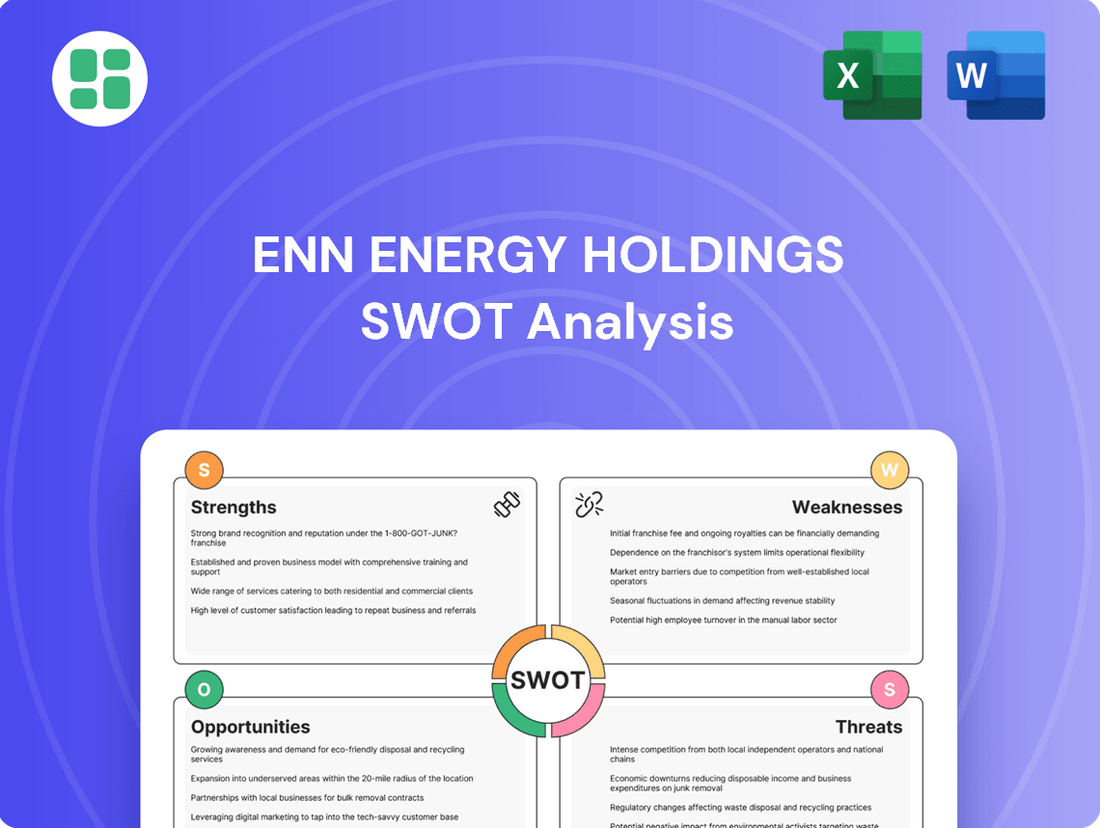

ENN Energy Holdings SWOT Analysis

This is the actual ENN Energy Holdings SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for ENN Energy Holdings.

Opportunities

China's unwavering commitment to its 'Dual Carbon' targets, aiming for carbon peak by 2030 and carbon neutrality by 2060, creates a fertile ground for ENN Energy. The nation's strategic shift towards increasing natural gas usage, evidenced by policies promoting the 'coal to gas' transition, directly fuels demand for ENN's core business.

This national imperative for cleaner energy sources is projected to sustain robust growth in natural gas consumption, with the International Energy Agency forecasting China's natural gas demand to reach approximately 700 billion cubic meters by 2030. ENN Energy, as a leading integrated energy provider, is exceptionally positioned to capitalize on this trend by offering comprehensive natural gas distribution and integrated energy solutions.

The national push for carbon reduction and improved energy efficiency is significantly boosting demand for integrated energy solutions. ENN Energy is strategically positioned to leverage this trend, focusing on innovations in distributed energy systems and energy engineering, which are projected to be major contributors to future revenue.

Government policies are actively promoting natural gas use and market-based pricing, which includes passing on gas costs to residents. This is a significant tailwind for ENN Energy, as it helps stabilize and potentially boost their profit margins by ensuring costs are covered.

The government's commitment to expanding gas infrastructure, such as pipelines and import terminals, as outlined in national five-year plans, directly benefits ENN Energy. This development strengthens their ability to secure gas supplies and reach more customers, improving overall market access and operational efficiency.

Advancements in Digital Intelligence and Technology Integration

ENN Energy is making significant strides in digital intelligence, notably through its Serlink Smart Energy Management Platform. This integration of AI and digital tools is designed to streamline operations, bolster safety protocols, and offer more sophisticated, personalized energy services to its clientele. This strategic move is poised to create distinct competitive edges and open doors to novel revenue streams.

The company's commitment to technological advancement is evident in its ongoing investments. For instance, in 2023, ENN Energy reported a substantial increase in its digital transformation initiatives, with a focus on smart grid technologies and data analytics to optimize energy distribution and consumption. This proactive approach positions ENN Energy to capitalize on the growing demand for efficient and intelligent energy solutions.

Key opportunities arising from these advancements include:

- Enhanced Operational Efficiency: AI-driven predictive maintenance and optimized resource allocation can significantly reduce costs and improve service reliability.

- New Service Development: The digital platforms enable the creation of value-added services like smart home energy management, demand-response programs, and personalized energy consulting.

- Improved Safety and Risk Management: Real-time monitoring and AI-powered anomaly detection can preemptively address potential safety hazards in infrastructure and operations.

- Data Monetization: Aggregated and anonymized data insights can be leveraged for market analysis and to inform future infrastructure development and service offerings.

Diversification into Emerging Green Technologies

ENN Energy Holdings has a significant opportunity to expand its energy offerings by investing in and developing new green technologies. This strategic move aligns with global shifts towards decarbonization and can position the company as a leader in the evolving energy landscape.

The company can leverage its existing infrastructure and expertise to explore promising avenues like natural-gas-based hydrogen projects. For instance, developing hydrogen blending stations, where hydrogen is mixed with natural gas for distribution, presents a tangible pathway to integrate this cleaner fuel into the existing supply chain. This approach offers a practical step towards a hydrogen economy without requiring entirely new distribution networks immediately.

Furthermore, ENN Energy can actively increase the share of other renewable and zero-carbon energy sources within its integrated energy business model. This includes expanding its capabilities in areas such as solar, wind, and potentially battery storage solutions. By diversifying its renewable energy portfolio, ENN Energy can reduce its reliance on traditional fossil fuels and cater to a growing demand for sustainable energy options.

- Hydrogen Integration: Exploring the commercial viability of hydrogen blending in existing natural gas networks, as seen in pilot projects globally.

- Renewable Energy Expansion: Increasing the proportion of solar and wind power generation within its distributed energy systems.

- Zero-Carbon Solutions: Investing in research and development for emerging zero-carbon energy technologies to build a future-proof portfolio.

ENN Energy's focus on digital transformation, particularly through its Serlink platform, offers significant opportunities for enhanced operational efficiency and new service development. The company's investment in smart grid technologies and data analytics, evident in its 2023 initiatives, positions it to optimize energy distribution and create value-added services like smart home management.

The company is well-positioned to capitalize on China's 'Dual Carbon' goals by expanding its integrated energy solutions and exploring green technologies. By investing in hydrogen blending and increasing its renewable energy portfolio, ENN can diversify its offerings and meet the growing demand for sustainable energy.

The government's support for natural gas infrastructure expansion and market-based pricing provides a stable environment for ENN's core business. This policy support, coupled with ENN's digital advancements, creates a strong foundation for continued growth and market leadership.

ENN Energy's strategic investments in digital intelligence and green technologies present a clear path for future revenue growth. By leveraging AI for predictive maintenance and developing new services like hydrogen integration, the company can solidify its competitive advantage.

Threats

While natural gas is seen as a bridge fuel, China's rapid expansion of renewable energy, especially solar and wind, presents a significant long-term challenge. Renewables have already exceeded their 2030 capacity targets, indicating a faster-than-expected shift away from traditional fuels.

This accelerated renewable deployment could potentially cap the future growth of natural gas within China's energy landscape. For instance, by the end of 2023, China's installed renewable energy capacity reached 1.47 billion kilowatts, a 21% increase from the previous year, signaling a strong competitive force.

Fluctuations in global energy prices, driven by geopolitical events and supply-demand shifts, pose a significant threat to ENN Energy's operational costs and profitability. For instance, the Brent crude oil price, a key benchmark, experienced considerable volatility throughout 2024, reacting to conflicts in Eastern Europe and the Middle East, directly impacting ENN's procurement expenses.

Trade tensions, particularly between major economies, can further exacerbate these risks by disrupting critical supply chains, such as liquefied natural gas (LNG) imports. Such disruptions can lead to price spikes and availability issues, impacting ENN's ability to secure stable and cost-effective energy resources for its operations.

China's economic slowdown, marked by weak consumer spending and persistent deflationary pressures, poses a significant threat to ENN Energy. This sluggish domestic economy directly impacts energy demand, particularly from industrial and commercial clients, which are key revenue drivers for the company.

The deepening real estate crisis in China further exacerbates these challenges. A struggling property sector means fewer new residential connections and reduced energy consumption from construction and related activities, directly affecting ENN Energy's growth prospects and operational performance in its core markets.

Potential for Adverse Regulatory or Policy Shifts

While ENN Energy Holdings has benefited from supportive policies in China, potential shifts in the nation's energy and environmental regulations pose a significant threat. Any move towards stricter controls or altered incentives could impact the company's operational costs and strategic direction. For instance, if China faces challenges in meeting its ambitious renewable energy targets, it might introduce policies that directly affect the natural gas sector, potentially increasing compliance burdens or altering market dynamics for distributors like ENN.

The risk of adverse regulatory changes is amplified by China's ongoing commitment to its climate goals. Should the government perceive a slowdown in progress, it could implement new policies that reshape the competitive landscape. This could manifest as new environmental standards or changes to subsidy structures, directly influencing ENN's profitability and market position.

- Regulatory Uncertainty: Changes in China's energy and environmental policies could negatively impact ENN Energy's operations and profitability.

- Compliance Burdens: Stricter regulations, potentially driven by climate goal challenges, may lead to increased compliance costs for natural gas distributors.

- Market Landscape Shifts: New policies could alter the competitive environment, affecting ENN's market share and growth opportunities.

Persistent Reliance on Coal in China's Energy Mix

China's ongoing commitment to coal poses a significant threat to ENN Energy Holdings' growth prospects. Despite ambitious clean energy goals, the nation continues to greenlight new coal power projects, with substantial investment expected through 2025. This persistent reliance on coal could decelerate the crucial 'coal to gas' transition, hindering the displacement of higher-emission fuels and consequently capping the expansion potential for natural gas demand.

The implications for ENN Energy are direct: the pace at which coal-fired power is replaced by natural gas is a key driver for its business. For instance, while China aims to peak carbon emissions before 2030, new coal capacity additions, such as those approved in 2024, directly challenge the speed of this transition. This creates uncertainty regarding the long-term demand trajectory for natural gas, a core component of ENN Energy's operations.

- Continued Coal Investment: China's National Development and Reform Commission (NDRC) approved the construction of new coal-fired power plants in 2024, with plans indicating further capacity additions into 2025, potentially adding tens of gigawatts.

- Impact on Gas Transition: The sustained use of coal as a baseload power source limits the market share available for natural gas in the power generation sector, a key area for ENN Energy's expansion.

- Regulatory Uncertainty: Evolving energy policies and the pace of coal phase-out create an unpredictable environment for natural gas infrastructure investment and utilization.

The accelerated growth of renewable energy sources in China, particularly solar and wind, poses a significant threat by potentially limiting the long-term demand for natural gas. By the end of 2023, China's installed renewable capacity reached 1.47 billion kilowatts, a 21% year-on-year increase, demonstrating its rapid expansion and competitive pressure.

Global energy price volatility, influenced by geopolitical events and supply-demand dynamics, directly impacts ENN Energy's operational costs. For instance, Brent crude oil prices saw considerable fluctuations throughout 2024, affecting procurement expenses. Trade tensions can further disrupt critical supply chains, like LNG imports, leading to price spikes and availability issues.

China's economic slowdown, characterized by weak consumer spending and deflationary pressures, directly affects energy demand from industrial and commercial clients, key revenue sources for ENN. The ongoing real estate crisis further compounds this, reducing new residential connections and energy consumption from construction activities.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including ENN Energy Holdings' official financial filings, comprehensive market research reports, and expert industry analysis to provide a robust and insightful overview.