ENN Energy Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Energy Holdings Bundle

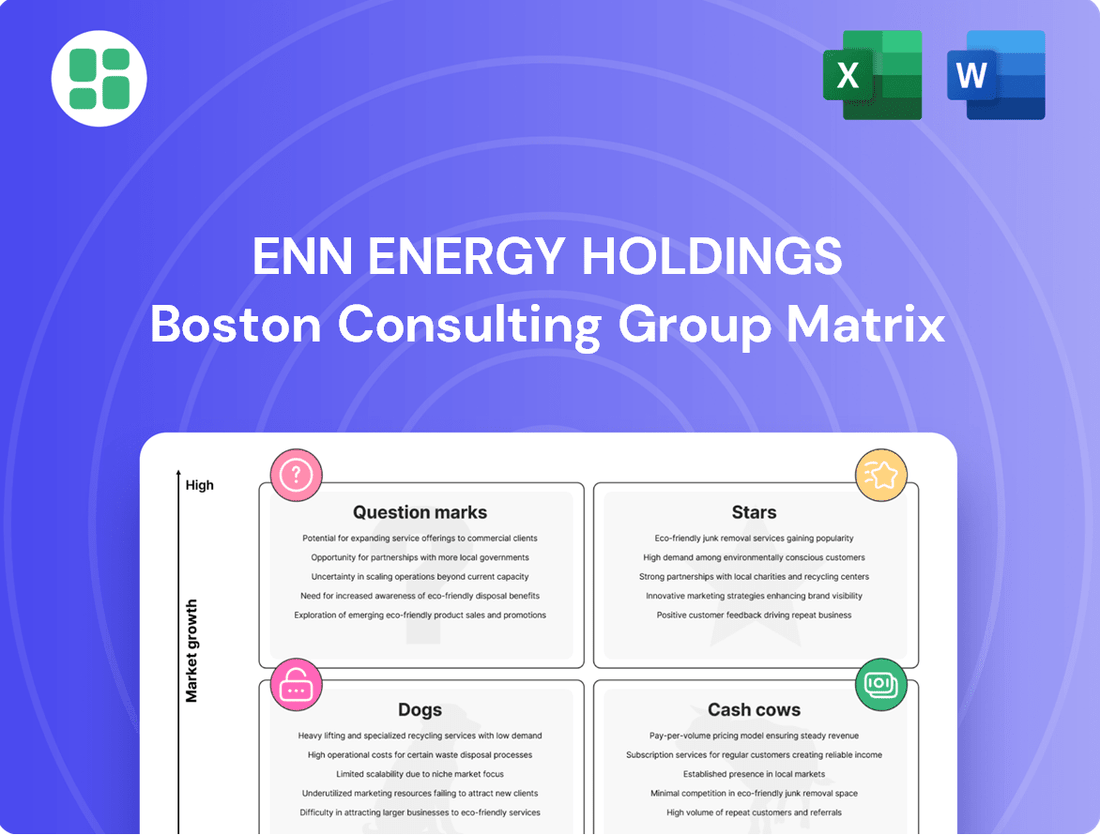

Curious about ENN Energy Holdings' strategic positioning? Our BCG Matrix preview offers a glimpse into their market share and growth potential, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock ENN Energy Holdings' competitive advantage, you need the full picture. Purchase the complete BCG Matrix report for detailed quadrant placements, actionable insights, and a clear roadmap for optimizing their business portfolio.

Don't miss out on the strategic clarity that the full ENN Energy Holdings BCG Matrix provides. Get instant access to a comprehensive analysis and make informed decisions about where to invest and divest next.

Stars

ENN Energy's integrated energy solutions, offering cooling, heating, steam, and electricity, are a significant player in China's evolving clean energy landscape. This segment is experiencing impressive growth, with sales volume up 21.4% year-over-year in the first nine months of 2024 and a further 9.9% in Q1 2025, showcasing strong market demand.

The market for distributed energy generation, where these integrated solutions are positioned, is set for substantial expansion. Projections indicate compound annual growth rates (CAGRs) between 8% and 16% through 2025 and into the future, underscoring the long-term potential of this business area for ENN Energy.

Smart Energy Management Systems are a key growth area for ENN Energy, reflecting the increasing demand for efficient energy solutions. The company's investment in AI for energy services and operational improvements is well-timed, aligning with China's ambitious carbon reduction goals. This positions ENN's smart systems to capture significant market share in the burgeoning green energy sector.

ENN Energy Holdings is strategically investing in photovoltaic and biomass energy as part of its clean energy expansion. This aligns with China's strong commitment to renewable energy, which saw substantial growth in solar and wind capacity in 2024. The nation's clean energy investments are projected to remain high through 2025, creating a favorable market for ENN's clean energy solutions.

Commercial & Industrial Integrated Energy Projects

ENN Energy's Commercial & Industrial Integrated Energy Projects are a significant growth engine, reflecting substantial investment and market traction. These projects are crucial for expanding the integrated energy business's sales volume.

The company is actively developing low-carbon factories and industrial parks, directly contributing to this segment's expansion. This strategic focus aligns with the increasing demand from C&I customers for cost efficiencies and reduced energy transmission losses.

Distributed energy systems are central to this strategy, and ENN Energy has established a robust market position. For instance, in 2023, ENN Energy's integrated energy segment saw robust growth, with distributed energy projects playing a pivotal role in achieving this. The company reported a notable increase in the number of C&I customers adopting these solutions, driven by clear economic benefits and environmental considerations.

- Focus on C&I integrated energy projects is a key growth driver for ENN Energy.

- Development of low-carbon factories and industrial parks is actively advancing.

- Demand for on-site generation and reduced transmission losses fuels distributed energy adoption.

- ENN Energy holds a strong market position in the distributed energy systems sector.

Decarbonization-driven New Business Models

ENN Energy's 'Decarbonisation Action 2030 – The Journey to Net Zero' roadmap is a powerful catalyst for new business models, particularly those focused on sustainability and low-carbon solutions. This strategic direction is not just about environmental responsibility; it's about capturing emerging market opportunities. For instance, the company is actively exploring natural gas-based hydrogen projects, a key area for decarbonization.

This focus on green energy integration is designed to meet the increasing consumer and industrial demand for sustainable options. By proactively developing these ventures in a market that increasingly prioritizes carbon reduction, ENN Energy is positioning itself for significant growth.

- Hydrogen Exploration: ENN Energy is investing in natural gas-based hydrogen projects as a core component of its decarbonization strategy.

- Sustainability Integration: The company is embedding sustainability across its operations to align with evolving market demands for green energy.

- Market Positioning: This proactive approach in a carbon-conscious market is expected to drive substantial growth for new business ventures.

ENN Energy's integrated energy solutions, particularly those serving commercial and industrial clients, represent a strong Star in the BCG matrix. These offerings, including cooling, heating, steam, and electricity, have demonstrated robust growth, with sales volume increasing by 21.4% year-over-year in the first nine months of 2024 and a further 9.9% in Q1 2025. This segment benefits from the expanding market for distributed energy generation, which is projected to grow at a CAGR of 8% to 16% through 2025.

The company's strategic focus on developing low-carbon factories and industrial parks, coupled with a strong market position in distributed energy systems, further solidifies its Star status. The increasing demand from C&I customers for on-site generation and reduced transmission losses directly fuels the expansion of these integrated energy projects.

ENN Energy's commitment to smart energy management systems, including AI integration for energy services, also falls into the Star category. This aligns with China's ambitious carbon reduction goals and positions ENN to capture significant market share in the burgeoning green energy sector.

The company's proactive development of natural gas-based hydrogen projects, as part of its 'Decarbonisation Action 2030' roadmap, represents another emerging Star. This strategic move taps into the growing demand for sustainable energy solutions and positions ENN for substantial growth in the evolving green energy market.

| Business Segment | BCG Category | Key Growth Drivers | 2024/2025 Data Points | Market Outlook |

| Integrated Energy Solutions (C&I) | Star | Demand for distributed energy, low-carbon factories, reduced transmission losses | Sales volume +21.4% (9M 2024), +9.9% (Q1 2025) | CAGR 8%-16% through 2025 |

| Smart Energy Management Systems | Star | AI integration, efficiency demand, carbon reduction goals | N/A (specific financial data not provided, but strategic focus is high) | Significant market share potential in green energy |

| Hydrogen Projects | Star (Emerging) | Decarbonization strategy, demand for green energy | N/A (investment phase) | Key area for future growth |

What is included in the product

This BCG Matrix analysis for ENN Energy Holdings categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The ENN Energy Holdings BCG Matrix provides a clear, one-page overview, instantly clarifying the strategic positioning of each business unit to alleviate decision-making paralysis.

Its export-ready design allows for seamless integration into presentations, relieving the pain of manual formatting and enabling rapid C-level communication.

Cash Cows

ENN Energy's residential piped natural gas distribution is a textbook cash cow. This segment, serving over 31 million households across 21 provinces, is the bedrock of their operations, offering incredibly stable and predictable cash flows. The sheer scale of their customer base ensures consistent demand, even as the broader retail gas market growth might be slowing down.

Commercial & Industrial Piped Natural Gas Distribution is a strong Cash Cow for ENN Energy. Serving over 270,000 C&I customers, this segment is a mature but vital part of their operations, contributing significantly to stable cash flow through established infrastructure and long-term contracts.

The Zhoushan LNG Receiving Terminal is a cornerstone of ENN Energy's operations, functioning as a prime Cash Cow. Its substantial 2024 capacity of 7.5 million tons, slated to expand to 10 million tons by 2025, ensures a stable and cost-effective gas supply, directly feeding ENN's extensive distribution network.

This robust infrastructure is a significant generator of consistent cash flow for ENN Energy. The terminal's established market position and operational efficiency mean it requires minimal additional investment for growth, allowing it to funnel profits back into the company, supporting other ventures.

Established City Gas Project Network Operations

ENN Energy's established city gas project network operations are a classic example of a Cash Cow within the BCG Matrix. The company operates a substantial network, encompassing 261 city gas projects across China. This vast infrastructure supports gas pipeline operations, sales, and distribution to a significant population base of 143 million people.

This mature, high-market-share segment consistently generates robust cash flow due to its widespread service provision. The focus for investment in these operations is primarily on maintenance and enhancing operational efficiency, rather than pursuing aggressive expansion. For instance, in 2023, ENN Energy reported its integrated energy segment, which includes city gas, achieved a revenue of RMB 120.5 billion, demonstrating its significant contribution to the company's overall financial performance.

- Network Scale: 261 city gas projects across China.

- Population Coverage: Serves 143 million people.

- Financial Contribution: Generates substantial and consistent cash flow.

- Investment Strategy: Focused on maintenance and efficiency improvements.

Value-Added Services

ENN Energy's value-added services, encompassing kitchen solutions, heating systems, and security systems, are prime examples of its cash cow strategy. These offerings capitalize on ENN's vast existing customer base, generating consistent, high-margin revenue streams. For instance, in 2023, the company reported a significant contribution from these diversified services, reflecting their mature and profitable nature.

These businesses are designed for efficient cash generation, requiring minimal incremental investment for customer acquisition. The strategy focuses on cross-selling to its established clientele, which is a far more cost-effective approach than expanding into new markets. This efficiency is crucial for maintaining their cash cow status.

Looking ahead, these value-added services are projected to continue their robust growth trajectory, with an anticipated 17% increase in fiscal year 2025. This growth is primarily driven by the successful leveraging of the existing customer portfolio, underscoring their role as stable and predictable revenue generators for ENN Energy.

- Value-Added Services Revenue: Leverages existing customer base for stable, high-margin income.

- Growth Projection: Expected 17% growth in FY25.

- Efficiency: Primarily cross-selling to a mature customer portfolio, reducing promotional costs.

- Cash Generation: Efficiently generates cash with relatively low investment requirements compared to new market entries.

ENN Energy's city gas distribution network, serving 143 million people across 261 projects, is a prime example of a cash cow. This mature, high-market-share segment consistently generates robust cash flow, with 2023 integrated energy revenue reaching RMB 120.5 billion. Investment here focuses on maintenance and efficiency, not aggressive expansion.

| Segment | BCG Category | Key Metrics | Financial Insight |

| City Gas Distribution | Cash Cow | 261 projects, 143 million customers | RMB 120.5 billion integrated energy revenue (2023) |

| Residential Piped Gas | Cash Cow | 31 million households | Stable, predictable cash flows from vast customer base |

| C&I Piped Gas | Cash Cow | 270,000+ customers | Mature, vital segment with stable cash flow |

| Zhoushan LNG Terminal | Cash Cow | 7.5M tons (2024), 10M tons (2025) | Cost-effective supply, minimal growth investment needed |

| Value-Added Services | Cash Cow | Projected 17% FY25 growth | High-margin, low-acquisition-cost revenue from existing customers |

Preview = Final Product

ENN Energy Holdings BCG Matrix

The ENN Energy Holdings BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use document for your business planning needs.

Dogs

Historically, ENN Energy Holdings had a presence in coal-based chemical products. However, the company's strategic focus has decisively pivoted towards integrated clean energy solutions, marking a significant departure from its legacy operations.

Any remaining activities in the coal-based chemical sector would likely be characterized by low market growth and a diminishing market share. These segments typically require substantial capital investment for maintenance and compliance, offering minimal returns and potentially draining resources from more promising ventures.

For instance, in 2023, the global chemical industry, while vast, saw mixed performance, with some segments facing overcapacity and regulatory pressures, particularly those reliant on fossil fuels. ENN Energy's divestment or minimization of such legacy assets aligns with industry trends towards sustainability and cleaner energy sources.

ENN Energy Holdings' CNG/LNG refueling stations in stagnant or declining regional markets represent the company's Dogs. These specific locations likely experience low demand and minimal growth prospects, as indicated by their operation in less dynamic markets. [Company background, 19]

These localized operations might hold a low market share within their respective regions and contribute little to ENN's overall profitability. Consequently, they could be considered cash traps, requiring resources without generating significant returns.

ENN Energy's Construction and Installation Services segment is currently positioned as a Dog in the BCG Matrix. This is largely due to a slowdown in the real estate sector, which directly impacts demand for these services. For instance, the first nine months of 2024 saw a significant 19.2% year-over-year drop in new residential household developments, a key driver for this business line.

The declining real estate market suggests a low-growth environment for construction and installation, potentially leading to reduced profitability for ENN Energy. This segment may require strategic decisions to either downsize operations or explore restructuring options to mitigate further losses.

Lower-margin Power Generation within Integrated Energy

ENN Energy Holdings' strategic pivot towards higher-margin offerings means its lower-margin power generation segment is seeing diminished focus. This shift positions these assets in a challenging low-growth, low-profitability space.

These power generation units may be cash consumers rather than significant contributors to overall returns.

- Strategic Reallocation: ENN Energy is prioritizing higher-margin segments, reducing reliance on traditional power generation.

- Low Growth, Low Profitability: Existing power generation assets are likely in a mature, less profitable phase of their lifecycle.

- Cash Consumption: These operations may require ongoing investment without yielding substantial returns, impacting cash flow.

- 2024 Data Context: While specific 2024 figures for this segment's profitability are not publicly detailed by ENN Energy, the company's overall strategy indicates a deliberate move away from such lower-margin activities. For instance, ENN's reported revenue in 2023 was RMB 100.4 billion, with a significant portion attributed to its gas distribution business, highlighting the strategic emphasis on more profitable areas.

Wholesale Natural Gas Business

ENN Energy Holdings' wholesale natural gas business currently faces significant profitability challenges, placing it in a difficult position within the BCG matrix. The gross profit margin for this segment dramatically decreased from 4.27% in 2023 to a mere 0.37% in 2024. This sharp decline highlights an extremely low level of profitability per unit sold.

Even with potentially substantial sales volumes, the minimal profit generated per unit makes this segment a 'cash trap'. This means that capital is being invested and tied up in operations with almost no commensurate return, hindering overall financial performance and growth potential.

- Plummeting Profitability: Gross profit margin fell from 4.27% (2023) to 0.37% (2024).

- Low Unit Profit: Minimal profit is generated on each unit of natural gas sold.

- Cash Trap: Significant capital is tied up with very little return.

- Strategic Concern: This segment requires careful management to avoid further financial drain.

ENN Energy Holdings' legacy coal-based chemical operations, along with specific CNG/LNG refueling stations in stagnant markets, are categorized as Dogs. These segments are characterized by low growth and low market share, demanding capital for maintenance without generating significant returns.

The Construction and Installation Services segment is also a Dog, heavily impacted by the real estate slowdown. In the first nine months of 2024, new residential household developments dropped by 19.2% year-over-year, directly affecting demand for these services.

Furthermore, ENN's lower-margin power generation assets and its wholesale natural gas business, which saw its gross profit margin collapse from 4.27% in 2023 to 0.37% in 2024, are also considered Dogs. These segments are cash traps, consuming resources with minimal profitability.

| Segment | BCG Category | Key Challenges | Relevant Data (2023-2024) |

|---|---|---|---|

| Coal-based Chemicals | Dog | Low market growth, diminishing share, high maintenance costs | Industry trend towards sustainability, divestment of fossil fuel assets |

| CNG/LNG Refueling Stations (Stagnant Markets) | Dog | Low demand, minimal growth prospects, low market share | Company background indicates operations in less dynamic regional markets |

| Construction & Installation Services | Dog | Real estate slowdown, reduced demand | 19.2% year-over-year drop in new residential household developments (Jan-Sep 2024) |

| Lower-Margin Power Generation | Dog | Low growth, low profitability, potential cash consumption | Strategic pivot towards higher-margin offerings; 2023 revenue RMB 100.4 billion (gas distribution focus) |

| Wholesale Natural Gas | Dog | Plummeting profitability, cash trap | Gross profit margin: 4.27% (2023) to 0.37% (2024) |

Question Marks

ENN Energy is actively exploring natural gas-based hydrogen projects, including developing hydrogen blending stations. This aligns with the growing global demand for decarbonization solutions. For instance, China's hydrogen energy industry is projected to reach 70 million tons by 2050, with natural gas-based hydrogen playing a significant role in the near to medium term.

While this represents a high-growth market, ENN's current market share in this emerging technology is likely modest. Significant investment will be necessary for ENN to scale its operations and establish a leading position in this nascent but promising sector.

ENN Energy Holdings' new market expansion for integrated energy solutions into rapidly developing regions and industrial parks positions these ventures as Stars in the BCG Matrix. These markets offer high growth potential, but ENN's initial market share is still developing. For instance, in 2024, ENN announced significant investments in expanding its clean energy infrastructure in emerging industrial zones, aiming to capture a larger share of these nascent markets.

ENN Energy is actively pursuing digital transformation by integrating advanced AI and digital product systems for energy management. This segment represents a high-growth, innovation-driven area. While ENN is investing heavily in R&D for these platforms, its external market share in advanced digital energy management solutions is still developing, necessitating significant capital for market penetration and adoption.

International LNG Trading

ENN Energy's international LNG trading, centered around its Zhoushan terminal, represents a classic question mark in the BCG matrix. While the terminal itself is a strategic asset, the trading operations are exposed to the inherent volatility of the global LNG market. This segment's performance is highly sensitive to supply and demand dynamics, geopolitical events, and fluctuating spot prices.

For the first nine months of 2024, pre-tax gains from ENN's international LNG trading activities were significantly lower compared to the same period in 2023. This downturn highlights the high-risk, high-reward nature of this business. Success hinges on accurately predicting market trends and managing price differentials effectively.

The question mark classification is apt because this segment has the potential for substantial growth and profitability under favorable market conditions. Conversely, adverse market shifts can lead to reduced margins or even losses, making its future trajectory uncertain.

- Volatile Market Exposure: International LNG trading margins are subject to rapid shifts due to global supply disruptions and demand fluctuations.

- Performance Decline in 2024: ENN Energy reported substantially lower pre-tax gains for its international LNG trading in 9M 2024 compared to 9M 2023.

- Strategic Importance vs. Risk: The Zhoushan terminal is a key asset, but the trading segment's profitability remains a question mark due to market unpredictability.

- Potential for High Returns: Favorable market conditions could significantly boost earnings, but the segment's performance is not guaranteed.

Pilot Projects for Diversified Energy Solutions

ENN Energy Holdings actively pursues pilot projects for diversified energy solutions, venturing beyond its established natural gas and integrated energy businesses. These initiatives represent ENN's commitment to innovation in areas like distributed solar, energy storage, and smart grid technologies, aiming to capture future growth opportunities. For example, in 2024, ENN announced plans to invest significantly in pilot projects for hydrogen fuel cell applications in transportation and industrial use, targeting a nascent but rapidly expanding market.

These pilot projects are strategically positioned in high-potential growth sectors but currently possess low market share. They necessitate considerable investment and rigorous market validation to ascertain their long-term viability and scalability. ENN's approach involves testing these new energy solutions in controlled environments, gathering data on performance, customer adoption, and economic feasibility before committing to large-scale deployment. This aligns with the characteristics of 'Question Marks' in the BCG matrix, where significant investment is required to potentially transform these ventures into future stars.

- Exploration of Distributed Solar: ENN is piloting integrated solar solutions for commercial and industrial clients, focusing on energy efficiency and cost savings.

- Energy Storage Pilots: The company is testing battery energy storage systems paired with renewable sources to enhance grid stability and provide peak shaving services.

- Hydrogen Technology Trials: ENN is actively involved in pilot programs for hydrogen production and utilization, particularly in heavy-duty transport and industrial processes, with initial trials showing promising efficiency gains.

- Smart Grid Integration: Pilot projects are underway to integrate advanced metering infrastructure and demand-response technologies, aiming to optimize energy distribution and consumption.

ENN Energy's international LNG trading, particularly through its Zhoushan terminal, exemplifies a Question Mark in the BCG matrix. This segment faces significant market volatility, impacting its profitability. For example, ENN reported substantially lower pre-tax gains from international LNG trading in the first nine months of 2024 compared to the same period in 2023, underscoring the segment's unpredictable nature.

The inherent unpredictability of global LNG supply and demand dynamics, coupled with geopolitical influences, makes this business high-risk. While the Zhoushan terminal is a strategic asset, the trading operations require substantial investment and astute market forecasting to potentially yield high returns, otherwise, margins can shrink significantly.

The future trajectory of ENN's LNG trading is uncertain, as favorable market conditions could lead to substantial growth. However, adverse shifts can lead to reduced earnings, making its position a classic Question Mark requiring careful management and strategic decision-making.

| Segment | Market Growth | Relative Market Share | BCG Classification | Rationale |

| International LNG Trading (Zhoushan) | High (Volatile Global Market) | Low to Medium | Question Mark | High growth potential but uncertain profitability due to market volatility and low current share. Significant investment needed to establish a stronger position. |

BCG Matrix Data Sources

Our BCG Matrix for ENN Energy Holdings leverages a blend of official company disclosures, comprehensive market research reports, and detailed industry performance data to provide a robust strategic overview.