ENN Energy Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Energy Holdings Bundle

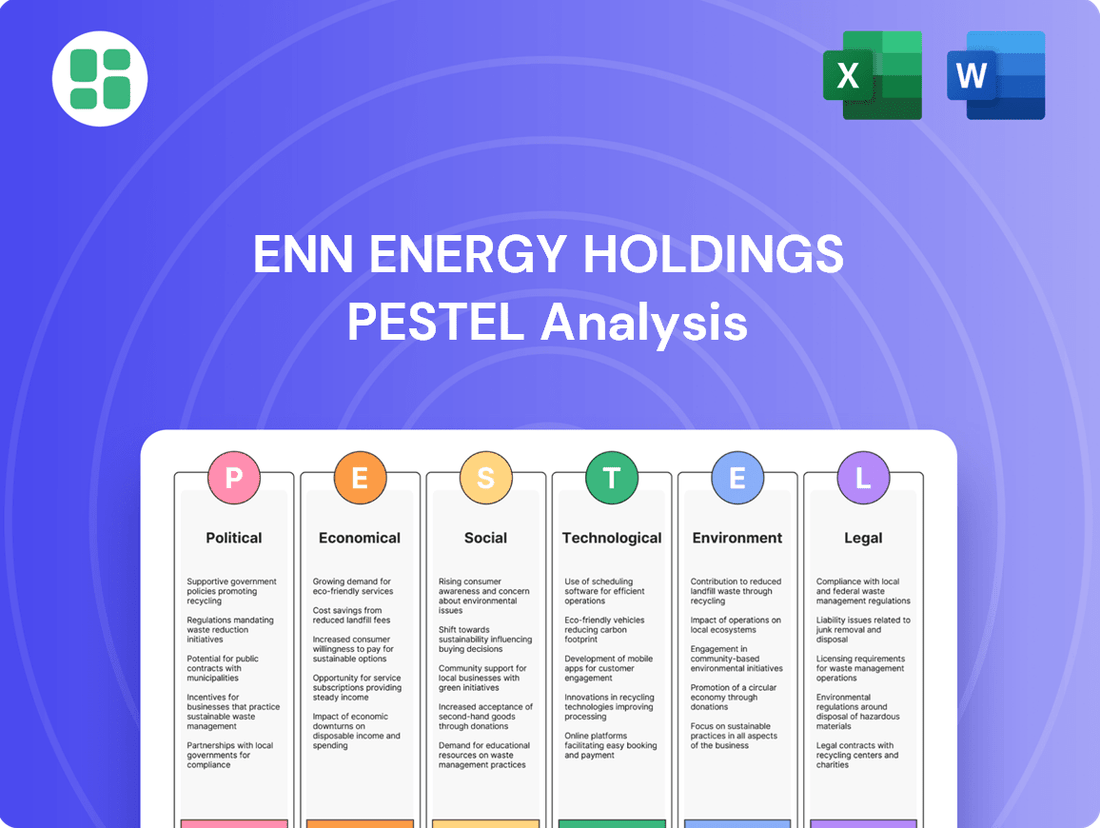

Uncover the critical political, economic, social, technological, legal, and environmental factors influencing ENN Energy Holdings. Our meticulously researched PESTLE analysis provides a clear roadmap of the external forces shaping their operations and future growth. Don't get left behind; download the full version now to gain a competitive edge and make informed strategic decisions.

Political factors

China's central government is aggressively pursuing decarbonization, setting ambitious targets for clean energy adoption and increasing natural gas consumption. For instance, the 14th Five-Year Plan (2021-2025) aims to increase the share of non-fossil fuels in primary energy consumption to around 20% by 2025, with natural gas playing a crucial role in this transition.

These government mandates directly fuel ENN Energy's strategic focus on integrated clean energy solutions, particularly in areas like distributed energy and renewable energy integration. The company's growth trajectory is intrinsically linked to the success and implementation of these national energy objectives.

Furthermore, regulatory frameworks surrounding new pipeline construction and the dynamic nature of natural gas pricing significantly impact ENN Energy's operational landscape and profitability. Policies that encourage or restrict infrastructure development, coupled with government influence on gas tariffs, are key determinants of the company's market position.

The Chinese government's influence over natural gas pricing, from city gate rates to consumer tariffs, directly affects ENN Energy's bottom line and market standing. For instance, in 2023, the National Development and Reform Commission (NDRC) continued to manage wholesale gas prices, impacting ENN's cost of goods sold.

Potential reforms to liberalize these prices present a double-edged sword for ENN, offering flexibility but also introducing market volatility. The stability of these pricing structures is paramount for ENN's ability to secure long-term infrastructure investments and forecast future revenues.

Government policies actively encourage distributed energy systems, including co-generation and renewables, which directly boosts ENN Energy's integrated energy solutions. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes green development and energy structure optimization, including a significant push for distributed solar and wind power.

These initiatives, often coupled with feed-in tariffs and tax incentives, make ENN Energy's diversified offerings more attractive. The nation's commitment to reducing carbon intensity, aiming for a peak in CO2 emissions before 2030, further underpins the growth of cleaner, localized energy generation, aligning with ENN's strategic direction.

Geopolitical Stability and Energy Security

China's commitment to energy security, a critical concern given global supply chain vulnerabilities and ongoing geopolitical tensions, directly influences the cost and availability of imported natural gas for companies like ENN Energy. Beijing's strategic focus on diversifying import routes and boosting domestic production, such as through enhanced shale gas exploration, aims to mitigate these risks. For instance, in 2023, China's natural gas imports, while significant, were subject to price fluctuations influenced by international market dynamics and the reliability of supply from key partners.

Government policies designed to secure a stable and diverse energy portfolio are paramount for ENN Energy's operational continuity. These policies can range from long-term supply agreements with countries like Russia and Central Asian nations to investments in domestic liquefied natural gas (LNG) terminals and pipelines. The success of these initiatives directly impacts ENN Energy's ability to maintain a consistent and cost-effective supply of natural gas to its customers across China.

- Diversification of Supply: China's ongoing efforts to reduce reliance on single-source gas imports, a trend that continued through early 2024, directly supports ENN Energy's supply chain resilience.

- Domestic Production Growth: Government targets for increasing domestic natural gas output, which saw a notable rise in 2023, provide a potential buffer against international price volatility for ENN Energy.

- Geopolitical Relations: The stability of diplomatic ties with major gas-exporting nations remains a key factor, as evidenced by the continued strategic energy partnerships China has cultivated.

Local Government Relationships and Approvals

ENN Energy Holdings' operations, particularly its vast gas distribution network and integrated energy projects, are deeply intertwined with local government relationships. These local authorities are the gatekeepers for essential permits, land rights, and the successful implementation of urban energy infrastructure plans. For instance, in 2023, ENN Energy secured approvals for several new city gas distribution projects, highlighting the ongoing need for positive local government engagement.

The company's ability to navigate these local dynamics directly impacts project timelines and overall feasibility. Policy shifts or varying regulatory approaches at the municipal level can introduce complexities, as seen in certain regions where local environmental standards have been tightened, requiring additional compliance steps for new pipeline constructions.

Key aspects of these relationships include:

- Permitting Processes: Streamlined local government approval processes are crucial for ENN Energy's project execution speed.

- Land Acquisition: Securing land rights for infrastructure development relies heavily on cooperation with local planning and land management departments.

- Policy Alignment: Variations in local energy policies and development plans can affect the economic viability and operational scope of ENN's projects.

- Community Engagement: Building trust and maintaining open communication with local communities, often facilitated by local government, is vital for social license to operate.

China's aggressive decarbonization goals, as outlined in the 14th Five-Year Plan (2021-2025), significantly boost ENN Energy's focus on clean and natural gas solutions. The plan targets a 20% share for non-fossil fuels in primary energy consumption by 2025, with natural gas playing a pivotal role in this energy transition.

Government policies directly influence ENN Energy's operational landscape, particularly regarding natural gas pricing, which remained under the purview of the National Development and Reform Commission (NDRC) in 2023. While price liberalization offers potential flexibility, it also introduces market volatility, impacting ENN's cost of goods sold and revenue forecasts.

China's emphasis on energy security, including diversifying import routes and boosting domestic production, aims to mitigate global supply chain risks for ENN Energy. For instance, domestic natural gas output saw a notable rise in 2023, providing a buffer against international price fluctuations.

Local government relationships are critical for ENN Energy's project execution, with permitting, land acquisition, and policy alignment at the municipal level directly impacting timelines and feasibility. Securing approvals for new city gas distribution projects in 2023 underscores the ongoing importance of positive local government engagement.

What is included in the product

This PESTLE analysis of ENN Energy Holdings examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

It provides a comprehensive understanding of the external landscape, highlighting key trends and their implications for ENN Energy Holdings's future growth and risk management.

A PESTLE analysis for ENN Energy Holdings offers a clear, summarized version of external factors for easy referencing during strategic planning meetings.

This analysis, segmented by PESTEL categories, allows for quick interpretation of market dynamics, alleviating the pain of deciphering complex external influences.

Economic factors

China's economic growth remains a significant driver for ENN Energy. The nation's GDP expanded by 5.2% in 2023, signaling continued economic momentum. This growth directly fuels demand for natural gas across residential, commercial, and industrial applications as living standards rise and businesses thrive.

Urbanization is a key factor, with China's urban population reaching 66.16% by the end of 2023. As cities grow, more households and businesses are integrated into natural gas networks, increasing customer penetration for ENN Energy's services. This trend is expected to continue as more rural populations migrate to urban centers.

Economic stability underpins industrial activity, a crucial segment for natural gas consumption. Sectors like manufacturing and energy-intensive industries rely on stable energy supplies, including natural gas, for their operations. ENN Energy's integrated energy solutions are well-positioned to benefit from this sustained industrial demand.

Natural gas price volatility directly influences ENN Energy's operational expenses and profit margins, as the company relies heavily on purchased gas supplies. For instance, in early 2024, global natural gas prices experienced significant fluctuations due to geopolitical events and weather patterns, impacting procurement costs for companies like ENN Energy.

While ENN Energy employs pricing mechanisms and supply contracts, sudden price swings can still compress margins. The company's strategic management of commodity price risk through hedging instruments and flexible contract structures is therefore paramount to maintaining financial stability and profitability amidst these market uncertainties.

Disposable income directly impacts ENN Energy's residential gas sales. As households have more discretionary funds, they are more likely to increase their gas consumption for heating, cooking, and other appliances. For instance, in 2024, China's per capita disposable income growth, while facing some headwinds, has remained positive, supporting household spending on essential services like energy.

Higher disposable incomes also encourage consumers to invest in more energy-efficient solutions and integrated energy services, which ENN Energy offers. This trend is supported by government initiatives promoting cleaner energy use. An economic slowdown, however, could dampen this demand, as consumers might cut back on non-essential energy usage or delay upgrades to more advanced systems.

Access to Capital and Interest Rates

ENN Energy's significant capital expenditures for pipeline network expansion and integrated energy projects are heavily reliant on consistent access to capital. Interest rates directly influence the cost of this financing, affecting the economic viability of new projects. For instance, as of early 2024, benchmark interest rates in key operating regions for ENN Energy, like China, have seen fluctuations, impacting borrowing costs for large infrastructure investments.

The company's ability to secure favorable loan terms and maintain a healthy debt-to-equity ratio is crucial for funding its ambitious growth plans. A strong and liquid financial market environment provides the necessary foundation for ENN Energy to execute its strategic initiatives, including potential acquisitions or significant upgrades to its existing energy infrastructure.

- Capital Intensity: ENN Energy's business model necessitates substantial ongoing investment in infrastructure, such as expanding its natural gas pipeline network and developing new integrated energy solutions.

- Interest Rate Sensitivity: Fluctuations in interest rates directly affect the cost of debt financing, a primary source of funding for ENN Energy's capital-intensive projects.

- Financing Costs: For example, a 1% increase in interest rates on a multi-billion dollar debt issuance could add tens of millions to annual interest expenses, impacting profitability and investment capacity.

- Market Liquidity: The availability of credit and the overall health of financial markets are critical for ENN Energy to access the necessary funds for its strategic expansion and development activities.

Industrial Output and Energy Demand

The performance of China's industrial sector is a critical driver for ENN Energy Holdings, especially its demand for natural gas and integrated energy solutions. Energy-intensive industries, such as manufacturing and chemicals, are major consumers. For instance, China's industrial production grew by 6.0% in the first half of 2024, signaling sustained demand for energy.

A slowdown in industrial output directly impacts gas consumption by commercial and industrial clients. Conversely, strong industrial expansion, like the 7.2% year-on-year increase in industrial value-added in May 2024, fuels the demand for cleaner energy alternatives that ENN Energy provides.

- Industrial Production Growth: China's industrial output saw a 6.0% increase in H1 2024, indicating robust energy needs.

- Energy-Intensive Sectors: Manufacturing and chemical industries are key consumers of natural gas and integrated energy services.

- Impact of Slowdowns: Reduced industrial activity can lead to lower gas consumption by ENN Energy's commercial and industrial customer base.

- Demand for Cleaner Energy: Economic growth in industrial sectors directly translates to increased demand for ENN's cleaner energy solutions.

The Chinese government's fiscal policies, including tax incentives and subsidies for clean energy adoption, directly influence ENN Energy's growth trajectory. For instance, continued support for natural gas as a transition fuel in 2024 provides a favorable operating environment. Government spending on infrastructure development also indirectly benefits ENN Energy by creating demand for its services.

Government investment in renewable energy infrastructure and smart grid technologies presents both opportunities and challenges. While ENN Energy focuses on natural gas, its integrated energy solutions can complement these advancements. The regulatory framework surrounding energy pricing and environmental standards also plays a crucial role in shaping ENN Energy's profitability and strategic direction.

Full Version Awaits

ENN Energy Holdings PESTLE Analysis

The preview shown here is the exact ENN Energy Holdings PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ENN Energy Holdings. You can trust that the insights and structured data you see in this preview are precisely what you'll be working with.

Sociological factors

Growing public awareness of air quality is a significant sociological factor influencing ENN Energy Holdings. Increasing concern over urban air pollution, particularly in China, is directly fueling demand for cleaner energy sources like natural gas. This societal shift is a powerful tailwind for ENN Energy’s core business, as consumers and policymakers alike push for improved environmental conditions.

This heightened public scrutiny translates into greater pressure on industries to reduce their emissions, further encouraging the adoption of cleaner fuels that ENN Energy provides. For instance, by 2023, many Chinese cities reported significant improvements in air quality, partly due to increased natural gas usage in industrial and residential sectors, a trend ENN Energy actively supports and benefits from.

China's ongoing urbanization, with an increasing percentage of its population residing in cities, directly fuels demand for ENN Energy's services. By the end of 2023, China's urbanization rate reached 66.16%, signifying a growing urban customer base for residential gas connections.

Modern urban living increasingly prioritizes convenience and cleaner energy sources. This shift is evident as more households adopt gas for heating, cooking, and water heating, aligning perfectly with ENN Energy's core business of pipeline gas distribution.

This sustained migration and evolving urban lifestyle trends are critical drivers for the expansion and utilization of ENN Energy's extensive gas pipeline network, ensuring a consistent growth trajectory for the company.

Societal awareness of environmental impact is fueling a significant increase in the demand for energy efficiency and smart solutions. Consumers and businesses alike are actively seeking ways to reduce their energy consumption and carbon footprint. This shift directly supports ENN Energy's strategic direction towards providing integrated energy solutions designed for optimized usage and cost reduction.

The growing preference for sustainable practices is evident in market trends. For instance, the global smart energy market was valued at approximately USD 65.2 billion in 2023 and is projected to grow substantially, with a compound annual growth rate (CAGR) of around 15.5% from 2024 to 2030. This expansion is largely driven by the increasing adoption of smart meters and digital platforms that enable better energy management, aligning with ENN Energy's service offerings.

Workforce Skills and Talent Availability

The shift to integrated clean energy solutions, a core focus for ENN Energy, demands a workforce proficient in specialized areas. This includes expertise in distributed energy systems, advanced digital analytics for grid management, and the intricate project management required for large-scale clean energy infrastructure. Without these skills, ENN Energy's capacity to innovate and broaden its service offerings will be significantly hampered.

The availability of qualified personnel is a critical determinant of ENN Energy's growth trajectory. Specifically, a robust pipeline of skilled engineers, adept technicians, and experienced IT professionals is essential for the company to maintain its competitive edge and execute its strategic expansion plans in the evolving energy landscape. For instance, in 2024, the demand for renewable energy engineers in China saw a notable increase, reflecting this broader trend.

- Specialized Skill Demand: Clean energy transition necessitates expertise in distributed energy, digital analytics, and complex project management.

- Talent Cruciality: Availability of skilled engineers, technicians, and IT professionals directly impacts ENN Energy's innovation and expansion capabilities.

- Investment Imperative: Strategic investment in workforce training and effective talent retention programs are vital for sustained success.

- Market Trend: Reports from 2024 indicated a growing demand for renewable energy specialists across the Asian market, highlighting potential talent acquisition challenges and opportunities.

Health and Safety Perceptions

Public perception of natural gas infrastructure safety is a cornerstone of consumer trust and market acceptance for ENN Energy. Negative perceptions stemming from incidents, such as leaks or explosions, can directly dampen demand and invite stricter regulatory oversight. In 2023, ENN Energy reported a significant focus on safety, investing ¥1.5 billion in infrastructure upgrades and safety training, aiming to reinforce its social license to operate.

ENN Energy's proactive approach to safety is crucial for its long-term viability. Maintaining high operational standards and engaging in transparent communication about safety protocols helps to build and preserve public confidence. The company's commitment is reflected in its safety performance metrics, with a reported 15% reduction in minor incidents year-on-year through to early 2024, underscoring their dedication to minimizing risks.

- Public Trust: Public perception directly influences demand for natural gas services.

- Incident Impact: Safety incidents can lead to increased regulatory scrutiny and reputational damage.

- ENN's Commitment: Stringent safety standards and transparent communication are key to maintaining social license.

- Safety Investment: ENN Energy's ¥1.5 billion investment in safety in 2023 highlights its dedication to operational integrity.

The increasing urbanization in China, with a rate reaching 66.16% by the end of 2023, directly expands ENN Energy's customer base for residential gas connections. This demographic shift, coupled with a growing preference for convenient and cleaner energy sources in modern urban lifestyles, fuels demand for ENN Energy's pipeline gas distribution services.

Societal emphasis on environmental impact drives demand for energy efficiency and smart solutions, aligning with ENN Energy's integrated energy offerings. The global smart energy market, valued around USD 65.2 billion in 2023 and projected for substantial growth, reflects this trend, with ENN Energy positioned to benefit from increased adoption of digital energy management platforms.

Public perception of safety significantly impacts ENN Energy's operations and market acceptance. The company's ¥1.5 billion investment in safety infrastructure and training in 2023, alongside a 15% year-on-year reduction in minor incidents by early 2024, demonstrates a commitment to maintaining public trust and operational integrity.

| Sociological Factor | Impact on ENN Energy | Supporting Data/Trend |

|---|---|---|

| Urbanization | Expanded customer base for residential gas. | China's urbanization rate: 66.16% (end of 2023). |

| Environmental Awareness | Increased demand for clean energy and efficiency solutions. | Global smart energy market: ~USD 65.2 billion (2023), ~15.5% CAGR (2024-2030). |

| Safety Perception | Crucial for public trust and regulatory acceptance. | ENN's safety investment: ¥1.5 billion (2023); Incident reduction: 15% (by early 2024). |

Technological factors

Technological innovations are significantly improving natural gas distribution. New pipeline materials, advanced monitoring systems, and smart grid technologies are boosting safety, efficiency, and reliability. For instance, advancements in composite materials can reduce the risk of corrosion and leaks compared to traditional steel pipelines.

The integration of IoT sensors and sophisticated data analytics is a game-changer, enabling predictive maintenance and optimizing how the entire natural gas network is managed. This means potential issues can be identified and addressed before they cause disruptions, leading to more consistent service for consumers.

These technological upgrades directly translate to reduced operational costs for companies like ENN Energy Holdings. By minimizing downtime and improving resource allocation, these advancements enhance service delivery and contribute to a more sustainable and cost-effective energy infrastructure, with companies investing billions annually in infrastructure upgrades and digitalization.

ENN Energy's strategic focus on integrated energy solutions is heavily influenced by technological advancements. The rapid development of distributed energy technologies like microgrids, combined heat and power (CHP) systems, and advanced energy storage is a key driver. These innovations allow ENN to move beyond traditional gas distribution, offering more holistic and customized energy services to its customers.

The company's commitment to research and development, alongside strategic collaborations, is vital for maintaining its competitive edge in this evolving landscape. For instance, ENN's investment in smart grid technologies and digital platforms aims to optimize energy distribution and consumption, reflecting the broader trend towards digitalization in the energy sector.

ENN Energy Holdings is leveraging digitalization to transform its operations. The company is integrating AI and big data analytics to optimize energy distribution and consumption, aiming for greater efficiency and cost savings. For instance, in 2023, ENN reported a significant increase in the adoption of its smart meter programs, which provide real-time data for better demand forecasting.

These digital advancements directly benefit customers by enabling more precise energy usage insights and personalized service offerings. Smart metering and advanced billing systems are streamlining operations, reducing errors, and improving the overall customer experience. This technological push is crucial for ENN as it navigates the evolving energy landscape.

Efficiency Improvements in CNG/LNG Technologies

Technological advancements are significantly boosting the efficiency, safety, and environmental credentials of compressed natural gas (CNG) and liquefied natural gas (LNG) refueling stations. These innovations translate into quicker refueling processes, lower operational emissions, and more space-efficient station designs. For instance, by 2024, new CNG compressor technologies are achieving refueling times up to 20% faster than previous generations, while advanced LNG vaporization systems reduce energy consumption by approximately 15%.

These improvements are crucial for expanding ENN Energy's refueling infrastructure. The development of modular and smaller-footprint refueling units allows for easier deployment in urban areas and at existing fuel depots. Furthermore, enhanced safety features, such as improved leak detection and automated shutdown systems, are becoming standard, building greater confidence in natural gas as a transportation fuel.

- Faster Refueling: New CNG compressor designs are reducing refueling times by up to 20% compared to earlier models.

- Energy Efficiency: Advanced LNG vaporization systems are demonstrating a 15% reduction in energy consumption.

- Network Expansion: More compact and modular station designs facilitate easier and faster network growth for ENN Energy.

- Environmental Performance: Innovations are leading to reduced fugitive emissions from refueling operations.

Renewable Energy Integration and Hybrid Systems

The integration of renewable energy sources like solar and wind with natural gas into hybrid systems is a key technological trend. ENN Energy can utilize its existing gas infrastructure to offer reliable backup or supplementary power for these often intermittent renewables, creating more robust and sustainable energy mixes.

This technological convergence allows for enhanced grid stability and a more efficient transition to cleaner energy. For instance, as of early 2025, China's installed solar capacity surpassed 700 GW, and wind power exceeded 400 GW, highlighting the growing need for complementary solutions. ENN Energy's ability to blend these sources positions it to capitalize on this expansion.

- Hybrid System Development: ENN Energy can develop and deploy hybrid energy solutions that combine natural gas with solar and wind power.

- Infrastructure Leverage: Existing natural gas pipelines and distribution networks can be repurposed or integrated to support renewable energy storage and delivery.

- Grid Stability: Hybrid systems offer greater grid reliability by mitigating the intermittency of renewable sources, ensuring a consistent energy supply.

- Market Opportunity: The increasing global demand for decarbonized and reliable energy solutions presents a significant market for ENN Energy's hybrid offerings.

Technological advancements are enhancing natural gas distribution through improved materials and smart grid integration, boosting safety and efficiency. IoT sensors and data analytics enable predictive maintenance, optimizing network management for consistent service. These upgrades reduce operational costs, with companies investing billions annually in digitalization and infrastructure improvements.

ENN Energy Holdings leverages digitalization, integrating AI and big data for optimized energy distribution, as seen in its 2023 smart meter program adoption increase. Digitalization improves customer insights and service through smart metering and advanced billing. Technological progress in CNG and LNG refueling stations, with faster refueling times and reduced energy consumption (e.g., 20% faster CNG, 15% less LNG energy), supports ENN's infrastructure expansion.

The convergence of natural gas with renewables like solar and wind, supported by ENN's infrastructure, enhances grid stability. With China's solar capacity exceeding 700 GW and wind over 400 GW by early 2025, hybrid solutions are crucial for a reliable, cleaner energy mix.

| Key Technological Advancements | Impact on ENN Energy | Relevant Data/Examples |

| Smart Grid & IoT Integration | Improved network management, predictive maintenance, enhanced reliability | Billions invested annually in digitalization; smart meter adoption increase in 2023 |

| CNG/LNG Refueling Tech | Faster refueling, reduced energy consumption, network expansion | 20% faster CNG refueling; 15% energy reduction in LNG vaporization (by 2024) |

| Hybrid Energy Systems | Integration of gas with renewables, grid stability | China's solar capacity >700 GW, wind >400 GW (early 2025) |

Legal factors

ENN Energy Holdings navigates a stringent regulatory landscape in China's energy sector, necessitating a range of licenses for its core activities like gas distribution and integrated energy projects. Adherence to these rules, which dictate service standards, safety protocols, and market entry, is crucial for maintaining operational continuity.

The company's 2023 financial report highlighted significant investment in infrastructure upgrades to meet evolving safety and environmental regulations. For instance, compliance with new pipeline integrity standards required approximately RMB 2 billion in capital expenditure, directly impacting operational costs and future expansion plans.

Fluctuations in licensing renewals or modifications to permit conditions, particularly concerning new energy sources or distributed generation, could directly influence ENN Energy's business scope and market positioning in the coming years.

Environmental protection laws in China, including stringent air quality standards and evolving emissions regulations, directly impact ENN Energy's operational costs and strategic direction, especially concerning its investments in clean energy solutions. The company must navigate these legal requirements to ensure compliance with national and provincial mandates, which are increasingly focused on reducing pollution and carbon footprints.

The legal framework actively promotes a transition away from coal towards cleaner energy sources like natural gas, aligning with ENN Energy's business model centered on integrated energy solutions and natural gas distribution. This regulatory push supports ENN's strategy, but also necessitates continuous investment in technology and infrastructure to meet or exceed mandated emission limits, such as those related to SO2 and NOx.

For instance, China's 14th Five-Year Plan (2021-2025) sets ambitious targets for reducing energy intensity and carbon emissions per unit of GDP, creating a favorable legal environment for companies like ENN Energy that are positioned to benefit from the shift to cleaner fuels and integrated energy services.

ENN Energy operates under a rigorous framework of safety regulations for its gas infrastructure, encompassing everything from pipeline design and construction to the ongoing operation and maintenance of storage facilities and refueling stations. These rules are critical for preventing accidents and safeguarding the public.

Adherence to these stringent standards is not optional; ENN Energy is legally obligated to meet them. For instance, in 2023, China's Ministry of Emergency Management continued to emphasize stricter oversight of hazardous chemical and gas operations, with enforcement actions leading to significant penalties for non-compliance, underscoring the financial and operational risks of falling short.

The legal landscape also mandates regular audits and proactive updates to safety protocols. This ensures that ENN Energy's practices remain current with evolving best practices and technological advancements in gas safety management, a crucial element in maintaining operational integrity and regulatory approval.

Contractual Law and Commercial Agreements

ENN Energy's operations are deeply intertwined with contractual law, particularly concerning its gas purchase agreements and distribution concessions. For instance, in 2023, the company reported significant revenue streams derived from these long-term supply and distribution contracts, underscoring their vital role in revenue stability. Navigating these agreements requires strict adherence to contractual terms and effective dispute resolution processes to ensure uninterrupted service delivery and financial performance.

The company's commercial agreements span various customer segments, from residential to industrial, each with specific service level agreements and pricing structures. These contracts are the bedrock of ENN Energy's customer relationships and revenue generation. In 2024, ongoing negotiations and renewals of these service contracts are crucial for maintaining market share and adapting to evolving customer demands. Failure to comply with these contractual obligations could lead to penalties and reputational damage.

- Gas Supply Contracts: Essential for securing feedstock, with terms often spanning decades.

- Distribution Concessions: Agreements with local governments granting rights to operate in specific territories, typically involving performance standards.

- Customer Service Agreements: Outlining terms of service, pricing, and responsibilities for residential, commercial, and industrial users.

- Maintenance and Operational Contracts: Agreements with third-party providers for infrastructure upkeep and specialized services.

Anti-Monopoly and Competition Laws

As a significant energy provider in China, ENN Energy Holdings operates under stringent anti-monopoly and competition laws. These regulations, enforced by bodies like the State Administration for Market Regulation (SAMR), are designed to foster fair play and prevent market dominance from stifling innovation or harming consumers. For instance, SAMR has actively investigated and fined companies for monopolistic practices in various sectors, setting a precedent for ENN Energy's operational conduct.

Compliance with these laws is not just a legal obligation but a strategic imperative for ENN Energy. Failure to adhere can result in substantial fines, divestiture orders, and reputational damage, impacting its ability to secure new projects or maintain existing licenses. The company must continuously monitor its market share and pricing strategies to ensure they remain within legal boundaries, particularly in regions where it holds a dominant position.

- Regulatory Scrutiny: ENN Energy faces oversight from China's anti-monopoly regulators, ensuring fair competition in the energy market.

- Market Fairness Mandate: Laws aim to prevent ENN Energy, as a dominant player in some regions, from engaging in practices that disadvantage competitors or consumers.

- Compliance Risks: Non-compliance can lead to significant penalties, impacting ENN Energy's financial performance and operational freedom.

- Competitive Landscape: Adherence to competition laws is crucial for maintaining ENN Energy's long-term viability and positive market standing.

ENN Energy Holdings operates within a complex legal framework in China, requiring adherence to numerous licenses and permits for its gas distribution and integrated energy services. The company's 2023 financial statements indicate substantial capital expenditure, with approximately RMB 2 billion allocated to infrastructure upgrades to meet evolving safety and environmental regulations, particularly new pipeline integrity standards.

The legal environment actively supports the transition to cleaner energy sources, aligning with ENN's strategy and necessitating continuous investment to meet emission limits. China's 14th Five-Year Plan (2021-2025) sets ambitious targets for reducing energy intensity, creating a favorable legal climate for ENN's business model.

Contractual law is fundamental to ENN Energy's operations, governing gas supply and distribution agreements. In 2023, these contracts were a significant source of revenue, highlighting the importance of strict compliance and effective dispute resolution for financial stability.

ENN Energy is subject to China's anti-monopoly laws, overseen by the State Administration for Market Regulation (SAMR), to ensure fair competition. Non-compliance risks substantial fines and reputational damage, making continuous monitoring of market share and pricing strategies a strategic imperative.

Environmental factors

China's commitment to peaking carbon emissions before 2030 and reaching carbon neutrality by 2060 significantly boosts demand for cleaner energy. This policy framework positions natural gas as a vital transition fuel, bridging the gap between coal and renewables, thereby supporting ENN Energy's core natural gas distribution business and its expansion into renewable energy solutions.

ENN Energy Holdings stands to gain significantly from China's ongoing efforts to enhance urban air quality, exemplified by campaigns like the 'Blue Sky Protection Campaign'. This governmental focus drives a greater adoption of natural gas as a cleaner alternative to coal across industrial, commercial, and residential sectors, directly boosting demand for ENN's core offerings.

In 2023, China's Ministry of Ecology and Environment reported a notable decrease in major air pollutants, with PM2.5 concentrations falling by an average of 8.3% nationwide compared to 2022, underscoring the effectiveness of these initiatives and the growing market for cleaner fuels like natural gas.

ENN Energy's commitment to providing clean energy solutions aligns perfectly with these environmental mandates, positioning the company as a key player in achieving national air quality targets while simultaneously expanding its market share.

Natural gas is playing a crucial role as a transition fuel in China's energy strategy, providing a cleaner option than coal while leveraging existing infrastructure. ENN Energy's distribution network directly supports this shift, facilitating the move towards lower carbon emissions. This transitional demand, however, is subject to the pace at which renewable energy sources are integrated into the grid, potentially influencing future natural gas consumption patterns.

Environmental Impact of Infrastructure Development

ENN Energy's infrastructure, including natural gas pipelines and LNG terminals, necessitates careful management of environmental impacts. These projects involve significant land use and can disrupt natural habitats. For instance, the expansion of gas infrastructure in 2024 requires meticulous environmental impact assessments to address potential habitat fragmentation and soil erosion.

Operational emissions from distributed energy facilities and ongoing maintenance of existing infrastructure are also key concerns. ENN Energy must adhere to stringent environmental regulations, which often mandate specific mitigation strategies and emissions reduction targets. Compliance with these requirements is crucial for maintaining operational licenses and public trust.

Sustainable construction practices are paramount to minimizing the ecological footprint of new developments. This includes employing techniques that reduce waste, conserve water, and prevent pollution. As of early 2025, ENN Energy is investing in advanced technologies for pipeline leak detection and repair to further curb potential methane emissions, a potent greenhouse gas.

- Land Use and Habitat: Infrastructure projects often require substantial land acquisition, potentially impacting biodiversity and ecosystem services.

- Operational Emissions: Facilities like LNG terminals and distributed energy plants can release greenhouse gases and other pollutants if not managed effectively.

- Regulatory Compliance: ENN Energy must navigate a complex web of environmental laws and regulations, including those related to emissions standards and environmental impact assessments.

- Sustainable Practices: Implementing eco-friendly construction methods and investing in emission reduction technologies are vital for responsible operations.

Climate Change Adaptation and Resilience

ENN Energy's extensive infrastructure, particularly its natural gas distribution networks and integrated energy solutions, faces tangible risks from climate change. Extreme weather events, such as intensified typhoons or prolonged heatwaves, could lead to disruptions in supply chains, damage to physical assets like pipelines and storage facilities, and increased operational costs for repairs and maintenance. For instance, the company's reliance on a vast network means that localized extreme weather can have a cascading effect on service delivery across multiple regions.

To safeguard its operations and ensure continuity of service, ENN Energy must embed robust climate change adaptation strategies into its core business planning. This involves proactively assessing the vulnerability of its existing infrastructure to predicted climate impacts and investing in resilience measures. A key component is the continuous evaluation and upgrading of systems to withstand more frequent and severe weather phenomena, thereby minimizing potential downtime and financial losses. The company's 2023 financial reports indicated significant capital expenditure on network upgrades, a portion of which is directly attributable to enhancing resilience against environmental factors.

- Infrastructure Vulnerability: ENN Energy's extensive network of pipelines and integrated energy facilities is exposed to physical risks from extreme weather events like floods and storms, which can disrupt operations and damage assets.

- Adaptation Strategy Imperative: The company is compelled to integrate climate adaptation into its operational framework to ensure the resilience of its energy supply and service delivery networks against a changing climate.

- Risk Assessment and System Robustness: Proactive risk assessment and the development of more robust, adaptable energy systems are crucial for maintaining service reliability and mitigating the financial impact of climate-related disruptions.

- Capital Investment for Resilience: ENN Energy's ongoing capital investments, such as those reported in its 2023 annual results, are increasingly allocated towards strengthening infrastructure against climate-induced stresses, reflecting a strategic shift towards enhanced resilience.

China's environmental policies, particularly its commitment to carbon neutrality by 2060, significantly favor natural gas as a transition fuel. This policy landscape directly supports ENN Energy's core business and its strategic pivot towards renewables.

ENN Energy's operations are directly impacted by China's air quality improvement initiatives, such as the 'Blue Sky Protection Campaign'. These efforts drive demand for cleaner fuels like natural gas, benefiting ENN's distribution network.

In 2023, China saw an 8.3% nationwide drop in PM2.5, highlighting the success of environmental campaigns and the increasing market acceptance of cleaner energy alternatives provided by companies like ENN Energy.

ENN Energy's infrastructure development, including pipeline expansions in 2024, requires rigorous environmental impact assessments to manage land use and potential habitat disruption.

PESTLE Analysis Data Sources

Our PESTLE analysis for ENN Energy Holdings is built on comprehensive data from official government reports, reputable financial institutions, and leading energy industry publications. We meticulously gather information on regulatory changes, economic forecasts, technological advancements, and environmental policies impacting the energy sector.