ENN Energy Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Energy Holdings Bundle

ENN Energy Holdings operates within a dynamic energy sector, where understanding the interplay of competitive forces is paramount. Our analysis reveals moderate threats from new entrants and substitutes, while buyer and supplier power present significant considerations.

The complete report reveals the real forces shaping ENN Energy Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ENN Energy Holdings, a significant player in China's natural gas distribution, faces considerable supplier bargaining power. Its reliance on a few major state-owned enterprises like PetroChina and Sinopec, alongside international LNG providers, means these suppliers can heavily influence pricing and contract conditions. For instance, in 2023, China's domestic natural gas production was around 230 billion cubic meters, with a substantial portion controlled by these large entities.

However, ENN's proactive strategy of developing its own LNG import capabilities, including the operation of the Zhoushan LNG terminal, offers a crucial counter-balance. This diversification allows ENN to access a broader range of gas sources and potentially secure more favorable terms by having alternative procurement options, especially when domestic prices rise.

The global liquefied natural gas (LNG) market presents a complex landscape for ENN Energy Holdings. While it offers avenues for diversification, the inherent price volatility, often driven by geopolitical events and shifting supply-demand dynamics, directly influences ENN's procurement expenses. For instance, ENN reported pre-tax LNG trading gains of RMB 280 million for the first nine months of 2024, a figure that, while meeting its annual target, underscores the susceptibility of these operations to market fluctuations.

Long-term supply contracts, like ENN Energy's 15-year agreement with BASF for its Zhanjiang facility, can secure a stable portion of natural gas supply and lock in costs. This strategy helps mitigate the risk of price volatility from suppliers, providing a degree of predictability for operational expenses. However, these long-term commitments can also reduce ENN Energy's agility to capitalize on sudden drops in market prices by switching to cheaper alternatives.

Governmental Price Mechanisms

Governmental price mechanisms in China directly impact ENN Energy Holdings' bargaining power with suppliers. Reforms, such as the phased implementation of gas cost pass-through for residential users, aim to stabilize ENN's margins by allowing it to adjust prices in response to supplier cost fluctuations. This regulatory framework, however, also seeks to maintain consumer affordability, potentially limiting ENN's ability to fully pass on all increased procurement expenses, thus influencing the supplier's leverage.

The Chinese government's evolving natural gas pricing policies are crucial. For instance, the National Development and Reform Commission (NDRC) has been instrumental in guiding these reforms. In 2023, the NDRC continued to refine pricing structures, balancing the need for market-oriented reforms with social considerations. This means ENN's ability to negotiate with suppliers is indirectly shaped by policies designed to ensure stable energy supply and fair pricing for end-users.

- Governmental Price Controls: China's price controls on natural gas can limit ENN's flexibility in passing on cost increases, thereby strengthening supplier bargaining power if ENN cannot fully recover higher procurement expenses.

- Cost Pass-Through Mechanisms: The extent to which ENN can pass through gas costs to residential customers, a key reform, directly influences its ability to absorb supplier price hikes and negotiate effectively.

- Regulatory Stability: A predictable and stable regulatory environment regarding gas pricing is essential for ENN to manage supplier relationships and maintain its margin stability.

Development of Integrated Energy Solutions

ENN Energy Holdings' move into integrated energy solutions, incorporating solar and biomass alongside natural gas, helps to dilute the bargaining power of traditional natural gas suppliers. This diversification means ENN is less beholden to any single fuel source.

By providing a wider array of energy options, ENN can negotiate from a stronger position, as its overall energy supply is not solely dependent on one commodity. This strategic pivot is crucial in managing supplier leverage.

- Diversified Energy Portfolio: ENN's integration of solar and biomass reduces reliance on natural gas, lessening the impact of natural gas supplier price hikes.

- Reduced Dependence: The company's ability to offer multiple energy solutions weakens the negotiating stance of any single fuel supplier.

- Strategic Advantage: This integrated approach provides ENN with greater flexibility and control over its energy sourcing, mitigating supplier power.

ENN Energy Holdings faces significant supplier bargaining power due to its reliance on a few key natural gas providers, both domestic and international. This concentration can lead to suppliers dictating terms and prices. For instance, in 2023, China's domestic natural gas production was approximately 230 billion cubic meters, largely controlled by state-owned entities.

However, ENN's strategic diversification into its own LNG import capabilities, such as operating the Zhoushan LNG terminal, provides a crucial counter-balance. This allows access to a broader range of gas sources, enhancing negotiation leverage. The company's move into integrated energy solutions, including solar and biomass, further dilutes the power of traditional natural gas suppliers by reducing overall dependence on a single fuel source.

Governmental price controls and cost pass-through mechanisms in China directly influence ENN's ability to negotiate with suppliers. Reforms aimed at stabilizing ENN's margins by allowing price adjustments in response to supplier cost fluctuations are vital. Yet, these reforms also balance consumer affordability, potentially limiting ENN's capacity to fully pass on all increased procurement expenses, thereby impacting supplier leverage.

| Supplier Type | Key Players | Impact on ENN | Mitigation Strategies |

|---|---|---|---|

| Domestic Natural Gas | PetroChina, Sinopec | High concentration, potential price influence | Long-term contracts, diversification of sources |

| International LNG | Global LNG Providers | Price volatility, geopolitical influence | LNG terminal operations, diversified procurement |

| Integrated Energy | N/A (Internal Development) | Reduced reliance on single fuel | Diversified energy portfolio (solar, biomass) |

What is included in the product

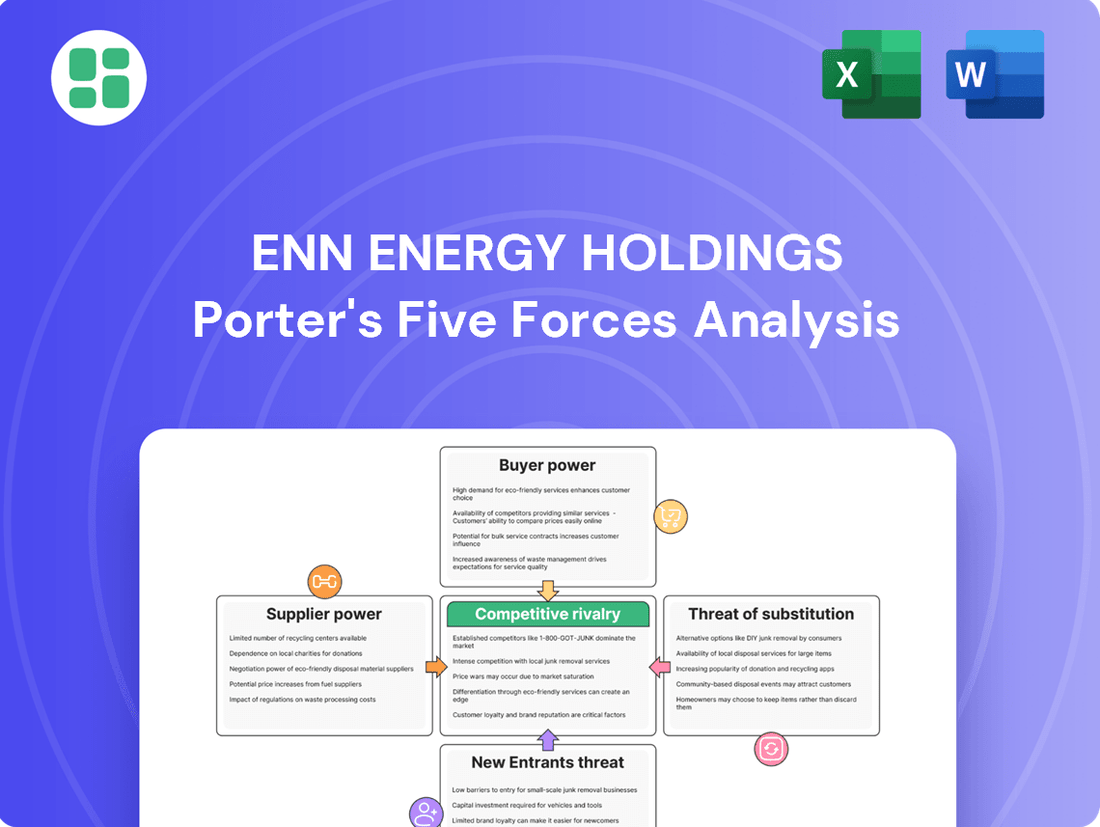

This analysis dissects the competitive landscape for ENN Energy Holdings, evaluating the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its energy business.

Quickly identify and mitigate competitive threats with a visual breakdown of ENN Energy's industry landscape, simplifying complex strategic pressures.

Customers Bargaining Power

ENN Energy's extensive customer network, reaching over 31 million residential households and more than 270,000 commercial and industrial (C&I) clients across 21 Chinese provinces, highlights a fragmented yet substantial customer base.

While the sheer volume of customers might suggest limited individual power, the presence of large-scale C&I users, who account for significant energy consumption, introduces a degree of concentrated bargaining power.

These major industrial clients can leverage their substantial purchase volumes to negotiate more favorable terms, potentially impacting ENN Energy's pricing and service agreements.

Commercial and industrial users, especially those with high energy demands, closely watch natural gas prices because these costs directly affect their operating expenses and their decisions about increasing usage. In 2024, for instance, fluctuations in wholesale natural gas prices significantly influenced the purchasing power of these ENN Energy customers.

This sensitivity means that ENN Energy must carefully manage its pricing to retain these customers. If prices become too high, these users might explore alternative energy solutions or reduce their consumption, directly impacting ENN's revenue streams and overall profitability from this crucial segment.

Residential gas prices are frequently subject to government regulation, which significantly curtails ENN Energy Holdings' ability to freely adjust pricing in line with fluctuating supply expenses. This regulatory environment directly impacts ENN's pricing power.

In 2024, ENN reported successfully passing through costs for 59% of its residential projects based on sales volume. The company has set an ambitious target to reach 80% by the end of the year. However, this cost pass-through mechanism is contingent upon obtaining necessary government approvals, which introduces uncertainty and can affect margin stability.

Switching Costs and Infrastructure Lock-in

For piped natural gas, customers face relatively high switching costs. The existing underground pipeline infrastructure makes it inconvenient and expensive for consumers to switch to a different energy provider, creating a significant lock-in effect for ENN Energy Holdings. This infrastructure dependency offers ENN a degree of insulation against customer churn, particularly within its established city gas distribution networks.

This lock-in is a key factor in the bargaining power of customers, as the cost and effort to change providers are substantial. For instance, in 2023, ENN Energy Holdings served approximately 25.4 million residential and commercial customers across China, many of whom are integrated into its extensive piped natural gas network.

- High Switching Costs: The physical infrastructure of piped gas networks makes changing suppliers a complex and costly undertaking for customers.

- Infrastructure Lock-in: Customers are effectively tied to ENN's network once connected, limiting their ability to easily switch to competitors.

- Reduced Customer Defection: This lock-in provides ENN with a stable customer base, particularly in long-term city gas projects.

- Customer Base Stability: As of 2023, ENN's vast network of over 25 million customers highlights the scale of this infrastructure-driven customer loyalty.

Integrated Energy Solutions and Value-Added Services

ENN Energy Holdings' strategic move into integrated energy solutions and value-added services, including smart home offerings and enterprise energy management, directly addresses customer bargaining power. By diversifying its product and service portfolio beyond traditional gas distribution, ENN fosters stronger customer loyalty.

This expansion creates stickier customer relationships, making it more difficult for customers to switch providers. For instance, by offering comprehensive energy management systems, ENN can lock in clients, thereby diminishing their ability to negotiate lower prices or demand more favorable terms.

- Integrated Solutions Enhance Loyalty: ENN's expansion into smart home and enterprise energy management creates deeper customer engagement.

- Reduced Price Sensitivity: Offering bundled services makes customers less likely to switch based solely on price.

- Increased Switching Costs: Implementing integrated systems raises the cost and complexity for customers to change energy providers.

While ENN Energy serves millions, the bargaining power of individual residential customers is low due to small consumption volumes and regulated pricing. However, large commercial and industrial clients possess significant leverage, especially when natural gas prices directly impact their operational costs, as seen in 2024's price fluctuations.

The company's ability to pass through costs to residential customers is regulated, with 59% of residential projects successfully passing costs in 2024, aiming for 80% by year-end, but this is subject to government approval.

High switching costs associated with existing piped gas infrastructure significantly reduce customer bargaining power, creating a lock-in effect. As of 2023, ENN's network served over 25 million customers, underscoring this infrastructure dependency.

ENN's expansion into integrated energy solutions further solidifies customer loyalty by increasing switching costs and reducing price sensitivity among its client base.

| Customer Segment | Bargaining Power Factors | Impact on ENN Energy |

|---|---|---|

| Residential | Low individual power, regulated pricing | Limited pricing flexibility, stable demand |

| Commercial & Industrial (C&I) | High volume purchasing, price sensitivity | Potential for negotiated discounts, revenue impact |

| All Customers | High switching costs (piped gas), integrated solutions | Customer lock-in, reduced churn, enhanced loyalty |

Preview the Actual Deliverable

ENN Energy Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for ENN Energy Holdings details the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the energy sector. This in-depth examination provides actionable insights into the competitive landscape and strategic positioning of ENN Energy Holdings.

Rivalry Among Competitors

The clean energy distribution market in China is quite expansive, yet it's populated by a considerable number of companies, which naturally fuels intense competition. This fragmentation means that while there's a large playing field, the rivalry among these numerous entities is a significant factor.

ENN Energy Holdings stands out as a major player, ranking among the top three in gas distribution. In 2024, the company held a notable 6.1% share of the market based on gas sales volume. However, this position is challenged by other substantial energy companies, including both state-owned enterprises and other private firms, all vying for market dominance.

ENN Energy Holdings faces intense competition from major energy companies such as Datang International Power Generation, Shenergy Group, China Gezhouba Group, and Zhejiang Zheneng Electric Power. These formidable players are active across diverse energy segments, mirroring ENN's own operational scope.

The rivalry is particularly fierce in the natural gas distribution sector and the burgeoning market for integrated energy solutions. Competitors are aggressively pursuing market share, leveraging their scale and established infrastructure to offer comprehensive energy services.

For instance, as of the first half of 2024, many of these large state-owned enterprises, including some of ENN's key rivals, reported significant growth in their natural gas sales volumes, indicating the high demand and competitive nature of this market segment.

The competitive landscape in the energy sector is evolving, with a strong trend towards integrated clean energy solutions. ENN Energy Holdings is actively participating in this shift, concentrating on building smart energy systems and digital services that support a low-carbon economy. This strategic pivot means competition is no longer just about supplying energy commodities but also about providing holistic energy management and efficiency services.

This focus on integrated solutions intensifies rivalry as companies strive to offer comprehensive packages. For instance, ENN's investment in digital platforms and smart grid technologies aims to differentiate its offerings. In 2023, ENN reported a significant increase in its integrated energy solutions segment, highlighting the growing market demand for these services and the competitive pressure to innovate in this area.

Regional Market Dynamics

Competitive rivalry within the regional energy market is a significant factor for ENN Energy Holdings. While some areas might feature exclusive distribution rights granted by local governments, leading to less direct competition for ENN in those specific zones, other regions experience much fiercer rivalry. This fluctuating competitive landscape necessitates a nuanced approach to market strategy.

ENN's extensive network, encompassing 261 city gas projects spread across 21 provinces in China, highlights its broad operational reach. However, the intensity of competition is not uniform across this footprint. Local market conditions, regulatory environments, and the presence of other energy providers mean that ENN must constantly adapt its strategies to the specific competitive pressures in each of its operating regions.

- Geographic Diversity: ENN Energy Holdings operates in 21 provinces, demonstrating a wide but varied market presence.

- Exclusive Rights: The presence of exclusive distribution rights in certain regions mitigates direct competition for ENN.

- Intense Competition: Conversely, other regions present significant competitive challenges from rival energy suppliers.

- Adaptable Strategy: ENN's success hinges on its ability to tailor strategies to the unique competitive intensity of each local market.

Policy-Driven Growth and Decarbonization

China's unwavering commitment to carbon reduction and enhanced energy efficiency, backed by robust policies favoring clean energy, creates significant growth avenues. This policy-driven environment naturally escalates competitive rivalry as numerous firms vie for dominance in burgeoning sectors such as green hydrogen and the integration of renewable energy sources.

ENN Energy Holdings' strategic focus on decarbonization is a key differentiator, positioning the company to leverage these evolving market dynamics. For instance, in 2024, China's National Development and Reform Commission continued to roll out incentives for renewable energy adoption, directly impacting ENN's operational landscape and competitive positioning.

- Policy Tailwinds: Government mandates for emission reduction and energy efficiency create a favorable, albeit competitive, market for ENN.

- Emerging Markets: The push for green hydrogen and broader renewable energy integration presents both opportunities and intensified competition.

- ENN's Strategy: ENN's proactive decarbonization roadmap is designed to capitalize on these policy-driven shifts.

- Competitive Intensity: The race to secure market share in clean energy technologies is driving up rivalry among energy providers.

Competitive rivalry is a defining characteristic for ENN Energy Holdings, particularly within China's dynamic clean energy sector. The market's fragmentation, despite ENN's leading position, means constant pressure from both state-owned giants and agile private firms. This intense competition is amplified by the sector's rapid evolution towards integrated energy solutions, pushing companies like ENN to innovate beyond traditional gas distribution.

The pursuit of market share in natural gas distribution and integrated energy services is fierce. For example, in the first half of 2024, many of ENN's major competitors, including large state-owned enterprises, reported substantial increases in their natural gas sales volumes, underscoring the high demand and aggressive competition. ENN's own strategic investments in digital platforms and smart grid technologies, which led to significant growth in its integrated energy solutions segment in 2023, are direct responses to this competitive pressure.

While ENN benefits from exclusive distribution rights in some localized areas, its broader operational footprint across 21 provinces exposes it to varied levels of rivalry. The company's extensive network of 261 city gas projects necessitates adaptable strategies to counter competitors who are also expanding their reach and service offerings, especially in the burgeoning clean energy market driven by China's decarbonization goals.

| Competitor | Market Segment Focus | 2024 Market Share (ENN's Estimate) | Key Competitive Action |

|---|---|---|---|

| Datang International Power Generation | Diversified Energy (incl. gas) | N/A (Major SOE) | Aggressive expansion in natural gas sales |

| Shenergy Group | Diversified Energy (incl. gas) | N/A (Major SOE) | Developing integrated energy solutions |

| China Gezhouba Group | Infrastructure & Energy | N/A | Investing in renewable energy integration |

| Zhejiang Zheneng Electric Power | Power Generation & Distribution | N/A | Focus on smart energy systems |

SSubstitutes Threaten

The increasing adoption of renewable energy sources like solar and wind power represents a significant threat of substitutes for ENN Energy Holdings. As these technologies become more cost-effective and their deployment accelerates in China, they offer viable alternatives to traditional fossil fuel-based energy.

China's energy landscape is rapidly transforming, with a new record for solar and wind power capacity additions set in 2024. This achievement, surpassing the nation's 2030 target six years ahead of schedule, underscores a powerful and accelerating shift away from fossil fuels, directly impacting the demand for ENN Energy's conventional offerings.

The development of hydrogen energy poses a significant threat of substitution for natural gas, particularly in China, a key market for ENN Energy Holdings. China is a global leader in hydrogen production and is aggressively pursuing green hydrogen initiatives, indicating a strong commitment to this alternative energy source.

By the end of 2024, China had implemented over 560 hydrogen energy-specific policies, as noted in the National Energy Administration's 2025 report. This substantial policy support underscores a long-term strategic shift, directly challenging the dominance of natural gas in various energy applications and potentially impacting ENN's future revenue streams.

The growing trend of electrification across heating, industrial applications, and transportation presents a significant threat of substitution for natural gas. Advancements in energy storage technologies are making electricity a more reliable and attractive alternative, directly challenging natural gas's market share.

By September 2024, China saw a substantial increase in its operational energy storage capacity. This expansion bolsters the grid's ability to handle fluctuating renewable energy sources and provides a more consistent power supply, thereby increasing the appeal of electricity over natural gas for various energy needs.

Biomass and Other Alternative Fuels

While biomass and other localized alternative fuels represent a smaller threat compared to large-scale natural gas, they can still act as substitutes in certain industrial applications or specific regions. For instance, a factory in an area with abundant agricultural waste might find biomass a more cost-effective or readily available energy source than piped natural gas.

ENN Energy Holdings itself is actively investing in and expanding its clean energy portfolio, which includes photovoltaics and biomass energy. This strategic move by ENN to diversify into these areas indicates an awareness of their potential as substitutes and a proactive approach to leveraging them.

The growth of the biomass sector, particularly in regions with strong agricultural or forestry industries, presents a potential challenge to natural gas demand. For example, by 2023, China's installed capacity for biomass power generation reached over 30 GW, demonstrating a significant and growing alternative energy source.

- Biomass as a Niche Substitute: Localized biomass solutions can compete with natural gas in specific industrial processes or geographic areas where feedstock is readily available and cost-effective.

- ENN's Diversification Strategy: ENN's own investment in photovoltaics and biomass energy signals recognition of these alternatives and a move to capture market share within them.

- Growing Biomass Capacity: China's installed biomass power generation capacity exceeded 30 GW by the end of 2023, highlighting the increasing scale and viability of this alternative fuel.

Policy Support for Clean Energy Transition

Government policies are a significant driver for clean energy adoption, directly impacting ENN Energy. China's commitment to carbon peaking before 2030 and carbon neutrality by 2060 creates a powerful incentive for substituting fossil fuels with renewable sources.

This strong policy support translates into accelerated development and deployment of non-fossil energy solutions. For instance, by the end of 2023, China's installed renewable energy capacity had surpassed 1.4 billion kilowatts, a substantial increase that directly challenges the long-term demand for natural gas, ENN Energy's core business.

- Government Mandates: China's national targets for emissions reduction create a favorable environment for clean energy substitutes.

- Subsidies and Incentives: Policy frameworks often include financial incentives that make renewable energy more competitive than natural gas.

- Technological Advancement: Government-backed research and development in clean energy technologies further lowers the cost and improves the efficiency of alternatives.

- Market Signals: Clear policy direction signals to investors and businesses the long-term viability of clean energy, encouraging capital reallocation away from fossil fuels.

The threat of substitutes for ENN Energy Holdings is substantial and growing, driven by advancements in renewable energy and supportive government policies. The increasing cost-effectiveness and rapid deployment of solar and wind power in China, with a new record for capacity additions in 2024, directly challenge ENN's reliance on natural gas. Furthermore, the aggressive pursuit of hydrogen energy, backed by over 560 hydrogen-specific policies implemented by the end of 2024, presents a significant long-term substitution risk.

| Substitute Energy Source | Key Driver | Impact on ENN Energy |

|---|---|---|

| Solar & Wind Power | Record capacity additions in 2024, cost-effectiveness | Reduced demand for natural gas in power generation |

| Hydrogen Energy | Extensive policy support (560+ policies by end of 2024) | Potential displacement of natural gas in industrial and transport sectors |

| Electrification (Heating, Transport) | Improved energy storage capacity | Direct competition with natural gas for heating and mobility |

| Biomass | Localized availability, 30+ GW installed capacity by end of 2023 | Niche substitution in specific industrial applications |

Entrants Threaten

The natural gas distribution and integrated energy solutions sectors in China demand significant capital for building essential infrastructure like pipelines, LNG terminals, and comprehensive energy stations. This substantial upfront investment acts as a formidable barrier, effectively discouraging many potential new players from entering the market.

Extensive licensing and regulatory hurdles present a significant barrier to entry in China's energy sector, a crucial aspect for ENN Energy Holdings. Navigating the complex web of approvals, licenses, and stringent safety and environmental standards requires substantial time, resources, and expertise. For instance, in 2024, the Chinese government continued to emphasize stricter environmental compliance for energy projects, making it more challenging for new, unestablished players to secure the necessary permits to operate at scale.

Established infrastructure presents a significant barrier for potential new entrants in the energy sector. Incumbent players, such as ENN Energy Holdings, benefit from extensive existing pipeline networks, established city gas distribution projects, and a substantial customer base. These existing assets create powerful network effects and economies of scale that are difficult for newcomers to replicate.

Building comparable infrastructure from the ground up is an exceptionally time-consuming and capital-intensive undertaking. For instance, the development of a new gas pipeline or a city-wide distribution network can take years and require billions in investment, making it a daunting prospect for any new competitor looking to enter the market.

Access to Natural Gas Resources and Supply Chains

Securing reliable and diversified access to natural gas resources, including domestic production and international Liquefied Natural Gas (LNG), presents a significant barrier for new entrants. Established companies like ENN Energy Holdings often possess deep, long-standing relationships with major global gas suppliers, ensuring consistent and often more favorable supply terms. In 2023, ENN Energy's natural gas sales volume reached 33.4 billion cubic meters, underscoring its substantial procurement capabilities.

Furthermore, ownership or preferential access to critical import infrastructure, such as LNG terminals and extensive pipeline networks, provides a distinct advantage. New entrants would face substantial capital investment and regulatory hurdles to replicate this level of supply chain integration. For instance, the development of a new LNG import terminal can cost billions of dollars and take many years to permit and construct, a challenge that existing players have already overcome.

- Supply Chain Control: Established players benefit from existing, robust relationships with upstream gas producers and midstream infrastructure providers, creating preferential access and potentially lower input costs.

- Infrastructure Investment: The high capital expenditure required for LNG regasification terminals, storage facilities, and extensive pipeline networks acts as a significant deterrent for potential new market participants.

- Economies of Scale: Larger, incumbent companies can leverage their scale to negotiate better pricing on gas procurement and optimize logistics, making it difficult for smaller new entrants to compete on cost efficiency.

Government Support and State-Owned Enterprises

While China's government aims to foster private sector involvement in energy, state-owned enterprises (SOEs) still hold considerable sway. SOEs often receive preferential treatment, including easier access to capital and favorable regulatory conditions, which can create significant hurdles for new, purely private companies entering the market. This imbalance in support and resources can limit the threat of new entrants, as establishing a competitive position against well-backed SOEs is challenging.

For instance, in 2024, SOEs continued to dominate key segments of China's energy infrastructure. ENN Energy Holdings, while a significant player, operates within a landscape where state backing provides substantial advantages. This government support for SOEs can manifest in direct subsidies, guaranteed market access, and lower borrowing costs, making it difficult for new private entities to compete on a level playing field.

- Dominance of SOEs: State-owned enterprises remain dominant in critical energy sectors, benefiting from government backing.

- Preferential Policies: SOEs enjoy advantages such as easier financing and favorable regulatory environments.

- Uneven Playing Field: New private entrants face challenges competing against the established advantages of SOEs.

- Impact on ENN: ENN Energy Holdings navigates this landscape where state support significantly influences market dynamics.

The threat of new entrants in China's integrated energy sector, where ENN Energy Holdings operates, is significantly mitigated by immense capital requirements for infrastructure development. Building extensive pipeline networks, LNG terminals, and energy stations demands billions of dollars, a substantial barrier for newcomers. For example, the ongoing expansion of China's natural gas grid in 2024 continues to require massive investment, reinforcing existing players' advantage.

Stringent regulatory and licensing processes further deter new entrants. Navigating complex approvals, safety standards, and environmental compliance, as emphasized by the government in 2024, requires significant time and expertise. Established companies like ENN have already invested heavily in meeting these requirements, creating a high hurdle for any aspiring competitor.

Existing infrastructure and strong supply chain relationships are also formidable barriers. ENN Energy's established network and procurement capabilities, evidenced by its 33.4 billion cubic meters of natural gas sales in 2023, are difficult and costly to replicate. New entrants would face immense challenges in securing gas supplies and building comparable distribution systems.

| Barrier Type | Description | Impact on New Entrants | Example Data/Context |

|---|---|---|---|

| Capital Intensity | High investment needed for infrastructure (pipelines, LNG terminals). | Deters entry due to massive upfront costs. | Ongoing 2024 grid expansion requires billions in investment. |

| Regulatory Hurdles | Complex licensing, safety, and environmental compliance. | Requires time, resources, and expertise to navigate. | Stricter environmental compliance emphasized by government in 2024. |

| Existing Infrastructure | Established networks and customer bases of incumbents. | Creates economies of scale and network effects difficult to match. | ENN's 2023 natural gas sales volume of 33.4 billion cubic meters. |

| Supply Chain Access | Securing gas resources and import infrastructure. | Favors established players with existing supplier relationships. | Development of new LNG terminals can cost billions and take years. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ENN Energy Holdings is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and official regulatory filings. We supplement this with insights from reputable industry research firms and macroeconomic databases to capture the full competitive landscape.