EnerSys SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnerSys Bundle

EnerSys, a leader in stored energy solutions, boasts strong brand recognition and a diverse product portfolio, but faces challenges from intense competition and evolving technological landscapes. Understanding these dynamics is crucial for any investor or strategist looking to navigate the energy storage market.

Want the full story behind EnerSys's competitive advantages, potential threats, and opportunities for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

EnerSys commands a robust global leadership position, underscored by its extensive network of manufacturing sites and distribution channels across continents. This international footprint, as of early 2024, enables streamlined operations and resilient supply chains, crucial for meeting diverse market demands efficiently.

The company's strength lies in its exceptionally diversified product portfolio, encompassing lead-acid, Thin Plate Pure Lead (TPPL), and increasingly, lithium-ion battery technologies. This broad offering, complemented by chargers and power systems, serves critical industries like telecommunications, motive power, and defense, mitigating sector-specific risks.

This diversification, coupled with a significant global presence, ensures EnerSys is not overly dependent on any single market segment or technology. For instance, in fiscal year 2023, the company reported net sales of $3.4 billion, with its Motive Power segment contributing approximately 57% and Reserve Power around 43%, showcasing a balanced revenue stream.

EnerSys has showcased impressive financial performance, with net sales reaching $3.6 billion in both fiscal year 2024 and fiscal year 2025. This consistent revenue, coupled with notable adjusted earnings per share growth, highlights the company's strong operational execution and market position.

The company's financial stability is further underscored by a robust balance sheet. EnerSys maintains a low net leverage ratio and healthy cash reserves, providing significant financial flexibility for future investments and strategic initiatives.

EnerSys demonstrates a commitment to shareholder value through consistent share repurchases and dividend payments. This disciplined approach to capital allocation reflects confidence in the company's ongoing profitability and long-term growth prospects.

EnerSys demonstrates a significant strength through its consistent investment in research and development, particularly focusing on cutting-edge battery technologies like lithium-ion and advanced lead-acid chemistries. This dedication ensures they remain at the forefront of innovation in a rapidly evolving energy storage landscape.

This commitment to R&D fuels the creation of high-performance, low-maintenance products. For instance, their NexSys™ BESS energy storage system and Synova™ Sync charger are designed to meet current market needs and provide a competitive advantage. EnerSys's innovative spirit has been recognized through various industry awards, underscoring their leadership in product development and sustainability.

Strategic Acquisitions and Market Expansion

EnerSys’s strategic acquisitions, such as the July 2024 purchase of Bren-Tronics, significantly bolster its defense sector capabilities and expand its lithium-based product portfolio. This move is projected to drive revenue and earnings per share growth in fiscal year 2025, demonstrating a clear path to enhanced financial performance.

The company is making calculated moves to deepen its presence in high-demand markets. By focusing on data centers, industrial automation, and defense, EnerSys is aligning itself with robust structural growth trends and the anticipated increase in global military expenditures.

This forward-thinking strategy is crucial for EnerSys’s sustained growth trajectory and its ambition to capture a larger share of the market.

- Acquisition of Bren-Tronics (July 2024): Enhanced defense applications and expanded lithium product offerings.

- Fiscal Year 2025 Projections: Expected contribution to revenue and EPS growth.

- Targeted High-Growth Sectors: Data centers, industrial automation, and defense.

- Market Alignment: Leveraging structural growth trends and increased global military spending.

Commitment to Sustainability and Operational Efficiency

EnerSys demonstrates a strong commitment to sustainability, targeting company-wide Scope 1 carbon neutrality by 2040. This ambition is supported by concrete actions, such as participation in the U.S. Department of Energy's Better Plants Program to reduce energy intensity.

These sustainability initiatives directly translate into operational efficiencies and significant cost savings for EnerSys. By optimizing energy usage and streamlining processes, the company enhances its bottom line.

The company's dedication to lean manufacturing principles and continuous cost optimization has historically resulted in robust profit margins and healthy cash flow generation. This financial discipline bolsters EnerSys's resilience and capacity for future investment.

- Sustainability Goal: Scope 1 carbon neutrality by 2040.

- Efficiency Programs: Participation in the U.S. Department of Energy's Better Plants Program.

- Financial Impact: Drives operational efficiencies and cost savings, supporting strong margins and cash flow.

EnerSys's market leadership is a significant strength, built on a broad global manufacturing and distribution network. This extensive reach, as of mid-2024, allows for efficient service across diverse geographies and ensures supply chain resilience. The company's diversified product line, including lead-acid, TPPL, and growing lithium-ion offerings, serves critical industries, reducing reliance on any single sector. Financially, EnerSys has shown consistent performance, with net sales reaching $3.6 billion in both fiscal years 2024 and 2025, supported by strong operational execution and a healthy balance sheet with a low net leverage ratio.

EnerSys's commitment to innovation is a key differentiator, with substantial R&D investments in advanced battery technologies like lithium-ion. This focus has yielded high-performance products, such as the NexSys™ BESS, and earned industry recognition. Strategic acquisitions, like Bren-Tronics in July 2024, further bolster its capabilities, particularly in the defense sector and lithium-based products, with projections for fiscal year 2025 revenue and EPS growth. The company's strategic alignment with high-growth markets like data centers and industrial automation, coupled with its focus on defense spending trends, positions it for sustained expansion.

Sustainability is a core strength, with EnerSys targeting Scope 1 carbon neutrality by 2040 and actively participating in energy efficiency programs like the U.S. Department of Energy's Better Plants Program. These efforts not only contribute to environmental goals but also drive operational efficiencies and cost savings, reinforcing the company's robust profit margins and cash flow generation. This financial discipline, combined with a commitment to shareholder value through consistent share repurchases and dividends, underscores EnerSys's financial stability and long-term growth prospects.

| Metric | Fiscal Year 2024 | Fiscal Year 2025 (Projected) | Key Strength |

|---|---|---|---|

| Net Sales | $3.6 billion | $3.6 billion | Consistent revenue, strong market position |

| Global Presence | Extensive manufacturing and distribution | Expanding | Supply chain resilience, market access |

| Product Portfolio | Lead-acid, TPPL, Lithium-ion, chargers | Growing Lithium-ion segment | Diversification, serving critical industries |

| R&D Investment | Significant | Continued focus on advanced batteries | Innovation leadership, competitive products |

| Acquisitions | Bren-Tronics (July 2024) | Integration and growth | Enhanced defense capabilities, expanded lithium offerings |

| Sustainability Goal | Scope 1 carbon neutrality by 2040 | On track | Operational efficiencies, cost savings |

What is included in the product

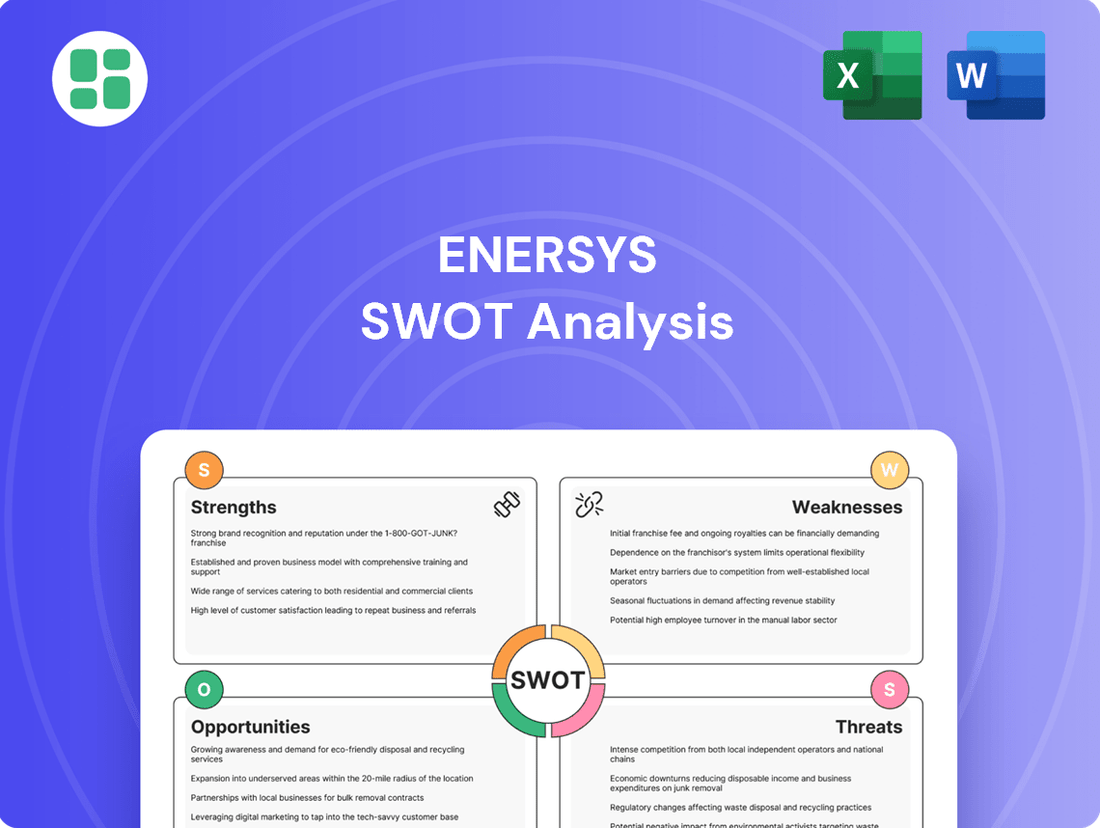

Delivers a strategic overview of EnerSys’s internal and external business factors, highlighting its strengths in product innovation and market leadership, while also identifying weaknesses in supply chain reliance and opportunities in emerging markets and threats from technological disruption.

Offers a clear, actionable framework to identify and address EnerSys's strategic vulnerabilities, turning potential threats into manageable challenges.

Weaknesses

EnerSys's reliance on specific industries means its revenue can swing with market cycles. For example, temporary slowdowns in telecom broadband investments or dips in US manufacturing can directly hit their sales. This cyclicality is a significant weakness.

These spending pauses can cause a noticeable drop in the volume of products sold, impacting short-term financial results. In the fourth quarter of 2024, EnerSys experienced a 6.9% decrease in volume, largely attributed to these telecom spending pauses, highlighting the direct impact of market fluctuations on their performance.

EnerSys's reliance on its manufacturing base presents a significant vulnerability. Disruptions in the global supply chain, a persistent concern, directly impact the company's ability to produce and deliver its energy storage solutions. This dependence means that events like geopolitical instability or natural disasters affecting key manufacturing hubs can halt operations.

Volatility in the prices of essential raw materials, such as lead and lithium, poses another challenge. For instance, lead prices, a critical component in traditional batteries, can fluctuate significantly due to global demand and supply dynamics. In 2024, lead prices have shown considerable movement, impacting the cost of goods sold for EnerSys and potentially squeezing profit margins if not effectively managed through hedging or pass-through mechanisms.

EnerSys operates in a fiercely competitive energy storage market, which is seeing increasing saturation. Strong international rivals, including established giants and emerging companies, particularly from Asia, exert significant pricing pressure. For instance, major players like East Penn Manufacturing and Exide Technologies are constantly vying for market share.

High Operating Costs and Investment Requirements

EnerSys faces substantial operating costs due to its extensive global manufacturing network and ongoing investment in advanced battery technologies. These significant capital expenditures, projected for fiscal year 2025, are necessary for staying competitive but can strain short-term financial performance and cash flow generation.

The company's commitment to continuous research and development, particularly in cutting-edge battery solutions, also contributes to high operating expenses. While vital for future growth and market positioning, these R&D outlays represent a considerable drain on immediate profitability.

- Global Manufacturing Footprint: Maintaining and upgrading facilities worldwide incurs significant operational overhead.

- R&D Investment: Continuous innovation in battery technology requires substantial and ongoing financial commitment.

- Capital Expenditures: Planned investments for fiscal year 2025, estimated in the hundreds of millions, impact short-term cash flow.

- Advanced Technology Expansion: Developing and scaling new battery chemistries and manufacturing processes are capital-intensive endeavors.

Integration Risks from Acquisitions

While EnerSys has pursued strategic acquisitions, such as the acquisition of Bren-Tronics in 2021 for $108 million, these moves introduce integration risks. Combining different operational systems, corporate cultures, and technological platforms can be complex and challenging. Successfully realizing the expected revenue and earnings per share (EPS) growth from these acquisitions hinges on effective post-merger integration and management. Any significant integration hurdles could negatively impact EnerSys's overall financial performance.

EnerSys's reliance on specific industries makes it susceptible to market cycles. For instance, slowdowns in telecom or manufacturing can directly impact sales, as seen in Q4 2024 when volume decreased by 6.9% due to telecom spending pauses.

The company's global manufacturing base is a vulnerability; supply chain disruptions, geopolitical instability, or natural disasters can halt production and delivery of energy storage solutions.

Fluctuations in raw material prices, like lead, a key component in traditional batteries, can squeeze profit margins if not managed effectively. For example, lead prices experienced notable volatility throughout 2024.

EnerSys faces intense competition from established players and emerging companies, particularly in Asia, leading to pricing pressure. Competitors like East Penn Manufacturing and Exide Technologies actively vie for market share.

High operating costs stem from its extensive global manufacturing network and significant investments in advanced battery technologies, impacting short-term cash flow. Planned capital expenditures for fiscal year 2025 are substantial.

Continuous R&D investment in cutting-edge battery solutions, while crucial for future growth, represents a considerable drain on immediate profitability.

Strategic acquisitions, such as the $108 million purchase of Bren-Tronics in 2021, introduce integration risks. Challenges in merging operational systems, cultures, and technologies could hinder the realization of expected growth.

| Weakness | Description | Impact Example |

| Market Cyclicality | Revenue tied to specific industry spending, vulnerable to slowdowns. | Q4 2024 volume down 6.9% due to telecom spending pauses. |

| Supply Chain Dependence | Reliance on global manufacturing; disruptions halt production. | Geopolitical instability or natural disasters can impede operations. |

| Raw Material Price Volatility | Fluctuations in lead and lithium prices affect costs. | Lead price movements in 2024 impacted cost of goods sold. |

| Intense Competition | Saturation in energy storage market leads to pricing pressure. | Rivals like East Penn and Exide compete for market share. |

| High Operating Costs | Global manufacturing and R&D investments strain cash flow. | Significant capital expenditures planned for FY2025. |

| Acquisition Integration Risks | Post-merger challenges can impact financial performance. | Integration of Bren-Tronics (2021) requires careful management. |

Preview the Actual Deliverable

EnerSys SWOT Analysis

The preview you see is the actual EnerSys SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at the company's Strengths, Weaknesses, Opportunities, and Threats, providing valuable insights for strategic decision-making.

Opportunities

The global market for energy storage is experiencing significant growth, projected to reach $261.7 billion by 2027, up from $101.1 billion in 2022, according to MarketsandMarkets. This expansion is fueled by the increasing adoption of electric vehicles and renewable energy sources, creating a substantial opportunity for companies like EnerSys. EnerSys's expertise in battery technology and energy storage systems positions it to meet the rising demand for reliable and efficient power solutions across various sectors.

The global shift towards renewable energy, like solar and wind power, coupled with the increasing electrification of industries, offers a substantial growth runway for EnerSys. This trend is particularly evident in material handling and industrial automation, sectors where EnerSys has a strong presence.

EnerSys's innovative battery and energy management solutions, including their NexSys™ BESS (Battery Energy Storage Systems), are strategically positioned to capitalize on this expansion. These systems are engineered to optimize energy usage and reduce costs for businesses transitioning to cleaner energy sources and electrified operations.

The Inflation Reduction Act (IRA) in the United States offers substantial tax incentives. The 45x Advanced Manufacturing Production Credit, for instance, is projected to deliver significant annual benefits to EnerSys, bolstering its financial performance.

These tax credits are instrumental in enhancing EnerSys's operating margins and overall profitability. This improved financial health allows the company to more readily fund its future growth initiatives and necessary investments, potentially reducing reliance on debt financing.

Technological Advancements in Lithium-Ion and Maintenance-Free Batteries

EnerSys is well-positioned to capitalize on the growing demand for advanced battery technologies. The company's strategic focus on higher-margin, maintenance-free solutions like lithium-ion and Thin Plate Pure Lead (TPPL) is a significant opportunity. These technologies are seeing increased adoption across critical industries such as motive power, aerospace, and data centers, where reliability and reduced upkeep are paramount.

This shift allows EnerSys to enhance its profitability on a per-unit basis. By expanding its manufacturing capacity and product portfolio in these cutting-edge battery segments, the company is aligning itself with market trends that favor performance and efficiency. For instance, the global motive power battery market, heavily influenced by electric forklift adoption, is projected to reach approximately $18.3 billion by 2029, with lithium-ion batteries capturing an increasing share.

- Increased Demand: Growing adoption of lithium-ion and TPPL batteries in motive power, aerospace, and data centers.

- Higher Profitability: Focus on higher-margin, maintenance-free battery technologies drives improved profitability per unit.

- Market Expansion: EnerSys is expanding offerings and manufacturing capabilities to meet this rising demand.

Strategic Restructuring and Operational Optimization

EnerSys's strategic restructuring, including workforce adjustments and manufacturing network streamlining, is designed to enhance efficiency and concentrate on lucrative technologies. These efforts are projected to yield substantial annualized cost reductions and foster better operational control.

This optimization allows for greater allocation of capital and skilled personnel towards innovation and expansion into rapidly growing markets. For instance, the company's focus on advanced battery technologies for motive power and energy storage solutions is a key area benefiting from this strategic shift.

The company has been actively optimizing its manufacturing footprint, a process that often involves consolidating operations or closing less efficient facilities. This aligns with a broader trend in the industrial sector towards leaner operations and greater supply chain resilience, especially in light of global economic shifts observed through 2024 and into 2025.

The anticipated annualized cost savings from these restructuring initiatives are a critical factor in improving EnerSys's profitability and competitive positioning. By reducing overhead and improving workflow, the company can better invest in research and development, a vital component for staying ahead in the rapidly evolving energy storage market.

EnerSys is poised to benefit from the accelerating global transition to cleaner energy and increased industrial electrification, particularly in material handling. The company's advanced battery solutions, such as NexSys™ BESS, are well-suited to meet this growing demand. Furthermore, favorable government incentives, like the US Inflation Reduction Act, are expected to significantly enhance EnerSys's financial performance and profitability.

Threats

The battery industry is experiencing a whirlwind of technological change. Innovations like solid-state batteries and advanced lithium-ion chemistries are emerging at a rapid pace, creating a significant threat of obsolescence for existing technologies. EnerSys faces the challenge of keeping its product offerings current in this dynamic environment.

To counter this, substantial and ongoing investment in research and development is crucial for EnerSys. Failing to adapt quickly means risking a loss of market share to nimbler competitors who can capitalize on these new battery technologies. For instance, the global battery market is projected to reach over $200 billion by 2027, highlighting the immense potential and the competitive pressure to innovate.

EnerSys faces significant threats from the volatility of raw material prices, particularly for lithium and lead, which are crucial for battery production. For instance, lead prices saw considerable fluctuations throughout 2023 and early 2024, impacting manufacturing costs. This price instability directly affects the company's cost of goods sold and, consequently, its profit margins.

Furthermore, global supply chain vulnerabilities pose a substantial risk. Disruptions stemming from geopolitical events, trade disputes, or unforeseen logistical challenges can impede the timely and cost-effective procurement of essential components. The ongoing impact of trade policies, including tariffs on imported materials, adds another layer of complexity and potential cost escalation for EnerSys.

Economic downturns pose a significant threat, as a general contraction or specific slowdowns in manufacturing and transportation, key sectors for EnerSys, can directly reduce demand for its energy storage solutions. For instance, a widespread recession in 2024 or 2025 could see industrial clients delaying capital expenditures on new equipment, impacting EnerSys's sales pipeline.

While EnerSys benefits from diversification across various industries, a prolonged and severe economic contraction could still lead to a broad-based decline in sales and revenue, even with its varied customer base. The company's performance is inherently tied to the health of the global economy, and widespread economic weakness would likely translate into lower order volumes.

Regulatory Changes and Environmental Compliance Costs

Evolving environmental regulations, especially those impacting battery production, disposal, and recycling, present a significant threat. Stricter rules could necessitate substantial capital outlays for EnerSys to adopt new manufacturing processes and advanced recycling technologies, potentially squeezing profit margins.

These increased compliance costs, driven by a global push for sustainability, could impact EnerSys's operational expenses. For instance, the European Union's Battery Regulation, fully applicable from February 2024, mandates specific recycled content and carbon footprint reporting, which could require significant investment in supply chain transparency and material sourcing.

- Increased Capital Expenditures: Investments in greener manufacturing and advanced recycling infrastructure.

- Operational Cost Escalation: Higher expenses related to compliance, reporting, and waste management.

- Supply Chain Adjustments: Need to source materials that meet new environmental standards, potentially at higher costs.

Geopolitical Tensions and Trade Barriers

Heightened geopolitical tensions and the potential for new trade barriers present a significant threat to EnerSys. These disruptions can severely impact international supply chains, leading to increased costs for importing and exporting essential components and finished goods. For instance, the ongoing trade disputes and regional conflicts in various parts of the world, as observed throughout 2024 and into early 2025, have already demonstrated their capacity to escalate shipping expenses and create uncertainty in market access. This directly affects EnerSys's ability to maintain competitive pricing for its energy storage solutions and execute its global market strategies effectively.

The imposition of tariffs or other trade restrictions can directly inflate the cost of raw materials and finished products for EnerSys, a company with a significant global manufacturing and distribution footprint. This could lead to:

- Increased operational costs: Tariffs on key components like lithium or nickel could raise production expenses.

- Reduced market access: Import restrictions in certain countries might limit EnerSys's ability to sell its products.

- Supply chain volatility: Geopolitical instability can lead to unpredictable disruptions in the availability of critical materials.

- Competitive disadvantage: Competitors in regions with fewer trade barriers might gain a pricing advantage.

EnerSys faces a significant threat from rapid technological advancements in battery technology, such as solid-state batteries, which could render its current offerings obsolete. The company must invest heavily in R&D to stay competitive, as the global battery market is projected to exceed $200 billion by 2027. Additionally, volatility in raw material prices, particularly for lead and lithium, directly impacts EnerSys's cost of goods sold and profit margins, as seen with lead price fluctuations throughout 2023 and early 2024.

SWOT Analysis Data Sources

This EnerSys SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analysis to provide a thorough strategic overview.