EnerSys Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnerSys Bundle

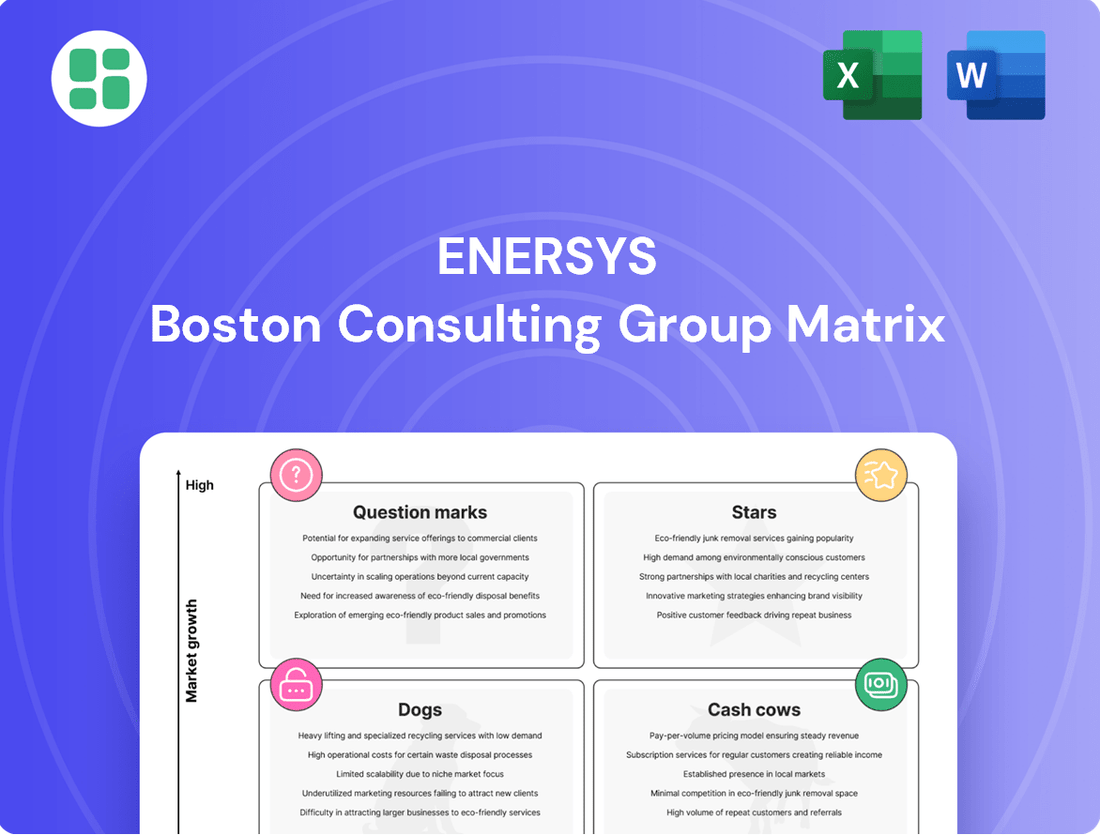

Uncover the strategic positioning of EnerSys's product portfolio with our insightful BCG Matrix preview. See where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and understand the immediate implications for their market performance.

This glimpse into EnerSys's BCG Matrix is just the starting point. Purchase the full report to gain a comprehensive understanding of each product's potential, unlock data-driven recommendations, and develop a winning strategy for resource allocation and future growth.

Stars

EnerSys's advanced lithium-ion solutions for industrial electrification represent a significant growth opportunity, aligning with the company's strategic focus on high-potential markets. The demand for these batteries is surging, fueled by the global push for electrification across various industrial applications, from material handling to motive power.

This segment is experiencing robust market growth, with projections indicating continued expansion as industries prioritize sustainability and operational efficiency. EnerSys is making substantial investments, including a planned gigafactory in South Carolina, to bolster its manufacturing capacity and meet this escalating demand. By enhancing its lithium-ion product portfolio, EnerSys aims to solidify its position as a key player in the industrial electrification revolution.

The demand for dependable energy for data centers is soaring, driven by the expansion of AI, IoT, and edge computing. This makes energy storage systems a rapidly growing market segment.

EnerSys holds a significant market share in providing battery backup solutions for data centers. The company is actively developing advanced energy storage systems to address the increasing needs for reliability and sustainability in this vital industry.

EnerSys's Specialty segment, which includes high-performance batteries for defense and aerospace, is seeing significant growth. This is largely due to increased global defense budgets, creating a strong demand for their specialized products.

The acquisition of Bren-Tronics in July 2024 was a key move, significantly boosting EnerSys's capabilities and market share in the military and defense sector. This strategic expansion highlights the company's commitment to this lucrative and expanding market.

Fast Charge and Storage Solutions

EnerSys's Fast Charge and Storage Solutions are poised to become stars in its product portfolio, with initial revenues expected in fiscal year 2025. This segment addresses the burgeoning demand for efficient energy management, particularly from renewable sources and for peak shaving applications. The introduction of products like the NexSys™ BESS energy storage system and Synova™ Sync charger highlights EnerSys's strategic move into this high-growth market.

The market for battery energy storage systems (BESS) is experiencing significant expansion. For instance, global BESS installations are projected to reach approximately 300 GW by 2030, a substantial increase from around 50 GW in 2023. This growth is driven by the increasing integration of intermittent renewables like solar and wind power, and the need for grid stability.

- Market Growth: The global BESS market is anticipated to grow at a compound annual growth rate (CAGR) of over 15% through 2030, indicating substantial opportunity for EnerSys's new offerings.

- Renewable Integration: As renewable energy sources become more prevalent, the demand for storage solutions to manage their intermittency is escalating rapidly.

- Peak Shaving Demand: Businesses and utilities are increasingly adopting energy storage to reduce costs by shaving peak demand charges, a key application for EnerSys's solutions.

- Technological Advancement: Continuous innovation in battery technology and charging infrastructure, exemplified by NexSys™ and Synova™, is crucial for capturing market share in this dynamic sector.

Maintenance-Free Motive Power Products

EnerSys's maintenance-free motive power products are a prime example of a Star in the Boston Consulting Group (BCG) matrix. These products, particularly batteries for electric forklifts and commercial electric vehicles, are driving significant volume growth for the company. This segment is benefiting from the broader trend of modernization, automation, and electrification in industries that rely on material handling and transportation.

The company holds a strong position in this growing market, which is characterized by a shift towards higher-value, less labor-intensive solutions. As of fiscal year 2024, EnerSys reported robust performance in its Motive Power segment, with net sales increasing year-over-year, largely attributed to the demand for these advanced battery technologies.

- High Market Share: EnerSys is a leader in the motive power battery market, especially with its advanced, maintenance-free offerings.

- Strong Volume Growth: The demand for electric forklifts and vehicles is fueling substantial sales volume increases for these products.

- Industry Modernization: The segment aligns with industry trends towards automation and electrification, favoring less labor-intensive solutions.

- Fiscal Year 2024 Performance: The Motive Power segment demonstrated healthy revenue growth, underscoring the success of its maintenance-free product lines.

EnerSys's advanced lithium-ion solutions for industrial electrification and its maintenance-free motive power products are prime examples of Stars in the BCG matrix. These segments exhibit high market share and are in high-growth markets, driving significant revenue for the company. The demand for these products is fueled by global electrification trends, industry modernization, and the increasing adoption of electric vehicles and equipment.

The company's Fast Charge and Storage Solutions, including products like NexSys™ BESS and Synova™ Sync chargers, are also positioned as Stars. These offerings cater to the rapidly expanding market for battery energy storage systems, driven by renewable energy integration and the need for grid stability. EnerSys's strategic investments, such as the planned South Carolina gigafactory, underscore its commitment to capturing growth in these dynamic sectors.

| Product Segment | Market Growth | Market Share | EnerSys's Position |

|---|---|---|---|

| Industrial Electrification (Lithium-ion) | High | Strong | Star |

| Motive Power (Maintenance-Free) | High | Leading | Star |

| Fast Charge & Storage Solutions (BESS) | High | Growing | Emerging Star |

What is included in the product

The EnerSys BCG Matrix analyzes its product portfolio by market share and growth, guiding strategic decisions.

A clear, visual BCG Matrix that pinpoints EnerSys's business units, alleviating the pain of strategic uncertainty.

Cash Cows

Traditional motive power lead-acid batteries are EnerSys's cash cows. These batteries, powering common equipment like standard forklifts, are a major revenue and profit driver for the company, churning out significant cash flow.

Although the growth rate for these established products is modest, EnerSys enjoys a dominant market position. This strong market share ensures a steady and reliable contribution to the company's overall financial health and stability, as seen in their consistent performance.

EnerSys holds a commanding position in the battery backup market for established telecommunications and broadband infrastructure, acting as a true cash cow. This sector, while experiencing some temporary spending slowdowns, represents a mature and stable market for the company.

Despite occasional pauses in capital expenditure by telecom providers, the essential nature of reliable power backup ensures consistent demand for EnerSys's products. This allows the company to generate steady cash flow with minimal need for aggressive marketing or promotional spending, a hallmark of a strong cash cow.

In 2024, the telecommunications sector continued its essential role, with companies like AT&T and Verizon investing billions in network maintenance and upgrades, underscoring the ongoing need for robust backup power solutions. EnerSys's established relationships and proven reliability in this space solidify its cash cow status.

EnerSys's Uninterrupted Power Supply (UPS) batteries for commercial use represent a classic Cash Cow. This segment benefits from a mature market where EnerSys holds a commanding position, ensuring consistent and predictable revenue. The demand for reliable backup power in commercial operations, from data centers to manufacturing, remains strong.

These battery solutions are vital for business continuity, making them essential purchases for many companies. The established market share and consistent demand mean that EnerSys can generate substantial profits with relatively low investment needs for maintenance and market upkeep. For instance, the global UPS market was valued at approximately $10.5 billion in 2023 and is projected to grow steadily, underscoring the stability of this sector for EnerSys.

Aftermarket Sales of Transportation Batteries

EnerSys views aftermarket sales of transportation batteries as a Cash Cow. This segment, primarily serving large trucks and premium automotive applications, is expected to see steady growth. The recurring nature of replacement and maintenance needs ensures a consistent revenue stream.

The transportation aftermarket is a mature market, meaning demand is stable and predictable. EnerSys's established presence in supplying batteries for these vehicles positions them well to capitalize on this ongoing demand. In 2024, the global automotive aftermarket was valued at over $400 billion, with battery replacements being a significant component.

- Stable Revenue: The aftermarket provides predictable cash flow due to consistent replacement needs.

- Mature Market: High adoption rates in transportation sectors ensure ongoing demand.

- Recurring Sales: Replacement cycles for batteries in trucks and premium vehicles drive repeat business.

- Market Size: The automotive aftermarket, a key area for transportation batteries, is a multi-billion dollar industry.

Legacy Chargers and Power Equipment

EnerSys's legacy chargers and power equipment represent a stable component of their business, acting as crucial support for their extensive battery offerings. These products are likely cornerstones in mature markets, benefiting from a substantial installed base of EnerSys batteries. They generate consistent, predictable cash flow, even if the growth potential is limited.

These mature products are designed to complement EnerSys's established battery lines, ensuring continued functionality and customer loyalty. Their high market share in niche segments translates into reliable revenue streams, reinforcing their status as cash cows within the company's portfolio.

- Steady Revenue: Legacy chargers and power equipment contribute predictable cash flow due to their essential role for existing battery installations.

- Mature Market Dominance: These products likely hold a significant market share in their respective, well-established market segments.

- Low Growth, High Profitability: While growth may be modest, the established nature of these products often leads to high profitability and efficient operations.

- Support for Installed Base: They are vital accessories that maintain the value and utility of EnerSys's large installed battery base.

EnerSys's traditional motive power lead-acid batteries are prime examples of their cash cows. These batteries, essential for standard forklifts and similar equipment, consistently generate substantial revenue and profit. While the growth in this segment is modest, EnerSys's dominant market position ensures a steady and reliable cash flow, contributing significantly to the company's financial stability.

The company also benefits from its strong position in the battery backup market for telecommunications and broadband infrastructure, another key cash cow. Despite occasional slowdowns in capital expenditure by telecom providers, the critical need for reliable power backup guarantees consistent demand for EnerSys's products, generating predictable cash flow with minimal marketing investment.

EnerSys's Uninterrupted Power Supply (UPS) batteries for commercial applications are also considered cash cows. This mature market, where EnerSys holds a commanding share, provides consistent and predictable revenue streams, vital for business continuity across sectors like data centers and manufacturing. The global UPS market's steady growth, valued at approximately $10.5 billion in 2023, highlights the stability of this segment.

Aftermarket sales of transportation batteries, particularly for large trucks and premium automotive applications, represent another cash cow for EnerSys. The recurring need for replacements and maintenance in this mature market ensures a consistent revenue stream. The global automotive aftermarket, a significant arena for these batteries, was valued at over $400 billion in 2024, underscoring the substantial and stable demand.

| Product Segment | BCG Category | Key Characteristics | 2024 Market Relevance |

| Motive Power Lead-Acid Batteries | Cash Cow | Dominant market share, stable demand, modest growth | Essential for forklifts and industrial equipment, consistent revenue |

| Telecom/Broadband Backup Batteries | Cash Cow | Mature market, critical infrastructure support, predictable cash flow | Supports essential telecom networks, ongoing demand despite CAPEX fluctuations |

| Commercial UPS Batteries | Cash Cow | High market share, vital for business continuity, steady revenue | Supports data centers and commercial operations, stable market growth |

| Transportation Aftermarket Batteries | Cash Cow | Recurring replacement needs, mature market, consistent sales | Significant portion of the $400B+ global automotive aftermarket |

Delivered as Shown

EnerSys BCG Matrix

The EnerSys BCG Matrix document you are previewing is the complete, unwatermarked report you will receive immediately after purchase. This means the strategic insights, detailed analysis, and professional formatting you see are precisely what you'll download, ready for immediate application in your business planning and decision-making processes.

Dogs

EnerSys's older lead-acid battery formulations, particularly those not incorporating advanced materials or designs, are likely categorized as Dogs. These products face declining demand as newer, more efficient battery technologies like lithium-ion gain traction, impacting their market share in a potentially shrinking segment.

For instance, while specific figures for these exact formulations aren't publicly detailed by EnerSys, the broader lead-acid battery market experienced a compound annual growth rate (CAGR) of around 3% to 4% in the years leading up to 2023, with growth concentrated in specific applications. Older, less advanced types within this market would naturally lag behind, exhibiting much lower or negative growth.

These Dog products generate minimal cash flow and may even require ongoing investment to maintain production or comply with evolving regulations, thus tying up valuable company resources that could be better allocated to Stars or Question Marks.

Older EnerSys power equipment, particularly legacy models and chargers, often lack the sophisticated cloud connectivity and advanced energy management features demanded by today's integrated systems. This technological gap can lead to a decline in market relevance as industries increasingly prioritize smart, interconnected solutions for efficiency and control.

If EnerSys has not actively updated these older product lines, they may represent a low market share within a rapidly evolving landscape. For instance, the global industrial battery market, which includes many of these legacy products, was valued at approximately $50 billion in 2023 and is projected to grow significantly, with a strong emphasis on smart battery management systems.

EnerSys, while strong in many areas, might have products catering to industrial sectors facing long-term contraction. Think about battery solutions for legacy manufacturing equipment or specific types of mining operations that are seeing reduced demand. These would likely represent EnerSys's "dogs" in the BCG matrix.

These "dog" products would be characterized by a low market share within these declining industrial segments. For instance, if a particular industrial sector, like traditional print media machinery, shrinks by an estimated 5% annually, and EnerSys's share of battery solutions for that niche is minimal, it fits the dog profile. Such offerings provide little growth potential and may even drain resources.

Underperforming Regional Product Lines

EnerSys, a global leader in stored energy solutions, faces challenges with certain regional product lines that are underperforming. These specific segments may be experiencing low market share and limited growth potential due to factors like intense local competition or adverse economic conditions within those particular geographic areas. For instance, in 2024, EnerSys's motive power segment in a specific European region saw a modest 2% year-over-year revenue increase, significantly lagging behind the company's overall 7% global growth for that segment, attributed to a strong presence of local battery manufacturers.

This underperformance necessitates a strategic re-evaluation. Decisions might involve divesting these specific regional product lines to focus resources on more promising markets or reducing investment to minimize further losses. Such a strategic move aligns with optimizing the company's portfolio for maximum efficiency and return on investment.

- Underperforming Regional Segments: Identified product lines in specific geographic markets are showing signs of stagnation.

- Key Drivers: Intense local competition and unfavorable regional economic conditions are primary contributors to underperformance.

- Strategic Implications: Potential for divestiture or reduced investment in these underperforming areas to reallocate capital.

- Example Scenario: A regional motive power segment in Europe experienced only 2% growth in 2024, falling short of global averages due to strong local competitors.

High-Maintenance, Low-Margin Offerings

EnerSys might classify certain product lines as "dogs" if they demand substantial ongoing maintenance and customer support, yet consistently generate low profit margins. These offerings drain valuable resources, diverting attention and capital from more profitable ventures. For example, if a legacy battery management system requires extensive technical assistance and software updates but contributes less than 5% to overall gross profit, it fits this category.

These "dogs" can negatively impact the company's financial health by consuming operational capacity without delivering commensurate returns. The strategic imperative is to identify these underperforming assets and consider options such as phasing them out or reducing investment to free up resources for growth areas. In 2024, EnerSys's focus on optimizing its product portfolio suggests a proactive approach to managing such offerings.

- Low Profitability: Products with gross profit margins below 10% that also have high service costs.

- Resource Drain: Offerings that consume a disproportionate amount of engineering or support staff time relative to their revenue contribution.

- Market Stagnation: Products in declining or saturated markets where further investment is unlikely to yield significant growth.

- Divestment Potential: Identifying these "dogs" allows for strategic decisions regarding minimization or divestment to improve overall portfolio efficiency.

EnerSys's "dogs" likely include older, less advanced lead-acid battery technologies and legacy equipment that face declining demand. These products, while potentially still functional, are overshadowed by newer, more efficient alternatives like lithium-ion, leading to a shrinking market share and minimal growth potential. For instance, the broader industrial battery market saw significant shifts towards advanced chemistries, with lead-acid's share facing pressure in applications demanding higher energy density and faster charging.

These offerings often require continued investment for maintenance or regulatory compliance, diverting resources from more promising segments. In 2024, EnerSys's strategic focus on portfolio optimization suggests an ongoing evaluation of such products to either divest or minimize investment, thereby improving overall operational efficiency and capital allocation towards Stars and Question Marks.

Products with low profitability and high service costs, or those in declining industrial sectors, represent EnerSys's "dogs." These segments, characterized by low market share and limited growth prospects, can drain resources without delivering commensurate returns. For example, a niche battery solution for a legacy manufacturing process that is itself in decline would fit this profile.

The company's performance in certain regional markets in 2024, where growth lagged behind global averages due to intense local competition, also highlights potential "dog" segments. These underperforming areas might necessitate divestiture or reduced investment to reallocate capital to more robust markets.

| Category | Description | Market Share | Market Growth | Strategic Consideration |

|---|---|---|---|---|

| Legacy Lead-Acid Batteries | Older formulations, less efficient than newer technologies. | Low | Declining or Stagnant | Divest or Minimize Investment |

| Outdated Power Equipment | Legacy chargers and systems lacking modern connectivity. | Low | Declining | Phasing Out or Support Reduction |

| Niche Industrial Solutions | Batteries for shrinking industrial sectors (e.g., legacy machinery). | Low | Negative or Stagnant | Divestment |

| Underperforming Regional Segments | Specific product lines in geographic areas with low growth and high competition. | Low | Below Average | Divestiture or Resource Reallocation |

Question Marks

EnerSys is actively developing advanced battery energy storage systems (BESS) tailored for renewable energy integration, a sector experiencing explosive growth. The global BESS market was valued at approximately $23.4 billion in 2023 and is projected to reach over $100 billion by 2030, demonstrating its significant expansion.

These innovative solutions position EnerSys to capitalize on the increasing demand for grid stability and renewable energy intermittency management. However, as a relatively new entrant in this rapidly evolving and competitive landscape, EnerSys's current market share in emerging BESS segments might be modest, necessitating continued investment in research, development, and manufacturing capacity to achieve significant scale and market penetration.

EnerSys's acquisition of Bren-Tronics significantly bolsters its presence in the defense sector, particularly in portable power solutions and a range of lithium batteries for military clients. This strategic move positions EnerSys to capitalize on the increasing demand for advanced power sources driven by evolving geopolitical landscapes.

The specialized batteries for new military applications represent a growth area for EnerSys, likely fitting into the question mark category of the BCG matrix. While this segment is expanding, it often involves niche, cutting-edge technologies where EnerSys is actively developing its market share, necessitating ongoing strategic investment to maintain a competitive edge.

EnerSys is exploring next-generation chargers, such as the Synova™ Sync, that enable two-way data and energy flow. This technology positions EnerSys to capitalize on the burgeoning smart energy management market, a sector projected for significant expansion in the coming years.

These advanced chargers are likely in the early stages of market adoption, indicating a smaller current market share within a high-growth technological segment. This aligns with the characteristics of a question mark in the BCG matrix, suggesting potential for future growth if market acceptance accelerates.

New Ventures in Advanced Automation and Robotics Power

EnerSys is strategically positioned to benefit from the burgeoning demand for advanced automation, particularly in powering robotics and automated guided vehicles (AGVs). This sector is experiencing significant expansion, with the global AGV market projected to reach approximately $10 billion by 2027, growing at a CAGR of over 15%.

While this market presents substantial growth opportunities, EnerSys's specific offerings within these advanced applications are likely still in their formative stages of market penetration. Continued investment in research and development, alongside aggressive market development strategies, will be crucial for EnerSys to capture a larger share of this dynamic and evolving industry.

- Market Growth: The global robotics market is expected to exceed $200 billion by 2030, driven by increased adoption in manufacturing, logistics, and healthcare.

- AGV Penetration: AGVs are becoming increasingly vital in warehouses and distribution centers, with adoption rates climbing as companies seek to improve efficiency and reduce labor costs.

- EnerSys's Role: EnerSys's advanced battery and power solutions are critical enablers for the extended operational uptime and performance required by these sophisticated automated systems.

- Strategic Focus: Continued innovation in energy density, charging speed, and battery management systems will be key for EnerSys to maintain a competitive edge in this high-growth segment.

Lithium-Ion Cell Gigafactory Production

EnerSys's strategic decision to build a lithium-ion cell gigafactory in South Carolina, with operations slated for late 2027, positions the company for substantial future growth. This ambitious project, representing a significant capital outlay, aims to tap into the burgeoning electric vehicle and energy storage markets.

While EnerSys currently holds a minimal share of actual lithium-ion cell production, this gigafactory project is designed to catapult them into a leadership position. It's a classic case of a potential future star in the BCG matrix, requiring significant investment now for anticipated high future returns.

- Projected Investment: EnerSys has committed to a substantial investment in the South Carolina gigafactory, though specific figures for the total project cost are still being finalized.

- Market Potential: The global lithium-ion battery market is projected to reach hundreds of billions of dollars by the end of the decade, driven by EV adoption and renewable energy integration.

- Operational Timeline: Production is anticipated to commence in late 2027, marking a significant long-term commitment to establishing a strong presence in cell manufacturing.

- Strategic Significance: This move diversifies EnerSys's portfolio beyond its traditional battery solutions, aiming to capture a larger share of the rapidly expanding battery technology sector.

EnerSys's venture into specialized military lithium batteries and advanced chargers for smart energy management represents classic question mark scenarios. These areas exhibit high market growth potential but currently have modest market share for EnerSys.

Significant investment in research, development, and market penetration is required to transform these segments into future stars. The success hinges on accelerating market adoption and maintaining a competitive technological edge.

The company's strategic focus on powering robotics and AGVs also falls into this category, demanding continued innovation to capture a larger portion of this expanding market.

| Segment | Market Growth Potential | Current Market Share (EnerSys) | Investment Needs |

|---|---|---|---|

| Military Lithium Batteries | High | Modest | High (R&D, Production) |

| Smart Energy Management Chargers | High | Low | High (Market Development) |

| Robotics & AGV Power Solutions | High | Developing | High (Innovation, Sales) |

BCG Matrix Data Sources

Our EnerSys BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.