EnerSys Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnerSys Bundle

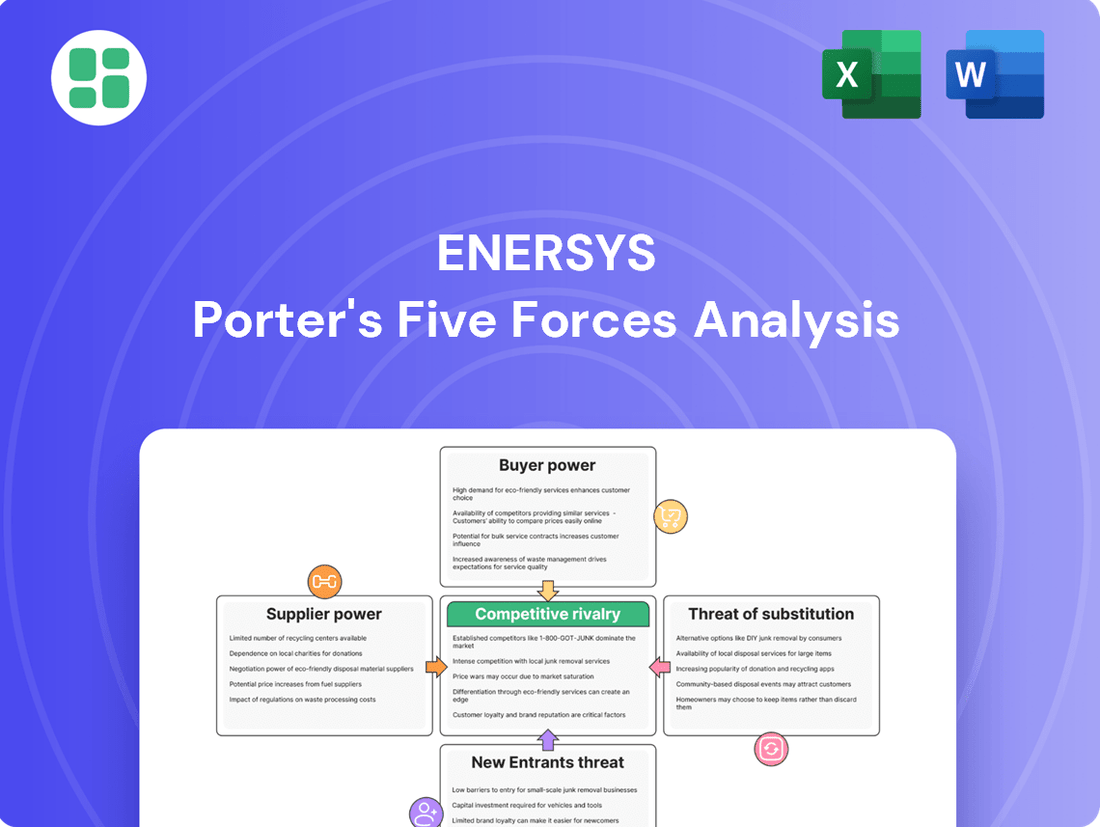

EnerSys operates in a dynamic market shaped by intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this landscape effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore EnerSys’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The supply chain for crucial battery components like lithium, cobalt, nickel, and graphite is heavily concentrated. A significant portion of these materials originates from just a few countries, with China being a prime example. This geographic concentration grants substantial bargaining power to these suppliers.

This concentration is amplified by geopolitical factors and potential export restrictions. These elements can introduce price instability and create disruptions in the availability of essential raw materials, impacting companies like EnerSys.

Manufacturing industrial batteries, particularly for sectors like motive power and energy storage, frequently necessitates highly specialized components and sophisticated production machinery. Suppliers offering proprietary materials or advanced manufacturing equipment, such as those crucial for Thin Plate Pure Lead (TPPL) battery technology or cutting-edge lithium-ion cell production, can wield significant bargaining power. For instance, companies specializing in high-purity lead or advanced electrolyte formulations can command premium pricing due to the limited number of qualified providers.

Switching suppliers for critical raw materials or complex components can be costly and time-consuming for EnerSys, impacting their bargaining power. For instance, transitioning to a new battery component supplier might involve extensive testing and validation to ensure compatibility and performance, a process that can extend product development cycles and incur significant R&D expenses.

These high switching costs translate into increased supplier power because EnerSys faces substantial hurdles in finding and integrating alternative sources. This includes the expense and time associated with qualifying new materials, potential retooling of production lines, and rigorous efforts to ensure new components meet the same product performance and safety standards EnerSys is known for.

Supplier Industry Growth and Profitability

The burgeoning demand for batteries, particularly from the electric vehicle (EV) and energy storage sectors, is a significant tailwind for battery component and raw material suppliers. This increased demand translates into a more favorable market for these suppliers, enabling them to negotiate better terms and potentially increase prices. For instance, the global automotive battery market was projected to reach over $150 billion by 2024, a substantial increase indicating robust demand for the underlying materials.

This strong market position for suppliers means they can exert greater influence over pricing and supply agreements, directly impacting EnerSys's cost of goods sold. Suppliers experiencing high growth and profitability are less incentivized to offer discounts or flexible terms, thereby increasing the bargaining power they hold over their customers like EnerSys.

- Increased Demand: The global push towards electrification, especially in transportation and grid-scale energy storage, fuels a consistent rise in battery production.

- Supplier Profitability: High demand allows suppliers to pass on increased raw material costs and maintain healthy profit margins, reducing their need to concede on pricing.

- Pricing Power: Suppliers of critical battery components and raw materials, such as lithium, cobalt, and nickel, are in a strong position to command higher prices due to limited supply and escalating demand.

- Impact on EnerSys: This dynamic can lead to higher input costs for EnerSys, potentially squeezing profit margins if these costs cannot be fully passed on to end customers.

Forward Integration Threat

The threat of forward integration by suppliers, while less pronounced for industrial battery manufacturers like EnerSys compared to consumer electronics, still represents a potential lever for suppliers. Some significant raw material providers or component manufacturers could explore integrating into battery cell production themselves, thereby becoming direct competitors. This possibility, even if not fully realized, can subtly bolster their bargaining power during price negotiations with EnerSys.

For instance, a major supplier of lithium or cobalt, critical components in many battery technologies, might assess the profitability of moving up the value chain. While EnerSys's focus on specialized industrial applications may deter some broad-based integration, the underlying risk remains. In 2024, the global battery market continued its expansion, driven by electric vehicles and energy storage, making upstream integration a more attractive proposition for large material suppliers seeking to capture greater value.

- Forward Integration Risk: Key raw material suppliers or component manufacturers may consider producing battery cells, potentially competing with EnerSys.

- Subtle Leverage: This threat, even if indirect, can strengthen supplier negotiating positions concerning pricing and terms.

- Market Dynamics: The growing global battery market in 2024 incentivizes upstream players to explore value chain expansion.

The bargaining power of suppliers for EnerSys is considerable, primarily due to the concentrated nature of raw material sourcing and the specialized components required for industrial batteries. Geopolitical factors and high switching costs further amplify this power, allowing suppliers to influence pricing and supply terms, impacting EnerSys's cost structure.

The increasing global demand for batteries, especially from the electric vehicle and energy storage sectors, strengthens supplier profitability and pricing power. This trend, evident in the projected growth of the automotive battery market to over $150 billion by 2024, means suppliers are less likely to offer concessions.

Suppliers of critical materials like lithium, cobalt, and nickel, along with those providing specialized manufacturing equipment or proprietary components, hold significant leverage. The potential for these suppliers to engage in forward integration into battery cell production also subtly bolsters their negotiating position.

| Factor | Impact on EnerSys | Supporting Data (2024 Projections/Trends) |

|---|---|---|

| Raw Material Concentration | Increased supplier leverage on pricing and availability | Limited number of countries dominate lithium, cobalt, nickel, graphite production. |

| Specialized Components | Suppliers of proprietary materials or advanced machinery have pricing power | Demand for TPPL and advanced lithium-ion components is high. |

| High Switching Costs | Makes it difficult for EnerSys to change suppliers, increasing supplier power | Costs include extensive testing, validation, and potential retooling. |

| Growing Battery Demand | Strengthens supplier profitability and pricing power | Global automotive battery market projected over $150 billion by 2024. |

| Forward Integration Risk | Potential for suppliers to become competitors, enhancing their leverage | Expansion of the global battery market incentivizes upstream players. |

What is included in the product

This analysis dissects the competitive forces impacting EnerSys, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the battery and energy storage industry.

Instantly identify and address critical competitive pressures within the energy storage market, allowing for proactive strategic adjustments.

Customers Bargaining Power

EnerSys's diverse customer base, spanning telecommunications, transportation, energy systems, and aerospace, significantly weakens customer bargaining power. No single industry segment holds enough sway to dictate terms, as revenue streams are spread across various demanding sectors. For instance, in 2023, EnerSys reported revenue from industrial end markets, with no single market representing an overwhelming portion of sales, underscoring this diversification.

EnerSys's batteries are crucial for many industries, powering everything from data centers to forklifts and military equipment. This essential role means customers often focus more on getting dependable power, rather than squeezing every last penny out of a deal.

Because these power solutions are so vital, customers are less likely to switch suppliers based solely on price. This gives EnerSys a stronger position in negotiations, as reliability and performance become the primary drivers for purchasing decisions.

While EnerSys serves a broad market, its bargaining power of customers can increase significantly within specific, concentrated segments. For instance, major telecom operators or large defense contractors represent substantial buyers. In 2024, these key accounts often account for a disproportionate share of revenue within their respective niches, giving them leverage to negotiate favorable pricing and contract terms.

High Switching Costs for Customers

High switching costs significantly bolster EnerSys's bargaining power with its customers. For many industrial applications, the integration of battery systems is not a simple plug-and-play operation. It often involves substantial upfront investment in customized solutions, specialized charging infrastructure, and intricate integration with existing operational technology. This deep integration makes switching to a competitor a costly and complex undertaking.

Consider the scenario of a large logistics company relying on a fleet of electric forklifts. Replacing their entire battery system, including the specialized chargers and the associated power management software, represents a major capital expenditure and operational disruption. This complexity and expense naturally reduce the customer's willingness to explore alternative suppliers, thereby strengthening EnerSys's position.

- Significant Upfront Investment: Customers often invest heavily in tailored battery solutions and charging infrastructure, making a change a major financial decision.

- Integration Complexity: Battery systems are frequently deeply embedded within a customer's operational workflow, requiring extensive customization and compatibility checks.

- Operational Disruption: Switching suppliers can lead to downtime, retraining of personnel, and potential inefficiencies during the transition period.

- Reduced Propensity to Switch: The combination of financial and operational hurdles discourages customers from seeking out alternative providers, enhancing vendor lock-in.

Demand Growth and Technology Adoption

The industrial battery market is experiencing significant demand growth, fueled by the accelerating trends of electrification and automation. In 2024, the global industrial battery market was valued at approximately $65 billion and is projected to reach over $100 billion by 2030, showcasing a strong upward trajectory.

Customers are increasingly adopting newer, maintenance-free battery technologies, such as lithium-ion. This shift is driven by the desire for improved performance and reduced operational costs. For instance, lithium-ion battery adoption in industrial applications has seen a compound annual growth rate of over 15% in recent years.

- Electrification and Automation Drive Demand: Global electrification initiatives and the expansion of automated systems in logistics and manufacturing are key demand drivers for industrial batteries.

- Customer Embrace of New Technology: The market sees a strong customer pull for advanced solutions like lithium-ion batteries, which offer longer lifecycles and lower maintenance compared to traditional lead-acid options.

- Impact on Bargaining Power: With robust demand and a preference for cutting-edge, reliable battery solutions, customers may have less leverage to negotiate aggressively on price as they prioritize securing supply for their expanding operational needs.

EnerSys's diverse customer base, spanning telecommunications, transportation, energy systems, and aerospace, significantly weakens customer bargaining power as no single industry segment holds enough sway to dictate terms. The essential nature of EnerSys's battery solutions for critical operations means customers prioritize reliability over aggressive price negotiation, further limiting their leverage.

While EnerSys's broad market reach generally dilutes customer power, large, concentrated customers in specific segments like major telecom operators or defense contractors can exert significant influence. These key accounts, often representing a substantial portion of revenue within their niches in 2024, possess the leverage to negotiate favorable pricing and contract terms, as seen in their ability to secure customized solutions.

| Customer Segment | 2024 Revenue Share (Estimated) | Bargaining Power Factor |

|---|---|---|

| Telecommunications | 15-20% | Moderate to High (Concentrated buyers) |

| Industrial/Logistics | 30-35% | Moderate (Diversified, but high switching costs) |

| Aerospace & Defense | 10-15% | High (Specialized needs, long contracts) |

| Energy Systems | 20-25% | Moderate (Growing demand, technology focus) |

| Other Markets | 10-15% | Low (Highly fragmented) |

What You See Is What You Get

EnerSys Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of EnerSys's competitive landscape through a detailed Porter's Five Forces analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This in-depth report is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

The industrial battery sector is highly fragmented, with a substantial number of global and regional competitors vying for market share. This intense competition means EnerSys must constantly innovate and manage costs to stay ahead.

Key rivals for EnerSys include established giants like East Penn Manufacturing, Exide Technologies, Hoppecke, and Clarios International. The market also sees increasing pressure from a growing contingent of Chinese manufacturers, often competing aggressively on price.

The industrial battery market is booming, with lithium-ion technology leading the charge. This growth offers a buffer against aggressive price wars, allowing several companies to thrive. For instance, the global industrial battery market was valued at approximately $60 billion in 2023 and is projected to reach over $90 billion by 2028, demonstrating significant expansion potential.

However, this growth is accompanied by a rapid technological evolution. The swift transition to newer battery chemistries and cutting-edge technologies fuels intense competition. Companies are locked in a race to develop and patent these advancements, aiming to secure a dominant position in the rapidly changing landscape.

EnerSys actively differentiates itself by focusing on advanced battery technologies such as Thin Plate Pure Lead (TPPL) and lithium-ion. These innovations, along with integrated energy systems, offer enhanced performance and extended lifespan, allowing EnerSys to command premium pricing and lessen direct price competition for these high-value offerings.

Global and Regional Competition

EnerSys faces intense competition across the globe, with significant pressure from international players, particularly those based in China. This robust rivalry, both on a global and regional level, directly influences pricing strategies and market share dynamics for EnerSys.

The company's broad international footprint and its strategic approach to localized manufacturing are key advantages in managing these varied competitive landscapes. By having production facilities in different regions, EnerSys can better adapt to local market conditions and customer needs.

- Global Competition: EnerSys competes with major battery manufacturers worldwide, including established Western companies and rapidly growing Asian competitors.

- Regional Nuances: Competition intensity varies by region, with specific local players often holding significant sway in their home markets. For instance, in Asia, Chinese manufacturers have been notably aggressive in expanding their market share.

- Pricing Pressure: The influx of lower-cost alternatives, especially from China, puts downward pressure on prices across the industry, impacting EnerSys's profit margins.

- Market Share Impact: Aggressive pricing and expanding production capacities by competitors directly challenge EnerSys's ability to maintain or grow its market share in key segments.

Capital Investments and Production Capacity

Competitors in the energy storage sector are aggressively expanding their production capabilities, especially for lithium-ion batteries. This significant investment in scale and advanced manufacturing techniques creates a highly competitive landscape.

For EnerSys, this means a constant need for substantial capital expenditure to maintain and grow its market share. Failing to keep pace with rivals' investments in capacity and process optimization could lead to price erosion and a disadvantage in supplying large-scale projects.

- Increased Investment in Lithium-Ion Production: Global investment in lithium-ion battery manufacturing capacity is projected to reach hundreds of billions of dollars by 2025, with major players announcing expansions.

- Focus on Manufacturing Efficiency: Companies are investing in automation and new production methods to lower costs per kilowatt-hour, putting pressure on less efficient producers.

- Capital Expenditure Requirements: EnerSys must allocate significant capital to upgrade existing facilities and potentially build new ones to meet growing demand and stay competitive on cost.

Competitive rivalry within the industrial battery sector remains intense, driven by a fragmented market and the rapid evolution of battery technologies, particularly lithium-ion. EnerSys faces established global players like East Penn Manufacturing and Clarios, alongside increasingly aggressive Chinese manufacturers who often compete on price, creating significant pressure on profit margins.

The global industrial battery market's substantial growth, projected to exceed $90 billion by 2028 from around $60 billion in 2023, fuels this rivalry as companies invest heavily in expanding production capacity, especially for lithium-ion. EnerSys's strategy of differentiating through advanced technologies like TPPL and lithium-ion, coupled with localized manufacturing, aims to mitigate direct price competition and maintain its market position.

| Key Competitor | Primary Market Focus | Competitive Strength |

|---|---|---|

| East Penn Manufacturing | Automotive, Industrial | Broad product portfolio, strong North American presence |

| Clarios International | Automotive, Industrial | Global reach, advanced lead-acid technology |

| Hoppecke | Industrial, Material Handling | Specialized solutions, strong European presence |

| Chinese Manufacturers (General) | Broad industrial, energy storage | Aggressive pricing, rapid capacity expansion |

SSubstitutes Threaten

The proliferation of lithium-ion batteries, especially the cost-effective Lithium Iron Phosphate (LFP) variants, presents a substantial threat to EnerSys's traditional lead-acid and nickel-based battery offerings. As of early 2024, the global lithium-ion battery market is projected to exceed $100 billion, driven by declining production costs and increasing demand in electric vehicles and energy storage.

Emerging chemistries like sodium-ion and solid-state batteries are also on the horizon, promising improved safety, energy density, and potentially lower costs, further diversifying the substitute landscape. For instance, advancements in sodium-ion technology are showing promise for grid-scale storage applications, a key market for EnerSys.

Fuel cell technology presents a significant threat of substitution for EnerSys, particularly in motive power and stationary applications. These systems offer advantages like rapid refueling and extended operational times, directly challenging battery-only solutions. For instance, in heavy-duty vehicles or backup power systems, the ability to quickly replenish a fuel cell's energy source can be a decisive factor over battery charging times.

Hybrid energy storage systems also act as substitutes by combining different technologies to achieve performance characteristics that might otherwise be met by traditional battery systems alone. These hybrids, which could integrate batteries with supercapacitors for burst power or flow batteries for longer durations, offer a flexible alternative that can be tailored to specific application needs, potentially reducing reliance on EnerSys's core offerings.

Improvements in grid reliability and the expansion of smart grid technologies present a potential threat to EnerSys by reducing the reliance on traditional battery backup systems. For instance, as of 2024, investments in grid modernization are accelerating globally, with the U.S. alone seeing significant federal funding aimed at enhancing grid resilience and reducing outages. This could diminish the demand for certain industrial uninterruptible power supply (UPS) solutions that EnerSys offers.

Energy Efficiency and Demand-Side Management

Improvements in energy efficiency for industrial equipment, coupled with advanced demand-side management systems, can significantly curb overall energy consumption. This directly reduces the need for extensive battery storage solutions, impacting the total addressable market for companies like EnerSys.

For instance, the U.S. Department of Energy reported that industrial sector energy intensity improved by 1.6% in 2023 compared to 2022, showcasing a tangible trend towards reduced energy demand. Such advancements act as a substitute by diminishing the volume of energy that needs to be stored or managed through traditional battery systems.

- Reduced Demand: Enhanced efficiency lowers the baseline energy requirement, lessening the necessity for large-scale battery backup.

- Smart Grids: Sophisticated demand-side management, often integrated with smart grid technologies, optimizes energy usage in real-time, making batteries less critical for peak shaving.

- Market Impact: These trends can shrink the addressable market for industrial battery solutions by offering alternative ways to manage energy needs.

- Technological Shift: Continuous innovation in energy conservation technologies presents an ongoing threat of substitution to battery storage providers.

Cost-Performance Evolution of Substitutes

The cost-performance ratio of substitute energy storage technologies continues to improve, posing a significant threat to traditional battery providers like EnerSys. Lithium-ion battery prices, for instance, have seen a substantial decline, with average prices per kilowatt-hour falling by over 90% in the last decade, reaching as low as $150/kWh in some bulk purchases by 2023, according to industry reports. This trend is further amplified by ongoing research and development in areas like solid-state batteries and flow batteries, which promise enhanced energy density and longevity at potentially lower long-term costs.

These advancements make substitutes increasingly competitive across various industrial applications, from electric vehicles to grid-scale storage. For example, the total cost of ownership for lithium-ion battery systems in stationary storage applications is projected to decrease further, making them more attractive than lead-acid alternatives in many scenarios. This economic viability directly pressures the sales and market share of companies relying on older or less cost-effective battery chemistries.

Key factors driving the attractiveness of substitutes include:

- Declining Lithium-ion Battery Costs: Continued price reductions make them a more viable alternative across a wider range of applications.

- Advancements in New Technologies: Innovations in solid-state and flow batteries offer improved performance characteristics.

- Improved Cost-Performance Ratio: The combination of falling prices and enhanced capabilities makes substitutes more appealing for industrial users.

- Growing Market Acceptance: Increased adoption in sectors like electric vehicles and renewable energy integration normalizes these alternatives.

The threat of substitutes for EnerSys is significant, primarily driven by the rapid advancements and cost reductions in alternative energy storage technologies. Lithium-ion batteries, particularly LFP variants, are becoming increasingly competitive, with the global market expected to surpass $100 billion in 2024. Emerging chemistries like sodium-ion and solid-state batteries also pose a growing challenge, offering potential improvements in safety and performance. Fuel cells, with their rapid refueling capabilities, and hybrid energy storage systems that combine different technologies, further diversify the substitute landscape, directly impacting EnerSys's traditional lead-acid and nickel-based offerings.

| Substitute Technology | Key Advantage | Market Trend (2024 Projection/Data) | Potential Impact on EnerSys |

|---|---|---|---|

| Lithium-ion Batteries (e.g., LFP) | Cost-effectiveness, high energy density | Global market > $100 billion | Direct competition in motive and stationary power |

| Sodium-ion Batteries | Lower cost potential, abundant materials | Growing interest for grid storage | Alternative for large-scale energy storage applications |

| Solid-State Batteries | Enhanced safety, higher energy density | Advancing R&D, potential for future market disruption | Long-term threat to current battery chemistries |

| Fuel Cells | Rapid refueling, extended operation | Increasing adoption in heavy-duty vehicles and backup power | Substitution in applications requiring quick energy replenishment |

| Hybrid Energy Storage Systems | Customizable performance (e.g., power + duration) | Flexible solutions for specific industrial needs | Reduced reliance on single-technology battery solutions |

Entrants Threaten

Establishing industrial battery manufacturing facilities, particularly for advanced lithium-ion technologies, requires immense capital. This includes the cost of building factories, acquiring specialized machinery, and investing heavily in research and development. For example, the construction of gigafactories, essential for large-scale production, can easily run into billions of dollars, creating a formidable barrier for any new company looking to enter the market.

Developing competitive industrial battery solutions demands significant investment in research and development, making it a substantial barrier for new entrants. EnerSys, for instance, leverages its deep technological expertise and a robust intellectual property portfolio, built over years of innovation, to maintain its market position. Newcomers struggle to replicate this level of R&D capability and access to cutting-edge, patented technologies.

EnerSys enjoys a significant advantage due to its deeply entrenched distribution channels and strong, long-standing relationships with major industrial clients spanning various sectors. For instance, in 2023, EnerSys continued to leverage its extensive network to serve critical industries like telecommunications and data centers, where reliability and established trust are paramount. This robust infrastructure and customer loyalty are not easily replicated, creating a substantial hurdle for any new entrants attempting to penetrate the market.

Regulatory Hurdles and Safety Standards

The industrial battery sector faces significant regulatory hurdles and safety standards. For instance, in 2024, the European Union continued to refine its Battery Regulation, imposing stricter requirements on battery design, production, and end-of-life management, impacting all market players, including potential new entrants.

Navigating these complex rules, which include environmental standards and certification processes, demands substantial investment and time. New companies must allocate considerable resources to ensure compliance, thereby increasing the barriers to entry.

These stringent requirements can significantly deter new entrants. For example, achieving certifications like UL 9540 for energy storage systems, a critical standard in North America, involves rigorous testing and can take months, if not years, to complete, adding to the overall cost and complexity of market entry.

- Regional variations in regulations: Safety and environmental standards differ across major markets like North America, Europe, and Asia.

- Certification costs: Obtaining necessary certifications for industrial batteries can range from tens of thousands to hundreds of thousands of dollars.

- Technological adaptation: New entrants must ensure their products meet evolving standards for battery chemistry, recyclability, and safety features.

- Compliance overhead: Ongoing adherence to regulations requires dedicated legal and technical teams, adding to operational expenses.

Supply Chain Complexity and Integration

The threat of new entrants in the energy storage sector, particularly for companies like EnerSys, is significantly mitigated by the intricate and deeply integrated nature of their supply chains. Establishing a robust and resilient supply chain for critical raw materials and components, especially in light of global concentration and geopolitical risks, is a formidable undertaking for any newcomer.

Existing players, having spent decades building and refining their supply networks, possess a considerable advantage. This integration allows them to achieve economies of scale and ensure reliability, making it exceptionally difficult for new entrants to compete on cost and dependability. For instance, EnerSys's long-standing relationships with raw material suppliers and its control over key manufacturing processes create substantial barriers to entry.

- Supply Chain Integration: EnerSys has cultivated decades-long relationships with suppliers of critical materials like lead, lithium, and specialized alloys, ensuring consistent quality and volume.

- Geopolitical Risk Mitigation: Established players have diversified sourcing strategies to buffer against global supply disruptions, a complex feat for new entrants.

- Cost Competitiveness: The scale and efficiency of existing, integrated supply chains enable lower per-unit production costs, a significant hurdle for startups.

- Technological Expertise: Decades of experience have also led to proprietary knowledge in material processing and battery manufacturing, further differentiating incumbents.

The threat of new entrants into the industrial battery market, where EnerSys operates, is considerably low. The sheer capital required for establishing manufacturing facilities, particularly for advanced battery technologies, presents a massive barrier. For instance, building gigafactories can cost billions of dollars. This high upfront investment, coupled with the need for extensive research and development to match existing technological capabilities and intellectual property, makes market entry extremely challenging for newcomers.

Porter's Five Forces Analysis Data Sources

Our EnerSys Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, SEC filings, and industry-specific market research from firms like IBISWorld. We also incorporate macroeconomic data and expert analyst reports to provide a comprehensive view of the competitive landscape.