EnerSys PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EnerSys Bundle

Navigate the complex external forces shaping EnerSys's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are impacting the company's operations and strategic direction. Gain the critical insights needed to anticipate challenges and capitalize on opportunities. Download the full version now and empower your decision-making with actionable intelligence.

Political factors

Government regulations significantly shape EnerSys's operations. For instance, evolving energy efficiency standards, like those mandated by the Department of Energy for battery systems, directly influence product design and manufacturing, pushing for more advanced and compliant solutions. Similarly, stringent industrial safety regulations, such as OSHA's Process Safety Management standards, require substantial investment in operational safety protocols and equipment.

Government policies also play a crucial role in market dynamics. Incentives for renewable energy integration and energy storage, such as the Investment Tax Credit (ITC) for battery storage projects, can boost demand for EnerSys's products. Conversely, changes in trade policies or tariffs on raw materials used in battery production can impact costs and competitiveness, as seen with past tariffs on lithium-ion battery components.

EnerSys's global operations are significantly influenced by trade policies and tariffs. Changes in international trade agreements, such as potential shifts in existing pacts or the formation of new ones, can directly impact the cost of sourcing raw materials and components, as well as the pricing of its energy storage solutions in various markets. For instance, the imposition or alteration of tariffs on critical materials used in battery production could increase manufacturing expenses, potentially affecting EnerSys's competitive pricing strategies and market access.

Trade tensions between major economic blocs, particularly those involving the United States, Europe, and China, can create volatility. For example, tariffs enacted in 2023 on certain manufactured goods could have led to increased import costs for EnerSys's components or finished products, necessitating adjustments in supply chain management and pricing. Conversely, favorable trade agreements could open new market opportunities or reduce operational costs, thereby enhancing EnerSys's profitability and market share.

Political stability in countries where EnerSys has manufacturing or significant customer bases is crucial. For instance, geopolitical tensions in Eastern Europe, a region with growing industrial demand, could impact supply chain logistics and raw material sourcing for battery production. Changes in trade policies or tariffs in major markets like the United States or Germany could also affect EnerSys's cost of goods sold and overall profitability.

Industrial Sector Support

Government support for critical industrial sectors directly impacts demand for EnerSys's power solutions. For instance, increased infrastructure spending on telecommunications and energy grids, often driven by national strategic initiatives, creates significant opportunities. In 2024, governments worldwide continued to prioritize grid modernization and renewable energy integration, with the U.S. alone allocating billions through the Infrastructure Investment and Jobs Act to upgrade its power infrastructure.

Public tenders for defense and transportation projects also represent a substantial market for EnerSys. These sectors require reliable and robust power systems, and government procurement policies favoring domestic production or specific technological capabilities can influence EnerSys's market access and sales. The ongoing global focus on energy security and resilient infrastructure, particularly in light of geopolitical shifts observed through 2024 and into 2025, further amplifies the importance of these government-backed initiatives.

Key areas of government focus influencing demand include:

- Telecommunications Infrastructure: Government investment in 5G deployment and broadband expansion requires significant power backup solutions.

- Energy Grid Modernization: National efforts to create more resilient and efficient power grids, incorporating renewable energy sources, drive demand for advanced battery storage and power management systems.

- Defense Sector Modernization: Military branches worldwide are upgrading their power systems for mobile and stationary applications, creating a consistent demand for specialized solutions.

- Transportation Electrification: Government incentives and mandates for electric vehicle adoption and charging infrastructure development necessitate robust power solutions for charging networks.

Geopolitical Relations

EnerSys's global operations are significantly shaped by geopolitical relations. Access to key battery materials like lithium and cobalt, essential for their energy storage solutions, can be disrupted by international trade disputes or political instability in supplier nations. For instance, the Democratic Republic of Congo, a major cobalt producer, has faced scrutiny regarding its mining practices, impacting supply chain stability. Similarly, evolving alliances and trade agreements influence EnerSys's ability to expand into new markets and secure technology transfer, crucial for staying competitive in the rapidly advancing battery technology sector.

International cooperation or conflict directly translates into risks and opportunities for EnerSys. Periods of heightened global tension can lead to increased demand for energy storage solutions in defense applications, a segment EnerSys serves. Conversely, widespread conflict could impede logistics and increase operational costs. The ongoing push for energy independence among various nations, often driven by geopolitical considerations, presents a significant opportunity for EnerSys to provide localized energy storage solutions.

- Supply Chain Vulnerability: Dependence on specific regions for critical minerals like lithium and cobalt exposes EnerSys to geopolitical risks.

- Market Access: Trade policies and international relations dictate EnerSys's ability to enter and operate in new geographical markets.

- Technological Advancement: Geopolitical cooperation or competition influences the pace and direction of technology transfer in the energy storage industry.

- Demand Fluctuations: Global political events can impact demand for energy storage, particularly in sectors like defense and national infrastructure.

Government policies and regulations are pivotal for EnerSys, influencing everything from product standards to market incentives. For example, the U.S. Department of Energy's evolving energy efficiency standards for battery systems directly impact EnerSys's product development, pushing for more advanced and compliant solutions. Furthermore, government investments in critical infrastructure, such as the billions allocated in 2024 through the U.S. Infrastructure Investment and Jobs Act for power grid modernization, create substantial demand for EnerSys's energy storage and power management systems.

Trade policies and geopolitical stability significantly affect EnerSys's global operations and supply chain. Fluctuations in tariffs on essential battery materials, like lithium and cobalt, can alter manufacturing costs and market competitiveness. For instance, trade tensions between major economic blocs in 2024 led to increased import costs for certain components, necessitating adjustments in EnerSys's supply chain strategies and pricing models.

Government support for sectors like telecommunications, defense, and transportation electrification directly fuels demand for EnerSys's solutions. Initiatives focused on 5G deployment, military modernization, and electric vehicle infrastructure expansion, as seen with continued global government spending through 2025, represent significant market opportunities for the company.

The interplay of government incentives, regulatory frameworks, and international relations presents both opportunities and challenges for EnerSys. For example, while government subsidies for renewable energy integration boost demand for battery storage, geopolitical instability can disrupt the supply of critical raw materials, impacting production costs. EnerSys must navigate these complex political landscapes to maintain its competitive edge and capitalize on emerging market trends.

What is included in the product

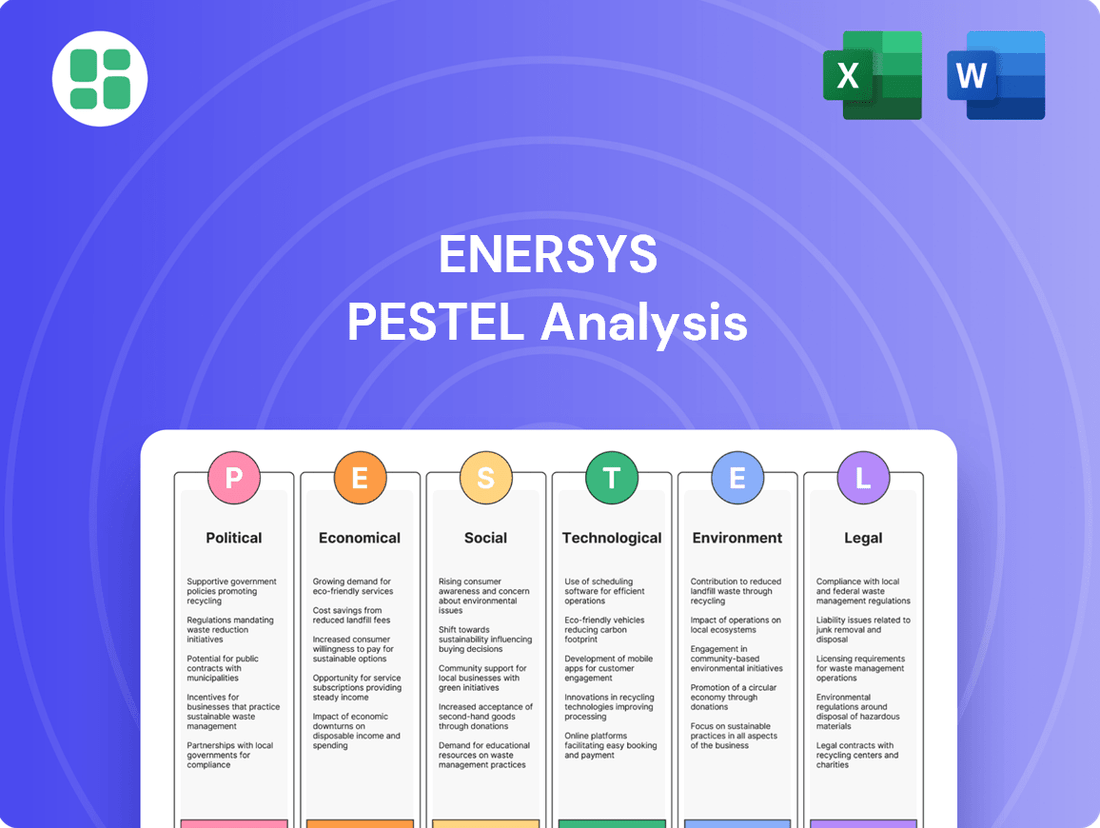

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting EnerSys, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these dynamic forces.

Offers a clear, actionable overview of external factors impacting EnerSys, simplifying complex market dynamics for strategic decision-making.

Economic factors

Global economic growth significantly impacts EnerSys, as a robust economy typically translates to increased industrial and manufacturing activity, directly boosting demand for their industrial batteries. For instance, projections for global GDP growth in 2024 and 2025, estimated around 2.7% to 3.0% by organizations like the IMF, signal potential for higher capital expenditures by businesses, leading to greater sales of new equipment and replacement batteries for EnerSys.

Conversely, economic slowdowns or recessions can dampen this demand. When businesses face uncertainty, they often cut back on capital spending, which can directly reduce the need for new battery systems and delay replacement cycles for existing ones. This sensitivity means EnerSys's performance is closely tied to the broader economic climate and the investment appetite of its industrial customer base.

Inflation significantly impacts EnerSys's operational expenses, especially the escalating costs of essential raw materials such as lead and lithium. For instance, lead prices, a critical component in traditional battery manufacturing, saw considerable volatility throughout 2023 and into early 2024, driven by supply chain disruptions and global demand shifts.

These rising material prices, coupled with increased manufacturing and transportation expenses, directly pressure EnerSys's profit margins. If the company cannot effectively pass these higher costs onto customers through strategic pricing adjustments, its profitability could be compressed, impacting overall financial performance.

Currency exchange rate fluctuations significantly impact EnerSys's global operations. For instance, a strengthening U.S. dollar in 2024 could make EnerSys's products manufactured in the U.S. less competitive in international markets, potentially reducing sales volume. Conversely, it could also decrease the reported value of earnings generated in foreign currencies when translated back into U.S. dollars.

Conversely, a weaker dollar can boost international revenue by making U.S.-made goods more affordable abroad and increasing the dollar-denominated value of overseas profits. In 2023, EnerSys reported that foreign currency headwinds impacted its net sales by approximately $20 million, highlighting the tangible effect of these economic factors on its financial performance.

Interest Rates and Access to Capital

Fluctuations in global interest rates directly impact EnerSys's cost of capital. For instance, if the Federal Reserve maintains a higher interest rate policy through 2024 and into 2025, EnerSys would face increased borrowing costs for crucial investments in research and development or expanding its manufacturing capabilities. This could make projects that require significant upfront funding less attractive.

Higher interest rates also ripple through to EnerSys's customers. Many of EnerSys's clients, particularly those making substantial capital expenditures on battery systems or energy storage solutions, often rely on financing. Elevated borrowing costs for these customers can lead to delayed or reduced purchasing decisions, directly affecting EnerSys's sales volume and revenue streams.

For example, the Federal Reserve kept its benchmark interest rate in the 5.25%-5.50% range through early 2024, a level not seen in decades. Should these rates persist or even increase in late 2024 or 2025, EnerSys's strategic growth initiatives, such as acquiring new technologies or building additional production facilities, will become more expensive to finance.

- Higher borrowing costs for EnerSys's capital expenditures.

- Potential slowdown in customer investment due to increased financing expenses.

- Impact on the attractiveness of large-scale projects for EnerSys and its clients.

Supply Chain Disruptions

Global supply chain disruptions, exacerbated by events like the COVID-19 pandemic and geopolitical tensions, significantly impact EnerSys by driving up logistics and raw material costs. For instance, the average cost to ship a 40-foot container globally saw dramatic increases, peaking at over $10,000 in late 2021, compared to around $2,000 pre-pandemic, directly affecting EnerSys's operational expenses.

These vulnerabilities can lead to material shortages, delaying production and product delivery for EnerSys. The semiconductor shortage, which continued to affect various industries through 2023 and into 2024, illustrates the potential for widespread component scarcity impacting battery manufacturing and related technologies.

- Increased Logistics Costs: Higher freight rates and fuel surcharges directly impact EnerSys's cost of goods sold.

- Material Shortages: Delays in sourcing critical components like lithium, cobalt, or specialized electronic parts can disrupt production schedules.

- Delivery Delays: Extended lead times for both incoming materials and outgoing products can affect customer satisfaction and revenue recognition.

- Inflationary Pressures: Supply chain bottlenecks contribute to broader inflation, potentially increasing the cost of labor and other operational inputs for EnerSys.

Global economic growth is a key driver for EnerSys, with projections for 2024 and 2025 indicating a moderate expansion around 2.7% to 3.0%. This growth typically fuels industrial and manufacturing activity, directly increasing demand for EnerSys's industrial batteries. However, economic downturns can significantly dampen this demand, as businesses often reduce capital expenditures during uncertain periods, impacting EnerSys's sales and replacement cycles.

Inflationary pressures, particularly concerning raw materials like lead and lithium, directly affect EnerSys's profit margins. For instance, lead prices experienced significant volatility in 2023 and early 2024 due to supply chain issues and shifting global demand. These rising material and operational costs necessitate careful pricing strategies to avoid margin compression.

Currency fluctuations also play a crucial role; a stronger U.S. dollar can make EnerSys's exports less competitive and reduce the reported value of overseas earnings. In 2023, currency headwinds impacted EnerSys's net sales by approximately $20 million, underscoring the tangible financial effects of these economic variables.

Interest rates directly influence EnerSys's cost of capital and its customers' purchasing decisions. Persistent higher rates through 2024 and 2025 increase borrowing costs for EnerSys's investments and can deter customers from financing large battery system acquisitions, potentially slowing sales growth.

What You See Is What You Get

EnerSys PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive EnerSys PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping EnerSys's strategic landscape.

Sociological factors

Global workforce demographics present a significant challenge for EnerSys. An aging population in developed nations, coupled with a shrinking pool of available skilled labor, makes it increasingly difficult to recruit and retain talent for critical manufacturing, engineering, and sales positions. For instance, the U.S. Bureau of Labor Statistics projected a shortage of over 500,000 skilled manufacturing workers by 2030, a trend that directly impacts companies like EnerSys.

Furthermore, the rapid pace of technological advancement necessitates continuous upskilling and reskilling of the existing workforce. EnerSys must invest in comprehensive training programs to ensure its employees can adapt to new automation, digital tools, and evolving product technologies. This commitment to learning is vital for maintaining a competitive edge and operational efficiency in the dynamic energy storage sector.

Societal awareness regarding environmental impact is increasingly shaping purchasing decisions, pushing industries towards greener practices. Consumers are actively seeking out products and services that align with sustainability goals, influencing corporate strategy across various sectors.

EnerSys faces a direct demand for battery solutions that not only perform well but also demonstrate a commitment to environmental responsibility. This includes a preference for batteries with extended lifespans, improved recyclability, and a demonstrably lower carbon footprint throughout their lifecycle. For instance, the global market for lithium-ion batteries, a key area for sustainability improvements, is projected to reach over $160 billion by 2027, highlighting the scale of this shift.

Societal expectations for robust health and safety standards are increasingly shaping how companies like EnerSys operate. This growing emphasis directly impacts operational procedures, product development, and the rigorous compliance measures EnerSys must undertake.

Adhering to these stringent safety regulations is not just a legal requirement but a critical factor for maintaining EnerSys's reputation and avoiding significant financial liabilities, particularly given its presence in demanding industrial sectors.

For instance, in 2024, the global industrial safety market was valued at approximately $50 billion, with a projected compound annual growth rate (CAGR) of over 7% through 2030, underscoring the significant investment and focus on safety across industries EnerSys serves.

Urbanization and Infrastructure Development

The relentless march of global urbanization is a significant tailwind for EnerSys. As more people flock to cities, the demand for reliable power solutions for everything from smart grids to electric public transport surges. This trend is projected to continue, with the UN estimating that 68% of the world's population will live in urban areas by 2050, up from 56% in 2021.

This societal shift directly translates into increased opportunities for EnerSys's reserve power and motive power segments. Think about the need for backup power in data centers supporting smart city initiatives or the batteries required for the growing electric bus fleets in metropolitan areas. The development of advanced infrastructure, including expanded telecommunications networks and modernized public transit, all rely on robust energy storage solutions.

EnerSys is well-positioned to capitalize on these growth areas:

- Smart City Growth: Investments in smart city infrastructure, including IoT devices and intelligent traffic management, require dependable backup power, a core EnerSys offering.

- Electrification of Transportation: The global push for cleaner public transportation, particularly electric buses, directly drives demand for EnerSys's motive power batteries. For instance, by 2030, it's anticipated that over 1.5 million electric buses will be operating worldwide.

- Telecommunications Expansion: The ongoing build-out of 5G networks and increased data consumption necessitate reliable power for cell towers and data centers, areas where EnerSys excels.

- Resilience and Reliability: Urban environments increasingly prioritize power resilience against outages, boosting the market for EnerSys's uninterruptible power supply (UPS) solutions.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for companies like EnerSys to actively engage in Corporate Social Responsibility (CSR) are increasingly influential. This includes a strong focus on ethical sourcing of raw materials, ensuring fair labor practices throughout the supply chain, and actively contributing to the communities where they operate. For instance, in 2024, consumer surveys indicated that over 70% of respondents consider a company's CSR initiatives when making purchasing decisions, directly impacting brand loyalty and market share.

Meeting these evolving CSR demands is not just about good practice; it's critical for maintaining a positive brand reputation and attracting top talent. EnerSys's commitment to sustainability, evidenced by their 2024 ESG report highlighting a 15% reduction in Scope 1 and 2 emissions, directly addresses these societal pressures. Furthermore, their community investment programs, which supported over 50 local initiatives in 2024, demonstrate a tangible commitment beyond basic compliance.

- Ethical Sourcing: Growing consumer demand for transparency in supply chains, pushing companies like EnerSys to verify the origins of their materials.

- Fair Labor Practices: Increased scrutiny on working conditions and wages across all tiers of operations, impacting recruitment and retention.

- Community Engagement: Societal expectation for businesses to be active partners in local development and environmental stewardship.

- Brand Reputation: Positive CSR performance directly correlates with enhanced brand image and customer trust, a key differentiator in the 2024 market.

Societal expectations regarding ethical business practices are increasingly influencing consumer and investor behavior. This means companies like EnerSys must demonstrate transparency in their supply chains and commitment to fair labor standards to maintain trust and market share.

The growing global emphasis on sustainability and environmental consciousness directly impacts the demand for EnerSys's products. Consumers and businesses alike are prioritizing energy storage solutions that offer longer lifespans, improved recyclability, and a reduced carbon footprint, driving innovation in battery technology.

EnerSys's commitment to Corporate Social Responsibility (CSR) is crucial for its brand image and talent acquisition. In 2024, over 70% of consumers considered a company's CSR initiatives in purchasing decisions, making initiatives like EnerSys's 15% reduction in Scope 1 and 2 emissions in their 2024 ESG report a significant competitive advantage.

Technological factors

EnerSys's competitive edge hinges on its ability to integrate evolving battery chemistries. The industry is seeing a significant shift towards lithium-ion, with ongoing research into solid-state and flow batteries promising higher energy density and faster charging capabilities. For instance, by late 2024, advancements in lithium-ion technology are expected to push energy densities beyond 300 Wh/kg, directly impacting EnerSys's motive power solutions.

These technological leaps necessitate substantial R&D investments to ensure EnerSys's product portfolio remains at the forefront. Adapting to demands for longer cycle life and improved safety in battery technology is crucial for maintaining market share. Companies investing in next-generation battery materials are poised to capture a larger portion of the rapidly expanding energy storage market, projected to reach over $100 billion globally by 2025.

The increasing adoption of sophisticated energy management systems, powered by IoT and AI, is a significant technological driver for EnerSys. These systems enable real-time monitoring and predictive maintenance for battery solutions, particularly crucial in the telecommunications and utility sectors. For instance, smart grids are increasingly relying on advanced battery storage to manage intermittent renewable energy sources, a trend expected to accelerate through 2025.

EnerSys's ability to develop smart battery systems that seamlessly integrate with these evolving smart grid infrastructures will be key. The global smart grid market was valued at approximately $27.8 billion in 2023 and is projected to reach $75.9 billion by 2030, growing at a CAGR of 15.4% according to some market analyses, highlighting a substantial opportunity for battery providers who can offer intelligent, connected solutions.

EnerSys is significantly leveraging automation and advanced manufacturing technologies to boost its production. By integrating robotics and Industry 4.0 principles, the company is enhancing operational efficiency and tightening quality control across its battery manufacturing processes. For instance, in 2023, EnerSys reported investments in new automated equipment aimed at improving throughput and reducing manual labor, contributing to a more cost-competitive market position.

These technological advancements directly translate to reduced lead times for EnerSys's product lines, a critical factor in the fast-paced energy storage market. The company's commitment to streamlining operations through automation allows for quicker responses to customer demand and a more agile supply chain. This strategic adoption of modern manufacturing techniques is crucial for maintaining EnerSys's competitive edge in the global battery industry.

Charging Technology Innovations

Innovations in charging technology significantly impact EnerSys's motive power solutions. Faster charging methods, like those enabling a full charge in under an hour for some electric forklifts, directly enhance operational efficiency for users. Wireless charging, while still emerging for heavy-duty applications, promises greater convenience and reduced downtime. Smart charging algorithms optimize battery health and energy consumption, crucial for fleet management. EnerSys's compatibility with evolving charging standards, such as the adoption of new DC fast-charging protocols, is paramount for market acceptance and future-proofing its product line. For instance, the growing demand for opportunity charging in logistics centers emphasizes the need for robust and rapid charging infrastructure that EnerSys must integrate with.

Key developments include:

- Advancements in Lithium-ion battery chemistry enabling higher energy density and faster charge rates.

- Development of inductive charging systems for automated guided vehicles (AGVs) and forklifts, reducing manual intervention.

- Integration of AI-powered charging management systems to predict usage patterns and optimize charging schedules for fleet efficiency.

- Industry-wide efforts to standardize charging interfaces and protocols to ensure interoperability across different equipment manufacturers.

Recycling and End-of-Life Technologies

Technological advancements in battery recycling are crucial for EnerSys, especially with the growing emphasis on environmental regulations and resource efficiency. Innovations in hydrometallurgical and pyrometallurgical processes are enabling higher recovery rates for valuable materials like lithium, cobalt, and nickel from spent batteries. For instance, by 2025, the global battery recycling market is projected to reach over $20 billion, highlighting the significant economic opportunity and necessity for companies like EnerSys to engage with these technologies.

The safe and efficient disposal of batteries, particularly for industrial applications where EnerSys operates, is also a key technological consideration. New methods for neutralizing hazardous components and preventing environmental contamination during the end-of-life phase are constantly emerging. EnerSys's commitment to sustainability and circular economy principles will be directly influenced by its adoption and integration of these cutting-edge recycling and disposal technologies.

EnerSys's strategic approach to these technological factors could involve:

- Investing in or partnering with advanced battery recycling facilities to secure raw material supply chains and manage end-of-life products.

- Developing internal capabilities or collaborating on R&D for proprietary recycling processes that offer competitive advantages.

- Ensuring compliance with evolving global e-waste and battery disposal regulations, which often mandate specific recycling efficiencies and material recovery targets.

- Exploring opportunities in battery refurbishment and second-life applications, further extending product lifecycles and reducing waste.

EnerSys's technological trajectory is heavily influenced by advancements in battery chemistries, particularly the move towards lithium-ion and emerging solid-state technologies. These innovations promise higher energy density, with lithium-ion expected to surpass 300 Wh/kg by late 2024, directly impacting motive power solutions.

The company must invest in R&D to keep pace with demands for longer cycle life and improved safety, as the global energy storage market is projected to exceed $100 billion by 2025.

Furthermore, the integration of IoT and AI in energy management systems is crucial, enabling predictive maintenance and supporting smart grids that manage renewable energy, a trend expected to accelerate through 2025.

EnerSys's adoption of automation and Industry 4.0 principles in manufacturing, as seen in its 2023 investments in automated equipment, is enhancing efficiency and quality control.

Legal factors

EnerSys operates under a complex web of product safety and liability laws worldwide, impacting everything from battery design to how they're sold. Meeting stringent standards like those set by the International Electrotechnical Commission (IEC) for battery safety is crucial. Failure to comply can lead to significant fines, costly product recalls, and severe damage to EnerSys's reputation, as seen with past incidents in the industrial battery sector where companies faced millions in damages.

EnerSys operates under a stringent framework of environmental regulations, impacting everything from hazardous waste disposal to air and water emissions. For instance, the U.S. Environmental Protection Agency (EPA) enforces the Resource Conservation and Recovery Act (RCRA), which dictates how companies manage hazardous waste. Failure to comply can result in significant penalties; in 2023, EPA enforcement actions resulted in over $10 billion in penalties.

Maintaining compliance with these diverse laws, including those governing chemical management and emissions standards, is not just a legal necessity but a prerequisite for continued operational licenses. In 2024, the push for stricter air quality standards, particularly concerning volatile organic compounds (VOCs) from manufacturing processes, is a key area of focus for companies like EnerSys, requiring ongoing investment in pollution control technologies.

Protecting EnerSys's intellectual property, such as patents for advanced battery chemistries and manufacturing techniques, is crucial for maintaining its competitive edge. The company actively safeguards its innovations, including trademarks for its brand names and trade secrets surrounding production efficiency.

EnerSys faces risks from potential intellectual property infringement by competitors, which could erode market share and profitability. To counter this, the company employs robust legal strategies for IP enforcement, including monitoring the market for unauthorized use of its technologies and pursuing legal action when necessary.

International Trade Laws and Sanctions

International trade laws significantly shape EnerSys's global operations. Import/export controls and customs regulations dictate the flow of goods and components, impacting supply chain efficiency and costs. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) enforces export controls, which could affect EnerSys's ability to sell certain battery technologies to specific countries.

Economic sanctions, such as those imposed by the United Nations or individual nations, can restrict market access and disrupt existing business relationships. Navigating these complex legal frameworks is crucial for maintaining smooth cross-border operations and avoiding penalties. In 2023, global trade disputes and the imposition of new tariffs by various countries continued to create an uncertain environment for international businesses like EnerSys.

- Customs Duties: Tariffs and duties on imported raw materials or finished goods can directly impact EnerSys's cost of goods sold and pricing strategies in different markets.

- Export Licensing: Obtaining necessary export licenses for advanced battery technologies is a legal requirement that can influence market entry and sales timelines.

- Sanctions Compliance: Adhering to sanctions regimes, such as those targeting Russia or Iran, prevents EnerSys from engaging in trade with restricted entities or countries, safeguarding its reputation and financial standing.

- Trade Agreements: Favorable trade agreements between countries can reduce barriers and facilitate smoother international trade for EnerSys, potentially lowering operational costs.

Labor and Employment Laws

EnerSys must navigate a complex web of labor and employment laws across its global operations. These regulations dictate everything from minimum wages and working hours to workplace safety standards and mandatory employee benefits, such as health insurance and retirement plans. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay requirements, while the Occupational Safety and Health Administration (OSHA) enforces workplace safety. In Europe, directives like the Working Time Directive influence employee working hours and rest periods.

Compliance with these varying legal frameworks is essential to prevent costly disputes, fines, and damage to the company's reputation. EnerSys's ability to manage its workforce effectively hinges on its adherence to these labor laws, which also encompass regulations regarding employee unions and collective bargaining agreements. For example, in countries with strong union presence, such as Germany, understanding and respecting co-determination laws is critical for maintaining stable labor relations.

- Minimum Wage Compliance: Adherence to national minimum wage laws, such as the US federal minimum wage of $7.25 per hour (though many states have higher rates) and varying minimums across European countries, is a baseline requirement.

- Working Conditions and Safety: Ensuring compliance with workplace safety regulations, like those enforced by OSHA in the US or similar bodies in other operating regions, is paramount.

- Employee Benefits and Protections: Meeting legal mandates for employee benefits, including paid time off, sick leave, and health insurance contributions, varies significantly by jurisdiction.

- Union Relations: Managing relationships with labor unions, respecting collective bargaining agreements, and adhering to laws governing union activities are crucial in regions where unionization is prevalent.

EnerSys's global operations are significantly shaped by international trade laws, including import/export controls and customs regulations that affect supply chain efficiency and costs. For instance, in 2023, ongoing global trade disputes and new tariffs highlighted the complexities businesses like EnerSys face in cross-border transactions.

Compliance with sanctions regimes, such as those imposed by the UN or individual nations, is critical for EnerSys to avoid restricted trade and maintain its reputation. Navigating these legal frameworks is essential for smooth international business and preventing penalties.

The company must also adhere to intellectual property laws to protect its innovations, like advanced battery chemistries. Potential infringement by competitors poses a risk to market share, necessitating robust legal strategies for IP enforcement.

| Legal Factor | Impact on EnerSys | 2024/2025 Relevance |

| Product Safety & Liability | Compliance with global standards (e.g., IEC) is vital to avoid fines, recalls, and reputational damage. | Increasingly stringent safety regulations for energy storage systems are anticipated. |

| Environmental Regulations | Adherence to laws on hazardous waste and emissions (e.g., EPA's RCRA) is mandatory to prevent penalties. | Focus on reducing VOC emissions and sustainable battery lifecycle management is growing. |

| Intellectual Property | Protecting patents and trade secrets is key to competitive advantage; monitoring for infringement is ongoing. | Innovation in battery technology necessitates strong IP protection strategies. |

| International Trade & Sanctions | Navigating customs, tariffs, and sanctions impacts supply chains and market access. | Geopolitical shifts and trade policy changes continue to influence global trade dynamics. |

Environmental factors

EnerSys, a leader in stored energy solutions, faces significant influence from evolving climate change policies. Global and national initiatives, such as carbon pricing mechanisms and ambitious emissions reduction targets, directly impact operational costs and market demand for their products. For instance, the European Union's Fit for 55 package aims for a 55% net greenhouse gas emission reduction by 2030, which will likely drive demand for energy storage solutions that enable renewable energy integration.

The increasing pressure to reduce the carbon footprint throughout the battery lifecycle, from production to disposal, presents both challenges and opportunities for EnerSys. Companies are scrutinizing supply chains for their environmental impact, and policies promoting battery recycling and the use of sustainable materials are becoming more prevalent. This trend could favor EnerSys if they can demonstrate robust environmental, social, and governance (ESG) practices and invest in greener manufacturing processes.

EnerSys's reliance on materials like lead, lithium, nickel, and cobalt for battery production exposes it to significant supply chain risks due to the finite nature of these resources. For instance, the global demand for lithium, crucial for many advanced battery chemistries, is projected to increase substantially, potentially driving up costs and creating sourcing challenges.

This resource scarcity necessitates a strategic focus on sustainable sourcing and the exploration of alternative materials. Companies are increasingly pressured by regulators and consumers to demonstrate responsible procurement, impacting operational costs and brand reputation. For example, the Democratic Republic of Congo, a major source of cobalt, faces scrutiny over its mining practices, highlighting the need for diversified and ethical supply chains.

The increasing global focus on environmental sustainability is driving stricter regulations for waste management, especially concerning industrial batteries. EnerSys faces pressure to actively participate in product take-back programs and invest in robust recycling infrastructure to align with circular economy principles. For instance, the European Union's Battery Regulation, fully applicable from February 2024, mandates increased recycled content in new batteries and sets ambitious collection targets, impacting companies like EnerSys operating within or supplying to these markets.

Pollution Control and Eco-Efficiency

EnerSys actively works to reduce pollution from its manufacturing, targeting air, water, and soil contamination. The company focuses on improving eco-efficiency by lowering energy and water consumption, alongside minimizing waste in its production cycles.

For instance, in 2023, EnerSys reported a reduction in greenhouse gas emissions intensity by 12% compared to their 2020 baseline, demonstrating progress in their environmental stewardship efforts.

- Energy Consumption Reduction: Efforts to optimize energy usage across facilities have led to a 5% year-over-year decrease in energy intensity per unit produced.

- Water Usage Efficiency: Implementing advanced water recycling systems has resulted in a 7% reduction in freshwater withdrawal for manufacturing operations.

- Waste Generation Management: Through improved material handling and recycling programs, EnerSys achieved a 9% decrease in non-hazardous waste sent to landfills in 2023.

- Emissions Control: Investments in advanced filtration technologies have contributed to a 10% reduction in volatile organic compound (VOC) emissions from key production sites.

Biodiversity and Ecosystem Impact

EnerSys's operations, spanning the sourcing of materials like lithium and cobalt for batteries to manufacturing and end-of-life product management, can impact local biodiversity. The mining of raw materials, often in sensitive regions, carries risks of habitat destruction and soil degradation. For instance, the Democratic Republic of Congo, a major cobalt producer, faces significant environmental challenges linked to mining, impacting its rich biodiversity.

Beyond direct resource extraction, manufacturing processes can lead to water usage and potential effluent discharge, affecting aquatic ecosystems if not managed responsibly. EnerSys's commitment to sustainability includes efforts to minimize its ecological footprint across its entire value chain. As of early 2024, the company has been investing in cleaner manufacturing technologies and exploring more sustainable sourcing options for its critical battery components.

The growing emphasis on the circular economy means companies like EnerSys are increasingly scrutinized for their approach to battery recycling and disposal. Improper disposal can lead to soil and water contamination, posing risks to flora and fauna. EnerSys's 2023 sustainability report highlighted a target to increase the recyclability of its battery chemistries, aiming to reduce the environmental impact of its products at the end of their lifecycle.

Key considerations for EnerSys regarding biodiversity and ecosystem impact include:

- Raw Material Sourcing: Assessing and mitigating the ecological impact of mining operations for critical battery minerals.

- Manufacturing Footprint: Managing water usage, waste generation, and potential emissions from production facilities.

- Product Lifecycle Management: Developing robust recycling programs and ensuring responsible disposal of end-of-life batteries.

- Supply Chain Transparency: Working with suppliers to ensure adherence to environmental standards that protect biodiversity.

Environmental regulations are a significant driver for EnerSys, influencing everything from material sourcing to product disposal. Stricter rules on emissions and waste management, like the EU's Battery Regulation effective in early 2024, push for greater recycling and reduced environmental impact throughout the battery lifecycle. EnerSys's 2023 sustainability report showed a 12% reduction in greenhouse gas emissions intensity compared to 2020, underscoring their efforts to comply with and adapt to these evolving environmental standards.

The company's commitment to eco-efficiency is demonstrated by concrete achievements: a 5% year-over-year decrease in energy intensity per unit produced and a 7% reduction in freshwater withdrawal due to advanced water recycling systems. Furthermore, EnerSys reduced non-hazardous waste sent to landfills by 9% in 2023, aligning with circular economy principles and stringent waste management regulations.

EnerSys faces scrutiny regarding the environmental impact of raw material extraction for batteries, such as lithium and cobalt, which can affect biodiversity. For instance, mining in regions like the Democratic Republic of Congo, a key cobalt source, raises concerns about habitat destruction. The company is actively working to mitigate these risks through sustainable sourcing and supply chain transparency.

| Environmental Metric | 2023 Performance | Target/Context |

|---|---|---|

| Greenhouse Gas Emissions Intensity Reduction | 12% (vs. 2020 baseline) | Driven by climate policies and ESG focus |

| Energy Intensity per Unit Produced | 5% decrease (year-over-year) | Operational efficiency improvements |

| Freshwater Withdrawal Reduction | 7% reduction | Impact of water recycling systems |

| Non-Hazardous Waste to Landfill Reduction | 9% decrease | Waste management and recycling initiatives |

| Volatile Organic Compound (VOC) Emissions Reduction | 10% reduction (key sites) | Investment in advanced filtration |

PESTLE Analysis Data Sources

Our EnerSys PESTLE Analysis is built on a robust foundation of data from leading industry publications, government energy agencies, and reputable market research firms. We meticulously gather information on political stability, economic forecasts, technological advancements, environmental regulations, and social trends impacting the energy sector.