Enel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enel Bundle

Enel, a global energy giant, possesses significant strengths in its diversified renewable energy portfolio and strong market presence. However, it also faces challenges related to regulatory changes and the capital-intensive nature of infrastructure development.

Want the full story behind Enel’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Enel's global integrated presence is a significant strength, covering the entire energy value chain from generation to retail. This comprehensive operational scope fosters synergistic benefits and diversifies revenue streams across its business segments. For instance, in 2023, Enel reported a net income of €6.5 billion, showcasing the profitability of its integrated model.

The company boasts a substantial international footprint, with key investments concentrated in Europe, Latin America, and North America. This geographical diversification helps mitigate risks associated with regional market volatility. As of the first half of 2024, Enel's renewables capacity reached approximately 73.4 GW, demonstrating its commitment to global expansion in sustainable energy.

Enel demonstrates exceptional leadership in the renewable energy sector, underscored by its ambitious decarbonization strategy. The company is firmly committed to achieving net-zero emissions by 2040 and plans to phase out coal-fired power generation entirely by 2027, aligning its operations with critical global sustainability targets.

This strategic direction is already yielding significant results, with Enel's zero-emission generation surpassing 82% of its total output in the first quarter of 2024. This impressive figure highlights Enel's substantial progress in its green energy transition and solidifies its position as a leader in the rapidly expanding clean energy market.

Enel is making significant investments in its electricity grids, planning to spend around €26 billion between 2025 and 2027. This substantial capital injection is aimed at upgrading grid quality, boosting resilience against disruptions, and driving digitalization.

This strategic focus on smart grids is vital for facilitating the ongoing energy transition and ensuring the reliable operation of a more complex, decentralized energy system. These modernization efforts are expected to improve operational efficiency and meet the increasing electricity demands from electrification and new technologies.

The company is strategically concentrating these grid investments in markets that offer supportive regulatory environments. This approach helps to ensure a more predictable and stable return on the capital being deployed.

Solid Financial Performance and Discipline

Enel has showcased remarkable financial strength, successfully meeting its 2024 targets. The company reported a notable increase in its ordinary EBITDA, reaching €22.1 billion, and its net ordinary income climbed to €7.5 billion. This robust performance underscores its disciplined financial management and operational effectiveness.

A key aspect of Enel's strength lies in its commitment to deleveraging. By the end of 2024, the company had reduced its net financial debt to €60.7 billion, improving its net financial debt to EBITDA ratio to 2.7x. This strategic focus on strengthening the balance sheet enhances financial flexibility and resilience.

- Strong Revenue Growth: Enel's ordinary revenue for 2024 reached €91.9 billion, reflecting solid operational execution.

- EBITDA Expansion: Ordinary EBITDA saw a significant increase to €22.1 billion in 2024, demonstrating improved profitability.

- Debt Reduction: The company successfully lowered its net financial debt to €60.7 billion by year-end 2024.

- Improved Financial Ratios: The net financial debt to EBITDA ratio stood at a healthy 2.7x in 2024.

Clear Strategic Vision and Efficiency Focus

Enel's strategic vision for 2025-2027 is a significant strength, prioritizing profitability and operational efficiency. This clear roadmap guides the company's capital allocation, focusing on investments that offer the best risk-adjusted returns. The emphasis on optimizing processes and offerings ensures Enel remains agile in a dynamic market.

The company is actively building a more resilient and flexible organizational structure. This adaptability is crucial for navigating the evolving energy landscape and economic uncertainties. Enel's strategic plan is designed to drive sustainable growth through focused execution.

- Strategic Plan 2025-2027: Outlines a clear path focused on profitability and efficiency.

- Selective Capital Allocation: Prioritizes investments with optimal risk/return profiles.

- Organizational Resilience: Fosters a leaner, more flexible structure to adapt to market changes.

- Efficiency Focus: Drives optimization across processes and product/service offerings.

Enel's integrated business model, spanning generation to retail, is a core strength, enabling synergistic advantages and diversified revenue. This model proved profitable in 2023, with the company reporting a net income of €6.5 billion. Its substantial global presence, particularly in Europe and Latin America, diversifies risk, and by mid-2024, Enel had approximately 73.4 GW of renewable capacity, showcasing its international expansion in sustainable energy.

The company's leadership in renewables is evident in its net-zero by 2040 target and planned coal phase-out by 2027. This commitment is already reflected in its operations, with over 82% of its energy output being zero-emission as of Q1 2024. Enel is also making substantial investments in its electricity grids, earmarking around €26 billion for upgrades between 2025 and 2027 to enhance quality, resilience, and digitalization, particularly in supportive regulatory markets.

Enel demonstrated strong financial performance in 2024, achieving its targets with ordinary EBITDA at €22.1 billion and net ordinary income at €7.5 billion. A key financial strength is its deleveraging strategy, reducing net financial debt to €60.7 billion by the end of 2024, resulting in a net financial debt to EBITDA ratio of 2.7x. This focus on balance sheet health provides financial flexibility.

| Financial Metric | 2023 | 2024 (Actual/Target) |

| Net Income | €6.5 billion | €7.5 billion (Net Ordinary Income) |

| Ordinary EBITDA | N/A | €22.1 billion |

| Net Financial Debt | N/A | €60.7 billion |

| Net Financial Debt/EBITDA | N/A | 2.7x |

What is included in the product

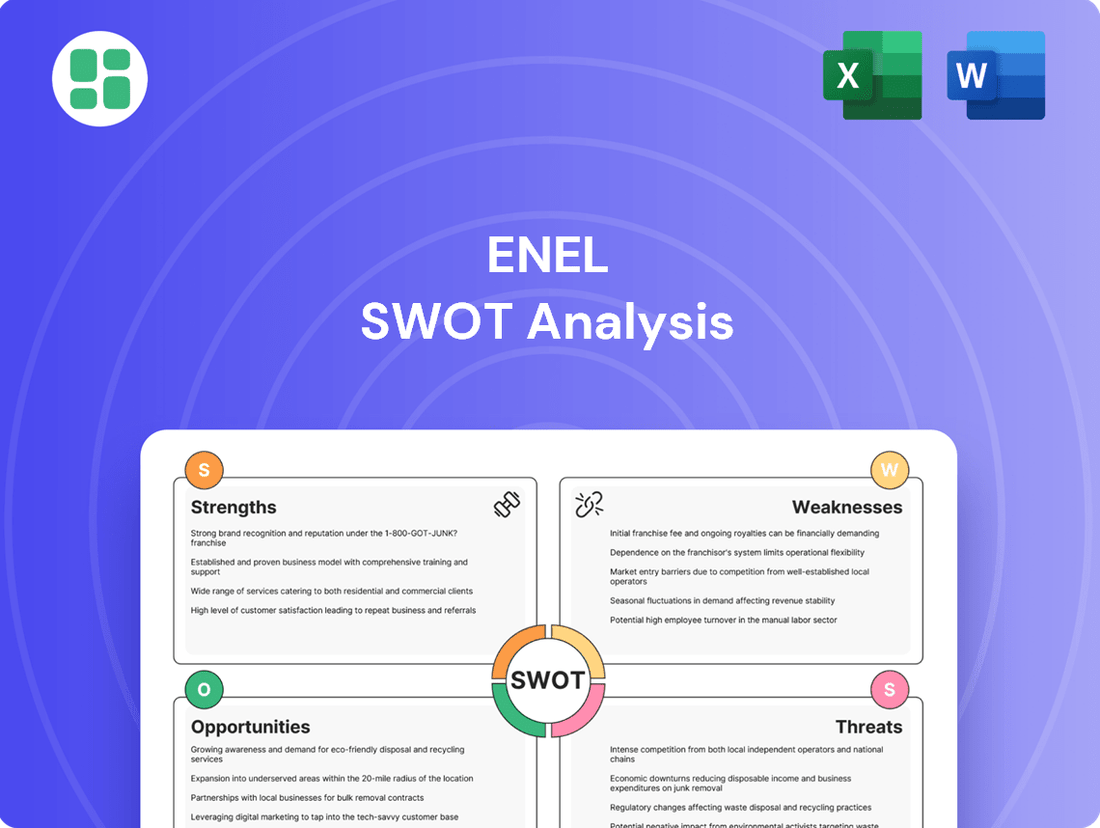

Delivers a strategic overview of Enel’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Identifies key Enel strengths and weaknesses to proactively address market challenges and capitalize on opportunities.

Weaknesses

Enel's total revenue saw a dip in 2024, largely due to reduced output from its thermoelectric power plants and falling prices in consumer markets. This decline, while a consequence of the company's strategic move towards decarbonization, presents a hurdle in sustaining overall revenue growth during this transition period.

Enel's strategic divestment plan, notably the sale of assets in Romania and Peru, has led to a reduction in the scope of consolidation. This means certain financial metrics, like reported revenues and EBITDA, have naturally decreased due to fewer operations being included. For instance, the sale of Enel Green Power Peru and Enel Distribución Perú in late 2022 and early 2023 removed significant revenue streams from the consolidated figures.

While these divestitures are crucial for debt reduction and sharpening the company's geographical focus, they can temporarily shrink Enel's overall operational scale and reported revenue. For example, the Romanian divestments alone represented a substantial portion of the company's previous European footprint. Effectively managing these transitions is paramount to ensuring that the benefits of a leaner structure outweigh the short-term impacts on financial reporting and operational size.

Enel's strategic focus for 2025-2027 highlights onshore wind, hydro, and battery storage, with solar PV receiving less explicit attention. This shift could lead to a less diversified renewable energy portfolio, potentially limiting exposure to high-growth solar markets and concentrating technology-specific risks.

Vulnerability to Regional Market Dynamics

Enel's exposure to regional market dynamics presents a significant weakness. For instance, in Latin America, the company has grappled with currency fluctuations and the unpredictable nature of hydrological conditions impacting its hydroelectric power generation. These factors can introduce volatility into its financial results, as seen in past quarters where adverse weather patterns in regions like Brazil affected output and profitability.

These regional specificities necessitate constant vigilance and adaptive strategies. Enel's reliance on hydroelectricity in certain territories means that changes in rainfall patterns, a direct consequence of climate shifts, can materially influence its energy production capacity and, consequently, its revenue streams. This makes forecasting and consistent performance more challenging in these particular markets.

- Currency Volatility: Fluctuations in currencies like the Argentine Peso or Brazilian Real can impact the reported value of Enel's assets and earnings in those regions when translated into Euros.

- Hydrological Dependence: Regions heavily reliant on hydroelectric power, such as parts of South America, are susceptible to drought or excessive rainfall, directly affecting energy generation volumes.

- Regulatory Uncertainty: Evolving energy policies and regulatory frameworks in different countries can create an unstable operating environment, potentially impacting pricing and investment returns.

- Economic Instability: Broader economic downturns or political instability within specific Latin American countries can dampen energy demand and affect Enel's ability to repatriate profits.

Operational Challenges in Distribution Networks

Enel's distribution operations encounter considerable hurdles in certain regions, notably Brazil, where pervasive cable theft disrupts power supply and incurs substantial financial losses. These incidents directly degrade customer service and necessitate increased spending on security and preventative measures, thus diverting capital from other growth initiatives.

For instance, in 2023, Enel reported that losses due to theft and technical issues in its Brazilian distribution segments amounted to a significant percentage of its operational costs, impacting overall profitability and service reliability.

- Cable Theft Impact: Widespread cable theft in Brazil leads to frequent power outages, affecting millions of customers and damaging Enel's reputation.

- Financial Strain: The cost of replacing stolen cables and implementing enhanced security measures diverts crucial funds from investments in network modernization and renewable energy projects.

- Service Quality Degradation: Operational challenges directly translate to a poorer quality of service for end-users, potentially leading to customer dissatisfaction and regulatory scrutiny.

Enel's strategic pivot away from solar PV towards onshore wind, hydro, and battery storage for its 2025-2027 plan might limit its participation in the rapidly expanding solar market. This concentration on specific renewable technologies could expose the company to greater technology-specific risks and potentially reduce diversification benefits in its renewable energy portfolio.

The company faces significant operational challenges in its distribution networks, particularly in Brazil, where cable theft leads to substantial financial losses and service disruptions. These losses, estimated to be a notable percentage of operational costs in 2023, necessitate increased spending on security and repairs, diverting capital from strategic growth areas.

Enel's reliance on hydroelectricity in regions like South America makes it vulnerable to hydrological variability, impacting energy generation and revenue streams due to unpredictable rainfall patterns. This dependence introduces volatility and complicates financial forecasting in these markets.

What You See Is What You Get

Enel SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global drive towards electrification, fueled by climate change concerns and technological advancements, is a significant tailwind for Enel. This transition creates a vast market for renewable energy generation and smart grid infrastructure, areas where Enel has substantial expertise and existing investments. For instance, the International Energy Agency (IEA) projects that renewable energy capacity additions will continue to break records, with solar PV and wind power leading the charge through 2025 and beyond, directly benefiting Enel's core operations.

Enel's significant investments in smart grid technologies and digitalization, including digital twins and edge computing, present a prime opportunity to boost grid efficiency and resilience. This focus allows for better integration of renewable energy sources, a key trend in the 2024-2025 energy landscape.

These technological advancements can unlock new revenue streams through innovative service offerings and enhance customer satisfaction by providing more reliable and responsive energy services. Furthermore, optimizing operations through digitalization is expected to lead to considerable cost reductions, improving Enel's profitability.

Enel is strategically positioned to capitalize on the accelerating global shift towards renewable energy. The company plans to install an additional 12 gigawatts of new renewable capacity by 2027, with a significant emphasis on onshore wind, hydro power, and crucially, battery storage solutions. This expansion directly aligns with the growing market demand for reliable and dispatchable renewable energy, a sector where battery storage is becoming increasingly vital.

Strategic Partnerships and Asset Rotation for Value Creation

Enel’s strategy of forming partnerships for renewable energy projects and selling off non-core assets is a smart way to free up capital and reduce risk. This allows them to reinvest in crucial growth areas. For instance, in 2023, Enel continued its active portfolio management, completing several asset disposals that contributed to its deleveraging targets.

This approach, often referred to as capital recycling, is key to unlocking the value embedded in their vast pipeline of renewable projects. By bringing in partners, Enel can share the development and operational risks while still benefiting from the project's long-term revenue streams. This also boosts their capacity to fund new, strategically important initiatives, like expanding their presence in emerging markets or investing in grid modernization technologies.

Key aspects of this strategy include:

- Partnership models: Enel actively seeks joint ventures and co-investment opportunities for large-scale renewable developments, sharing both capital expenditure and operational responsibilities.

- Asset monetization: The company systematically reviews its portfolio to identify and divest non-strategic or underperforming assets, generating cash for reinvestment.

- Risk optimization: By sharing project ownership, Enel mitigates exposure to individual project risks, enhancing the overall stability of its operations.

- Capital for growth: Funds generated from asset sales and partner contributions are strategically allocated to high-growth segments and innovation, such as battery storage and digital grid solutions.

Leveraging Supportive Regulatory Frameworks

Enel benefits significantly from supportive regulatory frameworks, particularly in its core European markets. For instance, Italy and Spain have established regulatory environments that actively encourage and reward investments in modernizing and expanding energy grids. This creates a more predictable and stable landscape for Enel's substantial capital expenditures in infrastructure development.

These favorable regulations effectively de-risk the significant capital deployment required for grid enhancements. By providing mechanisms that ensure stable and predictable returns on these investments, regulatory bodies foster an environment conducive to sustained growth and further infrastructure upgrades. This is crucial for Enel's strategy of investing in a more resilient and digitized energy system.

- Italy's regulatory framework, for example, has been designed to incentivize grid modernization, with mechanisms that allow for the recovery of investments and a fair return, supporting Enel's €27 billion investment plan for the 2024-2026 period focused on grids and renewables.

- Spain's regulatory approach also promotes grid development, aligning with the country's renewable energy targets and the need for a robust transmission and distribution network.

- The **predictability of returns** under these frameworks is a key factor in attracting the long-term capital needed for large-scale energy infrastructure projects.

Enel's strategic focus on renewable energy expansion, particularly in wind, hydro, and battery storage, positions it to capture significant market share. The company’s plan to add 12 GW of renewables by 2027 directly addresses the surging global demand for clean energy solutions, a trend projected to continue through 2025 and beyond according to IEA forecasts.

Digitalization of grids offers substantial operational efficiencies and new revenue streams. Enel's investment in smart grid technologies, including digital twins, enhances grid resilience and renewable energy integration, crucial for meeting 2024-2025 energy transition goals.

Favorable regulatory environments in key markets like Italy and Spain provide a stable foundation for Enel's infrastructure investments. Italy's regulatory framework, for instance, supports Enel's €27 billion investment plan for grids and renewables through 2026, ensuring predictable returns.

Strategic partnerships and asset monetization are key to unlocking capital for growth. Enel's active portfolio management in 2023, including asset disposals, generated cash for reinvestment in high-growth areas like battery storage and grid modernization.

Threats

Changes in energy policies, environmental regulations, and grid remuneration frameworks across Enel's many operating regions present a significant challenge. For instance, a shift towards less favorable feed-in tariffs for renewable energy in a key market could directly affect Enel's revenue streams from its solar and wind farms.

Unfavorable regulatory shifts, such as stricter emissions standards or a reduction in subsidies for green technologies, could increase operational costs or diminish the attractiveness of new investments. Delays in implementing supportive policies, like carbon pricing mechanisms or grid modernization incentives, might also hinder Enel's ability to achieve its strategic growth objectives and impact its projected investment returns.

The global energy market, especially in renewables and smart grids, is seeing fierce competition. Enel faces pressure from new companies entering the space and established players aggressively expanding their reach. This intensified rivalry can impact Enel's ability to maintain its market share and pricing power.

Enel's global presence exposes it to significant geopolitical and macroeconomic risks. For instance, the ongoing conflict in Eastern Europe and associated sanctions have directly impacted energy markets, contributing to significant price volatility. In 2024, inflation remained a concern in many of Enel's operating regions, with the Eurozone experiencing inflation rates that, while moderating from 2023 peaks, still influenced operating costs and consumer demand.

Currency fluctuations also pose a threat, as Enel generates revenue and incurs expenses in multiple currencies. A strengthening US dollar, for example, can negatively affect the reported earnings of its operations in countries with weaker currencies. Similarly, rising interest rates in 2024 and projected into 2025 increase the cost of borrowing, impacting Enel's ability to finance new renewable energy projects and potentially reducing profitability.

Cybersecurity Risks to Digitalized Infrastructure

Enel's extensive digitalization of its grids and operations, while enhancing efficiency, significantly elevates its exposure to cybersecurity risks. A successful cyberattack targeting critical energy infrastructure could result in severe operational disruptions, leading to widespread power outages and impacting millions of customers. For instance, the U.S. Department of Energy reported that in 2022, there were 138 reported cyber incidents affecting the energy sector, highlighting the persistent threat landscape.

The consequences of such breaches extend beyond immediate operational impacts. Enel faces the potential for substantial data loss, including sensitive customer information and proprietary operational data. Furthermore, regulatory bodies often impose significant financial penalties for security failures, and the reputational damage from a major cyber incident can erode customer trust and investor confidence, impacting long-term business continuity.

- Increased Attack Surface: Digitalization expands the potential entry points for cyber threats.

- Operational Disruption: Breaches can halt grid operations, leading to blackouts.

- Data Breach Costs: Financial penalties and reputational damage follow data compromise.

- Critical Infrastructure Vulnerability: Energy systems are prime targets for state-sponsored or sophisticated criminal actors.

Social and Environmental Opposition to Projects

Enel's expansion plans, especially for large renewable energy infrastructure like wind and solar farms, can encounter resistance from local communities and environmental advocates. This opposition can manifest as protests, legal challenges, or permit delays.

Such hurdles can significantly slow down project timelines and inflate development expenses. For instance, in 2024, several large-scale renewable projects across Europe faced significant community consultations and environmental impact assessments, leading to average project delays of 6-12 months and an estimated cost increase of 5-10%.

- Project Delays: Opposition can push back operational start dates, impacting revenue generation.

- Increased Costs: Legal battles, community compensation, and redesigns add to project budgets.

- Reputational Damage: Negative publicity can affect public perception and future project approvals.

- Capacity Impact: Delays and cancellations hinder Enel's ability to meet its renewable energy capacity targets, such as its 2030 goal of over 70 GW of installed renewable capacity.

Enel faces significant threats from evolving energy policies and regulations globally, which can impact revenue streams from renewable assets. Unfavorable shifts in subsidies or stricter environmental standards could increase operational costs and deter new investments, potentially slowing progress towards its 2030 renewable capacity targets.

Intensified competition in the renewable and smart grid sectors poses a challenge to Enel's market share and pricing power, with new entrants and established players aggressively expanding. Furthermore, geopolitical instability and macroeconomic factors like inflation and rising interest rates, as seen in 2024 and projected into 2025, create volatility and increase financing costs for new projects.

The company's extensive digitalization makes it vulnerable to cybersecurity threats, with potential for severe operational disruptions and data breaches, as evidenced by the persistent threat landscape in the energy sector. Community opposition and environmental concerns can also lead to project delays and increased costs, impacting Enel's ability to meet its ambitious growth objectives.

SWOT Analysis Data Sources

This Enel SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and insights from leading industry analysts to provide a well-rounded strategic perspective.