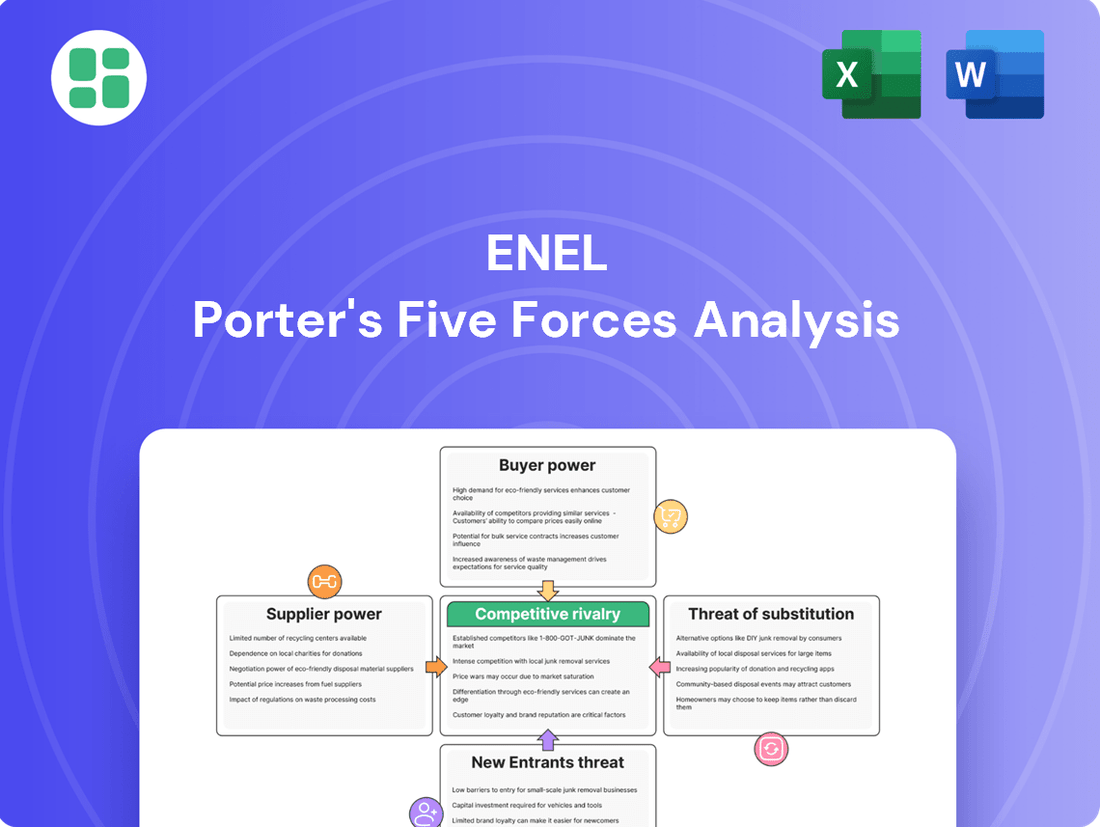

Enel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enel Bundle

Enel's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the looming threat of new entrants. Understanding these dynamics is crucial for navigating the energy sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Enel’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Enel's reliance on specialized technology for its renewable energy ventures, such as wind turbines and solar panels, is a key factor in supplier bargaining power. The market for these advanced components often features a limited number of highly capable manufacturers. This concentration means these suppliers can exert considerable influence over pricing and delivery schedules.

For instance, Enel's substantial investments in renewable capacity, with approximately €10 billion earmarked for 2024 alone and continued significant outlays through 2027, underscore its need for these specialized technologies. This ongoing demand from major players like Enel can strengthen the negotiating position of the few dominant suppliers in the sector.

The prices of critical raw materials like lithium for batteries and metals for grid infrastructure are a direct driver of Enel's operational expenses, significantly impacting the bargaining power of its suppliers. For instance, the price of natural gas, a key input for many energy companies, experienced notable volatility throughout 2024, demonstrating how commodity market swings can tilt power towards suppliers.

Enel's extensive renewable energy projects, such as its vast wind farms and solar installations, frequently hinge on the availability of specific local and regional assets, including land and particular geographical features. This reliance on localized resources can empower individual landowners or regional suppliers with considerable bargaining leverage, potentially influencing project expenses and development schedules.

For instance, securing suitable land for large-scale solar farms in sun-drenched regions or prime locations for wind turbines in consistently windy areas can become a point of negotiation. While specific 2024 data on land acquisition costs for Enel projects isn't publicly detailed, the general trend in renewable energy development shows that land availability and associated lease or purchase agreements are critical cost components. A report in early 2024 highlighted that land costs for solar projects in the US could range from $500 to $2,000 per acre, depending on location and quality.

Enel's expansive global footprint, however, serves as a strategic advantage, helping to dilute the impact of localized resource dependency. By diversifying its operations across numerous countries and regions, the company can mitigate the risks associated with a single local supplier or resource constraint, thereby maintaining a more stable operational and financial outlook.

Switching Costs for Critical Inputs

Switching major suppliers for critical infrastructure or specialized renewable energy components presents a significant challenge for Enel. Long-term contracts, the intricate technical integration required for new equipment, and rigorous qualification processes for new vendors can lock Enel into existing relationships, thereby bolstering the bargaining power of its current suppliers. For instance, in 2024, the global supply chain for advanced solar panels and wind turbine components continued to be dominated by a few key manufacturers, with lead times for new, highly specialized equipment often extending beyond 12 months, underscoring the difficulty of rapid supplier diversification.

Enel's strategic initiative to diversify its supply chain aims to mitigate these risks, but the inherent switching costs remain a substantial factor. These costs are not merely financial; they also encompass the time and resources needed to re-engineer systems, retrain personnel, and ensure the reliability and compatibility of new materials and technologies. This reality strengthens the hand of suppliers who provide essential, highly specialized inputs, as Enel must carefully weigh the potential benefits of a new supplier against the disruption and expense of the transition.

- High Integration Costs: Switching suppliers for specialized components like advanced grid management software or high-efficiency turbine blades can require extensive system reconfigurations, potentially costing millions of euros and delaying project timelines by months.

- Long-Term Contractual Obligations: Many of Enel's existing supply agreements for critical materials and equipment are multi-year contracts, making early termination or renegotiation costly and complex.

- Supplier Qualification Hurdles: Introducing new suppliers, particularly for safety-critical components in power generation, involves rigorous testing and certification processes that can take up to a year, limiting Enel's agility in the market.

- Specialized Technical Expertise: The unique technical specifications and proprietary technologies associated with certain renewable energy components mean that few suppliers can offer direct replacements, concentrating power among those who can.

Supplier's Potential for Forward Integration

In the energy sector, suppliers of specialized equipment, particularly for smart grids and renewable technologies, hold a degree of bargaining power through their potential for forward integration. This means they could, in theory, move into areas typically managed by energy companies like Enel, thereby diminishing Enel's direct control over parts of the energy value chain. For instance, a company developing cutting-edge grid management software might consider offering its own grid operation services.

While direct forward integration by Enel's suppliers into its core utility operations is not a widespread occurrence, the mere possibility can shift the balance of power. This threat can influence contract negotiations and pricing, as Enel must consider the strategic options available to its key technology providers. For example, if a supplier of advanced battery storage systems for utility-scale projects were to consider developing and operating its own storage facilities, it could leverage this position.

Enel's ongoing digital transformation, with its significant investments in smart grid technology and data analytics, is a strategic move to counter such potential shifts in supplier power. By enhancing its own capabilities and control over its operational data and infrastructure, Enel aims to maintain its competitive edge and reduce reliance on suppliers who might consider moving up the value chain. In 2024, Enel continued to invest heavily in digitalizing its networks, with a reported €2.5 billion allocated to network modernization and digitalization initiatives across its European operations.

The bargaining power of suppliers is also influenced by the concentration of specialized knowledge and intellectual property. For example, suppliers of critical components for offshore wind turbines, such as advanced blade designs or specialized gearbox technology, might possess unique expertise that is difficult for Enel to replicate internally or source from alternative providers. This can lead to situations where Enel faces limited options, thus increasing the supplier's leverage.

Suppliers of specialized renewable energy components and critical raw materials hold significant bargaining power over Enel. This is due to factors like limited competition among advanced technology manufacturers and the essential nature of inputs such as lithium and metals for grid infrastructure. Enel's substantial investment in renewables, with approximately €10 billion allocated for 2024, further solidifies the leverage of these few dominant suppliers.

The difficulty and cost associated with switching suppliers for highly integrated or specialized equipment, coupled with long-term contractual obligations, lock Enel into existing relationships. This situation strengthens the negotiating position of current providers, as demonstrated by the extended lead times of over 12 months for specialized renewable energy components observed in 2024.

| Factor | Impact on Enel | 2024 Data/Example |

| Limited Supplier Competition | Suppliers of advanced components can dictate terms. | Few manufacturers dominate the market for specialized wind turbines and solar panels. |

| Critical Raw Material Prices | Volatility in commodity prices directly affects Enel's costs. | Natural gas prices showed significant volatility in 2024, impacting energy input costs. |

| High Switching Costs | Difficulty and expense in changing suppliers reinforce existing relationships. | Lead times for specialized equipment exceeded 12 months in 2024, highlighting integration challenges. |

| Potential for Forward Integration | Suppliers could enter Enel's operational areas, shifting power dynamics. | Companies developing advanced grid software might offer grid operation services. |

What is included in the product

This analysis dissects the competitive forces impacting Enel, evaluating the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

In liberalized energy markets, Enel faces customers who are highly sensitive to price, especially large industrial and commercial entities where energy expenses are a major budget item. For instance, in 2024, industrial electricity prices in many European countries remained a significant concern for businesses, directly impacting their operational costs.

The presence of numerous energy suppliers grants customers the power to switch to competitors offering more attractive pricing. This competitive landscape in 2024 meant that providers needed to offer compelling value propositions beyond just electricity supply.

To counter this, Enel focuses on building customer loyalty by offering integrated services and product packages. These might include energy efficiency solutions, smart home technology, or flexible tariff options designed to provide greater value and reduce perceived price sensitivity.

Customers in many of Enel's core markets, like Italy and Spain, have a variety of electricity and gas providers to choose from. This availability of multiple energy retailers significantly boosts their bargaining power, as they can easily switch to a competitor offering better rates or services.

Enel is actively addressing this by focusing on growing its customer base in the liberalized market and enhancing the overall customer experience. This strategy aims to build loyalty and reduce customer churn in a competitive landscape.

The company's strategic roadmap for 2025-2027 reflects this commitment, with substantial investments earmarked for the customer segment. This financial backing underscores Enel's dedication to strengthening its position by prioritizing customer satisfaction and retention.

Customers are increasingly empowered through demand-side management and energy efficiency. The global smart home market, for instance, was valued at over $80 billion in 2023 and is projected to grow significantly, enabling consumers to actively manage their energy use. This shift reduces their dependence on traditional utility providers and strengthens their negotiating position, as they can opt for more efficient solutions or even generate their own power.

Threat of Customer Self-Generation (Prosumers)

The growing availability and decreasing cost of distributed energy solutions, like rooftop solar and home battery systems, are transforming consumers into 'prosumers.' These individuals can now generate their own electricity, lessening their reliance on traditional utility providers such as Enel.

Enel recognizes this shift and is actively participating in the renewable energy sector, investing in its own distributed generation capabilities. This strategic move allows Enel to align with market trends and potentially mitigate the impact of customers generating their own power.

- Prosumer Growth: By the end of 2023, the global installed capacity of rooftop solar PV reached over 200 GW, a significant increase from previous years, indicating a growing trend of self-generation.

- Battery Storage Adoption: Residential battery storage installations are also on the rise, with global capacity projected to exceed 50 GW by 2025, further enabling prosumers to manage their energy independence.

- Enel's Renewable Investments: Enel's 2024-2026 strategic plan includes substantial investments in renewable energy and grid modernization, reflecting an effort to adapt to and capitalize on the evolving energy landscape shaped by prosumers.

Regulatory Influence on Pricing and Switching

Even in deregulated energy markets, regulatory bodies significantly influence customer bargaining power. Consumer protection rules, such as mandated transparency in billing and service quality standards, directly impact how customers perceive and interact with utility providers like Enel. For instance, regulations that set price caps on certain energy components or limit exit fees can make it easier and less costly for customers to switch providers, thereby increasing their leverage.

These regulatory frameworks are designed to foster a more competitive environment, which inherently empowers customers. By ensuring fair practices and providing clear pathways for switching, regulators can prevent utilities from exploiting market dominance. Enel's strategic planning acknowledges this by focusing on operating within regulatory environments that are conducive to innovation and sustainable growth, implying an understanding of how these rules shape customer relations.

- Regulatory Price Caps: Limits on retail energy prices can directly reduce the perceived cost advantage of a single provider, making switching more attractive.

- Consumer Protection Laws: Mandates for clear billing, complaint resolution processes, and service standards enhance customer awareness and confidence, strengthening their position.

- Facilitated Switching: Regulations that simplify the process of changing energy suppliers reduce customer effort and risk, increasing their willingness to explore alternatives.

- Enel's Strategic Alignment: Enel's stated commitment to operating within supportive regulatory frameworks suggests an adaptation to, and leveraging of, these customer-empowering rules.

Customers possess significant bargaining power due to price sensitivity, especially large industrial users whose energy costs are a substantial portion of their budget. In 2024, industrial electricity prices in Europe remained a key concern for businesses, directly impacting their operational expenses.

The availability of multiple energy suppliers allows customers to easily switch to competitors offering better pricing or value. This competitive dynamic in 2024 compelled energy providers to differentiate their offerings beyond just supplying electricity.

Growing adoption of distributed energy solutions, like rooftop solar and battery storage, is transforming consumers into prosumers, reducing their reliance on traditional utilities. Global rooftop solar PV capacity exceeded 200 GW by the end of 2023, highlighting this trend.

| Factor | Impact on Enel | 2024/2025 Data Point |

|---|---|---|

| Price Sensitivity | High, especially for industrial clients | Industrial electricity prices a major concern for businesses in Europe |

| Supplier Availability | Enables customer switching | Numerous energy retailers in key markets like Italy and Spain |

| Prosumer Trend | Reduces reliance on utilities | Global rooftop solar PV capacity > 200 GW (end of 2023) |

Same Document Delivered

Enel Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It offers a comprehensive Porter's Five Forces analysis of Enel, detailing the competitive landscape and strategic implications for the energy giant. You'll gain actionable insights into industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products.

Rivalry Among Competitors

The energy sector, particularly renewables, is a crowded arena for Enel. Think of everything from established utility giants to nimble startups and tech companies entering the fray. This sheer volume and variety of players means competition is fierce.

This rivalry is only heating up. In 2024 alone, global renewable energy capacity additions reached a record high, injecting even more competition into the market. Companies are vying intensely for projects, customers, and market share.

The renewable energy sector is experiencing robust growth, fueled by global decarbonization mandates and favorable government incentives. This expansion has drawn substantial investment and a surge of new entrants, consequently heightening competitive pressures. For instance, in 2024, global renewable energy capacity additions were projected to reach record levels, with solar photovoltaic leading the charge.

Enel's strategic focus on achieving net-zero emissions by 2040 and its significant capital allocation towards renewable energy projects position it favorably within this evolving landscape. However, this proactive stance also places Enel squarely in a fiercely competitive and rapidly changing market, where innovation and efficiency are paramount for sustained success.

While electricity itself is often viewed as a commodity, Enel actively differentiates its offerings. This is achieved through a strong emphasis on renewable energy sources, the development of smart grid technologies, and the provision of integrated energy services. These efforts aim to move beyond basic electricity supply to offer more comprehensive solutions.

Enel's strategic approach involves bundling various products and services. This creates added value for customers, fostering stronger loyalty in a market where such differentiation can significantly impact competitive positioning. For instance, by offering a package of green energy, smart home devices, and energy efficiency advice, Enel can build a more robust customer relationship.

In 2024, the global renewable energy sector continued its robust growth, with significant investments in solar and wind power, areas where Enel has a strong presence. This focus on sustainability is a key differentiator, appealing to an increasingly environmentally conscious consumer base and business clientele. Enel's commitment to decarbonization, aiming for 100% decarbonized generation by 2040, underscores this product differentiation strategy.

High Fixed Costs and Exit Barriers

The energy sector, including Enel's operations, is inherently capital-intensive. Building and maintaining power generation facilities, extensive transmission networks, and distribution grids requires massive upfront investment. These high fixed costs create substantial barriers to exiting the market, as companies cannot easily divest specialized infrastructure. Consequently, firms are incentivized to fight fiercely for market share rather than withdraw, amplifying competitive rivalry.

Enel's significant investments in its European grids and renewable energy projects, such as its substantial solar and wind farm developments, exemplify these high fixed costs. For instance, in 2023, Enel reported capital expenditures of approximately €12.1 billion, largely directed towards grid modernization and renewable capacity expansion. This deep commitment to infrastructure solidifies its position but also means that exiting would incur immense losses, thus perpetuating intense competition among established players.

- High Capital Intensity: The energy industry demands enormous investment in generation, transmission, and distribution infrastructure.

- Significant Exit Barriers: Once invested, companies face substantial financial penalties and difficulties in divesting specialized energy assets.

- Aggressive Competition: The inability to easily exit forces companies to compete intensely to retain market share and profitability.

- Enel's Infrastructure Investment: Enel's ongoing substantial capital expenditure, totaling billions annually, reinforces these exit barriers and competitive pressures.

Geographical Focus and Market Consolidation

Enel is strategically refining its operational footprint, prioritizing core markets such as Italy, Iberia, and Latin America. This concentrated approach aims to enhance customer satisfaction and deepen market engagement within these key regions.

This strategic geographical focus, coupled with continuous market consolidation and the rotation of assets, directly influences the competitive landscape. It intensifies rivalry in specific, high-potential geographies where Enel is doubling down on its presence.

- Increased Competition in Core Markets: Enel's focus on Italy, Iberia, and Latin America means it faces more direct competition from other energy players with strong regional presences in these areas.

- Impact of Asset Rotations: As Enel divests certain assets and acquires others, the competitive intensity shifts. For instance, in 2023, Enel completed the sale of its entire stake in Enel Chile, a move that reshaped the competitive dynamics in that specific market.

- Market Consolidation Trends: The broader trend of consolidation in the European energy sector, for example, means fewer, larger players are vying for market share, leading to more concentrated and potentially aggressive competition in remaining attractive markets.

The competitive rivalry in the energy sector, especially renewables, is intense due to numerous players ranging from large utilities to emerging tech firms. This is amplified by record global renewable capacity additions in 2024, driving fierce competition for projects and customers.

Enel's strategic focus on core markets and its significant capital investments in infrastructure, like its €12.1 billion expenditure in 2023, create high barriers to exit. This forces companies to compete aggressively for market share, as divesting specialized energy assets is financially challenging.

Enel differentiates itself through a strong emphasis on renewables, smart grids, and integrated energy services, aiming to offer more than just electricity supply. This strategy, coupled with its commitment to net-zero emissions by 2040, positions it well but also places it in a highly competitive market where innovation is key.

| Key Factor | Description | Impact on Enel | 2024 Data Point | Enel Specific Example |

| Crowded Market | Numerous players from utilities to tech companies | Heightened competition for market share | Record renewable capacity additions | Strong presence in solar and wind |

| High Capital Intensity | Massive investment in infrastructure | Significant exit barriers, perpetuating rivalry | €12.1 billion capex in 2023 | Investments in European grids and solar/wind farms |

| Product Differentiation | Focus on renewables, smart grids, integrated services | Key for customer loyalty and competitive positioning | Growing demand for green energy | Bundling green energy with smart home devices |

SSubstitutes Threaten

The increasing viability of renewable self-generation poses a significant threat of substitution for traditional utility providers like Enel. As rooftop solar photovoltaic (PV) and small-scale wind technologies become more advanced and cost-effective, customers gain the ability to produce their own electricity. This trend directly reduces their dependence on grid-supplied power.

By 2024, the global installed capacity for solar PV alone was projected to surpass 1,500 GW, a testament to its growing accessibility and adoption. This decentralization means a growing segment of consumers can offset their energy purchases, impacting the revenue streams of established companies.

Enel itself recognizes this shift and is actively investing in its own renewable generation capacity, including distributed energy solutions. This strategic move aims to not only mitigate the threat of substitution but also to capitalize on the growing demand for self-generated and renewable energy sources.

Rapid advancements and cost reductions in battery energy storage systems (BESS) present a substantial threat of substitutes for traditional energy providers like Enel. For instance, by 2024, the global BESS market is projected to reach over $100 billion, driven by falling lithium-ion battery prices which have seen a decline of over 90% in the last decade. This allows customers to store energy, diminishing reliance on grid power during peak demand periods and potentially reducing the need for Enel's grid services.

Technologies and practices aimed at improving energy efficiency, like smart thermostats and advanced insulation, directly impact electricity consumption. By enabling consumers to use less energy, these innovations act as a substitute for traditional grid-supplied power. For instance, in 2023, the International Energy Agency reported that energy efficiency measures saved the equivalent of the European Union's total final energy consumption in 2022.

Enel actively participates in this market by offering integrated energy efficiency solutions. These services help customers reduce their demand, thereby lessening their reliance on the grid. This strategic positioning allows Enel to capture value by providing alternatives to simply supplying more energy.

Alternative Fuel Sources for Heating and Transport

While Enel primarily operates in the electricity sector, substitutes for its core offerings exist, particularly in heating and transport. For heating, alternative fuels like natural gas, propane, and even wood are direct substitutes for electric heating systems, which Enel's electricity powers. In transportation, while electric vehicles (EVs) are a key focus for Enel's electric mobility strategy, internal combustion engine (ICE) vehicles running on gasoline or diesel remain significant substitutes. The market share of EVs in new car sales globally reached approximately 14% in 2023, highlighting the continued dominance of traditional fuels.

The threat of substitutes is particularly relevant when considering the broader energy landscape. For instance, advancements in hydrogen fuel cell technology for vehicles present a potential substitute for battery-electric vehicles charged by grid electricity. Similarly, in the heating sector, the development and adoption of more efficient heat pumps or even geothermal systems can reduce reliance on electricity for climate control. Enel's strategy to expand its broader energy services and electric mobility infrastructure aims to mitigate this threat by capturing demand across various energy needs, including those potentially served by these substitutes.

- Heating Substitutes: Natural gas, propane, and biomass continue to be viable alternatives to electric heating, impacting electricity demand for residential and commercial spaces.

- Transport Substitutes: Hydrogen fuel cell vehicles and advanced biofuels offer alternative pathways for decarbonizing transport, posing a challenge to pure EV adoption reliant on grid electricity.

- Market Penetration: As of 2023, battery electric vehicles accounted for roughly 14% of global new car sales, indicating substantial market share still held by internal combustion engine vehicles and their associated fuel sources.

- Enel's Response: Enel's diversification into broader energy services and electric mobility aims to integrate these evolving energy demands and retain market relevance against a backdrop of diverse energy solutions.

Regulatory Support for Distributed Energy Resources

Government policies and incentives are a significant driver for distributed energy resources (DERs), acting as a potent substitute threat. For instance, the U.S. Inflation Reduction Act of 2022 offers substantial tax credits for solar and storage, accelerating consumer adoption. This shift empowers individuals and businesses to generate their own power, reducing reliance on traditional utility providers.

Regulations that champion local generation and microgrids further exacerbate this threat. By allowing consumers to bypass established utility services for a portion of their energy needs, these frameworks create competitive alternatives. In 2024, several states are actively exploring or implementing policies that facilitate community solar projects and virtual power plants, directly challenging incumbent business models.

Enel actively participates in advocacy to shape these regulatory landscapes. Their efforts aim to ensure that policies not only support DER adoption but also create a level playing field. This proactive engagement is crucial for managing the threat of substitutes by influencing the rules of the game in favor of integrated energy solutions that can incorporate distributed assets.

- Government Incentives: The U.S. federal investment tax credit (ITC) for solar energy, for example, has been extended and enhanced, providing a strong financial incentive for residential and commercial installations.

- Microgrid Development: As of 2024, numerous pilot programs and state-level initiatives are underway to support the development of microgrids, enabling localized energy independence.

- Demand-Side Flexibility: Utilities are increasingly offering programs that reward customers for reducing energy consumption during peak hours, a form of demand-side management that acts as a substitute for traditional supply-side investments.

- Enel's Advocacy: Enel's engagement includes lobbying for favorable net metering policies and interconnection standards, which are critical for the economic viability of DERs.

The increasing cost-effectiveness of self-generation technologies like solar PV and battery storage presents a significant threat of substitution for Enel. By 2024, global solar PV capacity was projected to exceed 1,500 GW, making it easier for consumers to produce their own electricity and reduce reliance on grid power. This trend directly impacts Enel's traditional revenue streams.

Advancements in energy efficiency also serve as a substitute, as they lower overall electricity consumption. For instance, the International Energy Agency noted in 2023 that efficiency measures saved energy equivalent to the EU's total final consumption in 2022. Enel is addressing this by offering its own efficiency solutions, aiming to capture value in reduced demand.

Beyond electricity, alternative fuels for heating and transport act as substitutes. While EVs are growing, internal combustion engine vehicles still hold significant market share, with EVs representing about 14% of global new car sales in 2023. Enel's strategy to expand into broader energy services and electric mobility aims to counter these diverse substitution threats.

Entrants Threaten

The energy sector, especially in power generation and distribution, demands massive upfront capital for infrastructure, power plants, and grid upgrades. Enel's commitment to invest €43 billion between 2025 and 2027 underscores these substantial financial hurdles, creating a formidable barrier for any new players attempting to enter the market at a comparable scale.

The energy sector, particularly for companies like Enel, faces formidable regulatory hurdles. Obtaining the necessary licenses, environmental permits, and complying with rigorous safety and operational standards are complex and time-consuming processes. These requirements significantly increase the upfront investment and operational costs for any new entrant, acting as a strong deterrent.

Established energy giants like Enel leverage substantial economies of scale across generation, transmission, and distribution, leading to lower per-unit costs. Newcomers would find it incredibly difficult to achieve similar cost efficiencies without massive upfront capital outlays and immediate market share acquisition.

Enel's extensive global infrastructure and vast customer network are key contributors to its scale advantages, creating a significant barrier for potential new entrants aiming to compete on cost.

Access to Distribution Channels and Grid Infrastructure

New companies looking to enter the energy market face significant hurdles in accessing established electricity grids and distribution networks. These vital infrastructures are typically controlled by incumbent utilities, such as Enel, making it difficult for newcomers to connect and serve customers. The sheer cost and time required to build entirely new grid infrastructure are often prohibitive, acting as a substantial barrier.

Enel's strategic investments in grid modernization, including digitalization and resilience enhancements, further solidify its competitive advantage and make it even more challenging for new entrants to compete. For instance, Enel's ongoing €20 billion investment plan through 2027 focuses on upgrading its Italian networks, increasing the difficulty for any new player to gain a foothold.

- Limited Access to Grid Infrastructure: Incumbent utilities like Enel control essential electricity grids, restricting new entrants' ability to connect and distribute power.

- High Cost of New Infrastructure: Building new distribution networks is prohibitively expensive and time-consuming, deterring new market participants.

- Enel's Infrastructure Investments: Enel's significant spending on grid digitalization and resilience, such as its €20 billion plan through 2027, strengthens its position and raises the barrier to entry.

Brand Loyalty and Customer Switching Costs

Brand loyalty and the perceived hassle of switching are significant hurdles for new entrants in the utility sector. While customers technically can change providers, many established utilities like Enel benefit from decades of brand recognition and trust, especially among residential users. This customer stickiness makes it challenging for newcomers to attract a substantial customer base without significant investment in marketing and incentives.

For instance, in many European markets where Enel operates, switching energy providers can involve administrative steps and a learning curve for consumers, reinforcing inertia. Enel's continuous efforts to enhance its brand image through sustainability initiatives and improved customer service further solidify this loyalty. In 2024, Enel reported a customer satisfaction score of 8.5 out of 10 across its key markets, underscoring the strength of its existing relationships.

- Customer Inertia: Many consumers stick with their current utility provider due to the perceived complexity and effort involved in switching.

- Brand Trust: Established companies like Enel leverage long-standing brand recognition and trust, which are difficult for new entrants to replicate quickly.

- Enel's Strategy: Enel focuses on building strong customer relationships and a positive brand image, aiming to minimize churn and deter new competitors.

- Market Data: In 2024, customer retention rates for major European utilities, including Enel, remained above 95% for residential customers, highlighting the challenge for new entrants.

The threat of new entrants for Enel is generally low due to substantial capital requirements and regulatory complexities inherent in the energy sector. Massive upfront investments in infrastructure and navigating stringent licensing processes create high barriers. Furthermore, established players like Enel benefit from significant economies of scale and control over essential grid access, making it difficult for newcomers to compete effectively on cost or reach customers.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Enel's €43 billion investment plan (2025-2027) highlights the immense capital needed for power generation and grid infrastructure. | Prohibitive for most new players. |

| Regulatory Hurdles | Complex licensing, environmental permits, and safety standards are time-consuming and costly to obtain. | Significantly increases entry costs and delays market access. |

| Economies of Scale | Enel's vast operational scale leads to lower per-unit costs, difficult for new entrants to match without massive investment. | New entrants struggle to achieve cost competitiveness. |

| Grid Access | Enel controls essential grid infrastructure, limiting new entrants' ability to connect and distribute power. | Restricts market reach and increases infrastructure development costs for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Enel Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Enel's annual reports, investor presentations, and regulatory filings. This is supplemented by industry-specific market research reports and data from energy sector consulting firms to provide a comprehensive view of the competitive landscape.