Enel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enel Bundle

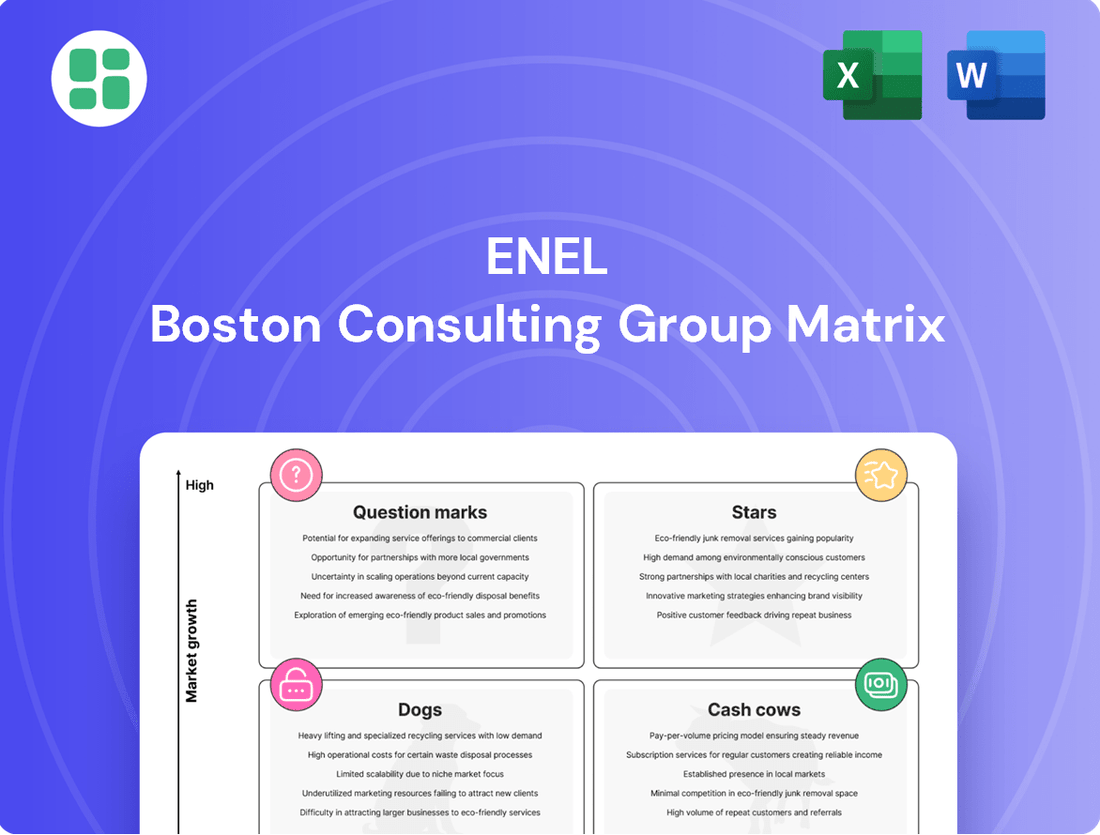

Uncover the strategic positioning of Enel's diverse portfolio with our comprehensive BCG Matrix analysis. See which of their energy solutions are market leaders (Stars), which consistently generate revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This preview offers a glimpse into Enel's market dynamics, but the full BCG Matrix report provides the in-depth data and actionable insights you need to make informed investment and strategic decisions. Don't miss out on understanding the complete picture of their business.

Ready to optimize your understanding of Enel's competitive landscape? Purchase the full BCG Matrix for a detailed breakdown, expert commentary, and strategic recommendations tailored to each quadrant. It's your shortcut to clarity and confident decision-making.

Stars

Enel is a powerhouse in renewable energy, particularly in wind and hydro. Their ambitious plan to add around 12 GW of new renewable capacity by 2027, with a significant portion coming from onshore wind, batteries, and hydro, highlights this segment's strong growth trajectory and Enel's dominant market presence.

This focus on expanding wind and hydro power is a key engine for Enel Green Power's revenue growth. It's directly contributing to the overall increase in the Group's EBITDA, underscoring the financial importance of these renewable assets.

Enel's substantial investments in upgrading and digitizing its electricity distribution networks, especially in Italy and Spain, place it firmly in the Stars category of the BCG Matrix. These smart grids are vital for incorporating increasing amounts of renewable energy and boosting grid resilience, ultimately leading to better service and operational efficiency.

The company has earmarked €26 billion for grid investments through 2027, with a significant 78% allocated to Italy and Spain. This focus underscores robust growth in digitalization efforts and Enel's dominant market position in these key regions.

Enel's Battery Energy Storage Systems (BESS) represent a significant growth opportunity, evidenced by their 1,618 MW of installed capacity as of March 2024, a remarkable 136.1% increase year-on-year. This rapid expansion highlights the critical role BESS plays in addressing renewable energy intermittency and bolstering grid stability.

The strategic importance of BESS within Enel's renewable energy portfolio solidifies its position as a Star. These systems are fundamental to integrating variable renewable sources and improving overall grid flexibility, making them a key investment focus for the company's future growth and operational efficiency.

Demand Response Solutions in North America

Enel North America is a significant player in the demand response market, actively expanding its capacity across the United States and Canada. This strategic move taps into the burgeoning demand for grid flexibility and reliability, crucial as renewable energy sources become more prevalent. Enel's commitment positions this segment as a Star within its portfolio, enhancing grid stability and operational efficiency.

The demand response sector is experiencing robust growth, driven by the need to balance an increasingly complex energy grid. In 2024, the North American demand response market was valued at approximately $3.5 billion, with projections indicating a compound annual growth rate of over 15% through 2030. Enel's continued investment and established footprint in this high-growth area solidify its Star status.

- Market Growth: The North American demand response market is projected to grow significantly, driven by grid modernization and renewable energy integration.

- Enel's Role: Enel North America is expanding its demand response capacity in the US and Canada, contributing to grid reliability.

- Financial Data: The market was valued at around $3.5 billion in 2024 and is expected to see over 15% CAGR.

- Strategic Importance: This segment is key to Enel's strategy for a more flexible and efficient energy grid.

Green Hydrogen Development

Enel Green Power is making significant strides in the green hydrogen sector, a key area for decarbonization in industries where direct electrification is challenging. Their strategy involves coupling renewable energy generation with hydrogen production facilities, positioning them for substantial future growth.

This focus on green hydrogen aligns with global efforts to reduce carbon emissions. Enel's early investments and ongoing pilot projects in this burgeoning market highlight its potential to become a dominant player, reflecting its status as a Star in the BCG matrix.

- Global Green Hydrogen Market Growth: The global green hydrogen market was valued at approximately USD 4.2 billion in 2023 and is projected to reach USD 68.4 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 36.5% during the forecast period.

- Enel's Strategic Investments: Enel Green Power has announced plans for several large-scale green hydrogen projects, including a significant investment in a facility in Spain aimed at producing 3,000 tons of green hydrogen annually by 2023, powered by 100 MW of renewable energy.

- Industry Adoption: Industries like heavy transport, steel manufacturing, and chemicals are increasingly looking to green hydrogen as a viable solution for reducing their carbon footprints, driving demand for production capabilities.

- Enel's Role as a Star: Enel's proactive engagement and substantial investments in green hydrogen production, leveraging its extensive renewable energy portfolio, firmly place it in the Star quadrant, indicating high market share in a rapidly expanding industry.

Enel's significant investments in advanced technologies like Battery Energy Storage Systems (BESS) and its expansion in the North American demand response market solidify its Star status. The company's commitment to grid modernization, particularly in Italy and Spain with a €26 billion allocation by 2027, further reinforces this position. These strategic moves are crucial for integrating renewable energy and enhancing grid stability, driving both operational efficiency and revenue growth.

| Segment | Market Growth | Enel's Position | Key Data Point |

| Battery Energy Storage Systems (BESS) | High Growth | Star | 1,618 MW installed capacity (March 2024), 136.1% YoY increase |

| Demand Response (North America) | High Growth (15%+ CAGR projected) | Star | Market valued at ~$3.5 billion (2024) |

| Smart Grids (Italy & Spain) | Strong Growth & Essential Infrastructure | Star | €26 billion investment through 2027 |

What is included in the product

The Enel BCG Matrix provides a strategic overview of Enel's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

This analysis guides Enel's investment decisions, highlighting which units to nurture, harvest, develop, or divest for optimal portfolio performance.

Enel BCG Matrix: A clear visual guide to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Enel's established hydroelectric assets are true cash cows, representing a mature business with a dominant market share. These large-scale plants consistently churn out significant cash flow with minimal need for further investment in promotion or placement, acting as a reliable revenue engine for the company. In 2023, Enel's hydroelectric generation contributed approximately 15% of its total renewable energy output, underscoring their steady and substantial contribution to the company's zero-emission generation goals.

Enel's regulated electricity distribution in Italy and Spain represents a classic cash cow. These mature markets offer stable, predictable revenue streams thanks to supportive regulatory frameworks that guarantee returns on infrastructure investments.

In 2023, Enel's Italian distribution network served approximately 32 million end-users, while Spain's network reached around 11 million. These operations are characterized by low growth potential but generate substantial and reliable cash flows, underpinning Enel's financial stability.

Enel's conventional thermal generation, while slated for phase-out by 2027, remains a vital cash cow, particularly in regions where it underpins grid stability and provides essential ancillary services. These assets continue to generate significant revenue in mature energy markets by ensuring reliable baseload power, even as their strategic focus shifts towards renewables.

Mature Retail Electricity and Gas Customer Base in Stable Markets

Enel's mature retail electricity and gas customer base in stable markets represents a significant Cash Cow. These operations generate reliable, consistent revenue streams and robust cash flow, underpinning the company's financial stability.

The key characteristic here is a high market share within low-growth environments. This allows Enel to effectively 'milk' these established customer relationships, requiring minimal incremental marketing or investment to maintain their position and extract value.

- Consistent Revenue Generation: Enel's extensive customer base in mature markets provides a predictable and stable income stream.

- High Market Share, Low Growth: These segments benefit from Enel's dominant position, even with limited market expansion.

- Strong Cash Flow: The mature nature of these operations translates into substantial cash generation with lower reinvestment needs.

- Minimal Investment Required: Established relationships and infrastructure mean that maintaining these Cash Cows demands less capital outlay.

Legacy Transmission Infrastructure

Enel's legacy transmission infrastructure, while not a high-growth sector, functions as a cash cow within its portfolio. These established assets possess a significant market share, delivering consistent and regulated income streams. For instance, in 2024, Enel's transmission segment, primarily through its Italian grid operator Enel Distribuzione, continues to be a bedrock of its financial stability.

These vital components of the energy ecosystem provide predictable revenue without the need for aggressive market expansion. Their role in ensuring grid reliability is paramount, underpinning Enel's overall operational strength. The regulated nature of these assets often translates into predictable returns, making them a dependable source of cash generation for the company.

- Stable, Regulated Income: Legacy transmission assets provide a predictable revenue stream, often backed by regulatory frameworks.

- High Market Share: Enel holds a substantial position in its existing transmission markets.

- Low Investment Needs: These assets typically require less capital expenditure compared to growth-oriented segments like smart grids.

- Essential Infrastructure: They are critical for energy delivery, ensuring operational continuity and reliability.

Enel's mature electricity distribution networks in Italy and Spain are prime examples of cash cows. These operations benefit from stable, regulated revenue streams and a dominant market share in their respective regions. In 2023, Enel's Italian distribution network served approximately 32 million end-users, with Spain's reaching around 11 million, highlighting their established customer base and low-growth, high-cash-flow profile.

Hydroelectric assets also function as cash cows, consistently generating substantial cash flow with minimal need for further investment. In 2023, these assets contributed about 15% of Enel's total renewable energy output, demonstrating their ongoing importance as a reliable revenue engine.

The company's legacy transmission infrastructure, particularly Enel Distribuzione in Italy, acts as another cash cow. These essential, regulated assets provide predictable income streams and a high market share, requiring limited capital expenditure for maintenance rather than expansion.

| Business Segment | Market Share | Growth Potential | Cash Flow Generation | Investment Needs |

|---|---|---|---|---|

| Hydroelectric Assets | Dominant (Renewables) | Low | High | Low |

| Regulated Distribution (Italy) | High | Low | High | Low |

| Regulated Distribution (Spain) | High | Low | High | Low |

| Legacy Transmission | High | Low | High | Low |

Full Transparency, Always

Enel BCG Matrix

The Enel BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase, containing no watermarks or demo content. This comprehensive analysis of Enel's business units, categorized by market growth and relative market share, is ready for your strategic decision-making. You can confidently expect the same high-quality, actionable insights that will empower your business planning and competitive analysis. This is the final, polished version, designed for immediate professional application.

Dogs

Enel's divestment of conventional thermal assets in Peru, Argentina, and Colombia exemplifies its strategic shift away from low-growth, low-market-share segments. These operations, likely generating modest returns, were sold to enhance financial flexibility and concentrate resources on more promising ventures.

Outdated or non-strategic small-scale generation assets, often characterized by inefficiency or limited market reach, would fall into the Dogs category within Enel's BCG Matrix. These might include older, smaller fossil fuel plants or geographically isolated renewable sites that don't align with Enel's primary focus on large-scale, high-growth renewable energy projects in core markets.

Such assets typically exhibit low market share and minimal growth potential. For instance, a small, aging diesel generator in a remote location might have negligible impact on Enel's overall portfolio, consuming operational resources without contributing significantly to strategic objectives or profitability. As of 2024, Enel has been actively divesting from non-core, smaller assets to streamline its operations and concentrate on its ambitious renewable energy expansion plans.

Following its geographical rebalancing strategy, any remaining small-scale or non-integrated business units in countries where Enel has reduced its presence or is planning to exit would be classified as Dogs. These operations typically have limited market share and minimal growth prospects within Enel's now more focused portfolio. For instance, in 2024, Enel continued its divestment of certain generation assets in Eastern Europe, potentially leaving behind smaller, non-core distribution networks in those regions that fit this category.

Enel X Way North America EV Charging Business

Enel X Way North America’s electric mobility business in the US and Canada, a segment that was divested in October 2024, clearly falls into the Dog category of the BCG Matrix. This business operated within the high-growth electric vehicle market but struggled significantly to gain traction.

The decision to close operations was attributed to challenging market dynamics, notably high interest rates, which impacted the cost of capital and investment returns. Despite the expanding EV market, Enel X Way North America was unable to secure a dominant market share or achieve consistent profitability, making it an unprofitable venture.

- High-Growth Market, Low Market Share: The North American EV charging market is experiencing substantial growth, with projections indicating continued expansion through 2030. However, Enel X Way North America failed to capitalize on this growth, remaining a minor player.

- Profitability Challenges: The business faced significant hurdles in achieving profitability, likely due to intense competition, high operational costs, and potentially pricing pressures.

- Divestiture as a Strategic Move: The closure and divestiture signal a strategic realignment for Enel, allowing the company to reallocate resources to more promising business units.

Early-Stage Solar PV Projects with Low Returns (as per new strategy focus)

Enel's strategic shift, outlined in its 2025-2027 plan, signals a reduced emphasis on new solar PV capacity additions. This recalibration prioritizes onshore wind, hydro, and battery storage projects, which are perceived to offer more attractive returns. Consequently, early-stage solar PV projects with inherently lower profitability are likely to be de-emphasized or even divested.

This strategic pivot is driven by a desire to optimize capital allocation towards segments promising higher returns on investment. For instance, while Enel's renewable capacity grew significantly, the specific contribution of new solar PV projects to overall profitability might be under scrutiny, leading to a more selective approach.

- Strategic Reallocation: Enel's 2025-2027 plan prioritizes wind, hydro, and battery storage over new solar PV capacity.

- Return Thresholds: Projects with lower expected returns, including some solar PV ventures, may not meet Enel's refined investment criteria.

- Market Dynamics: Favorable regulatory environments and higher power purchase agreement prices are crucial for the viability of solar PV projects.

- Portfolio Optimization: Enel aims to maximize profitability by focusing on renewable energy sources with stronger financial performance profiles.

Assets classified as Dogs within Enel's portfolio are those with low market share and minimal growth prospects, often representing legacy operations or ventures that haven't gained significant traction. Enel's strategic divestments in 2024, such as the sale of conventional thermal assets in Peru, Argentina, and Colombia, highlight its move away from these underperforming segments. Similarly, the closure of Enel X Way North America's electric mobility business in October 2024 illustrates a direct response to profitability challenges and a failure to capture significant market share despite a growing market.

| Business Unit/Asset Type | BCG Category | Rationale | Key Financial Indicator (Illustrative) | Strategic Action |

|---|---|---|---|---|

| Small-scale, aging fossil fuel plants | Dog | Low efficiency, limited market reach, non-core | Low EBITDA margin (e.g., <5%) | Divestment/Decommissioning |

| Enel X Way North America (EV Charging) | Dog | Low market share in high-growth market, profitability challenges | Negative Net Income (e.g., -$XX million in 2023) | Divested (October 2024) |

| Early-stage solar PV projects (lower returns) | Dog | De-emphasized in 2025-2027 plan, lower expected returns vs. wind/hydro | IRR below Enel's target hurdle rate (e.g., <8%) | Reduced investment/potential divestment |

Question Marks

While Enel X Way has shifted its focus away from North America, its e-mobility solutions remain a significant global endeavor, especially in integrated markets. These offerings, including smart EV charging infrastructure and advanced vehicle-to-grid (V2G) technologies, operate within a rapidly expanding sector.

Despite the high growth potential of the e-mobility market, Enel's current market share in many of these regions may still be relatively modest. This presents an opportunity for substantial investment to scale operations and secure a leading position in these key international markets.

Enel is strategically targeting greenfield renewable projects in emerging and challenging markets, recognizing their significant growth potential. These ventures, often found in regions like parts of Latin America or Africa, demand considerable upfront capital to establish a foothold and navigate complex regulatory or operational landscapes.

Enel is actively developing innovative energy services and digital solutions, moving beyond simply supplying electricity. This strategy focuses on bundling products and services to create integrated offerings that enhance customer value, such as smart home energy management or demand response programs. These initiatives tap into a growing market for energy efficiency and advanced energy services.

While these innovative services are positioned in a promising, expanding market, Enel's current penetration within this segment might be relatively low. This necessitates substantial investment in marketing, research, and development to effectively reach and onboard customers. For instance, by the end of 2023, Enel's digitalized customer base had reached 89 million, showcasing a strong foundation for deploying these new services.

Hydrogen Production for Industrial Decarbonization

Enel is strategically positioning itself within the burgeoning green hydrogen sector, particularly targeting hard-to-abate industries such as chemicals and aviation. This represents a high-growth, albeit currently nascent, market with significant potential to drive industrial decarbonization. While Enel's market share in this area is presently minimal, the substantial research and development (R&D) and investment required for scaling and proving commercial viability firmly place green hydrogen production within the Question Mark quadrant of the BCG matrix.

The global green hydrogen market is projected to reach hundreds of billions of dollars by the early 2030s, with significant government support and private investment flowing into the sector. For instance, the European Union's Hydrogen Strategy aims to produce 10 million tonnes of renewable hydrogen annually by 2030. Enel's involvement in pilot projects and partnerships underscores its commitment to capturing a share of this expanding market, though the path to profitability and market leadership requires navigating technological hurdles and securing competitive cost structures.

- Market Potential: The green hydrogen market is anticipated to grow exponentially, driven by decarbonization mandates and technological advancements.

- Enel's Position: Enel is an emerging player with a small current market share, focusing on high-impact sectors.

- Investment & R&D: Significant capital expenditure and ongoing research are critical for scaling production and achieving cost competitiveness.

- Strategic Importance: Green hydrogen is a key pillar for Enel's long-term sustainability and energy transition strategy.

Expansion into New Geographic Markets (e.g., selective new regions in Africa/Asia)

Enel's strategic rebalancing prioritizes its core markets, but the company is also considering opportunities in emerging regions like Africa and Asia. These moves would target areas with high growth potential but where Enel currently has a small footprint. Such expansion would necessitate substantial investment to build market presence.

For instance, in 2024, Enel continued its focus on markets like Italy, Spain, and Latin America, which represent its established strongholds. However, the company has also been evaluating specific opportunities in countries like South Africa, where renewable energy demand is rising, and in Southeast Asia, particularly in countries like Vietnam, known for its ambitious renewable energy targets. These selective ventures are designed to capture future growth while managing risk.

- Selective Growth: Enel may explore new geographic markets in Africa and Asia, focusing on regions with high growth potential.

- Low Initial Share: These ventures would start with a low market share, requiring significant strategic investment.

- Strategic Focus: The expansion aligns with Enel's broader strategy of rebalancing its portfolio towards core and high-potential markets.

Question Marks in Enel's BCG matrix represent business units with low market share in high-growth industries. These require significant investment to increase market share and become Stars, or they risk becoming Dogs if they fail to gain traction. Enel's strategic focus on green hydrogen and certain emerging markets exemplifies this category.

Significant investment in R&D and market development is crucial for these ventures. For example, Enel's commitment to green hydrogen, a sector projected for substantial growth, requires substantial capital to scale production and achieve cost competitiveness.

The company's exploration of new geographic markets in Africa and Asia also falls into this quadrant, demanding investment to build presence and market share in areas with high growth potential but low current penetration.

By strategically investing in these Question Marks, Enel aims to nurture them into future Stars, aligning with its long-term sustainability and energy transition goals.

| Enel Business Area | Industry Growth Rate | Enel Market Share | Investment Required | Strategic Outlook |

|---|---|---|---|---|

| Green Hydrogen | High | Low | High | Develop into Star or divest |

| Emerging Market Renewables (e.g., Africa, SE Asia) | High | Low | High | Develop into Star or divest |

| E-Mobility Solutions (North America focus) | High | Moderate to Low | Moderate | Re-evaluate or divest |

| Innovative Energy Services & Digital Solutions | High | Low | High | Develop into Star or divest |

BCG Matrix Data Sources

Our BCG Matrix is informed by a robust blend of financial disclosures, comprehensive market research, and industry performance data to provide strategic clarity.