Enel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enel Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Enel's strategic landscape. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and gain a decisive advantage.

Political factors

Enel's strategic direction is significantly shaped by government energy policies, especially those focused on decarbonization. For instance, the European Union's 'Fit for 55' package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels, directly influencing Enel's investments in renewables and grid modernization.

These ambitious emissions reduction targets necessitate substantial capital allocation towards green technologies, while also prompting the gradual divestment from or repurposing of fossil fuel assets. Enel's 2024-2028 strategic plan, for example, emphasizes a €10.1 billion investment in renewables and grids, reflecting this policy-driven shift.

Policy stability and predictability are paramount for Enel's long-term planning and the massive investments required for large-scale energy infrastructure projects. Uncertainty in regulatory frameworks, such as changes in renewable energy subsidies or carbon pricing mechanisms, can significantly impact project viability and investment decisions, potentially delaying or altering Enel's decarbonization roadmap.

Enel's operations are significantly influenced by geopolitical stability in its core markets, particularly in Europe and Latin America. For instance, the ongoing political developments in Italy, a major operational hub, and countries like Spain and Chile, directly impact Enel's regulatory environment and investment climate.

Political instability can lead to unexpected policy changes, affecting energy tariffs, renewable energy incentives, and the security of Enel’s substantial infrastructure investments. For example, shifts in government in Latin American countries have previously led to renegotiations of power purchase agreements, impacting revenue predictability.

In 2024, continued political transitions in several Latin American nations where Enel has a strong presence, coupled with evolving energy policies in Europe, highlight the need for robust risk management. Enel's 2023 financial reports indicated a focus on navigating these diverse political landscapes to ensure operational continuity and safeguard its asset base.

The global energy sector is experiencing a dynamic shift, with many regions pushing towards market liberalization to foster competition and efficiency. However, this trend is met with counter-movements of increased state intervention, particularly in response to energy security concerns and climate change initiatives. This push-and-pull directly impacts Enel's operational freedom and pricing strategies.

Regulatory frameworks are crucial. For instance, the European Union's ongoing efforts to reform its electricity market, including discussions around capacity mechanisms and the integration of renewables, directly influence how Enel generates and sells power. Grid access rules and wholesale market design determine the cost and feasibility of distributing energy, while retail tariff regulations affect profitability in consumer markets.

Enel's adaptability is key. In 2023, the company continued to navigate complex regulatory landscapes across its operating countries. For example, Italy's energy price cap discussions and Spain's renewable energy auction designs presented distinct challenges and opportunities. Enel's strategic investments in renewables, such as its significant solar and wind capacity additions, are often shaped by these evolving regulatory incentives and market access rules.

International Trade Policies and Agreements

Enel's operations are significantly shaped by international trade policies and agreements. Cross-border energy trade, particularly within the European Union, directly impacts Enel's ability to manage its energy portfolio and supply chains. For instance, EU directives on energy market integration and cross-border capacity allocation influence how Enel operates and invests in its infrastructure across member states.

International climate agreements, such as the Paris Agreement, establish the global roadmap for decarbonization, which is central to Enel's strategy. These accords influence national policies on renewable energy deployment and carbon pricing, affecting Enel's operational costs and investment decisions. As of early 2024, many nations are reinforcing their commitments, with some aiming to accelerate renewable energy targets to meet these global objectives.

- EU Green Deal: This comprehensive policy package aims to make Europe the first climate-neutral continent by 2050, directly supporting Enel's renewable energy focus.

- Global Carbon Markets: The expansion and evolution of international carbon trading mechanisms, like the EU Emissions Trading System (ETS), impact the profitability of fossil fuel generation versus renewables. In 2023, the EU ETS saw carbon prices averaging around €90 per tonne of CO2.

- Trade Tariffs and Supply Chains: Tariffs on imported components for renewable technologies, such as solar panels or wind turbines, can affect Enel's capital expenditure. For example, ongoing trade discussions and potential tariffs between major manufacturing hubs and key markets can create price volatility for these essential materials.

Government Support for Grid Modernization

Government support for grid modernization is a key political factor influencing Enel. Initiatives like the European Union's Recovery and Resilience Facility, which allocated significant funds towards green transition and digital infrastructure, directly benefit companies like Enel investing in smart grids. For instance, the facility's focus on digitalizing public services and infrastructure, including energy networks, creates a favorable environment for Enel's smart grid projects. This support, coupled with national programs across Enel's operating regions, is crucial for accelerating the deployment of advanced technologies.

This government backing translates into tangible opportunities for Enel through various channels. Public-private partnerships (PPPs) are becoming increasingly common, allowing Enel to collaborate with governments on large-scale smart city projects that integrate smart grid solutions. Regulatory incentives, such as feed-in tariffs for renewable energy or tax credits for grid upgrades, further de-risk investments and encourage the adoption of innovative technologies. These incentives are vital for enhancing grid resilience and enabling new energy services, directly aligning with Enel's strategic emphasis on smart infrastructure development.

The digitalization of energy networks, a core component of grid modernization, is actively promoted by governments worldwide. For example, in 2024, many countries are setting ambitious targets for smart meter deployment, which requires substantial investment in digital communication infrastructure. Enel's involvement in these projects positions it to capitalize on this trend. Smart city initiatives, often driven by government mandates and funding, further integrate smart grids into urban planning, creating a demand for Enel's expertise in managing and optimizing energy distribution in interconnected urban environments.

Key government support mechanisms for Enel's grid modernization efforts include:

- Direct funding and grants for smart grid pilot projects and infrastructure upgrades.

- Tax incentives and subsidies for the adoption of digital technologies in the energy sector.

- Support for public-private partnerships in developing smart city energy solutions.

- Favorable regulatory frameworks that encourage grid innovation and the deployment of new energy services.

Government energy policies, particularly those focused on decarbonization and climate targets like the EU's 'Fit for 55' package, are a primary driver for Enel's investment strategy. These policies mandate significant capital allocation towards renewables and grid upgrades, influencing Enel's asset portfolio towards green technologies. For instance, Enel's 2024-2028 strategic plan earmarks €10.1 billion for renewables and grids, directly responding to these policy imperatives.

Political stability and regulatory predictability are crucial for Enel's long-term infrastructure investments. Policy shifts, such as changes in renewable energy subsidies or carbon pricing, can impact project viability and investment decisions, potentially altering Enel's decarbonization timeline. Geopolitical stability in key markets like Italy and Latin America also plays a vital role, as political transitions can lead to unexpected policy changes affecting tariffs and investment security.

International trade policies and climate agreements, such as the Paris Agreement, shape global decarbonization roadmaps and national energy policies. These agreements influence renewable energy deployment and carbon pricing, impacting Enel's operational costs and investment decisions. For example, the EU's Emissions Trading System (ETS) saw carbon prices averaging around €90 per tonne of CO2 in 2023, highlighting the financial impact of carbon market evolution on energy generation choices.

Government support for grid modernization, including direct funding, tax incentives, and public-private partnerships, is a key enabler for Enel's smart grid initiatives. Programs like the EU's Recovery and Resilience Facility provide substantial funds for green transition and digital infrastructure, creating a favorable environment for Enel's smart grid projects and the digitalization of energy networks. Many countries are setting ambitious targets for smart meter deployment in 2024, requiring significant investment in digital infrastructure.

What is included in the product

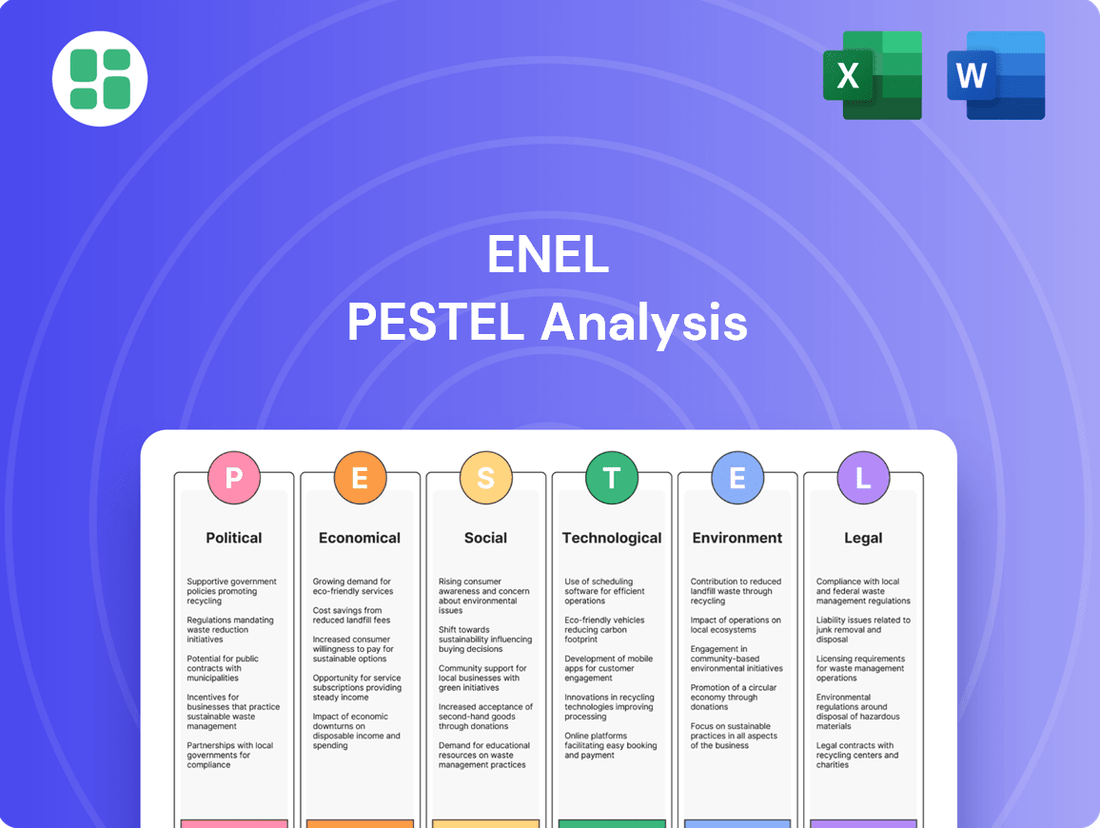

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Enel across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key trends, threats, and opportunities relevant to Enel's global operations.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on Enel's external environment to streamline strategic discussions.

Economic factors

Enel's profitability is significantly tied to the volatile global energy markets. For instance, in 2024, natural gas prices experienced considerable swings, impacting the operational costs for Enel's conventional power plants. While the company is expanding its renewable capacity, which offers some insulation, the overall energy price environment, including coal and carbon allowance costs, still shapes market competitiveness and Enel's financial performance.

Managing exposure to these commodity price fluctuations remains a key challenge for Enel. The company actively employs hedging strategies to mitigate some of this risk, but the inherent volatility in energy markets, as seen with the price of Brent crude oil which averaged around $83 per barrel in early 2024, directly influences Enel's cost structure and revenue potential across its diverse generation portfolio.

Rising inflation, a persistent concern throughout 2024 and into 2025, directly impacts Enel's operational expenses. For instance, the cost of essential raw materials like copper and natural gas has seen significant upward pressure, potentially squeezing profit margins. Labor costs have also followed suit, with wage demands increasing to keep pace with the cost of living.

Concurrently, central banks have maintained or even increased interest rates to combat inflation. This makes borrowing more expensive for Enel, a company heavily reliant on capital for its extensive infrastructure projects. For example, financing new renewable energy plants or upgrading existing grids becomes considerably costlier when benchmark interest rates are elevated, impacting the viability and return on investment for these crucial developments.

Enel's performance is closely tied to the economic growth of its operating regions. For instance, in 2023, the Eurozone, a key market for Enel, experienced a modest GDP growth of around 0.5%. This slower growth compared to previous years can translate to more subdued increases in energy demand from industrial and commercial clients.

Looking ahead to 2024 and 2025, projections suggest a gradual recovery. Forecasts from institutions like the European Commission anticipate a pick-up in Eurozone GDP growth, potentially reaching closer to 1.5% in 2025. Such an improvement would likely bolster industrial activity and consumer spending, driving higher electricity consumption and benefiting Enel's revenue streams.

However, regional disparities exist. While some European economies might see moderate growth, emerging markets where Enel also operates could present different economic trajectories. For example, Latin American economies, while facing their own challenges, might offer varied growth prospects that Enel needs to navigate, impacting its diversified revenue base.

Access to Capital and Financing for Projects

Enel's substantial investment plans, especially in renewable energy and grid upgrades, necessitate considerable capital. For instance, Enel announced an investment plan of €190 billion for the period 2023-2030, with a significant portion allocated to renewables and grid modernization. The accessibility of various and affordable financing avenues, such as green bonds and project finance, is vital for achieving these strategic goals.

Investor sentiment towards the energy transition and Enel's financial health directly impacts its ability to secure necessary funding. In 2023, Enel successfully issued €1.5 billion in sustainability-linked bonds, demonstrating continued investor appetite for its green initiatives. The company's credit rating also plays a critical role in determining borrowing costs and the overall ease of accessing capital markets.

- Capital Requirements: Enel's €190 billion investment plan (2023-2030) highlights the massive capital needs for its renewable and grid expansion strategies.

- Financing Instruments: The company relies on a mix of green bonds, traditional debt, equity, and project finance to fund its operations and growth.

- Investor Confidence: A strong track record in sustainability and financial stability is crucial for attracting investors and securing favorable financing terms, as seen with its successful green bond issuances.

- Cost of Capital: Market interest rates and Enel's creditworthiness directly influence the cost of borrowing, impacting project profitability and overall financial performance.

Currency Exchange Rate Volatility

Enel, as a global energy giant, faces significant exposure to currency exchange rate volatility. Operating across numerous countries means its financial results are reported in Euros, but revenues and expenses are incurred in various local currencies. For instance, fluctuations between the Euro and currencies like the US Dollar or Brazilian Real directly impact the translated value of Enel's earnings from these regions. This volatility can also affect the cost of capital for international projects and the real value of its foreign-denominated debt.

In 2024, the Euro experienced notable shifts against major currencies. For example, the Euro to US Dollar exchange rate saw periods of strengthening and weakening, influencing Enel's reported profits from its US operations. Similarly, emerging market currencies, where Enel has substantial investments, often exhibit higher volatility.

- Impact on Earnings Translation: A weaker Euro against currencies where Enel generates revenue would boost reported earnings, while a stronger Euro would have the opposite effect.

- Investment Costs: Exchange rate movements can alter the Euro cost of acquiring new assets or expanding operations in foreign markets.

- Debt Value: The Euro equivalent of Enel's foreign currency debt changes with exchange rate fluctuations, affecting its balance sheet and financial leverage.

- Risk Management Strategies: Enel employs hedging strategies, such as forward contracts and currency options, to mitigate the impact of adverse currency movements on its financial performance.

Economic conditions significantly shape Enel's operational landscape. Fluctuations in energy prices, as seen with natural gas and Brent crude in early 2024, directly impact Enel's costs and revenue potential. Rising inflation throughout 2024 and into 2025 increases operational expenses, from raw materials to labor, while higher interest rates make capital-intensive projects more expensive.

Economic growth in Enel's key markets, particularly the Eurozone, influences energy demand. While Eurozone GDP growth was modest in 2023, projections for 2024 and 2025 suggest a gradual recovery, which could boost Enel's revenue streams. However, regional economic disparities require careful navigation by the company.

Enel's substantial investment plans, such as the €190 billion allocation for 2023-2030, necessitate robust access to capital. The company relies on diverse financing instruments like green bonds, as evidenced by its successful €1.5 billion issuance in 2023, and investor confidence is paramount for securing favorable terms. Currency exchange rate volatility also affects Enel's financial results, as earnings from foreign operations are translated back into Euros, impacting reported profits and the cost of international investments.

Same Document Delivered

Enel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Enel.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing Enel's Political, Economic, Social, Technological, Legal, and Environmental landscape.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external factors affecting Enel's operations and strategy.

Sociological factors

Public acceptance of renewable energy is a significant driver for Enel's growth. Surveys in 2024 consistently show high levels of support for solar and wind power, with over 70% of respondents in key European markets favoring increased renewable energy deployment. This positive sentiment is vital for Enel as it navigates the permitting process for new wind farms and solar parks.

Enel actively engages with local communities to address concerns, a strategy that proved successful in its recent offshore wind project in the North Sea, which received strong local backing after extensive consultation. By demonstrating clear environmental benefits and mitigating potential visual or noise impacts, Enel secures the social license to operate, which is critical for timely project development and avoiding costly delays.

Consumers increasingly favor sustainable energy, driving demand for options like decentralized power generation and smart home energy management systems. This trend is evident in the projected growth of the global green energy market, which was valued at over $1.1 trillion in 2023 and is expected to reach $2.1 trillion by 2030, according to some market analyses.

Enel must align its retail services with these shifting preferences, focusing on customer retention and identifying new avenues for income within the expanding green economy. For instance, the adoption of electric vehicles, a key component of sustainable energy, saw a significant increase in 2023, with global EV sales surpassing 13 million units.

Demographic shifts significantly shape energy demand. Globally, the population is projected to reach 8.5 billion by 2030, with a growing proportion living in urban areas. This trend, as seen with over 56% of the world’s population residing in cities in 2023, directly increases the need for reliable and efficient energy distribution, a key area for Enel's smart grid investments.

The aging population in many developed economies, such as Europe where the median age is rising, also impacts energy consumption. Older demographics may have different energy usage patterns, potentially requiring more localized and accessible energy solutions. Enel's development of smart home energy management systems can cater to these evolving needs.

Labor Market Trends and Skills Availability

The global energy transition is reshaping the labor market, creating a significant demand for specialized skills in areas like renewable energy installation and maintenance, advanced grid technologies, and sophisticated data analytics. Enel, like many in the sector, must navigate this evolving landscape to secure the talent needed for its operations and future growth.

Attracting and retaining individuals with these in-demand skills presents both a challenge and a strategic opportunity for Enel in a highly competitive global labor market. For instance, by 2025, the International Renewable Energy Agency (IRENA) projects that the renewable energy sector could employ over 43 million people worldwide, a substantial increase from previous years, highlighting the competitive pressure for skilled workers.

To maintain operational excellence and foster innovation, Enel's investment in robust upskilling and reskilling initiatives is paramount. This ensures their existing workforce can adapt to new technologies and processes, such as the deployment of smart meters and digital substations, which are becoming increasingly central to energy infrastructure management.

- Demand for Specialized Skills: The shift to renewables and digital grids necessitates expertise in areas like solar PV installation, wind turbine maintenance, cybersecurity for energy systems, and big data analysis for grid optimization.

- Talent Acquisition and Retention: Enel competes for a limited pool of skilled professionals, requiring competitive compensation, appealing work environments, and clear career development paths to attract and keep top talent.

- Upskilling and Reskilling Investment: Continuous training programs are crucial for Enel to equip its workforce with the competencies needed for emerging technologies, thereby ensuring operational efficiency and fostering a culture of innovation.

- Impact of Automation: While automation may reduce the need for certain manual labor roles, it simultaneously increases the demand for individuals who can manage, maintain, and develop these automated systems.

Corporate Social Responsibility Expectations

Societal expectations for corporate social responsibility (CSR) are steadily rising, pushing companies like Enel to prioritize ethical conduct and sustainable business practices. This growing awareness means that how a company operates beyond just profit is increasingly scrutinized by the public and investors alike.

Enel's dedication to Environmental, Social, and Governance (ESG) principles is therefore crucial. This commitment encompasses fair labor practices, active community development initiatives, and maintaining transparent governance structures. For instance, Enel's 2023 Integrated Report highlighted €1.1 billion invested in community projects and sustainable development, demonstrating a tangible commitment to these ESG pillars.

These actions are not just about good PR; they directly impact Enel's ability to maintain its reputation, attract socially conscious investors, and build lasting trust with all its stakeholders. As of early 2025, a significant portion of institutional investment portfolios are now screened for ESG performance, underscoring the financial imperative behind these societal expectations.

- Rising Stakeholder Scrutiny: Consumers and investors increasingly demand transparency and ethical operations from energy companies.

- ESG Investment Growth: Global ESG assets are projected to exceed $50 trillion by 2025, making strong ESG performance a financial necessity.

- Reputational Capital: Positive CSR initiatives directly bolster brand image and customer loyalty, critical in a competitive energy market.

- Regulatory Alignment: Proactive CSR often anticipates future regulations, reducing compliance risks and costs.

Societal expectations for corporate social responsibility (CSR) are steadily rising, pushing companies like Enel to prioritize ethical conduct and sustainable business practices. This growing awareness means that how a company operates beyond just profit is increasingly scrutinized by the public and investors alike.

Enel's dedication to Environmental, Social, and Governance (ESG) principles is therefore crucial. This commitment encompasses fair labor practices, active community development initiatives, and maintaining transparent governance structures. For instance, Enel's 2023 Integrated Report highlighted €1.1 billion invested in community projects and sustainable development, demonstrating a tangible commitment to these ESG pillars.

These actions are not just about good PR; they directly impact Enel's ability to maintain its reputation, attract socially conscious investors, and build lasting trust with all its stakeholders. As of early 2025, a significant portion of institutional investment portfolios are now screened for ESG performance, underscoring the financial imperative behind these societal expectations.

| Sociological Factor | Enel's Response/Impact | Data/Trend (2024/2025) |

|---|---|---|

| Public Opinion on Renewables | High public acceptance drives demand for Enel's green energy solutions. | Over 70% support for renewables in key European markets (2024 surveys). |

| Consumer Preference for Sustainability | Increased demand for sustainable energy options and smart home systems. | Global green energy market projected to reach $2.1 trillion by 2030. |

| Corporate Social Responsibility (CSR) | Focus on ESG principles enhances reputation and investor appeal. | Enel invested €1.1 billion in community projects (2023); ESG assets to exceed $50 trillion by 2025. |

Technological factors

Continuous innovation directly impacts Enel's renewable generation. For instance, solar panel efficiency saw significant gains, with some commercial panels exceeding 23% efficiency by late 2024. Similarly, advancements in wind turbine design, including larger rotor diameters, are boosting energy capture, with new offshore turbines reaching capacities of 15 MW and beyond.

Investing in R&D and adopting new technologies is vital for Enel's competitive edge. The global market for battery energy storage systems, crucial for grid stability with renewables, was projected to reach over $100 billion by 2025, highlighting the importance of Enel's strategic investments in this area to accelerate the energy transition.

Enel is heavily invested in the advancement of smart grid technologies. This includes sophisticated systems like advanced metering infrastructure (AMI), which allows for real-time energy monitoring and billing. The company is also focusing on grid automation to improve reliability and reduce outages, alongside predictive maintenance tools to anticipate and address potential issues before they impact service. These technological upgrades are crucial for managing the complexities of modern energy systems.

The implementation of these smart grid solutions directly supports Enel's operational efficiency and its ability to offer innovative services. By enhancing grid resilience, these technologies ensure a more stable power supply. Furthermore, they optimize energy distribution, making the flow of electricity more efficient. This also facilitates better demand-side management, allowing consumers to adjust their usage, and enables the seamless integration of renewable energy sources like solar and wind power, which are often distributed across the grid.

Technological advancements are reshaping the energy landscape, offering significant opportunities for Enel. Innovations in energy efficiency, such as smart thermostats and advanced insulation, are becoming more accessible for both homes and businesses. This trend, combined with the increasing digitalization of energy services, allows Enel to develop more sophisticated offerings.

The digitalization of energy services, including smart grids and remote monitoring, is a key driver. Enel can leverage data analytics, artificial intelligence (AI), and the Internet of Things (IoT) to offer personalized energy insights to customers. For instance, by analyzing consumption patterns, Enel can help users optimize their energy usage, leading to cost savings and a reduced environmental footprint. This not only enhances customer value but also contributes to the overall efficiency of the energy system.

In 2024, the global smart grid market was valued at approximately $27.5 billion and is projected to grow substantially. Enel's investment in digital technologies, such as its smart meter rollout, positions it to capitalize on this growth. By 2023, Enel had already installed over 45 million smart meters across its global operations, enabling more granular data collection and personalized service delivery.

Cybersecurity Threats to Infrastructure

As energy grids become more interconnected and digitalized, the risk of cyberattacks on critical infrastructure escalates. Enel faces heightened vulnerability to disruptions, data breaches, and service interruptions. For instance, in 2023, the energy sector experienced a notable increase in sophisticated cyber threats targeting operational technology (OT) and information technology (IT) systems.

Enel must maintain substantial and ongoing investment in advanced cybersecurity measures. This proactive approach is essential to safeguard its digital infrastructure against evolving threats. Protecting against potential ransomware attacks and state-sponsored cyber espionage remains a critical focus for the company's resilience.

- Increased Attack Surface: The digitalization of energy grids expands the potential entry points for cyber adversaries.

- Sophistication of Threats: Cyberattacks are becoming more advanced, targeting both IT and OT systems to cause physical and operational damage.

- Regulatory Scrutiny: Governments worldwide are increasing regulations around critical infrastructure cybersecurity, demanding robust protection strategies.

- Financial Impact: Successful breaches can lead to significant financial losses through operational downtime, data recovery costs, and reputational damage.

Emerging Energy Technologies

The energy sector is experiencing rapid evolution driven by emerging technologies. Green hydrogen production, for instance, is gaining significant traction as a clean fuel alternative. By 2024, global investment in green hydrogen projects was projected to reach billions, indicating strong market confidence and potential for future growth.

Advanced nuclear technologies, like small modular reactors (SMRs), also present a compelling case for future energy solutions. These compact, factory-built reactors offer potential advantages in terms of cost, safety, and deployment flexibility. Several countries, including the United States and the United Kingdom, are actively supporting the development and demonstration of SMRs, with initial commercial deployments anticipated in the late 2020s and early 2030s.

Carbon capture, utilization, and storage (CCUS) technologies are crucial for decarbonizing hard-to-abate industries. As of 2024, numerous CCUS projects are operational or under development globally, supported by government incentives and corporate sustainability goals. Enel must closely monitor these advancements:

- Green Hydrogen: Assess its scalability and cost-competitiveness against other clean energy sources.

- SMRs: Evaluate regulatory frameworks and economic feasibility for potential integration into Enel's generation portfolio.

- CCUS: Analyze its role in achieving emissions reduction targets for existing or future industrial partnerships.

Technological advancements are critical for Enel's operational efficiency and its ability to integrate renewable energy sources. Smart grid technologies, including advanced metering infrastructure and grid automation, are key to managing complex energy systems and ensuring a stable power supply. By enhancing grid resilience and optimizing energy distribution, these innovations facilitate better demand-side management and the seamless integration of distributed renewables.

Digitalization, powered by AI and IoT, allows Enel to offer personalized energy insights and optimize customer energy usage, leading to cost savings and reduced environmental impact. The global smart grid market's significant growth, projected to continue, underscores the importance of Enel's investments in digital technologies like its extensive smart meter rollout, which by 2023 had surpassed 45 million installations.

Emerging technologies like green hydrogen and small modular reactors (SMRs) are reshaping the energy landscape, offering clean fuel alternatives and potential future energy solutions. Enel must monitor these advancements, assessing the scalability and cost-competitiveness of green hydrogen and the regulatory and economic feasibility of SMRs for potential portfolio integration.

The increasing digitalization of energy grids also heightens the risk of cyberattacks, necessitating substantial and ongoing investment in advanced cybersecurity measures to protect against evolving threats and ensure operational resilience.

Legal factors

Enel navigates a complex web of energy sector-specific regulations across its operating regions, impacting everything from power generation to customer billing. These rules, often national or even sub-national, dictate licensing, grid access, and pricing mechanisms. For instance, in the European Union, directives on renewable energy integration and market liberalization directly shape Enel's investment strategies and operational models.

Compliance with these stringent legal frameworks is paramount. Failure to adhere to technical standards for grid stability or market rules for wholesale electricity trading can lead to significant penalties and operational disruptions. In 2023, regulatory changes in Italy, for example, influenced grid connection fees, directly affecting the economics of new renewable projects Enel was developing.

Enel operates under increasingly stringent environmental protection laws that dictate everything from air emissions limits to water discharge standards and waste management protocols. These regulations, which are continuously evolving, directly impact how Enel designs, builds, and operates its power generation facilities, including its significant investments in renewable energy. For instance, in 2023, the European Union continued to refine its emissions trading system (ETS) and set ambitious targets for greenhouse gas reduction, directly affecting the operational costs of Enel's thermal power plants and the permitting processes for new projects.

Compliance with these multifaceted environmental standards is not merely a matter of avoiding fines; it's fundamental to Enel's ability to secure and maintain its license to operate. Failure to meet these requirements can lead to substantial penalties, operational disruptions, and damage to the company's reputation, as seen in past instances where energy companies faced significant fines for environmental non-compliance in various jurisdictions. Enel's ongoing commitment to sustainability, as demonstrated by its 2023-2027 strategic plan which targets significant growth in renewables, is intrinsically linked to its capacity to navigate and adhere to these complex legal frameworks.

Enel, as a significant energy provider globally, operates under strict antitrust and competition laws. These regulations aim to foster a fair marketplace and prevent monopolistic practices. For instance, in 2024, the European Union continued its focus on energy market competition, with the European Commission investigating several energy companies for potential anti-competitive behavior, though specific Enel investigations were not publicly detailed in early 2025.

Regulatory oversight of Enel's mergers, acquisitions, and daily market activities is intense. Such scrutiny can significantly shape its expansion plans and how it competes. For example, in 2024, Enel's acquisition of certain renewable energy assets in Italy faced detailed review from the Italian Competition Authority to ensure it didn't unduly restrict market competition.

Adherence to these legal frameworks is paramount for Enel to avoid substantial penalties and maintain its market standing. In 2023, the company paid €11 million in fines related to breach of competition rules in a specific market, underscoring the financial risks of non-compliance.

Data Privacy and Consumer Protection Regulations

Data privacy and consumer protection are critical for Enel, especially with its expanding digital operations in smart grids and customer engagement. Regulations like the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, mandate strict rules for handling personal data. Enel must prioritize secure data management, clear communication about data usage, and equitable business practices across its retail and service divisions to build and maintain customer confidence, thereby avoiding potential legal penalties.

The growing volume of data collected from smart meters and digital platforms means Enel is subject to increasing scrutiny regarding data security and consumer rights. For instance, in 2023, the European Union continued to emphasize robust data protection measures, with ongoing discussions about potential updates to existing frameworks. Enel's commitment to these regulations is not just about compliance; it's about fostering trust, which is essential for its service-oriented business model. Failure to adhere could lead to significant fines, such as those levied under GDPR, which can reach up to 4% of global annual revenue or €20 million, whichever is higher.

- GDPR Compliance: Enel must ensure all customer data handling aligns with GDPR's principles of lawfulness, fairness, transparency, purpose limitation, data minimization, accuracy, storage limitation, integrity, and confidentiality.

- Consumer Protection: Adherence to fair trading practices and transparent service agreements is vital, particularly in energy retail markets where consumer trust is paramount.

- Cybersecurity Investment: Significant investment in cybersecurity infrastructure is necessary to protect sensitive customer data from breaches, a growing concern highlighted by the increasing sophistication of cyber threats in 2024.

- Data Usage Transparency: Clear and accessible policies detailing how customer data is collected, used, and protected are essential for maintaining consumer trust and avoiding regulatory action.

International Legal Frameworks and Treaties

Enel's global operations are shaped by a complex web of international legal frameworks and treaties. These agreements are crucial for navigating cross-border energy projects and investments. For instance, bilateral investment treaties (BITs) offer protection for Enel's assets in foreign countries, ensuring fair treatment and preventing arbitrary expropriation. These treaties often include provisions for international arbitration, providing a mechanism for resolving disputes that may arise with host governments, as seen in past energy sector arbitrations involving major international players.

Furthermore, international energy agreements, often multilateral in nature, can influence market access and regulatory environments for Enel. These can range from agreements on the interconnection of energy grids to frameworks governing the trade of renewable energy certificates. The increasing focus on climate change also brings international environmental law and climate agreements into play, impacting Enel's strategic planning and operational compliance, particularly concerning emissions targets and renewable energy mandates established in global accords.

- Investment Protection: Enel's foreign direct investment (FDI) in countries like Brazil and Spain is often safeguarded by BITs, offering recourse against unfair treatment.

- Cross-Border Energy Trade: Agreements facilitating the exchange of electricity across national borders, such as those within the European Union, are vital for Enel's integrated energy network operations.

- Dispute Resolution: International arbitration rules, like those administered by the International Centre for Settlement of Investment Disputes (ICSID), provide a structured process for resolving legal conflicts arising from Enel's international projects.

- Climate Change Frameworks: Enel's commitment to decarbonization aligns with international climate agreements, influencing its renewable energy deployment targets and carbon pricing strategies.

Enel faces evolving legal landscapes across its operational territories, with a strong emphasis on energy market regulations and environmental compliance. In 2024, the company continued to adapt to directives on renewable energy integration and market liberalization within the EU, which directly influence investment decisions and operational models. Compliance with technical standards and market rules is critical to avoid penalties, as demonstrated by Italian grid connection fee adjustments in 2023 impacting renewable project economics.

The company's commitment to sustainability is intrinsically linked to its ability to navigate complex legal frameworks. For instance, the EU's emissions trading system and greenhouse gas reduction targets, refined in 2023, directly affect the operational costs of Enel's thermal plants and the permitting process for new developments. Failure to meet environmental standards can lead to substantial fines and operational disruptions, underscoring the importance of legal adherence for maintaining its license to operate.

Antitrust and competition laws are also significant legal factors for Enel. The EU's ongoing focus on energy market competition in 2024, including investigations into potential anti-competitive behavior, highlights the need for careful market conduct. Enel's acquisition activities, such as its 2024 review by the Italian Competition Authority for renewable asset purchases, illustrate the intense regulatory scrutiny shaping its expansion and competitive strategies. In 2023, the company incurred €11 million in fines for competition rule breaches, emphasizing the financial risks of non-compliance.

Data privacy and consumer protection are paramount, especially with Enel's growing digital footprint. Regulations like GDPR, in effect since 2018, mandate strict data handling protocols. The increasing volume of data from smart meters in 2023 brought heightened scrutiny on data security and consumer rights, with ongoing EU discussions on framework updates. Non-compliance with GDPR can result in fines up to 4% of global annual revenue or €20 million, whichever is higher, making robust cybersecurity investment and data usage transparency essential for maintaining customer trust.

Environmental factors

Global and national climate change policies, especially those mandating significant carbon emission reductions and implementing carbon pricing, are a major environmental force shaping Enel's strategy. For instance, the European Union's Fit for 55 package aims for a 55% net emission reduction by 2030 compared to 1990 levels, directly encouraging Enel's substantial investments in renewables.

These regulations directly influence Enel's investment decisions, steering capital towards renewable energy sources and low-carbon technologies while potentially diminishing the value of its existing fossil fuel infrastructure. The increasing prevalence of carbon taxes and emissions trading schemes, like the EU Emissions Trading System (ETS), which saw average prices around €90-€100 per tonne of CO2 in late 2023 and early 2024, directly impact operational costs and profitability.

Enel's operations are directly impacted by the availability of natural resources. Water is crucial for its hydropower plants and for cooling thermal power stations; for instance, in 2023, Enel's renewable energy sources, including hydro, accounted for a significant portion of its generation mix. The company must navigate the increasing scarcity of water in certain regions, necessitating robust water management strategies to ensure operational continuity and minimize environmental impact.

Furthermore, the transition to renewable energy technologies, a core part of Enel's strategy, relies on critical minerals like lithium and cobalt for battery production. Supply chain vulnerabilities and potential price volatility for these materials pose a significant environmental and economic challenge. Enel's commitment to sustainable sourcing and exploring alternative materials is therefore paramount for the long-term viability of its green energy projects.

Enel faces significant operational challenges from the escalating frequency and intensity of extreme weather events, a direct consequence of climate change. For instance, the company's infrastructure in regions prone to severe storms or prolonged heatwaves requires substantial upgrades to withstand these impacts, ensuring continuity of service. This translates to increased capital expenditure for grid modernization and climate adaptation strategies.

Biodiversity Protection and Land Use

Enel's expansion in renewable energy, such as its significant solar and wind projects, necessitates substantial land use. This can potentially affect local ecosystems and biodiversity. For instance, in 2023, Enel continued to focus on land restoration and biodiversity enhancement at its sites, with over 200 projects globally dedicated to this purpose.

Adherence to rigorous environmental impact assessments is crucial for Enel. The company must implement effective mitigation strategies and practice responsible land management to reduce its ecological footprint. By 2025, Enel aims to have 100% of its new renewable projects undergo detailed biodiversity impact assessments.

- Land Use Impact: Large-scale renewable projects like wind and solar farms require significant land, potentially impacting local ecosystems.

- Biodiversity Concerns: The expansion of infrastructure can affect the habitats and species present in these areas.

- Mitigation Strategies: Enel prioritizes environmental impact assessments and implements measures to minimize ecological footprints.

- Responsible Management: The company engages in responsible land management practices to protect biodiversity.

Waste Management and Circular Economy Principles

The environmental impact of waste from energy production, including plant decommissioning and renewable component disposal, presents a significant challenge. For instance, the end-of-life management of solar panels and wind turbine blades requires innovative solutions to prevent landfill burden and extract valuable materials.

Enel's commitment to circular economy principles is therefore vital for its long-term sustainability. This involves actively pursuing waste reduction, maximizing the reuse of materials, and enhancing recycling processes across its operations.

Key initiatives include:

- Developing advanced recycling technologies for solar panels and wind turbine blades.

- Implementing waste-to-energy solutions for by-products from conventional generation.

- Setting ambitious targets for waste reduction and material recovery in its 2024-2025 operational plans.

- Investing in research for biodegradable materials in renewable energy infrastructure.

Environmental regulations, particularly those focused on carbon emissions, are a primary driver for Enel's strategic direction. The EU's Fit for 55 package, aiming for a 55% net emission reduction by 2030, directly fuels Enel's substantial investments in renewable energy. Carbon pricing mechanisms, such as the EU ETS, which saw prices averaging €90-€100 per tonne of CO2 in late 2023 and early 2024, significantly influence operational costs.

Extreme weather events, exacerbated by climate change, pose a growing threat to Enel's infrastructure, necessitating increased capital expenditure for climate adaptation and grid modernization. The company's extensive renewable energy projects, like solar and wind farms, require significant land, prompting a focus on biodiversity impact assessments and land restoration, with over 200 global projects dedicated to this in 2023. By 2025, Enel targets 100% of new renewable projects to undergo detailed biodiversity impact assessments.

The management of waste from energy production, including the decommissioning of plants and disposal of renewable components like solar panels and wind turbine blades, presents a challenge. Enel is actively pursuing circular economy principles, focusing on waste reduction and material recovery, with ambitious targets set for its 2024-2025 operational plans.

| Environmental Factor | Impact on Enel | Key Data/Initiatives (2023-2025) |

| Climate Change Policies | Drives investment in renewables, impacts operational costs via carbon pricing. | EU Fit for 55 target (55% reduction by 2030); EU ETS prices €90-€100/tonne CO2 (late 2023-early 2024). |

| Extreme Weather Events | Requires infrastructure upgrades for resilience, increasing capital expenditure. | Ongoing grid modernization and climate adaptation strategies. |

| Land Use & Biodiversity | Requires careful management for renewable projects. | Over 200 global biodiversity enhancement projects (2023); 100% of new renewable projects to have biodiversity assessments by 2025. |

| Waste Management | Focus on circular economy principles for component disposal. | Ambitious waste reduction and material recovery targets for 2024-2025. |

PESTLE Analysis Data Sources

Our Enel PESTLE Analysis is built upon a robust foundation of data, drawing from official government publications, international energy organizations, and leading economic and environmental research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Enel.