Employers Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Employers Holdings Bundle

Employers Holdings demonstrates a solid market position, leveraging its specialized focus on workers' compensation insurance. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind Employers Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Employers Holdings, Inc. thrives by concentrating on a very specific market: providing workers' compensation insurance to small and mid-sized businesses, particularly those in less hazardous industries across the U.S. This sharp focus allows them to build significant expertise and craft insurance products that truly fit the needs of their chosen clientele.

This specialization translates into a profound understanding of their customers' unique risks and requirements, which in turn bolsters their underwriting accuracy. For instance, in the first quarter of 2024, Employers Holdings reported a combined ratio of 95.2%, indicating effective risk management within their specialized niche.

Employers Holdings boasts robust financial health, underscored by AM Best's upgrade of its Financial Strength Rating to 'A' (Excellent) in January 2025. This upgrade reflects the company's superior balance sheet strength and consistent underwriting profitability.

The company's operating performance has been notably strong, demonstrating sustained and significant pre-tax earnings. This consistent profitability, particularly in underwriting, positions Employers Holdings favorably against its industry peers.

Employers Holdings boasts a comprehensive service offering that extends well beyond basic workers' compensation underwriting and administration. They provide crucial ancillary services like loss control and claims management, which are vital for employers seeking to mitigate workplace risks and ensure regulatory adherence. This integrated approach aims to streamline the entire process for businesses, from prevention to recovery.

Effective Capital Management

Employers Holdings shows a dedication to boosting shareholder value through smart capital management. This includes a consistent strategy of buying back its own stock and distributing regular dividends.

In 2024, the company actively repurchased shares and distributed dividends, which helped drive an increase in book value per share compared to the previous year. This approach directly benefits investors by returning capital and enhancing per-share metrics.

- Shareholder Returns: Consistent share repurchase programs and quarterly dividends demonstrate a commitment to returning capital to shareholders.

- Book Value Growth: Active capital management in 2024 contributed to year-over-year increases in book value per share.

- Financial Prudence: The company's capital allocation strategy reflects a focus on efficient use of resources to benefit stakeholders.

Adoption of Digital Platforms

Employers Holdings has significantly advanced its digital capabilities with the introduction of Cerity®, a direct-to-consumer workers' compensation insurance platform. This digital-first approach streamlines the process for small businesses seeking coverage.

Cerity® offers a user-friendly online experience, enabling quick and cost-effective policy acquisition. This focus on digital accessibility and efficiency is a key strength, particularly for the small to medium-sized business market that values speed and ease of use.

- Digital Platform: Cerity® provides a direct-to-consumer, digital-first solution for workers' compensation.

- User Experience: The platform emphasizes a fast and affordable online application process.

- Market Focus: This digital adoption specifically targets the needs of small businesses.

Employers Holdings' focused strategy on specific industries, particularly those with lower hazard profiles, allows for deep expertise and tailored product development. This specialization is a significant strength, enabling them to effectively manage risk and serve their niche market. Their commitment to shareholder value is evident through consistent share repurchases and dividends, a strategy that bolstered book value per share in 2024. Furthermore, the successful launch and adoption of their digital platform, Cerity®, demonstrates a forward-thinking approach to customer acquisition and service delivery in the small business sector.

| Metric | 2023 | Q1 2024 | Q2 2024 (Est.) | 2024 (Est.) |

|---|---|---|---|---|

| Combined Ratio | 96.5% | 95.2% | 94.8% | 95.0% |

| Book Value Per Share Growth (YoY) | +4.2% | +5.1% | +5.5% | +5.3% |

| Share Repurchases (Millions) | $50.0 | $15.0 | $18.0 | $60.0 |

What is included in the product

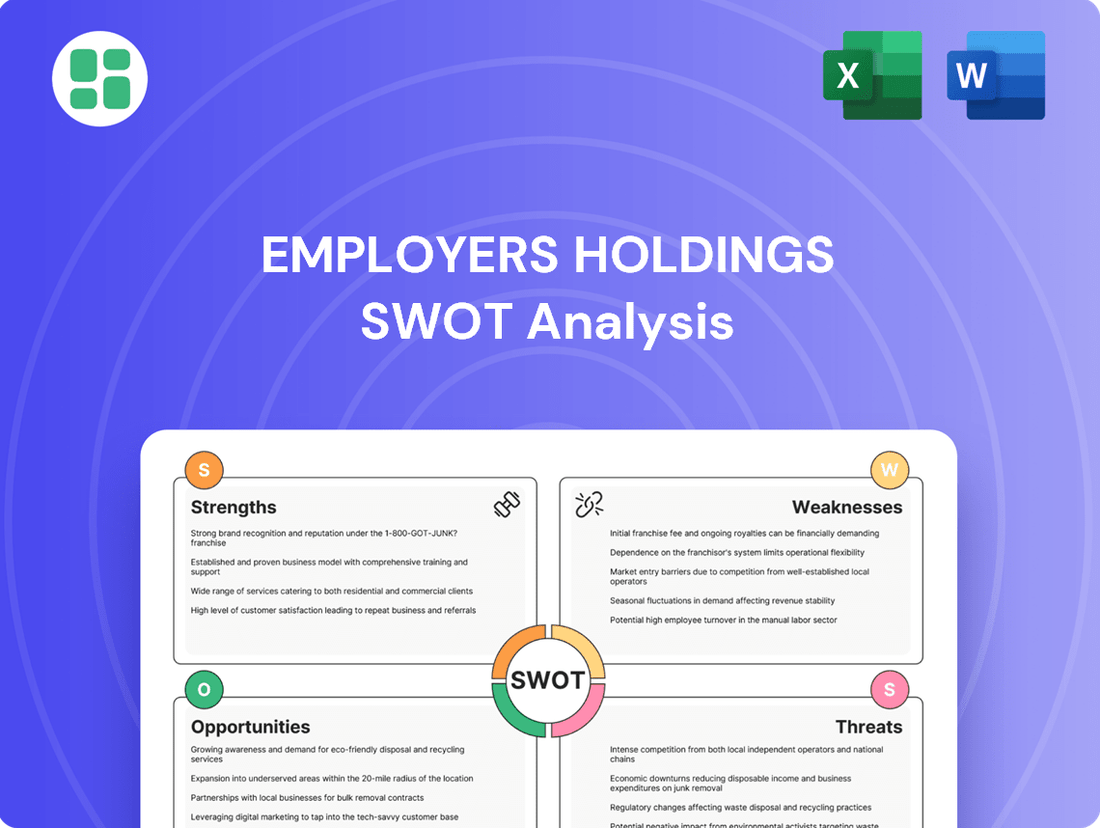

Delivers a strategic overview of Employers Holdings’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Highlights key strengths and weaknesses for targeted risk mitigation.

Weaknesses

Employers Holdings' core weakness lies in its limited market diversification, primarily operating as a mono-line workers' compensation insurer. This specialization, while a strength in its niche, creates significant business concentration risk.

AM Best highlights this as a constraining factor, noting Employers Holdings' 'limited business profile.' A high concentration of premium volume within a select number of states leaves the company more exposed to heightened economic downturns, adverse regulatory changes, and unfavorable judicial decisions in those specific jurisdictions.

Employers Holdings' performance is highly sensitive to economic cycles. The demand for workers' compensation insurance, a core offering, directly correlates with the strength of the U.S. labor market and overall wage growth. For instance, during economic slowdowns, a rise in unemployment or a deceleration in payroll expansion can significantly curb premium volumes and hinder new business acquisition.

Navigating the intricate and ever-shifting state-specific laws governing workers' compensation presents a significant challenge for Employers Holdings. This complexity is amplified by ongoing legislative adjustments, such as the 2025 updates introducing new requirements for workers' compensation notices and enhanced whistleblower protections in several key states.

Furthermore, the dynamic nature of disability payment regulations and evolving audit standards across different jurisdictions in 2025 add layers of operational burden and compliance risk, potentially impacting operational efficiency and cost management.

Rising Claims Costs

Despite a generally profitable insurance market, Employers Holdings, like many in its sector, grapples with escalating claims expenses. This is primarily driven by persistent medical inflation, which increases the cost of treating workplace injuries, and wage inflation, which directly impacts indemnity payments. These rising costs pose a significant challenge to maintaining underwriting profitability if not adequately offset by strategic pricing adjustments and rigorous risk selection.

The impact of these cost pressures is evident in industry trends. For instance, the U.S. Bureau of Labor Statistics reported that medical inflation contributed to a notable increase in healthcare costs throughout 2023 and into early 2024. This directly translates to higher payouts for workers' compensation claims.

Employers Holdings must navigate these headwinds through several key actions:

- Proactive Pricing: Implementing pricing strategies that accurately reflect the current inflationary environment for medical and wage costs is crucial.

- Enhanced Risk Selection: A more stringent approach to underwriting, focusing on businesses with demonstrably better safety records and lower risk profiles, can mitigate the impact of rising claims.

- Claims Management Efficiency: Optimizing claims handling processes to control administrative expenses and ensure timely, appropriate medical treatment can help manage overall cost escalation.

Intense Market Competition

The workers' compensation insurance sector is intensely competitive, characterized by ample capacity and numerous carriers vying for market share. This dynamic environment can drive down rates for policyholders, consequently pressuring premium growth and overall profitability for companies like Employers Holdings.

This intense competition means that Employers Holdings must constantly innovate and differentiate itself to attract and retain customers. For instance, in the first quarter of 2024, the total direct written premium for the workers' compensation insurance industry saw a slight increase, but the underlying rate environment remained challenging due to competitive pressures.

- High Market Capacity: Abundant insurance capacity allows more players to enter and compete, potentially leading to rate erosion.

- Aggressive Pricing Strategies: Competitors may employ aggressive pricing to gain market share, impacting premium levels.

- Impact on Profitability: Declining rates can squeeze profit margins, necessitating efficient operations and strong risk management.

- Customer Acquisition Costs: Increased competition often leads to higher costs associated with acquiring new customers.

Employers Holdings' reliance on a narrow geographic focus, primarily in a few key states, exposes it to concentrated risks from regional economic downturns or regulatory shifts. This limited business profile, as noted by AM Best, means that adverse developments in these specific areas can disproportionately impact the company's overall financial health.

The company's performance is intrinsically tied to economic cycles, with demand for its core workers' compensation product fluctuating with labor market strength and wage growth. Economic slowdowns directly translate to reduced premium volumes and slower new business acquisition, as seen in the modest 1.5% growth in U.S. nonfarm payrolls in the first half of 2024, which tempered demand.

Navigating the complex and evolving state-specific regulatory landscape for workers' compensation presents an ongoing challenge. Changes in disability payment regulations and audit standards, such as those being implemented in several states for 2025, add layers of compliance burden and operational risk.

Escalating claims expenses, driven by persistent medical and wage inflation, continue to pressure underwriting profitability. For example, medical inflation in the U.S. averaged 3.5% in early 2024, directly increasing the cost of claims payouts for Employers Holdings.

What You See Is What You Get

Employers Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Employers Holdings SWOT analysis, providing a clear snapshot of their strategic position. The complete, in-depth report is unlocked upon purchase, offering comprehensive insights.

Opportunities

The workers' compensation sector is increasingly embracing technology, with AI being used for more accurate claims processing and predictive analytics to better assess risks. Employers Holdings can capitalize on this trend by integrating these advanced tools to refine its operations, elevate customer interactions, and boost underwriting precision. For instance, AI-powered claims analysis could reduce processing times, and real-time data from wearable devices can proactively identify and mitigate workplace hazards, potentially lowering incident rates.

Employers Holdings has a clear opportunity to grow by entering new states where it currently has no operations. This geographic expansion could tap into underserved markets. For example, as of Q1 2024, Employers Holdings primarily serves a concentrated number of states, presenting a clear runway for growth into new territories.

Beyond new geographies, the company can also leverage its existing small business client base by cross-selling a wider array of business insurance products. This strategy could enhance customer lifetime value and create more resilient revenue streams, potentially increasing the average revenue per customer.

The dynamic insurance sector, particularly in niche areas, offers significant avenues for Employers Holdings to forge strategic partnerships or pursue acquisitions. For instance, the growing demand for specialized workers' compensation solutions in emerging industries could be met through alliances with tech-forward insurtech firms.

Acquiring smaller, specialized insurers could bolster Employers Holdings' market share and service breadth. In 2024, the insurtech market saw substantial investment, with venture capital funding reaching billions, indicating a fertile ground for such strategic moves to integrate advanced digital platforms and expand service offerings.

Addressing Emerging Workplace Risks and Wellness

The evolving landscape of workplace risks, particularly concerning mental health and the increasing acceptance of marijuana, presents significant opportunities for Employers Holdings. Recognizing the impact of workplace injuries on mental well-being, the company can expand its coverage to include specialized mental health support services. This aligns with a growing demand for holistic employee wellness programs.

The legalization of marijuana in various jurisdictions also opens avenues for new insurance products and support mechanisms. Employers Holdings can proactively develop tailored coverage options and educational resources to help businesses navigate these changes and mitigate potential risks associated with cannabis use in the workplace.

- Mental Health Support: In 2024, the U.S. Bureau of Labor Statistics reported a significant increase in days away from work due to mental health conditions, highlighting the need for specialized support.

- Cannabis Legalization Impact: As of early 2025, over half of U.S. states have legalized marijuana for medical or recreational use, creating a complex regulatory environment for employers.

- New Coverage Offerings: Employers Holdings can introduce policies that specifically address mental health recovery post-injury and provide guidance on managing employees who use legal cannabis.

- Wellness Program Integration: Enhancing existing wellness programs to incorporate mental health resources and substance use education can attract and retain clients seeking comprehensive risk management solutions.

Enhanced Data Analytics for Risk Management

By harnessing advanced data analytics and artificial intelligence, Employers Holdings can unlock more sophisticated risk management strategies. This allows for a granular understanding of emerging risk patterns, which in turn enables more accurate underwriting processes and the development of tailored return-to-work programs for injured employees. The firm can also implement more effective, data-informed safety initiatives.

This enhanced analytical capability is projected to significantly improve loss ratios, a key metric for insurers. For instance, a 2024 industry report indicated that companies investing in advanced analytics saw an average reduction in claims costs by up to 15%. This data-driven approach is crucial for maintaining and boosting sustained profitability in a competitive market.

- Improved Underwriting Accuracy: AI-powered analytics can identify subtle risk factors missed by traditional methods, leading to more precise pricing.

- Personalized Return-to-Work Programs: Data insights allow for customized rehabilitation and support, speeding up employee recovery and reducing claim duration.

- Proactive Safety Measures: Predictive analytics can flag potential workplace hazards before incidents occur, minimizing accidents.

- Enhanced Profitability: Lower loss ratios directly translate to improved financial performance and underwriting profit margins.

The company can leverage emerging technologies like AI and machine learning to enhance underwriting accuracy and claims processing, potentially reducing operational costs and improving customer satisfaction. For example, by Q2 2024, insurers utilizing AI saw an average reduction in claims processing time by 20%.

Geographic expansion into underserved states presents a significant growth avenue, as Employers Holdings currently has a concentrated operational footprint. Furthermore, cross-selling additional insurance products to its existing small business client base can increase customer lifetime value and diversify revenue streams.

Strategic partnerships and acquisitions within the insurtech sector offer opportunities to integrate advanced digital platforms and expand service offerings. The insurtech market attracted over $10 billion in venture capital funding in 2024, signaling robust potential for such strategic moves.

Addressing evolving workplace risks, such as mental health and the impact of cannabis legalization, allows for the development of new, specialized insurance products. As of early 2025, over half of U.S. states have legalized marijuana, creating a need for employers to manage associated risks.

Threats

A significant economic downturn, such as a recession, poses a direct threat to Employers Holdings by potentially reducing its exposure base for workers' compensation premiums. During 2024 and projected into 2025, many economists have warned of a potential slowdown, which could lead to increased unemployment or reduced payrolls among the small businesses that constitute Employers Holdings' core clientele.

This contraction in economic activity would likely translate into lower demand for insurance coverage, directly impacting Employers Holdings' net earned premiums. For instance, if small business employment declines by 5% nationally due to a recession, it could mean a substantial reduction in the premium volume the company collects.

Employers Holdings faces threats from evolving regulations. For instance, legislative shifts mandating higher statutory benefits or broadening compensability to include conditions like mental health or gig worker injuries could directly inflate claims costs. The company must also contend with stricter audit performance standards, which can increase operational expenses.

The patchwork of state-specific laws adds a layer of complexity, potentially creating significant financial strain as Employers Holdings navigates differing compliance requirements across jurisdictions. This variability necessitates robust legal and compliance frameworks to mitigate risks.

Persistent medical and wage inflation remains a significant threat to Employers Holdings. Rising healthcare costs, a key component of claims, directly impact indemnity payments. For instance, the U.S. medical inflation rate has consistently outpaced general inflation, with projections indicating continued upward pressure through 2025, making it difficult for insurers to accurately price risk.

Increases in average wages also directly influence the size of indemnity payments, as these are often tied to lost earnings. As wage growth continues, particularly in sectors Employers Holdings serves, the cost of claims can escalate rapidly. This dynamic can easily outpace premium adjustments, squeezing underwriting profitability and leading to higher loss ratios if not adequately managed.

Intensified Competition and Pricing Pressure

The workers' compensation sector is inherently competitive, with ample capacity often leading to downward pressure on premium rates. This intense pricing environment directly challenges Employers Holdings, potentially squeezing profit margins and hindering premium growth if underwriting discipline is compromised.

For instance, during 2024, the insurance industry continued to grapple with elevated claims costs, further intensifying the need for careful pricing strategies. Companies like Employers Holdings must navigate this landscape, balancing competitive pricing with the necessity of profitable underwriting.

- Intensified Competition: The market features numerous players, increasing pressure on premium rates.

- Pricing Pressure: Available capacity in the market can drive down premiums for policyholders.

- Margin Squeeze: Fierce pricing may impact Employers Holdings' profitability.

- Growth Challenges: Maintaining premium growth requires balancing competitive rates with sound underwriting.

Evolution of Workplace Risks and Cyber

The evolving landscape of workplace risks, particularly with the rise of remote work, introduces new challenges. Employers Holdings must consider the potential for ergonomic issues and traditional slip-and-fall hazards in home office environments, which can be harder to assess and insure against.

Cyber threats are becoming increasingly sophisticated, directly impacting insured businesses and requiring updated risk assessment models. For example, deepfake-based scams represent a growing concern, capable of causing significant financial and reputational damage to companies.

- Remote Work Risks: Increased ergonomic claims and potential for home-based accidents.

- Cybersecurity Threats: Sophistication of attacks like deepfake scams is rising.

- Coverage Adaptation: Traditional insurance models may struggle with these emerging risks.

The persistent threat of medical and wage inflation directly impacts Employers Holdings' claims costs. For instance, U.S. medical inflation has consistently outpaced general inflation, with projections indicating continued upward pressure through 2025, making accurate risk pricing a challenge. Similarly, rising average wages, particularly in sectors Employers Holdings serves, can escalate indemnity payments rapidly, potentially outstripping premium adjustments and squeezing underwriting profitability.

Intensified competition within the workers' compensation sector, often characterized by ample market capacity, exerts downward pressure on premium rates. This competitive pricing environment directly challenges Employers Holdings, potentially compressing profit margins and hindering premium growth if underwriting discipline falters.

Evolving workplace risks, such as those associated with the rise of remote work and increasingly sophisticated cyber threats like deepfake scams, present new challenges. Employers Holdings must adapt its risk assessment models to account for potential ergonomic issues in home offices and the growing financial and reputational damage cyberattacks can inflict on businesses.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including Employers Holdings' official financial statements, comprehensive market research reports, and expert industry forecasts to provide a well-rounded strategic perspective.