Employers Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Employers Holdings Bundle

Employers Holdings faces moderate bargaining power from buyers, as switching costs are relatively low for businesses seeking workers' compensation insurance. The threat of new entrants is also a significant factor, with regulatory hurdles and capital requirements being key barriers to entry.

The complete report reveals the real forces shaping Employers Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Reinsurers are increasingly flexing their muscles, a trend that intensified in 2024 and is anticipated to persist into 2025. This growing influence stems from a combination of factors, including a hardening market characterized by rising rates and more stringent underwriting. For primary insurers like Employers Holdings, this translates to higher reinsurance costs.

Several market dynamics are fueling reinsurers' enhanced bargaining power. An uptick in claims frequency, coupled with persistent inflation impacting claim severity, has put pressure on reinsurers' profitability. Furthermore, certain reinsurers are experiencing capital constraints, limiting their capacity and making them more selective about the risks they assume, thereby strengthening their negotiating position.

The impact on companies like Employers Holdings is direct: they face increased expenses for reinsurance coverage. This could necessitate absorbing these higher costs, potentially squeezing profit margins, or passing them along to their policyholders in the form of higher premiums. For instance, the global reinsurance market saw significant rate increases in 2024, with some property catastrophe renewals experiencing hikes of 20% or more.

The workers' compensation sector's increasing dependence on sophisticated technologies such as AI and data analytics for claims, risk, and underwriting is amplifying the leverage of specialized tech suppliers. These firms provide essential tools that boost efficiency and personalization, making their offerings vital for maintaining a competitive edge.

Employers Holdings, like its peers, must adopt these technologies to optimize operations and achieve better results, thereby granting these technology providers significant bargaining power. For instance, the global AI in insurance market was projected to reach $2.5 billion in 2023 and is expected to grow substantially, highlighting the increasing reliance and supplier influence.

Medical and legal service providers wield considerable influence over Employers Holdings. Their specialized expertise is crucial for managing claims effectively and directly impacts the ultimate cost of those claims. This leverage stems from the essential nature of their services in treating injured workers and navigating intricate legal frameworks.

Factors like escalating medical inflation and a rise in litigation expenses amplify the bargaining power of these suppliers. For instance, the U.S. medical inflation rate has shown persistent upward trends, impacting healthcare costs significantly. Similarly, legal defense costs can escalate rapidly, especially in complex workers' compensation cases, putting pressure on Employers Holdings' bottom line.

Employers Holdings' dependence on these external service providers for claims resolution, worker rehabilitation, and legal compliance underscores their strong position. The company needs these entities to ensure efficient operations and mitigate financial risks associated with workplace injuries and legal challenges.

Actuarial and Specialized Consulting Services

Specialized actuarial and consulting firms wield significant bargaining power because their niche expertise in risk assessment, pricing, and navigating complex insurance regulations is indispensable. These services are critical for accurate underwriting and ensuring the financial health of insurers like Employers Holdings.

Employers Holdings relies heavily on precise actuarial analysis to effectively manage its financial reserves and refine its pricing strategies. The demand for these specialized skills, coupled with a limited supply of qualified providers, allows these firms to command higher fees and favorable contract terms.

- High demand for specialized knowledge: Actuarial services are essential for regulatory compliance and accurate risk pricing in the insurance sector.

- Limited supply of experts: The number of highly skilled actuaries and specialized consultants is relatively small, increasing their leverage.

- Criticality of services: The accuracy of actuarial work directly impacts an insurer's profitability and solvency, making it difficult to substitute.

- Impact on Employers Holdings: For Employers Holdings, the cost and quality of these services directly influence underwriting profitability and capital adequacy.

Talent Pool for Skilled Professionals

The availability and cost of highly skilled professionals, such as experienced underwriters, claims adjusters, and data scientists, represent a significant form of supplier power for Employers Holdings. In 2024, the demand for specialized expertise, particularly in areas like artificial intelligence and the management of complex claims, has intensified. This tight labor market directly impacts labor costs and can affect operational efficiency.

Employers Holdings must actively compete for this critical talent to maintain its high service quality and robust underwriting discipline. For instance, the average salary for an experienced insurance underwriter in the US can range from $70,000 to $100,000 annually, with specialized roles commanding even higher figures. This cost is a direct reflection of the bargaining power held by these skilled individuals.

- Skilled Labor Costs: In 2024, the competition for experienced underwriters and claims adjusters has driven up average salaries, impacting Employers Holdings' operational expenses.

- Specialized Expertise Demand: The increasing need for professionals skilled in AI and complex claims handling further elevates the bargaining power of these suppliers.

- Service Quality Impact: Employers Holdings' ability to attract and retain top talent is crucial for maintaining its service standards and underwriting accuracy.

Suppliers of specialized technology, particularly those offering AI and data analytics solutions, hold significant bargaining power over Employers Holdings. This is due to the increasing reliance on these tools for operational efficiency and competitive advantage in the insurance sector.

Medical and legal service providers also exert strong influence, as their expertise is critical for managing claims costs and navigating legal complexities. Escalating medical inflation and rising litigation expenses further amplify their leverage.

Specialized actuarial and consulting firms possess considerable bargaining power due to their indispensable niche expertise in risk assessment and regulatory compliance, directly impacting underwriting profitability and financial health.

The availability and cost of highly skilled professionals, such as experienced underwriters and claims adjusters, represent another key area of supplier power, with demand intensifying for specialized skills in 2024.

| Supplier Type | Key Factors Influencing Power | Impact on Employers Holdings |

|---|---|---|

| Technology Providers (AI/Data Analytics) | Increasing reliance for efficiency; limited supply of specialized skills | Higher costs for essential tools; pressure to adopt new technologies |

| Medical & Legal Services | Essential for claims management; impact of inflation and litigation | Increased claims costs; potential for higher operational expenses |

| Actuarial & Consulting Firms | Critical niche expertise; limited supply of qualified professionals | Higher fees for essential risk assessment and regulatory guidance |

| Skilled Labor (Underwriters, Adjusters) | High demand for specialized talent; tight labor market | Increased labor costs; competition for talent impacts operational capacity |

What is included in the product

This analysis tailors Porter's Five Forces to Employers Holdings, examining the intensity of rivalry, buyer and supplier power, threats from new entrants and substitutes, and their impact on the company's profitability and strategic positioning.

Quickly identify and mitigate competitive threats with a visual representation of each force, enabling targeted strategic adjustments.

Customers Bargaining Power

Small businesses, the core customer base for Employers Holdings, often exhibit significant price sensitivity when it comes to workers' compensation insurance. This is particularly true for those without a history of claims, making them more inclined to seek out the most affordable options. This inherent price sensitivity can translate into considerable downward pressure on insurance premiums, especially in a crowded marketplace.

The workers' compensation insurance sector, while generally profitable, has seen increasing competition. This heightened competition, coupled with the emergence of new market participants, has contributed to a trend of declining rates for policyholders in recent years. For instance, data from industry reports in late 2023 and early 2024 indicated a softening market with premium decreases in certain segments, directly impacting the pricing power Employers Holdings can exert.

Customers in the workers' compensation market benefit from a wide array of insurance options, with numerous carriers competing for business. This includes both specialized insurers and those offering multiple lines of coverage, providing ample choice.

The significant availability of insurance capacity means customers can readily compare quotes from different providers. With relatively low costs associated with switching insurers, clients possess substantial bargaining power, driving competitive pricing.

In 2024, the insurance market continued to see robust competition, with carriers actively seeking to expand their market share in the workers' compensation sector. This environment further empowers customers to negotiate favorable terms.

Insurance brokers and agents are key players in how Employers Holdings reaches its customers. These intermediaries often act as trusted advisors for small business owners, and their collective voice can sway purchasing decisions. In 2024, a significant portion of small business insurance policies are still placed through these channels, highlighting their influential role.

Because small business owners rely on the expertise of brokers and agents to navigate complex insurance options, these intermediaries gain substantial bargaining power. They can effectively consolidate demand from numerous smaller clients, making their preferences a significant factor for Employers Holdings.

Employers Holdings' distribution strategy heavily depends on these broker and agent relationships. Maintaining strong partnerships is therefore critical for the company to ensure continued access to its target market and to manage the influence these intermediaries wield.

Impact of Claims Experience on Customer Priorities

For small businesses, price is often the primary driver. However, once a business experiences claims, their priorities shift. They begin to value robust risk management, efficient claims handling, and comprehensive employee services much more than just the lowest premium.

This shift in customer priorities presents a significant opportunity for Employers Holdings. By highlighting its strengths in loss control and claims management, the company can effectively reduce the bargaining power of customers who might otherwise focus solely on price. In 2024, a strong claims management process can be a key differentiator, especially for businesses that have faced the complexities of workplace incidents.

- Price Sensitivity Declines Post-Claims: Studies indicate that businesses experiencing even one significant claim are more likely to switch providers based on service quality and risk mitigation support rather than solely on cost.

- Value of Risk Management Services: Employers Holdings' investment in loss control programs, which aim to prevent future claims, directly addresses this evolving customer need, thereby strengthening customer loyalty.

- Claims Handling as a Competitive Edge: Efficient and empathetic claims processing is paramount. Employers Holdings' ability to manage claims effectively can transform a potentially negative experience into a positive differentiator, reducing customer reliance on price alone.

Regulatory Requirements for Coverage

The bargaining power of customers in the workers' compensation insurance market, particularly for a company like Employers Holdings, is influenced by regulatory requirements. Workers' compensation insurance is typically mandated by states, meaning employers cannot simply opt out of coverage. This creates a fundamental demand for the service, limiting the customer's ability to entirely forgo the product.

However, the specific regulations vary significantly from state to state, impacting customer choice. Employers can shop around for providers that meet these diverse state-specific eligibility requirements and offer competitive pricing. While the mandate ensures a baseline demand, this regulatory landscape allows customers to exercise some leverage by comparing options and seeking the most cost-effective compliant coverage.

- Mandatory Coverage: State laws requiring workers' compensation insurance limit customers' ability to avoid purchasing coverage.

- State-Specific Regulations: Varying eligibility criteria and compliance rules across states empower customers to compare and select providers.

- Price Sensitivity: Despite the mandatory nature, customers can still exert pressure on pricing by exploring different compliant insurance options.

The bargaining power of customers for Employers Holdings is shaped by their price sensitivity, the availability of alternatives, and the influence of intermediaries like brokers. While mandatory coverage ensures a baseline demand, the competitive landscape in 2024 allowed customers to leverage choice to drive down prices.

For small businesses, especially those with a clean claims history, the focus remains on affordability. However, the value proposition shifts significantly after a claim, with risk management and claims handling becoming paramount. Employers Holdings can mitigate customer bargaining power by emphasizing these service strengths.

The insurance market in 2024 saw continued competition, with carriers vying for market share. This environment, coupled with the ease of switching providers for many clients, means customers can effectively negotiate for better terms and pricing, directly impacting Employers Holdings.

| Factor | Impact on Employers Holdings' Customer Bargaining Power | 2024 Market Context |

|---|---|---|

| Price Sensitivity | High for small businesses without claims history | Continued focus on cost-effective solutions |

| Availability of Alternatives | Numerous competitors offer similar coverage | Robust competition among insurers |

| Intermediary Influence (Brokers) | Brokers consolidate demand and advise clients | Significant portion of policies placed through brokers |

| Post-Claim Priorities | Shift from price to service quality and risk management | Strong claims handling as a differentiator |

| Regulatory Mandate | Ensures baseline demand for workers' comp | State variations allow for provider comparison |

Preview the Actual Deliverable

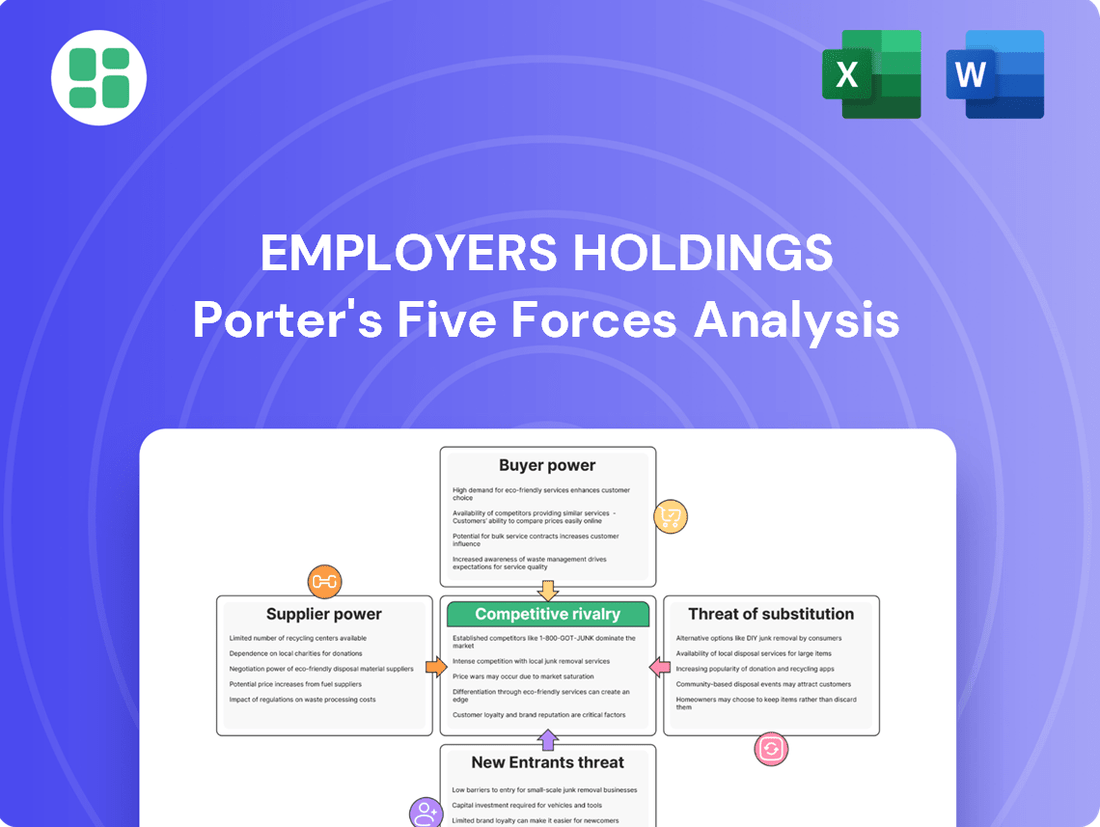

Employers Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Employers Holdings, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides actionable insights into the strategic positioning and potential challenges faced by Employers Holdings within its industry, offering a thorough understanding of the forces shaping its profitability and competitive advantage.

Rivalry Among Competitors

The U.S. workers' compensation insurance market is quite crowded, with a large number of private insurance companies vying for business. This fragmentation means that no single company holds a dominant market share, intensifying the rivalry among them. For Employers Holdings, this translates into a constant battle for customers.

This intense competition, fueled by new companies entering the market and ample available capacity, has historically driven down insurance rates for businesses. In 2023, for example, continued competitive pressures in the workers' compensation market contributed to a challenging environment for premium growth across the industry, impacting companies like Employers Holdings.

The workers' compensation insurance market has shown robust profitability for years, with combined ratios frequently dipping below 90% over the last decade. This sustained financial success acts like a magnet, drawing in new companies eager to capture a piece of the market and prompting established players to broaden their operations.

This increased competition naturally heats up the rivalry among existing insurers. As more players vie for market share, there's a palpable pressure to lower prices and trim underwriting margins, making it harder for any single company to stand out and maintain high profitability.

The workers' compensation insurance market, where Employers Holdings operates, is characterized by a significant lack of product differentiation. Core coverage is largely standardized due to state mandates, making it challenging for insurers to stand out based on policy features alone. This commoditization forces competition to shift towards other factors like pricing, customer service, and the effectiveness of claims handling.

In 2023, the net written premiums for Employers Holdings were $1.9 billion, reflecting the competitive landscape where policy features are similar. To combat this, differentiation strategies often focus on value-added services. Employers Holdings, for instance, emphasizes its expertise in serving small to medium-sized businesses, offering tailored risk management and loss control programs to enhance client safety and reduce claims, thereby creating a competitive edge beyond the basic insurance product.

Industry Maturity and Slowing Premium Growth

The workers' compensation market, while benefiting from a strong labor market and wage increases, is fundamentally mature. This maturity means that overall growth is slowing, making competition fiercer as companies vie for existing business rather than capitalizing on market expansion. For instance, some analyses in late 2023 and early 2024 suggested a slowdown in payroll growth, which directly impacts premium volume for insurers.

This dynamic intensifies rivalry. When the pie isn't growing as quickly, companies must fight harder for their slice. This can manifest in more aggressive pricing strategies or increased marketing efforts to capture market share from competitors. The overall effect is a more challenging environment where differentiation and efficiency become paramount for success.

- Mature Market Dynamics: The workers' compensation sector is characterized by its maturity, leading to slower overall premium growth compared to earlier stages of market development.

- Impact of Macroeconomic Conditions: Premium growth rates are increasingly sensitive to macroeconomic factors, including shifts in employment levels and wage inflation, which can lead to volatility.

- Intensified Competition: As market expansion slows, insurers face heightened competition, often resorting to price adjustments and aggressive market share acquisition strategies.

- Slipping Premiums: Reports from late 2023 and early 2024 indicated instances of premium declines attributed to factors such as a deceleration in payroll growth.

High Exit Barriers

The insurance sector, by its nature, presents substantial hurdles for companies looking to exit. These barriers are rooted in the significant capital reserves insurers must maintain, the long-term nature of liabilities they assume, and strict regulatory compliance requirements. These factors often keep even underperforming companies in the market, thereby perpetuating intense competition.

For Employers Holdings, this translates into a persistent competitive landscape. Companies are less likely to cease operations, meaning Employers Holdings must continually contend with a consistent set of rivals, all vying for market share. This dynamic is a hallmark of mature industries where established players face ongoing pressure to innovate and maintain efficiency.

- High Capital Requirements: Insurers need substantial capital to cover potential claims and meet solvency regulations.

- Long-Tail Liabilities: Many insurance policies, particularly in areas like workers' compensation, involve liabilities that can extend for decades, making a clean exit difficult.

- Regulatory Oversight: Insurance is a heavily regulated industry, and exiting requires navigating complex approval processes and ensuring all outstanding obligations are met.

- Impact on Employers Holdings: This environment necessitates a strong focus on operational efficiency and risk management to remain competitive against entrenched players.

The workers' compensation insurance market is highly competitive, with many insurers offering similar products. This lack of differentiation forces companies like Employers Holdings to compete primarily on price and customer service. The market's maturity means growth is slower, intensifying the struggle for market share, as evidenced by Employers Holdings' $1.9 billion in net written premiums in 2023, reflecting the crowded field.

High capital requirements and regulatory hurdles make exiting the insurance market difficult, keeping even weaker players in the game and sustaining intense rivalry. This means Employers Holdings must consistently battle established competitors, underscoring the need for operational efficiency and strong risk management to maintain its position.

| Metric | Value (2023) | Significance |

|---|---|---|

| Employers Holdings Net Written Premiums | $1.9 billion | Indicates market presence amidst intense competition. |

| Industry Combined Ratio (Historical Average) | Below 90% | Suggests sustained profitability attracting new entrants and intensifying rivalry. |

| Market Maturity | Mature | Leads to slower growth and fiercer competition for existing business. |

SSubstitutes Threaten

For larger corporations, the ability to self-insure for workers' compensation represents a significant substitute for traditional insurance policies. This is particularly true when considering the financial capacity and administrative infrastructure these larger entities possess to manage claims and regulatory compliance directly.

However, for the small to medium-sized businesses that Employers Holdings primarily serves, self-insurance is a far less practical or attractive option. The inherent volatility of claims, coupled with the complex legal and administrative burdens, poses substantial risks that many smaller operations cannot effectively absorb.

In 2024, the market for workers' compensation insurance remained robust, but the trend of larger companies exploring self-insurance continued, driven by a desire to control costs and manage their own risk profiles more directly. This strategic shift highlights a key competitive pressure for insurers focused on larger enterprise clients.

Alternative risk transfer (ART) mechanisms like captives and risk retention groups present a potential substitute for traditional insurance, particularly for larger entities. These ARTs allow businesses to self-insure, retaining risk and potentially reducing long-term costs, though they demand significant financial acumen and operational scale. For instance, the U.S. captive insurance market generated over $70 billion in premiums in 2023, illustrating its growing presence.

While ARTs offer a substitute, their complexity and capital requirements generally limit their appeal to small and medium-sized businesses. Employers Holdings' strategic focus on this market segment naturally diminishes the direct threat from ARTs, as their primary customer base typically lacks the resources and expertise to implement such sophisticated risk management solutions.

In certain regions, state-sponsored or monopolistic government funds operate as alternatives to private workers' compensation insurance. These government-backed entities can cap the pricing power and market share of private insurers like Employers Holdings, acting as a direct substitute. For instance, in states like Washington, Ohio, North Dakota, and Wyoming, workers' compensation is exclusively handled by state funds, meaning private carriers have no access to these markets.

Direct Employer Liability (Non-Compliance)

The most direct, though legally non-compliant and highly risky, 'substitute' for employers would be to simply forgo workers' compensation insurance. However, this is illegal in most U.S. states and carries severe penalties, making it an unsustainable and negligible threat for legitimate businesses. Employers Holdings operates in a market where compliance is generally mandatory, with states like California imposing fines of up to $100,000 for non-compliance.

This illegal avoidance strategy is not a viable alternative for most employers, especially those operating in industries with a higher risk of workplace injuries. The potential legal repercussions and financial penalties far outweigh any perceived cost savings. For instance, in 2023, the National Council on Compensation Insurance (NCCI) reported that the total cost of workers' compensation claims in the U.S. exceeded $60 billion.

- Illegal Avoidance: Employers choosing not to carry workers' compensation insurance is illegal in most U.S. states.

- Severe Penalties: Non-compliance can result in significant fines, such as up to $100,000 in California.

- Unsustainable Strategy: The risks and penalties associated with non-compliance make it an unviable option for legitimate businesses.

- Market Compliance: Employers Holdings operates in a sector where adherence to insurance mandates is the norm.

Focus on Risk Mitigation and Prevention

While not a direct substitute for insurance itself, a strong emphasis on workplace safety and preventative measures by employers can significantly reduce their reliance on comprehensive insurance policies. By actively mitigating risks and minimizing claims through robust loss control programs, companies can lessen their perceived need for extensive coverage.

Employers Holdings actively supports this by offering dedicated loss control services. These services empower clients to address potential hazards and prevent injuries, thereby reducing the likelihood of substantial claims and, consequently, their dependence on the full breadth of insurance protection.

For instance, in 2024, many businesses are investing more heavily in safety training and technology. A report from the National Safety Council indicated a 15% increase in spending on workplace safety initiatives by mid-sized companies compared to 2023, directly impacting their claims frequency and the perceived value of high-limit insurance products.

- Reduced Claims: Proactive safety measures lower the frequency and severity of workplace incidents.

- Lower Premiums: A history of fewer claims can lead to more competitive insurance pricing.

- Enhanced Reputation: Strong safety records improve a company's image and attractiveness to talent.

- Focus on Prevention: Employers Holdings' loss control services align with this trend by offering expertise in risk mitigation.

The threat of substitutes for Employers Holdings primarily stems from self-insurance options and alternative risk transfer mechanisms, though these are largely viable only for larger enterprises. For the small to medium-sized businesses Employers Holdings serves, these substitutes are less practical due to complexity and capital requirements.

State-sponsored monopolistic funds in certain regions also act as direct substitutes, limiting private insurers' market access. While illegal avoidance of insurance is technically a substitute, the severe penalties make it negligible for compliant businesses. The focus on workplace safety can reduce reliance on insurance, a trend Employers Holdings supports through loss control services.

| Substitute Type | Target Market | Viability for SMBs | Impact on Employers Holdings |

|---|---|---|---|

| Self-Insurance | Large Corporations | Low | Limited direct impact on core customer base |

| Alternative Risk Transfer (ART) | Large Corporations | Low | Limited direct impact on core customer base |

| State-Monopolistic Funds | Businesses in specific states (e.g., WA, OH) | N/A (Market exclusion) | Market exclusion in certain regions |

| Illegal Avoidance | N/A (Non-compliant) | Negligible (High risk) | Minimal due to legal mandates |

| Workplace Safety Initiatives | All Employers | High | Potential reduction in demand for comprehensive coverage |

Entrants Threaten

Entering the workers' compensation insurance sector demands significant capital. Companies need funds for underwriting risks, setting aside reserves for claims, and building out essential operational infrastructure. For instance, in 2024, the average startup capital for a new specialty insurer can easily run into tens of millions of dollars, depending on the scale and target market. This substantial financial hurdle acts as a strong deterrent for many aspiring new entrants, particularly those lacking robust financial backing or established credit lines.

This high capital requirement is a key protective factor for established players like Employers Holdings. It effectively limits the number of new competitors that can realistically enter the market, thereby reducing the intensity of competitive pressure and allowing Employers Holdings to maintain a more stable market position.

The workers' compensation insurance sector presents a formidable threat of new entrants due to its intricate regulatory framework. Each state maintains its own unique set of laws, licensing stipulations, and ongoing compliance duties, creating a complex web for newcomers to untangle. For instance, as of the first half of 2024, navigating these state-specific requirements demands substantial investment in legal counsel and operational know-how, effectively acting as a significant barrier.

New entrants into the insurance market, especially those targeting small businesses, face a significant hurdle in establishing robust distribution channels. These channels, primarily independent insurance agents and brokers, are crucial for reaching the target customer base and often have deep-seated relationships built over years.

Building these networks from the ground up is a costly and lengthy endeavor. For instance, recruiting and training a network of agents requires substantial investment in marketing, compensation, and support infrastructure. This barrier effectively protects incumbent players like Employers Holdings, who already possess these vital connections.

In 2024, the insurance brokerage sector continued to consolidate, with larger firms acquiring smaller ones, further solidifying the importance of established relationships. This trend makes it even more challenging for new entrants to gain traction without significant capital and a well-defined strategy for channel development.

Brand Reputation and Trust

In the insurance sector, particularly for specialized providers like Employers Holdings, a strong brand reputation and deep customer trust are paramount. Newcomers often struggle to replicate the established credibility that incumbent players have cultivated over years of reliable service and consistent performance.

For instance, in 2023, the insurance industry saw a continued emphasis on customer loyalty, with surveys indicating that over 60% of consumers prioritize trust and reputation when selecting an insurance provider. This presents a significant barrier for new entrants aiming to disrupt the market.

- Brand Reputation: Established insurers benefit from decades of building trust, a critical factor in policyholder retention.

- Customer Trust: A proven track record in claims handling and customer service is difficult for new companies to quickly establish.

- Incumbent Advantage: Companies like Employers Holdings have long-standing relationships with their target market, small businesses, making it harder for new entrants to gain traction.

Economies of Scale in Operations and Data

Incumbent insurers, like Employers Holdings, leverage significant economies of scale in core operations such as underwriting, claims processing, and sophisticated data analytics. This scale allows them to spread fixed costs over a larger volume of business, leading to lower per-unit operating expenses.

A key advantage for established players is their extensive historical claims data. This rich dataset, accumulated over years, is crucial for developing highly accurate risk assessment models and precise pricing strategies. For example, by analyzing millions of past claims, insurers can better predict future losses and set premiums accordingly, offering a competitive edge.

New entrants face a substantial barrier in replicating these capabilities. They would need to invest heavily and rapidly to build comparable operational efficiencies and acquire vast amounts of relevant data. Without this, achieving cost competitiveness and offering attractive pricing against established insurers like Employers Holdings would be exceedingly difficult.

- Economies of Scale: Incumbents benefit from lower per-unit costs in underwriting and claims management.

- Data Advantage: Vast historical claims data enables superior risk assessment and pricing accuracy.

- New Entrant Hurdle: Replicating operational scale and data sets requires significant investment and time.

- Competitive Pricing: Incumbents' cost efficiencies translate to more competitive pricing, challenging new entrants.

The threat of new entrants in the workers' compensation insurance market is moderate, primarily due to high capital requirements and stringent regulatory landscapes. Established players like Employers Holdings benefit from significant economies of scale and a strong brand reputation, making it challenging for newcomers to compete on cost and trust. Access to extensive historical claims data also provides incumbents with a crucial advantage in risk assessment and pricing.

| Factor | Impact on New Entrants | Mitigation for Employers Holdings |

|---|---|---|

| Capital Requirements | High (tens of millions for specialty insurers in 2024) | Established financial stability |

| Regulatory Complexity | Significant (state-specific laws, licensing) | Existing compliance infrastructure |

| Distribution Channels | Difficult to build (agent relationships) | Existing broker networks |

| Brand Reputation & Trust | Challenging to replicate (60%+ consumers prioritize trust in 2023) | Long-standing customer loyalty |

| Economies of Scale & Data | Costly to achieve | Operational efficiencies and historical data advantage |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Employers Holdings is built upon a robust foundation of data, drawing from company annual reports, SEC filings, and industry-specific market research from firms like IBISWorld.