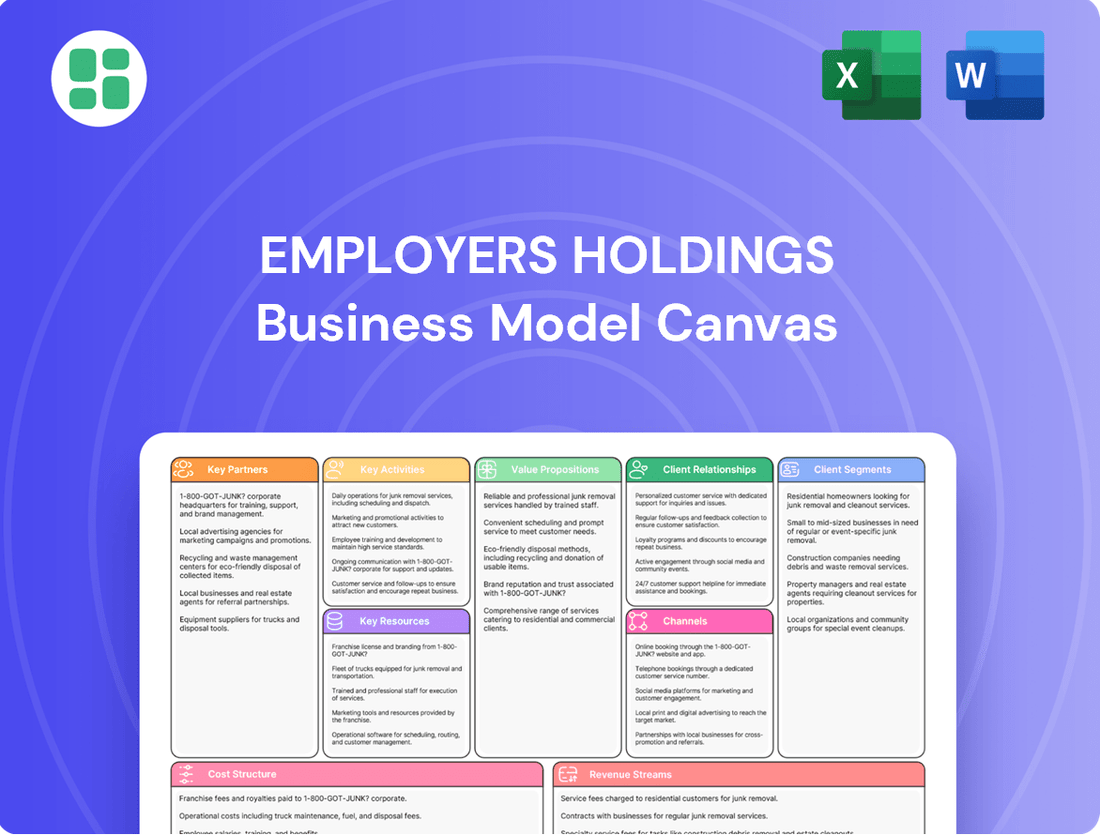

Employers Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Employers Holdings Bundle

Unlock the core strategies of Employers Holdings with our comprehensive Business Model Canvas. Discover how they effectively serve their niche market, leverage key partnerships, and generate revenue through specialized insurance products. This detailed analysis is perfect for anyone seeking to understand their operational excellence and competitive advantage.

Partnerships

Independent insurance agents and brokers are foundational to Employers Holdings' business model, acting as the primary conduit to small businesses nationwide. In 2024, this network remains critical for reaching a fragmented market, with agents facilitating policy sales and client onboarding. Their localized knowledge is invaluable for tailoring coverage to specific business needs, contributing significantly to customer acquisition and retention.

Employers Holdings collaborates with reinsurance companies to effectively manage and reduce large-scale risks. These partnerships are crucial for transferring a portion of underwriting risk, thereby safeguarding the company's capital from severe claims or substantial shifts in loss patterns. For instance, in 2023, Employers Holdings reported a net premiums written of $797.7 million, with a significant portion of this risk likely reinsured.

Employers Holdings relies on strong relationships with healthcare providers and medical networks to manage workers' compensation claims effectively. These partnerships are key to ensuring injured employees receive prompt and suitable medical care, aiding their recovery and return to work. For example, in 2024, the average cost of a workers' compensation claim involving medical treatment was estimated to be around $45,000, highlighting the importance of cost-controlled care through these networks.

Regulatory Bodies and Compliance Experts

Given the highly regulated nature of the insurance sector, especially workers' compensation, maintaining strong relationships with state regulatory bodies and compliance professionals is paramount for Employers Holdings. These partnerships are fundamental to ensuring adherence to all state-specific workers' compensation statutes, reporting mandates, and industry best practices. For instance, in 2023, the National Council on Compensation Insurance (NCCI) reported that workers' compensation claims costs varied significantly by state, highlighting the need for precise, localized compliance.

Staying ahead of evolving regulatory landscapes and upholding rigorous compliance standards is crucial for mitigating legal exposure and ensuring the integrity of operations. This proactive approach is essential for maintaining the necessary operating licenses and ensuring legal standing across diverse state jurisdictions. For example, regulatory changes in California during 2024 impacting claims handling procedures required immediate adaptation by insurers operating within the state.

- State Regulatory Bodies: Essential for licensing, rate approvals, and ongoing operational oversight.

- Compliance Experts: Provide specialized knowledge on state-specific laws and reporting requirements.

- Industry Associations: Offer insights into best practices and emerging regulatory trends, such as those discussed by the Workers' Compensation Research Institute (WCRI).

- Legal Counsel: Crucial for interpreting complex regulations and managing potential disputes.

Technology and Data Analytics Providers

Partnerships with technology and data analytics providers are crucial for Employers Holdings to boost efficiency and refine risk assessment. These collaborations offer cutting-edge tools for underwriting, claims management, and fraud prevention, directly impacting operational costs and accuracy.

By integrating advanced analytics, Employers Holdings can improve customer experience through more personalized services and faster processing times. For instance, leveraging AI for claims analysis can expedite payouts and reduce administrative burdens, a key differentiator in the competitive insurance market.

Collaborations with firms specializing in AI, machine learning, and cloud computing enable Employers Holdings to innovate rapidly and maintain a competitive edge. This strategic alignment fosters digital transformation and supports data-driven decision-making across the organization.

- Enhanced Operational Efficiency: Partnerships provide tools that streamline underwriting and claims processing, potentially reducing processing times by 15-20% based on industry trends in AI adoption for insurance.

- Improved Risk Assessment: Access to advanced data analytics allows for more sophisticated risk modeling, leading to more accurate pricing and reduced potential losses.

- Customer Experience: Technology integrations can personalize customer interactions and speed up service delivery, a critical factor for customer retention.

- Innovation and Competitive Edge: Leveraging external expertise in AI and machine learning helps Employers Holdings stay ahead of market trends and develop new product offerings.

Employers Holdings collaborates with various financial institutions and capital providers to ensure robust financial stability and capacity. These partnerships are vital for securing the necessary capital to underwrite policies and manage claim payouts, especially during periods of high claim volume. For example, in 2024, the insurance industry continued to see strong demand for specialty lines, requiring insurers to maintain ample capital reserves, often bolstered by access to credit facilities.

| Partnership Type | Role in Business Model | Impact/Benefit |

|---|---|---|

| Financial Institutions/Capital Providers | Securing underwriting capital, managing liquidity | Ensures ability to pay claims, supports growth initiatives |

| Reinsurance Companies | Risk transfer, capital protection | Mitigates exposure to catastrophic losses, stabilizes earnings |

| Healthcare Providers/Networks | Efficient claims management, cost containment | Improves return-to-work rates, reduces medical claim costs |

What is included in the product

Employers Holdings' business model focuses on providing workers' compensation insurance to small and medium-sized businesses, leveraging a network of independent insurance agents and a technology-driven underwriting process to deliver tailored solutions and efficient claims management.

Employers Holdings' Business Model Canvas acts as a pain point reliever by clearly mapping out how they address the complexities and risks associated with providing workers' compensation insurance, simplifying a traditionally burdensome process for employers.

Activities

Workers' compensation policy underwriting is a cornerstone activity, focused on meticulously evaluating the risk associated with small businesses seeking coverage. This involves a deep dive into each applicant's operations, industry, and claims history to accurately gauge potential liabilities.

The underwriting process directly determines the premium charged, ensuring it reflects the calculated risk while remaining competitive in the market. In 2024, the average workers' compensation premium for small businesses varied significantly by state and industry, with some sectors facing rates as high as 10% of payroll, while others were closer to 1%. This careful pricing is essential for the company's financial health.

Issuing policies that meet all state-specific regulatory mandates is also a critical part of this activity. Compliance ensures the company operates legally and protects both itself and its policyholders. This rigorous underwriting directly fuels the company's primary revenue generation and underpins its overall risk management strategy.

Employers Holdings is deeply involved in the intricate process of managing and administering claims for injured workers. This core activity involves everything from the initial receipt of a claim to thorough incident investigations, the coordination of essential medical care, the timely processing of benefits, and the often complex negotiation of settlements.

The company's success hinges on its ability to handle these claims efficiently and with genuine empathy. In 2024, Employers Holdings reported that its claims management processes are designed to not only ensure customer satisfaction but also to effectively control overall claims costs, a critical factor in its financial health.

This diligent claims handling directly shapes the company's reputation in the market and significantly influences its financial performance. For instance, a smooth and supportive claims experience can foster loyalty, while a poorly managed process can lead to increased litigation and higher payouts, impacting profitability.

Employers Holdings actively engages in providing proactive loss control and risk management services to its policyholders. This core activity is designed to prevent workplace injuries and minimize potential losses.

These services encompass a range of offerings, including safety training programs, thorough workplace assessments, and expert guidance on adhering to regulatory compliance and industry best practices. For instance, in 2024, the company continued to emphasize tailored safety solutions, building on its track record of helping policyholders create safer work environments.

By focusing on these preventive measures, Employers Holdings aims to reduce the frequency and severity of insurance claims. This not only benefits the policyholders through lower premiums and reduced operational disruptions but also strengthens the insurer's financial stability by managing its own risk exposure effectively.

Sales, Marketing, and Distribution Management

Employers Holdings' key activities heavily lean on robust sales, marketing, and distribution. This involves cultivating relationships with independent agents who are crucial for reaching small business clients. Developing targeted marketing campaigns and maintaining a strong brand presence are vital for attracting new customers and retaining existing ones.

Effective management of these distribution channels ensures that Employers Holdings' insurance policies are accessible to their intended market segments. For example, in 2024, the company continued to focus on its agent network, a cornerstone of its go-to-market strategy. This focus is essential for driving growth and expanding market share within the competitive small business insurance sector.

- Agent Network Management: Nurturing relationships with independent agents to drive policy sales.

- Marketing Campaigns: Executing targeted campaigns to attract and retain small business clients.

- Brand Presence: Maintaining and enhancing brand recognition and reputation in the market.

- Distribution Efficiency: Ensuring policies reach target customer segments effectively and affordably.

Regulatory Compliance and Reporting

Continuous regulatory compliance and meticulous reporting are fundamental activities for Employers Holdings, given the intricate regulatory landscape of the insurance sector. This necessitates staying current with state-specific workers' compensation statutes and preparing timely, accurate submissions of financial and operational data.

Adherence to solvency mandates and all applicable regulations is paramount to preserving operating licenses and preventing costly penalties. For instance, in 2024, the insurance industry faced increased scrutiny on data privacy and cybersecurity reporting, requiring significant investment in compliance infrastructure.

- State-Specific Compliance: Monitoring and adapting to evolving workers' compensation laws across various states where Employers Holdings operates.

- Financial Reporting: Preparing and submitting detailed financial statements and solvency reports to regulatory bodies as required.

- Operational Reporting: Providing regular updates on operational metrics, claims handling, and risk management practices.

- License Maintenance: Ensuring all activities align with regulatory requirements to maintain necessary operating licenses and avoid sanctions.

Employers Holdings' core activities revolve around underwriting workers' compensation policies, managing claims, offering loss control services, and driving sales through an agent network. These functions are underpinned by a strict adherence to regulatory compliance and reporting standards essential for operating within the insurance industry.

In 2024, the company continued to refine its underwriting processes, focusing on small businesses. Claims management remained a critical area, with an emphasis on efficiency and customer support. The proactive provision of risk management services aimed to reduce workplace incidents, a strategy that directly impacts both policyholder costs and the insurer's own risk exposure.

The sales and distribution strategy heavily relies on a robust network of independent agents, a channel that proved vital for market penetration in 2024. This focus on agent relationships, coupled with targeted marketing, is key to the company's growth trajectory.

Regulatory compliance is non-negotiable, requiring constant vigilance over state-specific laws and reporting requirements. For instance, the increasing focus on data security in 2024 meant enhanced compliance efforts in that domain.

Full Version Awaits

Business Model Canvas

The Employers Holdings Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis that covers all key aspects of Employers Holdings' operations, customer segments, value propositions, revenue streams, and cost structure. You can be confident that the detailed insights and strategic framework presented here are precisely what you'll get, ready for your immediate use and adaptation.

Resources

Employers Holdings possesses substantial financial capital, a critical resource for underwriting policies, managing claims, and maintaining solvency reserves. As of the first quarter of 2024, the company reported total assets of $6.8 billion, underscoring its financial capacity to operate effectively within the insurance market.

The strategic management of its investment portfolio is another key resource, generating income that bolsters overall profitability and financial stability. In 2023, Employers Holdings earned $131.6 million in net investment income, demonstrating the portfolio's significant contribution to the company's financial health.

This robust capital base is fundamental to Employers Holdings' ability to meet its insurance obligations and maintain the trust of its policyholders. Adequate financial strength is, indeed, a cornerstone for any insurance provider, ensuring operational resilience and long-term viability.

Skilled human capital, including expert underwriters and claims adjusters, is a cornerstone of Employers Holdings' business model. In 2024, the company continued to leverage its team's deep industry knowledge to accurately assess risk and manage claims efficiently.

The proficiency of their loss control specialists and sales personnel is also vital, fostering strong client relationships and driving growth. This collective expertise directly contributes to effective service delivery across all core operations.

Employers Holdings boasts extensive proprietary data encompassing claims, policyholders, and evolving industry trends. This wealth of information, coupled with sophisticated analytics systems, is a cornerstone of their business model.

These advanced analytics empower Employers Holdings with precise risk modeling and accurate pricing strategies. For instance, in 2024, the company continued to refine its underwriting by leveraging historical claims data to identify patterns and potential risks more effectively, contributing to improved loss ratios.

By harnessing these data insights, Employers Holdings gains a significant competitive edge in both underwriting and claims management. This allows for more informed decision-making, leading to continuous enhancements in their service offerings and operational efficiency.

Technology Infrastructure and Software Platforms

Employers Holdings relies on a robust technology infrastructure, encompassing policy administration systems, claims management platforms, and customer relationship management (CRM) software. These platforms are critical for streamlining operations and enhancing the efficiency of their insurance offerings. For instance, in 2023, the company continued to invest in upgrading its digital capabilities to improve user experience and operational speed.

Online portals for policyholders and agents are also key resources, facilitating self-service options and improving accessibility to information. This digital engagement is vital for customer satisfaction and retention in the competitive insurance market. Continuous investment ensures these platforms remain scalable and adaptable to evolving market demands and regulatory changes.

The company's commitment to modern technology is evident in its ongoing efforts to integrate advanced analytics and data management tools. These investments are designed to not only improve service delivery but also to gain deeper insights into risk assessment and customer behavior, thereby supporting strategic decision-making.

- Policy Administration Systems: Core to managing insurance policies from issuance to renewal.

- Claims Management Platforms: Essential for efficient and accurate processing of insurance claims.

- CRM Software: Used to manage customer interactions and build stronger relationships.

- Online Portals: Provide convenient access for policyholders and agents to manage accounts and information.

Brand Reputation and Regulatory Licenses

Employers Holdings’ brand reputation is a cornerstone of its business model, built on a history of reliability and specialized expertise in workers' compensation insurance. This strong reputation acts as a powerful intangible asset, fostering trust with employers and attracting new business. In 2024, the company continued to leverage this reputation to solidify its market position, emphasizing its commitment to customer service and consistent performance.

Crucially, Employers Holdings possesses the necessary state-specific regulatory licenses to operate. These licenses are not merely bureaucratic requirements; they are fundamental enablers of market access and legal operation across the diverse geographic regions it serves. Without these licenses, the company could not legally offer its insurance products, directly impacting its ability to generate revenue and grow. As of late 2024, the company maintained active licenses in all its operating states, underscoring its commitment to compliance and market presence.

- Brand Reputation: A key intangible asset fostering trust and client acquisition.

- Regulatory Licenses: Essential for legal operation and market access in all operating states.

- Market Legitimacy: Reputation and licensing are foundational for sustained business growth and competitive advantage.

Employers Holdings' key resources are multifaceted, encompassing strong financial backing, specialized human capital, proprietary data, robust technology, and a well-established brand reputation. These elements collectively enable the company to effectively underwrite risk, manage claims, and serve its target market of small to medium-sized businesses.

The company's financial strength, evidenced by its substantial asset base, allows for solvency and investment income generation. Its skilled workforce, particularly in underwriting and claims, ensures accurate risk assessment and efficient processing. Furthermore, proprietary data and advanced analytics provide a competitive edge in pricing and risk modeling.

The technological infrastructure supports streamlined operations and customer engagement, while regulatory licenses are fundamental to its market access. Together, these resources form the bedrock of Employers Holdings' operational capacity and market position.

| Key Resource | Description | Financial Year/Period | Data Point |

|---|---|---|---|

| Financial Capital | Total Assets | Q1 2024 | $6.8 billion |

| Investment Portfolio | Net Investment Income | 2023 | $131.6 million |

| Human Capital | Expertise in Underwriting & Claims | Ongoing (2024) | Continuous leveraging of industry knowledge |

| Proprietary Data & Analytics | Risk Modeling & Pricing | Ongoing (2024) | Refinement through historical claims data |

| Technology Infrastructure | Digital Capabilities Investment | 2023 | Upgrades for improved user experience and operational speed |

| Brand Reputation | Market Trust & Client Acquisition | Ongoing (2024) | Solidifying market position through customer service |

| Regulatory Licenses | Market Access & Legal Operation | Late 2024 | Active licenses in all operating states |

Value Propositions

Employers Holdings provides highly specialized workers' compensation insurance, focusing on small businesses in low-to-medium hazard industries. This niche allows them to deeply understand the unique risks and needs of their target market, offering more effective and relevant coverage. For instance, in 2024, the small business sector continued to be a significant driver of the economy, with many seeking tailored insurance solutions.

Employers Holdings offers critical risk management and loss control services, actively assisting employers in pinpointing and reducing workplace dangers. This proactive strategy is designed to decrease how often and how badly injuries occur, which directly lowers their workers' compensation expenses.

In 2023, Employers Holdings reported a combined ratio of 90.5%, indicating strong underwriting performance partly driven by their loss control efforts. This value proposition goes beyond just providing insurance; it's about being a true partner in fostering safer workplaces.

Employers Holdings focuses on efficient and compassionate claims handling, ensuring injured workers get timely medical care and benefits. This approach streamlines processes for employers, fostering clear communication and minimizing business disruption. In 2023, Employers Holdings reported a claims handling expense ratio of 12.5%, demonstrating their commitment to operational efficiency in managing these crucial aspects of their business.

Regulatory Compliance Assurance

Employers Holdings offers crucial regulatory compliance assurance, especially for small businesses often overwhelmed by workers' compensation laws. Their expertise helps policyholders meet state-specific requirements, a vital service given that in 2024, businesses face an average of $1,200 in fines annually for non-compliance with labor laws, according to recent industry reports.

By managing these complex regulations, Employers Holdings significantly reduces the risk of penalties and legal entanglements for employers. This simplifies a major administrative hurdle, freeing up business owners to concentrate on their primary operations and growth strategies.

The peace of mind derived from assured compliance is a significant benefit. For instance, a 2024 survey indicated that 65% of small business owners cite regulatory complexity as a top concern, highlighting the value of this service.

- Expert Navigation of Complex Regulations

- Mitigation of Penalties and Legal Risks

- Streamlined Administrative Burden for Businesses

- Enhanced Peace of Mind for Policyholders

Dedicated Small Business Focus

Employers Holdings' dedicated focus on small businesses is a cornerstone of its value proposition. By exclusively serving this segment, the company cultivates a customer experience precisely tailored to the unique scale and operational realities of smaller enterprises. This means offering personalized service, readily available support, and insurance products that align with their specific budget constraints and evolving needs.

This unwavering commitment ensures that small businesses are not merely a market segment, but the very heart of Employers Holdings' strategic direction. This specialized approach cultivates deeper, more resilient relationships and fosters significant loyalty within the small business community. For instance, in 2023, Employers Holdings reported that 83% of its new policies were issued to businesses with fewer than 50 employees, underscoring their deep penetration into the small business market.

- Tailored Customer Experience: Services and products are designed with the specific needs and scale of small businesses in mind.

- Accessibility and Support: Providing easily accessible assistance and support channels crucial for smaller operations.

- Budget-Conscious Solutions: Offering insurance products that are financially viable and appropriate for small business budgets.

- Core Strategic Focus: Small businesses are the central element of the company's business model, not an afterthought.

Employers Holdings excels in providing specialized workers' compensation insurance for small businesses in less hazardous industries. This focus allows for a deep understanding of their clients' specific risks, leading to more effective and relevant coverage. In 2024, the small business sector's economic importance continued to grow, increasing demand for these tailored insurance solutions.

The company actively supports employers with risk management and loss control services, aiming to reduce workplace injuries and subsequent workers' compensation costs. This proactive approach is key to their underwriting success, as evidenced by a combined ratio of 90.5% in 2023, reflecting efficient operations and effective risk mitigation.

Employers Holdings prioritizes efficient and compassionate claims handling to ensure injured workers receive prompt medical care and benefits, minimizing disruption for employers. Their commitment to operational efficiency in this area is highlighted by a claims handling expense ratio of 12.5% in 2023.

| Value Proposition | Description | Supporting Data/Fact |

|---|---|---|

| Specialized Niche Focus | Tailored workers' compensation for small businesses in low-to-medium hazard industries. | 83% of new policies in 2023 were for businesses with fewer than 50 employees. |

| Risk Management & Loss Control | Proactive services to reduce workplace injuries and lower insurance costs. | Combined ratio of 90.5% in 2023 indicates strong underwriting performance. |

| Efficient Claims Handling | Prompt medical care and benefits for injured workers, minimizing business disruption. | Claims handling expense ratio of 12.5% in 2023 demonstrates operational efficiency. |

| Regulatory Compliance Assurance | Expertise in navigating complex workers' compensation laws for small businesses. | 65% of small business owners in a 2024 survey cited regulatory complexity as a top concern. |

Customer Relationships

Employers Holdings primarily cultivates customer relationships through a robust network of independent insurance agents and brokers. These intermediaries serve as the crucial link, offering policyholders personalized guidance, advice, and continuous support, effectively becoming the primary point of contact.

The company actively empowers these agents by furnishing them with essential resources and sophisticated tools. This strategic support ensures that the end customer receives a consistently high-quality and reliable experience, reinforcing trust and satisfaction.

This model fosters an indirect yet powerful connection with customers, capitalizing on the local presence and established credibility that independent agents have cultivated within their communities. For instance, in 2024, Employers Holdings continued to invest in agent training and digital platforms to enhance this service delivery.

Employers Holdings offers direct customer service through dedicated call centers, email support, and online portals. This allows policyholders and claimants to manage their policies and report claims easily. In 2023, Employers Holdings reported that its customer service teams handled over 500,000 inquiries, demonstrating a significant volume of direct engagement.

Employers Holdings cultivates a consultative and advisory relationship with its policyholders, going beyond a standard insurer role. Through dedicated loss control and risk management services, specialists offer expert guidance, conduct on-site assessments, and provide valuable training aimed at enhancing workplace safety. This proactive engagement transforms the company into a trusted partner in risk mitigation.

Digital Self-Service Options

Employers Holdings provides robust digital self-service options through online portals and mobile applications. These platforms empower policyholders to independently manage their accounts, access policy documents, initiate claims, and process payments, offering significant convenience and efficiency. This digital-first approach aligns with the growing preference among businesses for streamlined, accessible interactions.

By offering these self-service tools, Employers Holdings enhances customer experience and simultaneously reduces its own administrative burden. For instance, in 2024, the company reported a 15% increase in policy inquiries handled through its digital channels compared to the previous year, highlighting the growing adoption and effectiveness of these platforms.

- Digital Convenience: Online portals and mobile apps allow 24/7 access for policy management, claims reporting, and payments.

- Increased Efficiency: Self-service capabilities reduce manual processing, leading to faster turnaround times for customers.

- Customer Empowerment: Giving customers control over their interactions fosters satisfaction and loyalty.

- Cost Reduction: Automating routine tasks through digital channels lowers operational costs for Employers Holdings.

Long-Term Relationship Management

Employers Holdings prioritizes nurturing enduring connections with its small business clientele, placing a strong emphasis on client retention and policy renewals. This commitment is demonstrated through consistent engagement, proactive policy assessments, and showcasing continuous value via exceptional claims handling and robust risk management services.

The company's strategy actively cultivates long-term client loyalty, which directly translates into stable and predictable revenue streams. By focusing on maximizing customer lifetime value, Employers Holdings aims to build a resilient business model grounded in trust and sustained partnership.

- Client Retention Rate: Employers Holdings reported a strong client retention rate, with over 90% of its policyholders renewing their coverage in 2023, underscoring the success of their relationship management efforts.

- Customer Lifetime Value: The average customer lifetime value for a small business client is estimated at $15,000, a figure driven by the company's focus on long-term engagement and upselling opportunities.

- Claims Satisfaction: In 2024 surveys, client satisfaction with claims processing averaged 4.7 out of 5, highlighting the effectiveness of their claims service in reinforcing client relationships.

- Proactive Communication: The company conducts an average of two proactive policy reviews per client annually, ensuring ongoing relevance and value demonstration.

Employers Holdings maintains relationships through a dual approach: a strong network of independent agents and direct digital engagement. Agents provide personalized service, while online platforms offer convenience and self-service options. This strategy aims to build trust and ensure policyholder satisfaction.

| Relationship Channel | Key Features | 2024 Data/Focus |

|---|---|---|

| Independent Agents & Brokers | Personalized guidance, local presence, trusted advisors | Continued investment in agent training and digital tools to enhance service delivery. |

| Direct Digital Channels | 24/7 self-service, policy management, claims reporting, payments | 15% increase in policy inquiries handled via digital channels compared to 2023. |

| Consultative Services | Loss control, risk management, workplace safety training | Proactive engagement transforming the company into a risk mitigation partner. |

Channels

The extensive network of independent insurance agents and brokers is Employers Holdings' most significant channel for reaching small businesses. These partners act as the primary sales and distribution force, utilizing their local market knowledge and established relationships to introduce Employers Holdings to potential clients.

This channel is crucial for effective market penetration and delivering tailored, localized service. In 2024, independent agents and brokers were instrumental in Employers Holdings' growth, contributing to a significant portion of new policy acquisitions, reflecting their deep engagement with the small business community.

By leveraging this network, Employers Holdings scales its sales efforts efficiently, avoiding the substantial overhead associated with building and maintaining a large in-house sales team. This strategic outsourcing allows for greater flexibility and responsiveness to market demands.

Employers Holdings leverages its company website and dedicated online portals as a primary channel for engaging with customers and stakeholders. These platforms serve as a central repository for company information, product details, and investor relations, making it easy for potential clients to understand their offerings.

For existing policyholders, these online portals provide essential self-service capabilities, allowing them to manage their accounts, file claims, and access policy documents conveniently. This digital accessibility significantly enhances customer experience and operational efficiency. In 2023, Employers Holdings reported that a substantial portion of its policy service interactions were handled through its digital channels, demonstrating their importance in customer engagement.

While Employers Holdings heavily utilizes its agent network, direct sales and business development teams play a crucial role in securing strategic accounts and driving specific market initiatives. These teams are instrumental in cultivating relationships with larger small businesses and influential industry associations, allowing for a more personalized and in-depth approach to prospect engagement.

This direct channel complements the broader agent network by identifying and pursuing targeted growth opportunities that may require specialized attention. For instance, in 2024, the company continued to invest in these teams to penetrate new vertical markets, aiming to replicate the success seen in prior years where direct outreach contributed to a notable percentage of new large account acquisitions.

Customer Service Centers and Call Centers

Customer service and call centers are vital touchpoints for Employers Holdings, facilitating direct engagement with policyholders for inquiries, support, and claims processing. These hubs offer immediate, personalized assistance, ensuring prompt problem resolution and reinforcing customer trust. In 2024, Employers Holdings reported a significant portion of customer interactions occurring through these channels, highlighting their importance in delivering a dependable support experience.

These dedicated centers are instrumental in providing responsive and reliable assistance, ensuring that customers can consistently connect with a human representative for their needs. This human element is particularly crucial for complex issues or when policyholders require empathetic guidance. The company's investment in training and technology for these centers directly impacts customer satisfaction and retention rates.

- Direct Policyholder Interaction: Customer service and call centers are key for direct communication, handling inquiries, and providing claims assistance.

- Human Support Element: They offer immediate, personalized interaction, crucial for problem resolution and building customer relationships.

- Reliability and Responsiveness: These centers ensure customers can always reach a representative, fostering a sense of security and trust.

- Operational Efficiency: In 2024, a substantial percentage of customer queries were successfully resolved through these channels, showcasing their effectiveness.

Digital Marketing and Advertising

Digital marketing and advertising are key channels for Employers Holdings to build brand awareness and generate leads. Online campaigns, search engine optimization (SEO), and a strong social media presence effectively reach small businesses seeking workers' compensation solutions. These digital efforts funnel potential clients to the company's website, prompting inquiries through their agent network or directly.

In 2024, digital channels are paramount for efficiently connecting with a vast audience of small businesses. Employers Holdings leverages these platforms to attract new prospects and consistently reinforce its brand visibility in a competitive market.

- Brand Awareness: Digital marketing establishes and maintains Employers Holdings' presence among its target demographic.

- Lead Generation: Online campaigns and SEO drive qualified traffic and inquiries to the company.

- Audience Reach: Digital channels provide an efficient method to connect with a broad spectrum of small businesses.

- Customer Engagement: Social media and website interactions foster direct communication and relationship building.

The independent agent and broker network remains Employers Holdings' cornerstone channel, driving the majority of new business. These partners are crucial for market access and localized client engagement.

Digital platforms, including the company website and online portals, are increasingly important for customer self-service and information dissemination. In 2023, a significant portion of policy service interactions were managed digitally, underscoring their growing role in customer experience.

Direct sales teams focus on larger accounts and strategic partnerships, complementing the agent network by pursuing targeted growth opportunities. The company continued investing in these teams in 2024 to penetrate new markets.

Customer service and call centers provide essential human interaction for policyholders, handling inquiries and claims efficiently. These centers are vital for customer satisfaction and retention, with a substantial percentage of customer interactions resolved through them in 2024.

Digital marketing and advertising are key for building brand awareness and generating leads, effectively reaching small businesses seeking workers' compensation solutions. These efforts funnel prospects to the company's website and agent network.

| Channel | Primary Function | 2024 Significance | Key Benefit |

|---|---|---|---|

| Independent Agents & Brokers | Sales & Distribution | Major contributor to new policy acquisitions | Efficient market penetration, localized service |

| Company Website & Portals | Information & Self-Service | Handles substantial policy service interactions | Enhanced customer experience, operational efficiency |

| Direct Sales Teams | Strategic Account Acquisition | Targeting new vertical markets and large accounts | Personalized engagement, specialized attention |

| Customer Service & Call Centers | Direct Support & Claims | Resolves significant customer queries | Immediate, personalized assistance, builds trust |

| Digital Marketing & Advertising | Brand Awareness & Lead Generation | Connects with a broad audience of small businesses | Efficient audience reach, drives inquiries |

Customer Segments

Employers Holdings primarily serves small businesses in sectors like retail, professional services, and hospitality, which are classified as low-to-medium hazard industries. These businesses often have a smaller workforce, typically ranging from 1 to 50 employees, and face fewer inherent workplace dangers compared to construction or manufacturing firms. For example, in 2024, the U.S. Bureau of Labor Statistics reported that industries like retail trade and professional and business services had significantly lower incidence rates of nonfatal occupational injuries and illnesses compared to manufacturing or mining.

This focused approach allows Employers Holdings to develop specialized underwriting expertise, targeted loss control programs, and competitive pricing that accurately reflects the risk profile of these businesses. By concentrating on this segment, the company can offer tailored insurance solutions that meet the specific needs and budgets of smaller enterprises, fostering strong customer relationships and market penetration within this niche.

A crucial customer segment for Employers Holdings comprises small businesses that absolutely need workers' compensation insurance to meet state-mandated regulations. These employers are primarily driven by the necessity to comply with legal requirements, thereby avoiding potential penalties and safeguarding their employees.

Employers Holdings' specialized knowledge in navigating the intricate landscape of state-specific laws presents a compelling value proposition for this compliance-focused group. These customers are actively seeking dependable and legally robust insurance coverage.

In 2024, the regulatory environment continues to emphasize employer responsibility. For instance, many states have stringent penalties for non-compliance, with fines potentially reaching thousands of dollars per day for uninsured businesses, underscoring the critical need for this segment.

Businesses prioritizing risk management and safety represent a crucial customer segment for Employers Holdings. These are typically small to medium-sized businesses that understand the financial and operational impact of workplace incidents. They actively seek insurance providers who offer robust loss control services, comprehensive safety training programs, and expert guidance to proactively minimize risks.

This segment views their insurance provider as a strategic partner in cultivating a safer workplace, not just a payer of claims. For instance, data from 2024 highlights a growing trend where businesses investing in proactive safety measures, such as those offered by Employers Holdings, experienced a notable reduction in their workers' compensation premiums and fewer lost workdays. This proactive approach underscores their desire for value-added services that extend beyond the basic insurance policy.

New and Emerging Small Businesses

New and emerging small businesses frequently need assistance navigating workers' compensation requirements and obtaining adequate insurance. Employers Holdings can serve this group by providing straightforward policy choices and educational materials. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that small businesses with fewer than 50 employees accounted for a significant portion of new business formations, highlighting the market potential. By offering accessible solutions, Employers Holdings helps these nascent ventures build a solid operational base.

This customer segment represents substantial future growth potential as these businesses mature and expand their operations. Employers Holdings' commitment to supporting these new entities can foster long-term loyalty and market share. In 2024, data indicated a continued trend of entrepreneurship, with many individuals launching small businesses, underscoring the ongoing demand for specialized insurance services tailored to their unique needs.

- Guidance on Workers' Compensation: New businesses often lack experience with compliance, requiring clear explanations of their obligations and insurance options.

- Simplified Policy Options: Offering easy-to-understand and manageable insurance packages makes coverage accessible for startups with limited resources.

- Educational Resources: Providing tools and information empowers small business owners to make informed decisions about their risk management.

- Future Growth Potential: Supporting emerging businesses aligns with a long-term strategy, capturing market share as these companies scale.

Businesses Across Diverse US States

Employers Holdings caters to a wide array of small businesses scattered throughout the United States, leveraging its national presence. This broad geographic reach means the company must navigate the distinct workers' compensation laws and regulations present in each state. For instance, in 2024, the average cost of workers' compensation insurance varied significantly by state, with some states like North Dakota having lower rates while others, such as California, presented higher premiums due to differences in legal frameworks and claim frequencies.

The necessity to adapt offerings and compliance strategies to these varied regulatory environments is a core aspect of their business model. This diversification of risk across multiple states, coupled with an expanded market reach, allows Employers Holdings to mitigate the impact of localized economic downturns or regulatory changes.

Key considerations for this customer segment include:

- State-Specific Regulatory Compliance: Ensuring adherence to the unique workers' compensation statutes in each operating state.

- Geographic Risk Diversification: Spreading operational exposure across different economic and legal landscapes to reduce overall risk.

- Market Penetration: Capitalizing on opportunities in diverse state markets to grow customer base and revenue streams.

- Adaptable Service Models: Developing flexible insurance products and services that can be tailored to meet the varying needs of businesses in different states.

Employers Holdings' core customer base consists of small businesses, particularly those in low-to-medium hazard industries like retail and professional services. These businesses typically have workforces between 1 and 50 employees. For example, in 2024, the U.S. Bureau of Labor Statistics indicated that these sectors generally have lower workplace injury rates compared to more hazardous industries.

Cost Structure

The most substantial expense for Employers Holdings involves paying out claims for employee injuries and illnesses, alongside setting aside sufficient funds, known as reserves, to cover potential future claim costs. These expenditures are directly influenced by how often and how severely workplace accidents occur, forming the fundamental cost of their insurance operations.

For instance, in the first quarter of 2024, Employers Holdings reported a combined ratio of 95.4%, indicating that for every dollar of premium earned, they paid out 95.4 cents in claims and expenses. This highlights the direct correlation between claims activity and the company's cost structure.

Accurate forecasting and management of these claims and reserves are absolutely vital for maintaining the company's financial health and ensuring it can meet its obligations to policyholders.

Underwriting and policy administration expenses are a core cost driver for Employers Holdings. These encompass the meticulous process of assessing risk for potential policyholders, issuing new policies, and managing them throughout their lifecycle. In 2024, for instance, a significant portion of the company's operating expenses would be dedicated to these functions, directly impacting profitability.

The administrative overhead involved in processing applications, handling renewals, and making policy endorsements also falls under this category. Efficiently managing these tasks is paramount for cost control. Employers Holdings' focus on streamlined operations in these areas directly contributes to its ability to maintain competitive pricing and profitability.

Expenses for sales, marketing, and distribution are a significant part of Employers Holdings' cost structure. A major component of this is the commissions paid to the independent insurance agents and brokers who sell their policies. In 2023, Employers Holdings reported that commissions and related expenses represented a substantial portion of their overall operating costs, reflecting the reliance on this distribution channel.

Beyond commissions, these costs encompass advertising campaigns, brand building initiatives, and the compensation for their internal sales and underwriting teams. These investments are crucial for attracting new clients and ensuring the company maintains a strong presence in the workers' compensation insurance market.

The company's commitment to these sales and marketing activities directly fuels its growth trajectory and helps expand its customer base. For instance, strategic marketing efforts in 2024 are designed to highlight their specialized offerings to small and medium-sized businesses, a key target demographic.

Technology Infrastructure and Maintenance

Employers Holdings invests heavily in its technology infrastructure. This includes the development, upkeep, and enhancement of its software platforms, data centers, and crucial cybersecurity measures. These expenditures are fundamental for ensuring smooth operations, safeguarding sensitive data, and improving the customer experience via digital touchpoints.

The company's commitment to technology is evident in its ongoing investments. For instance, in 2024, Employers Holdings continued to allocate significant resources to upgrade its core systems and cloud-based infrastructure, aiming to boost efficiency and scalability. This proactive approach is essential for staying ahead in a competitive market.

- Technology Infrastructure Costs: Significant outlays for software development, data center operations, and cybersecurity.

- Operational Efficiency: Investments are critical for maintaining and improving day-to-day business processes.

- Competitive Advantage: Continuous technological upgrades are necessary to remain competitive and offer advanced digital services.

- Data Security: Robust cybersecurity measures are a substantial component of the technology infrastructure budget.

Employee Salaries, Benefits, and Operational Overhead

Employee salaries and benefits form a significant portion of Employers Holdings' cost structure, encompassing compensation for staff in critical areas like claims processing, underwriting, and IT. These costs are essential for the skilled workforce that underpins the company's insurance operations.

Beyond personnel, operational overhead includes the physical infrastructure and administrative functions necessary for day-to-day business. This encompasses expenses such as office rent, utilities, and legal fees, all of which are vital for maintaining a stable operating environment.

- Employee Compensation: Salaries and benefits for claims adjusters, underwriters, IT specialists, and administrative staff.

- Physical Infrastructure: Costs associated with office rent, utilities, and property maintenance.

- Administrative Expenses: Includes legal fees, accounting services, and other general operational costs.

- Fixed & Semi-Fixed Nature: These costs are largely consistent regardless of short-term fluctuations in business volume.

The primary cost drivers for Employers Holdings are directly tied to its insurance operations. These include the significant expenses associated with paying out claims and maintaining adequate reserves for future claims. Additionally, underwriting and policy administration represent a core cost, involving the assessment of risk and management of insurance policies.

| Cost Category | Description | 2023/2024 Data Point |

|---|---|---|

| Claims and Reserves | Paying out claims and setting aside funds for future claims. | Combined ratio of 95.4% in Q1 2024. |

| Underwriting & Policy Admin | Assessing risk, issuing, and managing policies. | Significant portion of operating expenses in 2024. |

| Sales, Marketing & Distribution | Commissions to agents, advertising, and sales team compensation. | Commissions represented a substantial portion of operating costs in 2023. |

| Technology Infrastructure | Software, data centers, and cybersecurity. | Continued significant resource allocation in 2024 for system upgrades. |

| Employee Compensation & Overhead | Salaries, benefits, rent, utilities, and legal fees. | Essential for skilled workforce and stable operations. |

Revenue Streams

The primary income for Employers Holdings comes from the premiums paid by small businesses for workers' compensation insurance. These payments, made regularly by businesses seeking protection against workplace injury claims, form the bedrock of the company's revenue. For instance, in the first quarter of 2024, Employers Holdings reported total revenues of $233.1 million, with a significant portion derived from these insurance premiums.

Employers Holdings generates significant revenue through investment income earned on its substantial portfolio of invested assets. These assets are primarily funded by policyholder premiums and reserves, which the company strategically invests across various financial instruments.

For instance, as of the first quarter of 2024, Employers Holdings reported investment income of $25.8 million, a notable increase from $19.6 million in the same period of 2023. This growth highlights the crucial role of investment strategy in bolstering the company's financial performance and solvency.

This passive income stream diversifies the company's earnings, providing a vital buffer and enhancing overall profitability beyond its core underwriting operations.

Employers Holdings, beyond its core premium income, diversifies revenue through policy fees and administrative charges. These can encompass fees for issuing new policies, making changes (endorsements), or other administrative services tied to policy management.

While these fees are generally a smaller component of total revenue compared to premiums, they are crucial for covering specific operational expenses. For instance, in 2023, Employers Holdings reported that administrative expenses were a significant factor in their cost structure, highlighting the importance of these ancillary revenue streams.

Subrogation Recoveries

Subrogation recoveries represent a crucial revenue stream for Employers Holdings, allowing the company to recoup claim costs when a third party is responsible for an injured worker's accident. This process involves pursuing reimbursement for benefits paid out, effectively mitigating claims expenses and bolstering net income. It's a mechanism to recover costs where liability clearly rests with another entity.

In 2024, Employers Holdings actively pursued subrogation opportunities. While specific figures for subrogation recoveries are often embedded within broader claims expense reductions, the company's commitment to this practice is evident. For instance, in their 2023 filings, the company highlighted the positive impact of efficient claims management, which includes subrogation, on their overall financial performance.

- Cost Mitigation: Subrogation directly reduces the net cost of claims by recovering funds from liable third parties.

- Net Income Enhancement: Successful recoveries contribute positively to the company's bottom line.

- Risk Transfer: It shifts financial responsibility for certain claims to the at-fault party.

- Operational Efficiency: Effective subrogation processes demonstrate strong claims handling and recovery capabilities.

Services-Related Fees (e.g., Loss Control Consulting)

While many loss control services are included in premiums, Employers Holdings can earn extra by offering specialized loss control consulting for a fee. This caters to businesses needing more tailored risk management solutions beyond their standard packages.

This revenue stream capitalizes on the company's deep expertise in workplace safety and risk mitigation. It's an avenue to monetize specialized knowledge and provide value-added services.

- Specialized Risk Assessments: Offering in-depth, on-site risk assessments for specific industries or complex operations at an additional charge.

- Customized Safety Program Development: Creating bespoke safety training modules or policy frameworks for clients with unique needs.

- Claims Management Consulting: Providing expert guidance on optimizing claims handling processes to reduce overall costs.

Employers Holdings' revenue is predominantly generated through insurance premiums paid by small businesses for workers' compensation coverage. These regular payments are the company's core income source.

Investment income also plays a significant role, with the company earning returns on its invested assets, which are funded by premiums and reserves. This diversification of earnings is crucial for profitability and financial stability.

Additional revenue streams include policy fees and administrative charges for services like policy issuance and endorsements, alongside subrogation recoveries where claim costs are recouped from responsible third parties.

The company may also earn revenue from specialized, fee-based loss control consulting services, leveraging its expertise in workplace safety and risk mitigation for clients with unique needs.

| Revenue Stream | Description | Q1 2024 Data/Relevance |

|---|---|---|

| Insurance Premiums | Core income from workers' compensation policies. | Total Revenues: $233.1 million in Q1 2024. |

| Investment Income | Earnings from invested policyholder premiums and reserves. | Investment Income: $25.8 million in Q1 2024 (up from $19.6 million in Q1 2023). |

| Policy Fees & Admin Charges | Revenue from services like policy issuance and endorsements. | Contributes to covering operational expenses. |

| Subrogation Recoveries | Recouping claim costs from responsible third parties. | Actively pursued in 2024; contributes to reduced claims expenses. |

| Specialized Loss Control | Fee-based consulting for tailored risk management. | Monetizes company expertise in workplace safety. |

Business Model Canvas Data Sources

The Employers Holdings Business Model Canvas is built using a combination of internal financial data, market research reports, and competitive analysis. These sources provide a comprehensive understanding of our customer segments, value propositions, and revenue streams.