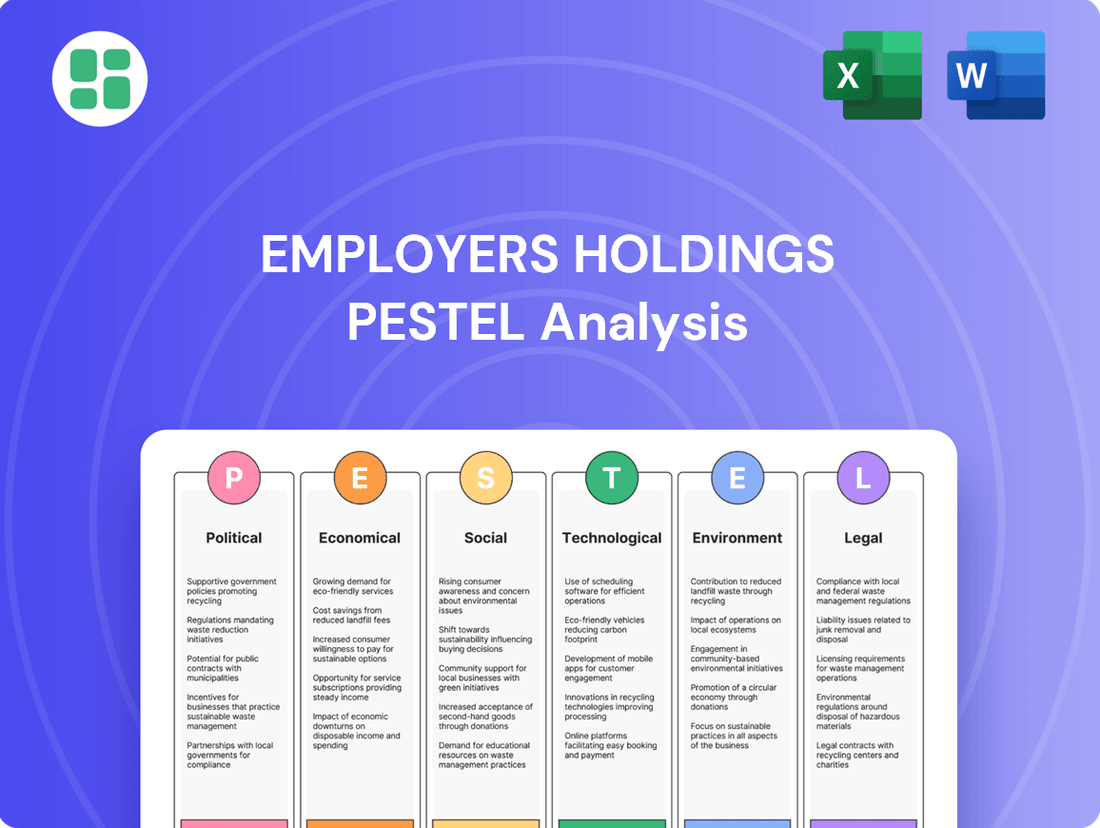

Employers Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Employers Holdings Bundle

Gain a competitive edge with our in-depth PESTLE Analysis for Employers Holdings. Understand how evolving political landscapes, economic fluctuations, and technological advancements are shaping its operational environment. This comprehensive report offers actionable intelligence to refine your own market strategy and anticipate future challenges and opportunities. Download the full version now for a strategic advantage.

Political factors

Governmental influence significantly shapes workers' compensation insurance rates, with state-level regulations and political decisions playing a crucial role. States frequently review and approve rate filings, and political pressure can be exerted to maintain lower premiums for businesses.

For example, anticipation is building for proposed decreases in workers' compensation insurance rates in several states for 2025. This trend is attributed to advancements in workplace safety and the integration of technology, which ultimately lead to cost savings that can be passed on to employers.

Legislative reforms at the state level directly impact Employers Holdings' operations, as workers' compensation laws vary significantly by state. These changes can involve expanding employee rights, adjusting benefits, or modifying employer responsibilities, such as stricter mandates for workplace safety.

New laws in California for 2025, for example, include mandatory insurance for certain licensed contractors and increased disability payments, potentially affecting premium structures and claims management for Employers Holdings.

Government initiatives designed to bolster small businesses, Employers Holdings' core clientele, can significantly impact its market. For instance, the U.S. Small Business Administration (SBA) reported approving over $28.8 billion in loans to small businesses in fiscal year 2023, demonstrating ongoing policy support.

These policies, which can include tax credits, grants, and reduced regulatory burdens, directly influence the financial health and operational capacity of SMEs. A more solvent and stable small business sector, fostered by such support, translates into a larger and more reliable pool of potential customers for Employers Holdings' insurance products.

Political Stability and Regulatory Environment

Political stability is a cornerstone for insurers like Employers Holdings, enabling consistent long-term planning and investment. Uncertainty stemming from shifting political landscapes or policy reversals can significantly disrupt underwriting strategies and capital deployment.

The workers' compensation sector, in particular, is highly sensitive to legislative and judicial pronouncements. For instance, changes in state-specific regulations regarding claim handling or benefit levels directly influence Employers Holdings' operational costs and risk assessments.

- 2024 Regulatory Focus: States are actively reviewing and updating workers' compensation laws, with particular attention on medical cost containment and return-to-work programs.

- Impact on Premiums: Regulatory changes can lead to adjustments in premium rates, affecting the competitive positioning of companies like Employers Holdings.

- Litigation Trends: Court decisions on employment law and insurance disputes can set precedents that alter the legal and financial landscape for employers and their insurers.

Federal Policy Impact on State Laws

While workers' compensation is largely a state matter, federal policy can significantly shape how states approach these regulations. For instance, federal economic stimulus packages or changes in national labor laws can encourage states to review and potentially adapt their workers' compensation benefits or eligibility criteria to align with broader national economic goals. Employers Holdings must stay abreast of these federal influences, as they can lead to a ripple effect on state-specific compliance requirements and the overall landscape of employee benefits.

The federal government's role in labor and health policy can indirectly impact state-level workers' compensation frameworks. For example, federal mandates concerning workplace safety or healthcare access might prompt states to reconsider their existing workers' compensation provisions to ensure consistency or to address emerging health concerns. This necessitates a dual focus for Employers Holdings, monitoring both federal legislative trends and the subsequent state-level responses to maintain strategic alignment and operational readiness.

- Federal Labor Law Influence: Federal actions, such as potential updates to the Fair Labor Standards Act (FLSA) or Occupational Safety and Health Administration (OSHA) standards, could prompt states to review their workers' compensation benefit levels or dispute resolution processes.

- Economic Stimulus Impact: Federal economic stimulus measures, particularly those focused on job creation or wage subsidies, might lead states to adjust their workers' compensation premium structures or experience rating systems to encourage employer participation.

- Healthcare Policy Alignment: Federal shifts in healthcare policy, like changes to the Affordable Care Act (ACA) or Medicare, could influence how states manage medical cost containment within their workers' compensation systems.

Governmental actions directly influence Employers Holdings by shaping workers' compensation rates and regulations, with state-level decisions being particularly impactful. Anticipated rate decreases in several states for 2025, driven by improved safety and technology, highlight this dynamic. New California laws in 2025, mandating insurance for certain contractors and increasing disability payments, exemplify how legislative reforms directly affect premium structures and operational costs.

Federal policies, such as economic stimulus or labor law changes, can prompt states to review their workers' compensation systems, creating a ripple effect on compliance for companies like Employers Holdings. For instance, federal shifts in healthcare policy might influence state approaches to medical cost containment within workers' compensation. This necessitates a dual focus on both federal and state legislative trends to maintain strategic alignment.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Employers Holdings, providing a comprehensive overview of the external forces shaping its operating landscape.

It offers actionable insights for strategic decision-making by highlighting key trends and potential challenges within each of these critical macro-environmental dimensions.

A clear, concise PESTLE analysis of Employers Holdings, presented in an easily digestible format, alleviates the pain of sifting through complex data, enabling faster strategic decision-making.

Economic factors

The overall economic health is a critical driver for Employers Holdings. A strong economy, characterized by robust job growth, directly translates to more small businesses expanding or starting up, thereby increasing the demand for workers' compensation insurance. For instance, the U.S. Bureau of Labor Statistics reported that in May 2024, total nonfarm payroll employment rose by 272,000, indicating a healthy labor market that benefits insurance providers like Employers Holdings.

Conversely, economic downturns pose a significant risk. Recessions can lead to small business closures and reduced payrolls, shrinking the pool of potential clients and decreasing premium volumes. The susceptibility of the workers' compensation market to these economic shocks means that a slowdown could impact Employers Holdings' profitability, even if the market has shown recent strength.

Rising wages directly impact workers' compensation claim costs, particularly indemnity payments, which are typically a percentage of an injured worker's earnings. The U.S. Bureau of Economic Analysis indicated a significant 5.60% wage increase in October 2024 over the previous year, a trend anticipated to persist into 2025.

This sustained wage inflation can lead to higher overall claim severity for companies like Employers Holdings. Consequently, insurers may need to adjust their premium pricing strategies and underwriting practices to account for these escalating benefit payouts.

Medical costs are a substantial driver of workers' compensation claims, with medical inflation a persistent worry for insurance leaders. While overall medical inflation has been relatively stable, specific elements within workers' compensation can lead to fluctuations. Notably, medical severity saw a reported increase of 6% in 2024, directly affecting insurer profitability.

Interest Rate Movements and Investment Income

As an insurer, Employers Holdings relies heavily on investment income derived from its reserves. Interest rate movements are therefore a critical economic factor influencing its profitability. For instance, in the first quarter of 2024, the Federal Reserve maintained its benchmark interest rate, which generally supports stable investment income for insurers.

Higher interest rates can significantly boost investment income, providing a buffer against potential underwriting losses and enhancing overall financial performance. Conversely, lower rates can compress these returns.

- Impact on Investment Income: Rising interest rates generally increase the yield on fixed-income securities held by Employers Holdings, boosting investment income.

- Profitability Offset: Investment income often serves to offset underwriting results, meaning higher rates can improve net profitability even if underwriting margins are tight.

- 2024 Trends: Through the first half of 2024, while rates remained elevated compared to prior years, subtle shifts in yield curves could impact the specific types of investments favored by the company.

Premium Pricing and Market Competition

The workers' compensation landscape has seen increased profitability, fostering a highly competitive market. This has led to stable or even decreased premium rates in certain segments, a trend that might not persist. Some industry analysts predict a future rise in costs, potentially prompting insurers to implement higher premiums.

Employers Holdings navigates this environment by balancing competitive pricing strategies with the necessity of maintaining underwriting profitability. While claim frequency has been on a downward trend, the severity of claims is increasing, presenting a complex challenge. For instance, in 2024, the National Council on Compensation Insurance (NCCI) reported a continued trend of declining claim frequency, but a notable increase in the average cost per claim, particularly for more severe injuries.

- Competitive Pressure: Profitable market conditions in 2024 have intensified competition, potentially suppressing premium growth.

- Anticipated Rate Hikes: Industry experts foresee a potential increase in claim severity, which could drive insurers to raise rates in the near future.

- Balancing Act: Employers Holdings must manage aggressive pricing to remain competitive while ensuring underwriting profitability amidst rising claim costs.

- Claim Trends: Declining claim frequency is offset by increasing claim severity, a key factor impacting future pricing strategies.

Economic growth directly fuels demand for Employers Holdings' services, as more businesses mean more potential clients for workers' compensation insurance. For example, the U.S. economy saw a 1.3% annualized growth rate in the first quarter of 2024, signaling a generally favorable environment for business expansion. However, rising wage inflation, with average hourly earnings increasing by 4.1% year-over-year as of May 2024, directly increases claim costs, particularly for indemnity payouts, impacting insurer profitability.

| Economic Factor | Data Point (2024/2025 Trends) | Impact on Employers Holdings |

|---|---|---|

| GDP Growth (Q1 2024) | 1.3% (annualized) | Positive impact on demand for insurance due to business expansion. |

| Wage Inflation (May 2024) | 4.1% (year-over-year) | Increases claim severity and costs, particularly indemnity payments. |

| Interest Rates (Federal Reserve Policy) | Rates held steady through early 2024, with potential for cuts later. | Affects investment income; stable or rising rates generally benefit investment returns. |

What You See Is What You Get

Employers Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Employers Holdings dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

You'll gain valuable insights into how these external forces shape Employers Holdings' market position and future growth opportunities. The detailed examination provides a robust understanding of the business landscape for informed decision-making.

Sociological factors

The U.S. workforce is aging, with the median age of workers projected to reach 43.9 by 2030, according to the Bureau of Labor Statistics. This demographic shift can impact claim frequency and severity, as older workers may experience different types of injuries. Employers Holdings must consider how this evolving workforce impacts their risk profiles and insurance offerings.

A strong safety culture is paramount, and organizations are increasingly prioritizing it. For instance, in 2024, companies are investing more in proactive safety training and technology, like AI-powered risk assessment tools, to reduce workplace incidents. This focus on prevention can lead to a decrease in the overall number of claims filed, directly benefiting insurers like Employers Holdings.

Beyond physical safety, mental health is gaining significant attention. Many employers are expanding mental health benefits and resources in 2024, recognizing its link to overall employee well-being and productivity. This holistic approach to safety can further contribute to a decline in claims related to stress and burnout.

The widespread adoption of hybrid and remote work models, accelerated by events in recent years, significantly reshapes workplace risk profiles for Employers Holdings. While traditional physical injuries might decrease, there's a notable rise in concerns like mental health claims and ergonomic issues stemming from home office setups. For instance, a 2024 survey indicated that 60% of employees working remotely reported experiencing some form of musculoskeletal discomfort, highlighting a new area for risk management.

The rise of the gig economy, with an estimated 59 million Americans participating in freelance work in 2023, poses a significant challenge for employers offering workers' compensation. Many gig workers operate as independent contractors, often falling outside traditional employee classifications and thus missing out on essential coverage.

Legislative shifts, exemplified by California's AB5 law, are beginning to address this gap by reclassifying certain independent contractors as employees, potentially expanding the market for insurers. However, these changes also introduce new compliance burdens and complexities for businesses and their insurance providers.

Public Perception and Trust in Insurance

Public perception of the insurance industry significantly shapes customer loyalty and brand reputation, particularly concerning how insurers support injured workers and manage claims. A recent survey indicated that 65% of consumers consider ethical treatment and transparency in claims processing as the most critical factors when choosing an insurer. This highlights the importance of maintaining trust for a competitive edge.

Insurers are increasingly integrating social responsibility into their Environmental, Social, and Governance (ESG) strategies. For instance, Employers Holdings' commitment to fair claims handling and community support is a key element in building positive public perception. This focus on social impact is becoming a differentiator, with 70% of investors now considering ESG performance when making investment decisions in the financial sector.

- Public Trust: 65% of consumers prioritize ethical treatment and claim transparency when selecting an insurer.

- Brand Reputation: Positive public perception, driven by fair claims handling, directly impacts customer loyalty.

- ESG Integration: 70% of investors consider ESG performance, making social responsibility a crucial business aspect.

- Competitive Advantage: Demonstrating social responsibility and transparency can differentiate insurers in a crowded market.

Mental Health and Workplace Injuries

There's a growing understanding that mental health is closely linked to workplace injuries. This means insurers like Employers Holdings are seeing more claims that involve psychological impacts alongside physical ones. For instance, a significant percentage of workers' compensation claims now have a mental health component, with some studies suggesting it impacts recovery times and return-to-work success.

This shift is prompting a more comprehensive approach to workers' compensation. Insurers are beginning to incorporate behavioral health support directly into their programs. While this can lead to better outcomes for employees, it also means new types of claims and added layers of complexity for managing those claims. For example, the cost of claims involving mental health issues can be higher, and the assessment process more intricate.

Furthermore, the legal landscape is evolving. Several states are actively expanding their workers' compensation coverage to explicitly include mental health conditions, even those that arise independently of physical injury but are work-related. This trend highlights the increasing societal recognition of mental well-being in the workplace and its direct impact on employee health and safety, which insurers must navigate.

- Increased Mental Health Claims: A growing number of workers' compensation claims now include mental health diagnoses, impacting recovery timelines and overall claim costs.

- Holistic Program Integration: Insurers are integrating behavioral health support into workers' compensation programs to improve recovery outcomes and return-to-work rates.

- State-Level Coverage Expansion: Several states are updating regulations to include mental health issues within workers' compensation benefits, creating new claim categories.

- Complexity in Claims Management: The inclusion of mental health aspects introduces new complexities in claims assessment, management, and potential litigation for insurers.

The aging U.S. workforce, with the median worker age projected to reach 43.9 by 2030, presents evolving risk profiles for insurers like Employers Holdings. Companies are prioritizing safety cultures, investing in training and technology, with 60% of remote workers in 2024 reporting musculoskeletal discomfort, indicating new risk areas.

Mental health is increasingly recognized as critical, with expanded benefits in 2024 aimed at improving well-being and productivity, potentially reducing stress-related claims. The gig economy, involving 59 million Americans in 2023, creates coverage gaps, though legislative changes like California's AB5 are beginning to address this.

Public trust is vital, with 65% of consumers prioritizing ethical treatment and transparency in claims processing. Insurers integrating social responsibility into ESG strategies, where 70% of investors consider ESG performance, can gain a competitive edge.

The growing recognition of mental health's link to workplace injuries is leading to more complex claims. Insurers are integrating behavioral health support, which, while beneficial for employees, introduces new claim types and management challenges, with several states expanding workers' compensation to cover work-related mental health conditions.

Technological factors

Artificial intelligence and data analytics are significantly reshaping Employers Holdings' approach to risk assessment, policy underwriting, and claims processing. These advanced technologies are enabling more precise identification of potential risks and streamlining operational workflows.

AI-powered systems can proactively identify potential claims, leading to earlier intervention and mitigation efforts. This not only improves efficiency in claims processing but also enhances accuracy and can provide timely fraud detection alerts, a critical aspect in the insurance industry.

For instance, by mid-2024, many insurers are reporting substantial improvements in claims processing times, with some AI tools reducing handling time by up to 30%. This enhanced efficiency translates to better outcomes for both Employers Holdings and its policyholders.

The insurance industry's move towards digital policy and claims management is a significant technological shift. This digitalization eliminates paper-based processes, boosting efficiency and enabling seamless, real-time data integration. For Employers Holdings, this is evident in their Cerity® platform, which is designed as a digital-first solution, streamlining the offering of fast and affordable coverage. This digital approach not only enhances customer experience through quicker turnaround times but also drives substantial operational efficiencies.

Wearable devices and the Internet of Things (IoT) are transforming risk prevention for employers. These technologies allow for real-time monitoring of worker well-being and environmental hazards, acting as an early warning system. For instance, sensors can detect fatigue, improper lifting techniques, or exposure to dangerous substances, flagging potential issues before an incident occurs.

The data collected from wearables and IoT devices offers invaluable insights into workplace safety. By analyzing this information, employers can identify recurring risks and implement targeted interventions. This proactive stance is crucial; a 2024 report indicated that companies leveraging IoT for safety saw a 15% decrease in workplace accidents compared to those that did not.

This shift towards data-driven safety management is directly impacting claim frequency. By mitigating risks before they escalate into injuries, companies can significantly reduce their workers' compensation claims. For example, in the construction sector, wearable sensors monitoring worker fatigue have been linked to a notable reduction in falls from heights, a leading cause of severe injuries.

Cybersecurity Risks and Data Protection

As Employers Holdings, like many insurers, increasingly digitizes its operations, the threat of cyberattacks escalates, making robust data protection essential. The company must invest in advanced cybersecurity measures to safeguard sensitive policyholder data and maintain operational integrity. This is a critical concern across the entire commercial insurance sector, impacting trust and business continuity.

The escalating sophistication of cyber threats necessitates significant investment in predictive cyber risk modeling and secure data handling practices. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the financial imperative for insurers to fortify their defenses. Employers Holdings needs to prioritize these investments to mitigate potential breaches and protect its reputation.

- Increased Digitalization: Insurance operations are rapidly moving online, expanding the attack surface for cybercriminals.

- Data Protection Mandates: Stringent regulations like GDPR and CCPA require insurers to implement comprehensive data security protocols.

- Financial Impact of Breaches: The average cost of a data breach for organizations in the financial sector reached $5.72 million in 2023, according to IBM's Cost of a Data Breach Report.

- Reputational Damage: A successful cyberattack can severely erode customer trust and lead to significant loss of business.

Blockchain for Transparency and Security

Blockchain technology is revolutionizing claims management for employers by bolstering security and transparency. Its ability to create tamper-proof digital records significantly reduces the risk of fraud and disputes, as data integrity is inherently maintained and verifiable. This streamlined, trustworthy process benefits all stakeholders, from employers to insurers and claimants.

For Employers Holdings, this translates into a more efficient and reliable claims handling system. By leveraging blockchain, the company can ensure that policy information and claims data remain unaltered and easily auditable. This is particularly crucial for multi-state policy management, where cross-state compliance can be complex. For example, the global blockchain in insurance market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating a strong industry trend towards adopting such technologies.

- Enhanced Data Integrity: Blockchain ensures claims data is immutable, preventing unauthorized alterations and reducing disputes.

- Fraud Reduction: Tamper-proof records make fraudulent claims more difficult to submit and process.

- Streamlined Compliance: Facilitates easier adherence to regulations across different states for multi-state policies.

- Increased Trust: Verifiable and transparent processes build confidence among employers, employees, and insurance providers.

The integration of artificial intelligence and data analytics is transforming how Employers Holdings assesses risk and manages policies. These technologies allow for more precise risk identification and streamline underwriting processes, leading to improved efficiency. By mid-2024, many insurers reported AI tools reducing claims processing time by up to 30%, a trend Employers Holdings is likely leveraging.

The rise of wearable devices and the Internet of Things (IoT) offers new avenues for proactive risk prevention in workplaces. Real-time monitoring of worker well-being and environmental hazards can flag potential issues before they cause injury. Companies using IoT for safety saw a 15% decrease in workplace accidents in 2024, highlighting the impact on claim frequency.

The increasing digitalization of insurance operations, exemplified by platforms like Employers Holdings' Cerity®, boosts efficiency and customer experience but also heightens the need for robust cybersecurity. The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, making data protection a critical investment for insurers to maintain trust and operational integrity.

Blockchain technology is enhancing security and transparency in claims management, creating tamper-proof records that reduce fraud and disputes. The global blockchain in insurance market was valued at approximately $1.5 billion in 2023, indicating a significant industry shift towards these secure, verifiable systems for improved data integrity and compliance.

Legal factors

Workers' compensation laws are primarily governed by individual states, creating a complex regulatory environment for Employers Holdings. Each state possesses unique statutes dictating coverage mandates, benefit structures, claims processing, and dispute resolution mechanisms. For instance, in 2024, Florida enacted changes to its workers' compensation system, impacting benefit levels and eligibility, while California continues to refine its regulations to address rising medical costs and fraud, demonstrating the constant need for insurers to adapt to these diverse legal frameworks.

Employers Holdings, like all insurers, faces significant compliance burdens due to strict data privacy laws, including the California Consumer Privacy Act (CCPA) and emerging state-level regulations. These laws govern how insurers handle sensitive personal and medical information. Failure to comply can result in substantial fines, with CCPA penalties reaching up to $7,500 per intentional violation as of 2024.

Ensuring robust data security practices and adherence to these evolving privacy frameworks is crucial for Employers Holdings. This not only helps avoid legal penalties but also maintains vital consumer trust in an era where data breaches are a constant concern. The company must invest in advanced cybersecurity measures and ongoing training to safeguard policyholder data effectively.

Litigation trends, particularly the increasing severity of claims, pose a significant challenge for insurers like Employers Holdings. This rise in claim costs, sometimes referred to as social inflation, can be driven by factors like larger jury awards and escalating legal expenses. For instance, while claim frequency might be decreasing, the average cost of each claim can still climb, impacting an insurer's bottom line.

Mandatory Coverage and Employer Compliance

New legislation expanding mandatory workers' compensation coverage directly benefits Employers Holdings by increasing the potential market size. For instance, California's directive for all licensed contractors to secure insurance by 2026 broadens the pool of eligible clients. This legal push ensures a wider base of businesses are compelled to seek insurance solutions.

Concurrently, more stringent penalties for employers failing to comply with insurance mandates encourage greater adherence. This heightened enforcement translates to a more robust demand for Employers Holdings' services as businesses prioritize compliance to avoid significant fines. These legal frameworks create a more stable and predictable operating environment.

- Expanded Market: California's 2026 contractor insurance mandate is a prime example of legal expansion.

- Increased Compliance: Stricter penalties for non-compliance incentivize businesses to secure coverage.

- Broader Insured Base: Legal mandates effectively create a larger, more consistent customer base.

Changes in Reimbursement Rates for Medical and Expert Services

Legislative changes to how much medical professionals and expert witnesses are paid in workers' compensation cases directly impact how much claims cost. These adjustments are a key legal factor for companies like Employers Holdings. For instance, Florida's Workers' Compensation law updates for 2025 are set to substantially raise reimbursement rates for these services. This will inevitably increase the overall cost of claims for insurers operating in that state.

The implications of these rate changes are significant for financial planning and risk assessment within the insurance sector. Insurers must account for these increased operational expenses when setting premiums and managing their reserves. Failure to adapt to these evolving legal mandates could lead to underpricing of risk and reduced profitability.

- Florida's 2025 Workers' Compensation Law: Expected to increase medical and expert service reimbursement rates.

- Impact on Claims Costs: Higher reimbursement rates directly translate to increased overall claims expenses for insurers.

- Financial Planning Necessity: Companies like Employers Holdings must adjust financial models to reflect these legal changes.

- Risk Assessment Adjustment: The legal landscape requires continuous monitoring to accurately price insurance policies.

Navigating the patchwork of state-specific workers' compensation laws remains a core legal challenge for Employers Holdings. Each state's unique statutes on coverage, benefits, and claims processing necessitate constant adaptation, as seen with Florida's 2024 benefit adjustments and California's ongoing regulatory refinements. Furthermore, stringent data privacy laws like CCPA, with penalties up to $7,500 per intentional violation in 2024, demand robust compliance and cybersecurity investments to maintain trust.

Legal mandates expanding workers' compensation coverage, such as California's 2026 contractor insurance requirement, directly broaden the market for Employers Holdings. Simultaneously, increased penalties for non-compliance drive greater demand for insurance solutions. Changes in legislation affecting medical and expert witness fees, like Florida's 2025 updates expected to raise reimbursement rates, directly impact claims costs, requiring insurers to adjust financial models and risk assessments accordingly.

Environmental factors

Climate change is increasingly presenting significant environmental challenges that directly affect workplace safety and insurance claims. The heightened frequency and intensity of extreme weather events, like the record-breaking wildfire seasons in 2023 and the numerous hurricane landfalls along the U.S. coastlines, pose direct physical risks to employees and business operations. These events can lead to injuries, property damage, and business interruptions, all of which translate into higher claims for insurers like Employers Holdings.

For Employers Holdings, which underwrites workers' compensation and other business insurance across the United States, these physical risks are a critical consideration in its underwriting and risk assessment processes. Regions prone to hurricanes, floods, or wildfires require more robust risk modeling and potentially higher premiums to account for the escalating likelihood of catastrophic events. This growing concern is not unique to Employers Holdings; the entire global insurance industry is grappling with how to price and manage the escalating costs associated with climate-related disasters.

Environmental, Social, and Governance (ESG) factors are increasingly vital for insurers like Employers Holdings, driven by rising demands from consumers, regulators, and investors. This growing emphasis translates to pressure for the company to embed ESG principles across its operations, from sustainable underwriting practices to investment portfolio management.

The landscape of ESG reporting is rapidly evolving, with significant developments anticipated. For instance, the Securities and Exchange Commission's (SEC) climate disclosure rules, finalized in early 2024, will begin impacting publicly traded companies, with initial reports for some expected in 2025, setting a precedent for broader ESG accountability.

The sustainability practices of Employers Holdings' small business clients can indirectly shape their risk profiles and appeal as policyholders. Businesses demonstrating robust environmental management and safety protocols often present lower inherent risks, which can influence underwriting decisions and the resulting premium structures.

For instance, a small construction firm that prioritizes waste reduction and implements advanced safety training might be viewed more favorably than one with laxer standards. This trend is particularly relevant as the insurance industry increasingly looks for ways to support clients in their journey toward more sustainable operations, potentially offering incentives or specialized coverage.

Environmental Regulations Affecting Client Businesses

New and more stringent environmental regulations can significantly increase operational costs and alter risk profiles for businesses that Employers Holdings insures. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to focus on reducing greenhouse gas emissions and improving air and water quality, potentially impacting industries like manufacturing and transportation, which are key sectors for Employers Holdings.

Businesses facing substantial compliance costs or potential environmental liabilities might necessitate specialized risk management and insurance products. This could lead to a greater demand for tailored policies that cover pollution liability or environmental remediation, directly influencing the service offerings of Employers Holdings. The economic health of client industries is also tied to their ability to adapt to these evolving environmental standards.

- Increased Compliance Costs: Industries may see higher expenses related to pollution control, waste management, and reporting requirements.

- Demand for Specialized Insurance: Businesses with significant environmental exposure will likely seek policies covering pollution, remediation, and legal defense.

- Impact on Client Profitability: Stringent regulations can reduce profit margins for insured businesses, potentially affecting their ability to afford certain insurance premiums.

- Shift in Insurable Risks: The nature of insurable risks evolves as new environmental challenges and regulatory frameworks emerge.

Public Health Crises and Workplace Risks

The COVID-19 pandemic underscored how public health emergencies dramatically reshape workplace risks and the frequency of claims. For Employers Holdings, this means anticipating evolving safety protocols and potential increases in specific types of workers' compensation claims related to infectious diseases or mental health impacts stemming from widespread crises.

The lingering effects of past health events continue to influence the insurance landscape. For instance, by the end of 2023, many businesses were still grappling with the financial fallout from supply chain disruptions and labor shortages exacerbated by the pandemic, indirectly impacting their risk profiles and insurance needs.

- Shifting Claims Landscape: Public health crises can lead to spikes in claims related to mental health, long-term disability, and even fatalities, requiring insurers like Employers Holdings to adjust their underwriting and reserving strategies.

- Increased Demand for Certain Coverages: Businesses may seek enhanced coverage for business interruption, cyber risks (as remote work increases), and employee well-being programs in response to pandemic-induced vulnerabilities.

- Regulatory Adaptation: Governments may implement new regulations or provide financial support mechanisms during health crises, which insurers must navigate and adapt to, potentially affecting premium structures and policy terms.

Environmental regulations are becoming more stringent, impacting businesses Employers Holdings insures. For example, the EPA's continued focus on reducing greenhouse gases in 2024 means industries like manufacturing and transportation face higher compliance costs and altered risk profiles. This drives demand for specialized insurance covering pollution and remediation, directly influencing Employers Holdings' product offerings.

The increasing frequency and intensity of extreme weather events, such as the record wildfire seasons of 2023, directly affect workplace safety and insurance claims for Employers Holdings. These events lead to injuries, property damage, and business interruptions, all contributing to higher claims costs for insurers. Regions prone to such disasters necessitate more robust risk modeling and potentially higher premiums.

ESG considerations are paramount, with evolving reporting standards like the SEC's climate disclosure rules, expected to impact companies starting in 2025. Furthermore, the sustainability practices of Employers Holdings' small business clients can shape their risk profiles, with companies demonstrating strong environmental management often presenting lower inherent risks.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Employers Holdings is meticulously crafted using data from official government labor statistics, economic forecasts from reputable financial institutions, and industry-specific reports on employment trends. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.