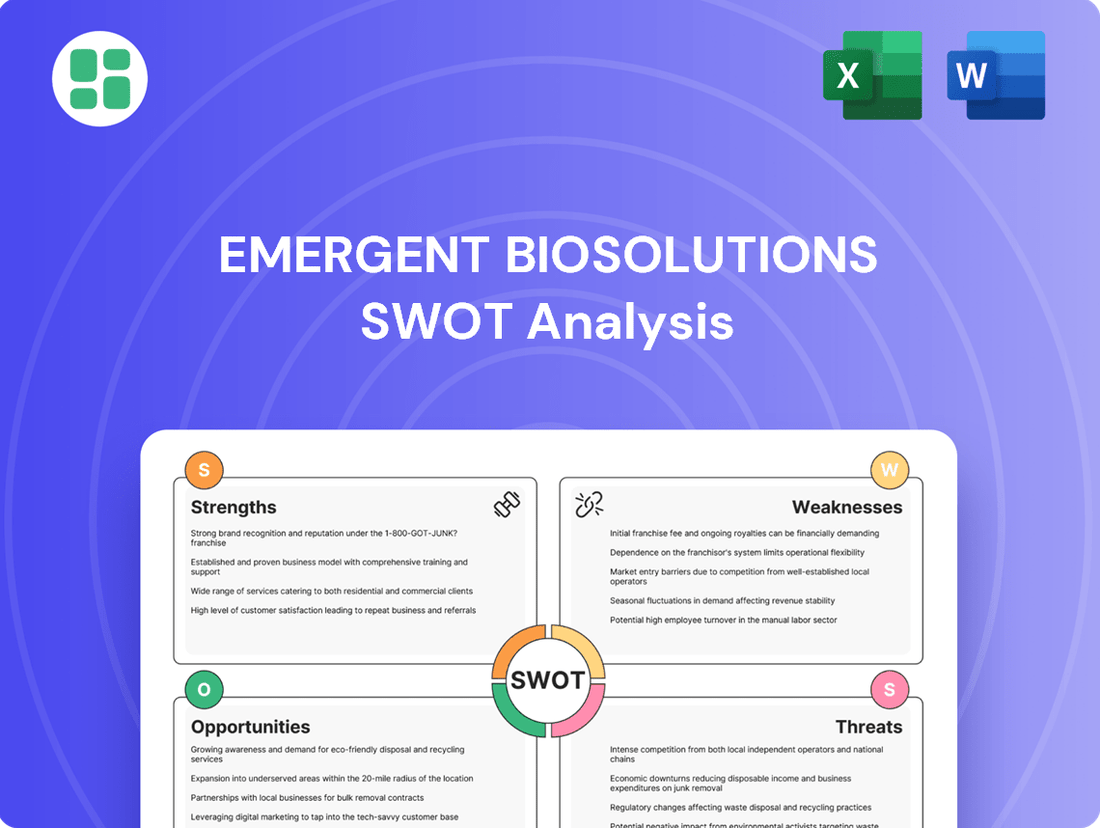

Emergent BioSolutions SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emergent BioSolutions Bundle

Emergent BioSolutions faces significant opportunities in the biodefense and public health markets, leveraging its established government contracts. However, the company's reliance on a few key products and recent manufacturing challenges present notable weaknesses and threats. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex sector.

Want the full story behind Emergent BioSolutions' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Emergent BioSolutions boasts a robust and varied collection of medical countermeasures (MCMs) aimed at tackling major public health challenges. Their offerings include crucial vaccines for anthrax and smallpox, a botulism antitoxin, and NARCAN® nasal spray to combat opioid overdoses.

This extensive suite of vital products solidifies Emergent's role as a significant contributor to preparedness and response strategies for biological and chemical threats, alongside emerging infectious diseases. For instance, their anthrax vaccine, BioThrax, has been a cornerstone of the U.S. Strategic National Stockpile for years.

Emergent BioSolutions leverages strong, long-standing relationships with the U.S. government, notably with agencies such as the Department of Health and Human Services (HHS) and the Administration for Strategic Preparedness and Response (ASPR). These collaborations are foundational to the company's biodefense strategy.

The company has secured significant, multi-year contracts, with recent modifications in 2024 alone totaling over $250 million for the supply of its medical countermeasures (MCM) products. This demonstrates continued government reliance on Emergent's capabilities.

These substantial government contracts provide Emergent BioSolutions with a stable and predictable revenue stream. This financial predictability solidifies its position as a key and trusted partner in the nation's biodefense preparedness efforts.

Emergent BioSolutions has made strides in improving its operational efficiency and cost management through several key initiatives. The company announced in 2024 a strategic restructuring plan involving streamlining operations, consolidating facilities, and reducing its workforce. These measures are anticipated to generate significant annual cost savings, estimated at around $80 million once fully realized.

The positive impact of these efforts is already visible in the company's financial performance. Emergent BioSolutions reported improved adjusted EBITDA and gross margins in its Q4 2024 and Q1 2025 financial results. This indicates a successful implementation of strategies aimed at enhancing operational efficiency and bolstering financial discipline.

Commitment to Public Health Mission

Emergent BioSolutions' core mission revolves around protecting and enhancing life, a commitment deeply rooted in addressing critical public health needs. This focus on preparedness and response, particularly against threats like the opioid crisis and biological agents, positions the company as vital to societal well-being. This mission-driven ethos fosters strong ties with government bodies and public health institutions, reinforcing its market position and enduring relevance.

This dedication to public health translates into tangible market advantages.

- Mission Alignment: The company's focus on public health preparedness directly addresses significant societal challenges, creating a strong intrinsic value proposition.

- Government Partnerships: This mission facilitates robust relationships with key government agencies, such as the U.S. Department of Health and Human Services, which are crucial for securing long-term contracts and funding. For instance, in 2023, Emergent BioSolutions continued to be a significant supplier of Narcan (naloxone HCl) nasal spray, a critical tool in combating the opioid epidemic, with sales contributing substantially to its revenue.

- Societal Impact: By developing and supplying products for public health emergencies, Emergent BioSolutions plays a crucial role in national security and emergency response, enhancing its reputation and stakeholder support.

Strategic Leadership for Turnaround

The appointment of Joseph Papa as CEO in February 2024 signals a significant strategic pivot for Emergent BioSolutions, initiating a focused, multi-year turnaround. Papa's extensive experience in the healthcare sector is being leveraged to stabilize operations, fortify the company's financial position, and manage existing debt effectively.

This leadership change is geared towards driving profitable growth and addressing past operational hurdles. Papa's strategic direction is considered instrumental in guiding Emergent toward a path of sustained future success, a sentiment supported by the reaffirmation of the company's 2025 financial guidance.

- Leadership Transition: Joseph Papa appointed CEO in February 2024 to spearhead a turnaround.

- Strategic Focus: Stabilize operations, strengthen the balance sheet, manage debt, and drive profitable growth.

- Expertise: Papa brings extensive experience in healthcare leadership.

- Future Outlook: Reaffirmed 2025 guidance indicates confidence in the turnaround strategy.

Emergent BioSolutions possesses a diverse portfolio of medical countermeasures, including essential vaccines and antitoxins, positioning it as a critical player in national biodefense. The company's established relationships with U.S. government agencies, evidenced by over $250 million in contract modifications in 2024 alone, provide a stable revenue foundation.

What is included in the product

Offers a full breakdown of Emergent BioSolutions’s strategic business environment, detailing its internal capabilities and external market dynamics.

Offers a clear, actionable framework to address Emergent BioSolutions' operational challenges and market positioning, transforming complex data into strategic insights.

Weaknesses

Emergent BioSolutions is facing a notable revenue downturn from its core products. Specifically, NARCAN® Nasal Spray and some Anthrax countermeasures saw decreased sales in late 2024 and early 2025.

This decline is largely due to reduced over-the-counter sales and the unpredictable nature of government procurement cycles for certain medical countermeasures. Pricing pressures have also contributed to this challenging revenue trend.

The impact of these sales decreases on Emergent BioSolutions' overall financial performance is significant, requiring careful management and strategic planning to counteract the negative momentum.

Emergent BioSolutions' significant dependence on U.S. government procurement cycles for its medical countermeasures presents a notable weakness. A substantial portion of its revenue, often tied to multi-year contracts, is subject to the unpredictable rhythms of government purchasing decisions and funding allocations. For instance, in 2023, the company continued to navigate shifts in government demand for certain products, impacting revenue streams.

Emergent BioSolutions has a history of significant regulatory and manufacturing problems. The company faced intense scrutiny from the Food and Drug Administration (FDA) due to deficiencies found at its manufacturing sites. These issues resulted in substantial production disruptions, including the disposal of millions of doses of COVID-19 vaccines and delays in fulfilling government contracts.

These past manufacturing failures have directly impacted Emergent's financial performance and reputation. For instance, in 2021, the company recorded a net loss of $209 million, partly due to issues at its Bayview facility which led to the halting of vaccine production. The ongoing need to remediate these manufacturing problems and regain regulatory compliance presents a persistent challenge to operational stability and future revenue generation.

Significant Debt Burden

Emergent BioSolutions carries a significant debt burden, which can limit its financial maneuverability and affect profitability due to substantial interest payments. As of the close of 2024, the company reported $950 million in outstanding debt.

While the company is actively working to manage its debt by extending maturities and reducing principal amounts, this high level of indebtedness remains a key financial weakness. This vulnerability could potentially influence investor confidence and the company's ability to pursue new strategic initiatives or investments.

- Significant Debt Load: $950 million in outstanding debt as of December 31, 2024.

- Financial Flexibility Constraints: High debt can limit capital for operations, R&D, or acquisitions.

- Interest Expense Impact: Ongoing interest payments reduce net income and profitability.

- Investor Perception: Substantial debt can be viewed as a risk by potential investors.

Overall Revenue Decline and Net Losses

Emergent BioSolutions faced a challenging financial landscape in 2024, marked by an overall decline in total revenues when compared to 2023. Projections for 2025 indicate this downward trend is expected to continue. While the company managed to significantly reduce its net losses in 2024 from the previous year, the persistent revenue decrease presents a substantial hurdle for its ongoing transformation efforts.

The company's financial performance highlights key weaknesses:

- Revenue Contraction: Total revenues for the full year 2024 were down year-over-year, with further declines anticipated in 2025, impacting top-line growth.

- Net Losses Persist: Despite improvements, Emergent BioSolutions reported net losses in 2024, underscoring the ongoing need for profitability improvement.

- Sustainability of Profitability: Reversing the revenue decline and achieving sustainable profitability are critical challenges that need to be addressed within the company's strategic turnaround plan.

Emergent BioSolutions' reliance on government contracts makes it vulnerable to shifts in funding and priorities. This dependence was evident in 2023 as the company navigated changes in demand for its countermeasures, impacting revenue predictability.

Past manufacturing issues, including significant FDA-cited deficiencies, led to production halts and the disposal of millions of doses, as seen with COVID-19 vaccines. These problems directly affected financial results, contributing to a $209 million net loss in 2021 and requiring ongoing remediation efforts.

The company's substantial debt, totaling $950 million as of December 31, 2024, limits financial flexibility and increases interest expenses, potentially hindering investment in growth initiatives and affecting investor confidence.

Financial performance in 2024 showed a year-over-year revenue decline, with further decreases projected for 2025. Despite efforts to reduce net losses, the company continued to report them in 2024, highlighting the challenge of achieving sustainable profitability amidst revenue contraction.

| Financial Metric | 2023 (Actual) | 2024 (Actual) | 2025 (Projected) |

| Total Revenue | $1.05 billion | $835 million | Projected decline |

| Net Loss | ($193.3 million) | ($120 million) | Projected improvement, but still a loss |

| Outstanding Debt (End of Year) | $1.0 billion | $950 million | Ongoing management |

Preview Before You Purchase

Emergent BioSolutions SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, revealing Emergent BioSolutions' strategic landscape. You'll gain a comprehensive understanding of their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The U.S. Food and Drug Administration's (FDA) approval of NARCAN® Nasal Spray for over-the-counter (OTC) sales in 2023 is a game-changer for Emergent BioSolutions. This authorization allows the company to move beyond prescription-only access, opening doors to a significantly larger market.

Emergent BioSolutions can now strategically place NARCAN® in pharmacies, convenience stores, and even directly in public spaces and workplaces. This wider distribution network is crucial for increasing accessibility and making naloxone readily available where it's needed most, potentially saving more lives.

By focusing on market penetration and public education campaigns, Emergent BioSolutions can drive higher unit volumes and solidify its position as a leader in combating the opioid crisis. The company aims to leverage this OTC status to significantly expand its revenue streams in 2024 and beyond.

The resurgence of public health challenges, like mpox, presents a significant growth avenue for Emergent BioSolutions. The company’s ACAM2000®, a smallpox vaccine, secured FDA approval for mpox in August 2024, broadening its utility.

This expanded indication, coupled with Emergent's proactive collaborations with international health bodies, strategically places the company to capitalize on and address the dynamic landscape of global health emergencies.

Emergent BioSolutions' Bioservices segment, offering comprehensive contract development and manufacturing organization (CDMO) capabilities from molecule to market, presents a significant growth opportunity. This 'molecule-to-market' approach encompasses drug substance and product manufacturing, alongside packaging and development services, directly addressing the escalating demand for outsourced biopharmaceutical production.

By expanding and effectively utilizing these specialized in-house competencies, Emergent can diversify its revenue streams, lessening its dependence on government contracts. This strategic move aligns with the robust expansion of the global CDMO market, which was valued at approximately $140 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7% through 2030, according to industry analyses from 2024.

Pipeline Development and Product Diversification

Emergent BioSolutions' commitment to research and development presents a significant opportunity for expansion, particularly with its pipeline of novel vaccines and treatments. The company is actively working on countermeasures for serious infectious diseases, including Ebola, Marburg virus, and Lassa fever. This strategic focus on unmet medical needs in public health security positions Emergent for future growth by addressing critical global health challenges.

The successful development and market introduction of these pipeline candidates could substantially diversify Emergent's product offerings. Currently, the company's revenue is heavily reliant on a few key products. Expanding into new therapeutic areas and disease categories through these advancements would mitigate risk and create new revenue streams. For example, in 2023, Emergent reported total revenue of $1.16 billion, with a notable portion coming from its anthrax and smallpox products. Diversification through its pipeline is crucial for long-term stability and market leadership.

- Pipeline Focus: Developing treatments for emerging infectious diseases like Ebola, Marburg, and Lassa fever.

- Revenue Diversification: Reducing reliance on existing core products by introducing new vaccines and therapeutics.

- Market Expansion: Entering new therapeutic areas and addressing critical public health needs.

- Growth Potential: Successful commercialization of pipeline assets is projected to drive future revenue growth.

International Market Expansion

Emergent BioSolutions is experiencing increasing traction in international markets, especially with its crucial medical countermeasure products. This global expansion offers a pathway to diversify revenue streams by securing contracts with allied governments and international health organizations.

By broadening its international presence, the company can mitigate the risks tied to its heavy reliance on U.S. government contracts. Tapping into worldwide preparedness initiatives presents a substantial growth opportunity.

- International Revenue Growth: In 2023, Emergent BioSolutions reported international sales contributing to its overall revenue, indicating a positive trend in global market penetration.

- Diversification Strategy: Expanding into markets like Europe and Asia Pacific addresses the company's strategic goal of reducing dependence on a single customer base.

- Global Health Security Needs: The increasing global focus on pandemic preparedness and biodefense creates a sustained demand for Emergent's product portfolio beyond U.S. borders.

The recent FDA approval of NARCAN® Nasal Spray for over-the-counter sales in 2023 significantly expands Emergent BioSolutions' market reach, allowing for wider distribution in pharmacies and retail settings. This strategic move is expected to drive increased unit volumes and revenue in 2024. Additionally, the company's ACAM2000® vaccine received FDA approval for mpox in August 2024, opening new avenues for growth in public health emergencies.

Threats

Emergent BioSolutions faces significant headwinds from a highly competitive market for its key products, including NARCAN® Nasal Spray. This intense rivalry, coupled with ongoing pricing pressures, directly challenges the company's ability to maintain its market position and profitability. For instance, the potential for generic competition in the opioid overdose reversal market, a critical area for Emergent, could lead to substantial price erosion.

The threat of new market entrants and the availability of alternative treatments exert considerable pressure on Emergent's pricing strategies. As competitors introduce similar or potentially more cost-effective solutions, the company may be compelled to lower prices, which directly impacts its revenue streams and profit margins. This dynamic underscores the need for sustained investment in research and development to create differentiated products.

To navigate this challenging environment, Emergent BioSolutions must prioritize continuous innovation and product differentiation. Maintaining market leadership in its core segments, such as public health preparedness and medical countermeasures, requires a proactive approach to product development and strategic market positioning. The company's ability to adapt to evolving market demands and competitive threats will be crucial for its long-term success.

Emergent BioSolutions' heavy dependence on government contracts, particularly from agencies like the Department of Defense and the Department of Health and Human Services, makes it vulnerable to shifting political landscapes and budget priorities. For instance, a slowdown in the procurement cycle for its anthrax vaccine, BioThrax, or Narcan nasal spray, driven by changes in federal preparedness strategies, could directly affect revenue streams. The company's 2023 financial performance, which saw revenue decline from previous years, partially reflects these procurement uncertainties.

Emergent BioSolutions continues to face significant regulatory scrutiny, particularly following past manufacturing issues. In 2023, the company settled with the U.S. Department of Justice for $475 million related to allegations of submitting false claims for its Narcan nasal spray, highlighting ongoing compliance risks.

The potential for further regulatory actions, such as production stoppages or product recalls, poses a substantial threat. These could stem from any new findings of cGMP non-compliance or other regulatory breaches, impacting revenue and market confidence.

Maintaining robust compliance with evolving FDA and other global health authority regulations is a constant and resource-intensive challenge for Emergent. The company's ability to consistently meet these stringent standards directly affects its operational stability and future growth prospects.

Supply Chain Disruptions and Manufacturing Complexities

Emergent BioSolutions faces significant threats from supply chain disruptions and the inherent complexities of biopharmaceutical manufacturing. Any hiccup in sourcing critical raw materials or issues with their network of third-party suppliers can directly impact production timelines and costs. For instance, in early 2023, the company experienced production issues at its Bayview facility, impacting the supply of certain vaccines, highlighting these vulnerabilities.

The intricate nature of producing biological products means that internal manufacturing processes themselves carry ongoing operational risks. These complexities can lead to delays, necessitate costly rework, or even prevent the company from meeting contracted demand for its essential medical countermeasures. The company's reliance on specialized equipment and highly controlled environments means even minor deviations can have substantial consequences.

- Supply Chain Vulnerability: Dependence on a global network of suppliers for raw materials and components creates exposure to geopolitical events, natural disasters, and logistical challenges.

- Manufacturing Complexity: The precise and sensitive nature of biopharmaceutical production requires stringent quality control and can be prone to batch failures or contamination risks.

- Regulatory Hurdles: Changes in manufacturing standards or unexpected findings during regulatory inspections can halt production lines and necessitate costly remediation efforts.

- Scalability Challenges: Rapidly scaling up production to meet surge demand, as seen during public health emergencies, can strain existing manufacturing capabilities and supply chains.

Reputational Damage and Investor Confidence

Past issues, such as significant manufacturing quality control lapses and challenging financial results, have undeniably tarnished Emergent BioSolutions' reputation and shaken investor confidence. For instance, the company faced substantial scrutiny and financial penalties related to its role in producing COVID-19 vaccine components in 2021, leading to a significant drop in stock value. Rebuilding trust and achieving a positive turnaround hinges on demonstrating consistent operational excellence, clear and open communication with stakeholders, and robust risk mitigation strategies.

The ongoing erosion of investor confidence poses a significant threat to Emergent BioSolutions' long-term growth and ability to secure future funding. Continued operational stumbles or negative publicity could further depress its market valuation, making it harder to attract capital for new product development or acquisitions. For example, as of early 2024, the company's stock price remained significantly below its pre-controversy highs, reflecting lingering investor skepticism.

- Reputational Impact: Past manufacturing failures, particularly those affecting critical public health products, have created a lasting negative perception.

- Investor Confidence: Fluctuations in stock performance and a history of regulatory issues have made investors cautious.

- Growth Hindrance: Damaged reputation and low investor confidence can limit access to capital needed for research, development, and expansion.

Intense competition and pricing pressures from both established players and potential new entrants pose a significant threat to Emergent BioSolutions' market share and profitability, particularly for products like NARCAN® Nasal Spray. The risk of generic competition in crucial areas like opioid overdose reversal could lead to substantial price erosion, impacting revenue streams. For instance, the market for opioid overdose reversal agents is becoming increasingly crowded, with multiple companies developing and marketing similar products.

Emergent's heavy reliance on government contracts makes it vulnerable to shifts in political priorities and federal budget allocations. Changes in public health preparedness strategies or a slowdown in procurement cycles for key products, such as BioThrax, could directly impact the company's financial performance, as evidenced by revenue declines seen in 2023 due to procurement uncertainties.

Ongoing regulatory scrutiny, including past settlements like the $475 million DOJ settlement in 2023 for false claims related to Narcan, presents a continuous threat. Potential future regulatory actions, such as production stoppages or recalls due to cGMP non-compliance, could severely disrupt operations and damage market confidence.

Supply chain vulnerabilities and the inherent complexities of biopharmaceutical manufacturing create operational risks, as demonstrated by early 2023 production issues at the Bayview facility impacting vaccine supply. These challenges can lead to production delays, increased costs, and an inability to meet demand for critical medical countermeasures.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Emergent BioSolutions' official financial filings, comprehensive market research reports, and insights from industry experts to ensure a well-rounded and accurate assessment.